|

市場調查報告書

商品編碼

1910549

功率模組封裝:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Power Module Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

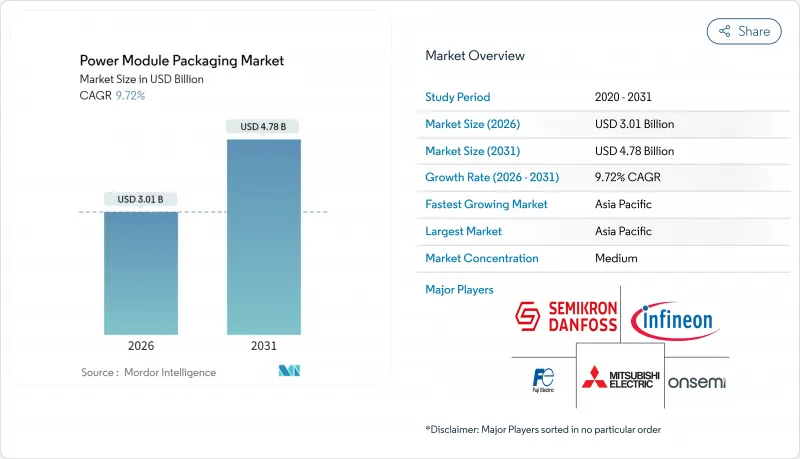

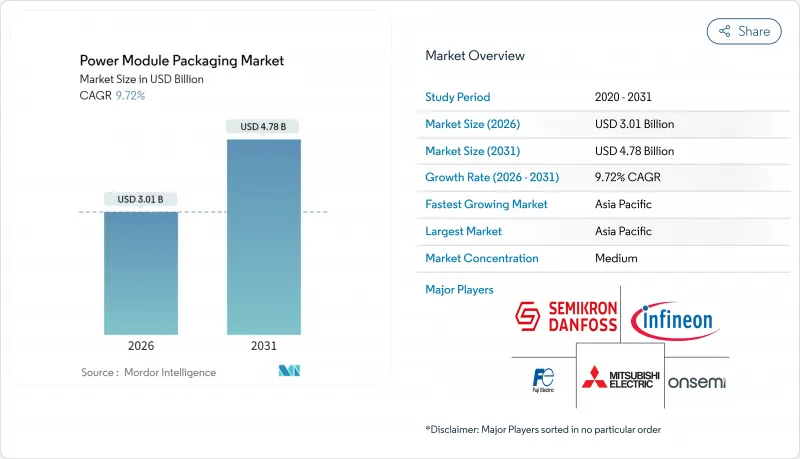

預計到 2026 年,功率模組封裝市場規模將達到 30.1 億美元,高於 2025 年的 27.4 億美元。預計到 2031 年,該市場規模將達到 47.8 億美元,2026 年至 2031 年的複合年成長率為 9.72%。

隨著寬能能隙半導體從利基市場走向主流市場,電動車採用800V架構,以及工業馬達驅動裝置優先考慮能源效率,市場需求正在加速成長。能夠實現低熱阻、高電流密度以及在200°C以上高溫下可靠運行的封裝創新正成為關鍵的競爭優勢,尤其是在汽車製造商尋求小型化而不犧牲使用壽命可靠性的情況下。地域多角化,特別是馬來西亞、印度和印尼的多元化,透過擴大製造地和降低地緣政治風險,進一步推動了市場發展。競爭格局正在發生變化,碳化矽(SiC)和氮化鎵(GaN)裝置對傳統矽解決方案的利潤率構成壓力,而氮化鋁等先進陶瓷基板則透過實現雙面冷卻設計而不斷擴大市場佔有率。

全球功率模組封裝市場趨勢與洞察

加速在電動車驅動逆變器中採用碳化矽和氮化鎵功率裝置

隨著汽車製造商優先考慮延長續航里程和提升快速充電能力,碳化矽(SiC)在電池式電動車(BEV)領域正日益普及。特斯拉的初步演示數據顯示,與矽基IGBT相比,SiC的續航里程提升了約7%,這一里程碑式的成績推動了整個行業的廣泛應用,儘管SiC裝置的成本更高。弗勞恩霍夫研究所改良的直接冷卻變頻器架構透過取消底板,將效率提升至99.5%,這顯示封裝技術的進步能夠直接轉化為動力系統性能的提升。向800V汽車系統的廣泛過渡帶來了絕緣和局部放電方面的挑戰,而這些挑戰只有透過先進的基板和低電感互連技術才能解決,從而推動了對高階模組的需求。隨著越來越多的原始設備製造商(OEM)推出900V電池組,將SiC晶粒與雙面冷卻封裝相結合的供應商將佔據有利地位,確保長期設計應用。

對節能型工業馬達驅動裝置的需求日益成長

電動馬達約佔全球工業電力消耗量的70%,專家估計,如果普遍採用變速驅動器,其發電量可抵銷數座中型發電廠的發電量。然而,已開發國家僅有15%的三相馬達採用了電子調速技術,這意味著巨大的潛力尚未充分開發。在冷暖氣空調(HVAC)等變負載應用中,基於碳化矽(SiC)的驅動模組可實現15%至40%的節能,因為在這些應用中,壓縮機很少滿載運作。第七代車規級IGBT技術提高了允許的結溫,從而可以使用更小的散熱器和更緊湊的機櫃設計,進而降低安裝成本。政府的能源效率法規和不斷上漲的電費持續推動高性能封裝技術的發展,以確保產品在20年的工業運作週期內保持可靠性。

先進包裝設備需要高資本投資

根據SEMI的預測,300毫米晶圓廠的產能正在成長,其中一部分產能將分配給雷射切割和混合鍵合線等先進封裝設備。寬能能隙裝置需要燒結爐能夠處理超過250°C的溫度,且拾放精度需達到±3μm以內,這提高了新製造商的進入門檻。電動車電池工廠也面臨類似的資本投資負擔,顯示資本密集度是整個電氣化價值鏈上的系統性障礙。資金籌措壁壘在缺乏成熟半導體產業叢集的地區尤為突出,這延緩了南亞和拉丁美洲的多元化發展目標,並限制了這些地區近期的產能擴張。

細分市場分析

到2025年,基板將佔總收入的27.85%,這鞏固了其在熱控制和電隔離方面的核心地位。晶片貼裝預計將成為成長最快的組件,複合年成長率將達到10.96%,因為銀燒結和瞬態液相鍵合技術使得晶片能夠在200°C以上溫度下運行,而無需使用鉛基合金。基板正逐漸被直接基板冷卻方法所取代,這種方法縮短了熱路徑;而陶瓷封裝能夠降低結溫12 K,其應用也日益廣泛,尤其是在高功率風力發電轉換器領域。

採用銅夾的先進平面互連技術消除了焊線的可靠性缺陷,提高了電流密度,並減少了電動車驅動逆變器的封裝面積。導熱界面材料演變為奈米結構碳網路,其理論電阻值接近 0.1 mm²K/W,從而延長了高循環應力下的使用壽命。由於原始設備製造商 (OEM) 要求對散熱層疊性能承擔單一責任,因此能夠垂直整合基板壓制、金屬化和燒結貼裝服務的供應商正在贏得合約。這種綜合辦法在低功耗消費性電子領域日益成長的商品化壓力下,保護了供應商的利潤空間。

在功率模組封裝市場,IGBT模組憑藉著成熟的生產線和1,200V以下應用領域的有利成本優勢,預計到2025年將維持36.88%的市場佔有率。然而,SiC模組到2031年將以10.52%的複合年成長率成長,其在電動車動力系統和快速充電器中具有更高的開關速度和顯著降低的導通損耗。 GaN模組的成長主要得益於市場對高頻通訊整流器日益成長的需求,而英飛凌對GaN Systems的收購將進一步鞏固其競爭地位。

在對成本要求較高的家電和消費電源領域,Si-MOSFET模組依然具有吸引力;而在高壓直流輸電線路和感應加熱等應用中,閘流體繼續發揮重要作用,因為在這些應用中,可靠性比開關速度更為重要。預計在十年內,向200mm SiC晶圓的過渡將使其在成本上與矽晶圓相媲美。然而,汽車級SiC晶圓的產量比率仍是其大規模生產的一大障礙。因此,對於寬能能隙半導體晶圓廠而言,能夠提供先進偵測能力並實現零ppm缺陷目標的封裝公司至關重要。

區域分析

預計到2025年,亞太地區將佔全球支出的48.35%,年複合成長率達11.37%,主要得益於中國OSAT生態系統受益於人工智慧伺服器和電動車的強勁成長動能。印度100億美元的獎勵計畫以及美光在古吉拉突邦投資8.25億美元建設晶圓廠,都顯示印度政府正積極採取措施,力爭在2027年前大幅提升後端產能。馬來西亞則受惠於英特爾70億美元的封裝擴張計畫以及美光在檳城的投資,正努力將自身打造成為一個能夠有效緩解台海風險的互補型產業中心。

北美《晶片技術創新法案》(CHIPS Act)累計527億美元,優先發展先進封裝技術,以加強國內供應鏈。安姆科(Amcor)位於亞利桑那州、投資20億美元的工廠計劃於2026年運作,屆時將生產人工智慧加速器模組。隨著晶圓廠對關鍵設備的本地外包半導體測試與測試(OSAT)機構進行認證,預計區域市場佔有率將逐步成長。歐洲正致力於實現汽車碳化矽(SiC)供應鏈的自給自足,沃爾夫斯皮德(Wolfspeed)在德國投資30億美元,建造一條符合原始設備製造商(OEM)電氣化目標的外延片和模組生產線。歐洲版的《晶片技術創新法案》旨在協調各國的支持措施,但其資金規模仍低於美國,鼓勵企業加強跨境合作。

中東和非洲地區正迎來基於吉瓦級太陽能和發電工程的蓬勃發展,新業務機會日益增加。併網逆變器對這些項目至關重要,海灣國家的主權財富基金正透過與經驗豐富的組件製造商成立合資企業,建構本地組裝系統。憑藉豐富的可再生能源資源,該地區正為未來的氫能出口奠定基礎。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加速採用碳化矽和氮化鎵功率元件於電動車牽引逆變器

- 對節能型工業馬達驅動裝置的需求日益成長

- 與可再生能源相關的高功率逆變器的擴展

- 對電動車車載充電器小型化的需求

- 引入雙面冷卻基板可降低熱阻

- 亞洲的本土化政策加強了國內包裝供應鏈。

- 市場限制

- 先進包裝設備需要高資本投資

- 一級OSAT廠商市場整合導致利潤率承壓

- 新型無鉛晶片黏接材料在200°C以上溫度下的可靠性問題

- 高導熱陶瓷(AlN、Si3N4)供應瓶頸

- 產業價值鏈分析

- 監管環境

- 技術展望

- 宏觀經濟因素如何影響市場

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代產品和服務的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按組件

- 基板

- 底板

- 模具連接

- 基板安裝

- 封裝

- 互連

- 其他部件

- 按功率設備類型

- IGBT模組

- Si-MOSFET模組

- SiC模組

- 氮化鎵模組

- 閘流體和其他模組

- 按功率範圍

- <600 V

- 600-1200 V

- 1200-1700 V

- >1700 V

- 最終用戶

- 車

- 產業

- 可再生能源

- 家用電子電器

- 資料中心和電信

- 鐵路和交通運輸

- 航太/國防

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Infineon Technologies AG

- Mitsubishi Electric Corporation(Powerex Inc.)

- Fuji Electric Co. Ltd

- Semikron-Danfoss GmbH & Co. KG

- Hitachi Ltd(Power Electronics Systems)

- STMicroelectronics NV

- Amkor Technology Inc.

- ON Semiconductor Corporation

- Wolfspeed Inc.

- ROHM Semiconductor

- Texas Instruments Inc.

- Littelfuse Inc.(IXYS)

- Microchip Technology Inc.

- Nexperia BV

- Vishay Intertechnology Inc.

- Dynex Semiconductor Ltd

- Danfoss Silicon Power GmbH

- Power Integrations Inc.

- SanRex Corporation

- Alpha & Omega Semiconductor Ltd

- Kyocera Corporation

- Heraeus Electronics GmbH

- TT Electronics plc

- Advanced Power Electronics Corp.

- Shanghai Electric Power Semiconductor Device Co. Ltd

- Cissoid SA

- Celestica Inc.

第7章 市場機會與未來展望

Power Module Packaging market size in 2026 is estimated at USD 3.01 billion, growing from 2025 value of USD 2.74 billion with 2031 projections showing USD 4.78 billion, growing at 9.72% CAGR over 2026-2031.

Demand is accelerating as wide-bandgap semiconductors transition from a niche to a mainstream market, electric vehicles adopt 800V architectures, and industrial motor drives prioritize energy efficiency improvements. Packaging innovation that delivers lower thermal resistance, higher current density, and reliable operation beyond 200°C has become a decisive competitive advantage, especially as automotive OEMs demand smaller footprints without compromising lifetime reliability. Regional diversification, most notably in Malaysia, India, and Indonesia, adds further impetus by expanding the manufacturing footprint and reducing geopolitical risk. Competitive dynamics are shifting as SiC and GaN devices place legacy silicon solutions under margin pressure, while advanced ceramic substrates, such as aluminum nitride, capture market share by enabling double-sided cooling designs.

Global Power Module Packaging Market Trends and Insights

Accelerating Adoption of SiC and GaN Power Devices in EV Traction Inverters

SiC penetration in battery electric vehicles is increasing as OEMs prioritize range extension and fast-charge capability. Early field data from Tesla demonstrated roughly 7% range gain over silicon IGBT alternatives, a benchmark that triggered broad industry replication despite SiC's higher device cost. Fraunhofer's Enhanced Direct-cooling Inverter architecture increased efficiency to 99.5% by eliminating baseplates, demonstrating how packaging advances directly translate into drivetrain gains. Widespread migration to 800V vehicle systems raises insulation and partial discharge challenges that only advanced substrates and low-inductance interconnects can address, thereby boosting premium module demand. As more OEMs unveil 900-V battery packs, suppliers that marry SiC dies with double-sided-cooling packaging are positioned to secure long-term design wins.

Growing Demand for Energy-Efficient Industrial Motor Drives

Electric motors account for approximately 70% of global industrial power consumption, and experts estimate that the universal deployment of variable-speed drives could offset the equivalent output of several mid-sized power stations. Yet only 15% of three-phase motors in developed economies employ electronic speed control, leaving vast untapped potential. SiC-based drive modules deliver 15-40% energy savings across variable-load applications such as HVAC, where compressors seldom operate at full load. Generation 7 automotive-grade IGBT technology increases the permissible junction temperature, enabling smaller heatsinks and more compact cabinet designs, which in turn lower installation costs. Governments' efficiency mandates and rising electricity prices provide a durable tailwind for high-performance packaging that can guarantee reliability over 20-year industrial duty cycles.

High Capex Requirements for Advanced Packaging Equipment

SEMI forecasts that 300 mm fab equipment will increase with a rising slice earmarked for advanced packaging gear such as laser dicing and hybrid-bonding lines. Wide-bandgap devices require sintering ovens capable of profiles exceeding 250 °C and pick-and-place accuracy within +-3 µm, which raises the barrier to entry for newcomers. EV battery plants face parallel capex burdens, illustrating how capital intensity is a systemic hurdle across electrification value chains. Financing obstacles are felt most acutely in regions that lack mature semiconductor clusters, slowing diversification goals and tempering near-term capacity additions in South Asia and Latin America.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Renewable-Energy-Linked High-Power Inverters

- Miniaturisation Mandate from On-Board Chargers in E-Mobility Fleets

- Margin Squeeze Caused by Market Consolidation Among Tier-1 OSATs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Substrates captured 27.85% of 2025 revenue, underscoring their pivotal role in controlling heat and electrical isolation. Die attach is projected to post an 10.96% CAGR, the fastest component trajectory, as silver sintering and transient-liquid-phase bonding enable operation beyond 200 °C without the use of lead-based alloys. Baseplates are steadily displaced by direct-substrate-cooling schemes that collapse thermal paths, while ceramic encapsulants that pare junction temperature by 12 K widen their footprint, especially in high-power wind converters.

Advanced planar interconnects using copper clips eliminate wire-bond reliability weak points and enhance current density, thereby reducing package footprints within EV traction inverters. Thermal interface materials are evolving toward nano-structured carbon networks, nearing the theoretical resistance of 0.1 mm2K/W, which extends mission life under high-cycle stress. Suppliers that vertically integrate substrate pressing, metallization, and sintered attach services are winning contracts as OEMs demand single-source responsibility for thermal stack-up performance. The holistic approach safeguards supplier margins even as commoditization pressures intensify in lower-power consumer segments.

IGBT modules retained 36.88% of the 2025 value within the power module packaging market, buoyed by entrenched manufacturing lines and favorable cost curves for <=1200 V applications. Yet SiC modules will grow at a 10.52% CAGR through 2031, unlocking superior switching speeds and slashing conduction losses in EV drivetrains and fast chargers. GaN modules are witnessing growth in high-frequency telecom rectifier demand, with Infineon's acquisition of GaN Systems amplifying its competitive firepower.

Si-MOSFET modules remain attractive for cost-sensitive appliance and consumer power supplies, while thyristors retain relevance in HVDC links and induction heating, where ruggedness takes precedence over switching speed. The transition to 200 mm SiC wafers promises cost parity with silicon within the decade; however, automotive-grade SiC yields remain the gating factor for volume ramp. Packaging houses offering deep inspection competence and zero-ppm defect targets are, therefore, essential allies to wide-bandgap fab owners.

The Power Module Packaging Market Report is Segmented by Components (Substrate, Baseplate, Die Attach, and More), Power Device Type (IGBT Modules, Si-MOSFET Modules, and More), Power Range (< 600 V, 600 - 1200 V, 1200 - 1700 V, and More), End-User (Automotive, Industrial, and More), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region led with 48.35% of 2025 spending and is expected to compound at a 11.37% CAGR as China's OSAT ecosystem benefits from AI server and EV momentum. India's USD 10 billion incentive scheme and Micron's USD 825 million Gujarat plant underscore a policy drive that will add meaningful backend capacity by 2027. Malaysia is bolstered by Intel's USD 7 billion packaging expansion and Micron's investment in Penang, positioning the country as a complementary hub that can mitigate Taiwan Strait risk.

North America's CHIPS Act earmarks USD 52.7 billion and prioritizes advanced packaging to shore up domestic supply; Amkor's USD 2 billion Arizona site will handle AI accelerator modules when it comes online in 2026. Regional share is poised to rise modestly as fabs qualify local OSATs for critical installations. Europe focuses on automotive SiC supply-chain sovereignty, with Wolfspeed planning USD 3 billion for a German epi-wafer and module line that dovetails with OEM electrification targets. The European Chips Act aims to harmonize national incentives, yet it still lags behind U.S. funding levels, prompting companies to enhance cross-border collaboration.

The Middle East and Africa present emerging greenfield opportunities anchored in gigawatt-scale solar and wind projects that require grid-forming inverters. Gulf sovereign funds are exploring joint ventures with experienced module makers to establish local assembly, leveraging abundant renewable energy to power future hydrogen exports.

- Infineon Technologies AG

- Mitsubishi Electric Corporation (Powerex Inc.)

- Fuji Electric Co. Ltd

- Semikron-Danfoss GmbH & Co. KG

- Hitachi Ltd (Power Electronics Systems)

- STMicroelectronics N.V.

- Amkor Technology Inc.

- ON Semiconductor Corporation

- Wolfspeed Inc.

- ROHM Semiconductor

- Texas Instruments Inc.

- Littelfuse Inc. (IXYS)

- Microchip Technology Inc.

- Nexperia B.V.

- Vishay Intertechnology Inc.

- Dynex Semiconductor Ltd

- Danfoss Silicon Power GmbH

- Power Integrations Inc.

- SanRex Corporation

- Alpha & Omega Semiconductor Ltd

- Kyocera Corporation

- Heraeus Electronics GmbH

- TT Electronics plc

- Advanced Power Electronics Corp.

- Shanghai Electric Power Semiconductor Device Co. Ltd

- Cissoid SA

- Celestica Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating adoption of SiC and GaN power devices in EV traction inverters

- 4.2.2 Growing demand for energy-efficient industrial motor drives

- 4.2.3 Expansion of renewable-energy-linked high-power inverters

- 4.2.4 Miniaturisation mandate from on-board chargers in e-mobility fleets

- 4.2.5 Emergence of double-sided-cooling substrates lowering thermal resistance

- 4.2.6 Localisation policies in Asia boosting domestic packaging supply chains

- 4.3 Market Restraints

- 4.3.1 High capex requirements for advanced packaging equipment

- 4.3.2 Margin squeeze caused by market consolidation among Tier-1 OSATs

- 4.3.3 Reliability concerns over new lead-free die-attach materials > 200 °C

- 4.3.4 Supply bottlenecks for high-thermal-conductivity ceramics (AlN, Si3N4)

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Components

- 5.1.1 Substrate

- 5.1.2 Baseplate

- 5.1.3 Die Attach

- 5.1.4 Substrate Attach

- 5.1.5 Encapsulations

- 5.1.6 Interconnections

- 5.1.7 Other Components

- 5.2 By Power Device Type

- 5.2.1 IGBT Modules

- 5.2.2 Si-MOSFET Modules

- 5.2.3 SiC Modules

- 5.2.4 GaN Modules

- 5.2.5 Thyristor and Other Modules

- 5.3 By Power Range

- 5.3.1 < 600 V

- 5.3.2 600 - 1200 V

- 5.3.3 1200 - 1700 V

- 5.3.4 > 1700 V

- 5.4 By End-user

- 5.4.1 Automotive

- 5.4.2 Industrial

- 5.4.3 Renewable Energy

- 5.4.4 Consumer Electronics

- 5.4.5 Data Centres and Telecom

- 5.4.6 Rail and Transportation

- 5.4.7 Aerospace and Defence

- 5.4.8 Other End-users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Infineon Technologies AG

- 6.4.2 Mitsubishi Electric Corporation (Powerex Inc.)

- 6.4.3 Fuji Electric Co. Ltd

- 6.4.4 Semikron-Danfoss GmbH & Co. KG

- 6.4.5 Hitachi Ltd (Power Electronics Systems)

- 6.4.6 STMicroelectronics N.V.

- 6.4.7 Amkor Technology Inc.

- 6.4.8 ON Semiconductor Corporation

- 6.4.9 Wolfspeed Inc.

- 6.4.10 ROHM Semiconductor

- 6.4.11 Texas Instruments Inc.

- 6.4.12 Littelfuse Inc. (IXYS)

- 6.4.13 Microchip Technology Inc.

- 6.4.14 Nexperia B.V.

- 6.4.15 Vishay Intertechnology Inc.

- 6.4.16 Dynex Semiconductor Ltd

- 6.4.17 Danfoss Silicon Power GmbH

- 6.4.18 Power Integrations Inc.

- 6.4.19 SanRex Corporation

- 6.4.20 Alpha & Omega Semiconductor Ltd

- 6.4.21 Kyocera Corporation

- 6.4.22 Heraeus Electronics GmbH

- 6.4.23 TT Electronics plc

- 6.4.24 Advanced Power Electronics Corp.

- 6.4.25 Shanghai Electric Power Semiconductor Device Co. Ltd

- 6.4.26 Cissoid SA

- 6.4.27 Celestica Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment