|

市場調查報告書

商品編碼

1911430

印度資訊通訊技術:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)India ICT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

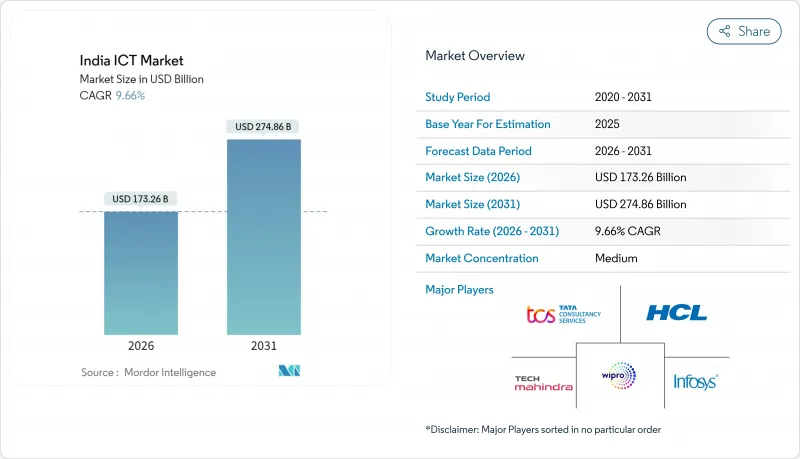

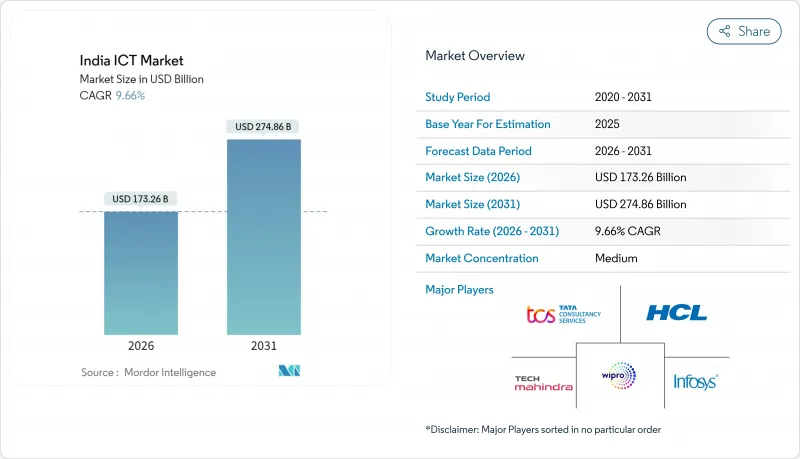

印度資訊通訊技術市場規模預計到 2026 年將達到 1,732.6 億美元,高於 2025 年的 1,580 億美元。

預計到 2031 年,該市場規模將達到 2,748.6 億美元,從 2026 年到 2031 年的複合年成長率為 9.66%。

這一成長軌跡反映了印度資訊通訊技術市場受益於政府數位化項目、創紀錄的企業雲端遷移以及快速成長的消費者連接。大規模超大規模資料中心業者計劃、蓬勃發展的Start-Ups生態系統以及與生產連結獎勵計畫,持續推動技術投資從成本最佳化轉向策略差異化。通訊業者正在將5G網路擴展到二線城市,而企業則將預算重新分配到雲端原生架構、人工智慧和網路安全領域。儘管人才短缺和農村地區最後一公里光纖覆蓋不足限制了原本強勁的成長前景,但持續的技能培訓舉措和BharatNet的推出有望在中期內推動市場改善。

印度資訊通訊技術市場趨勢與洞察

政府的「數位印度」計畫和與生產連結獎勵計畫將促進企業科技支出。

生產連結獎勵計畫計畫已吸引14.6兆盧比的投資,並創造了125兆盧比的生產價值,使印度電子製造業產能從2014年的24兆盧比成長到2024年的98兆盧比。印度人工智慧使命已撥款12.5億美元用於運算、創新和Start-Ups融資,以建立國家人工智慧基礎設施。 82%的執行長計劃在2025年將其數位化預算增加5%以上,以應對合規義務和競爭需求。執行長(NIC)將IT容量擴展至1000兆瓦,儲存容量擴展至100PB,這表明政府對公共基礎設施的長期承諾,並將轉化為對私人技術的需求。這些措施將透過確保強大的國內供應鏈、加速企業現代化以及推動超大規模資料中心業者資料中心計劃,來增強印度的資訊通訊技術市場。

後疫情時代加速雲採用

67%的印度企業已將工作負載遷移到雲端平台,混合雲環境已成為主流部署模式。預計2028年,公共雲端收入將達242億美元,複合年成長率達23.8%。微軟、亞馬遜和谷歌等超大規模資料中心業者雲端服務商將投資2,17億美元,用於建立符合資料主權規範和效能目標的在地化基礎設施。企業人工智慧支出成長率是整體數位支出的2.2倍,並依賴提供可擴展運算和現成機器學習服務的雲端平台。雲端原生架構能夠加速產品週期,並大幅減少營運瓶頸,進而增強印度資訊通訊技術市場早期採用者的競爭優勢。

尖端領域存在技能缺口與高離職率

由於人工智慧、雲端架構和網路安全領域的人才需求遠超供給,目前約有30萬個技術職缺。專業離職率率高於行業平均水平,他們紛紛轉向全球發展機會和Start-Ups,導致企業內部知識流失。薪資上漲推高了計劃成本,擠壓了印度資訊通訊技術(ICT)市場服務供應商的利潤空間。健康資訊學和工業IoT等領域的專業人才短缺加劇了這一困境,因為大學難以即時調整課程。除非技能再培訓專案能夠迅速擴大規模,否則交付速度和創新步伐都將面臨放緩的風險。

細分市場分析

到2025年,電信服務將佔印度資訊通訊技術(ICT)市場的36.50%,這主要得益於4G和5G的廣泛部署以及穩定的頻譜政策。硬體需求正隨著生產關聯激勵(PLI)計劃的實施而同步成長,該計劃鼓勵設備和組件製造的本地化,從而降低進口依賴並加強供應鏈。隨著企業將分析技術融入業務流程,軟體(尤其是人工智慧平台)的採用率正經歷兩位數的成長。 IT服務正持續從人員增補模式轉向諮詢主導、以結果基本契約,從而確保利潤率。雲端服務雖然規模較小,但預計將以15.71%的複合年成長率(CAGR)實現最快成長,這反映了資料中心建設的推進以及企業向營運支出(OPEX)模式的轉變。

雲端服務的強勁發展勢頭正助力基礎設施即服務 (IaaS)、平台即服務 (PaaS)和軟體即服務(SaaS) 在印度資訊通訊技術 (ICT) 市場中佔據越來越大的佔有率。電信公司正利用其基地台資源提供邊緣雲端服務,而硬體供應商則向國內原始設備製造商 (OEM) 提供人工智慧最佳化晶片。軟體供應商正與超大規模資料中心業者中心營運商合作,提供包含生成式人工智慧的垂直整合解決方案,從而創造交叉銷售協同效應。整體而言,隨著新的雲端原生企業逐步取代傳統的託管服務契約,市場競爭日益激烈。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 行動數據消費量的爆炸性成長和價格實惠的 4G/5G費率方案

- 政府的「數位印度」計畫和生產連結獎勵計畫(PLI)將促進企業在技術方面的支出。

- 後疫情時代加速雲採用

- 微企業數位商務的快速成長

- 超大規模資料中心業者資料中心在區域城市的擴張(此趨勢鮮為人知)

- 氣候科技對綠色資料中心的需求

- 市場限制

- 尖端領域存在技能缺口與高離職率

- 農村地區最後一公里光纖網路的碎片化

- 供應鏈對進口半導體的依賴性

- 電力成本波動影響資料中心投資報酬率

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 按類型

- 硬體

- 電腦硬體

- 網路裝置

- 周邊設備

- IT軟體

- IT服務

- 託管服務

- 業務流程服務

- 商業諮詢服務

- 雲端服務

- IT基礎設施

- IT安全

- 通訊服務

- 硬體

- 按最終用戶公司規模分類

- 主要企業

- 小型企業

- 按行業

- BFSI

- 政府和公共機構

- 零售、電子商務與物流

- 製造業和工業4.0

- 醫療保健和生命科學

- 遊戲和電子競技

- 石油和天然氣(上游、中游、下游)

- 能源與公共產業

- 其他行業

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Tata Consultancy Services Ltd

- HCL Technologies Ltd

- Infosys Ltd

- Tech Mahindra Ltd

- Wipro Ltd

- Bharti Airtel Ltd

- Reliance Jio Infocomm Ltd

- Vodafone Idea Ltd

- IBM India Pvt Ltd

- Accenture Solutions Pvt Ltd

- Capgemini Technology Services India Ltd

- Mphasis Ltd

- Mindtree Ltd

- Larsen & Toubro Infotech Ltd

- Oracle India Pvt Ltd

- Cisco Systems India Pvt Ltd

- Amazon Internet Services Pvt Ltd(AWS India)

- Google Cloud India Pvt Ltd

- Microsoft Corporation India Pvt Ltd

- Dell Technologies India

- Hewlett Packard Enterprise India

- Atria Convergence Technologies Ltd

- Bharat Sanchar Nigam Ltd

- Sify Technologies Ltd

- Allied Digital Services Ltd

第7章 市場機會與未來趨勢

- 閒置頻段與未滿足需求評估

The India ICT market size in 2026 is estimated at USD 173.26 billion, growing from 2025 value of USD 158 billion with 2031 projections showing USD 274.86 billion, growing at 9.66% CAGR over 2026-2031.

The growth trajectory reflects how the India ICT market benefits from government digitization programs, record enterprise cloud migrations, and fast-rising consumer connectivity. Large hyperscaler projects, a flourishing startup ecosystem, and production-linked incentives continue to shift technology investments from cost optimization to strategic differentiation. Telecom operators are expanding 5G networks into Tier-2 cities, while enterprises channel budgets toward cloud-native architectures, artificial intelligence, and cybersecurity. Talent shortages and rural last-mile fiber gaps temper the otherwise buoyant outlook, but ongoing skilling initiatives and BharatNet roll-outs offer medium-term relief

India ICT Market Trends and Insights

Government Digital India and PLI Incentives Boosting Enterprise Tech Spend

The Production Linked Incentive scheme has attracted INR 1.46 lakh crore investments and generated INR 12.50 lakh crore production value, transforming electronics manufacturing capacity from INR 2.4 lakh crore in 2014 to INR 9.8 lakh crore in 2024. The IndiaAI mission allocates USD 1.25 billion to compute, innovation, and startup funding, laying a sovereign AI foundation. Eighty-two percent of CXOs plan digital budgets to rise by more than 5% during 2025, responding to compliance obligations and competitive needs. National Informatics Centre expansion to 1,000 MW IT load and 100 PB storage signals a long-term public infrastructure commitment that cascades into private technology demand. These interventions reinforce the India ICT market by ensuring robust local supply chains, stimulating enterprise modernization, and anchoring hyperscaler data-center projects.

Accelerated Cloud Adoption After COVID-19

Sixty-seven percent of Indian organizations are migrating workloads to cloud platforms, making hybrid the dominant deployment choice. Public-cloud revenue is forecast to reach USD 24.2 billion by 2028, growing at a 23.8% CAGR. Hyperscaler commitments totaling USD 21.7 billion from Microsoft, Amazon, and Google secure localized infrastructure that answers data sovereignty norms and performance targets. Enterprise AI spending is expanding at 2.2X the pace of general digital outlays, tethered to cloud platforms that deliver scalable compute and ready-made ML services. Cloud-native architectures speed product cycles and slash operational bottlenecks, reinforcing the competitive edge of early movers within the India ICT market.

Skill-Gap and High Attrition in Cutting-Edge Domains

Roughly 300,000 technology vacancies remain open, as AI, cloud-architecture, and cybersecurity demands outrun talent supply. Attrition in niche skills exceeds sector norms as specialists pursue global opportunities or startups, diluting institutional knowledge. Rising wage offers inflate project costs and squeeze margins across service providers in the India ICT market. Domain expertise shortages, such as healthcare informatics and industrial IoT, magnify the constraint because universities struggle to adapt curricula in real-time. Unless reskilling programs scale rapidly, delivery timelines and innovation velocity risk deceleration.

Other drivers and restraints analyzed in the detailed report include:

- MSME Digital-Commerce Boom

- Exploding Mobile-Data Consumption and Affordable 4G/5G Tariffs

- Fragmented Last-Mile Fiber in Rural Belts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Telecommunication Services captured 36.50% India ICT market share in 2025, underpinned by vast 4G and 5G roll-outs and a consistent spectrum policy. Hardware demand rises in sync with PLI incentives that localize device and component manufacturing, reducing reliance on imports and strengthening supply resilience. Software adoption, especially AI-enabled platforms, records double-digit growth as enterprises embed analytics in workflows. IT Services continues the pivot from staff-augmentation to consulting-led, outcome-based engagements, safeguarding margins. Cloud Services, while smaller, shows the steepest climb at a 15.71% CAGR, reflecting data-center buildouts and enterprise shift to OPEX models.

Momentum in Cloud Services translates into a growing slice of the India ICT market size for infrastructure-as-a-service, platform-as-a-service, and software-as-a-service lines. Telecom firms pursue edge-cloud offerings to leverage tower real estate, and hardware vendors push AI-optimized chips to domestic OEMs. Software suppliers align with hyperscalers to offer vertical solutions infused with generative AI, creating cross-selling synergies. Overall, competition intensifies as cloud-native entrants nibble at legacy managed-service accounts.

The India ICT Market Report is Segmented by Type (Hardware, Software, IT Services, Telecommunication Services), Enterprise Size (Large Enterprises, Smes), Industry Vertical (BFSI, Government and Public Administration, Retail, E-Commerce and Logistics, Manufacturing and Industry 4. 0, Healthcare and Life Sciences, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Tata Consultancy Services Ltd

- HCL Technologies Ltd

- Infosys Ltd

- Tech Mahindra Ltd

- Wipro Ltd

- Bharti Airtel Ltd

- Reliance Jio Infocomm Ltd

- Vodafone Idea Ltd

- IBM India Pvt Ltd

- Accenture Solutions Pvt Ltd

- Capgemini Technology Services India Ltd

- Mphasis Ltd

- Mindtree Ltd

- Larsen & Toubro Infotech Ltd

- Oracle India Pvt Ltd

- Cisco Systems India Pvt Ltd

- Amazon Internet Services Pvt Ltd (AWS India)

- Google Cloud India Pvt Ltd

- Microsoft Corporation India Pvt Ltd

- Dell Technologies India

- Hewlett Packard Enterprise India

- Atria Convergence Technologies Ltd

- Bharat Sanchar Nigam Ltd

- Sify Technologies Ltd

- Allied Digital Services Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exploding mobile-data consumption and affordable 4G/5G tariffs

- 4.2.2 Government "Digital India" and PLI incentives boosting enterprise tech spend

- 4.2.3 Accelerated cloud adoption after COVID-19

- 4.2.4 MSME digital-commerce boom

- 4.2.5 Growing hyperscaler colocation in Tier-2 cities (under-the-radar)

- 4.2.6 Climate-tech demand for green data-centres (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Skill-gap and high attrition in cutting-edge domains

- 4.3.2 Fragmented last-mile fibre in rural belts

- 4.3.3 Supply-chain dependence on imported semiconductors

- 4.3.4 Power-cost volatility hitting data-centre ROI (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Hardware

- 5.1.1.1 Computer Hardwar

- 5.1.1.2 Networking Equipment

- 5.1.1.3 Peripherals

- 5.1.2 IT Software

- 5.1.3 IT Services

- 5.1.3.1 Managed Services

- 5.1.3.2 Business Process Services

- 5.1.3.3 Business Consulting Services

- 5.1.3.4 Cloud Services

- 5.1.4 IT Infrastructure

- 5.1.5 IT Security

- 5.1.6 Communication Services

- 5.1.1 Hardware

- 5.2 By End-user Enterprise Size

- 5.2.1 Large Enterprises

- 5.2.2 SMEs

- 5.3 By Industry Vertical

- 5.3.1 BFSI

- 5.3.2 Government and Public Administration

- 5.3.3 Retail, E-commerce and Logisitcs

- 5.3.4 Manufacturing and Industry 4.0

- 5.3.5 Halthcare and Life Sciences

- 5.3.6 Gaming and Esports

- 5.3.7 Oil and Gas (Up-, Mid-, Down-stream)

- 5.3.8 Energy and Utilities

- 5.3.9 Other Verticals

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Tata Consultancy Services Ltd

- 6.4.2 HCL Technologies Ltd

- 6.4.3 Infosys Ltd

- 6.4.4 Tech Mahindra Ltd

- 6.4.5 Wipro Ltd

- 6.4.6 Bharti Airtel Ltd

- 6.4.7 Reliance Jio Infocomm Ltd

- 6.4.8 Vodafone Idea Ltd

- 6.4.9 IBM India Pvt Ltd

- 6.4.10 Accenture Solutions Pvt Ltd

- 6.4.11 Capgemini Technology Services India Ltd

- 6.4.12 Mphasis Ltd

- 6.4.13 Mindtree Ltd

- 6.4.14 Larsen & Toubro Infotech Ltd

- 6.4.15 Oracle India Pvt Ltd

- 6.4.16 Cisco Systems India Pvt Ltd

- 6.4.17 Amazon Internet Services Pvt Ltd (AWS India)

- 6.4.18 Google Cloud India Pvt Ltd

- 6.4.19 Microsoft Corporation India Pvt Ltd

- 6.4.20 Dell Technologies India

- 6.4.21 Hewlett Packard Enterprise India

- 6.4.22 Atria Convergence Technologies Ltd

- 6.4.23 Bharat Sanchar Nigam Ltd

- 6.4.24 Sify Technologies Ltd

- 6.4.25 Allied Digital Services Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-Need Assessment