|

市場調查報告書

商品編碼

1836521

歐洲汽車空氣濾清器:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Europe Automotive Airfilters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

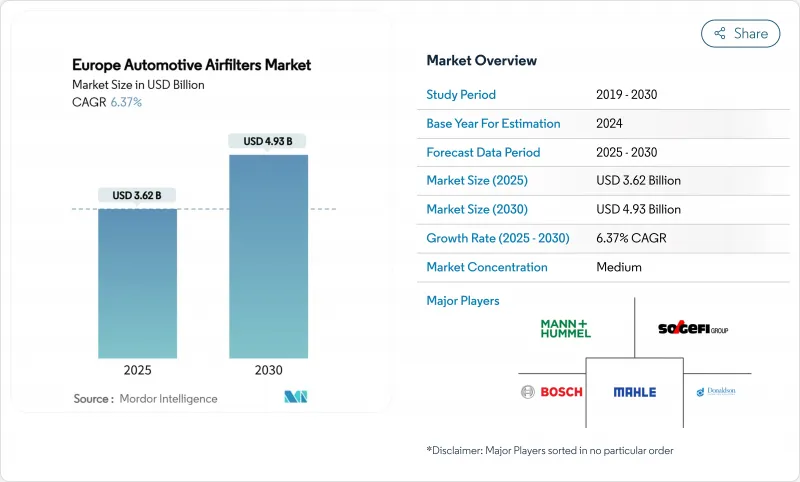

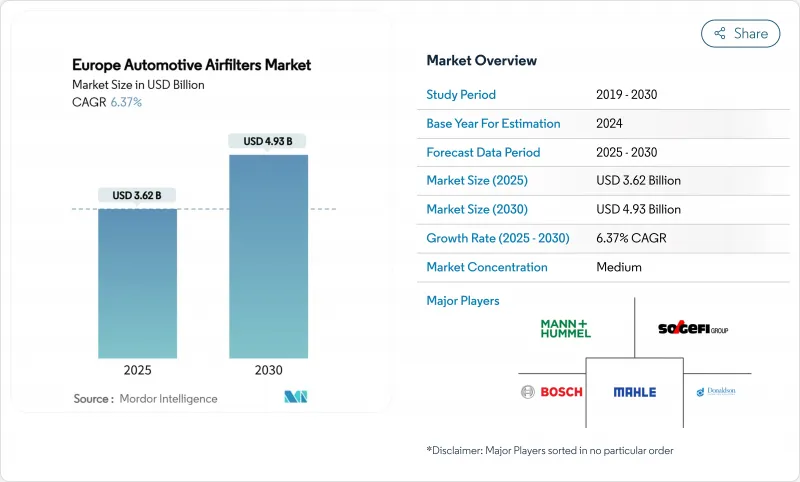

預計 2025 年歐洲汽車空氣濾清器市場規模為 36.2 億美元,到 2030 年將達到 49.3 億美元,預測期間(2025-2030 年)的複合年成長率為 6.37%。

圍繞著歐7的強勁監管勢頭、城市低排放氣體區的快速擴張以及消費者持續的健康意識,都在推動這一成長。目標商標產品製造商 (OEM) 正在重新設計進氣和座艙濾清器,以滿足奈米級顆粒物法規的要求,而獨立的售後市場參與者則正在利用歐洲大陸約2.8億輛老舊車輛。因此,歐洲汽車空氣濾清器市場正從商品量轉向加值性能,將過濾為下一代出行中合規性關鍵、消費者可見且支援遙測的組件。

歐洲汽車空氣濾清器市場趨勢與洞察

汽車市場老化加劇了對獨立售後市場的需求

到2025年,西歐的平均車齡將達到12年,車齡年資為15至20年。舊式內燃機 (ICE) 車型需要頻繁更換進氣濾清器和座艙濾清器,而獨立維修店憑藉極具競爭力的價格和廣泛的庫存單位 (SKU) 覆蓋範圍,已在當地售後市場佔據了相當大的佔有率。即使純電動車 (BEV) 的普及消除了未來對進氣濾清器的需求,歐洲汽車空氣濾清器市場仍將保持強勁勢頭,至少還能再撐一個完整的更換週期,因為剩餘的內燃機汽車能夠保證長期使用。電商平台正在積極應對,他們擴大了傳統平台的庫存單位 (SKU) 選擇,推出自有品牌活性碳座艙濾清器,並利用電商平台觸達分散的農村車主。

加速過濾器更換週期,以符合歐盟 7 和歐盟 VI-D排放氣體標準

歐盟委員會於2024年5月發布了歐7法規,引入了汽油車10奈米顆粒物基準值,並規定廢氣和非廢氣顆粒物均需終身符合排放標準。隨著車載診斷系統監測濾清器劣化,進氣和座艙濾清器必須比以往更長時間地保持高效,高里程車輛必須盡可能縮短實際更換週期。因此,OEM級供應商正在將高利潤的多層濾清器與監管認證和RFID標籤捆綁銷售,以提高單位收入,並加強歐洲汽車空氣濾清器市場,使其成為關鍵的合規槓桿,而非可有可無的維護部件。

純電動車的普及正在減少對進氣引擎空氣濾清器的需求

電池式電動車無需燃燒空氣濾清器,從而消除了新車需求中進氣濾清器的全部材料成本。德國將在2024年組裝135萬輛電動車,並計畫在2025年達到167萬輛(依據車隊平均二氧化碳排放法規)。因此,歐洲汽車空氣濾清器市場面臨結構性產量阻力,尤其是在電氣化發展最快的高階市場。座艙濾清器、電池組冷卻微濾器和空氣乾燥器濾芯正呈現抵消性成長,但平均每輛車的產量正在下降。中期收益影響將集中在高價值進氣部件上,這些部件傳統上由研發預算覆蓋,迫使供應商重新專注於複合材料座艙和溫度控管領域。

報告中分析的其他促進因素和限制因素

- 消費者對車內空氣品質和過敏的擔憂日益增加

- 原始設備製造商轉向超低壓降介質,以最大限度地延長電動車續航里程

- 車輛小型化,減少濾芯的數量/尺寸

細分分析

到2024年,紙質濾清器將佔據歐洲汽車空氣濾清器市場佔有率的56.17%,為高容量乘用車系列提供可靠的氣流阻力和成本效益。幾十年來,由於成熟的供應鏈和本地紙漿加工能力,這種傳統基材支撐著歐洲汽車空氣濾清器市場的規模。然而,受消費者對車內揮發性有機化合物 (VOC) 吸附和過敏原中和的需求推動,預計到2030年,活性碳和新興複合材料的複合年成長率將達到6.51%。

主機廠正將奈米纖維層疊在纖維素骨架上,生產出能夠捕捉10奈米顆粒的混合片材,同時保持低於15帕的壓力降。紗布和發泡體分別在性能調校和非公路設備領域仍然是利基選擇,其含油層和超大孔隙使其適用於多塵環境。隨著歐盟7標準的成熟,紙質材料的佔有率將逐漸下降,但其可回收成分和低體積能量特性將使其保持競爭力,確保其在歐洲汽車空氣濾清器市場中繼續存在,而非被徹底取代。

到2024年,車廂濾清器將佔歐洲汽車空氣濾清器市場規模的61.22%,這得益於疫情後的健康擔憂、都市區霧霾加劇以及過敏認證的市場吸引力。預計到2030年,該細分市場的複合年成長率將達到6.47%,超過進氣濾清器,因為在污染嚴重的大都會圈,更換頻率可能達到每年兩次。原始設備製造商正在透過在手套箱後方整合過濾濾芯介面來簡化自助更換流程,從而刺激獨立零件零售商的電商銷售。

進氣過濾器繼續佔據剩餘的市場佔有率,並面臨純電動車(BEV)的替換,但仍服務於歐洲龐大的傳統內燃機車隊。單位需求的波動正促使供應商向用於座艙和暖通空調(HVAC)應用的雙功能顆粒濾芯領域拓展。在電動車中,座艙過濾器的選擇會影響暖通空調(HVAC)的消費量,因此先進的低壓降設計贏得了高利潤的工廠安裝。聯網汽車儀錶板可以提醒駕駛者顆粒物積聚的突然增加,鼓勵及時更換,並維持整個歐洲汽車空氣濾清器市場的高單價。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 汽車產業的老化正在推動對獨立售後市場(IAM)的需求

- 歐7和歐VI-D排放標準加速濾網更換週期

- 消費者對車內空氣品質和過敏的擔憂日益增加

- 推動超低壓損介質的OEM,最大限度地延長電動車續航里程

- 歐洲城市級低排放氣體區(LEZ)的擴張

- 透過基於訂閱的無線 (OTA) 機上空氣品質服務產生經常性過濾收益

- 市場限制

- 純電動車的普及將減少對進氣引擎空氣濾清器的需求

- 隨著汽車小型化,濾芯數量和尺寸不斷減少

- 特種不織布和活性碳介質的供應瓶頸

- 高階市場擴大採用可清洗的高性能過濾器

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模與成長預測:價值(美元)

- 依材料類型

- 紙

- 紗布

- 形式

- 活性碳/複合材料

- 按過濾器類型

- 進氣過濾器

- 車廂濾清器

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 大型商用車和公車

- 按銷售管道

- OEM

- 售後市場

- 按國家

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- MANN+HUMMEL

- MAHLE

- Sogefi

- Robert Bosch GmbH

- Donaldson

- Hengst SE

- Freudenberg Filtration Tech.

- Ahlstrom

- Cummins Inc.

- DENSO

- K&N Engineering

- Purolator Filters LLC

- Advanced Flow Engineering

- AIRAID

- S&B Filters

- AL Filters

- JS Automobiles

- Allena Group

- Wsmridhi Manufacturing

- UFI Filters

第7章 市場機會與未來展望

The Europe Automotive Airfilters Market size is estimated at USD 3.62 billion in 2025, and is expected to reach USD 4.93 billion by 2030, at a CAGR of 6.37% during the forecast period (2025-2030).

Strong regulatory momentum around Euro 7, rapid expansion of city-level Low-Emission Zones, and persistent consumer health awareness anchor this expansion. Original-equipment manufacturers (OEMs) are redesigning intake and cabin filtration to meet nanometer-scale particulate limits, and independent aftermarket players are capitalizing on the continent's aging approximately 280 million-unit vehicle-parc. The Europe automotive air filters market is therefore transitioning from commodity volumes toward value-added performance, positioning filtration as a compliance-critical, consumer-visible, and telemetry-enabled component of next-generation mobility.

Europe Automotive Airfilters Market Trends and Insights

Ageing Car-Parc Expanding Independent Aftermarket Demand

Western Europe's average vehicle age reached 12 years in 2025, while Eastern European fleets stretch to 15-20 years. Older internal-combustion-engine (ICE) models require frequent intake and cabin filter swaps, and independent garages capture a considerable share of the regional aftermarket by offering competitive pricing and broad SKU coverage. Even as BEV penetration removes future intake filter demand, the residual ICE fleet guarantees long-dated volume, keeping the Europe automotive air filters market robust through at least one more full replacement cycle. Aftermarket specialists respond by widening SKU assortments for legacy platforms, introducing private-label activated-carbon cabin elements, and adopting e-commerce marketplaces to reach dispersed rural owners.

Euro 7 and Euro VI-D Emission Norms Accelerating Filter Replacement Cycles

The European Commission published Euro 7 rules in May 2024, introducing 10-nanometer particulate thresholds for gasoline vehicles and lifetime compliance for both tailpipe and non-exhaust particles. Because on-board diagnostics now monitor filter degradation, intake and cabin elements must sustain efficiency far longer than legacy, compressing real-world replacement to as low as possible in high-mileage fleets. OEM-grade suppliers therefore bundle higher-margin, multilayer elements that carry regulatory certificates and embedded RFID tags, lifting revenue per unit and reinforcing the Europe automotive air filters market as a critical compliance lever rather than a discretionary maintenance part.

BEV Adoption Shrinking Demand for Intake Engine Air-Filters

Battery-electric vehicles do not require combustion air filtration, removing entire intake filter bill-of-materials from new-vehicle demand. Germany assembled 1.35 million EVs in 2024 and is targeting 1.67 million units in 2025 under fleet-average CO2 rules, while Norway's new-car market reached majority of BEV share. The Europe automotive air filters market therefore confronts a structural volume headwind, chiefly in premium segments where electrification advances fastest. Counterbalancing growth arises in cabin filters, battery-pack cooling micro-filters, and air-drier cartridges-yet unit counts per vehicle fall on average. Medium-term revenue impact centers on high-value intake elements whose margins historically funded R&D budgets, compelling suppliers to pivot toward composite cabin and thermal-management niches.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Consumer Focus on In-Cabin Air Quality and Allergies

- OEM Drive for Ultra-Low Pressure-Drop Media to Maximize EV Range

- Vehicle Downsizing Reducing Number/Size of Filter Elements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paper-based filters captured 56.17% of Europe automotive air filters market share in 2024, producing dependable airflow resistance and cost efficiency across high-volume passenger car lines. This traditional substrate underpinned Europe automotive air filters market size for decades, benefitting from mature supply chains and regional pulp processing capacity. Activated-carbon and emerging composite variants, however, are outpacing at 6.51% CAGR to 2030 as consumers demand volatile-organic-compound (VOC) adsorption and allergen neutralization within constrained cabin spaces.

OEMs are layering nanofibers atop cellulose backbones, creating hybrid sheets that trap 10-nanometer particles while holding pressure drops below 15 Pa. Gauze and foam remain niche options in performance tuning and off-highway equipment, respectively, where oil-impregnated layers or oversized pores suit dusty environments. As Euro 7 matures, paper's share erodes gradually but retains relevance due to recyclable composition and low embodied energy, ensuring coexistence rather than outright displacement inside the Europe automotive air filters market.

Cabin filters held 61.22% of the Europe automotive air filters market size in 2024, a position fortified by post-pandemic health concerns, urban smog episodes, and the marketing appeal of allergy certification. The segment grows at a 6.47% CAGR through 2030, outpacing intake filters, because replacement frequency can reach twice per year in polluted metropolitan zones. OEMs integrate filtration cartridge access behind glove boxes, simplifying do-it-yourself swaps and stimulating e-commerce sales by independent parts retailers.

Intake filters, covering the residual share, confront BEV substitution but still service Europe's large legacy ICE fleet. Turbulence in unit demand pushes suppliers to diversify toward dual-function cabin and HVAC micro-particle elements. Within EVs, cabin filter selection affects HVAC energy draw; thus, advanced low-pressure-drop designs win high-margin factory installs. Connected vehicle dashboards now alert drivers when particulate accumulation spikes, triggering timely replacements and preserving premium unit values across the Europe automotive air filters market.

The Europe Automotive Airfilters Market Report is Segmented by Material Type (Paper, Gauze, and More), Filter (Intake Filters and Cabin Filters), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM and Aftermarket), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- MANN+HUMMEL

- MAHLE

- Sogefi

- Robert Bosch GmbH

- Donaldson

- Hengst SE

- Freudenberg Filtration Tech.

- Ahlstrom

- Cummins Inc.

- DENSO

- K&N Engineering

- Purolator Filters LLC

- Advanced Flow Engineering

- AIRAID

- S&B Filters

- AL Filters

- JS Automobiles

- Allena Group

- Wsmridhi Manufacturing

- UFI Filters

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing car-parc expanding independent aftermarket (IAM) demand

- 4.2.2 Euro 7 & Euro VI-D emission norms accelerating filter replacement cycles

- 4.2.3 Heightened consumer focus on in-cabin air quality & allergies

- 4.2.4 OEM drive for ultra-low pressure-drop media to maximise EV range

- 4.2.5 Expansion of city-level Low-Emission Zones (LEZs) across Europe

- 4.2.6 Subscription-based OTA cabin-air-quality services creating recurring filter revenue

- 4.3 Market Restraints

- 4.3.1 BEV adoption shrinking demand for intake engine air-filters

- 4.3.2 Vehicle downsizing reducing number/size of filter elements

- 4.3.3 Supply bottlenecks for specialty non-woven & activated-carbon media

- 4.3.4 Rising adoption of washable performance filters in premium segment

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Material Type

- 5.1.1 Paper

- 5.1.2 Gauze

- 5.1.3 Foam

- 5.1.4 Activated-carbon / Composite

- 5.2 By Filter Type

- 5.2.1 Intake Filters

- 5.2.2 Cabin Filters

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Heavy Commercial Vehicles & Buses

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 MANN+HUMMEL

- 6.4.2 MAHLE

- 6.4.3 Sogefi

- 6.4.4 Robert Bosch GmbH

- 6.4.5 Donaldson

- 6.4.6 Hengst SE

- 6.4.7 Freudenberg Filtration Tech.

- 6.4.8 Ahlstrom

- 6.4.9 Cummins Inc.

- 6.4.10 DENSO

- 6.4.11 K&N Engineering

- 6.4.12 Purolator Filters LLC

- 6.4.13 Advanced Flow Engineering

- 6.4.14 AIRAID

- 6.4.15 S&B Filters

- 6.4.16 AL Filters

- 6.4.17 JS Automobiles

- 6.4.18 Allena Group

- 6.4.19 Wsmridhi Manufacturing

- 6.4.20 UFI Filters

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment