|

市場調查報告書

商品編碼

1906221

中東和非洲IT服務:市場佔有率分析、行業趨勢、統計數據和成長預測(2026-2031年)Middle East And Africa IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

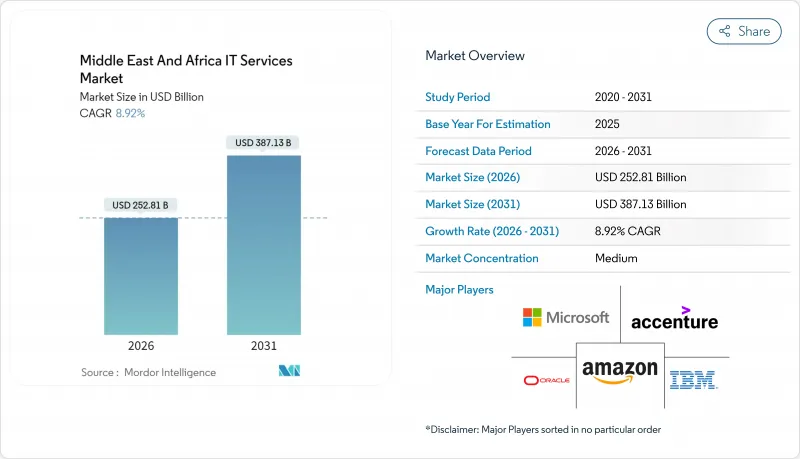

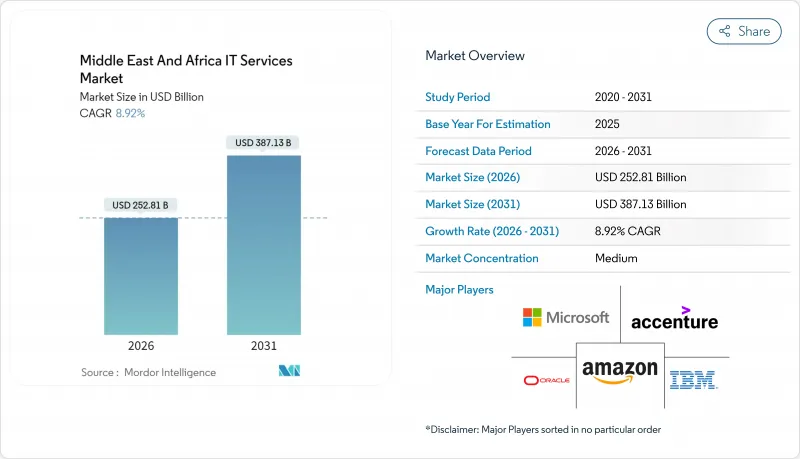

2025 年中東和非洲 IT 服務市場價值為 2321 億美元,預計從 2026 年的 2528.1 億美元成長到 2031 年的 3871.3 億美元,預測期(2026-2031 年)複合年成長率為 8.92%。

政府主導的數位化計畫加速推進、主權財富基金的技術指令以及5G的廣泛應用,正在改變波灣合作理事會(GCC)和非洲主要經濟體企業的IT支出模式。雲端運算的普及、超大規模資料中心投資的激增以及全部區域的金融科技蓬勃發展,都推動了對諮詢、實施和管理服務的需求。同時,精通雲端原生技術的雙語人才長期短缺以及跨境資料法律的分散化限制了成長前景,迫使服務提供者改進其交付模式和合規策略。全球整合商利用其規模和技術優勢,而區域專家則利用其在地化需求和阿拉伯語能力,雙方的競爭格局正在趨於平衡。

中東和非洲IT服務市場趨勢與洞察

基於國家願景的雲端優先政策

沙烏地阿拉伯的數位政府政策以248億美元的基礎建設資金和覆蓋全國的5G網路為支撐,旨在2030年將90%的公共服務遷移到雲端。阿拉伯聯合大公國和卡達也在推行類似的政策,推動需求從傳統外包轉向雲端原生服務交付,這需要大規模整合、網路安全和託管服務的支援。為了保持競爭力,私人企業也正在效仿這些公共部門的標桿,推動混合雲端諮詢和平台服務的持續普及。

超大規模資料中心建設激增

沙烏地阿拉伯斥資210億美元建設計畫資料中心,以及由微軟、貝萊德和淡馬錫主導的300億美元區域人工智慧基礎建設聯盟,正在改變當地的託管經濟格局。新增的區域容量符合資料居住法規,支援對延遲敏感的工作負載,並能以高於傳統託管服務的服務利潤率實現邊緣運算應用。

雙語雲原生人才短缺

南非在全球IT人才外流方面排名第三,2%的職缺為國際職位,導致本地人才流失嚴重。海灣合作理事會(計劃對精通阿拉伯語和英語的專業人才的需求加劇了人才短缺,迫使供應商依賴外籍員工和分散的海外團隊,從而增加了交付成本和周轉時間。

細分市場分析

到2025年,雲端和平台服務將佔中東和北非地區IT服務市場佔有率的34.83%,預計複合年成長率將達到10.72%,這反映了企業向人工智慧架構的轉型。傳統外包對於傳統工作負載仍然重要,但隨著雲端原生服務的成熟,其價格面臨壓力。隨著網路風險在關鍵基礎設施中日益成長,資安管理服務正在推動中東和北非地區IT服務市場的成長。 AWS、微軟和Oracle在區域內的超大規模擴張,使服務供應商能夠提供即時分析和物聯網編配等附加價值服務,從而取代利潤率低的基礎設施支援服務。

隨著企業對其關鍵業務應用程式進行平台重構,並針對邊緣運算用例重新建構網路架構,對諮詢和實施支援的需求仍然強勁。公共部門對文件管理和公民服務功能的業務流程外包 (BPO) 需求穩定。提供諮詢、遷移支援和長期管理服務的供應商能夠與客戶建立持續的合作關係,並降低服務同質化的風險。

儘管大型企業預計到2025年將佔總支出的67.55%,但中小企業預計將以10.18%的複合年成長率成長,這主要得益於海灣合作理事會(GCC)提供的雲端服務補貼和技術援助計畫。政府正撥款400億美元幫助中小企業數位化,降低企業資源規劃(ERP)、客戶關係管理(CRM)和電子商務平台的進入門檻。這正在推動中東和北非(MENA)地區標準化SaaS IT服務市場的快速擴張。

大型企業持續授予人工智慧、預測性維護和多重雲端管治計劃多年期、數百萬美元的合約。然而,價格敏感度日益提高,促使企業採用績效付費的合約模式。將交付團隊細分為高高觸感企業計劃和自動化中小企業工作的供應商,正在最佳化資源利用率和利潤率。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- “2030願景計畫”中的“雲端優先措施”

- 全部區域超大規模資料中心投資激增

- 數位公共服務與電子政府支出

- 區域金融科技繁榮推動了對託管服務的需求。

- 主權財富基金委託人工智慧和生成式人工智慧

- 5G和邊緣運算的普及推動了整合計劃的發展

- 市場限制

- 雙語雲原生人才長期短缺

- 跨境數據流動監管分散

- 非洲部分地區能源成本高且電網不穩定

- 地緣政治不穩定影響外包合約

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 影響市場的宏觀經濟因素

第5章 市場規模與成長預測

- 按服務類型

- IT諮詢與實施支持

- IT外包(ITO)

- 業務流程外包(BPO)

- 資安管理服務

- 雲端和平台服務

- 按最終用戶公司規模分類

- 小型企業

- 主要企業

- 按最終用戶行業分類

- BFSI

- 製造業

- 政府/公共部門

- 醫療保健和生命科學

- 零售和消費品

- 通訊與媒體

- 物流/運輸

- 能源與公共產業

- 其他終端用戶產業

- 按部署模式

- 陸上交付

- 近岸交付

- 離岸交付

- 按國家/地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 阿曼

- 巴林

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 肯亞

- 摩洛哥

- 其他非洲地區

- 中東

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Accenture plc

- International Business Machines Corporation(IBM)

- Oracle Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- SAP SE

- Tata Consultancy Services Limited

- Infosys Limited

- Wipro Limited

- HCL Technologies Limited

- Google LLC(Google Cloud)

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Tech Mahindra Limited

- NTT Data Corporation(Dimension Data)

- Gulf Business Machines(GBM)

- STC Solutions(Saudi Telecom Company)

- eand(Etisalat Group)

- Ooredoo QPSC

- Alareeb ICT Company

- Raqmiyat LLC

- Atos SE

- Deloitte Touche Tohmatsu Limited

第7章 市場機會與未來展望

The Middle East and Africa IT services market was valued at USD 232.1 billion in 2025 and estimated to grow from USD 252.81 billion in 2026 to reach USD 387.13 billion by 2031, at a CAGR of 8.92% during the forecast period (2026-2031).

Accelerated government-backed digitization programs, sovereign-wealth-fund technology mandates, and widespread 5G coverage are reshaping enterprise IT spending patterns across the Gulf Cooperation Council (GCC) and key African economies. Rising cloud adoption, surging hyperscale data-center investments, and a region-wide fintech boom are intensifying demand for consultative, implementation, and managed-service offerings. Meanwhile, chronic shortages of bilingual cloud-native professionals and fragmented cross-border data laws temper growth prospects, prompting providers to refine delivery models and compliance strategies. Competitive dynamics remain balanced as global integrators leverage scale and technology depth while regional specialists capitalize on localization requirements and Arabic language capabilities.

Middle East And Africa IT Services Market Trends and Insights

Cloud-First Mandates Under National Visions

Saudi Arabia's digital-government policy targets 90% cloud migration of public services by 2030, backed by USD 24.8 billion in infrastructure funding and nationwide 5G coverage. Comparable agendas in the UAE and Qatar require extensive integration, cybersecurity, and managed-service support, shifting demand from legacy outsourcing toward cloud-native delivery. Private enterprises mirror these public-sector benchmarks to sustain competitive parity, driving sustained uptake of hybrid-cloud consulting and platform services.

Surge in Hyperscale Data-Center Build-Outs

Saudi Arabia's USD 21 billion data-center pipeline and a USD 30 billion regional AI-infrastructure alliance anchored by Microsoft, BlackRock, and Temasek are transforming local hosting economics. Newly available in-region capacity satisfies data-residency statutes, supports latency-sensitive workloads, and enables edge-computing use cases that command higher service margins than traditional colocation offerings.

Bilingual Cloud-Native Talent Shortage

South Africa ranks third worldwide for outbound IT-talent recruitment, and 2% of all posted roles are international, draining local capacity. GCC projects intensify shortages by requiring Arabic-English fluent professionals, forcing providers to rely on expatriate hires or distributed offshore teams that increase delivery costs and timelines.

Other drivers and restraints analyzed in the detailed report include:

- Digital Public-Services Spending

- Fintech-Led Managed-Services Uptake

- Fragmented Cross-Border Data Laws

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment accounted for 34.83% of the Middle East and Africa IT services market share in 2025, yet cloud and platform services are set to grow at 10.72% CAGR, reflecting enterprises' pivot toward AI-ready architectures. Traditional outsourcing retains relevance for legacy workloads but faces pricing pressure as cloud-native offerings mature. The Middle East and Africa IT services market size attributed to managed security services is expanding as cyber-risk escalates across critical infrastructure. Regional hyperscale expansions by AWS, Microsoft, and Oracle allow providers to layer value-added services such as real-time analytics and IoT orchestration, displacing low-margin infrastructure support.

Demand for consulting and implementation remains robust as enterprises re-platform core applications and re-architect networks for edge-computing use cases. Business-process outsourcing maintains steady public-sector demand for document-management and citizen-service functions. Providers that bundle consulting, migration, and long-term managed services create sticky client relationships, mitigating commoditization risk.

Large enterprises represented 67.55% of 2025 spend, but SMEs are forecast to post a 10.18% CAGR, buoyed by subsidized cloud vouchers and technical-support schemes across GCC economies. Government funds worth USD 40 billion are earmarked for SME digital-enablement, lower entry barriers to ERP, CRM, and e-commerce platforms. The Middle East and Africa IT services market size for standardized SaaS onboarding is therefore rising sharply.

Large enterprises continue to award multi-year, multi-million-dollar contracts for AI, predictive maintenance, and multi-cloud governance projects. However, price sensitivity has increased, prompting outcome-based contracts. Providers that segment delivery teams for high-touch enterprise projects and automated SME engagements optimize utilization and margin.

The Middle East and Africa IT Services Market is Segmented by Service Type (IT Consulting and Implementation, IT Outsourcing, and More), End-User Enterprise Size (Small and Medium Enterprises and Large Enterprises), End-User Vertical (BFSI, Manufacturing, and More), Deployment Model (Onshore Delivery, Nearshore Delivery, and Offshore Delivery), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Accenture plc

- International Business Machines Corporation (IBM)

- Oracle Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- SAP SE

- Tata Consultancy Services Limited

- Infosys Limited

- Wipro Limited

- HCL Technologies Limited

- Google LLC (Google Cloud)

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Tech Mahindra Limited

- NTT Data Corporation (Dimension Data)

- Gulf Business Machines (GBM)

- STC Solutions (Saudi Telecom Company)

- eand (Etisalat Group)

- Ooredoo Q.P.S.C.

- Alareeb ICT Company

- Raqmiyat LLC

- Atos SE

- Deloitte Touche Tohmatsu Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first initiatives under Vision 2030 programs

- 4.2.2 Surge in hyperscale data-center investments across GCC

- 4.2.3 Digital public-services and e-government spending

- 4.2.4 Regional fintech boom driving managed-services demand

- 4.2.5 AI and generative-AI mandates by sovereign wealth funds

- 4.2.6 5G and edge-computing rollout fuelling integration projects

- 4.3 Market Restraints

- 4.3.1 Chronic shortage of bilingual cloud-native talent

- 4.3.2 Fragmented cross-border data-flow regulations

- 4.3.3 High energy cost and unreliable grids in parts of Africa

- 4.3.4 Geopolitical volatility affecting outsourcing contracts

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 IT Consulting and Implementation

- 5.1.2 IT Outsourcing (ITO)

- 5.1.3 Business Process Outsourcing (BPO)

- 5.1.4 Managed Security Services

- 5.1.5 Cloud and Platform Services

- 5.2 By End-User Enterprise Size

- 5.2.1 Small and Medium Enterprises (SMEs)

- 5.2.2 Large Enterprises

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Manufacturing

- 5.3.3 Government and Public Sector

- 5.3.4 Healthcare and Life-Sciences

- 5.3.5 Retail and Consumer Goods

- 5.3.6 Telecom and Media

- 5.3.7 Logistics and Transport

- 5.3.8 Energy and Utilities

- 5.3.9 Other End-User Verticals

- 5.4 By Deployment Model

- 5.4.1 Onshore Delivery

- 5.4.2 Nearshore Delivery

- 5.4.3 Offshore Delivery

- 5.5 By Country

- 5.5.1 Middle East

- 5.5.1.1 Saudi Arabia

- 5.5.1.2 United Arab Emirates

- 5.5.1.3 Qatar

- 5.5.1.4 Kuwait

- 5.5.1.5 Oman

- 5.5.1.6 Bahrain

- 5.5.1.7 Rest of Middle East

- 5.5.2 Africa

- 5.5.2.1 South Africa

- 5.5.2.2 Egypt

- 5.5.2.3 Nigeria

- 5.5.2.4 Kenya

- 5.5.2.5 Morocco

- 5.5.2.6 Rest of Africa

- 5.5.1 Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Accenture plc

- 6.4.2 International Business Machines Corporation (IBM)

- 6.4.3 Oracle Corporation

- 6.4.4 Microsoft Corporation

- 6.4.5 Amazon Web Services, Inc.

- 6.4.6 SAP SE

- 6.4.7 Tata Consultancy Services Limited

- 6.4.8 Infosys Limited

- 6.4.9 Wipro Limited

- 6.4.10 HCL Technologies Limited

- 6.4.11 Google LLC (Google Cloud)

- 6.4.12 Capgemini SE

- 6.4.13 Cognizant Technology Solutions Corporation

- 6.4.14 Tech Mahindra Limited

- 6.4.15 NTT Data Corporation (Dimension Data)

- 6.4.16 Gulf Business Machines (GBM)

- 6.4.17 STC Solutions (Saudi Telecom Company)

- 6.4.18 eand (Etisalat Group)

- 6.4.19 Ooredoo Q.P.S.C.

- 6.4.20 Alareeb ICT Company

- 6.4.21 Raqmiyat LLC

- 6.4.22 Atos SE

- 6.4.23 Deloitte Touche Tohmatsu Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment