|

市場調查報告書

商品編碼

1910699

印度低溫運輸物流:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)India Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

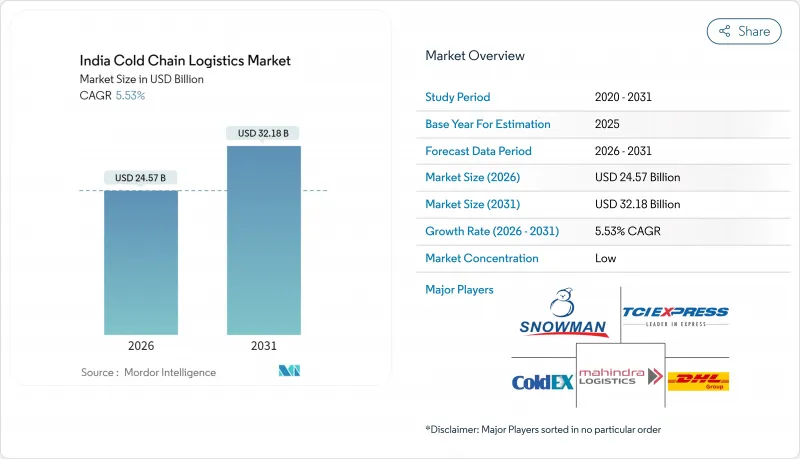

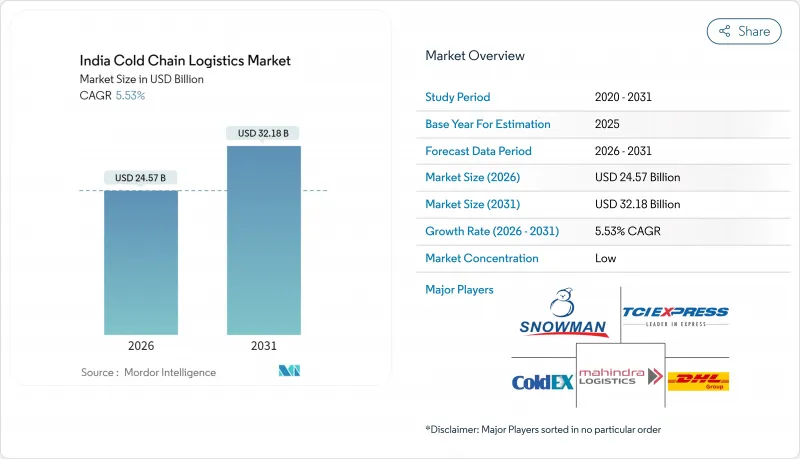

據估計,印度低溫運輸物流市場規模從2025年的232.8億美元成長到2026年的245.7億美元,預計到2031年將達到321.8億美元,2026年至2031年的複合年成長率為5.53%。

蓬勃發展的都市區餐飲服務業、倉儲公共補貼以及生物製藥醫藥產品線的共同推動,印度物流業正從傳統的分散式散裝倉儲模式向一體化、端到端的溫控解決方案發生決定性轉變。印度冷凍行動計畫旨在推廣節能資產,而國家物流政策則致力於提高物流業佔GDP的比重,以反映效率的提升,鼓勵營運商升級車隊並採用基於人工智慧的路線規劃。液化天然氣高速公路、生鮮電商配送中心以及基於電子車輛識別碼(eVIN)的疫苗監測系統,都進一步強化了對可靠的超低溫配送的需求。同時,高效能壓縮機的進口關稅壁壘以及冷凍車司機長期短缺,限制了短期發展勢頭,同時也提高了市場准入門檻,有利於具有規模優勢的一體化運營商。私人企業對太陽能混合動力倉庫和綠色能源冷凍車的投資,進一步凸顯了那些尋求碳中和成長路徑的企業之間的差異化優勢。

印度低溫運輸物流市場趨勢與洞察

國家天然氣管網的擴建將使冷藏液化天然氣卡車運輸成為可能。

預計2030年,全國天然氣管道滲透率將達70%。這將促成1,000座液化天然氣(LNG)加氣站的建設,使冷藏車與柴油相比,燃料成本降低約20%,長途運輸的二氧化碳排放減少約25%。古吉拉突邦和拉賈斯坦邦已在其高出口量路線上建造了LNG走廊,馬哈拉施特拉邦的葡萄和洋蔥出口商也受益於運輸過程中更穩定的溫度控制。馬哈拉斯特拉邦石油公司計劃在2025年建成50座LNG零售站,將縮短加氣間隔,並加速冷凍車改造計畫的實施。更清潔的燃燒帶來的更低維護成本將使車隊所有者的生命週期成本降低30-40%,進一步推動印度低溫運輸物流市場對LNG的採用。

政府補貼的大型冷藏倉庫項目

在「總理農民財富計畫」(PM Kisan Sampada Yojana)下,394個已獲批准的計劃旨在透過標準化樞紐建設,將果蔬採後損失減少25%至30%。國家低溫運輸發展中心提供工程模板,以協調包裝廠和運輸規範,從而提高印度低溫運輸物流市場的互通性。補貼將彌補小規模農業邦的資金缺口,但當地電網的可靠性和操作人員培訓對於專案實施至關重要,目前正在推廣公私合營,以維修太陽能備用電源裝置。

地方城市電網不穩定

大城市以外的冷庫經常遭遇停電,導致依賴柴油發電機,會使能源成本增加18%至22%,增加溫度波動的風險,進而降低生鮮食品的價值。雖然阿薩姆邦的一個太陽能原型機可以將溫度維持在攝氏4至10度之間長達30小時,但高昂的前期成本阻礙了小規模生產商採用該技術。長期電網現代化對於農村低溫運輸的永續性仍然至關重要。

細分市場分析

至2025年,冷藏將佔印度低溫運輸物流市場40.62%的佔有率。這主要歸因於以往對農產品散裝商品的投資分散,以及「總理農民收入補貼計畫」(PM Kisan Sampada)仍可用於擴大產能。雖然目前80%的冷藏運輸路線為道路運輸運輸,但專用貨運走廊(DFC)的建設有望推動運輸方式的轉變並縮短停留時間。從條碼貼標到套件組裝附加價值服務預計將推動市場在2031年前以5.22%的複合年成長率成長,因為全通路零售商正在尋求一站式解決方案。像Snowman 物流這樣的營運商正在建立多客戶冷庫,並配備用於品質保證審核和托盤重新包裝的整合工作台,從而提高交叉轉運的處理速度。

對綜合服務日益成長的需求也促使公共一體化倉儲模式的出現。透過將資本投資與第三方物流管理合約分離,這種模式使中小型生產者無需前期投資即可使用更完善的設施。印度貨櫃公司(CONCOR)的鐵路專用冷藏貨櫃抵達東部的漁業樞紐,減少了產品新鮮度的劣化,並擴大了印度海運出口的低溫運輸物流市場。雖然空運走廊是一個小眾市場,貨運量佔不到2%,但它對於將高價值生技藥品運往歐洲和北美仍然至關重要。隨著零售商將倉庫管理系統(WMS)平台直接連接到倉庫溫度記錄,服務供應商正在利用數據分析儀表板來最佳化庫存週轉並減少能源高峰,從而實現盈利。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 都市化帶動餐飲業快速發展

- 政府補貼的大型冷藏倉庫項目

- 拓展生物製劑及疫苗研發管線

- 最後一公里冷藏生鮮電商配送的需求

- 引入人工智慧最佳化路線和載重規劃

- 以綠色能源為基礎的冷藏車隊

- 市場限制

- 二、三線城市電網不穩定

- 小規模倉庫所有權分散化

- 冷藏車駕駛人短缺

- 對高效率壓縮機徵收高額進口關稅

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按服務類型

- 冷藏保管

- 公共倉庫

- 私人倉庫

- 冷藏運輸

- 道路運輸

- 鐵路

- 海上運輸

- 航空郵件

- 附加價值服務

- 冷藏保管

- 按溫度類型

- 冷藏(0-5°C)

- 冷凍(-18 至 0°C)

- 環境的

- 超低溫冷凍(低於-20°C)

- 透過使用

- 水果和蔬菜

- 肉類/家禽

- 魚貝類

- 乳製品和冷凍甜點

- 麵包糖果甜點

- 速食食品

- 藥品和生物製藥

- 疫苗和臨床試驗材料

- 化學品/特殊材料

- 其他生鮮產品

- 按地區

- 印度北部

- 新德里(NCR)

- 旁遮普邦

- 哈里亞納邦

- 其他

- 南印度

- 卡納塔克邦

- 泰米爾納德邦

- 特倫甘納邦

- 其他

- 西印度群島

- 馬哈拉斯特拉邦

- 古吉拉突邦

- 其他

- 東印度

- 西孟加拉邦

- 奧裡薩邦

- 其他

- 印度中部

- 中央邦

- 恰蒂斯加爾邦

- 印度北部

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Snowman Logistics Ltd

- ColdEx Logistics Pvt Ltd

- TCI Express Ltd

- DHL Supply Chain India

- Mahindra Logistics Ltd

- Gubba Cold Storage Ltd

- Cold Star Logistics Pvt Ltd

- CONCOR Cold Chain Logistics

- Crystal Logistics Cool Chain Ltd

- RK Foodland Pvt Ltd

- Indraprastha Cold Storage

- Arihant Cold Storage

- Godamwale

- Siddhi Cold Chain

- Coldrush Logistics

- Coldman Warehousing & Distribution

- Indicold Private Limited

- GK Cold Chain Solutions

- Transworld

- CEVA Logistics(Stellar Value Chain Solutions Pvt Ltd)

第7章 市場機會與未來展望

The India Cold Chain Logistics Market size in 2026 is estimated at USD 24.57 billion, growing from 2025 value of USD 23.28 billion with 2031 projections showing USD 32.18 billion, growing at 5.53% CAGR over 2026-2031.

Rapid urban food-service growth, public subsidies for warehousing, and biologics-heavy pharma pipelines collectively steer a decisive move from isolated bulk storage toward integrated end-to-end temperature-controlled solutions. The India Cooling Action Plan promotes energy-efficient assets, while the National Logistics Policy targets a logistics-to-GDP ratio that signifies enhanced efficiency, encouraging operators to upgrade fleets and adopt AI-based routing. LNG-ready highways, e-grocery fulfillment hubs, and eVIN-enabled vaccine monitoring strengthen demand for reliable sub-zero distribution. Meanwhile, import duty barriers on high-efficiency compressors and a chronic reefer-driver shortfall temper near-term momentum but also raise entry thresholds that favor integrated operators with scale advantages. Private investments in solar-hybrid depots and green-energy reefer fleets further differentiate players seeking carbon-aligned growth trajectories.

India Cold Chain Logistics Market Trends and Insights

Expansion of National Gas Grid Enabling LNG-Fuelled Reefer Trucking

Nationwide pipeline roll-outs are slated to lift natural-gas coverage to 70% by 2030, underpinning 1,000 LNG fueling points that offer refrigerated fleets fuel cost savings near 20% against diesel and carbon cuts near 25% for long hauls. Gujarat and Rajasthan already deploy LNG corridors on export-heavy routes, while Maharashtra's grape and onion exporters gain from steadier line-haul temperatures. Indian Oil's target of 50 LNG retail sites by 2025 shortens refueling gaps and accelerates reefer conversion programs. Lower maintenance expenses from cleaner combustion add 30-40% life-cycle savings for fleet owners, supplying further tailwinds to the India cold chain logistics market adoption curves.

Government-Subsidized Bulk-Cold-Storage Schemes

Under the PM Kisan Sampada Yojana, 394 sanctioned projects aim to curb the 25-30% post-harvest losses in fruit and vegetables by building standardized hubs. The National Centre for Cold-chain Development provides engineering templates that unify pack-house and transport specs, improving interoperability across the India cold chain logistics market. Subsidies close funding gaps in smaller agri-states, but execution rests on local grid reliability and operator training, prompting public-private tie-ups for solar-backup retrofits.

Power-Grid Instability in Tier-2/3 Cities

Cold stores outside metro hubs confront frequent outages that trigger diesel genset reliance, lifting energy spends by 18-22% and risking temperature excursions that jeopardize perishable value. Solar-powered prototypes in Assam sustain 4-10 °C for 30 hours, but upfront costs deter adoption among smallholders. Long-term grid modernization remains pivotal to rural cold chain viability.

Other drivers and restraints analyzed in the detailed report include:

- Pharma Biologics & Vaccine Pipeline Expansion

- E-Grocery Last-mile Refrigerated Demand

- Fragmented Ownership of Small Warehouses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerated storage retains 40.62% India cold chain logistics market share in 2025, owing to historically siloed investments in bulk agri commodities, and it still attracts PM Kisan Sampada grants for capacity additions. Road haulage underpins 80% of refrigerated transportation lanes, but Dedicated Freight Corridors promise modal shifts that can curb dwell times. Value-added services, from barcoded labeling to kitting, are forecast to outperform at a 5.22% CAGR through 2031 as omnichannel retailers seek single-window solutions. Operators such as Snowman Logistics now position multi-client chambers adjacent to integration desks that handle QA audits and pallet reconsolidation, bolstering cross-dock velocity.

Demand for comprehensive offerings also sparks hybrid public-private depot models that split shell investment from 3PL management contracts, letting smaller farmers tap upgraded facilities without upfront capital. Rail-enabled reefer containers by CONCOR reach eastern fishery hubs, shrinking spoilage and expanding the reach of the India cold chain logistics market size for marine exports. Air-cargo corridors stay niche, accounting for less than 2% of volumes, yet remain indispensable for high-value biologics dispatches to Europe and North America. As retailers link WMS platforms directly to warehouse temperature logs, service providers monetize data analytics dashboards that optimize SKU rotation and cut energy peaks.

The India Cold Chain Logistics Market Report is Segmented by Service Type (Refrigerated Storage, Refrigerated Transportation, and Value-Added Services), Temperature Type (Chilled, Frozen, Ambient, and Deep-Frozen/Ultra-Low), Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy & Frozen Desserts, and More), Region (North India, South India, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Snowman Logistics Ltd

- ColdEx Logistics Pvt Ltd

- TCI Express Ltd

- DHL Supply Chain India

- Mahindra Logistics Ltd

- Gubba Cold Storage Ltd

- Cold Star Logistics Pvt Ltd

- CONCOR Cold Chain Logistics

- Crystal Logistics Cool Chain Ltd

- R. K. Foodland Pvt Ltd

- Indraprastha Cold Storage

- Arihant Cold Storage

- Godamwale

- Siddhi Cold Chain

- Coldrush Logistics

- Coldman Warehousing & Distribution

- Indicold Private Limited

- GK Cold Chain Solutions

- Transworld

- CEVA Logistics (Stellar Value Chain Solutions Pvt Ltd)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urbanisation-linked Food-service Boom

- 4.2.2 Government-subsidised Bulk-Cold-Storage Schemes

- 4.2.3 Pharma Biologics & Vaccine Pipeline Expansion

- 4.2.4 E-grocery Last-mile Refrigerated Demand

- 4.2.5 AI-optimised Route & Load Planning Adoption

- 4.2.6 Green-Energy-Based Reefer Fleets

- 4.3 Market Restraints

- 4.3.1 Power-grid Instability in Tier-2/3 Cities

- 4.3.2 Fragmented Ownership of Small Warehouses

- 4.3.3 Reefer-truck Driver Shortage

- 4.3.4 High Import Duty on High-efficiency Compressors

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Refrigerated Storage

- 5.1.1.1 Public Warehousing

- 5.1.1.2 Private Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.2.1 Road

- 5.1.2.2 Rail

- 5.1.2.3 Sea

- 5.1.2.4 Air

- 5.1.3 Value-Added Services

- 5.1.1 Refrigerated Storage

- 5.2 By Temperature Type

- 5.2.1 Chilled (0-5 °C)

- 5.2.2 Frozen (-18-0 °C)

- 5.2.3 Ambient

- 5.2.4 Deep-Frozen / Ultra-Low (less than-20 °C)

- 5.3 By Application

- 5.3.1 Fruits & Vegetables

- 5.3.2 Meat & Poultry

- 5.3.3 Fish & Seafood

- 5.3.4 Dairy & Frozen Desserts

- 5.3.5 Bakery & Confectionery

- 5.3.6 Ready-to-Eat Meals

- 5.3.7 Pharmaceuticals & Biologics

- 5.3.8 Vaccines & Clinical Trial Materials

- 5.3.9 Chemicals & Specialty Materials

- 5.3.10 Other Perishables

- 5.4 By Region

- 5.4.1 North India

- 5.4.1.1 Delhi-NCR

- 5.4.1.2 Punjab

- 5.4.1.3 Haryana

- 5.4.1.4 Others

- 5.4.2 South India

- 5.4.2.1 Karnataka

- 5.4.2.2 Tamil Nadu

- 5.4.2.3 Telangana

- 5.4.2.4 Others

- 5.4.3 West India

- 5.4.3.1 Maharashtra

- 5.4.3.2 Gujarat

- 5.4.3.3 Others

- 5.4.4 East India

- 5.4.4.1 West Bengal

- 5.4.4.2 Odisha

- 5.4.4.3 Others

- 5.4.5 Central India

- 5.4.5.1 Madhya Pradesh

- 5.4.5.2 Chhattisgarh

- 5.4.1 North India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Snowman Logistics Ltd

- 6.4.2 ColdEx Logistics Pvt Ltd

- 6.4.3 TCI Express Ltd

- 6.4.4 DHL Supply Chain India

- 6.4.5 Mahindra Logistics Ltd

- 6.4.6 Gubba Cold Storage Ltd

- 6.4.7 Cold Star Logistics Pvt Ltd

- 6.4.8 CONCOR Cold Chain Logistics

- 6.4.9 Crystal Logistics Cool Chain Ltd

- 6.4.10 R. K. Foodland Pvt Ltd

- 6.4.11 Indraprastha Cold Storage

- 6.4.12 Arihant Cold Storage

- 6.4.13 Godamwale

- 6.4.14 Siddhi Cold Chain

- 6.4.15 Coldrush Logistics

- 6.4.16 Coldman Warehousing & Distribution

- 6.4.17 Indicold Private Limited

- 6.4.18 GK Cold Chain Solutions

- 6.4.19 Transworld

- 6.4.20 CEVA Logistics (Stellar Value Chain Solutions Pvt Ltd)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment