|

市場調查報告書

商品編碼

1910895

德國低溫運輸物流:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Germany Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

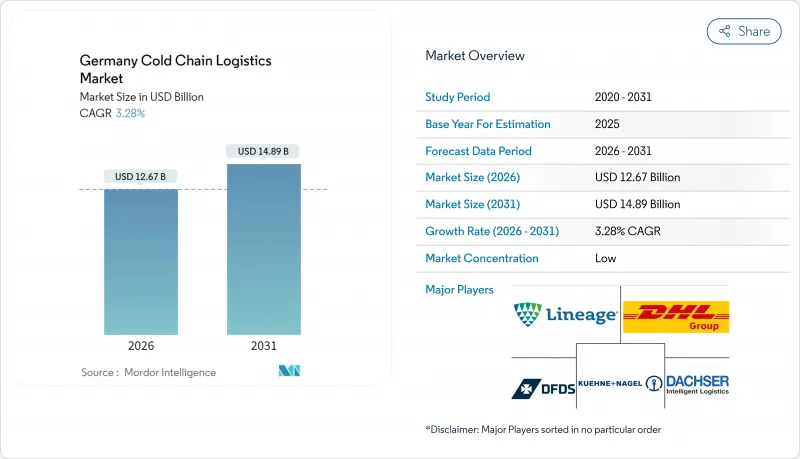

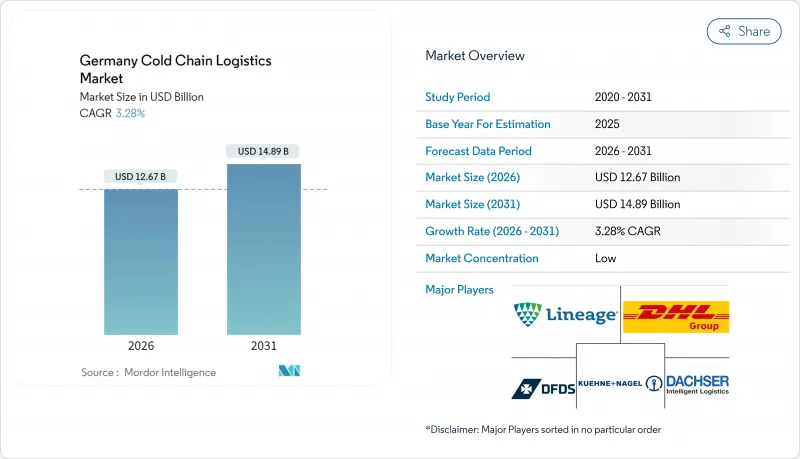

2025年德國低溫運輸物流市場價值122.7億美元,預計2031年將達到148.9億美元,高於2026年的126.7億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 3.28%。

強勁的電商食品需求、生物製藥出口的持續成長勢頭以及零售商對自動化保鮮管理項目的投資,正支撐著冷鏈物流市場的近期擴張;而天然製冷劑的維修和電動運輸車輛的引入,則提升了長期效率。現有的第三方物流供應商正透過物聯網追蹤、預測性維護和人工智慧驅動的路線最佳化等技術,對其網路數位化,以控制不斷上漲的能源成本並應對日益嚴格的環境法規。隨著客戶尋求端到端的合規解決方案,向超冷庫和綜合附加價值服務的多元化發展正在擴大利潤空間。德國低溫運輸物流市場持續受益於其位於歐洲貿易路線中心的戰略位置,以及政府為支持永續基礎設施更新而製定的獎勵。

德國低溫運輸物流市場趨勢與洞察

電子商務主導的B2C食品分銷擴張

預計到2024年,生鮮食品線上銷售額將達到32億美元,並在2025年進一步成長15-20%。這促使零售商和專業業者建造配備雙區自動化系統(2°C和常溫)的微型倉配中心,每小時可處理1,000份訂單。電動配送車輛,例如Aldi的「Mein Aldi」和Picnic配送中心使用的車輛,可減少排放氣體並符合嚴格的都市區噪音法規。更小的購物車和更短的配送時間正推動成本結構轉向更快速、數據驅動的路線規劃工具。物流業者正在利用預測分析,根據溫度敏感度重新安排配送順序,從而減少廢棄物並縮短最後一公里配送。這些營運效率的提升正在加快德國低溫運輸物流市場的服務水平,同時擴大其目標消費群。

擴大生物製藥和mRNA藥物的出口

預計到2024年,德國藥品出口額將達到1,058億歐元(1,167.6億美元),其中對溫度敏感的生技藥品成長最為迅速。光是DHL集團就計畫在2030年投資20億歐元(22億美元),用於建造符合GDP認證的物流中心、配備感測設備以及組成多溫區運輸車隊,以保障生技藥品和細胞療法產品的運輸安全。法蘭克福和慕尼黑周邊的生物技術走廊目前需要對-70°C至+25°C範圍內的貨物進行持續監控,這推動了即時追蹤、監管鏈文檔記錄以及人工智慧驅動的冷卻最佳化升級。這些能力正在鞏固德國作為歐洲領先的新型治療方法出口門戶的地位,並推動德國低溫運輸物流市場的加值服務收入成長。

合格冷凍技術人員短缺

截至2024年,超過60%的冷凍技師職缺仍未填補,這反映出勞動力老化和新入行者(尤其是女性)的缺乏。人才短缺導致維修前置作業時間延長和服務成本上升,迫使營運商採用遠距離診斷和預測性維護。儘管學徒制改革取得了一定進展,但德國低溫運輸物流行業的技能短缺預計至少還會持續兩年。

細分市場分析

到2025年,冷藏運輸將佔德國總收入的60.55%,鞏固德國作為歐洲門戶的地位。公路、鐵路、海運和空運線路相互連接,有效率運輸溫控貨物。黑格爾曼集團安裝的200台配備遠端資訊處理功能的冷王(Thermo King)設備便是該領域技術優勢的有力例證。在預測期內,自動化和電動車(EV)的普及應用將促進跨境物流,並持續保障生物製藥和高階食品的品質。

附加價值服務預計將以4.55%的複合年成長率成長,成為該細分市場中成長最快的領域。日益嚴格的GDP(溫度控制配送計畫)和HACCP(危害分析和關鍵控制點)合規監管要求,推動了對專業包裝、批次級監控和文件支援服務的需求。像Lineage 物流這樣的倉儲營運商正在將自動化揀貨和包裝系統與即時儀錶板整合,並將倉儲、運輸和合規活動整合到單一服務合約中。因此,隨著製造商將複雜操作外包,監管機構的審查力度加大,德國低溫運輸物流市場增值解決方案的市場規模預計將在未來幾年內持續成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務主導了B2C生鮮配送的成長

- 擴大生物製藥和mRNA藥物的出口

- 零售商推廣「雙鮮」自有品牌

- 電動車相容型多溫卡車車身需求激增

- 海產加工向北海沿岸港口近岸轉移

- 改用氨/二氧化碳天然冷媒的維修給予稅收優惠

- 市場限制

- 合格冷凍技術人員短缺

- 大型冷藏倉庫的電力價格波動

- 各城市對夜間送貨的噪音排放規定有差異

- 新建倉庫的規劃核准程序冗長

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按服務類型

- 冷藏保管

- 公共倉庫

- 私人倉庫

- 冷藏運輸

- 道路運輸

- 鐵路運輸

- 海上運輸

- 空運

- 附加價值服務

- 冷藏保管

- 按溫度類型

- 冷藏(0-5 度C)

- 冷凍(-18 至 0°C)

- 環境的

- 極低溫度(低於-20 度C)

- 透過使用

- 水果和蔬菜

- 肉類和家禽

- 魚貝類

- 乳製品和冷凍甜點

- 麵包和糖果

- 速食食品

- 藥品和生物製藥

- 疫苗和臨床試驗用品

- 化學品/特殊材料

- 其他生鮮產品

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Kuehne+Nagel International AG

- DHL Group

- Lineage Logistics LLC

- DFDS Logistics

- Dachser SE

- DSV

- Pfenning Logistics

- NewCold Advanced Logistics

- Heuer Logistics GmbH & Co. KG

- BLG Logistics

- Frigolanda Cold Logistics

- Scan Global Logistics

- Nordfrost GmbH & Co. KG

- Thermotraffic GmbH

- HAVI Logistics GmbH

- Fiege Logistik Stiftung & Co. KG

- CEVA Logistics

- Yusen Logistics

- Hellmann Worldwide Logistics

- Rhenus Logistics

第7章 市場機會與未來展望

The Germany Cold Chain Logistics Market was valued at USD 12.27 billion in 2025 and estimated to grow from USD 12.67 billion in 2026 to reach USD 14.89 billion by 2031, at a CAGR of 3.28% during the forecast period (2026-2031).

Robust e-commerce grocery demand, sustained biologics export momentum, and retailer investments in automated freshness programs underpin near-term expansion, while natural-refrigerant retrofits and electrified transport fleets reinforce long-term efficiencies. Established third-party logistics providers are digitalizing networks with IoT tracking, predictive maintenance, and AI-driven route optimization to contain rising energy costs and comply with tightening environmental rules. Portfolio diversification into ultra-low-temperature storage and integrated value-added services is widening margins as clients look for end-to-end compliance solutions. The Germany cold chain logistics market continues to benefit from the country's geographic position at the heart of European trade lanes and from public incentives supporting sustainable infrastructure upgrades.

Germany Cold Chain Logistics Market Trends and Insights

E-commerce-led rise in B2C grocery fulfillment

Online fresh-food sales reached USD 3.2 billion in 2024 and are expected to climb a further 15-20% in 2025, prompting retailers and pure-play operators to build micro-fulfillment centers equipped with dual-zone automation that can process 1,000 orders per hour at 2°C and ambient temperatures. Electric-vehicle delivery fleets, as adopted by Aldi's "Mein Aldi" and Picnic's hub model, reduce emissions and meet strict urban noise caps. Smaller basket sizes and shorter delivery windows have shifted cost structures toward high-velocity, data-driven routing tools. Logistics providers now deploy predictive analytics to re-sequence drops by thermal sensitivity, trimming spoilage and last-mile mileage. These operational upgrades accelerate the Germany cold chain logistics market's service standard while enlarging its addressable consumer base.

Growth of biologics & mRNA-based pharma exports

Germany exported EUR 105.8 billion (USD 116.76 billion) in pharmaceuticals during 2024, with temperature-sensitive biologics providing the fastest lift. DHL Group alone is investing EUR 2 billion (USD 2.20 billion) by 2030 in GDP-certified hubs, sensing equipment, and multi-temperature fleets to safeguard biologics and cell-therapy shipments. Biotech corridors around Frankfurt and Munich now demand continuous -70 °C to +25 °C visibility, triggering upgrades in real-time tracking, chain-of-custody documentation, and AI-enabled cooling optimization. These capabilities cement Germany's role as the preferred European export gateway for novel therapies, boosting premium service revenue across the Germany cold chain logistics market.

Scarcity of licensed refrigeration technicians

More than 60% of open refrigeration jobs remained unfilled in 2024, reflecting an aging workforce and limited new entrants, particularly women. Shortfalls elevate maintenance lead times and service costs, compelling operators to deploy remote diagnostics and predictive maintenance. Apprenticeship reforms are in place, yet the Germany cold chain logistics industry faces at least a two-year skill-gap overhang.

Other drivers and restraints analyzed in the detailed report include:

- Retailer push for "Doppelte Frische" (Double-Fresh) private labels

- Surge in EV-Compatible multi-temp truck bodies

- Grid-Energy price volatility for large cold stores

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerated transportation supplied 60.55% of 2025 revenue, underscoring Germany's status as a pan-European gateway where motorway, rail, sea, and air corridors interlock to move temperature-controlled cargo efficiently. Hegelmann Group's deployment of 200 telematics-enabled Thermo King units exemplifies the segment's technological edge. Over the forecast horizon, automation and EV adoption will continue to smooth cross-border flows and guarantee integrity for biologics and premium grocery lines.

Value-added services are forecast to expand at a 4.55% CAGR, the fastest within this classification. Rising regulatory burdens around GDP and HACCP compliance fuel demand for specialized packaging, batch-level monitoring, and documentation support. Storage operators such as Lineage Logistics are integrating automated pick-and-pack systems and real-time dashboards that merge warehousing, transport, and compliance activities into single-service agreements. The Germany cold chain logistics market size for value-added solutions is therefore primed for multi-year compound expansion as manufacturers outsource complexity and regulators tighten oversight.

The Germany Cold Chain Logistics Market Report is Segmented by Service Type (Refrigerated Storage, Refrigerated Transportation, Value-Added Services), Temperature Type (Chilled, Frozen, Ambient, Deep-Frozen/Ultra-Low), Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy & Frozen Desserts, Pharmaceuticals & Biologics and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Kuehne + Nagel International AG

- DHL Group

- Lineage Logistics LLC

- DFDS Logistics

- Dachser SE

- DSV

- Pfenning Logistics

- NewCold Advanced Logistics

- Heuer Logistics GmbH & Co. KG

- BLG Logistics

- Frigolanda Cold Logistics

- Scan Global Logistics

- Nordfrost GmbH & Co. KG

- Thermotraffic GmbH

- HAVI Logistics GmbH

- Fiege Logistik Stiftung & Co. KG

- CEVA Logistics

- Yusen Logistics

- Hellmann Worldwide Logistics

- Rhenus Logistics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-Commerce-led Rise in B2C Grocery Fulfilment

- 4.2.2 Growth of Biologics & mRNA-Based Pharma Exports

- 4.2.3 Retailer Push for "Doppelte Frische" (Double-Fresh) Private Labels

- 4.2.4 Surge in EV-Compatible Multi-Temp Truck Bodies

- 4.2.5 Near-Shoring of Seafood Processing to North Sea Ports

- 4.2.6 Tax Incentives for Ammonia/CO2 Natural-Refrigerant Retrofits

- 4.3 Market Restraints

- 4.3.1 Scarcity of Licensed Refrigeration Technicians

- 4.3.2 Grid-Energy Price Volatility for Large Cold Stores

- 4.3.3 Patchwork Municipal Noise-Emission Limits on Night-Time Deliveries

- 4.3.4 Lengthy Planning Approvals for Green-Field Warehouses

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Refrigerated Storage

- 5.1.1.1 Public Warehousing

- 5.1.1.2 Private Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.2.1 Road

- 5.1.2.2 Rail

- 5.1.2.3 Sea

- 5.1.2.4 Air

- 5.1.3 Value-Added Services

- 5.1.1 Refrigerated Storage

- 5.2 By Temperature Type

- 5.2.1 Chilled (0-5°C)

- 5.2.2 Frozen (-18 to 0°C)

- 5.2.3 Ambient

- 5.2.4 Deep-Frozen / Ultra-Low (less than-20°C)

- 5.3 By Application

- 5.3.1 Fruits and Vegetables

- 5.3.2 Meat and Poultry

- 5.3.3 Fish and Seafood

- 5.3.4 Dairy and Frozen Desserts

- 5.3.5 Bakery and Confectionery

- 5.3.6 Ready-to-Eat Meals

- 5.3.7 Pharmaceuticals and Biologics

- 5.3.8 Vaccines and Clinical Trial Materials

- 5.3.9 Chemicals and Specialty Materials

- 5.3.10 Other Perishables

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Kuehne + Nagel International AG

- 6.4.2 DHL Group

- 6.4.3 Lineage Logistics LLC

- 6.4.4 DFDS Logistics

- 6.4.5 Dachser SE

- 6.4.6 DSV

- 6.4.7 Pfenning Logistics

- 6.4.8 NewCold Advanced Logistics

- 6.4.9 Heuer Logistics GmbH & Co. KG

- 6.4.10 BLG Logistics

- 6.4.11 Frigolanda Cold Logistics

- 6.4.12 Scan Global Logistics

- 6.4.13 Nordfrost GmbH & Co. KG

- 6.4.14 Thermotraffic GmbH

- 6.4.15 HAVI Logistics GmbH

- 6.4.16 Fiege Logistik Stiftung & Co. KG

- 6.4.17 CEVA Logistics

- 6.4.18 Yusen Logistics

- 6.4.19 Hellmann Worldwide Logistics

- 6.4.20 Rhenus Logistics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment