|

市場調查報告書

商品編碼

1740775

功率模組封裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Power Module Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

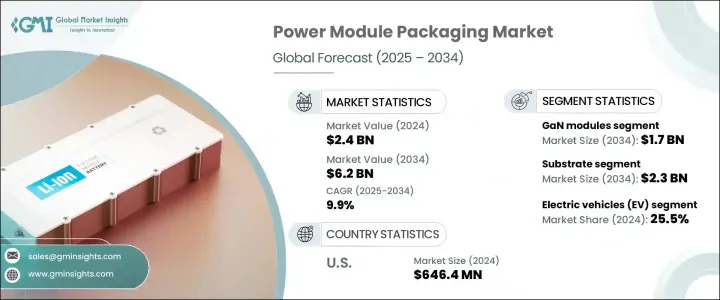

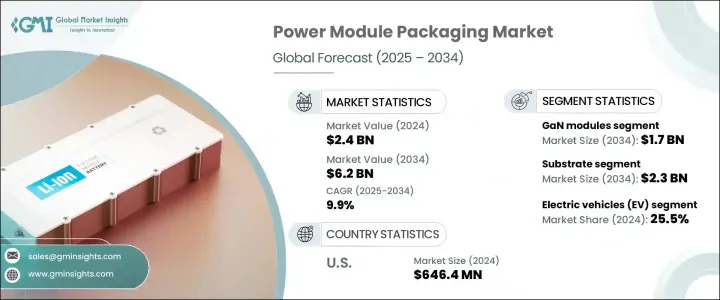

2024年,全球功率模組封裝市場規模達24億美元,預計到2034年將以9.9%的複合年成長率成長,達到62億美元,這得益於電動車(EV)的快速普及以及智慧電網基礎設施的大量投資。隨著全球各行各業向電氣化和永續能源解決方案邁進,對高性能功率模組封裝的需求持續成長。該市場受益於汽車、工業和消費性電子等各領域能源消耗的不斷成長,而高效的能源轉換和強大的熱管理對這些領域至關重要。

半導體材料的技術進步,加上對緊湊、可靠和高效模組的需求,正在重塑競爭格局。功率模組封裝正在不斷發展,以滿足從自動駕駛汽車到下一代再生能源工廠等新興應用的嚴格要求。製造商面臨越來越大的壓力,需要提供既支援小型化又不影響性能的創新設計,而最終用戶也擴大尋求能夠確保耐用性、節能和降低維護成本的解決方案。市場也越來越關注永續性,參與者正在探索可回收和環保的包裝材料,以符合全球綠色能源目標。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 62億美元 |

| 複合年成長率 | 9.9% |

隨著電動車日益成為主流,對能夠確保電動車動力系統高效能轉換和有效熱管理的功率模組封裝解決方案的需求急劇成長。此外,再生能源產業的擴張在推動市場成長方面發揮著至關重要的作用。隨著向風能、太陽能和水力發電等清潔能源的轉變日益加劇,對用於管理能量轉換、儲存和分配的高效電力電子設備的需求也日益成長。功率模組封裝可確保系統可靠且有效率地運行,尤其是在大規模再生能源裝置日益普及的背景下。高效能功率模組對於處理來自再生能源的可變功率輸入和確保穩定的電網整合至關重要。採用先進封裝的功率模組可顯著提高功率轉換效率並最大限度地降低能量損失,隨著資料中心的擴展以滿足全球對雲端運算和巨量資料分析的需求,這一點變得越來越重要。

功率模組封裝市場包括GaN模組、SiC模組、FET模組、IGBT模組等,其中GaN模組預計將佔據主導地位。到2034年,GaN模組市場規模預計將達到17億美元,這得益於其高開關頻率、緊湊設計和極低的能量損耗等優勢,使其成為快速充電系統、電動車和資料中心的理想選擇。基板市場佔據24%的市場佔有率,隨著銅和鋁碳化矽(AlSiC)等先進材料的需求激增,該市場也正在獲得發展,這些先進材料在高功率、高頻應用中具有卓越的散熱性和機械穩定性。

受汽車電氣化、再生能源應用和資料中心蓬勃發展的推動,2024年美國功率模組封裝市場規模達6.464億美元。然而,對中國進口產品徵收的關稅擾亂了供應鏈,並推高了生產成本。安靠科技、富士電機、日立、英飛凌科技和京瓷等主要廠商正在大力投資創新設計、先進材料和策略合作,以在這個充滿活力且快速發展的市場中保持領先地位。

全球功率模組封裝市場的主要公司包括安靠科技 (Amkor Technology)、富士電機 (Fuji Electric)、日立 (Hitachi)、英飛凌科技 (Infineon Technologies) 和京瓷 (Kyocera)。為了鞏固市場地位,各公司專注於材料和設計的持續創新,以滿足日益成長的節能解決方案需求。他們正在投資先進的製造技術,並探索能夠改善功率模組熱管理和可靠性的新材料。各公司也正在加強研發力度,以打造客製化的封裝解決方案,滿足電動車和再生能源等產業的特定需求。與行業領導者建立策略合作夥伴關係,使公司能夠擴展自身能力並利用新技術,確保在快速發展的市場中保持競爭力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(銷售價格)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 供應方影響(原料)

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 電動車(EV)的普及率不斷提高

- 對再生能源系統的需求不斷增加

- 對高效能電力電子元件的需求不斷成長

- 工業自動化和機器人技術的成長

- 增加對智慧電網基礎設施的投資

- 產業陷阱與挑戰

- 初期投資和製造成本高

- 複雜的設計和熱管理挑戰

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- GaN模組

- SiC模組

- 場效電晶體模組

- IGBT模組

- 其他

第6章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 基材

- 底板

- 晶片黏接

- 基板附著

- 封裝

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 電動車(EV)

- 馬達

- 鐵路牽引

- 風力渦輪機

- 光電設備

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 澳新銀行

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- MEA 其餘地區

第9章:公司簡介

- Amkor Technology

- Fuji Electric

- Hitachi

- Infineon Technologies

- Kyocera

- MacMic Science and Technology

- Microchip

- Mitsubishi Electric

- ON Semiconductor (onsemi)

- Renesas Electronics

- ROHM Semiconductor

- Semikron Danfoss

- Starpower Semiconductor

- Texas Instruments

- Toshiba

The Global Power Module Packaging Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 9.9% to reach USD 6.2 billion by 2034, driven by the rapid adoption of electric vehicles (EVs) and substantial investments in smart grid infrastructure. As global industries move toward electrification and sustainable energy solutions, the demand for high-performance power module packaging continues to accelerate. The market is benefiting from rising energy consumption across various sectors, including automotive, industrial, and consumer electronics, where efficient energy conversion and robust thermal management are critical.

Technological advancements in semiconductor materials, coupled with the need for compact, reliable, and efficient modules, are reshaping the competitive landscape. Power module packaging is evolving to meet the stringent requirements of emerging applications, from autonomous vehicles to next-generation renewable energy plants. Manufacturers are under growing pressure to deliver innovative designs that support miniaturization without compromising performance, while end users are increasingly seeking solutions that ensure durability, energy savings, and reduced maintenance costs. The market is also seeing heightened focus on sustainability, with players exploring recyclable and environmentally friendly packaging materials to align with global green energy goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 9.9% |

As electric vehicles become more mainstream, the need for power module packaging solutions that guarantee efficient energy conversion and effective thermal management in EV powertrains is rising sharply. Moreover, the expansion of the renewable energy sector plays a crucial role in driving market growth. As the shift toward cleaner energy sources like wind, solar, and hydropower intensifies, the demand for efficient power electronics to manage energy conversion, storage, and distribution grows. Power module packaging ensures systems operate reliably and efficiently, especially as large-scale renewable energy installations become more common. High-efficiency power modules are critical for handling variable power inputs from renewables and ensuring stable grid integration. Power modules with advanced packaging significantly enhance power conversion efficiency and minimize energy losses, which is becoming increasingly important as data centers expand to meet the global demand for cloud computing and big data analytics.

The power module packaging market includes GaN modules, SiC modules, FET modules, IGBT modules, and others, with GaN modules expected to lead. By 2034, the GaN module segment is projected to hit USD 1.7 billion, driven by advantages such as high switching frequencies, compact design, and minimal energy losses, making them ideal for fast charging systems, EVs, and data centers. The baseplate segment, accounting for a 24% market share, is gaining traction as demand surges for advanced materials like copper and aluminum silicon carbide (AlSiC), which offer superior heat dissipation and mechanical stability in high-power, high-frequency applications.

The U.S. power module packaging market was valued at USD 646.4 million in 2024, fueled by rapid automotive electrification, renewable energy adoption, and the boom in data centers. However, tariffs on Chinese imports have disrupted supply chains and raised production costs. Key players like Amkor Technology, Fuji Electric, Hitachi, Infineon Technologies, and Kyocera are investing heavily in innovative designs, advanced materials, and strategic collaborations to stay ahead in this dynamic and fast-evolving market.

Key companies in the Global Power Module Packaging Market include Amkor Technology, Fuji Electric, Hitachi, Infineon Technologies, and Kyocera. To strengthen their position in the market, companies are focusing on continuous innovation in materials and designs to meet the growing demand for energy-efficient solutions. They are investing in advanced manufacturing techniques and exploring new materials that improve the thermal management and reliability of power modules. Companies are also enhancing their R&D efforts to create customized packaging solutions that cater to the specific needs of industries like electric vehicles and renewable energy. Strategic collaborations and partnerships with industry leaders allow companies to expand their capabilities and leverage new technologies, ensuring they remain competitive in a rapidly evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-Side impact (Raw Materials)

- 3.2.1.3.1.1 Price volatility in key materials

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-Side impact (Selling Price)

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.3 Key companies impacted

- 3.2.1.3.4 Strategic industry responses

- 3.2.1.3.4.1 Supply chain reconfiguration

- 3.2.1.3.4.2 Pricing and product strategies

- 3.2.1.3.4.3 Policy engagement

- 3.2.1.3.5 Outlook and future considerations

- 3.2.1.3.1 Supply-Side impact (Raw Materials)

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing adoption of electric vehicles (EVs)

- 3.3.1.2 Increasing demand for renewable energy systems

- 3.3.1.3 Rising need for high-efficiency power electronics

- 3.3.1.4 Growth in industrial automation and robotics

- 3.3.1.5 Increasing investments in smart grid infrastructure

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment and manufacturing costs

- 3.3.2.2 Complex design and thermal management challenges

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 GaN module

- 5.3 SiC module

- 5.4 FET module

- 5.5 IGBT module

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Substrate

- 6.3 Baseplate

- 6.4 Die attach

- 6.5 Substrate attach

- 6.6 Encapsulations

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Electric vehicles (EV)

- 7.3 Motors

- 7.4 Rail tractions

- 7.5 Wind turbines

- 7.6 Photovoltaic equipment

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 ANZ

- 8.4.7 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of MEA

Chapter 9 Company Profiles

- 9.1 Amkor Technology

- 9.2 Fuji Electric

- 9.3 Hitachi

- 9.4 Infineon Technologies

- 9.5 Kyocera

- 9.6 MacMic Science and Technology

- 9.7 Microchip

- 9.8 Mitsubishi Electric

- 9.9 ON Semiconductor (onsemi)

- 9.10 Renesas Electronics

- 9.11 ROHM Semiconductor

- 9.12 Semikron Danfoss

- 9.13 Starpower Semiconductor

- 9.14 Texas Instruments

- 9.15 Toshiba