|

市場調查報告書

商品編碼

1851533

美國汽車空氣濾清器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)United States Automotive Air Filters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

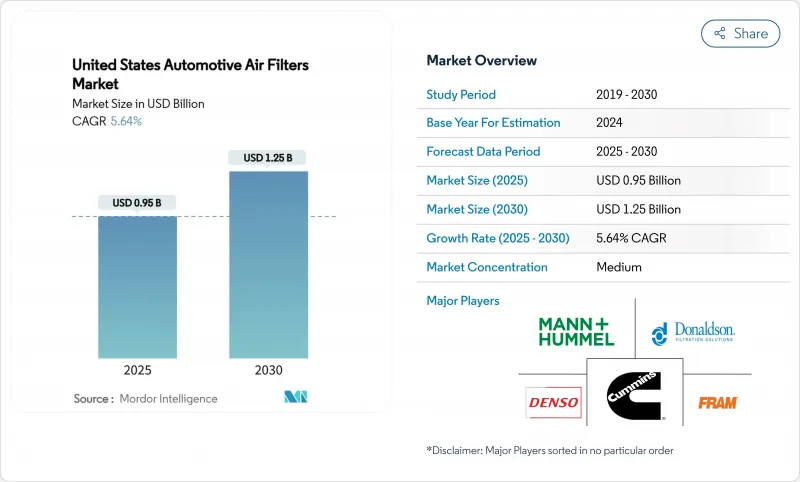

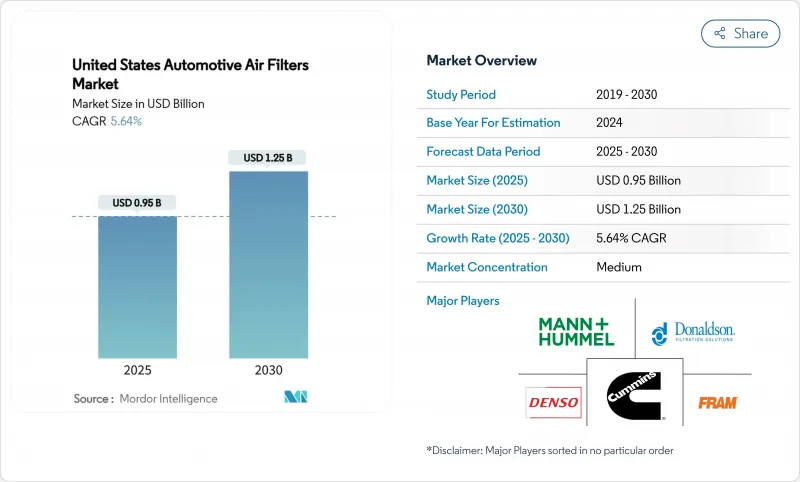

預計到 2025 年,美國汽車空氣濾清器市場價值將達到 9.5 億美元,到 2030 年將達到 12.5 億美元,年複合成長率為 5.64%。

國內汽車保有量老化、排放氣體法規日益嚴格以及疫情後人們對車內空氣品質的擔憂,共同推動了汽車市場的穩定成長。平均車齡達到創紀錄的12.6年,這促使汽車不斷更換;同時,美國環保署(EPA)將顆粒物排放限值設定為0.5毫克/英里,迫使汽車製造商整合高效汽油顆粒過濾器。隨著消費者尋求抵禦過敏原和病原體,車廂過濾器創新也在加速發展,奈米纖維濾材因其更高的捕獲效率和更低的壓力降而備受青睞。 2025年5月進口關稅上調後,供應鏈重組促使製造商轉向本地採購,而具有前瞻性的供應商正在投資研發先進的溫度控管過濾器,以應對未來內燃機汽車保有量下降的影響。

美國汽車空氣濾清器市場趨勢與洞察

汽車產量增加和停車場擴建

汽車生產的復甦和停車場的擴建將帶來雙重需求激增。約有1.1億輛汽車處於6-14年的使用壽命高峰期,佔所有車輛的38%,這將導致濾清器更換頻率的增加。消費者推遲購買新車並將支出轉向維修配件,也支撐了售後市場的強勁成長。隨著美國組裝廠產能的提升和供應鏈的逐步恢復正常,OEM需求也將隨之成長。在此背景下,原廠安裝濾清器和替換濾清器的銷售量均呈現穩定成長。

嚴格的美國環保署排放法規

美國環保署針對2027-2032款輕型車輛的最終規定,將車隊平均溫室氣體排放減半,並首次設定了0.5毫克/英里的全國顆粒物排放限值。這要求汽車製造商為缸內直噴引擎配備汽油顆粒過濾器,實際上增加了一條全新的大批量過濾器生產線。加州和其他一些適用《177條款》的州已經設定了更嚴格的基準值,這將導致採購週期提前,並對整個供應商產生連鎖反應。

轉向純電動車會減少內燃機過濾器的體積。

純電動車將不再需要燃油濾清器和機油濾清器,並降低對進氣濾清器的需求。美國環保署 (EPA) 預測,到 2032 年,輕型汽車銷量中將有 30% 至 56% 為電動車,這將對純燃油汽車市場構成結構性挑戰。新興的純電動車溫度控管濾清器可以部分取代燃油濾清器,但到 2030 年仍無法完全抵消燃油濾清器需求的下降,從而削弱傳統零件製造商的整體成長前景。

細分市場分析

到2024年,紙質濾芯仍將佔據美國汽車空氣濾清器市場42.38%的佔有率。由於其成熟的模具基礎和大規模生產能力,該細分市場對DIY愛好者和車隊管理人員來說仍具有吸引力的單價。儘管如此,奈米纖維複合材料預計到2030年將以8.54%的複合年成長率成長,成為所有基材中成長最快的。合成熔噴混合物佔據中價格分佈市場,兼具耐用性和可接受的效率,而紗布和發泡體則被高性能愛好者和專用非公路設備所採用。

隨著製造商維修國內生產線以大規模生產奈米級卷材,減少進口依賴並配合關稅減免策略,市場趨勢正在轉變。永續性壓力也在影響材料的選擇:在新的詢價函中,不含 PFAS 的塗層和再生纖維正從可選要求轉變為基本要求。能夠兼顧環保資格和過濾性能的供應商將在美國汽車空氣濾清器市場中獲得優勢。在預測期內,即使傳統紙張的產量趨於穩定,向先進材料的價值轉移也將支撐價格的實現。

到2024年,車內過濾器將佔總銷售量的56.27%,凸顯了消費者對車載健康功能的偏好。雖然粒狀物過濾器仍然是銷量領先的產品,但由於人們對過敏原、野火煙霧和空氣傳播病毒的敏感性增加,高效空氣微粒過濾器(HEPA)和抗病毒過濾器的銷量到2030年將以12.83%的複合年成長率成長。進氣過濾器對於內燃機(ICE)引擎仍然至關重要,中型卡車和非公路用設備的需求將保持穩定,但隨著純電動車(BEV)市場佔有率的成長,其銷量將逐漸下降。燃油、機油和變速箱過濾器在售後市場依然強勁,但在原廠配套通路的需求趨於平穩,因為原廠配套產品採用了更長壽的設計。

高階車廂空氣濾芯也將推動淨利率成長,抵消傳統引擎空氣濾芯銷售下滑的影響。汽車製造商目前正大力宣傳空氣品質技術,將其作為競爭優勢,並將先進的濾芯與連網感測器捆綁銷售,以便在需要更換濾芯時提醒駕駛員。監管機構正在考慮制定車內空氣品質標準,進一步鞏固了該品類的地位。綜上所述,這些因素共同確保車廂產品將繼續成為美國汽車空氣濾芯市場的主要成長引擎。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 汽車產量增加和公園面積成長

- 嚴格的EPA/CARB排放法規

- 老舊車輛推動售後市場需求

- 車內空氣清淨機在汽車空調系統的應用日益普及

- 電動動力傳動系統需要複雜的熱管理和空氣管理。

- 奈米纖維和抗病毒介質進入大規模生產階段

- 市場限制

- 向純電動車的轉型將減少內燃機過濾器的數量。

- 原料(纖維素、合成樹脂)價格波動

- 延長原廠保養週期可降低更換頻率

- 可清洗/可重複使用過濾器的成長

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依材料類型

- 紙媒

- 合成

- 紗布

- 形式

- 奈米纖維/複合材料

- 其他

- 按篩選類型

- 進氣過濾器

- 纖維素攝取量

- 合成攝取

- 奈米纖維/複合材料攝入

- 空調濾芯

- 顆粒物

- 活性碳

- 高效能空氣濾清器/抗病毒

- 進氣過濾器

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中型和重型商用車輛

- 非公路(建築和農業)

- 摩托車

- 按銷售管道

- OEM

- 售後市場

- 透過分銷管道

- 線上零售商

- 實體店面銷售

- 服務中心/經銷商

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- KandN Engineering Inc.

- Mahle GmbH

- AL Group Ltd.

- Parker-Hannifin Corp.

- MANN+HUMMEL Group

- Denso Corporation

- Robert Bosch GmbH

- ACDelco(General Motors)

- First Brands Group LLC

- Cummins Filtration Inc.

- Donaldson Company Inc.

- Sogefi Filtration USA

- Fram Group

- Baldwin Filters

- Ahlstrom-Munksjo

- Hengst North America

- WIX Filters

- Fleetguard

- Freudenberg Filtration Technologies

第7章 市場機會與未來展望

The United States automotive air filters market is valued at USD 0.95 billion in 2025 and is projected to grow at a 5.64% CAGR to reach USD 1.25 billion by 2030.

Steady expansion is underpinned by an aging national vehicle fleet, stricter emissions rules, and post-pandemic concern for in-car air quality. A record average vehicle age of 12.6 years boosts replacement volumes, while Environmental Protection Agency (EPA) particulate limits of 0.5 mg/mi compel automakers to integrate high-efficiency gasoline particulate filters. Cabin filter innovation accelerates as consumers seek allergen and pathogen protection, and nanofiber media gains traction by delivering higher capture efficiency with lower pressure drop. Supply-chain reconfiguration after the May 2025 import-tariff hike is pushing manufacturers toward regionalized sourcing, and forward-looking suppliers are investing in advanced thermal-management filtration to offset future internal-combustion-engine (ICE) volume attrition.

United States Automotive Air Filters Market Trends and Insights

Rise in Vehicle Production and Parc Growth

Vehicle production recovery and an expanding parc create a dual-demand surge. About 110 million units sit in the 6-14-year sweet spot for service, representing 38% of the total fleet and translating into higher filter-replacement frequency. Robust aftermarket expansion is supported by consumers deferring new-car purchases, which channels spending toward maintenance parts. OEM demand also rises as U.S. assembly plants ramp up output following supply-chain normalization. Together, these trends underpin stable volume increases across both factory-installed and replacement filters.

Stringent EPA Emission Standards

The EPA final rule for model-year 2027-2032 light-duty vehicles cuts fleet-average greenhouse-gas emissions in half and sets the first nationwide 0.5 mg/mi particulate limit. Automakers must therefore fit gasoline particulate filters on direct-injection engines, effectively adding an entirely new high-volume filter line. Compliance pressure is highest in California and other Section 177 states that historically adopt more aggressive thresholds, driving early procurement cycles that ripple through the supplier base.

Shift Toward BEVs Curbing ICE Filter Volumes

Battery-electric models eliminate fuel and oil filters and cut intake-air filter demand. The EPA forecasts that 30%-56% of light-duty sales will be electric by 2032, producing a structural headwind for ICE-specific categories. Although emerging BEV thermal-management filters offer partial volume substitution, they cannot fully offset the decline through 2030, tempering overall growth prospects for legacy component makers.

Other drivers and restraints analyzed in the detailed report include:

- Aging Fleet Boosting Aftermarket Demand

- Rising Adoption of Cabin Filters for In-Car Air Quality

- Raw-Material Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paper still commands 42.38% of the United States automotive air filters market share in 2024, owing to low cost and wide availability. The segment's entrenched tooling base and mass-production scale keep unit prices attractive for do-it-yourself shoppers and fleet managers alike. Nevertheless, nanofiber composites are forecast to grow at an 8.54% CAGR through 2030, the fastest among all substrates, as automakers and tier-ones specify media that deliver superior particulate capture without boosting pressure drop. Synthetic melt-blown blends occupy a mid-price niche, marrying durability with acceptable efficiency, while gauze and foam serve performance enthusiasts and specialty off-highway equipment.

Momentum is shifting as manufacturers retrofit domestic lines to mass-produce nano-enabled rolls, reducing import exposure and aligning with tariff-mitigation strategies. Sustainability pressures also influence material choice: PFAS-free coatings and recycled fibers are moving from optional to baseline requirements in new RFQs. Suppliers able to balance environmental credentials with filtration performance gain an edge in the United States automotive air filters market. Over the forecast horizon, value migration toward advanced materials supports price realization even as traditional paper volumes plateau.

Cabin units generated 56.27% of 2024 revenue, underscoring the consumer pivot toward wellness features inside the vehicle. Particulate cabin filters remain the volume leader, yet HEPA and antiviral variants are advancing at a 12.83% CAGR to 2030, driven by heightened sensitivity to allergens, wildfire smoke, and airborne viruses. Intake-air filters, still essential for ICE engines, face gradual volume erosion as BEVs gain share, although medium-duty trucks and off-highway machinery sustain demand. Fuel, oil, and transmission filters hold steady in the aftermarket but plateau in OEM channels as factory-filled units adopt extended-life designs.

Premium cabin media also deliver higher margins that offset sliding sales of traditional engine-air elements. Automakers now market air-quality technology as a competitive differentiator, bundling advanced filters with connected sensors that alert drivers when replacements are due. Regulatory bodies are exploring indoor-air-quality standards, further legitimizing the category. Collectively, these forces ensure cabin products remain the principal growth engine within the United States automotive air filters market.

The United States Automotive Air Filters Market Report is Segmented by Material Type (Paper, Synthetic, and More), Filter Type (Intake Filters [Cellulose Intake and More] and Cabin Filters [Particulate and More]), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM and Aftermarket), and Distribution Channel (Online Retailers and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- KandN Engineering Inc.

- Mahle GmbH

- AL Group Ltd.

- Parker-Hannifin Corp.

- MANN+HUMMEL Group

- Denso Corporation

- Robert Bosch GmbH

- ACDelco (General Motors)

- First Brands Group LLC

- Cummins Filtration Inc.

- Donaldson Company Inc.

- Sogefi Filtration USA

- Fram Group

- Baldwin Filters

- Ahlstrom-Munksjo

- Hengst North America

- WIX Filters

- Fleetguard

- Freudenberg Filtration Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in vehicle production and parc growth

- 4.2.2 Stringent EPA / CARB emission standards

- 4.2.3 Aging fleet boosting aftermarket demand

- 4.2.4 Rising adoption of cabin filters for in-car air quality

- 4.2.5 Electrified powertrains need advanced thermal-air management

- 4.2.6 Nanofiber and antiviral media enter mass production

- 4.3 Market Restraints

- 4.3.1 Shift toward BEVs curbing ICE filter volumes

- 4.3.2 Raw-material (cellulose, synthetics) price volatility

- 4.3.3 Extended OEM service intervals lower replacement frequency

- 4.3.4 Growth of washable / reusable filters

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Material Type

- 5.1.1 Paper

- 5.1.2 Synthetic

- 5.1.3 Gauze

- 5.1.4 Foam

- 5.1.5 Nanofiber / Composite

- 5.1.6 Others

- 5.2 By Filter Type

- 5.2.1 Intake Filters

- 5.2.1.1 Cellulose Intake

- 5.2.1.2 Synthetic Intake

- 5.2.1.3 Nanofiber / Composite Intake

- 5.2.2 Cabin Filters

- 5.2.2.1 Particulate

- 5.2.2.2 Activated Carbon

- 5.2.2.3 HEPA / Antiviral

- 5.2.1 Intake Filters

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.3.4 Off-Highway (Construction and Agriculture)

- 5.3.5 Two-Wheelers

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Distribution Channel

- 5.5.1 Online Retailers

- 5.5.2 Brick and Mortar Retail

- 5.5.3 Service Centers and Dealerships

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 KandN Engineering Inc.

- 6.4.2 Mahle GmbH

- 6.4.3 AL Group Ltd.

- 6.4.4 Parker-Hannifin Corp.

- 6.4.5 MANN+HUMMEL Group

- 6.4.6 Denso Corporation

- 6.4.7 Robert Bosch GmbH

- 6.4.8 ACDelco (General Motors)

- 6.4.9 First Brands Group LLC

- 6.4.10 Cummins Filtration Inc.

- 6.4.11 Donaldson Company Inc.

- 6.4.12 Sogefi Filtration USA

- 6.4.13 Fram Group

- 6.4.14 Baldwin Filters

- 6.4.15 Ahlstrom-Munksjo

- 6.4.16 Hengst North America

- 6.4.17 WIX Filters

- 6.4.18 Fleetguard

- 6.4.19 Freudenberg Filtration Technologies

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment