|

市場調查報告書

商品編碼

1844571

汽車空氣濾清器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Air Filter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

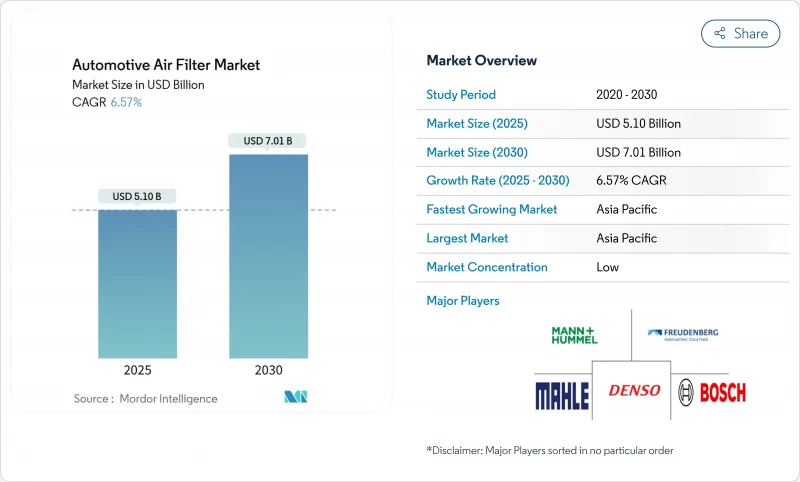

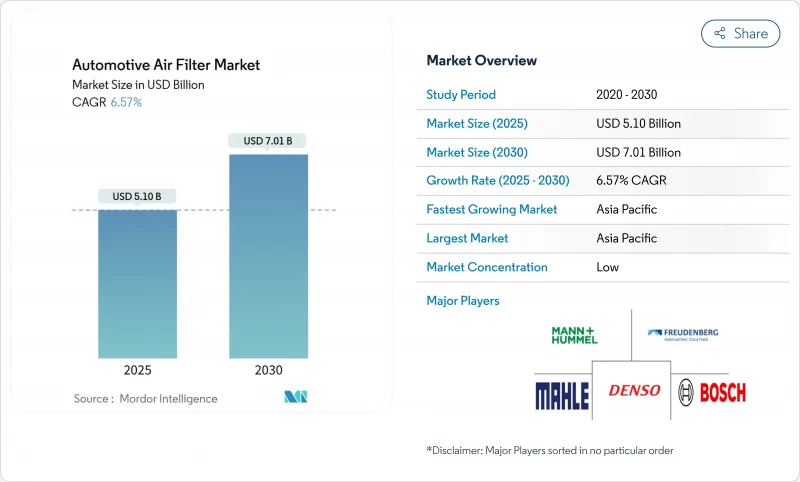

預計汽車空氣濾清器市場規模到 2025 年將達到 51 億美元,到 2030 年將達到 70.1 億美元,複合年成長率為 6.57%。

歐洲、北美和亞洲主要經濟體排放法規的日益嚴格,加上消費者對車內空氣品質的擔憂,推動了強勁的需求成長。為了符合歐盟7、EPA 2027-2032多污染物排放標準以及Bharat Stage VI排放標準,原始目標商標產品製造商 (OEM) 擴大指定使用高效微粒空氣 (HEPA) 系統和靜電奈米纖維濾材。電動車 (EV) 平台也帶來了巨大的機遇,因為電池散熱系統和更安靜的駕駛室會加劇過濾性能的差異。同時,售後市場經銷商正在利用預測性維護數據來定位優質的替換濾材,以應對合成濾材提供的更長的維護間隔。

全球汽車空氣濾清器市場趨勢與洞察

嚴格的廢氣排放法規和車內空氣品質法規

主要汽車市場法規趨同,對先進過濾技術的需求空前高漲,旨在保護引擎並改善車內空氣品質。歐盟的歐7法規首次限制輪胎和煞車磨損排放的顆粒物排放,要求過濾系統能夠捕捉廢氣中常見的顆粒物以外的其他顆粒物。這項擴展與美國環保署的Tier 4標準重疊,後者要求達到0.5 mg/mi PM排放的車輛配備汽油顆粒物過濾器,從根本上將過濾的價值提案從可選的舒適功能轉變為合規的必需品。柬埔寨將於2030年採用歐盟6/VI標準,這標誌著監管協調將擴展到新興市場以外的領域,為過濾供應商創造全球機會。緊迫的監管時間表迫使原始設備製造商加快過濾技術的整合,而合規期限人為地造成了需求激增,使供應商能夠獲得易於部署的解決方案。加州的「先進清潔車 II」計畫要求到 2035 年銷售 100% 零排放車,但這反而會增加對過濾設備的需求,因為電動車需要先進的車廂空氣管理系統來維持電池熱效率。

全球車輛數量和服務間隔里程數增加

全球汽車保有量(尤其是在新興市場)的擴張,正在創造持續的售後市場需求,其成長速度超過了新車產量。合成潤滑油的應用和引擎耐久性的提高延長了保養間隔,但這反而增加了濾清器系統的壓力。這種動態有利於高階濾清器製造商,他們可以透過符合OEM規格的長壽命產品來獲得高額淨利率。車隊營運商越來越認知到高階濾清器對其總擁有成本的益處,而預測性維護演算法能夠實現基於狀態的更換計劃,從而最佳化濾清器利用率,同時防止引擎過早磨損。隨著商用車每年行駛里程超過個人乘用車,人們轉向「出行即服務」模式,這推動了濾清器更換頻率的提高,並為售後市場供應商創造了更可預測、更有利可圖的更換週期。

長壽命合成介質延長更換間隔

先進的合成濾材技術將維護間隔延長至傳統更換週期之外,反而限制了市場成長。奈米纖維塗層技術,例如 Hollingsworth & Vose 的 NANOWEB 系統,增強了深層過濾和脈衝清潔能力,使過濾器能夠更長時間地保持高效,同時降低更換頻率。這項技術進步帶來了一個典型的創新者困境:卓越的產品性能會因為需要更少的更換次數而縮小潛在的市場規模。豪華汽車製造商擴大將長壽命過濾系統作為標準配置,以降低維護成本並提高客戶滿意度,這無意中縮小了其售後市場的收益潛力。豪華電動車中密封座艙濾清器模組的「使用壽命」趨勢完全消除了售後市場的更換機會,迫使供應商在原廠組裝中獲取更高的利潤,而不是依賴常規的售後市場銷售。伊朗 Behran Filter Company 獲得了其基於奈米技術的「Nano Namad」汽車空氣過濾器的首個許可,這表明新興市場正在向延長維護間隔的先進過濾技術邁進。過濾器製造商需要在技術進步與商業模式的永續性之間取得平衡,這可能需要轉向基於訂閱的維護服務和增值監控系統,以產生與物理過濾器更換頻率無關的經常性收入流。

細分分析

到2024年,進氣濾清器將佔據55.21%的市場佔有率,這反映了其在所有車型中的普遍應用,以及出於引擎保護要求而強制更換的周期。然而,車廂空氣濾清器將成為成長的驅動力,到2030年,其複合年成長率將達到9.21%。

博世推出的FILTER+pro車內空氣濾清器,其抗菌層可有效對抗病毒、細菌和過敏原,展現了傳統供應商如何透過創新在車內過濾領域獲取溢價。空氣品質法規的趨同和消費者健康意識的提升,正在持續推動車內濾清器升級的需求,促使汽車製造商在高階車型中統一採用HEPA級系統。受引擎保護需求的推動,進氣濾清器的需求保持穩定,但由於技術成熟和更換週期的確定,其成長率落後於車內濾清器。靜電濾清器和奈米纖維濾清器代表了該行業的技術前沿,供應商對性能超越傳統濾清器的先進顆粒物捕獲能力提出了更高的要求。

纖維素價格低廉,且為製造商所熟知,到 2024 年將保持 44.18% 的佔有率。奈米纖維和 HEPA 介質的汽車空氣過濾市場規模預計將以 11.48% 的複合年成長率擴大,這清楚地表明優質、高效的介質正在引領技術創新的步伐。

奈米纖維層增加了深度負載和高容塵量,同時保持了低阻力,這是提升引擎性能和暖通空調能源效率的關鍵優勢。供應商正在將其專有的奈米塗層整合到傳統基材上,以打造差異化的產品,從而獲得顯著的價格溢價。活性碳製造商正在投資回收技術,以應對原料價格波動,從而強化汽車製造商和監管機構所要求的性能與永續性的雙重價值提案。

區域分析

受中國電動車熱潮和印度巴拉特第六階段排放標準的推動,亞太地區到2024年的市佔率將達到38.75%。預計該地區在預測期內的複合年成長率將達到6.41%。本地供應商正在與全球品牌合作,以獲得先進的媒體許可,而中國、泰國和越南的經濟高效的製造工廠則支持全球需求。澳洲採用與歐6d相當的廢氣排放法規,將進一步擴大符合法規的市場。

在歐洲,歐盟7標準納入了非廢氣顆粒物排放標準,擴大了輪胎磨損過濾器和煞車粉塵過濾器的市場空間。德國汽車製造商在高效能空氣過濾器(HEPA)和感測器整合方面處於領先地位,通常與曼胡默爾等供應商進行聯合設計。漢格斯特在羅馬尼亞的工廠表明,東歐的成本基礎正在吸引新的產能。消費者將先進的過濾與健康和環保責任聯繫在一起,這支撐了其溢價。

在北美,美國環保署 (EPA) 2027-2032 年法規確保了對高效能引擎空氣和座艙系統的持續需求。加州的零排放汽車強制要求將刺激對電動車專用溫度控管過濾器的需求。 Hannon Systems 位於安大略的電動車壓縮機工廠證明了供應商為滿足該地區日益成長的電動車產量而進行的投資。售後市場物流的加強和 DIY 文化的興起預計將推動性能升級的快速普及。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 嚴格的廢氣排放法規和車內空氣品質法規

- 全球汽車保有量和服務間隔里程的成長

- 重污染大城市消費者的健康意識

- 用於電動車和高階 OEM 平台的 HEPA 級過濾器

- 感測器啟動的智慧型 HVAC過濾模組

- 預測性車隊維護演算法可提高過濾器周轉率

- 市場限制

- 長壽命合成介質延長更換間隔

- 不織布和活性碳價格不穩定

- 豪華電動車密封式「報廢」車艙濾清器模組導致售後市場下滑

- 純電動車中超高效能介質的能量/重量損失

- 價值/供應鏈分析

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭的激烈程度

第5章市場規模及成長預測

- 依產品類型

- 進氣過濾器

- 車廂空氣濾清器

- 混合/靜電奈米纖維過濾器

- 電增強型(ePM1)過濾器

- 按濾材

- 纖維素

- 合成/熔噴

- 活性碳複合材料

- 奈米纖維/HEPA等級

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中大型商用車

- 按銷售管道

- OEM配件

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 中東和非洲

- 海灣合作理事會國家

- 土耳其

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略性舉措(併購、合資、產能)

- 市佔率分析

- 公司簡介

- MANN+HUMMEL GmbH

- MAHLE GmbH

- Donaldson Company Inc.

- Robert Bosch GmbH

- Sogefi SpA

- Cummins Inc.

- DENSO Corporation

- Parker-Hannifin Corp.

- Ahlstrom-Munksjo

- Freudenberg & Co. KG

- Hengst SE

- K&N Engineering Inc.

- Champion Laboratories Inc.

- Fram Group LLC

- Hollingsworth & Vose Co.

第7章 市場機會與未來展望

The automotive air filtration market size stands at USD 5.10 billion in 2025 and is forecast to reach USD 7.01 billion by 2030, advancing at a 6.57% CAGR.

Tightening emission norms in Europe, North America, and key Asian economies, together with consumer attention to in-cabin air quality, sustain a robust demand pipeline. Original equipment manufacturers (OEMs) increasingly specify high-efficiency particulate air (HEPA) systems and electrostatic nano-fiber media to comply with Euro 7, EPA 2027-2032 multi-pollutant standards, and Bharat Stage VI rules. Electric-vehicle (EV) platforms amplify the opportunity because battery thermal systems and silent cabins highlight filtration performance differences. At the same time, aftermarket distributors leverage predictive maintenance data to position premium replacement filters, countering the lengthening service intervals delivered by synthetic media.

Global Automotive Air Filter Market Trends and Insights

Strict Emission & In-Cabin Air-Quality Mandates

Regulatory convergence across major automotive markets creates unprecedented demand for advanced filtration technologies that address engine protection and cabin air quality. The EU's Euro 7 regulation introduces particulate emissions limits from tire and brake wear for the first time, requiring filtration systems to capture particles beyond traditional exhaust emissions. This regulatory expansion coincides with the EPA's Tier 4 standards mandating gasoline particulate filters for vehicles achieving 0.5 mg/mi PM emissions, fundamentally altering the filtration value proposition from an optional comfort feature to a regulatory compliance necessity. Cambodia's adoption of Euro 6/VI standards by 2030 demonstrates regulatory harmonization extending beyond developed markets, creating global scale opportunities for filtration suppliers. The regulatory timeline compression forces OEMs to accelerate filtration technology integration, with compliance deadlines creating artificial demand spikes that benefit suppliers with ready-to-deploy solutions. California's Advanced Clean Cars II program mandating 100% zero-emission vehicle sales by 2035 paradoxically increases filtration demand as EVs require sophisticated cabin air management systems to maintain battery thermal efficiency.

Growing Global Vehicle Parc & Service-Interval Mileage

The expanding global vehicle fleet, particularly in emerging markets, creates sustained aftermarket demand that outpaces new vehicle production growth rates. Extended service intervals, driven by synthetic lubricant adoption and improved engine durability, paradoxically increase filtration system stress as filters must perform longer between replacements while maintaining efficiency standards. This dynamic benefits premium filter manufacturers who can command higher margins for extended-life products that meet OEM specifications. Fleet operators increasingly recognize the benefits of premium filtration for total cost of ownership, with predictive maintenance algorithms enabling condition-based replacement schedules that optimize filter utilization while preventing premature engine wear. The shift toward mobility-as-a-service models intensifies filter replacement frequency as commercial vehicles accumulate higher annual mileage than private passenger cars, creating a more predictable and lucrative replacement cycle for aftermarket suppliers.

Long-Life Synthetic Media Extending Replacement Intervals

Advanced synthetic filter media technologies paradoxically constrain market growth by extending service intervals beyond traditional replacement cycles. Nano-fiber coating technologies, such as Hollingsworth & Vose's NANOWEB system, enhance depth filtration and pulse-cleaning capabilities, enabling filters to maintain efficiency longer while reducing replacement frequency. This technological advancement creates a classic innovator's dilemma where superior product performance reduces total addressable market size by decreasing replacement frequency. Premium vehicle manufacturers increasingly specify long-life filtration systems as standard equipment to reduce maintenance costs and improve customer satisfaction scores, inadvertently constraining aftermarket revenue potential. The trend toward "lifetime" sealed cabin filter modules in luxury EVs eliminates aftermarket replacement opportunities entirely, forcing suppliers to capture higher margins during OEM fitment rather than relying on recurring aftermarket sales. Iran's Behran Filter Company, receiving the first "Nano Namad" license for nanotechnology-based car air filters, demonstrates how emerging markets are leapfrogging to advanced filtration technologies that extend service intervals. Filter manufacturers must balance technological advancement with business model sustainability, potentially requiring shift toward subscription-based maintenance services or value-added monitoring systems that generate recurring revenue streams independent of physical filter replacement frequency.

Other drivers and restraints analyzed in the detailed report include:

- Consumer Health Awareness in High-Pollution Megacities

- HEPA-Grade Filters Adopted by EV & Premium OEM Platforms

- Volatile Non-Woven & Activated-Carbon Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Air-intake filters command 55.21% market share in 2024, reflecting their universal application across all vehicle types and mandatory replacement cycles driven by engine protection requirements. However, cabin air filters emerge as the growth catalyst with 9.21% CAGR through 2030, propelled by consumer health awareness and regulatory mandates for in-cabin air quality improvement.

Bosch's introduction of FILTER+pro cabin air filters with antimicrobial layers effective against viruses, bacteria, and allergens demonstrates how traditional suppliers innovate to capture premium pricing in the cabin filtration segment. The convergence of air quality regulations and consumer health consciousness creates sustained demand for cabin filtration upgrades, with OEMs increasingly specifying HEPA-grade systems as standard equipment in premium vehicle segments. Air-intake filters maintain steady demand driven by engine protection requirements, though growth rates lag cabin filters due to mature technology and established replacement cycles. The electrostatic and nano-fiber segments represent the industry's technological frontier, where suppliers command premium pricing for advanced particle capture capabilities that exceed traditional media performance.

Cellulose retained a 44.18% share in 2024 because it is inexpensive and well-understood by manufacturers. The automotive air filtration market size for nano-fiber and HEPA media is projected to expand at 11.48% CAGR, a clear indicator that premium, high-efficiency media sets the innovation pace.

Nanofiber layers add depth loading and high dust-holding capacity while maintaining low restriction, a critical benefit for engine performance and HVAC energy efficiency. Suppliers integrate proprietary nano-coatings into traditional substrates to create differentiated SKUs with significant price premiums. Activated-carbon producers invest in recycling technology to combat feedstock price swings, reinforcing the dual performance and sustainability value proposition demanded by automakers and regulators.

The Automotive Air Filter Market Report is Segmented by Product Type (Air-Intake Filters, Cabin Air Filters, Hybrid Filters, and More), Filter Media (Cellulose, Synthetic, Activated-Carbon Composite, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM Fitment and Aftermarket) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific's 38.75% share in 2024 is backed by China's EV surge and India's Bharat Stage VI norms. The region is anticipated to grow with a 6.41% CAGR during the forecast period. Local suppliers collaborate with global brands to secure advanced media licenses, while cost-efficient manufacturing plants in China, Thailand, and Vietnam feed worldwide demand. Australia's adoption of Euro 6d-equivalent tailpipe limits further widens the regulatory addressable market.

Euro 7's inclusion of non-exhaust particles in Europe opens niches for tire-wear capture devices and brake-dust filters. German OEMs spearhead HEPA and sensor integration, often co-engineering with suppliers such as MANN+HUMMEL. Hengst's Romanian plant shows that Eastern Europe's cost base attracts new capacity. Consumers associate advanced filtration with wellness and environmental responsibility, supporting premium pricing.

The EPA's 2027-2032 rules in North America guarantee sustained demand for high-efficiency engine-air and cabin systems. California's zero-emission vehicle mandate stimulates demand for EV-specific thermal-management filters. Hanon Systems' Ontario EV compressor plant signals supplier investment to serve growing regional EV output. Well-developed aftermarket logistics and strong do-it-yourself cultures ensure rapid uptake of performance upgrades.

- MANN+HUMMEL GmbH

- MAHLE GmbH

- Donaldson Company Inc.

- Robert Bosch GmbH

- Sogefi SpA

- Cummins Inc.

- DENSO Corporation

- Parker-Hannifin Corp.

- Ahlstrom-Munksjo

- Freudenberg & Co. KG

- Hengst SE

- K&N Engineering Inc.

- Champion Laboratories Inc.

- Fram Group LLC

- Hollingsworth & Vose Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strict emission & in-cabin air-quality mandates

- 4.2.2 Growing global vehicle parc & service-interval mileage

- 4.2.3 Consumer health awareness in high-pollution megacities

- 4.2.4 HEPA-grade filters adopted by EV & premium OEM platforms

- 4.2.5 Sensor-activated smart HVAC filtration modules

- 4.2.6 Predictive fleet-maintenance algorithms driving filter turnover

- 4.3 Market Restraints

- 4.3.1 Long-life synthetic media extending replacement intervals

- 4.3.2 Volatile non-woven & activated-carbon prices

- 4.3.3 Sealed "lifetime" cabin-filter modules in luxury EVs reduce aftermarket

- 4.3.4 Energy/weight penalty of ultra-high-efficiency media in BEVs

- 4.4 Value/Supply-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value in USD and Volume in Units)

- 5.1 By Product Type

- 5.1.1 Air-Intake Filters

- 5.1.2 Cabin Air Filters

- 5.1.3 Hybrid / Electrostatic Nano-fiber Filters

- 5.1.4 Electrically-enhanced (ePM1) Filters

- 5.2 By Filter Media

- 5.2.1 Cellulose

- 5.2.2 Synthetic/Melt-blown

- 5.2.3 Activated-Carbon Composite

- 5.2.4 Nano-fiber/HEPA Grade

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.4 By Sales Channel

- 5.4.1 OEM Fitment

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia & New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC Countries

- 5.5.5.2 Turkey

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JV, and Capacity)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 MANN+HUMMEL GmbH

- 6.4.2 MAHLE GmbH

- 6.4.3 Donaldson Company Inc.

- 6.4.4 Robert Bosch GmbH

- 6.4.5 Sogefi SpA

- 6.4.6 Cummins Inc.

- 6.4.7 DENSO Corporation

- 6.4.8 Parker-Hannifin Corp.

- 6.4.9 Ahlstrom-Munksjo

- 6.4.10 Freudenberg & Co. KG

- 6.4.11 Hengst SE

- 6.4.12 K&N Engineering Inc.

- 6.4.13 Champion Laboratories Inc.

- 6.4.14 Fram Group LLC

- 6.4.15 Hollingsworth & Vose Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment