|

市場調查報告書

商品編碼

1851807

先進積體電路基板:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Advanced IC Substrates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

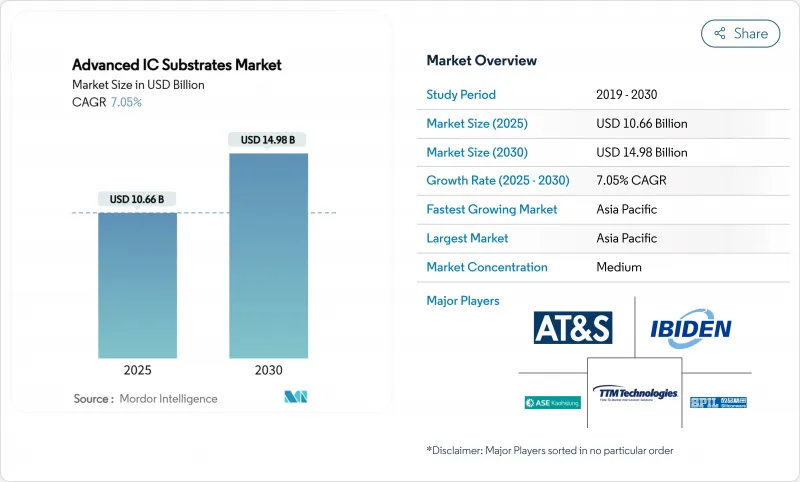

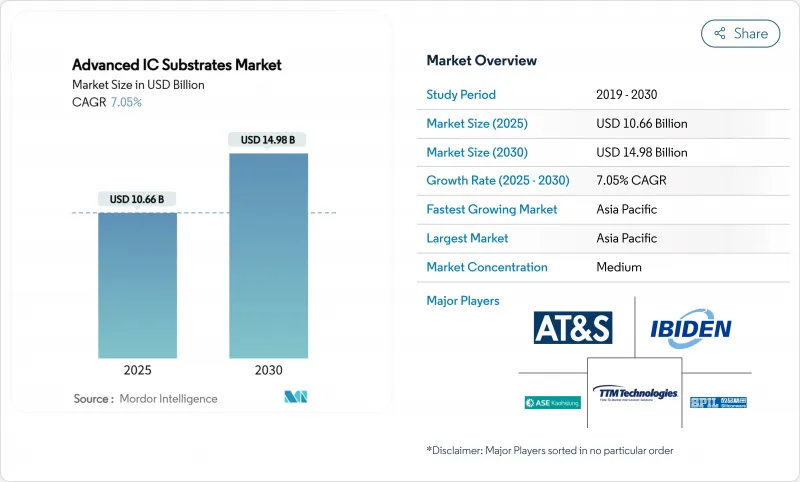

預計到 2025 年,先進 IC基板市場規模將達到 106.6 億美元,到 2030 年將達到 149.8 億美元,年複合成長率為 7.05%。

市場需求已從傳統運算轉向以人工智慧為中心的工作負載,這些工作負載需要更高的層數、更精細的線寬和更嚴格的翹曲控制。亞太地區的基板供應商受益於此轉變,因為他們已經擁有大規模的ABF生產能力,並且與代工廠的封裝生產線有著緊密的聯繫。一家大型雲端服務供應商將長期採購協議的期限提前至2025年,以確保CoWoS和FC-BGA的供應安全,這進一步增強了基板製造商的定價權。同時,玻璃芯技術的創新日趨成熟,為計劃在本十年後半期商業化的超高密度封裝提供了ABF以外的戰略選擇。

全球先進積體電路基板市場趨勢與洞察

AI/HPC加速器對ABF基板的需求快速成長

2025年生成式人工智慧伺服器的大規模部署導致味之素積層製造膜(ABF)供應緊張,ABF面板的前置作業時間超過35週,現貨價格溢價高達25%,遠超2024年的合約價格。台灣供應商優尼美光、金碩和南亞PCB在經歷了長期的庫存調整後,營收已恢復兩位數成長,但仍以90%的運轉率維持營運以滿足需求。三星馬達在2025年第二季提高了其用於人工智慧的ABF產量,並開始試生產玻璃芯。台積電已宣布計劃將其CoWoS年產量翻番,這意味著基板需求將顯著超過現有產能。綜上所述,這些發展導致供應缺口擴大了20%, 基板製造商預計,這一缺口要等到2026年新生產線運作後才能彌補。

小型化和異質整合趨勢

晶片組架構、無芯中介層和矽通孔技術重新定義了封裝設計規則,推動基板線寬在製造過程中降至 10µm 以下。應用材料公司強調,與單晶片晶粒相比,封裝內整合離散晶片組可實現更高的每瓦性能。拓普科技推出了一種無芯有機中介層,其熱膨脹係數比傳統的 ABF 解決方案低 45%,從而減輕了多晶粒堆疊中的機械應力。博通公司的 3.5D XDSiP 技術整合了超過 6000mm² 的矽晶圓和 12 個 HBM 堆疊,顯示市場對能夠在有限空間內佈線數千個高速訊號的基板的需求日益成長。台積電和日月光已投資建造尺寸達 310 x 310mm 的面板級封裝生產線,以提高步進馬達效率並降低每平方英吋成本。這些變化使先進 IC基板市場成為下一代運算密度的關鍵推動因素。

ABF基板物產能短缺及前置作業時間急劇增加

2024-2025 年先進 IC基板市場受限於 ABF 面板產能的持續短缺。 ABF 樹脂的近乎獨家供應商味之素承認,在新的樹脂反應器於 2026 年運作之前,供需缺口將達到 20%。代工廠也證實了這項限制,台積電宣布只能滿足 80% 的 CoWoS 需求。積水化學等競爭對手試圖擺脫對其他積層製造流程的依賴,但高階 AI 封裝的認證週期減緩了其應用。日東紡持續面臨低熱膨脹係數 T 型玻璃芯材的短缺,導致產能擴張受阻,前置作業時間顯著延長。基板製造商實施了線上計量以提高一次產量比率並擴大現有產能,但大多數客戶在 2025 年之前仍需遵守配額計劃。

細分市場分析

2024年,FC-BGA基板佔據了先進IC基板市場45%的佔有率。 FC-BGA基板憑藉其在AI加速器和伺服器CPU中所需的成熟電氣性能而佔據主導地位。由於GPU製造商競相確保產能,其利用率在2025年仍維持高位。然而,成長重心轉向了用於汽車網域控制器和折疊式行動裝置的軟硬複合CSP生產線。軟硬複合CSP的產量以8.1%的複合年成長率成長,吸引了能夠平衡彎曲半徑和可控電阻的新型層壓板供應商。 FC-CSP繼續為中階行動處理器提供動力,但成本壓力限制了平均售價的成長。有機BGA/LGA繼續用於傳統桌面平台,但其設計優勢已被覆晶方案所取代。面板級FC基板(仍歸類於「其他」)目前正由台積電和日月光進行試驗和量產,使每個面板的可用面積增加了七倍,並創造了新的規模經濟效益。

FC-BGA 仍然是 CoWoS 製造流程的主力軍。設計人員要求 14-26 層,這迫使對套準精度抗蝕劑更高的要求。為了應對這項挑戰,基板製造商採用了人工智慧光學檢測技術,以便在疊層早期檢測過孔到走線的偏差。隨著汽車製造商將資訊娛樂系統升級到 15 吋曲面顯示螢幕,需要 Z 軸方向的軟性,軟硬複合CSP 也從中受益。此外,折疊式產品中攝影機整合度的提高也促進了剛撓性 CSP 的發展。這些動態共同支撐了軟硬複合在 2030 年前的持續流行,而 FC-BGA 將在先進 IC基板市場保持其高價值地位。

預計到2024年,ABF將佔據先進IC基板市場61%的佔有率。味之素專有的樹脂配方贏得了客戶在2.5D和3D堆疊領域的信賴,確保了穩定的介電性能和可鑽孔性。供應商在2025年擴大了ABF混合車間,但產量成長落後於需求,增強了賣方的議價能力。玻璃基板在2024年的出貨量佔比不到2%,但預計複合年成長率將達到14.1%。玻璃基板在200mm x 200mm尺寸下具有±5µm的平整度,與ABF相比,能夠實現更精細的重分佈層和更高的I/O密度。英特爾退出內部研發,促使第三方玻璃供應商獲得認可,並加速了生態系統的完善。

在汽車控制單元領域,BT樹脂仍佔有重要地位,因為基板溫度通常高達150°C。陶瓷和低溫共燒陶瓷(LTCC)晶片為承受持續熱循環的功率元件提供動力,在ABF晶片產能過剩時,它們能夠提供一定的收入緩衝。玻璃基板的認證在通孔形成均勻性方面面臨挑戰,但早期生產的良率在回流焊接過程中顯示出良好的翹曲指標。 AMD已表示計劃將2026年的CPU平台轉向玻璃基板,並敦促基板製造商在量產爬坡推出確保產能。如果產量比率能夠維持穩定,到2030年,玻璃基板的收入佔有率可望達到或超過5%。

先進 IC基板市場按基板類型(FC-BGA、FC-CSP、有機 BGA/LGA 等)、核心材料(ABF、BT、玻璃等)、封裝技術(2D覆晶、2.5D 中介層等)、裝置節點(≥28 奈米、16/14-10 奈米地區等)、終端用戶(A.A)、終端用戶、北美地區運輸/北美地區、北美地區和亞地區運輸公司。

區域分析

到2024年,亞太地區將佔據先進積體電路基板市場69%的佔有率。台灣的優尼美光、金碩和南亞PCB預計將在2025年恢復兩位數成長,因為人工智慧伺服器的需求將取代2023年庫存調整對出貨量造成的負面影響。日本在3.9兆日圓(約255億美元)的補貼下重振經濟,重新將九州打造成為以台積電熊本工廠為中心的封裝中心。韓國宣布了一項4,710億美元的綜合叢集計劃,旨在邏輯晶片廠附近建設ABF-CoWoS生產線,目標是到2030年將晶圓月產量提升至770萬片。中國推出了區域獎勵以擴大覆晶和SiP產能,但出口限制阻礙了工具的獲取,並減緩了玻璃芯的普及。

在北美,根據《晶片封裝和封裝法案》(CHIPS Act)進行的在地化工作取得了進展。台積電位於亞利桑那州的園區已轉型為六晶圓廠佈局,並計劃增設ABF生產線以降低風險。 Entegris公司獲得了高達7500萬美元的聯邦資金,用於基板鍍銅過程中使用的過濾介質。一家大型OSAT公司評估了擴大其美國業務以滿足國防晶片封裝需求的可能性,儘管該公司也對薪資上漲表示擔憂。

歐洲的重點是汽車和功率裝置。安森美半導體(OnSemi)位於捷克的碳化矽(SiC)工廠在歐洲建立了一條完整的逆變器基板供應鏈。德國和法國探索了一條聯合ABF(先進基板製造)試點生產線,以支援英特爾和台積電的代工廠擴張。同時,越南、印度和馬來西亞尋求組裝補貼。安姆科(Amcor)在北寧省開設了一家價值16億美元的工廠,印度核准了760億盧比(約9.1億美元)的OSAT合資企業,該合資企業由CG Power和瑞薩電子主導。這些舉措分散了先進積體電路基板市場的地理風險。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- AI/HPC加速器對ABF基板的需求激增

- 小型化和異質整合趨勢

- 5G 的普及促進了高頻射頻封裝的發展

- 汽車和電動車的電氣化需要高度可靠的基板。

- 玻璃芯基板可解鎖兩倍以上的層數。

- 與基板工廠相關的晶片類補貼

- 市場限制

- ABF基板生產能力短缺和前置作業時間突然增加

- 高資本密集度和複雜流程

- 覆銅板價格波動

- 加強積垢膜化學物質排放的監管

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 定價分析

- 宏觀經濟因素的影響

第5章 市場規模與成長預測

- 基板類型

- FC-BGA

- FC-CSP

- 有機BGA/LGA

- 剛柔結合型和軟性CSP

- 其他

- 依核心材料

- ABF

- BT

- 玻璃

- LTCC/HTCC

- 陶瓷製品

- 透過包裝技術

- 2D覆晶

- 2.5D 中介層

- 3D-IC/SoIC

- 扇出WLP

- SiP/模組

- 按裝置節點(nm)

- 28奈米或以上

- 16/14-10 nm

- 7-5 nm

- 4奈米或更小

- 按最終用途行業分類

- 行動和消費者

- 汽車與運輸

- 資訊科技和通訊基礎設施

- 資料中心/人工智慧和高效能運算

- 工業、醫療及其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 南美洲

- 巴西

- 其他南美洲國家

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 台灣

- 印度

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ASE Technology Holding Co., Ltd.

- AT&S Austria Technologie & Systemtechnik AG

- Siliconware Precision Industries Co., Ltd.

- TTM Technologies, Inc.

- Ibiden Co., Ltd.

- Kyocera Corporation

- Fujitsu Interconnect Technologies Ltd.

- JCET Group Co., Ltd.

- Panasonic Holdings Corporation

- Kinsus Interconnect Technology Corp.

- Unimicron Technology Corp.

- Nan Ya Printed Circuit Board Corp.

- Samsung Electro-Mechanics Co., Ltd.

- LG Innotek Co., Ltd.

- Simmtech Co., Ltd.

- Shinko Electric Industries Co., Ltd.

- Shennan Circuits Co., Ltd.

- Zhen Ding Technology Holding Ltd.

- Daeduck Electronics Co., Ltd.

- Meiko Electronics Co., Ltd.

- WUS Printed Circuit Co., Ltd.

- Zhejiang Kingdom Sci-Tech Co., Ltd.

- SKC Absolics Inc.

- Tripod Technology Corp.

- Toppan Inc.

第7章 市場機會與未來展望

The advanced IC substrates market size stood at USD 10.66 billion in 2025 and is forecast to climb to USD 14.98 billion by 2030, translating into a 7.05% CAGR.

Demand shifted decisively from traditional computing toward AI-centric workloads that require higher layer counts, finer linewidths, and tighter warpage control. Asia-Pacific-based substrate vendors benefited from this pivot because they already possessed high-volume ABF capacity and close relationships with foundry packaging lines. Major cloud service providers accelerated long-term purchase agreements in 2025 to secure guaranteed CoWoS and FC-BGA supply, further tilting pricing power to substrate producers. At the same time, glass-core innovation matured, creating a strategic alternative to ABF for ultra-high-density packages scheduled for commercial release in the latter half of the decade.

Global Advanced IC Substrates Market Trends and Insights

Surge in ABF-substrate demand for AI/HPC accelerators

Massive roll-outs of generative-AI servers in 2025 tightened supplies of Ajinomoto Build-up Film, pushing lead-times for ABF panels past 35 weeks and triggering spot-price premiums of up to 25% over 2024 contract levels. Taiwanese suppliers Unimicron, Kinsus, and Nan Ya PCB restored double-digit revenue growth after concluding a prolonged inventory correction, yet still operated at 90% utilization to keep pace with demand. Samsung Electro-Mechanics ramped AI-oriented ABF volume in Q2 2025 and started pilot glass-core runs, reflecting a dual-sourcing strategy aimed at mitigating single-material risk. TSMC disclosed plans to double annual CoWoS output, implying substrate demand well above existing capacity. Collectively, these moves widened a 20% supply gap that substrate makers do not expect to close until fresh lines come online in 2026.

Miniaturization and heterogeneous integration trend

Chiplet architectures, coreless interposers, and through-silicon vias redefined package design rules and pushed substrate line-widths below 10 µm in production settings. Applied Materials highlighted that on-package integration of discrete chiplets delivered superior performance per watt compared with monolithic die approaches. TOPPAN unveiled a coreless organic interposer with a 45% lower coefficient of thermal expansion than legacy ABF solutions, easing mechanical stress inside multi-die stacks. Broadcom's 3.5D XDSiP technology integrated more than 6,000 mm2 of silicon and 12 HBM stacks, underscoring the demand for substrates that can route thousands of high-speed signals in confined footprints. TSMC and ASE invested in panel-level packaging lines up to 310 X 310 mm to gain stepper efficiency and reduce cost per square inch. These shifts position the advanced IC substrates market as a pivotal enabler for next-generation compute density.

ABF-substrate capacity shortage and lead-time spikes

A persistent deficit in ABF panel output restricted upside for the advanced IC substrates market during 2024-2025. Ajinomoto, the near-monopoly supplier of ABF resin, acknowledged a 20% demand-supply gap that would remain until new resin reactors started in 2026. Foundries confirmed the constraint when TSMC said it could satisfy only 80% of CoWoS demand. Competitors such as Sekisui Chemical aimed to break dependence on alternate build-up chemistries, yet qualification cycles for high-end AI packages slowed adoption. Parallel shortages of T-Glass core material, prized for low expansion coefficients, delayed capacity expansions at Nittobo, compounding lead-time spikes. Substrate makers deployed inline metrology to raise first-pass yield and stretch existing capacity, but most customers still entered allocation programs through 2025.

Other drivers and restraints analyzed in the detailed report include:

- 5G build-out boosting high-frequency RF packaging

- Automotive-EV electrification needs high-reliability substrates

- High capital intensity and process complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

FC-BGA substrates accounted for 45% of the advanced IC substrates market share in 2024. Their lead is derived from proven electrical performance required by AI accelerators and server CPUs. Utilization stayed high through 2025 as GPU makers rushed to secure capacity. Growth, however, shifted toward rigid-flex CSP lines that served automotive domain controllers and foldable mobile devices. Rigid-flex volume increased at an 8.1% CAGR, attracting new laminate suppliers able to balance bend radius with controlled impedance. FC-CSP continued to service mid-tier mobile processors, but its cost pressures limited ASP upside. Organic BGA/LGA remained relevant for legacy desktop platforms, yet ceded design wins to flip-chip options. Panel-level FC substrates, still counted under "Others," emerged in pilot volumes at TSMC and ASE, promising 7X usable area per panel and opening new economies of scale.

FC-BGA stayed the workhorse for CoWoS build-ups. Designers demanded 14-26 layer counts, forcing tighter registration tolerances. In response, substrate makers installed AI-enabled optical inspection to catch via-to-trace violations early in the stack. Rigid-flex CSP benefited when automakers migrated infotainment units to 15-inch curved displays that required Z-axis flexibility. Increased camera integration in foldables presented an additional pull. These dynamics support sustained penetration for rigid-flex through 2030 while FC-BGA continues to anchor high-value positions within the advanced IC substrates market.

ABF represented 61% of the advanced IC substrates market size in 2024. Ajinomoto's exclusive resin recipe established consistent dielectric performance and drillability that customers trusted for 2.5D and 3D stacks. Suppliers expanded ABF mixing rooms in 2025, but output gains lagged demand growth, reinforcing seller leverage. Glass substrates, though less than 2% of 2024 shipments, recorded a 14.1% forecast CAGR. Flatness within +-5 µm across 200 mm x 200 mm plates allowed finer redistribution layers and higher I/O density than ABF. Intel's exit from in-house development validated third-party glass suppliers and accelerated ecosystem readiness.

BT resin preserved relevance in automotive control units where 150 °C board temperatures were common. Ceramic and LTCC segments supplied power devices exposed to continuous thermal cycling and offered incremental revenue buffers when ABF lines were oversold. Qualification of glass cores faced hurdles in via formation uniformity, but early builds delivered promising warpage metrics at reflow. AMD signaled its intention to switch its 2026 CPU platforms to glass, encouraging substrate makers to lock capacity slots well ahead of volume ramps. If yields hold, glass could equal or surpass 5% revenue share by 2030.

Advanced IC Substrates Market is Segmented by Substrate Type (FC-BGA, FC-CSP, Organic BGA/LGA, and More), Core Material (ABF, BT, Glass, and More), Packaging Technology (2D Flip-Chip, 2. 5D Interposer, and More), Device Node (>=28 Nm, 16/14-10 Nm, and More), End-Use Industry (Mobile and Consumer, Automotive and Transportation, and More), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa).

Geography Analysis

Asia-Pacific captured 69% of the advanced IC substrates market in 2024. Taiwan's Unimicron, Kinsus, and Nan Ya PCB returned double-digit growth in 2025 as AI server demand replaced the inventory correction that weighed on 2023 shipments. Japan's resurgence, backed by JPY 3.9 trillion (USD 25.5 billion) in subsidies, re-established Kyushu as a packaging hub anchored by TSMC's Kumamoto fab. South Korea announced a USD 471 billion integrated cluster plan designed to deliver 7.7 million wafer starts per month by 2030, embedding ABF-CoWoS lines adjacent to logic fabs. China deployed regional incentives to build flip-chip and SiP capacity, but export restrictions narrowed tooling access, slowing glass-core adoption.

North America's advanced localization efforts under the CHIPS Act. TSMC's Arizona campus moved to a six-fab vision with potential ABF lines colocated for risk mitigation. Entegris secured up to USD 75 million in federal support for filtration media used in substrate copper plating. OSAT giants evaluated U.S. expansion to satisfy defense-oriented chip packaging mandates, though wage inflation remained a concern.

Europe focused on automotive and power devices. OnSemi's Czech SiC facility created an end-to-end supply chain for inverter substrates inside the bloc. Germany and France considered joint ABF pilot lines to support foundry expansions by Intel and TSMC. Meanwhile, Vietnam, India, and Malaysia pursued assembly subsidies. Amkor opened a USD 1.6 billion plant in Bac Ninh, and India approved INR 7,600 crore (USD 910 million) for an OSAT venture led by CG Power and Renesas. These moves diversified geographic risk in the advanced IC substrates market.

- ASE Technology Holding Co., Ltd.

- AT&S Austria Technologie & Systemtechnik AG

- Siliconware Precision Industries Co., Ltd.

- TTM Technologies, Inc.

- Ibiden Co., Ltd.

- Kyocera Corporation

- Fujitsu Interconnect Technologies Ltd.

- JCET Group Co., Ltd.

- Panasonic Holdings Corporation

- Kinsus Interconnect Technology Corp.

- Unimicron Technology Corp.

- Nan Ya Printed Circuit Board Corp.

- Samsung Electro-Mechanics Co., Ltd.

- LG Innotek Co., Ltd.

- Simmtech Co., Ltd.

- Shinko Electric Industries Co., Ltd.

- Shennan Circuits Co., Ltd.

- Zhen Ding Technology Holding Ltd.

- Daeduck Electronics Co., Ltd.

- Meiko Electronics Co., Ltd.

- WUS Printed Circuit Co., Ltd.

- Zhejiang Kingdom Sci-Tech Co., Ltd.

- SKC Absolics Inc.

- Tripod Technology Corp.

- Toppan Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in ABF-substrate demand for AI/HPC accelerators

- 4.2.2 Miniaturisation and heterogeneous integration trend

- 4.2.3 5G build-out boosting high-frequency RF packaging

- 4.2.4 Automotive-EV electrification needs high-reliability substrates

- 4.2.5 Glass-core substrates unlock >2X layer counts

- 4.2.6 CHIPS-style subsidies tied to substrate fabs

- 4.3 Market Restraints

- 4.3.1 ABF-substrate capacity shortage and lead-time spikes

- 4.3.2 High capital intensity and process complexity

- 4.3.3 Copper-clad-laminate price volatility

- 4.3.4 Tighter chemical-emission rules for build-up films

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Analysis

- 4.9 Impact of Macroeconomic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Substrate Type

- 5.1.1 FC-BGA

- 5.1.2 FC-CSP

- 5.1.3 Organic BGA/LGA

- 5.1.4 Rigid-Flex and Flex CSP

- 5.1.5 Others

- 5.2 By Core Material

- 5.2.1 ABF

- 5.2.2 BT

- 5.2.3 Glass

- 5.2.4 LTCC / HTCC

- 5.2.5 Ceramic

- 5.3 By Packaging Technology

- 5.3.1 2D Flip-Chip

- 5.3.2 2.5D Interposer

- 5.3.3 3D-IC / SoIC

- 5.3.4 Fan-Out WLP

- 5.3.5 SiP / Module

- 5.4 By Device Node (nm)

- 5.4.1 >=28 nm

- 5.4.2 16/14-10 nm

- 5.4.3 7-5 nm

- 5.4.4 4 nm and below

- 5.5 By End-Use Industry

- 5.5.1 Mobile and Consumer

- 5.5.2 Automotive and Transportation

- 5.5.3 IT and Telecom Infrastructure

- 5.5.4 Data-centre / AI and HPC

- 5.5.5 Industrial, Medical and Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 France

- 5.6.3.3 United Kingdom

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 Taiwan

- 5.6.4.5 India

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ASE Technology Holding Co., Ltd.

- 6.4.2 AT&S Austria Technologie & Systemtechnik AG

- 6.4.3 Siliconware Precision Industries Co., Ltd.

- 6.4.4 TTM Technologies, Inc.

- 6.4.5 Ibiden Co., Ltd.

- 6.4.6 Kyocera Corporation

- 6.4.7 Fujitsu Interconnect Technologies Ltd.

- 6.4.8 JCET Group Co., Ltd.

- 6.4.9 Panasonic Holdings Corporation

- 6.4.10 Kinsus Interconnect Technology Corp.

- 6.4.11 Unimicron Technology Corp.

- 6.4.12 Nan Ya Printed Circuit Board Corp.

- 6.4.13 Samsung Electro-Mechanics Co., Ltd.

- 6.4.14 LG Innotek Co., Ltd.

- 6.4.15 Simmtech Co., Ltd.

- 6.4.16 Shinko Electric Industries Co., Ltd.

- 6.4.17 Shennan Circuits Co., Ltd.

- 6.4.18 Zhen Ding Technology Holding Ltd.

- 6.4.19 Daeduck Electronics Co., Ltd.

- 6.4.20 Meiko Electronics Co., Ltd.

- 6.4.21 WUS Printed Circuit Co., Ltd.

- 6.4.22 Zhejiang Kingdom Sci-Tech Co., Ltd.

- 6.4.23 SKC Absolics Inc.

- 6.4.24 Tripod Technology Corp.

- 6.4.25 Toppan Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment