|

市場調查報告書

商品編碼

1910724

歐洲消費品包裝市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031年)Europe Consumer Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

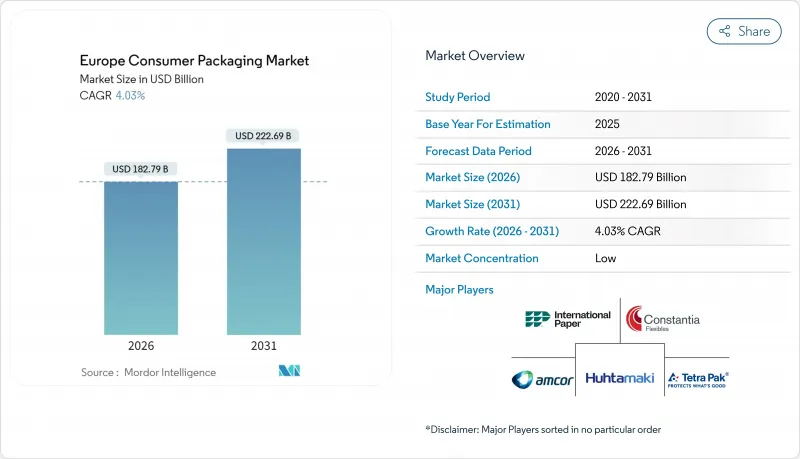

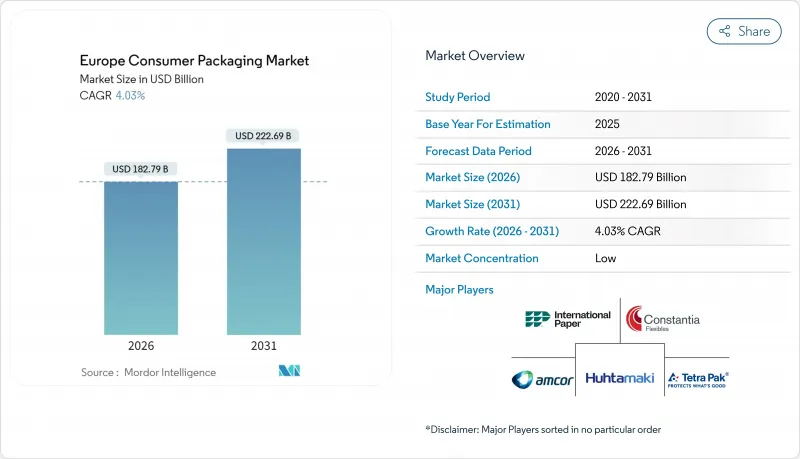

2025年歐洲消費品包裝市場價值為1757.1億美元,預計將從2026年的1827.9億美元成長到2031年的2226.9億美元,在預測期(2026-2031年)內複合年成長率為4.03%。

歐盟包裝和包裝廢棄物法規的推出、品牌加速推動閉合迴路系統以及履約履約的持續成長,共同推動了市場成長。纖維、純PET和輕質金屬材料的替代品正在重塑資本配置,而能源價格飆升則迫使加工商調整營運規模。數位印刷技術縮短了從設計到上市的周期,並支持SKU細分,而押金返還計劃則透過將回收材料引入高價值飲料應用領域,進一步改變了競爭格局。

歐洲消費品包裝市場趨勢與洞察

出於便利性考慮,對柔軟性塑膠包裝的需求增加。

隨著都市區外帶消費的復甦,軟包裝正逐漸取代玻璃和金屬容器。分裝袋包裝,加上易開易封的特性,迎合了25至45歲人群的移動生活方式,他們重視便攜性和保鮮性。價格波動幅度仍然不大。儘管7微米鋁箔的價格在2024年底上漲了4%,但加工商正透過使用帶有阻隔塗層的輕質薄膜來抵消成本上漲,從而在不增加體積的情況下延長保存期限。如今,功能性比外形更重要,醬料和嬰兒食品等液體產品正從較重的硬質容器轉向吸嘴袋。因此,軟包裝在食品和個人護理領域的市場佔有率持續成長。

電子商務的快速成長催生了對最後一公里包裝的需求。

直銷物流模式增加了包裝必須承受的多重接觸點,包括輸送機上的跌落、溫度變化以及送貨上門時的檢查。包裝廢棄物法規 (PPWR) 規定,到 2030 年,40% 的運輸和零售包裝必須可重複使用,這迫使零售商在自動化和永續性之間尋求平衡。市場對兼具緩衝性和體積效率的模塑纖維內襯和精密設計的瓦楞紙箱的需求正在蓬勃發展。波蘭和西班牙的電子商務滲透率成長最快,加劇了歐洲消費品包裝市場的區域成長差距。品牌所有者正在利用數位印刷技術將每個小包裹變成行銷畫布,使開箱體驗從成本中心轉變為收入來源。

聚合物、紙漿和紙張價格波動

原料價格波動擠壓了加工商的利潤空間,並擾亂了與季度指數掛鉤的固定價格合約。由於下游需求疲軟,聚乙烯價格在2024年初走軟;而當亞洲供應鏈不穩定時,PET價格則趨緊,顯示預測投入品價格走勢十分困難。在紡織業,由於造紙廠停產和物流瓶頸,塗佈紙價格在2024年第二季飆升了約10%,之後趨於穩定。向回收和紙漿資產的垂直整合正在獲得支持,但這會佔用原本可用於創新和地理擴張的資金。

細分市場分析

2025年,紙和紙板市場將維持35.22%的銷售佔有率,主要得益於電商物流供應商和餐飲服務業的一次性產品需求。在有利的法規和消費者意識的提升下,歐洲紙質消費包裝市場規模預計將溫和成長。然而,PET 5.74%的複合年成長率凸顯了市場成長動能的顯著轉變,這主要得益於押金返還機制的經濟效益以及品牌對使用食品級再生材料的承諾。到了2024年,單層PET飲料瓶的平均再生材料含量將達到24%,這推動歐洲消費包裝市場佔有率的成長,也證明閉合迴路的可行性。同時,由於新的法規推動一次性瓶蓋、刀叉餐具和輕質購物袋退出市場,PE(聚乙烯)和PP(聚丙烯)市場面臨挑戰。

PET的優勢因其機械回收率可達75%(在最佳化後的工廠中)而進一步增強,從而縮小了與纖維基紙盒的碳排放差距。同時,玻璃產業協會呼籲投資200億歐元用於熔爐電氣化,但不斷上漲的電價正在削弱其競爭力。鋁在循環利用方面仍具有優勢,但廢舊鋁罐片的供應量取決於各地區的回收率。特種聚合物在一些對性能要求高於可回收性的領域找到了成長機會,例如藥品泡殼包裝和個人保健產品的幫浦零件。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對注重便利性的柔軟性塑膠包裝的需求不斷成長。

- 電子商務的快速成長催生了對最後一公里包裝的需求。

- 轉向更輕、更易開啟的包裝

- 歐盟的《一次性塑膠指令》正在推動對單一材料的研究和發展。

- 押金返還制度促進了對再生聚乙烯(rPET)的需求。

- 數位印刷技術實現了SKU多樣化和小批量生產。

- 市場限制

- 聚合物、紙漿和紙張價格波動

- 歐盟擴大難以回收包裝的禁令

- 多層軟性包裝的回收缺口

- 由於能源價格大幅上漲,玻璃和金屬成本也隨之上漲。

- 產業供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 材料

- 塑膠

- PE(聚乙烯)

- PP(聚丙烯)

- PET(聚對苯二甲酸乙二醇酯)

- 聚氯乙烯(PVC)

- 其他塑膠

- 紙和紙板

- 紙板

- 瓦楞紙板和襯紙

- 模塑纖維

- 玻璃

- 金屬

- 能

- 瓶蓋和封口

- 管子

- 其他金屬

- 塑膠

- 按包裝類型

- 難的

- 軟包裝

- 半剛性

- 按最終用戶行業分類

- 食物

- 飲料

- 製藥和醫療保健

- 化妝品、個人護理、居家護理

- 其他終端用戶產業

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 波蘭

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor PLC

- Huhtamaki Oyj

- Mondi PLC

- International Paper Company

- Tetra Pak International SA

- Ardagh Group SA

- Crown Holdings, Inc.

- Constantia Flexibles Holding GmbH

- Sealed Air Corporation

- Sonoco Products Company

- Stora Enso Oyj

- Smurfit Kappa Group Limited

- Ball Corporation

- Berry Global, Inc.

- Greiner Packaging International GmbH

- Albea Group SAS

- Gerresheimer AG

- Vetropack Holding AG

- Massilly Holding

第7章 市場機會與未來展望

The Europe consumer packaging market was valued at USD 175.71 billion in 2025 and estimated to grow from USD 182.79 billion in 2026 to reach USD 222.69 billion by 2031, at a CAGR of 4.03% during the forecast period (2026-2031).

Growth is steered by the EU Packaging and Packaging Waste Regulation, accelerating brand commitments to closed-loop systems, and sustained momentum in e-commerce fulfillment. Material substitution toward fiber, mono-PET, and lightweight metal formats is reshaping capital allocation, while energy-price shocks force converters to reassess operating footprints. The competitive field is further altered by digital printing, which shortens design-to-launch cycles and supports SKU fragmentation, and by deposit-return infrastructure that channels recycled feedstock into high-value beverage applications.

Europe Consumer Packaging Market Trends and Insights

Convenience-driven demand for flexible plastic packs

Flexible formats continue to migrate volume from glass and metal as on-the-go consumption rebounds across urban corridors. Portion-controlled pouches with easy-open reclosable features meet the mobile lifestyle of 25- to 45-year-olds who prize portability and freshness. Price movements remain modest. 7-micron aluminum foil rose 4% in late 2024, but converters offset cost upticks through barrier-coated lightweight films that extend shelf life without adding bulk. Functionality now outweighs format loyalty, drawing liquid applications such as sauces and baby food toward spouted pouches and away from heavier rigid alternatives. The result is sustained share capture for flexibles in both food and personal-care aisles.

E-commerce boom creating last-mile packaging needs

Direct-to-consumer fulfillment adds multiple touchpoints where packs must survive conveyor drops, temperature shifts, and doorstep scrutiny. The PPWR mandates 40% reusable transport and sales packaging by 2030, pressuring retailers to harmonize automation with sustainability. Demand is surging for molded-fiber inserts and precision-engineered corrugated boxes that balance cushioning with dimensional efficiency. Poland and Spain show the steepest e-commerce penetration curves, widening the regional growth gap within the European consumer packaging market. Brand owners also leverage digital print to transform each parcel into a marketing canvas, elevating unboxing to a revenue lever rather than a cost center.

Volatile polymer and paper pulp prices

Feedstock swings erode converter margins and disrupt pricing contracts fixed on quarterly indices. Polyethylene values softened in early 2024 amid weak downstream demand, yet PET tightened when Asian supply lines faltered, demonstrating the difficulty of forecasting input trajectories. On the fiber side, coated paper spiked nearly 10% in Q2 2024 before easing, driven by mill maintenance outages and logistics bottlenecks. Vertical integration into recycling or pulp assets is gaining favor, but it locks capital that could fund innovation or geographic expansion.

Other drivers and restraints analyzed in the detailed report include:

- Shift toward lightweighting and easy-open formats

- EU Single-Use Plastics Directive spurring mono-material R&D

- Expanding EU bans on difficult-to-recycle formats

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paper and board defended 35.22% of 2025 revenue on the strength of e-commerce shippers and foodservice disposables. The Europe consumer packaging market size for paper-based solutions is projected to expand modestly as regulatory goodwill and consumer perception remain supportive. However, PET's 5.74% CAGR underscores a decisive momentum swing driven by deposit-return economics and brand pledges for food-grade recycled content. Europe consumer packaging market share gains accrue to mono-PET beverage bottles that averaged 24% recycled resin in 2024, validating closed-loop viability. In contrast, PE and PP navigate headwinds from single-use caps, cutlery, and thin grocery bags disappearing under new bans.

The PET narrative is reinforced by mechanical recycling yields that reach 75% in optimized plants, narrowing the carbon delta versus fiber-based cartons. Meanwhile, glass lobbies are campaigning for EUR 20 billion in furnace electrification, but elevated electricity tariffs cloud competitiveness. Aluminum retains a strong circularity story, yet the liquidity of post-consumer can sheet fluctuates with regional redemption rates. Specialty polymers hold pockets of growth in pharma blister packs and personal-care pump components, where performance trumps uniform recyclability mandates.

The Europe Consumer Packaging Market Report is Segmented by Material (Plastic (PE, PP, PET, and More), Paper and Board (Cartonboard, Molded Fiber, and More), Glass, and Metal (Cans, Caps and Closures, Tubes, and More)), Packaging Format (Rigid, Flexible, and Semi-Rigid), End-User Industry (Food, Beverage, Pharmaceutical and Healthcare, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor PLC

- Huhtamaki Oyj

- Mondi PLC

- International Paper Company

- Tetra Pak International SA

- Ardagh Group S.A.

- Crown Holdings, Inc.

- Constantia Flexibles Holding GmbH

- Sealed Air Corporation

- Sonoco Products Company

- Stora Enso Oyj

- Smurfit Kappa Group Limited

- Ball Corporation

- Berry Global, Inc.

- Greiner Packaging International GmbH

- Albea Group S.A.S.

- Gerresheimer AG

- Vetropack Holding AG

- Massilly Holding

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convenience-driven demand for flexible plastic packs

- 4.2.2 E-commerce boom creating last-mile packaging needs

- 4.2.3 Shift toward lightweighting and easy-open formats

- 4.2.4 EU Single-Use Plastics Directive spurring mono-material R&D

- 4.2.5 Deposit-return schemes scaling rPET demand

- 4.2.6 Digital printing enabling SKU proliferation and short-runs

- 4.3 Market Restraints

- 4.3.1 Volatile polymer and paper pulp prices

- 4.3.2 Expanding EU bans on difficult-to-recycle formats

- 4.3.3 Recycling gaps for multilayer flexibles

- 4.3.4 Energy-price shocks inflating glass and metal costs

- 4.4 Industry Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.1.1 PE (Polyethylene)

- 5.1.1.2 PP (Polypropylene)

- 5.1.1.3 PET (Polyethylene Terephthalate)

- 5.1.1.4 PVC (Polyvinyl Chloride)

- 5.1.1.5 Other Plastics

- 5.1.2 Paper and Board

- 5.1.2.1 Cartonboard

- 5.1.2.2 Containerboard and Linerboard

- 5.1.2.3 Molded Fiber

- 5.1.3 Glass

- 5.1.4 Metal

- 5.1.4.1 Cans

- 5.1.4.2 Caps and Closures

- 5.1.4.3 Tubes

- 5.1.4.4 Other Metals

- 5.1.1 Plastic

- 5.2 By Packaging Format

- 5.2.1 Rigid

- 5.2.2 Flexible

- 5.2.3 Semi-rigid

- 5.3 By End-user Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Pharmaceutical and Healthcare

- 5.3.4 Cosmetics, Personal and Home Care

- 5.3.5 Other End-user Industry

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Poland

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 Huhtamaki Oyj

- 6.4.3 Mondi PLC

- 6.4.4 International Paper Company

- 6.4.5 Tetra Pak International SA

- 6.4.6 Ardagh Group S.A.

- 6.4.7 Crown Holdings, Inc.

- 6.4.8 Constantia Flexibles Holding GmbH

- 6.4.9 Sealed Air Corporation

- 6.4.10 Sonoco Products Company

- 6.4.11 Stora Enso Oyj

- 6.4.12 Smurfit Kappa Group Limited

- 6.4.13 Ball Corporation

- 6.4.14 Berry Global, Inc.

- 6.4.15 Greiner Packaging International GmbH

- 6.4.16 Albea Group S.A.S.

- 6.4.17 Gerresheimer AG

- 6.4.18 Vetropack Holding AG

- 6.4.19 Massilly Holding

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment