|

市場調查報告書

商品編碼

1911742

德國電動自行車:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Germany E-Bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

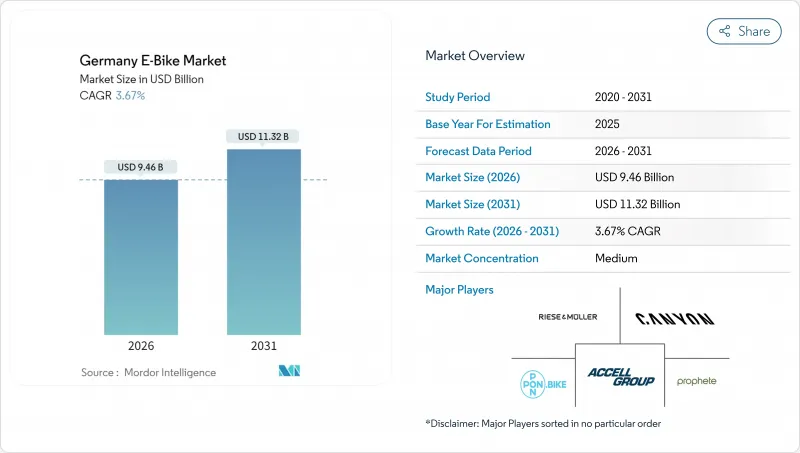

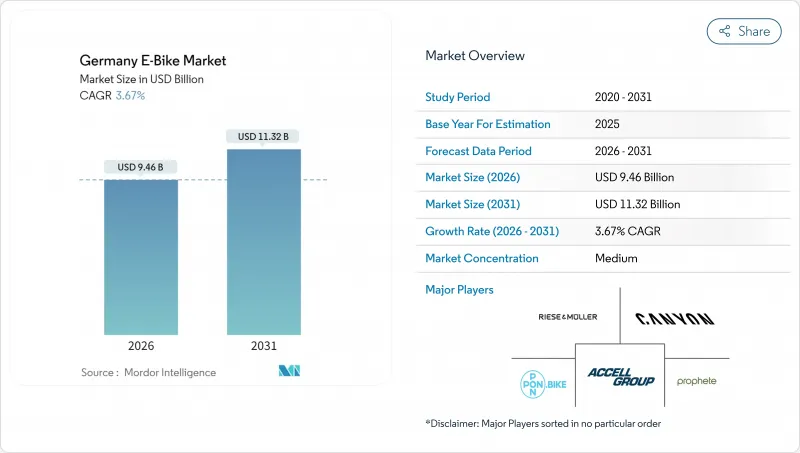

德國電動自行車市場預計將從 2025 年的 91.3 億美元成長到 2026 年的 94.6 億美元,預計到 2031 年將達到 113.2 億美元,2026 年至 2031 年的複合年成長率為 3.67%。

隨著疫情後需求激增逐漸恢復正常,成長模式正轉向穩定的更換週期,商用車隊規模不斷擴大,新裝數量也逐漸增加。電池法規、企業出行預算和基礎設施的改善都在支撐成長勢頭,即便平均售價趨於穩定。競爭格局反映了行業整合、庫存調整以及從追求銷量轉向追求盈利的重大轉變,但德國電動自行車市場在2024年仍將佔據自行車總銷量的相當大佔有率。

德國電動自行車市場趨勢與洞察

都市區壅塞導致的交通方式轉變

德國聯邦政府宣布了國家自行車計畫(NCP)3.0,這是一項旨在全國推廣自行車出行的戰略舉措,其願景展望至2030年。 NCP 3.0的主要目標是提升德國自行車出行的吸引力和安全性,並顯著增加騎乘者的出行里程。儘管電動自行車在自行車總量中所佔比例較小,但它們在整體自行車出行中發揮著至關重要的作用。預計到2025年,慕尼黑將擁有1,200公里的專用自行車道,以開闢出先前僅供汽車通勤的道路。電動自行車續航里程長、坡道輔助功能以及受天氣影響小等優點,解釋了為什麼城市居民更傾向於用電動自行車而非傳統自行車來替代汽車。

企業出行預算租賃

德國企業自行車租賃的蓬勃發展主要得益於稅收政策。 2019 年對《所得稅法》的修訂允許員工透過工資扣除的方式租賃自行車或電動式自行車,只需將製造商建議零售價的一小部分作為每月課稅員工福利。國家自行車計畫 3.0 將企業自行車租賃定位為推動通勤方式從汽車轉向自行車的「關鍵措施」。據估計,如果大部分短程通勤都轉向自行車或電動式自行車,將顯著減少每年的二氧化碳排放量。工資總額租賃模式使員工能夠以大幅折扣的價格使用自行車。雇主重視每月扣款的可預測性,而供應商則看重大批量合約的穩定性,因為這種合約受零售價格波動的影響較小。

補貼後的初始成本較高

2024年的調查顯示,消費者對價格的敏感度日益提高,許多人推遲了大額非必需品的購買。儘管當年的平均零售價格有所下降,但許多購物者仍然將某些價格區間視為心理上的界線。由於缺乏全國性的獎勵,德國的消費支持力道低於鄰國法國,這促使人們在邊境城鎮進行跨境購物。

細分市場分析

由於其法律地位與自行車相同,無需繳納保險和辦理牌照,到2025年,助力型電動自行車將佔據德國電動自行車市場79.35%的佔有率。隨著通勤者尋求在長途路線上以45公里/小時的速度巡航,高速輔助電動自行車的複合年成長率將達到3.76%。預計在2026年至2031年間,這一細分市場將成為德國電動自行車市場成長的主要動力之一。

關於EPAC定義的監管爭論將是預測結果的一個重要因素。德國車輛協會(ZIV)提案最大功率限制在750瓦,輔助比設定為1:4,旨在維持其非機動車輛的分類。而德國電動自行車協會(LEVA-EU)則認為,更嚴格的法規會扼殺貨運領域的創新。預計2026年將推出的決定可能會擴大或縮小高輔助自行車的潛在市場規模,直接影響德國電動式自行車市場佔有率的演變。

預計到2025年,都市區用途電動自行車將佔德國電動自行車市場總收入的70.92%,構成比貨運/多用途電動自行車市場預計到2031年將以3.74%的複合年成長率成長,成為德國電動自行車市場成長最快的細分市場。隨著宅配公司和生鮮平台為了符合都市區排放控制區的要求而將其「最後一公里」配送車輛電動化,貨運/多用途電動自行車市場正在迅速擴張。

預計2024年貨運車輛數量將顯著成長,較上年增幅尤為顯著。許多車輛標配1000Wh電池,無需充電即可完成一整班運輸。加之柏林柴油車禁令的實施,商業訂單可望帶來穩定的市場需求,從而穩定過去受消費季節性影響的季度運輸週期。

到 2025 年,鋰離子電池組將佔出貨量的 99.82%,並將支撐德國電動自行車市場規模的大部分成長,到 2031 年,其複合年成長率將達到 3.67%。其他化學技術目前仍僅限於售價低於 1000 美元的入門級車型和實驗性的固態電池試點計畫。

歐盟電池法規將於 2027 年 2 月起強制實施數位護照制度,並設定 2028 年實現 51% 的回收目標。這些措施將使循環經濟實踐制度化,並加強鋰離子電池的現有優勢,同時促進歐洲的電池生產,減少範圍 3 的排放,並降低運輸風險。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章:主要產業趨勢

- 年度自行車銷售額

- 平均銷售價格和價格範圍構成

- 電動自行車及零件的跨境貿易

- 電動自行車在自行車總銷量中所佔的百分比

- 單程通勤距離為 5-15 公里的通勤者比例 (%)

- 自行車和電動式自行車租賃市場規模

- 電動自行車電池組價格

- 電池化學價格比較

- 最後一公里(超本地化)配送量

- 受保護的自行車道(公里)

- 健行和戶外活動的參與率

- 電動自行車電池容量(瓦時)

- 都市交通壅塞指數

- 法律規範

- 電動自行車型式認證與認可

- 進出口/貿易限制

- 分類、道路使用法規和使用者規則

- 電池、充電器和充電安全

第5章 市場情勢

- 市場概覽

- 市場促進因素

- 都市區壅塞導致的交通方式轉變

- 企業出行預算租賃

- 電池和馬達技術的進步

- 政府採購獎勵

- 環保意識與排放減量目標

- 旅遊需求推動電動山地自行車道的擴張

- 市場限制

- 補助結束後,初期成本較高

- 國內電池供應風險

- 售後服務工廠的瓶頸

- 竊盜保險費上漲

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第6章 市場規模及成長預測(價值及數量)

- 依推進類型

- 踏板輔助

- 速度踏板

- 油門輔助

- 透過使用

- 貨物/多用途

- 城鎮/城市

- 健行/登山

- 依電池類型

- 鉛酸電池

- 鋰離子電池

- 其他

- 按下馬達安裝位置

- 輪轂(前/後)

- 中置馬達

- 透過驅動系統

- 鏈傳動

- 皮帶傳動

- 透過馬達輸出

- 小於250瓦

- 251~350 W

- 351~500 W

- 501~600 W

- 600瓦或以上

- 按價格範圍

- 低於1000美元

- 1,000-1,499 美元

- 1500-2499美元

- 2,500-3,499 美元

- 3,500-5,999 美元

- 超過6000美元

- 按銷售管道

- 線上

- 離線

- 按最終用途

- 商業航運

- 零售和商品分銷

- 食品/飲料配送

- 服務供應商

- 個人和家庭用途

- 公共利益

- 其他

- 商業航運

第7章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Accell Group

- Canyon Bicycles GmbH

- CUBE Bikes

- Giant Manufacturing Co. Ltd.

- KTM Fahrrad GmbH

- Merida Industry Co. Ltd.

- Pon Holdings BV

- Prophete In Moving GmbH

- Riese & Muller GmbH

- Specialized Bicycle Components, Inc.

- Winora Staiger GmbH

- Bulls Bikes(ZEG)

- STEVENS Vertriebs GmbH

- Moustache Bikes

- Urban Arrow

第8章:市場機會與未來展望

第9章:CEO們需要思考的關鍵策略問題

The German E-Bike market is expected to grow from USD 9.13 billion in 2025 to USD 9.46 billion in 2026 and is forecast to reach USD 11.32 billion by 2031 at 3.67% CAGR over 2026-2031.

Demand normalization after the pandemic surge now pivots growth toward steady replacement cycles, commercial fleet expansions, and incremental first-time adoption. Battery regulation, corporate mobility budgets, and improving infrastructure sustain forward momentum even as average selling prices stabilize. Competitive dynamics reflect consolidation, inventory rebalancing, and a decisive shift from volume chasing to profitability, yet the German E-Bike market continues to capture a notable share of total bicycle sales as of 2024.

Germany E-Bike Market Trends and Insights

Urban Congestion-Driven Modal Shift

Germany's Federal Government has unveiled the National Cycling Plan (NCP) 3.0, a strategic initiative aimed at promoting cycling across the nation, with a vision extending to 2030. NCP 3.0's primary objective is to enhance the appeal and safety of cycling in Germany, thereby aiming for a substantial uptick in the distance covered by cyclists . E-bikes, although forming a smaller portion of the total fleet, play a disproportionately significant role in overall bicycle usage. Protected lanes in Munich are set to reach 1,200 km by 2025, enabling commutes once considered car-only. Longer range, hill-flattening assistance, and lower weather sensitivity explain why urban residents substitute cars with e-bikes more often than with acoustic bikes.

Corporate Mobility-Budget Leasing

Germany's corporate bike-leasing boom is largely driven by fiscal policy. A 2019 amendment to the Income Tax Act, which allows employees leasing bicycles or e-bikes through salary sacrifice to treat only a small portion of the manufacturer's list price as a monthly taxable benefit. The National Cycling Plan 3.0 highlights company-bike leasing as a "key action" to shift work-related travel from cars. They estimate a substantial annual CO2 saving if a significant portion of short commutes transitions to bicycles or e-bikes. Through gross-salary leasing, employees enjoy significant savings on bike models. Employers value the predictability of monthly deductions, while suppliers appreciate the stability of bulk contracts, which are less vulnerable to retail fluctuations.

High Upfront Cost Post-Subsidy

In 2024, consumers became increasingly price-conscious, with many opting to delay significant discretionary purchases, according to surveys. In 2024, average retail prices declined, but many mainstream buyers still perceive a specific price point as a psychological ceiling. Without nationwide incentives, Germany ranks below neighboring France on net purchase support, encouraging cross-border shopping in border towns.

Other drivers and restraints analyzed in the detailed report include:

- Battery and Motor Technology Advances

- Government Purchase Incentives

- Domestic Battery-Cell Supply Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pedal-assisted systems generated 79.35% of the Germany E-Bike market in 2025, benefiting from a bicycle-equivalent legal status that avoids insurance and license requirements. Speed Pedelecs post a 3.76% CAGR as commuters seek 45 km/h cruising on longer routes. This segment will contribute disproportionately to the expansion of the German e-bike market between 2026 and 2031.

Regulatory debate on EPAC definitions adds forecast volatility. ZIV's proposal to cap peak power at 750 W and maintain a 1:4 assist ratio aims to preserve the non-motor-vehicle classification. Advocacy group LEVA-EU counters that tighter rules would restrain cargo innovation. A decision expected in 2026 could widen or narrow the addressable market for high-assist bicycles, directly influencing Germany's E-Bike market share trajectories.

City/Urban riding held 70.92% of 2025 revenue, but the cargo/utility segment is on track for a 3.74% CAGR to 2031, the top growth lane within the German E-Bike market. Cargo/Utility usage follows closely as parcel companies and grocery platforms electrify last-mile fleets to meet city emission zones.

In 2024, the industry experienced significant growth in cargo units, reflecting a notable year-on-year increase, with many fleets now spec 1,000 Wh batteries to secure a full shift without midday recharging. Combined with diesel vehicle bans in Berlin, fleet orders promise steady demand inflows that stabilize quarterly shipment cycles previously driven by consumer seasonality.

Lithium-ion packs represented 99.82% of 2025 shipments and will chart a parallel 3.67% CAGR through 2031, underpinning most gains in the German E-Bike market size. Alternative chemistries remain relegated to sub-USD 1,000 entry bikes or experimental solid-state pilots.

The EU Battery Regulation introduces mandatory digital passports from February 2027 and collection targets of 51% by 2028. These measures institutionalize circular-economy practices, reinforcing lithium-ion incumbency while encouraging European cell production to cut embedded scope-3 emissions and lower transport risk.

The Germany E-Bike Market Report is Segmented by Propulsion Type (Pedal Assisted, Speed Pedelec, and More), Application Type (Cargo/Utility, City/Urban, and More), Battery Type (Lead Acid Battery, Lithium-Ion Battery, and More), Motor Placement (Hub (Front/Rear), Mid-Drive), Drive Systems, Motor Power, Price Band, Sales Channel, and End Use. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Accell Group

- Canyon Bicycles GmbH

- CUBE Bikes

- Giant Manufacturing Co. Ltd.

- KTM Fahrrad GmbH

- Merida Industry Co. Ltd.

- Pon Holdings B.V.

- Prophete In Moving GmbH

- Riese & Muller GmbH

- Specialized Bicycle Components, Inc.

- Winora Staiger GmbH

- Bulls Bikes (ZEG)

- STEVENS Vertriebs GmbH

- Moustache Bikes

- Urban Arrow

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Key Industry Trends

- 4.1 Annual Bicycle Sales

- 4.2 Average Selling Price & Price-Band Mix

- 4.3 Cross-Border Trade in E-Bikes & Parts

- 4.4 E-Bike Share of Total Bicycle Sales

- 4.5 Commuters with 5-15 km One-Way Trips (%)

- 4.6 Bicycle/E-Bike Rental Market Size

- 4.7 E-Bike Battery Pack Price

- 4.8 Battery Chemistry Price Comparison

- 4.9 Last-Mile (Hyper-Local) Delivery Volume

- 4.10 Protected Bicycle Lanes (km)

- 4.11 Trekking/Outdoor Activity Participation

- 4.12 E-Bike Battery Capacity (Wh)

- 4.13 Urban Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.14.1 Homologation & Certification of E-Bicycles

- 4.14.2 Export-Import & Trade Regulation

- 4.14.3 Classification, Road Access and User Rules

- 4.14.4 Battery, Charger and Charging Safety

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Urban Congestion-Driven Modal Shift

- 5.2.2 Corporate Mobility-Budget Leasing

- 5.2.3 Battery and Motor Technology Advances

- 5.2.4 Government Purchase Incentives

- 5.2.5 Environmental Awareness and CO2 Targets

- 5.2.6 Tourism-Driven E-MTB Trail Expansion

- 5.3 Market Restraints

- 5.3.1 High Upfront Cost Post-Subsidy

- 5.3.2 Domestic Battery-Cell Supply Risk

- 5.3.3 After-Sales Workshop Bottlenecks

- 5.3.4 Rising Theft-Insurance Premiums

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces

- 5.7.1 Threat of New Entrants

- 5.7.2 Bargaining Power of Suppliers

- 5.7.3 Bargaining Power of Buyers

- 5.7.4 Threat of Substitutes

- 5.7.5 Competitive Rivalry

6 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 6.1 By Propulsion Type

- 6.1.1 Pedal Assisted

- 6.1.2 Speed Pedelec

- 6.1.3 Throttle Assisted

- 6.2 By Application Type

- 6.2.1 Cargo/Utility

- 6.2.2 City/Urban

- 6.2.3 Trekking/Mountain

- 6.3 By Battery Type

- 6.3.1 Lead Acid Battery

- 6.3.2 Lithium-ion Battery

- 6.3.3 Others

- 6.4 By Motor Placement

- 6.4.1 Hub (Front/Rear)

- 6.4.2 Mid-Drive

- 6.5 By Drive Systems

- 6.5.1 Chain Drive

- 6.5.2 Belt Drive

- 6.6 By Motor Power

- 6.6.1 Below 250 W

- 6.6.2 251-350 W

- 6.6.3 351-500 W

- 6.6.4 501-600 W

- 6.6.5 Above 600 W

- 6.7 By Price Band

- 6.7.1 Up to USD 1,000

- 6.7.2 USD 1,000-1,499

- 6.7.3 USD 1,500-2,499

- 6.7.4 USD 2,500-3,499

- 6.7.5 USD 3,500-5,999

- 6.7.6 Above USD 6,000

- 6.8 By Sales Channel

- 6.8.1 Online

- 6.8.2 Offline

- 6.9 By End Use

- 6.9.1 Commercial Delivery

- 6.9.1.1 Retail and Goods Delivery

- 6.9.1.2 Food and Beverage Delivery

- 6.9.2 Service Providers

- 6.9.3 Personal and Family Use

- 6.9.4 Institutional

- 6.9.5 Others

- 6.9.1 Commercial Delivery

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 7.4.1 Accell Group

- 7.4.2 Canyon Bicycles GmbH

- 7.4.3 CUBE Bikes

- 7.4.4 Giant Manufacturing Co. Ltd.

- 7.4.5 KTM Fahrrad GmbH

- 7.4.6 Merida Industry Co. Ltd.

- 7.4.7 Pon Holdings B.V.

- 7.4.8 Prophete In Moving GmbH

- 7.4.9 Riese & Muller GmbH

- 7.4.10 Specialized Bicycle Components, Inc.

- 7.4.11 Winora Staiger GmbH

- 7.4.12 Bulls Bikes (ZEG)

- 7.4.13 STEVENS Vertriebs GmbH

- 7.4.14 Moustache Bikes

- 7.4.15 Urban Arrow