|

市場調查報告書

商品編碼

1851919

壁紙:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)Wallpaper - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

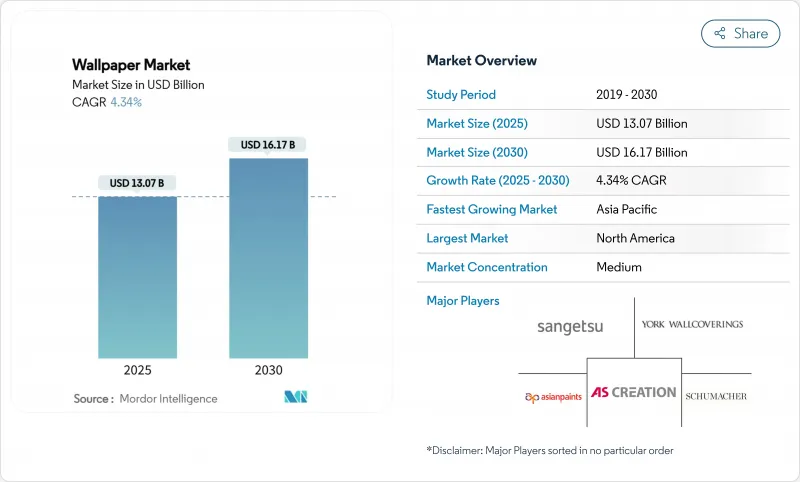

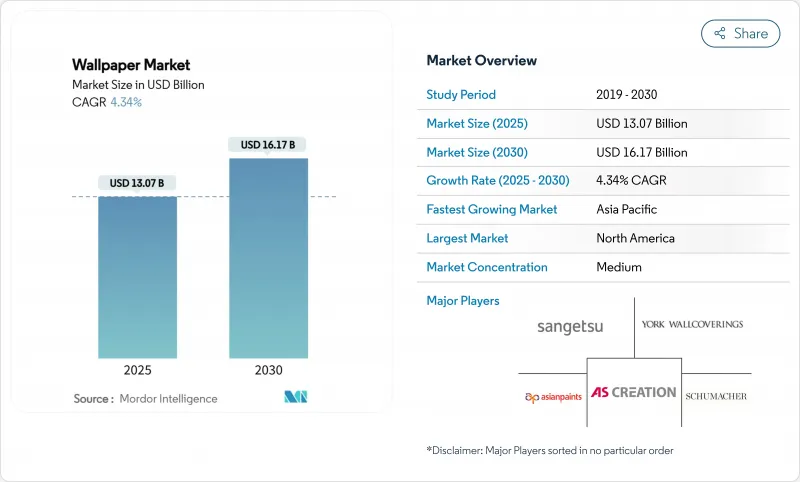

全球壁紙市場預計到 2025 年將達到 130.7 億美元,到 2030 年將達到 161.7 億美元,在此期間的複合年成長率為 4.34%。

數位印刷、抗菌塗層和自黏基材的融合,加上家庭裝修的激增、飯店翻新週期的加快以及中等收入家庭對室內美學日益成長的期望,將推動市場需求。目前,商業應用引領著這一趨勢,海灣合作理事會(GCC)和東協地區的飯店建築項目持續指定使用能夠承受高強度維護的優質耐用壁紙。隨著東南亞各國政府補貼經濟適用房項目,以及北美屋主選擇獨特的裝飾而非例行粉刷,住宅應用正在加速成長。儘管供應鏈面臨PVC價格波動和關稅上漲的挑戰,製造商正透過垂直整合、長期樹脂合約以及非乙烯基基材的創新來確保淨利率。競爭優勢則依賴全通路分銷、永續性認證以及透過客製印刷快速將設計概念轉化為成品捲材。

全球壁紙市場趨勢與洞察

北美和歐洲對數位印刷個人化配件的需求激增

Roland DG 和Panasonic Housing Solutions(以下簡稱Panasonic)宣布,按需數位印刷技術使設計師擺脫了製版和最低起訂量的限制,能夠實現系列化圖案、低至 2 毫米的觸感 3D 紋理以及快速原型製作,從而縮短從設計到施工的周期。 Roland DG 和Panasonic Housing Solutions 也推出了 DIMENSE 技術,該技術無需額外的壓紋工序即可產生雕塑般的表面。高階塗料製造商 Benjamin Moore 與 Alpha 研討會合作,推出每碼售價 125 美元的手工繪製壁紙。歐洲領導企業 Sanderson Design Group 也正積極開拓這個市場,推出融合傳統工藝與現代科技的產品,每卷售價在 13,900 日元至 35,100 日元之間,這表明富裕階層願意為 Sanderson 獨特的品牌故事買單。電子商務加速了普及:Graham & Brown 的 B2B 入口網站在短短 12 週內就實現了 90% 的客戶採用率,減少了訂購摩擦和庫存風險,提高了製造商的利潤率,並使數位化工作流程成為客製化住宅和精品商業計劃的預設模式。

東南亞城市中等收入住宅的快速成長

2024年第一季,印尼建築業佔GDP的10.23%,而越南在2025年上半年建造了超過60萬套社會住宅。印尼的「百萬套房屋」計畫等政府計畫以及卡達支持的融資管道,正在提升首次購屋者的購買力,並鼓勵他們選擇既注重品牌導向又經濟實惠的裝修方案。亞洲開發銀行預測,2025年區域GDP成長率將達到4.5%,這將支撐家庭裝修支出。國際生產商紛紛在區域內設立工廠,以規避關稅並縮短前置作業時間,而本土品牌則利用進口替代獎勵。千禧世代的線上購物習慣正在推動數位客製化平台的流量成長,並進一步增強對數位印刷產品的需求。

市面上有許多替代品可供選擇

塗料、裝飾面板和數位顯示器不斷提升其價值提案,隨著易於維護和互動內容的興起,壁紙的市場佔有率正在被蠶食。剪切機塗料的PaintShield技術將殺菌保護直接融入塗料中,可在兩小時內殺死99.9%的細菌,從而佔據了以往專供特種壁紙的預算。紋理塗料、牆貼和植物牆滿足了親生物設計理念,而模組化面板系統則使辦公室能夠在一夜之間重新配置空間。日益豐富的選擇迫使壁紙生產商更加重視觸感深度、材料循環利用和安裝效率。

細分市場分析

預計到2025年,不織布產品將以6.06%的複合年成長率成長,超過壁紙市場的整體成長速度。透氣且尺寸穩定的基材簡化了安裝和拆卸過程。由於其醫用級的耐用性和市場競爭力,預計到2024年,乙烯基材料將保持32.43%的市場佔有率。然而,環保意識正在推動對生物基PVC、再生PET和無溶劑油墨的需求。紙質產品在傳統家居中逐漸減少,但仍蓬勃發展,因為在這些家居環境中,真實性比易於維護更為重要。織物表面覆蓋物觸感溫暖,並具有內建隔音功能,使其成為高階小眾空間的理想選擇。 Boras Peter的Viared工廠展現了其技術上的多樣性,在同一屋簷下運作表面印刷、凹版印刷、絲網印刷和數位印刷機,以匹配每種材料的印刷特性。

不織布的發展動能與永續性法規相交會,促使市場轉向FSC認證纖維和水性黏合劑。該領域的靈活性使其能夠迅速採用抗菌化學品和自黏黏合劑,從而拓展了終端應用範圍,從出租公寓到小兒科診所均有涵蓋。乙烯基創新者正透過不含鄰苯二甲酸酯的配方和節能型壓花固化劑來應對挑戰,以捍衛其市場佔有率。金屬箔和玻璃纖維增強片材等新型複合材料則瞄準了需要阻燃和電磁屏蔽等功能性應用的細分市場。

到2024年,數位技術將佔壁紙產量的58.42%,年成長率達7.32%,這將把壁紙市場轉變為訂單客製化的模式。噴墨印表機頭與UV固化化學技術的結合,可在各種基材上達到即時固化和鮮豔的色彩飽和度,而乳膠系統則符合低VOC排放標準。Canon指出,數位技術無需製版,因此可以滿足從客製化單捲到中型飯店訂單的各種批量需求,且無需支付設定費用。絲網印刷憑藉其豐富的油墨覆蓋和特殊效果,尤其是在傳統大馬士革圖案方面,仍然無可匹敵。柔版印刷在長期商業領域逐漸佔有一席之地,其高精度重複性使得滾筒投資物有所值。混合生產線正在興起,在傳統工作站之前整合單一途徑數位單元,以便在批量印刷的底布上疊加定製圖案。

高速打樣循環和人工智慧色彩匹配軟體將概念到上市的時間從數月縮短至數天,使設計師能夠跟上潮流趨勢。成本效益不僅限於庫存。數位印刷的小批量生產能力可減少營運成本,降低報廢庫存,而UV- LED燈的高效性則可降低能源成本,並幫助印刷企業實現碳中和目標。 Octink 50年的發展歷程表明,傳統印刷企業無需放棄其印刷技術傳統即可維修為數位印刷。

區域分析

北美地區在2024年引領出貨量,主要得益於其成熟的整修文化和數位印刷工作流程的早期應用。在美國,儘管原料成本波動較大,但受彈性零售理念推動的自黏壁紙趨勢仍將推動市場需求成長。加拿大建築材料市場預計到2026年將成長4.5%至5.5%,這將為其潛在市場帶來更多新建計劃。墨西哥正在崛起為近岸外包中心,為尋求降低亞洲貨運波動風險的美國高階品牌提供成本效益高的生產方案。約克壁紙公司透過收購一家獨立的表面印刷企業,進一步鞏固了其區域領先地位,並強化了其本地供應鏈。

受設計傳統和嚴格環保法規的驅動,歐洲市場維持較高的價格溢價。德國和義大利強制要求使用無溶劑印刷,並加速推廣水性油墨。英國室內設計正迎來手工藝的復興,桑德森(Sanderson)推出的羊毛風格「奧威爾編織」(Orwell Weaves)和「鄉村林地」(Country Woodland)系列便是例證。西班牙等南部市場則專注於抗紫外線牆壁材料,以配合飯店露台的設計。東歐市場的需求受外匯波動影響較大,但波蘭和捷克的翻新津貼正在緩解銷售下滑。循環經濟指令允許生產商對「從搖籃到搖籃」的基材進行認證,並試行回收計畫。

亞太地區銷量成長最為迅猛。印尼計劃每年交付300萬套住房,越南的社會住宅建設目標也將新增數十萬套。中國國內生產雄心與出口生產同步成長,維持受益於規模經濟的超大規模生產線。印度裝飾塗料領導企業亞洲塗料(Asian Paints)正利用全通路技術,透過其服務部門交叉銷售壁紙套裝。日本和韓國等成熟市場青睞高性能產品:三月(Sangetsu)的再生PET玻璃薄膜符合低碳建築標準,同時提供紫外線和隔熱保護。澳洲正專注於為易受山火侵襲的地區提供阻燃牆面織物,從而拓展其功能性細分市場。該地區到2025年第一季已有2,074筆飯店業交易,確保了合約量的持續成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 北美和歐洲對數位印刷個人化裝飾品的需求激增

- 東南亞城市中等收入住宅的快速成長

- 酒店業更新周期推動海灣合作理事會和東協地區的高階商業產品發展

- 美國零售商品行銷正轉向使用自黏乙烯基材料。

- 醫療維修採用抗菌塗層壁紙

- 市場限制

- 市面上有許多替代品可供選擇

- PVC價格波動對利潤率帶來壓力

- 暴露在高溫高濕的環境中會縮短壽命

- 供應鏈分析

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 乙烯基塑膠

- 不織布

- 紙本

- 織物(絲綢、亞麻布等)

- 其他壁紙類型

- 透過印刷技術

- 數位(噴墨/EP)

- 螢幕

- 柔版印刷

- 其他印刷技術

- 最終用戶

- 住宅

- 商業的

- -飯店業

- 公司總部

- -美容美髮水療中心

- - 醫院

- 其他最終用戶

- 透過分銷管道

- 直銷

- 間接銷售

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲、紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Sangetsu Corporation

- York Wall Coverings Inc.

- AS Creation Tapeten AG

- Brewster Home Fashion LLC

- Grandeco Wallfashion Group

- Erismann & Cie. GmbH

- Sanderson Design Group PLC

- Tapetenfabrik Gebr. Rasch GmbH & Co. KG

- Marshalls Wallcoverings

- Asian Paints Ltd(Nilaya)

- Eximus Wallpaper

- Gratex Industries Ltd

- Graham & Brown Ltd

- Wallquest Inc.

- Adornis Wallpapers

- Arte International

- 4walls

- Omexco NV

- Life n Colors Private Limited

- Komar Products GmbH

- Houfling GmbH(Hohenberger)

第7章 市場機會與未來展望

The global wallpaper market size reached USD 13.07 billion in 2025 and is forecast to touch USD 16.17 billion by 2030, advancing at a 4.34% CAGR during the period.

Demand expands as digital printing, antimicrobial coatings, and peel-and-stick substrates converge with surging residential renovation activity, intensified hospitality refresh cycles, and rising interior-aesthetic expectations among mid-income households. Commercial installations currently lead because hotel construction pipelines in the GCC and ASEAN continue to specify premium, durable wallcoverings that withstand rigorous maintenance schedules. Residential adoption accelerates as Southeast Asian governments subsidize affordable housing programs and North American homeowners opt for personalized decor over routine repainting. Supply chains face vinyl-chloride price swings and tariff hikes, yet manufacturers defend margins through vertical integration, long-term resin contracts, and innovation in non-vinyl substrates. Competitive differentiation now hinges on omnichannel distribution, sustainability credentials, and the speed with which on-demand printing can translate design concepts into finished rolls.

Global Wallpaper Market Trends and Insights

Surge in Demand for Digitally-Printed Personalised Decor in North America and Europe

On-demand digital printing liberates designers from plate-making and minimum-run constraints, enabling serialized patterns, tactile 3D textures up to 2 mm, and fast prototyping that shortens design-to-installation cycles. Roland DG and Panasonic Housing Solutions unveiled DIMENSE technology that produces sculpted surfaces without extra embossing passes, widening creative scope and cost efficiency. Luxury paint maker Benjamin Moore collaborated with The Alpha Workshops to hand-paint wallpapers retailing at USD 125 per yard, proof that customization supports 40-60% price premiums. European stalwarts such as Sanderson Design Group chase this segment with heritage-meets-digital launches that sell for ¥13,900-¥35,100 per roll, validating affluent willingness to pay for unique stories Sanderson. Ecommerce accelerates uptake: Graham & Brown's B2B portal reached 90% client adoption in just 12 weeks, cutting order friction and inventory risk. These gains lift manufacturer margins and position digital workflows as the default mode for bespoke residential and boutique commercial projects.

Rapid Mid-Income Urban Housing Boom in Southeast Asia

Indonesia reported construction representing 10.23% of GDP in Q1 2024 while Vietnam initiated over 600,000 social housing units during H1 2025, setting a long-tail demand curve for mid-priced wallcoverings that balance aesthetics with affordability. Government programs such as Indonesia's One Million House plan and Qatar-backed financing channels lift first-time buyers' purchasing power, steering them toward branded yet cost-effective decor choices. Asian Development Bank forecasts 4.5% regional GDP growth for 2025, underpinning discretionary renovation spending. International producers answer with regional plants that dodge tariffs and shorten lead times, while local brands exploit import substitution incentives. Millennials' online buying habits drive traffic to digital customization platforms, further intensifying the pull on digitally printed offerings.

Easy Availability of Substitutes in the Market

Paints, decorative panels, and digital displays constantly upgrade value propositions, eroding wallpaper's share where maintenance simplicity or interactive content holds sway. Sherwin-Williams Paint Shield introduces microbicidal functions directly into paint, killing 99.9% of bacteria in 2 hours and capturing budgets once reserved for specialty wallcoverings. Textured paints, wall decals, and living-plant walls fulfil biophilic design briefs, while modular panel systems allow offices to reconfigure spaces overnight. The broadening substitute set compels wallpaper producers to stress tactile depth, material circularity, and installation efficiency.

Other drivers and restraints analyzed in the detailed report include:

- Hospitality Refresh Cycles Driving Premium Commercial Wallpaper in GCC and ASEAN

- Retail Visual-Merchandising Shift to Peel-and-Stick Vinyl in the U.S.

- Vinyl-Chloride Price Volatility Compressing Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-woven products opened 2025 with a 6.06% CAGR outlook, eclipsing overall wallpaper market growth as breathable, dimensionally stable substrates simplify installation and removal tasks. Premium installers champion the category because dry-strippable properties cut labour by up to 30%. Vinyl retained 32.43% wallpaper market share in 2024 thanks to hospital-grade durability and cost competitiveness, yet environmental scrutiny intensifies calls for bio-PVC, recycled PET, and solvent-free inks. Paper-based lines contract, surviving mostly in heritage residences where authenticity tops maintenance ease. Fabric surface coverings serve niche luxury spaces, offering tactile warmth and built-in acoustic dampening. Borastapeter's Viared facility illustrates technical diversity, running surface, gravure, screen, and digital presses under one roof to match each material's printability.

Non-woven momentum intersects sustainability regulation, prompting marketing pivots toward FSC-certified fibres and water-based adhesives. The segment's agility allows quick adoption of antimicrobial chemistries or peel-and-stick adhesives, widening end-use scope from rental apartments to pediatric clinics. Vinyl innovators respond with phthalate-free formulations and energy-saving emboss cures to defend share. Emerging composites such as metallic foils or glass fibre reinforced sheets target functional niches demanding fire retardancy or electromagnetic shielding.

Digital technologies captured 58.42% of production in 2024 and are adding 7.32% annually, transforming the wallpaper market into a make-to-order paradigm. Inkjet heads paired with UV-curable chemistries deliver immediate curing and vibrant colour saturation on diverse substrates, while latex systems comply with low-VOC codes. Canon's guidance confirms that digital eliminates plates, enabling batch sizes from a single customised roll to mid-volume hospitality orders without setup penalties. Screen printing retains pockets where rich ink laydown and special effects are still unrivalled, particularly for heritage damasks. Flexography holds ground in long-run commercial corridors where precision repeatability justifies cylinder investments. Hybrid lines emerge, integrating single-pass digital units ahead of conventional stations so bespoke motifs overlay mass-printed bases.

Rapid proofing loops and AI colour-matching software compress concept-to-market timelines from months to days, letting designers react to viral trends. Cost advantages extend beyond inventory: digital short-run capabilities reduce working capital and shrink obsolete stock write-offs. Meanwhile, UV-LED lamp efficiencies drop energy bills, helping printers meet carbon-neutral targets. Octink's 50-year trajectory shows legacy shops can retrofit for digital without surrendering printcraft heritage.

The Wallpaper Market Report is Segmented by Wallpaper Type (Vinyl, Non-Woven, Paper-Based, Fabric, Other), Printing Technology (Digital, Screen, Flexographic, Other), End User (Residential, Commercial), Distribution Channel (Direct Sales, Indirect Sales), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led 2024 shipments on the back of established renovation culture and early adoption of digital-print workflows. The U.S. peel-and-stick craze, fuelled by flexible retail concepts, bolsters forecast demand despite raw-material cost swings. Canada's construction-materials market expects 4.5-5.5% growth through 2026, adding institutional projects to the addressable base. Mexico emerges as a near-shoring hub, providing cost-efficient production for premium U.S. brands looking to mitigate Asian freight volatility. York Wallcoverings consolidates regional leadership after acquiring independent surface-print operations, strengthening local supply chains.

Europe preserves a strong pricing premium through design heritage and stringent eco-regulation. Germany and Italy push solvent-free print mandates, prompting accelerated adoption of water-based inks. United Kingdom interiors celebrate artisanal revival, evident in Sanderson's wool-inspired Orwell Weaves and Country Woodland launches. Southern markets such as Spain emphasise UV-stable outdoor wall applications to complement hospitality terraces. Eastern Europe's demand fluctuates with currency swings, though renovation subsidies in Poland and Czechia cushion volume declines. Circular-economy directives drive producers to certify cradle-to-cradle substrates and pilot take-back schemes.

Asia-Pacific records the steepest volume climb; Indonesia plans to deliver three million homes yearly while Vietnam's social housing targets add hundreds of thousands of units. China's domestic appetite strengthens alongside export output, sustaining mega-scale lines that benefit from economies of scope. India's decorative coatings leader Asian Paints leverages omnichannel reach to cross-sell wallpaper bundles under its services arm. Mature markets Japan and South Korea favour high-function products: Sangetsu's recycled-PET glass films meet low-carbon building codes while offering UV heat-shielding. Australia pivots to fire-retardant wall fabrics for bushfire-vulnerable regions, enriching the functional niche. Collectively, the region's 2,074-project hospitality pipeline through Q1 2025 guarantees sustained contract volumes.

- Sangetsu Corporation

- York Wall Coverings Inc.

- A.S. Creation Tapeten AG

- Brewster Home Fashion LLC

- Grandeco Wallfashion Group

- Erismann & Cie. GmbH

- Sanderson Design Group PLC

- Tapetenfabrik Gebr. Rasch GmbH & Co. KG

- Marshalls Wallcoverings

- Asian Paints Ltd (Nilaya)

- Eximus Wallpaper

- Gratex Industries Ltd

- Graham & Brown Ltd

- Wallquest Inc.

- Adornis Wallpapers

- Arte International

- 4walls

- Omexco NV

- Life n Colors Private Limited

- Komar Products GmbH

- Houfling GmbH (Hohenberger)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Demand for Digitally-Printed Personalised Decor in North America and Europe

- 4.2.2 Rapid Mid-Income Urban Housing Boom in Southeast Asia

- 4.2.3 Hospitality Refresh Cycles Driving Premium Commercial products in GCC and ASEAN

- 4.2.4 Retail Visual-Merchandising Shift to Peel-and-Stick Vinyl in the U.S.

- 4.2.5 Adoption of Antimicrobial Coated Wallcoverings in Healthcare Renovations

- 4.3 Market Restraints

- 4.3.1 Easy Availability of Substitues in the Market

- 4.3.2 Vinyl-Chloride Price Volatility Compressing Margins

- 4.3.3 Shorter Life-span on Exposure to Heat and Moisture

- 4.4 Supply-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Vinyl

- 5.1.2 Non-woven

- 5.1.3 Paper-based

- 5.1.4 Fabric (Silk, Linen, etc.)

- 5.1.5 Other wallapaper Type

- 5.2 By Printing Technology

- 5.2.1 Digital (Inkjet/EP)

- 5.2.2 Screen

- 5.2.3 Flexographic

- 5.2.4 Other Printing Technology

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 -Hospitality

- 5.3.4 - Corporate Office Space

- 5.3.5 -Salons and Spas

- 5.3.6 - Hospitals

- 5.3.7 -Other End User

- 5.4 By Distribution Channel

- 5.4.1 Direct Sales

- 5.4.2 Indirect Sales

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Sangetsu Corporation

- 6.4.2 York Wall Coverings Inc.

- 6.4.3 A.S. Creation Tapeten AG

- 6.4.4 Brewster Home Fashion LLC

- 6.4.5 Grandeco Wallfashion Group

- 6.4.6 Erismann & Cie. GmbH

- 6.4.7 Sanderson Design Group PLC

- 6.4.8 Tapetenfabrik Gebr. Rasch GmbH & Co. KG

- 6.4.9 Marshalls Wallcoverings

- 6.4.10 Asian Paints Ltd (Nilaya)

- 6.4.11 Eximus Wallpaper

- 6.4.12 Gratex Industries Ltd

- 6.4.13 Graham & Brown Ltd

- 6.4.14 Wallquest Inc.

- 6.4.15 Adornis Wallpapers

- 6.4.16 Arte International

- 6.4.17 4walls

- 6.4.18 Omexco NV

- 6.4.19 Life n Colors Private Limited

- 6.4.20 Komar Products GmbH

- 6.4.21 Houfling GmbH (Hohenberger)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment