|

市場調查報告書

商品編碼

1906228

義大利資訊通訊技術市場:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031 年)Italy ICT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

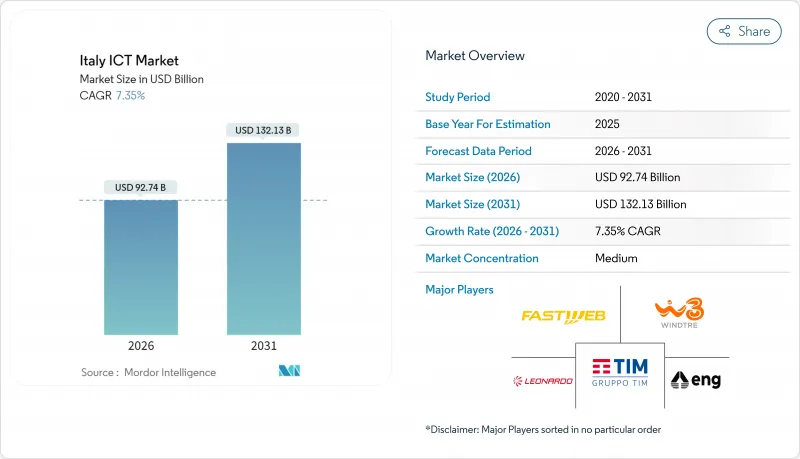

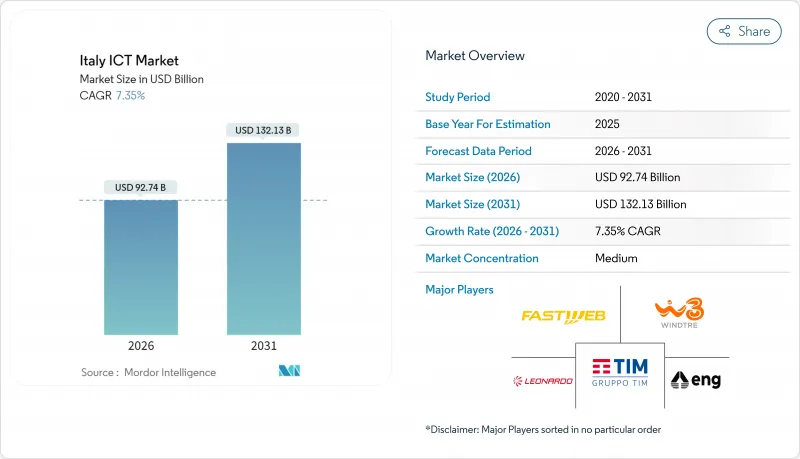

2025 年義大利 ICT 市場規模價值為 863.9 億美元,預計將從 2026 年的 927.4 億美元成長到 2031 年的 1321.3 億美元,在預測期(2026-2031 年)內複合年成長率為 7.35%。

目前的成長勢頭得益於政府的《國家復甦與韌性計劃》、私營部門的資本流入以及向自主雲架構的快速轉型,這些轉型減少了對舊有系統的依賴。北部製造中心的邊緣運算試點、全國範圍內的5G網路密集化以及網路安全的快速投入,正在推動以數據為中心的服務轉型。同時,來自超大規模資料中心業者和本土營運商的加大投資,正使義大利ICT市場成為歐洲數位價值鏈的核心參與者。 Fastweb和沃達豐的合併加劇了競爭,在現有營運商TIM的基礎設施之外,又出現了一個完整的網路,從而擴大了連接選擇範圍並降低了價格。

義大利資訊通訊技術市場趨勢與洞察

NRRP資助的數位投資激增

「轉型5.0計畫」已向企業數位化和能源效率領域注入138億美元,訂單。歐盟復甦資金至少20%必須用於數位化目標的分配規則,進一步增強了支出的永續性。在義大利南部(梅佐焦爾諾)建立本地供應基地的供應商將受益於3.27億美元的義大利南部預算撥款,該撥款旨在縮小區域差距,並滿足傳統服務不足地區不斷成長的需求。這一輪資金支持將持續到2029年,為系統整合商和營運商創造可預測的業務管道。

企業雲端遷移加速

義大利電信(TIM)2024年雲端業務營收成長19%,其中網路安全部門銷售額翻番,顯示雲端採用與安全需求成長之間存在關聯。微軟正在投資47億美元在義大利新建資料中心區域和人工智慧研究實驗室,而亞馬遜雲端服務(AWS)也在邊緣區域投資13億美元,預計五年內將為義大利GDP貢獻9.58億美元。這些舉措透過降低延遲、滿足數據主權法規要求以及吸引應用開發加入本地生態系統,正在重振義大利的ICT市場。結合本地可用區和本地邊緣伺服器的混合架構如今已成為主要製造商和銀行的標配,並將加速到2027年的工作負載遷移。

數位技能短缺

只有45%的義大利人具備基本的數位技能,低於歐盟設定的2030年80%的目標。目前,義大利網路安全專業人員缺口已超過1萬人,到2027年,資訊通訊技術(ICT)人才缺口可能高達17.5萬人,這將導致薪資上漲和計劃週期延長。義大利大學每年培養4.4萬名ICT畢業生,而全國實際需要8.8萬人。這迫使企業要麼引進人才,要麼將專業任務外包。儘管國家復甦與韌性計畫(PNRR)以及私立院校的技能發展計畫展現出一定的成效,但結構性改善預計要到2028年才能實現,義大利ICT市場的成長預計將會趨於平緩。

細分市場分析

截至2025年,電信服務將佔義大利資訊通訊技術(ICT)市場的34.12%,反映出義大利在5G和光纖回程傳輸的大規模投資。隨著銀行、公共產業和公共機構在國家網路安全策略的指導下加強關鍵業務,IT安全/網路安全產業正以12.4%的複合年成長率快速成長。預計到2025年,義大利與安全相關的ICT市場規模將達到24.7億美元,其中24億美元將用於威脅預防計劃。

預計2025年至2026年間,義大利將投資109億美元建置邊緣資料中心,將推動硬體銷售成長;同時,零售和物流行業的雲端原生開發和低程式碼應用也將帶動軟體需求。中小企業將外包轉型工作,IT供應商將從中受益;隨著超大規模雲端服務商在地化,雲端超大規模資料中心業者產業也將實現兩位數成長。這些因素共同推動義大利ICT市場維持成長勢頭,擺脫對傳統電信收入來源的依賴。

大型企業憑藉多年數位化策略和內部IT團隊的支持,將在2025年佔據義大利ICT市場59.15%的佔有率,它們目前優先考慮人工智慧增強型分析、自主資料架構和零信任架構。同時,中小企業的支出將以7.95%的複合年成長率成長,縮小數位落差,釋放潛在需求。一項價值3.27億美元的代金券計畫以及義大利南部地區的寬頻補貼政策降低了進入門檻。

然而,中小企業的採購仍然分散,營運商擴大將網路連接、雲端服務和安全性整合到固定價格套餐中。由於這些整合服務,Fastweb 和沃達豐企業部門在 2025 年第一季實現了 2.7% 的營收成長。那些能夠提供方便用戶使用型入口網站、雙語支援和按需付費模式的供應商,將有機會在義大利 ICT 市場抓住新的機會。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 市場定義與研究假設

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- NRRP資助的數位投資激增

- 企業正快速遷移到雲端。

- 全國範圍內的5G和FTTH部署

- 促進主權雲和 GAIA-X 合規性

- 製造叢集中的邊緣運算

- 公共部門混合雲端(PSN) 遷移

- 市場限制

- 數位技能短缺

- 宏觀經濟和能源價格波動

- 中小企業資訊通訊技術採購分散化問題

- 6G頻段監理延遲

- 價值/供應鏈分析

- 重要法規結構評估

- 關鍵相關人員影響評估

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素的影響

第5章 市場規模與成長預測

- 按類型

- IT硬體

- 電腦硬體

- 網路裝置

- 周邊設備

- IT軟體

- IT服務

- 託管服務

- 業務流程服務

- 商業諮詢服務

- 雲端服務

- IT基礎設施/資料中心

- IT安全/網路安全

- 解決方案

- 應用程式安全

- 雲端安全

- 資料安全

- 身分和存取管理

- 基礎設施保護

- 綜合風險管理

- 網路安全設備

- 其他解決方案

- 服務

- 專業服務

- 託管服務

- 解決方案

- 通訊服務

- IT硬體

- 按最終用戶公司規模分類

- 小型企業

- 主要企業

- 按最終用戶行業分類

- BFSI

- 資訊科技和電信

- 政府機構

- 零售與電子商務

- 製造業

- 衛生保健

- 能源與公共產業

- 其他

- 透過部署模式

- 本地部署

- 雲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Telecom Italia SpA(TIM)

- Fastweb SpA

- Vodafone Italia SpA

- Wind Tre SpA

- Leonardo SpA

- IBM Italia SpA

- Accenture SpA

- Capgemini Italia SpA

- Oracle Italia Srl

- Microsoft Italia Srl

- Google Cloud Italy Srl

- Amazon Web Services Italy Srl

- Engineering Ingegneria Informatica SpA

- Reply SpA

- AlmavivA SpA

- SIA SpA(Nexi Group)

- Dedagroup SpA

- Aruba SpA

- Dell Technologies Italy Srl

- Hewlett Packard Enterprise Italia Srl

- SAP Italia SpA

- Cisco Systems Italy Srl

- Italtel SpA

- InfoCert SpA

第7章 市場機會與未來趨勢

- 評估差距和未滿足的需求

The Italy ICT market was valued at USD 86.39 billion in 2025 and estimated to grow from USD 92.74 billion in 2026 to reach USD 132.13 billion by 2031, at a CAGR of 7.35% during the forecast period (2026-2031).

Current momentum stems from the government's National Recovery and Resilience Plan, private-sector capital inflows, and rapid migration toward sovereign cloud architectures that reduce legacy system dependence. Edge computing pilots in Northern manufacturing hubs, nationwide 5G densification, and fast-growing cybersecurity spend reinforce the shift toward data-centric services. At the same time, heightened investment from hyperscalers and domestic operators positions the Italy ICT market as a core part of Europe's digital value chain. Competitive intensity has risen following the Fastweb + Vodafone integration, which introduced a second full-service network alongside incumbent TIM's infrastructure, enabling broader connectivity options and nudging prices lower.

Italy ICT Market Trends and Insights

NRRP-funded Digital Investment Surge

The Piano Transizione 5.0 channelled USD 13.8 billion into enterprise digitalisation and energy efficiency, triggering record purchase orders for cloud, cybersecurity, and data integration tools . Allocation rules that earmark at least 20% of EU Recovery funds for digital objectives further extend the spending runway. Vendors that establish local delivery facilities in Mezzogiorno benefit from a USD 327 million Southern Italy budget line, which addresses regional gaps while lifting demand in traditionally underserved provinces. The funding cycle supports the Italy ICT market through 2029, creating a predictable pipeline for system integrators and telecom carriers.

Rapid Enterprise Cloud Migration

TIM recorded 19% cloud revenue growth in 2024, while its cybersecurity unit doubled sales, proving the link between cloud adoption and stronger security demand . Microsoft pledged USD 4.7 billion for new Italian data-center regions and AI labs, and AWS added USD 1.3 billion for edge zones that will inject USD 958 million into GDP over five years. These moves lower latency, address data-sovereignty rules, and draw application developers into local ecosystems, fuelling the Italy ICT market. Hybrid architectures that combine local availability zones with on-premise edge servers are now standard for large manufacturers and banks, accelerating workload migration through 2027.

Digital-Skills Deficit

Only 45% of Italians hold basic digital capabilities, below the EU's 80% target for 2030. Unfilled cybersecurity roles already exceed 10,000, and a 175,000-person ICT shortage is possible by 2027, squeezing wages and elongating project cycles. Universities produce 44,000 ICT graduates per year against 88,000 needed, prompting firms to import talent or outsource specialised tasks. Upskilling programmes in the PNRR and private academies help, yet structural relief will not arrive before 2028, capping the growth pace of the Italy ICT market.

Other drivers and restraints analyzed in the detailed report include:

- Nationwide 5G and FTTH Roll-out

- Sovereign-Cloud and GAIA-X Compliance Push

- Macroeconomic and Energy-Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Communication Services contributed a 34.12% share to the Italy ICT market in 2025, reflecting sizeable 5G and fiber backhaul capex. IT Security/Cybersecurity is expanding at an 12.4% CAGR as banks, utilities, and public agencies harden critical workloads under the National Cybersecurity Strategy. The Italy ICT market size for security reached USD 2.47 billion in 2025 and is projected to grow alongside USD 2.4 billion earmarked for threat-defence projects.

Edge-enabled data-center builds worth USD 10.9 billion for 2025-2026 elevate hardware sales, while software demand is fuelled by cloud-native development and low-code adoption in retail and logistics. IT Services vendors benefit from SMEs that outsource transformation tasks, and cloud units record double-digit gains as hyperscalers localise capacity. Together these shifts indicate the Italy ICT market will carry momentum beyond traditional telecom revenue streams.

Large Enterprises captured 59.15% of the Italy ICT market in 2025 thanks to multi-year digital agendas and in-house IT teams. They now prioritise AI-enhanced analytics, sovereign data fabrics, and zero-trust architectures. Conversely, SMEs are expected to expand spending at 7.95% CAGR, narrowing the digital divide and broadening addressable demand. Voucher schemes worth USD 327 million in Southern Italy, plus subsidised broadband tariffs, lower entry barriers.

SME procurement, however, remains fragmented, prompting operators to bundle connectivity, cloud, and security into fixed-price packages. Fastweb + Vodafone's Enterprise Business Unit posted 2.7% revenue growth in Q1 2025 on these converged offers. Vendors that combine user-friendly portals, bilingual support, and pay-as-you-grow terms are positioned to capture incremental Italy ICT market opportunities.

Italy ICT Market Report is Segmented by Type (IT Hardware [Computer Hardware, and More], IT Software, IT Services [Managed Service, and More], IT Infrastructure, and More), End-User Enterprise Size (Small and Medium Enterprise, Large Enterprises), End-User Industry (BFSI, IT and Telecom, and More), and Deployment Mode (On-Premise, Cloud). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Telecom Italia S.p.A. (TIM)

- Fastweb S.p.A.

- Vodafone Italia S.p.A.

- Wind Tre S.p.A.

- Leonardo S.p.A.

- IBM Italia S.p.A.

- Accenture S.p.A.

- Capgemini Italia S.p.A.

- Oracle Italia S.r.l.

- Microsoft Italia S.r.l.

- Google Cloud Italy S.r.l.

- Amazon Web Services Italy S.r.l.

- Engineering Ingegneria Informatica S.p.A.

- Reply S.p.A.

- AlmavivA S.p.A.

- SIA S.p.A. (Nexi Group)

- Dedagroup S.p.A.

- Aruba S.p.A.

- Dell Technologies Italy S.r.l.

- Hewlett Packard Enterprise Italia S.r.l.

- SAP Italia S.p.A.

- Cisco Systems Italy S.r.l.

- Italtel S.p.A.

- InfoCert S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 NRRP-funded digital investment surge

- 4.2.2 Rapid enterprise cloud migration

- 4.2.3 Nationwide 5G and FTTH roll-out

- 4.2.4 Sovereign-cloud and GAIA-X compliance push

- 4.2.5 Edge computing in manufacturing clusters

- 4.2.6 Public-sector hybrid cloud (PSN) transition

- 4.3 Market Restraints

- 4.3.1 Digital-skills deficit

- 4.3.2 Macroeconomic and energy-price volatility

- 4.3.3 Fragmented SME ICT procurement

- 4.3.4 Regulatory delay for 6G spectrum

- 4.4 Value / Supply-Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 IT Hardware

- 5.1.1.1 Computer Hardware

- 5.1.1.2 Networking Equipment

- 5.1.1.3 Peripherals

- 5.1.2 IT Software

- 5.1.3 IT Services

- 5.1.3.1 Managed Services

- 5.1.3.2 Business Process Services

- 5.1.3.3 Business Consulting Services

- 5.1.3.4 Cloud Services

- 5.1.4 IT Infrastructure / Data Centers

- 5.1.5 IT Security / Cybersecurity

- 5.1.5.1 Solutions

- 5.1.5.1.1 Application Security

- 5.1.5.1.2 Cloud Security

- 5.1.5.1.3 Data Security

- 5.1.5.1.4 Identity and Access Management

- 5.1.5.1.5 Infrastructure Protection

- 5.1.5.1.6 Integrated Risk Management

- 5.1.5.1.7 Network Security Equipment

- 5.1.5.1.8 Other Solutions

- 5.1.5.2 Services

- 5.1.5.2.1 Professional Services

- 5.1.5.2.2 Managed Services

- 5.1.5.1 Solutions

- 5.1.6 Communication Services

- 5.1.1 IT Hardware

- 5.2 By End-user Enterprise Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 IT and Telecom

- 5.3.3 Government

- 5.3.4 Retail and E-commerce

- 5.3.5 Manufacturing

- 5.3.6 Healthcare

- 5.3.7 Energy and Utilities

- 5.3.8 Others

- 5.4 By Deployment Mode

- 5.4.1 On-premise

- 5.4.2 Cloud

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Telecom Italia S.p.A. (TIM)

- 6.4.2 Fastweb S.p.A.

- 6.4.3 Vodafone Italia S.p.A.

- 6.4.4 Wind Tre S.p.A.

- 6.4.5 Leonardo S.p.A.

- 6.4.6 IBM Italia S.p.A.

- 6.4.7 Accenture S.p.A.

- 6.4.8 Capgemini Italia S.p.A.

- 6.4.9 Oracle Italia S.r.l.

- 6.4.10 Microsoft Italia S.r.l.

- 6.4.11 Google Cloud Italy S.r.l.

- 6.4.12 Amazon Web Services Italy S.r.l.

- 6.4.13 Engineering Ingegneria Informatica S.p.A.

- 6.4.14 Reply S.p.A.

- 6.4.15 AlmavivA S.p.A.

- 6.4.16 SIA S.p.A. (Nexi Group)

- 6.4.17 Dedagroup S.p.A.

- 6.4.18 Aruba S.p.A.

- 6.4.19 Dell Technologies Italy S.r.l.

- 6.4.20 Hewlett Packard Enterprise Italia S.r.l.

- 6.4.21 SAP Italia S.p.A.

- 6.4.22 Cisco Systems Italy S.r.l.

- 6.4.23 Italtel S.p.A.

- 6.4.24 InfoCert S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment