|

市場調查報告書

商品編碼

1851424

快速消費品包裝:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)FMCG Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

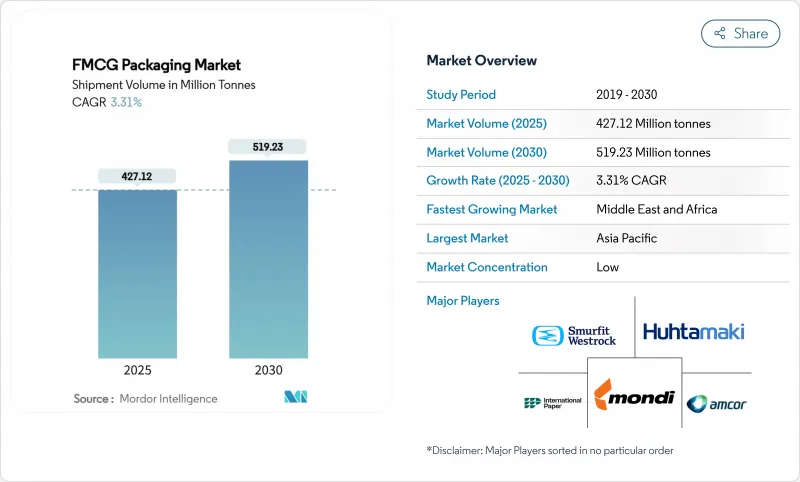

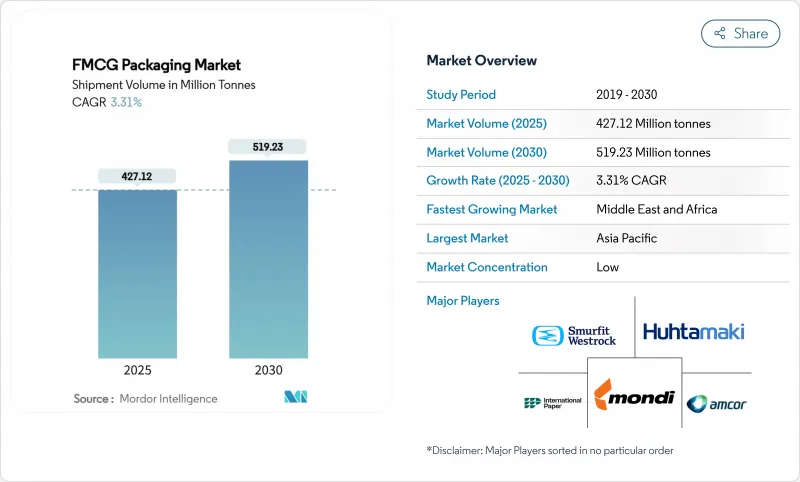

預計到 2025 年,快速消費品包裝市場將達到 4.2712 億噸,到 2030 年將擴大到 5.1923 億噸,年複合成長率為 3.31%。

成長的驅動力來自家庭對基本包裝的穩定需求、不斷擴大的電子商務交易量以及鼓勵使用可回收和可重複填充解決方案的政策措施。大型加工商正在重新設計包裝形式,以減少材料用量和運輸成本,同時保護商品在更長、更複雜的供應鏈中流通。生物基基材和化學回收樹脂正從試點階段走向商業化生產,但塑膠因其阻隔性和輕質特性仍然至關重要。亞太地區的需求成長主要得益於快速的都市化和家庭消費規模的縮小,而中東和非洲地區則由於現代零售業的普及,經歷了最快的噸位成長。

全球快速消費品包裝市場趨勢與洞察

電子商務的快速成長需要輕巧、防護性強的包裝。

如今,線上零售商在組裝包裝設計方案時,會重點考慮小包裹的耐用性、尺寸重量限制以及便捷的退貨流程。品牌擁有者則指定使用緩衝郵件袋、氣柱袋和客製尺寸的紙箱,以減少包裝空隙和降低運費。包裝廠正在增設數位印刷生產線,使每個托運人都能攜帶可掃描的條碼,用於驗證真偽或觸發補貨服務。能夠顯示衝擊和溫度不當情況的智慧指示器正逐漸成為高階包裝的標配,而小包裹保險公司為可追溯包裝提供更低保費的做法也進一步強化了這一趨勢。這些需求持續推高了對軟性薄膜和瓦楞紙板的需求,促使樹脂供應商開發出能夠保持其機械性能的可直接替代型再生樹脂。

亞洲都市區單份消費的蓬勃發展推動了便利商店業態的發展

在中國、印度和東南亞,單人家庭的增加和交通堵塞正在推動分裝袋、杯裝和小袋包裝食品的普及。製造商正在實現高速灌裝封口生產線的自動化,從而在價格分佈競爭的同時,減少因大包裝產品部分使用而造成的食物廢棄物。零售商正在為可重複密封的零食包裝和單份即食食品分配更多貨架空間,這促使加工商加強隔離層確保內容物新鮮直至最後一份。這種成長趨勢也蔓延至家居和個人保養用品,可重複填充的膠囊和便於攜帶的迷你包裝迎合了忙碌的都市生活方式。對兼具易撕口和抗摔性能的複合材料的需求,正在推動亞洲產能的顯著成長。

樹脂價格波動會為規劃帶來不確定性。

原油和石腦油基準價格的波動擾亂了季度合約談判,迫使加工商對沖原料風險或加快回收和生物基替代。規模較小的公司難以負擔價格飆升,利潤空間受到擠壓,資本支出放緩。特種添加劑的突然短缺(通常與地緣政治事件相關)迫使企業臨時調整配方,從而導致停工和客戶罰款。為因應這種情況,跨國公司會分散採購管道並簽訂多年供應協議,同時財務團隊會實施與產業基準掛鉤的成本轉嫁條款。這種動盪局面有利於擁有綜合樹脂資產和充足營運成本的製造商。

細分市場分析

預計到2024年,塑膠仍將佔據快速消費品包裝市場62.45%的佔有率,這反映了其無與倫比的強度重量比和廣泛的加工性能。生物基和可堆肥塑膠雖然仍處於小眾市場,但隨著加工商將具有增強氧氣和水分阻隔性能的PLA和PHA共混物商業化,其市場佔有率正以6.85%的複合年成長率成長。由於可無限循環利用,硬金屬在高階飲料包裝領域備受青睞;而紙板在乾貨和個人保健產品領域市場佔有率不斷擴大,因為這些領域可以使用纖維基壁材。在快速消費品包裝市場,聚乙烯和聚丙烯因其成本效益,仍是軟性複合材料的首選材料。然而,化學回收目前在北美和歐洲正在蓬勃發展,高品質的消費後樹脂有望緩解原生塑膠的需求。反應塗層生產線的創新使得紙杯無需塑膠內襯即可盛裝酸性果汁,從而為塑膠替代開闢了新的途徑。

塑膠供應商正透過推出經認證的循環利用型聚乙烯(PE)和熱解(PP)產品來應對永續性壓力,這些產品源自於熱解油,為品牌商提供了一種無需更換即可減少排放且無需更換現有生產線的便捷途徑。隨著政府綠色採購政策的逐步實施,預計到2030年,生物基樹脂在快速消費品包裝市場的市場規模將超過800萬噸。同時,鋁材在氣霧罐和寵物食品托盤等產品中的輕盈優勢,恰好滿足了需要經久耐用、可多次循環使用的填充站的需求。玻璃在對口味完整性要求極高的領域仍然佔有一席之地,但由於重量和易碎性等問題,其市場佔有率受到限制。總而言之,材料的選擇取決於功能性能、法規遵循和整體碳排放影響之間的平衡,而不僅僅是單位成本。

到2024年,軟包裝將以54.65%的市佔率主導快速消費品包裝市場,並在2030年之前以6.35%的複合年成長率成長。品牌擁有者看重的是軟包裝低材料與產品比、高圖形表現力以及更高的包裝效率,這使得每個托盤可以容納更多產品。電子商務的興起推動了對便於郵寄的枕形包裝和無需額外填充即可承受自動化分類的多層包裝袋的需求。零嘴零食和糖果甜點產品正透過連續運動的水平成形充填密封(HFFS)生產線以每分鐘超過1500包的速度進行生產,這凸顯了遞歸式包裝最佳化帶來的營運優勢。

在結構和可重複密封性至關重要的細分市場中,硬質容器仍然佔據主導地位。 PET寶特瓶是碳酸飲料的首選包裝,而玻璃瓶則代表高檔醬料的質感。採用模壓蓋的「硬質-軟質」混合型包裝袋設計融合了兩種材質的優點,與同等尺寸的玻璃容器相比,重量最多可減輕70%。快速消費品硬包裝的市場規模預計將以個位數低成長率成長,這反映出成熟品類的市場飽和,但可重複灌裝的個人護理用品分配器領域則蘊藏著新的機會。設備製造商現在提供模組化填充模組,可在同一生產線上加工灌裝好的包裝袋、罐子和瓶子,使加工商能夠對沖不同包裝形式之間的需求波動。

快速消費品包裝市場報告按材料類型(紙/紙板、塑膠、金屬、玻璃、生物基和可堆肥材料)、包裝類型(軟包裝、硬包裝)、最終用途行業(食品、食品飲料、個人護理和化妝品、其他)、分銷管道(直銷、間接銷售)和地區進行細分。市場預測以噸為單位。

區域分析

到2024年,亞太地區將佔全球出貨量的45.63%,成為快速消費品包裝市場的核心。中國和印度將憑藉其樹脂裂解廠、薄膜擠出廠和加工廠集群,滿足龐大的國內需求並支撐出口。都市區微型廚房和便利的飲食習慣正在推動單份包裝袋的普及,而各國減少塑膠用量的政策則加速了紙基軟包裝的試驗。可支配所得的成長正促使個人護理產品轉向高階包裝,進而提升人均包裝強度。在印度和東南亞,政府支持的低溫運輸將進一步推動保溫運輸箱和防篡改密封件的需求。

北美市佔率持續保持穩定,這主要得益於電子商務的普及和瓦楞紙包裝產能的成長。 Smurfit 和 WestRock 的合併案價值 200 億美元,體現了企業透過擴大規模來降低固定成本、為循環經濟研發提供資金的策略。例如,Green Bay Packaging 在阿肯色州投資 10 億美元興建的牛皮箱紙板廠,增強了國內供應的穩定性,並拓展了輕質襯板產品線。美國各州關於飲料容器中再生材料含量的法規,促進了 PET 回收計劃的發展,並鼓勵當地加工商取得 rPET 原料。加拿大和墨西哥預計將從近岸外包中獲益,近岸外包是指將消費品填充生產線轉移到更靠近核心需求地的地區。

歐洲成熟市場正利用技術創新來滿足包裝廢棄物法規中嚴格的可回收性目標。德國和法國正在升級其物料回收設施和化學回收檢測設施,以達到再生材料含量的最低標準。高階糖果甜點品牌正選擇使用具有生物阻隔性能的纖維性包裝,而英國超級市場正在進行可重複填充試用,以測試消費者對可回收包裝袋的接受度。這些措施將保持包裝噸位的穩定,但將價值重心轉移到更高規格的材料和相關的數位化服務。

儘管基數較低,但中東和非洲地區仍將以6.58%的複合年成長率實現最快成長,這主要得益於有組織零售業的擴張以及人口成長帶動包裝食品需求的成長。海灣國家將投資建造先進的彈性生產線,以滿足國內速食連鎖店和出口訂單的需求。南非和肯亞將吸引行動牛奶和果汁紙盒填充設備,從而延長無冷藏地區的保存期限。來自歐洲和亞洲的外國直接投資將引進多層擠出技術,以提升當地產能。

在南美洲,巴西和哥倫比亞的經濟改革提振了消費支出,推動了消費的穩定成長。巴西以甘蔗為原料的生物基聚乙烯(bioPE)產能也使全球品牌能夠專注於可再生材料。關稅結構持續影響工廠位置決策,促使加工商採取跨國佈局,業務遍及南方共同市場和太平洋聯盟。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務的快速成長需要既能提供保護又輕巧的包裝。

- 亞洲都市區單份消費的蓬勃發展推動了便利商店業態的興起

- 即飲飲料的快速成長推動了高阻隔袋的應用。

- 個人護理產品的優質化推動了智慧化和裝飾性包裝的發展

- 新興市場低溫運輸的擴展將推動多層薄膜的使用。

- 市場限制

- 樹脂價格波動會為規劃帶來不確定性。

- 開發中國家缺乏回收基礎設施

- 一次性塑膠禁令也波及傳統軟塑膠

- 供應鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依材料類型

- 紙和紙板

- 塑膠

- 聚乙烯(低密度聚乙烯/高密度聚乙烯)

- 聚丙烯(PP)

- 聚對苯二甲酸乙二醇酯(PET)

- 其他塑膠(PVC、PS 等)

- 金屬

- 玻璃

- 生物基和可堆肥材料

- 按包裝類型

- 軟包裝

- 小袋和袋子

- 薄膜和包裝

- 其他軟包裝

- 硬包裝

- 瓶子和罐子

- 能

- 托盤和容器

- 其他硬質包裝

- 軟包裝

- 按最終用途行業分類

- 食物

- 飲料

- 個人護理和化妝品

- 家居用品

- 醫藥和醫療保健

- 其他終端用戶產業

- 透過分銷管道

- 直銷

- 間接銷售

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor plc

- Ball Corporation

- Mondi Group

- International Paper Co.

- Sealed Air Corporation

- Constantia Flexibles

- Smurfit Westrock Plc

- Crown Holdings Inc.

- Coveris Holdings SA

- Graphic Packaging International LLC

- Tetra Pak International

- Stora Enso Oyj

- Sonoco Products Co.

- Huhtamaki Oyj

- Toyo Seikan Group HD

- Nampak Ltd

- Mpact Pty Ltd

- Albea SA

- Owens-Illinois(OI)

- Verallia SA

- Napco National

- 3P Gulf Group

第7章 市場機會與未來展望

The FMCG packaging market reached 427.12 million tonnes in 2025 and is forecast to climb to 519.23 million tonnes by 2030, advancing at a 3.31% CAGR.

Growth rests on steady household demand for packaged essentials, expanding e-commerce volumes, and policy measures that reward recyclable and refillable solutions. Large converters are redesigning formats to trim material use and freight costs while protecting goods that travel through longer, more complex supply chains. Bio-based substrates and chemical-recycled resins are moving from pilot to commercial scale, yet plastics remain indispensable in high-barrier and lightweight roles. Regional demand is led by Asia-Pacific thanks to rapid urbanization and small-household purchasing, while Middle East and Africa (MEA) offers the quickest tonnage expansion as modern retail spreads.

Global FMCG Packaging Market Trends and Insights

Rapid Growth of E-commerce Requiring Protective, Lightweight Packs

Online retail now frames design briefs around parcel durability, dimensional weight limits, and friction-free returns. Brand owners specify cushioned mailers, air-column pouches, and fit-to-size cartons that slash void space and freight spend. Packaging plants add digital print lines so each shipper can carry scannable codes that confirm authenticity or trigger replenishment services. Smart indicators that reveal impact or temperature misuse are becoming standard on premium categories, a trend reinforced by parcel insurers who offer lower premiums for traceable packs. These needs keep flexible films and corrugated board in high demand and encourage resin suppliers to accelerate drop-in recycled grades that retain mechanical properties.

Urban Single-Serve Consumption Boom in Asia Boosting Convenience Formats

Rising numbers of single-person households and congested commutes in China, India, and Southeast Asia spur uptake of portion-controlled pouches, cups, and sachets. Manufacturers are automating high-speed fill-seal lines to reach price points competitive with bulk packs while trimming food waste from partially used larger units. Retailers dedicate premium shelf space to resealable snack packs and ready-to-eat meals sized for one, pushing converters to enhance barrier layers that keep contents fresh until the last serving. Growth spills into home-care and personal-care items, where refill pods and travel-friendly minis fit hectic urban lifestyles. Demand for laminates that couple easy-tear openings with drop-resistance underpins a notable slice of incremental Asian capacity additions.

Resin Price Volatility Creating Planning Uncertainty

Fluctuating crude-oil and naphtha benchmarks upset quarterly contract negotiations, prompting converters to hedge feedstock or accelerate substitution toward recycled and bio-based grades. Smaller firms lacking scale struggle to absorb spikes, which compress margins and slow capital investment. Sudden shortages of specialty additives, often linked to geopolitical events, force ad-hoc reformulations that risk downtime and customer penalties. In response, multinationals diversify sourcing and lock in multi-year supply pacts, while financial teams roll out cost-pass-through clauses keyed to industry indices. Such turbulence favors producers with integrated resin assets and strong working-capital positions.

Other drivers and restraints analyzed in the detailed report include:

- RTD Beverage Surge Driving High-Barrier Pouch Adoption

- Premiumisation in Personal-Care Triggering Smart and Decorative Packs

- Single-Use-Plastic Bans Dampening Conventional Flexibles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics maintained a 62.45% share of the FMCG packaging market in 2024, reflecting unmatched strength-to-weight ratios and broad processability. Bio-based and compostable grades, though still niche, are expanding at 6.85% CAGR as converters commercialize PLA and PHA blends with enhanced oxygen and moisture barriers. Rigid metals find favor in premium beverage lines for infinite recyclability, and paperboard gains share where dry food or personal-care formats permit fiber-based walls. The FMCG packaging market continues to favor polyethylene and polypropylene in flexible laminates thanks to cost efficiency, but chemical recycling, now scaling in North America and Europe, promises high-quality post-consumer resins that moderate virgin demand. Innovations in reactive coating lines let paper cups hold acidic juices without plastic liners, opening another pathway for plastics displacement.

Plastics suppliers counter sustainability pressures by launching certified-circular PE and PP grades derived from pyrolysis oil, giving brand owners a drop-in route to lower emissions while retaining incumbent converting lines. The FMCG packaging market size for bio-based resins is projected to surpass 8 million tonnes by 2030 as governmental green-procurement rules take hold. Meanwhile, aluminum's light-weight advantage in aerosol cans and pet-food trays aligns with refill stations that prefer robust formats surviving multiple cycles. Glass stays relevant where taste neutrality is prized, yet weight and breakage limit its volume share. Overall, material choice now hinges on balancing functional performance, regulatory compliance, and total carbon impact rather than unit price alone.

With a 54.65% share in 2024, flexible formats dominate the FMCG packaging market and are tracking a 6.35% CAGR to 2030. Brand owners value lower material-to-product ratios, high graphics potential, and pack-out efficiency that allows more units per pallet. The shift to e-commerce adds demand for mail-friendly pillow packs and multi-layer sachets that endure automated sortation without extra void fill. Continuous-motion horizontal form-fill-seal (HFFS) lines supply snack and confectionery categories at speeds exceeding 1,500 packs per minute, highlighting the operational gains that recursive format optimisation delivers.

Rigid options still command niches where structure and reclosability are critical. PET bottles retain leadership in carbonated soft drinks, while glass jars project premium cues in gourmet sauces. Hybrid "rigid-in-flexible" pouch designs with molded caps combine both worlds, slicing weight by up to 70% versus equivalently sized glass containers. The FMCG packaging market size for rigid formats is forecast to post low-single-digit growth, reflecting saturation in mature categories but fresh opportunities in refillable personal-care dispensers. Equipment builders now offer modular filler blocs that handle fitment pouches, jars, and bottles on one line, letting converters hedge against demand swings across formats.

The FMCG Packaging Market Report is Segmented by Material Type (Paper and Paperboard, Plastics, Metal, Glass, Bio-Based and Compostable Materials), Packaging Type (Flexible Packaging, Rigid Packaging), End-Use Industry (Food, Beverages, Personal Care and Cosmetics, and More), Distribution Channel (Direct Sales, Indirect Sales), and Geography. The Market Forecasts are Provided in Terms of Volume (Tonnes).

Geography Analysis

Asia-Pacific generated 45.63% of 2024 shipments, positioning the region as the anchor of the FMCG packaging market. China and India supply mammoth domestic demand and serve export flows, leveraging clusters of integrated resin crackers, film extruders, and converting plants. Urban micro-kitchens and on-the-go eating habits fuel single-serve pouch uptake, while national plastic-reduction mandates accelerate trials of paper-based flexibles. Rising disposable incomes enable trading-up to premium personal-care formats, deepening per-capita packaging intensity. Government-backed cold-chain corridors in India and Southeast Asia unleash further need for insulated shippers and tamper-evident seals.

North America follows with a stable share rooted in broad e-commerce penetration and advanced corrugated capacity. The Smurfit-WestRock merger, valued at USD 20 billion, exemplifies the push for scale to dilute fixed costs and fund circular-economy R&D. Investments such as Green Bay Packaging's USD 1 billion kraft linerboard mill in Arkansas strengthen domestic supply security and expand lightweight liner offerings. United States state regulations on recycled content in beverage containers catalyze PET reclaim projects, pushing local converters to lock in rPET feedstock. Canada and Mexico gain from near-shoring that relocates consumer-goods filling lines closer to core demand.

Europe's mature market taps innovation to meet its stringent recyclability targets under the Packaging and Packaging Waste Regulation. Germany and France upgrade MRFs and chemical-recycling pilots to satisfy minimum recycled-content thresholds, while brand owners redesign individual packs to pass "sort-ability" tests. Premium confectionery chooses fiber-based wrapping with bio-barriers, and UK supermarkets roll out refill trials that test shopper uptake of returnable pouches. These initiatives stabilize overall tonnage but shift value toward higher-spec materials and linked digital services.

Middle East and Africa register the fastest 6.58% CAGR, albeit from a lower base, as organized retail expands and population growth drives packaged staples. Gulf states invest in state-of-the-art flexible plants that supply both domestic fast-food chains and export orders. South Africa and Kenya attract mobile filling units for milk and juice cartons that extend shelf life in areas lacking refrigeration. Foreign direct investment from European and Asian groups introduces multilayer extrusion technology, lifting local capabilities.

South America offers steady upside as economic reforms in Brazil and Colombia revive consumer spending. Regional fiber availability supports cost-competitive corrugated, and sugar-cane-based bio-PE capacity in Brazil gives global brands a renewable-content narrative. Tariff structures still influence plant-location decisions, nudging converters to adopt multinational footprints that straddle Mercosur and Pacific Alliance blocs.

- Amcor plc

- Ball Corporation

- Mondi Group

- International Paper Co.

- Sealed Air Corporation

- Constantia Flexibles

- Smurfit Westrock Plc

- Crown Holdings Inc.

- Coveris Holdings S.A.

- Graphic Packaging International LLC

- Tetra Pak International

- Stora Enso Oyj

- Sonoco Products Co.

- Huhtamaki Oyj

- Toyo Seikan Group HD

- Nampak Ltd

- Mpact Pty Ltd

- Albea S.A.

- Owens-Illinois (O-I)

- Verallia SA

- Napco National

- 3P Gulf Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Growth of E-commerce Requiring Protective, Lightweight Packs

- 4.2.2 Urban Single-Serve Consumption Boom in Asia Boosting Convenience Formats

- 4.2.3 RTD Beverage Surge Driving High-Barrier Pouch Adoption

- 4.2.4 Premiumisation in Personal-Care Triggering Smart and Decorative Packs

- 4.2.5 Cold-Chain Expansion in Emerging Markets Raising Multilayer Film Usage

- 4.3 Market Restraints

- 4.3.1 Resin Price Volatility Creating Planning Uncertainty

- 4.3.2 Recycling-Infrastructure Deficit in Developing Nations

- 4.3.3 Single-Use-Plastic Bans Dampening Conventional Flexibles

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VOLUME)

- 5.1 By Material Type

- 5.1.1 Paper and Paperboard

- 5.1.2 Plastics

- 5.1.2.1 Polyethylene (LDPE/HDPE)

- 5.1.2.2 Polypropylene (PP)

- 5.1.2.3 Polyethylene Terephthalate (PET)

- 5.1.2.4 Other Plastics (PVC, PS,etc)

- 5.1.3 Metal

- 5.1.4 Glass

- 5.1.5 Bio-based and Compostable Materials

- 5.2 By Packaging Type

- 5.2.1 Flexible Packaging

- 5.2.1.1 Pouches and Bags

- 5.2.1.2 Films and Wraps

- 5.2.1.3 Other Flexible Packaging

- 5.2.2 Rigid Packaging

- 5.2.2.1 Bottles and Jars

- 5.2.2.2 Cans

- 5.2.2.3 Trays and Containers

- 5.2.2.4 Other Rigid Packaging

- 5.2.1 Flexible Packaging

- 5.3 By End-use Industry

- 5.3.1 Food

- 5.3.2 Beverages

- 5.3.3 Personal Care and Cosmetics

- 5.3.4 Household Care Products

- 5.3.5 Pharmaceuticals and Healthcare

- 5.3.6 Other End-use Industry

- 5.4 By Distribution Channel

- 5.4.1 Direct Sales

- 5.4.2 Indirect Sales

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Ball Corporation

- 6.4.3 Mondi Group

- 6.4.4 International Paper Co.

- 6.4.5 Sealed Air Corporation

- 6.4.6 Constantia Flexibles

- 6.4.7 Smurfit Westrock Plc

- 6.4.8 Crown Holdings Inc.

- 6.4.9 Coveris Holdings S.A.

- 6.4.10 Graphic Packaging International LLC

- 6.4.11 Tetra Pak International

- 6.4.12 Stora Enso Oyj

- 6.4.13 Sonoco Products Co.

- 6.4.14 Huhtamaki Oyj

- 6.4.15 Toyo Seikan Group HD

- 6.4.16 Nampak Ltd

- 6.4.17 Mpact Pty Ltd

- 6.4.18 Albea S.A.

- 6.4.19 Owens-Illinois (O-I)

- 6.4.20 Verallia SA

- 6.4.21 Napco National

- 6.4.22 3P Gulf Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment