|

市場調查報告書

商品編碼

1836482

北美汽車空氣濾清器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)North America Automotive Airfilters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

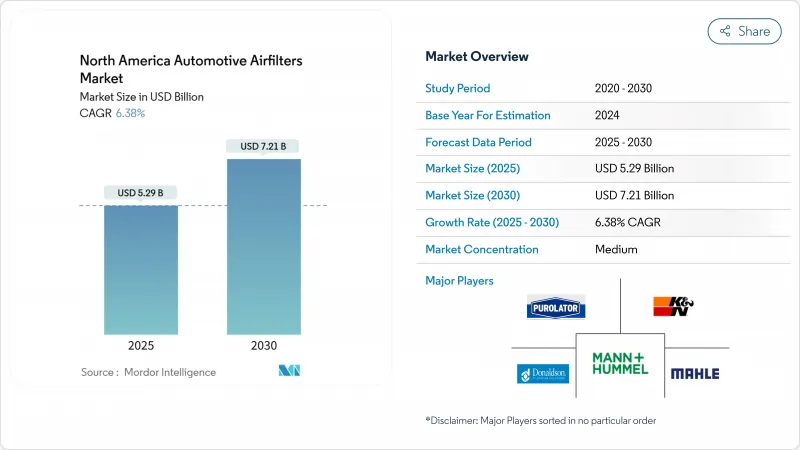

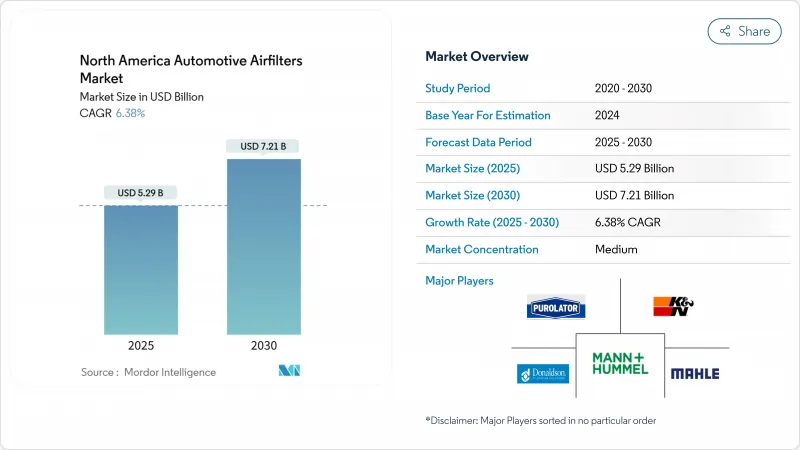

北美汽車空氣濾清器市場預計在 2025 年達到 52.9 億美元,到 2030 年將達到 72.1 億美元,複合年成長率為 6.38%。

北美汽車空氣濾清器市場的穩定擴張得益於老舊車輛強勁的更換需求、美國和加拿大日益嚴格的顆粒物和氮氧化物法規,以及市場轉向高階座艙濾清器。由於野火煙霧、都市區霧霾和日常長途通勤,過濾已從一項日常維護工作轉變為一項健康保護措施,座艙濾清器如今佔據了汽車保有量的絕大部分。隨著監管機構要求在不影響氣流的情況下提高過濾效率,奈米纖維濾材的採用正在加速,而線上零售商則透過為消費者提供透明的定價和選擇來重塑市場經濟。同時,電池式電動車佔有率的上升和長期引擎進氣濾清器數量的下降,迫使供應商將北美汽車空氣濾清器市場的重點轉向HEPA座艙、溫度控制和智慧感測器產品。

北美汽車空氣濾清器市場趨勢與洞察

美國和加拿大加強PM和NOx排放法規,加速過濾器升級週期

加州於2024年12月核准的《先進清潔汽車II》豁免法案進一步收緊了區域標準,並將遲早影響北美汽車空氣濾清器市場。奈米纖維複合材料能夠以較低的壓降實現所需的捕集效率,從而保持燃油經濟性。隨著PM2.5法規收緊至9µg/m³,能夠證明過濾性能的供應商將享有定價權,而傳統的纖維素產品線將面臨利潤壓縮。重型車輛標準將於2027年生效,這將提高耐用性和保固門檻,鼓勵輕型買家認知到長壽命過濾器的根本價值,並鞏固北美汽車空氣濾清器市場的高階地位。

野火過後快速了解客艙空氣質量

2024 年,創紀錄的森林大火產生的煙霧籠罩了加州、奧勒岡州和不列顛哥倫比亞省數週,導致顆粒物讀數超過健康警戒基準值,並引發了消費者對 HEPA 級車廂過濾器的需求。同樣的想法也蔓延到了道路上。通勤者將他們的汽車視為移動庇護所,並要求過濾器能夠過濾掉病毒、過敏原和煙霧。大眾市場原始設備製造商對此做出了回應,他們提供曾經僅用於高階裝飾的多層車廂濾芯,售後市場公司正在為舊款車型提供改裝套件。促銷宣傳活動強調世界衛生組織的 PM2.5 指導和兒童呼吸系統健康,以證明高階提升銷售的合理性。導航應用程式會疊加煙霧地圖,促使駕駛員啟動再循環並提醒他們更換過濾器,從而加強回饋迴路。 Cabin Media 是北美汽車空氣濾清器市場的核心參與者。

長壽命可清洗棉紗布過濾器可更換競食

高性能品牌銷售的可重複使用棉紗布過濾器的使用壽命從 12 個月延長至近五年。愛好者欣賞改進的氣流和永續性訊息,特別是在沙漠環境中,因為在沙漠環境中灰塵較大,需要經常更換。零售商強調 50,000 英里的保固期和終身成本節約,從傳統的紙質生產線中獲取價值。主流採用仍然受到高昂的前期成本和繁瑣的加油過程的限制,這些過程可能會污染空氣流量感知器。即使是適度的轉換率也會蠶食北美汽車空氣濾清器市場售後市場的銷售量。製造商正在透過推出帶有抗菌襯裡的可清洗、插入式座艙過濾器來應對,在恢復收益的同時與循環經濟目標保持一致。

報告中分析的其他促進因素和限制因素

- 配備專用 HEPA 車廂過濾器的 EV/HV 平台

- 支援物聯網的智慧過濾器和更換預測應用程式整合

- 到 2035 年,純電動車的普及將消除對引擎進氣過濾器的需求

細分分析

隨著監管機構將重點放在 PM2.5 捕獲上,預計到 2024 年奈米纖維複合材料的複合年成長率將達到 8.30%,是所有材料中成長最快的。紙張/纖維素仍佔北美汽車空氣濾清器市場的 43.25%,但紙張和纖維素難以在不增加褶皺厚度(這會阻礙氣流)的情況下達到新的效率目標。靜電紡絲奈米纖維可去除 99.9998% 的 300-500nm 顆粒,且壓降較低。供應商正在將奈米纖維塗層與纖維素芯混合,以降低成本並利用現有生產線。隨著原始設備製造商 (OEM) 追求碳中和供應鏈,植物來源聚合物和再生纖維素正在吸引研發資金。氧化石墨烯增強纖維素奈米纖維在實驗室測試中實現了 99.98% 的捕獲率,同時可在土壤中生物分解,為未來的主流應用指明了方向。

聚丙烯和紙漿價格的波動將阻礙對沖策略較弱的小型企業,迫使它們轉向契約製造或專業領域。擁有紙漿和樹脂工廠的垂直整合跨國公司擁有成本優勢,可以嘗試融合熔噴、紡粘和電紡層的混合堆疊技術。從2025年到2030年,奈米纖維的應用將逐漸從渦輪增壓汽油SUV轉向輕型商用貨車,到2030年,北美汽車空氣濾清器市場規模將從個位數擴大到15%左右。

車廂濾清器已佔銷售額的 55.10%。這是北美汽車空氣濾清器市場舒適性超過動力傳動系統零件的罕見例子。受野火煙霧、疫情和 HEPA 過濾器定位的推動,車廂單元的複合年成長率為 7.50%。引擎濾清器對於所有銷售的內燃機汽車仍然必不可少,但隨著純電動車規模的擴大,檢查間隔將會增加,銷量將逐漸下降。美國能源局研究確定了空氣清淨機的能量係數,間接促使汽車工程師朝著更高的 CADR(潔淨空氣輸送率)目標邁進。汽車車廂濾清器正在抄襲家用空氣清淨機的行銷語言,包括多層顆粒碳抗菌堆疊、智慧型手機控制的再循環和 LED 壽命指示器。供應商透過向活性碳中註入銅或銀離子來區分,承諾在幾分鐘內惰性病毒。這種技術轉變鞏固了車廂濾清器作為北美汽車空氣濾清器市場經濟成長引擎的地位。

儘管HEPA(高效空氣濾清器)備受追捧,但大眾市場車輛仍在繼續配備符合成本限制的顆粒物專用座艙濾清器。售後市場將填補這一空白,2025年在線銷售的替換座艙濾清器中,30%將升級為活性碳或HEPA。因此,即使純電動車(BEV)取消了引擎濾清器,經銷商仍將看到平均售價上漲、銷量結構變化和利潤貢獻提升。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 美國和加拿大的PM和NOx排放法規更加嚴格(EPA Tier-3、CARB LEV III)

- 山火過後車內空氣淨化的快速認知

- 車齡超過 12.5 年的輕型車輛的老化正在推高售後市場的車輛數量。

- 配備專用 HEPA 車廂過濾器的 EV/HV 平台

- 支援物聯網的智慧過濾器和更換預測應用程式整合

- 原始設備製造商轉向渦輪增壓汽油SUV的低摩擦奈米纖維引擎介質

- 市場限制

- 長壽命、可清洗的棉紗布過濾器導致更換競食

- 隨著純電動車的普及,到2035年,引擎進氣過濾器的需求將消失

- 聚丙烯和纖維素紙漿價格波動對淨利率帶來壓力

- 由於假冒電商過濾器的廣泛存在,品牌佔有率下降

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 依材料類型

- 紙張/纖維素

- 合成紗布/棉

- 形式

- 奈米纖維複合材料

- 其他活性物(活性碳、金屬網)

- 按過濾器類型

- 進氣(引擎)空氣濾清器

- 車廂空氣濾清器

- 按車輛類型

- 搭乘用車

- 輕型商用車(LCV)

- 中型和重型商用車(MHCV)

- 按銷售管道

- OEM

- 售後市場

- 獨立售後市場

- 授權服務中心

- 網路零售

- 按國家

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Mann+Hummel

- Donaldson Company

- Purolator Filters LLC

- K&N Engineering

- AIRAID(Truck Hero)

- S&B Filters Inc.

- Mahle GmbH

- Bosch Automotive Aftermarket

- Denso Corporation

- Cummins Filtration

- Fram Group

- Clarcor(Part of Parker-Hannifin)

- ACDelco(GM)

- AFE Power

- Wix Filters

- Sogefi Group

- H&V(Engineered Media)

- Roki Co., Ltd.

- Champion Laboratories

- Luber-finer

第7章 市場機會與未來展望

The North America Automotive Air Filters market generated USD 5.29 billion in 2025 and is forecast to climb to USD 7.21 billion by 2030, advancing at a 6.38% CAGR.

Robust replacement demand from an ageing vehicle parc, tightening U.S.-Canada particulate and NOx limits, and migration toward premium cabin filtration underpin this steady expansion of the North America automotive air filters market. Cabin filters now dominate unit volumes because wildfire smoke episodes, urban smog, and prolonged daily commutes convert filtration from a maintenance chore into a health safeguard. Nanofiber media adoption accelerates as regulators press for higher filtration efficiency without airflow penalties, while online retail reshapes route-to-market economics by giving consumers transparent pricing and choice. At the same time, the rising share of battery electric vehicles erodes long-term engine-intake filter volumes, forcing suppliers to pivot toward HEPA cabin, thermal-management, and smart-sensor products within the North American automotive air filters market.

North America Automotive Airfilters Market Trends and Insights

Stricter U.S.-Canada PM & NOx Emission Norms Drive Filter Upgrade Cycles

U.S. EPA light- and medium-duty standards for model years 2027-2032 push fleet average CO2 targets to 85 g/mile, compelling automakers to specify higher-efficiency engines and cabin media that capture finer particulates without throttling airflow.California's Advanced Clean Cars II waiver, approved in December 2024, further tightens regional benchmarks that sooner or later cascade across the North American automotive air filters market. Nanofiber composites benefit by delivering the required capture efficiency with lower pressure drop, preserving fuel economy. Suppliers capable of documenting filtration performance under the tougher PM2.5 limit of 9 µg/m3 secure pricing power, whereas legacy cellulose lines suffer margin compression. Heavy-duty standards effective from 2027 raise durability and warranty thresholds, nudging light-duty buyers to perceive long-life filters as baseline value, reinforcing premium tiers within the North America automotive air filters market.

Rapid Cabin-Air Quality Awareness Post-Wildfire Seasons

Record wildfire smoke in 2024 blanketed California, Oregon, and British Columbia for weeks, pushing particulate readings above health-alert thresholds and igniting consumer demand for HEPA-grade cabin filters. State policy reviews now mandate high-efficiency filtration for buildings exposed to smoke plumes.That same mindset spills onto driveways: commuters treat vehicles as rolling shelters and seek filters with viral, allergen, and smoke removal claims. Mass-market OEMs respond by offering multi-layer cabin cartridges once limited to luxury trims, while aftermarket players package retrofit kits for older models. Promotional campaigns highlight World Health Organization PM2.5 guidance and children's respiratory health to justify a premium upsell. The feedback loop tightens as navigation apps overlay smoke maps, nudging drivers to activate recirculation and reminding them to change filters. This human-health narrative cements Cabin Media as the North American automotive air filter market's heartbeat.

Long-Life Washable Cotton Gauze Filters Cannibalizing Replacements

Reusable cotton-gauze filters marketed by performance brands extend service life from 12 months to nearly 5 years. Enthusiasts appreciate airflow gains and sustainability messaging, especially in desert states where dust traditionally forces frequent swaps. Retailers emphasize 50,000-mile warranties and lifetime cost savings, pulling value away from conventional paper lines. Mainstream uptake remains capped by a higher upfront price and the messy oil-recharge process that can foul mass-airflow sensors. Nevertheless, even modest conversion rates shave volumes in the aftermarket segment of the North America automotive air filters market. Manufacturers counter by launching drop-in washable cabin filters with antimicrobial linings, recapturing revenue while aligning with circular-economy goals.

Other drivers and restraints analyzed in the detailed report include:

- EV/HV Platforms Adopting Dedicated HEPA Cabin Filters

- Integration of IoT-Enabled Smart Filters With Predictive Replacement Apps

- BEV Adoption: Eliminating Engine-Intake Filter Demand By 2035

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Nanofiber composites held a modest slice in 2024 yet are on course for 8.30% CAGR, the fastest of any material, as regulators focus on PM2.5 capture. While Paper/Cellulose still accounts for 43.25% of the North American automotive air filters market, paper and cellulose struggle to meet new efficiency targets without thickening pleats that choke airflow. Electrospun nanofibers remove 99.9998% of 300-500 nm particles at low pressure drop, a metric validated in Macromolecular Materials and Engineering studies. Suppliers blend nanofiber coatings with cellulose cores to keep costs palatable and to use existing production lines. Sustainability pressures add complexity: plant-based polymers and recycled cellulose draw R&D funding as OEMs pursue carbon-neutral supply chains. Graphene-oxide-reinforced cellulose nanofibers delivered 99.98% capture in laboratory tests while biodegrading in soil, signaling pathways for future mainstream deployment.

Price volatility in polypropylene and pulp hampers smaller firms with weak hedging strategies, pushing them toward contract manufacturing or specialty niches. Vertically integrated multinationals with pulp plantations and resin plants enjoy cost leverage and can experiment with hybrid stacks mixing melt-blown, spunbond and electrospun layers. Over 2025-2030, nanofiber adoption trickles down from turbo-gasoline SUVs into light commercial vans, raising the North America automotive air filters market size captured by the material from single digits to mid-teens by decade's end.

Cabin filters already control 55.10% of revenue. They are fighting engine-intake filters for every incremental dollar, a rare instance where a comfort feature outranks a drivetrain component in the North America automotive air filters market. Cabin units grow 7.50% CAGR, boosted by wildfire smoke, pandemics, and HEPA positioning. Engine filters remain essential for sold internal-combustion vehicles but confront longer service intervals and gradual volume attrition as BEVs scale. Research from the U.S. Department of Energy sets energy factors for air cleaners, indirectly nudging automotive engineers toward higher CADR (clean air delivery rate) targets. Automotive cabins copy home-air-purifier marketing language: multi-layer particulate-carbon-antimicrobial stacks, smartphone-controlled recirculation, and LED life indicators. Suppliers differentiate by impregnating activated carbon with copper or silver ions, promising viral inactivation within minutes, a claim validated by ISO 18184 tests. This technology shift cements cabin filters as the North America automotive air filter market's economic growth engine.

Despite the glamour around HEPA, mass-market vehicles continue to ship with particulate-only cabin filters that comply with cost ceilings. The aftermarket fills the gap: 30% of replacement cabin filters sold online in 2025 carry carbon or HEPA upgrades. As a result, distributors watch average selling price climb while the volume mix changes, improving margin contribution even as BEVs delete engine filters.

The North America Automotive Air Filters Market is Segmented by Material Type (Paper / Cellulose, Synthetic Gauze / Cotton, and More), Filter Type (Intake Filters and Cabin Filters), by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEMs and Aftermarket) and Country (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Mann+Hummel

- Donaldson Company

- Purolator Filters LLC

- K&N Engineering

- AIRAID (Truck Hero)

- S&B Filters Inc.

- Mahle GmbH

- Bosch Automotive Aftermarket

- Denso Corporation

- Cummins Filtration

- Fram Group

- Clarcor (Part of Parker-Hannifin)

- ACDelco (GM)

- AFE Power

- Wix Filters

- Sogefi Group

- H&V (Engineered Media)

- Roki Co., Ltd.

- Champion Laboratories

- Luber-finer

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter U.S.-Canada PM & NOx emission norms (EPA Tier-3, CARB LEV III)

- 4.2.2 Rapid cabin-air quality awareness post-wildfire seasons

- 4.2.3 Ageing light-vehicle parc greater than 12.5 yrs fueling aftermarket volumes

- 4.2.4 EV/HV platforms adopting dedicated HEPA cabin filters

- 4.2.5 Integration of IoT-enabled smart filters with predictive replacement apps

- 4.2.6 OEM shift toward low-restriction nanofiber engine media for turbo-gasoline SUVs

- 4.3 Market Restraints

- 4.3.1 Long-life washable cotton gauze filters cannibalising replacements

- 4.3.2 BEV adoption eliminating engine-intake filter demand by ~2035

- 4.3.3 Polypropylene & cellulose pulp price volatility squeezing margins

- 4.3.4 Proliferation of counterfeit e-commerce filters undermining branded share

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Material Type

- 5.1.1 Paper/Cellulose

- 5.1.2 Synthetic Gauze/Cotton

- 5.1.3 Foam

- 5.1.4 Nanofiber Composite

- 5.1.5 Others (Activated Carbon, Metal Mesh)

- 5.2 By Filter Type

- 5.2.1 Intake (Engine) Air Filters

- 5.2.2 Cabin Air Filters

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles (LCV)

- 5.3.3 Medium and Heavy Commercial Vehicles (MHCV)

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.4.2.1 Independent Aftermarket

- 5.4.2.2 Authorized Service Centers

- 5.4.2.3 Online Retail

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Mann+Hummel

- 6.4.2 Donaldson Company

- 6.4.3 Purolator Filters LLC

- 6.4.4 K&N Engineering

- 6.4.5 AIRAID (Truck Hero)

- 6.4.6 S&B Filters Inc.

- 6.4.7 Mahle GmbH

- 6.4.8 Bosch Automotive Aftermarket

- 6.4.9 Denso Corporation

- 6.4.10 Cummins Filtration

- 6.4.11 Fram Group

- 6.4.12 Clarcor (Part of Parker-Hannifin)

- 6.4.13 ACDelco (GM)

- 6.4.14 AFE Power

- 6.4.15 Wix Filters

- 6.4.16 Sogefi Group

- 6.4.17 H&V (Engineered Media)

- 6.4.18 Roki Co., Ltd.

- 6.4.19 Champion Laboratories

- 6.4.20 Luber-finer

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment