|

市場調查報告書

商品編碼

1906932

北美過程自動化市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031 年)North America Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

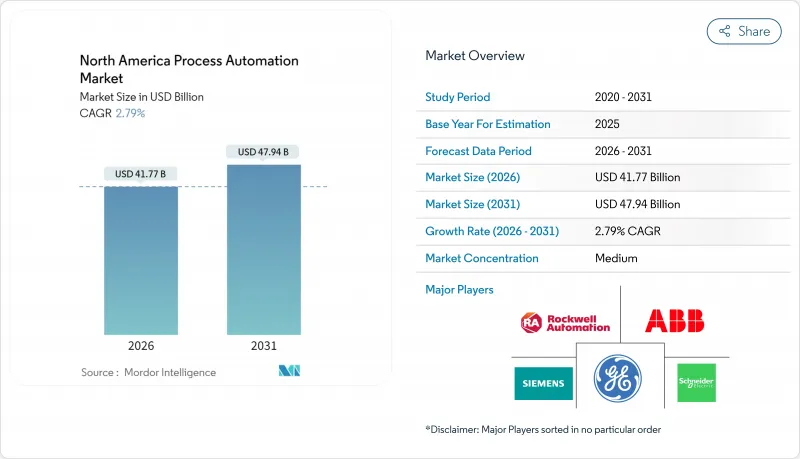

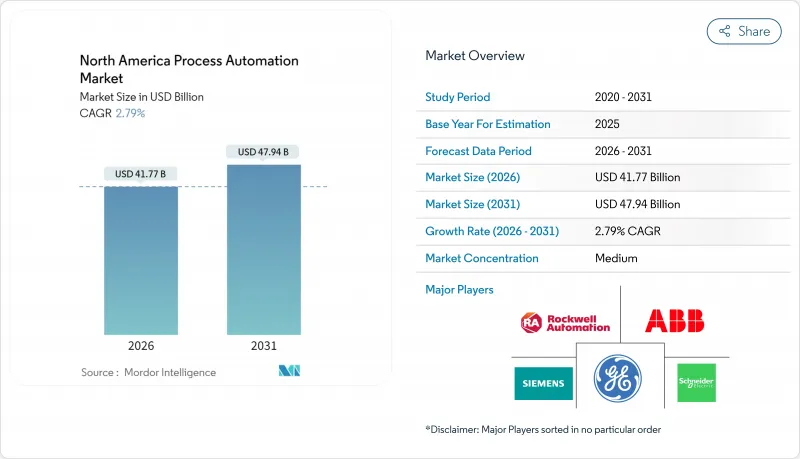

預計北美製程自動化市場將從 2025 年的 406.4 億美元成長到 2026 年的 417.7 億美元,到 2031 年將達到 479.4 億美元,2026 年至 2031 年的複合年成長率為 2.79%。

穩健的成長主要得益於大規模的裝機量、持續的效率提升措施以及日益嚴格的環境法規。石油和天然氣業者仍然是領先的採用者,而製藥公司則展現出最快的成長速度,因為連續生產技術正獲得美國食品藥物管理局(FDA) 的支持。有線通訊協定在控制室連線方面仍然佔據主導地位,但隨著 ISA100 和 WirelessHART 的日趨成熟,無線網路正呈現出最高的成長速度。隨著製造商透過預測分析將營運數據貨幣化,同時將安全關鍵邏輯保留在本地,雲端和邊緣配置正在加速推進。

北美過程自動化市場趨勢與洞察

更加重視提高能源效率和降低營運成本

不斷上漲的電費和燃料價格使得即時能源最佳化成為經營團隊的首要任務。海德堡材料公司實施了先進的製程控制軟體,該軟體能夠根據負載波動微調燃燒過程,從而將窯爐能耗降低了15%,每年節省280萬美元。五大湖地區的一家鋼鐵廠也實施了類似的舉措,以減少冬季天然氣價格高峰期的用量。能源需量反應計畫會獎勵那些將電力消耗量工序轉移到用電低谷時段的工廠,迅速收回感測器維修的成本。持續監測能夠發現隱藏的損耗,例如壓縮空氣洩漏,這些損耗通常佔工廠電費的20%至30%。當初步試點計畫展現出節能效果後,企業財務部門核准大規模的多年預算,以維持製程自動化市場的發展動能。

安全儀器系統的需求不斷成長

工業事故的增加促使監管力道加大,並加速了安全系統的升級。 ISA-84 標準現要求煉油廠每五年檢驗其安全完整性等級 (SIL)。艾默生的 DeltaV SIS 將邏輯控制器與製程控制整合,從而減少了設計工作量和測試停機時間。為響應新的州級法規,雪佛龍投資 4500 萬美元建立了一個冗餘邏輯平台,顯著降低了跳閘造成的生產損失。供應商現在提供捆綁式診斷服務,用於在跳閘發生前檢測閥門卡滯和感測器漂移。這些變化共同推動了對認證硬體、檢驗工具以及支援流程自動化市場的全生命週期服務合約的需求。

高昂的初始資本支出和整合複雜性

在涉及多家供應商的工廠維修中,整合成本可能高達計劃總成本的 60%。技術人員必須在短暫停機期間執行專有標籤映射、中間件開發和切換工作,這增加了總安裝成本。過長的停機時間會延長投資回收期。在化工等對原物料價格敏感的行業,利潤率波動會增加資金籌措難度。儘管供應商現在將節能保固捆綁銷售,但財務長仍要求投資回收期不超過三年,這限制了製程自動化技術在短期內的應用。

細分市場分析

到2025年,有線電視網路將佔營收的69.25%,這主要得益於其在保護安全關鍵迴路方面的確定性效能。這一主導地位是連結類別中對流程自動化市場規模貢獻最大的因素。然而,隨著網狀拓撲結構在腐蝕性或爆炸性區域實現99.9%的可用性,無線通訊協定的可靠性正在不斷提高。埃克森美孚在貝城的成功案例證明,無線部署可以將安裝預算降低40%。新興的私有5G網路正在推動人們對行動資產追蹤和無線機器人的興趣,這意味著每個資產的感測器數量有望實現兩位數的成長。製造商目前正在嘗試將以乙太網路為基礎的控制器與WirelessHART現場設備結合的混合架構,以平衡運作和柔軟性。

領先採用者正在量化臨時監控計劃的即時成效,這些專案如果採用傳統的佈線方式,根本無法通過資本委員會的批准。服務承包商尤其讚賞快速試運行,尤其是在工期緊張的情況下。可靠性團隊發現,閘道器內建的高階診斷功能能夠在訊號劣化影響控制迴路之前將其識別出來。同時,ISA/IEC 62443 等工業網路安全框架的同步發展,也緩解了人們對無線攻擊面的擔憂。隨著試點用例逐漸成熟並最終落地,無線技術將縮小差距,並持續推動製程自動化市場的穩定成長。

到2025年,硬體系統將維持26.88%的製程自動化市場佔有率,反映出市場對PLC、分散式控制系統和安全邏輯控制器的持續需求。然而,工廠管理人員越來越傾向於使用演算法而非機殼來獲取競爭優勢。隨著先進的控制、製造執行和分析工具挖掘出更多未開發的數據,軟體平台將實現3.92%的複合年成長率。Schneider Electric的EcoStruxure融合了SCADA和雲微服務,使工程師能夠近乎即時地根據洞察採取行動。

在監管機構要求使用數位化批次記錄和進行能源強度審核的領域,軟體正蓬勃發展。製藥公司正在採用在線連續光譜技術和模型預測控制來滿足FDA的品質源自於設計(QbD)要求,從而推動了軟體的普及。同時,開放原始碼歷史資料管理系統和容器編排管理正在緩解供應商鎖定問題。雖然硬體對於確定性控制仍然至關重要,但差異化將取決於軟體如何有效地創造價值。這種轉變將推動服務和訂閱收入的成長,從而增強製程自動化市場的長期成長。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 越來越重視提高能源效率和降低營運成本

- 安全儀器系統的需求不斷成長

- 工業IoT平台的普及

- 轉向預測性和規範性維護分析

- 碳排放強度懲罰加速數位化過程控制

- 老年技術純熟勞工駕駛遙控和自動駕駛汽車

- 市場限制

- 高昂的初始資本支出和整合複雜性

- 現有設備互通性方面的挑戰

- 營運網路安全人才短缺

- 長期服務合約的鎖定效應限制了供應商的變更。

- 產業價值/價值鏈分析

- 監管現狀和標準

- 技術展望(邊緣運算和人工智慧分析)

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 工業自動化重點領域分析(美國和加拿大)

- 宏觀經濟趨勢的影響(與通膨相關的資本投資、製造業回流)

- 疫情後的經濟復甦主題(V型復甦/溫和復甦/停滯)

- 美國-基準 -最終用戶效能變化

- 加拿大 -基準 -可變最終用戶效能

- 供給方面的挑戰和政策獎勵策略

第5章 市場規模與成長預測

- 透過通訊協定

- 有線

- 無線的

- 依系統類型

- 硬體

- SCADA

- 分散式控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 人機介面(HMI)

- 製程安全系統

- 閥門和致動器

- 電動機

- 感測器和發射器

- 軟體

- 高階過程控制(ARC、MVC、推理)

- 數據分析與報告

- 製造執行系統(MES)

- 其他軟體

- 硬體

- 按組件

- 硬體

- 軟體

- 服務

- 透過部署模式

- 本地部署

- 雲和邊緣

- 按最終用戶行業分類

- 石油和天然氣

- 化工/石油化工

- 電力/公共產業

- 用水和污水

- 食品/飲料

- 紙漿和造紙

- 製藥

- 其他終端用戶產業

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Rockwell Automation, Inc.

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Omron Corporation

- Fuji Electric Co., Ltd.

- Delta Electronics, Inc.

- Yokogawa Electric Corporation

- Phoenix Contact GmbH & Co. KG

- Bosch Rexroth AG

- Beckhoff Automation GmbH & Co. KG

- Festo SE & Co. KG

- Endress+Hauser Group Services AG

- Aspen Technology, Inc.

- AVEVA Group plc

- Azbil Corporation

第7章 市場機會與未來展望

The North America process automation market is expected to grow from USD 40.64 billion in 2025 to USD 41.77 billion in 2026 and is forecast to reach USD 47.94 billion by 2031 at 2.79% CAGR over 2026-2031.

Moderate growth stems from a large installed base, incremental efficiency initiatives, and stricter environmental mandates. Oil and gas operators remain the principal adopters, while pharmaceutical manufacturers post the fastest expansion as continuous manufacturing gains U.S. Food and Drug Administration support. Wired protocols still dominate control-room links, yet wireless networks post the highest growth as ISA100 and WirelessHART mature. Cloud and edge deployments accelerate as manufacturers monetize operational data through predictive analytics while keeping safety-critical logic on-premises.

North America Process Automation Market Trends and Insights

Rising Focus on Energy-Efficiency and OPEX Reduction

Escalating electricity and fuel prices make real-time energy optimization a board-level priority. Heidelberg Materials cut kiln energy use by 15% and saved USD 2.8 million annually after installing advanced process control software that fine-tunes combustion in response to load swings. Similar initiatives in Great Lakes steel mills reduce natural-gas intensity during winter price spikes. Demand response programs reward plants that shift power-intensive steps to off-peak hours, creating quick payback on sensor retrofits. Continuous monitoring uncovers hidden losses such as compressed-air leaks, which often consume 20-30% of a plant's electricity bill. Once initial pilots validate savings, corporate finance teams release larger multiyear budgets, sustaining the process automation market momentum.

Heightened Demand for Safety-Instrumented Systems

Industrial incidents have tightened regulatory scrutiny, accelerating safety-system upgrades. ISA-84 now obliges refineries to verify safety integrity levels at five-year intervals. Emerson's DeltaV SIS integrates logic solvers with process control, trimming engineering hours and reducing test downtime. Chevron invested USD 45 million in redundant logic platforms after new state mandates, slashing trip-related lost-production events. Vendors bundle diagnostics that flag valve stiction and sensor drift before trips occur. Together, these changes lift demand for certified hardware, validation tools, and lifecycle service contracts that underpin the process automation market.

High Upfront CAPEX and Integration Complexity

Retrofitting a multi-vendor plant can push integration costs to 60% of project value. Technicians must map proprietary tags, develop middleware, and stage cutovers during short turnarounds, inflating total installed cost. Payback lengthens when downtime overruns occur. Financing hurdles magnify in commodity-price-sensitive sectors like chemicals, where margins fluctuate. Vendors now bundle energy-savings guarantees, yet CFOs still insist on under-three-year returns, limiting near-term process automation market uptake.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of Industrial IoT Platforms

- Shift Toward Predictive and Prescriptive Maintenance Analytics

- Operational Cybersecurity Talent Deficit

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wired networks secured 69.25% of 2025 revenue thanks to deterministic performance that safeguards safety-critical loops. That dominance translates to the largest process automation market size contribution within connectivity categories. Yet wireless protocols are gaining credibility as mesh topologies deliver 99.9% availability in corrosive or explosive zones. ExxonMobil's success at Baytown proves wireless deployment can slash installation budgets by 40%. Emerging private 5G spurs interest in mobile asset tracking and untethered robotics, foreshadowing double-digit sensor counts per asset. Manufacturers now pilot hybrid architectures that pair Ethernet-based controllers with WirelessHART field instruments, striking a balance between uptime and flexibility.

First adopters quantify quick wins in temporary monitoring projects that would never clear the capital committee under traditional cabling assumptions. Service contractors appreciate faster commissioning, especially on turnarounds with compressed schedules. Reliability teams confirm that advanced diagnostics embedded in gateways pinpoint signal degradation before it imperils control loops. Parallel growth in industrial cybersecurity frameworks such as ISA/IEC 62443 calms worries over radio attack surfaces. As test use cases mature into permanent installations, wireless will narrow its gap, sustaining incremental gains in the process automation market.

Hardware systems retained a 26.88% share of the process automation market size in 2025, reflecting the enduring need for PLCs, distributed control systems, and safety logic solvers. However, plant managers increasingly view algorithms, not enclosures, as the source of competitive edge. Software platforms post a 3.92% CAGR as advanced control, manufacturing execution, and analytics tools mine untapped data. Schneider Electric's EcoStruxure blends SCADA with cloud micro-services, letting engineers act on insights in near real time.

Software gains momentum wherever regulators demand digital batch records or energy-intensity audits. Pharmaceutical firms embed inline spectroscopy and model-predictive control to satisfy FDA quality-by-design mandates, lifting software penetration. Meanwhile, open-source historians and container orchestration reduce vendor lock-in fears. Hardware still matters for determinism, but differentiation now hinges on how adeptly software extracts value. This pivot enlarges service and subscription revenue, reinforcing the long-term expansion of the process automation market.

The North America Process Automation Market Report is Segmented by Communication Protocol (Wired, Wireless), System Type (Hardware, Software), Component (Hardware, Software, Services), Deployment Mode (On-Premises, Cloud and Edge), End-User Industry (Chemical and Petrochemical, Power and Utilities, Water and Wastewater, Food and Beverage, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Rockwell Automation, Inc.

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Omron Corporation

- Fuji Electric Co., Ltd.

- Delta Electronics, Inc.

- Yokogawa Electric Corporation

- Phoenix Contact GmbH & Co. KG

- Bosch Rexroth AG

- Beckhoff Automation GmbH & Co. KG

- Festo SE & Co. KG

- Endress+Hauser Group Services AG

- Aspen Technology, Inc.

- AVEVA Group plc

- Azbil Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising focus on energy-efficiency and OPEX reduction

- 4.2.2 Heightened demand for safety-instrumented systems

- 4.2.3 Proliferation of Industrial IoT platforms

- 4.2.4 Shift toward predictive and prescriptive maintenance analytics

- 4.2.5 Carbon-intensity penalties accelerating digital process control

- 4.2.6 Aging skilled workforce driving remote and autonomous operations

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX and integration complexity

- 4.3.2 Brown-field interoperability challenges

- 4.3.3 Operational cybersecurity talent deficit

- 4.3.4 Long-term service-contract lock-ins limiting vendor switch

- 4.4 Industry Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape and Standards

- 4.6 Technological Outlook (Edge and AI analytics)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Industrial-Automation Hot-Spots Analysis (US and Canada)

- 4.9 Macroeconomic Trend Impact (inflation-linked capex, reshoring)

- 4.10 Pandemic Recovery Themes (V-shape / Mid-range / Slump)

- 4.11 US - Base-Variable End-user Performance

- 4.12 Canada - Base-Variable End-user Performance

- 4.13 Supply-related Challenges and Policy Stimulus

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Communication Protocol

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By System Type

- 5.2.1 Hardware

- 5.2.1.1 SCADA

- 5.2.1.2 Distributed Control System (DCS)

- 5.2.1.3 Programmable Logic Controller (PLC)

- 5.2.1.4 Human-Machine Interface (HMI)

- 5.2.1.5 Process Safety Systems

- 5.2.1.6 Valves and Actuators

- 5.2.1.7 Electric Motors

- 5.2.1.8 Sensors and Transmitters

- 5.2.2 Software

- 5.2.2.1 Advanced Process Control (ARC, MVC, Inferential)

- 5.2.2.2 Data Analytics and Reporting

- 5.2.2.3 Manufacturing Execution Systems (MES)

- 5.2.2.4 Other Software

- 5.2.1 Hardware

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Deployment Mode

- 5.4.1 On-Premises

- 5.4.2 Cloud and Edge

- 5.5 By End-user Industry

- 5.5.1 Oil and Gas

- 5.5.2 Chemical and Petrochemical

- 5.5.3 Power and Utilities

- 5.5.4 Water and Wastewater

- 5.5.5 Food and Beverage

- 5.5.6 Pulp and Paper

- 5.5.7 Pharmaceutical

- 5.5.8 Other End-user Industry

- 5.6 By Country

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes global overview, market overview, core segments, financials, strategy, market share, products and services, recent developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Siemens AG

- 6.4.3 Schneider Electric SE

- 6.4.4 General Electric Company

- 6.4.5 Rockwell Automation, Inc.

- 6.4.6 Emerson Electric Co.

- 6.4.7 Mitsubishi Electric Corporation

- 6.4.8 Honeywell International Inc.

- 6.4.9 Omron Corporation

- 6.4.10 Fuji Electric Co., Ltd.

- 6.4.11 Delta Electronics, Inc.

- 6.4.12 Yokogawa Electric Corporation

- 6.4.13 Phoenix Contact GmbH & Co. KG

- 6.4.14 Bosch Rexroth AG

- 6.4.15 Beckhoff Automation GmbH & Co. KG

- 6.4.16 Festo SE & Co. KG

- 6.4.17 Endress+Hauser Group Services AG

- 6.4.18 Aspen Technology, Inc.

- 6.4.19 AVEVA Group plc

- 6.4.20 Azbil Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Investment Analysis