|

市場調查報告書

商品編碼

1906259

印尼低溫運輸物流:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Indonesia Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

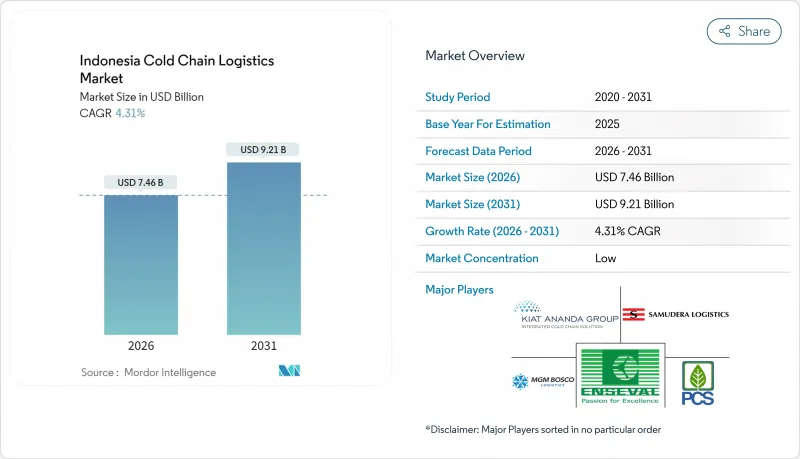

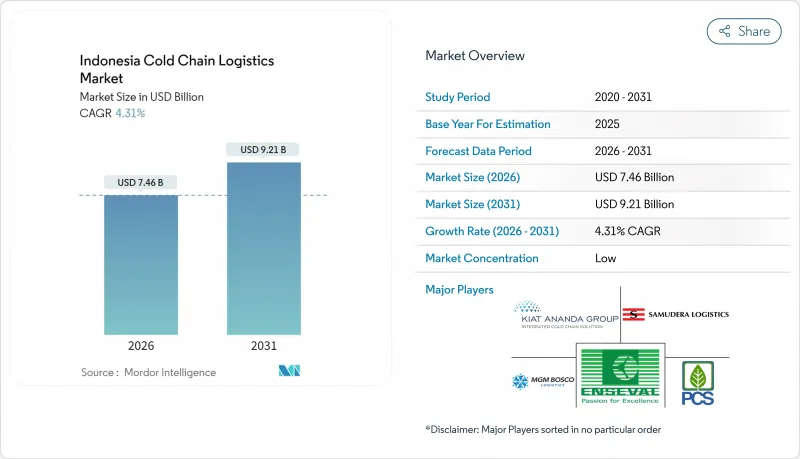

2025年,印尼低溫運輸物流市場價值為71.5億美元,預計從2026年的74.6億美元成長到2031年的92.1億美元,在預測期(2026-2031年)內複合年成長率為4.31%。

此次市場回暖反映了印尼致力於物流基礎設施現代化、降低全國配送成本以及開發高價值生鮮食品新出口管道的努力。政府的「印尼物流」(SiNasLog)計畫進一步推動了成長勢頭,該計畫旨在到2024年將物流成本佔GDP的比重降至14.29%,並力爭到2045年降至8%。生鮮電商的快速普及、水產品出口的激增以及全國範圍內的疫苗分發,都推動了對溫控倉儲設施和附加價值服務的需求。企業正投資物聯網感測器、區塊鏈溯源技術和太陽能微型冷藏倉庫,以提高可靠性、符合清真認證標準,並將服務擴展到偏遠島嶼。港口數位化和船隊升級以適應冷藏船的需求,將進一步鞏固印尼作為區域冷藏物流樞紐的地位。

印尼低溫運輸物流市場趨勢與洞察

冷凍水產品和肉類出口快速成長

印尼是世界第二大漁業生產國,海洋事務和漁業部正致力於提升水產養殖標準,以滿足高階出口市場的需求。蘇門答臘島和蘇拉威西島新建的冷藏保管縮短了出口前置作業時間,並幫助加工商滿足美國和歐盟的溫度控制通訊協定。近期一份每月向美國出口160萬枚雞蛋的契約,印證了需要經認證的冷藏設施的蛋白質出口量不斷成長。一個整合的品質保證平台結合了物聯網感測器和區塊鏈技術,確保監管鏈數據的安全,從而增強了買家的信心和定價權。隨著海灣市場對經認證的清真水產品需求不斷成長,以出口為導向的加工商正在增建符合政府第42/2024號法規的專用清真冷庫。這些投資吸引了國際航空公司增加冷藏航班,從而擴大了印尼的低溫運輸物流市場。

生鮮電商和最後一公里冷藏配送業務快速成長

印尼電子商務市場預計將從2024年的587億美元快速成長至2028年的868.1億美元,其中生鮮食品類別成長尤為顯著。網購消費者期望生鮮和冷凍食品在24小時內送達,這迫使平台業者在人口密集的都市區地區部署暗店、轉運微型樞紐和冷藏摩托車配送網路。根據第31/2023號部長級條例簡化的許可程序,Start-Ups得以快速部署冷藏配送服務。大型小包裹整合商,例如NCS,目前營運160個配備自主研發的倉庫管理系統(WMS)的多功能倉庫,可在揀貨過程中維持±1°C的溫度精度。先進的溫度探頭可向配送員的手持終端機發送即時警報,防止產品劣化,增強消費者信心。這些發展為印尼低溫運輸物流市場注入了新的資金,並推動了使用電池驅動的冷藏摩托車進行零排放城市配送的試驗。

電力和柴油燃料成本上漲

冷庫耗電量龐大,2024年電力和柴油價格的上漲將對營運商的利潤率造成壓力。雖然卡車生物柴油計畫已推進至B35混合燃料,但固定式冷庫仍依賴石化燃料發電。普拉博沃總統提出的「15年內逐步淘汰燃煤發電廠」的目標需要新增75吉瓦可再生能源,但程序上的延誤阻礙了產能擴張。太陽能冷凍系統前景廣闊:本地設計的太陽能冷凍機組單價為2,682美元,能源效率比(COP)為0.69,適用於疫苗儲存。然而,資金籌措障礙和複雜的土地租賃條款限制了其推廣應用。因此,在低碳電力更廣泛應用之前,高昂的能源成本將阻礙印尼低溫運輸物流市場的擴張。

細分市場分析

至2025年,冷藏倉儲將佔印尼低溫運輸物流市場53.40%的佔有率,並繼續作為該國國家糧食安全儲備的基石。政府的米、雞蛋和水產品儲備需要在雅加達、泗水和棉蘭附近建造大型冷庫,以確保戰略儲備能夠出口並抵禦通貨膨脹。營運商正在對其設施維修,使其採用氨或二氧化碳製冷系統,以符合《基加利協議》的標準。利用數位雙胞胎技術最佳化氣流模式,已使能源消耗年減了8%。區塊鏈技術的整合檢驗清真出口貨物的真偽,並縮短目的港的清關程序。

隨著製造商將先前內部完成的標籤、包裝和品質保證工作外包,附加價值服務正以4.73%的複合年成長率快速成長。 42/2024號法規強制要求清真產品和非清真產品分開存放,這推動了對隔離式倉庫和認證檢驗員的需求激增。這為第三方物流(3PL)營運商帶來了機會。在運輸領域,道路運輸主導採用保溫硬箱和GPS定位感測器,實現了98.35%的溫度記錄即時上傳。市佔率依然可觀,但較為分散。海運需求不斷成長,主要得益於印尼Samudera公司斥資2.8億美元擴充船隊,加強了從望加錫到中國的支線運輸服務。 DHL開設香港至雅加達的直航服務,縮短了高價值生技藥品的交付時間,進一步鞏固了高階空運市場。這些服務創新正在重塑印尼低溫運輸物流市場的競爭格局。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 冷凍水產品和肉類出口快速成長

- 生鮮電商和最後一公里冷藏配送業務快速成長

- 政府推動「SiNasLog」物流基礎設施的發展

- 擴大藥品低溫運輸(疫苗/生物製藥)

- 出口對清真認證低溫運輸的需求

- 適用於離網島嶼的太陽能微型冷藏倉庫

- 市場限制

- 電力和柴油燃料成本上漲

- 爪哇走廊以外的產能缺口

- 持有資格的冷藏車駕駛人短缺

- 逐步減少基加利冷媒相關的改造成本

- 價值/供應鏈分析

- 監管環境

- 政府法規和政策

- 清真標準和認證的影響

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈/供應鏈分析

第5章 市場規模與成長預測

- 按服務類型

- 冷藏保管

- 公共倉庫

- 私人倉庫

- 冷藏運輸

- 道路運輸

- 鐵路

- 海上運輸

- 航空郵件

- 附加價值服務

- 冷藏保管

- 按溫度類型

- 冷藏(0-5°C)

- 冷凍(-18 至 0°C)

- 環境的

- 超低溫冷凍(低於-20°C)

- 透過使用

- 水果和蔬菜

- 肉類/家禽

- 魚貝類

- 乳製品和冷凍甜點

- 麵包糖果甜點

- 蒸餾食品

- 藥品和生技藥品

- 疫苗和臨床試驗材料

- 化學品/特殊材料

- 其他生鮮產品

- 按地區(印尼)

- 爪哇島(雅加達和博多)

- 蘇門答臘

- 加里曼丹

- 蘇拉威西

- 努沙登加拉,峇里島

- 其他

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Kiat Ananda Group

- Enseval Putera Megatrading Tbk

- MGM Bosco Logistics

- Samudera Logistics

- Pluit Cold Storage

- PT International Mega Sejahtera

- PT YCH Indonesia

- PT Wira Logitama Saksama

- DHL Supply Chain Indonesia

- PT BGR Logistik Indonesia

- PT Wahana Cold Storage

- Yusen Logistics

- Ninja Xpress

- Nippon Express

- PT Tira Cipta Logistik(TCL)

- CKL Indonesia Raya(CKL Cargo)

- PT Perishable Logistics Indonesia(PLI)

- PT Mitsubishi Logistics Indonesia

- JAS Worldwide

- Coolkas

第7章 市場機會與未來展望

第8章附錄

- 冷藏倉儲設施年度統計數據

- 冷凍食品進出口貿易數據

- 食品運輸和儲存的法規結構

- 食品飲料產業指標

The Indonesia Cold Chain Logistics Market was valued at USD 7.15 billion in 2025 and estimated to grow from USD 7.46 billion in 2026 to reach USD 9.21 billion by 2031, at a CAGR of 4.31% during the forecast period (2026-2031).

The market's upward trajectory reflects Indonesia's efforts to modernize logistics infrastructure, lower nationwide distribution costs, and unlock new export channels for high-value perishable goods. Growth momentum is reinforced by the government's SiNasLog program, which reduced logistics costs to 14.29% of GDP in 2024 and is targeting 8% by 2045. Rapid e-grocery adoption, surging seafood exports, and nationwide vaccine distribution have pushed up demand for temperature-controlled storage and value-added services. Companies are investing in IoT sensors, blockchain traceability, and solar-powered micro cold stores to improve reliability, meet halal certification rules, and extend reach to off-grid islands. Digitalization of ports and reefer-friendly vessel upgrades further strengthen Indonesia's role as a regional refrigeration hub.

Indonesia Cold Chain Logistics Market Trends and Insights

Surge in Frozen Seafood & Meat Exports

Indonesia remains the world's second-largest fisheries producer, and the Ministry of Marine Affairs and Fisheries is upgrading aquaculture standards to satisfy premium export markets. New cold storage nodes on Sumatra and Sulawesi shorten export lead times, helping processors meet U.S. and EU temperature protocols. A recent deal to ship 1.6 million eggs monthly to the United States underlines rising protein export volumes that need certified refrigerated handling. Integrated quality-assurance platforms combine IoT sensors and blockchain to secure chain-of-custody data, boosting buyer confidence and pricing power. As demand for verified halal seafood rises in Gulf markets, export-oriented processors are adding dedicated halal-only cold rooms compliant with Government Regulation 42/2024. These investments broaden the Indonesian cold chain logistics market by attracting international carriers to schedule additional reefer-equipped sailings.

E-grocery & Last-mile Refrigerated Delivery Boom

Indonesia's e-commerce value is forecast to jump from USD 58.7 billion in 2024 to USD 86.81 billion in 2028, with groceries as a standout growth category. Online shoppers expect fresh and frozen items to arrive within 24 hours, forcing platforms to deploy dark stores, cross-dock micro hubs, and refrigerated two-wheeler fleets in dense urban corridors. Ministerial Regulation 31/2023 simplified licensing, enabling start-ups to roll out chilled delivery services faster. Large parcel integrators such as NCS now operate 160 multipurpose warehouses equipped with proprietary WMS that maintain +-1 °C precision during order picking. Advanced temperature probes dispatch real-time alerts to riders' handhelds, preventing spoilage and reinforcing consumer trust. These dynamics inject fresh capital into the Indonesia cold chain logistics market and foster experimentation with battery-powered refrigerated bikes for zero-emission urban fulfillment.

High Electricity & Diesel Costs

Cold rooms draw heavy power, yet grid tariffs and generator diesel prices climbed in 2024, squeezing operators' margins. While the biodiesel program advanced to a B35 blend for trucks, stationary warehouses still rely on fossil-based electricity. President Prabowo's pledge to retire coal plants within 15 years requires 75 GW of new renewables, but procedural delays slow capacity additions. Solar chillers show promise: locally engineered units cost USD 2,682 each and deliver a 0.69 coefficient of performance suitable for vaccines. Yet financing hurdles and land-lease complexities limit widespread deployment. High energy costs, therefore, temper the Indonesia cold chain logistics market expansion until low-carbon electricity becomes more accessible.

Other drivers and restraints analyzed in the detailed report include:

- Government "SiNasLog" Logistics-Infrastructure Push

- Pharmaceutical Cold-Chain Expansion (Vaccines/Biologics)

- Capacity Gap Outside Java Corridor

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerated storage contributed 53.40% to the Indonesia cold chain logistics market in 2025 and continues to anchor national food security reserves. Government rice, egg, and seafood buffers require bulk cold depots near Jakarta, Surabaya, and Medan, ensuring strategic stockpiles remain export-ready and inflation-proof. Operators retrofit facilities with ammonia or CO2 systems to comply with Kigali standards, while digital twins optimize airflow patterns and cut energy use 8% year-on-year. Blockchain integration verifies product authenticity for halal export consignments, shortening clearance at destination ports.

Value-added services are expanding at a 4.73% CAGR as manufacturers outsource labelling, portioning, and quality-assurance workflows that once occurred in-house. Regulation 42/2024 compels separate halal and non-halal lines, spurring demand for segregated rooms and certified inspectors, a boon for third-party logistics (3PLs). Transportation retains a large but fragmented share, led by road carriers deploying insulation-grade rigid boxes and GPS-linked sensors that upload 98.35% of temperature logs in real time. Maritime traffic gains from Samudera Indonesia's USD 280 million vessel expansion, bolstering feeder links from Makassar to China. Airfreight's premium niche is reinforced by DHL's direct Hong Kong-Jakarta rotation, shaving delivery times for high-value biologics. Collectively, service innovation is reshaping competitive boundaries within the Indonesia cold chain logistics market.

The Indonesia Cold Chain Logistics Market Report is Segmented by Service Type (Refrigerated Storage, Refrigerated Transportation, and Value-Added Services), Temperature Type (Chilled, Frozen, Ambient, and Deep-Frozen/Ultra-Low), Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy & Frozen Desserts, and More), Region (Java, Sumatra, Kalimantan, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Kiat Ananda Group

- Enseval Putera Megatrading Tbk

- MGM Bosco Logistics

- Samudera Logistics

- Pluit Cold Storage

- PT International Mega Sejahtera

- PT YCH Indonesia

- PT Wira Logitama Saksama

- DHL Supply Chain Indonesia

- PT BGR Logistik Indonesia

- PT Wahana Cold Storage

- Yusen Logistics

- Ninja Xpress

- Nippon Express

- PT Tira Cipta Logistik (TCL)

- CKL Indonesia Raya (CKL Cargo)

- PT Perishable Logistics Indonesia (PLI)

- PT Mitsubishi Logistics Indonesia

- JAS Worldwide

- Coolkas

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in frozen seafood & meat exports

- 4.2.2 E-grocery & last-mile refrigerated delivery boom

- 4.2.3 Government "SiNasLog" logistics-infrastructure push

- 4.2.4 Pharmaceutical cold-chain expansion (vaccines/biologics)

- 4.2.5 Halal-certified cold-chain demand for exports

- 4.2.6 Solar-powered micro cold-stores in off-grid islands

- 4.3 Market Restraints

- 4.3.1 High electricity & diesel costs

- 4.3.2 Capacity gap outside Java corridor

- 4.3.3 Shortage of certified reefer-truck drivers

- 4.3.4 Kigali refrigerant phase-down retrofit costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.5.1 Government regulations & initiatives

- 4.5.2 Halal standards & certification impacts

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Value-Chain / Supply-Chain Analysis

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Refrigerated Storage

- 5.1.1.1 Public Warehousing

- 5.1.1.2 Private Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.2.1 Road

- 5.1.2.2 Rail

- 5.1.2.3 Sea

- 5.1.2.4 Air

- 5.1.3 Value-Added Services

- 5.1.1 Refrigerated Storage

- 5.2 By Temperature Type

- 5.2.1 Chilled (0-5 °C)

- 5.2.2 Frozen (-18-0 °C)

- 5.2.3 Ambient

- 5.2.4 Deep-Frozen / Ultra-Low (less than-20 °C)

- 5.3 By Application

- 5.3.1 Fruits & Vegetables

- 5.3.2 Meat & Poultry

- 5.3.3 Fish & Seafood

- 5.3.4 Dairy & Frozen Desserts

- 5.3.5 Bakery & Confectionery

- 5.3.6 Ready-to-Eat Meals

- 5.3.7 Pharmaceuticals & Biologics

- 5.3.8 Vaccines & Clinical Trial Materials

- 5.3.9 Chemicals & Specialty Materials

- 5.3.10 Other Perishables

- 5.4 By Region (Indonesia)

- 5.4.1 Java (Jakarta & BOD)

- 5.4.2 Sumatra

- 5.4.3 Kalimantan

- 5.4.4 Sulawesi

- 5.4.5 Bali & Nusa Tenggara

- 5.4.6 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.4.1 Kiat Ananda Group

- 6.4.2 Enseval Putera Megatrading Tbk

- 6.4.3 MGM Bosco Logistics

- 6.4.4 Samudera Logistics

- 6.4.5 Pluit Cold Storage

- 6.4.6 PT International Mega Sejahtera

- 6.4.7 PT YCH Indonesia

- 6.4.8 PT Wira Logitama Saksama

- 6.4.9 DHL Supply Chain Indonesia

- 6.4.10 PT BGR Logistik Indonesia

- 6.4.11 PT Wahana Cold Storage

- 6.4.12 Yusen Logistics

- 6.4.13 Ninja Xpress

- 6.4.14 Nippon Express

- 6.4.15 PT Tira Cipta Logistik (TCL)

- 6.4.16 CKL Indonesia Raya (CKL Cargo)

- 6.4.17 PT Perishable Logistics Indonesia (PLI)

- 6.4.18 PT Mitsubishi Logistics Indonesia

- 6.4.19 JAS Worldwide

- 6.4.20 Coolkas

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment

8 Appendix

- 8.1 Annual Statistics on Refrigerated Storage Facilities

- 8.2 Import-Export Trade Data of Frozen Food Products

- 8.3 Regulatory Framework on Food Transport & Storage

- 8.4 Food & Beverage Sector Indicators