|

市場調查報告書

商品編碼

1851282

分散式發電:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Distributed Power Generation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

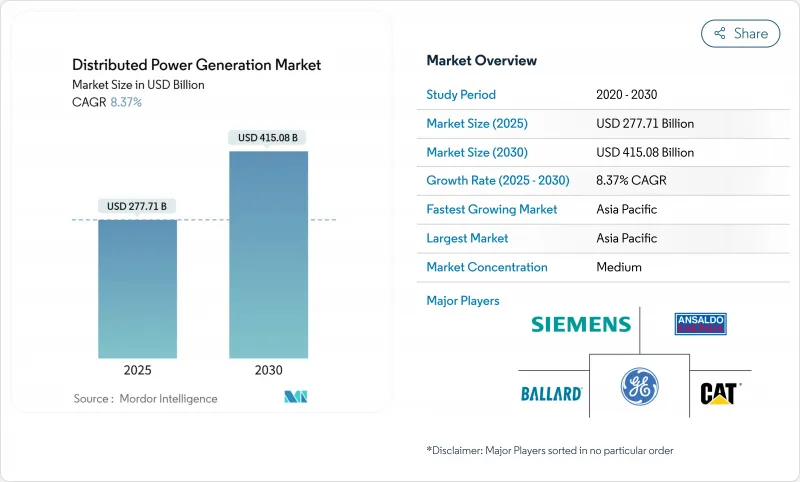

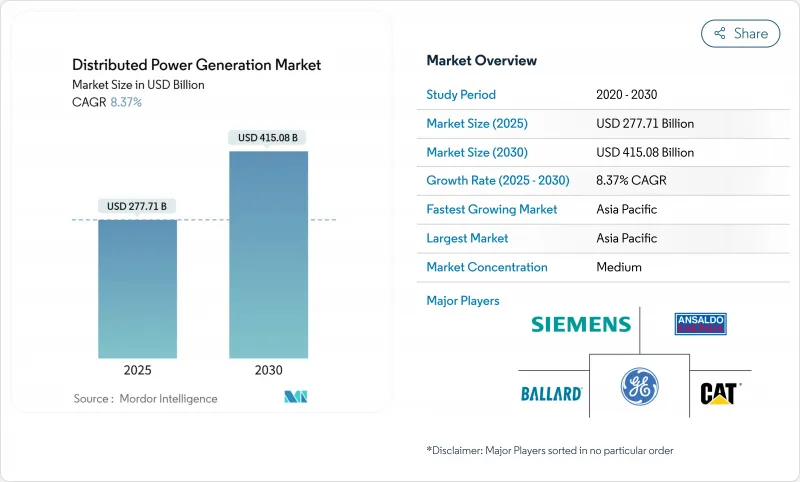

預計到 2025 年,分散式發電市場規模將達到 2,777.1 億美元,到 2030 年將達到 4,150.8 億美元,預測期(2025-2030 年)複合年成長率為 8.37%。

此次擴張反映了能源供應結構從集中式向本地化資產的轉變,後者融合了太陽能、燃料靈活型引擎和數位化控制系統。資本成本下降、可再生能源發展的法規以及日益成長的電網韌性需求是關鍵促進因素。亞太地區將支撐能源供應量和發展勢頭,北美將利用豐富的天然氣資源,而歐洲將優先考慮能源安全。技術競賽將圍繞氫燃料電池和整合微電網展開,這些微電網將與儲能、軟體和服務結合。同時,互聯瓶頸、儲能資本需求以及日益嚴格的排放法規也增加了投資風險。

全球分散式發電市場趨勢與洞察

小型太陽能光電發電的平準化電成本(LCOE)正在快速下降。

到2024年,中國拓普康(TOPCon)組件的價格將降至每瓦0.16美元,這將拉低全部區域的平準化電費,並重塑分散式經濟格局。標準化的安裝規範、低成本的逆變器以及財政激勵措施將產生越來越大的影響,使亞太地區成為全球小型太陽能發電的標竿。各國政府正在簡化授權和電網規範,進一步縮短計劃週期。價格壓力迫使其他地區的供應商透過提高效率和針對特定應用的設計來脫穎而出。

商業和工業用錶後安裝蓬勃發展

歐洲企業正加速推動自發電,以對沖批發價格波動風險並履行企業脫碳承諾。在歐盟新規的推動下,德國屋頂光電裝置創下歷史新高。歐盟新規要求自2026年起新建商業建築必須安裝太陽能光電系統,並於2028年將此要求擴展至現有建築維修。儲能系統與太陽能光電系統結合,能夠實現負載轉移和輔助設備服務收入,使分散式資產成為兼具經濟效益和環保效益的工具。在聯邦稅收優惠和各州清潔能源政策的推動下,北美企業也正在效仿這一模式。

新興國家電網互聯的障礙

全球可再生能源併網申請已超過3000吉瓦,其中80%的申請因成本上升和核准流程冗長而被撤回。由於新興市場電網缺乏現代化標準和勞動力,小型計劃面臨的延誤尤其嚴重。儘管「先到先得」的改革正在進行中,但已開發市場以外的進展仍然緩慢,限制了近期再生能源併網的普及。

細分市場分析

到2024年,太陽能產業將佔總收入的35%,這主要得益於住宅和輕型商業屋頂採用的簡化安裝系統和逆變器套件。預計到2024年,太陽能發電將佔分散式電力市場889億美元的佔有率。燃料電池雖然目前規模較小,但其複合年成長率將達到11.8%,成為成長最快的領域,這主要得益於資料中心園區計劃對無柴油執行時間的需求。Caterpillar公司在懷俄明州的一個超大規模資料中心檢驗了一套1.5兆瓦的氫燃料電池備用系統,該系統實現了99.999%的服務水準目標。風力微型渦輪機和往復式燃氣引擎則主要面向那些優先考慮土地利用效率和熱電聯產能力的特定設施。目前的競爭重點在於儲能和電力電子設備的整合,而非獨立的發電系統。

2024年,0-100kW的住宅和小型企業系統將佔市場需求的47%,這反映了套件設備採購和承包安裝模式的普及。以銷量計算,該細分市場佔據最大的市場佔有率。同時,到2030年,1000kW以上的解決方案將以10.2%的複合年成長率成長,因為工業園區為了避免電網限制而選擇自發電。供應商將透過數位孿生和維運分析來最佳化調度,以適應公用事業公司的收費標準,從而實現差異化競爭。 101至1000kW的中階機組主要安裝在醫院和大學校園內,兼具標準化撬裝設備和有限的客製化工程功能。

分散式發電市場報告按技術(太陽能、風力發電機、燃氣渦輪機、柴油發電機、燃料電池、其他)、額定功率(0-100千瓦、101-1000千瓦、其他)、燃料類型(可再生、不可可再生)、連接方式(併網、離網)、最終用戶(住宅、通訊類型(可再生能源、非再生能源)、連接方式(併網、離網)、最終用戶(住宅、電信類型(可再生能源、非再生能源)、連接方式(併網、離地)、最終

區域分析

到2024年,亞太地區將佔據分散式發電市場44%的收入佔有率,並將在2030年之前繼續維持11.1%的年複合成長率,成為全球成長最快的地區。該地區的領先地位得益於大規模生產的光伏組件、廣泛的政策獎勵以及不斷成長的電力需求。光是中國的屋頂光電專案到2024年就將新增超過50吉瓦的裝置容量,而印度的配電公司正在將屋頂光電裝置整合為虛擬電廠。東南亞一些國家的政府已經正式推行淨額收費制度,開放了用戶側光電投資。

北美地區天然氣儲量絕對值排名第二,這得益於其豐富的天然氣資源和優惠的稅額扣抵。美國市政電力公司在密西根州推出的20兆瓦電錶後端項目,正是市政公用事業公司如何利用本地抑低尖峰負載的典範。 30個州級可再生能源組合標準鼓勵在學校和市政設施中採用太陽能+儲能系統。維吉尼亞、德克薩斯州和亞伯達的資料中心叢集正在推動雙燃料和氫燃料引擎的早期應用,進一步提升了該地區的能源需求。

在天然氣供應因地緣政治因素而中斷之後,歐洲分散式能源戰略與能源安全的迫切需求相契合。歐盟太陽能標準要求新商業建築自2026年起必須配備太陽能發電設施,促使開發商採用分散式佈局。法國正在加速商業不動產的維修,要求面積超過1500平方公尺的停車場必須使用50%的太陽能,違者將被處以最高4萬歐元的罰款。德國簡化了功率不超過800瓦的「陽台發電裝置」的註冊流程,擴大了家庭用戶的參與範圍。歷史城區的發展受到遺產位置限制和冗長的市級授權。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲小型太陽能光電發電的平準化度電成本快速下降

- 歐洲商業和工業(C&I)電錶後端安裝蓬勃發展

- 在非洲和島嶼的通訊塔上部署微電網

- 天然氣價格波動導致北美沼氣發電機需求改變

- 美國市政公共產業強制性可再生能源組合標準(RPS)

- 中東資料中心氫燃料電池試點項目

- 市場限制

- 新興經濟體電力網互聯的障礙

- 針對間歇性分散式發電的資本密集型儲能組合方案

- 歐盟都市區嚴格的氮氧化物/粒狀物排放法規抑制了柴油發電機的銷售

- 歷史城區屋頂太陽能發電的審核制度十分複雜

- 供應鏈分析

- 監理展望

- 技術展望

- 波特的五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過技術

- 太陽能發電(最高 5 兆瓦,屋頂和地面安裝)

- 風力發電機(最高 5 兆瓦)

- 微型渦輪機

- 燃氣渦輪機(最高 50 兆瓦)

- 燃料電池(PEMFC、SOFC 等)

- 柴油發電機

- 天然氣發電機

- 水力發電和小型水力(10兆瓦以下)

- 其他(生質能熱電聯產、史特靈引擎)

- 額定功率

- 0~100 kW

- 101~1,000 kW

- 1000千瓦或以上

- 按燃料類型

- 可再生

- 不可可再生

- 連結性別

- 併網

- 離網及偏遠地區

- 最終用戶

- 住房

- 商業設施

- 工業和製造業

- 公用事業和獨立發電商峰值/儲備

- 電信資料中心

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 北歐國家

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、夥伴關係、購電協議)

- 市場佔有率分析(主要企業的市場排名/佔有率)

- 公司簡介

- Caterpillar Inc.

- Cummins Inc.

- Siemens AG

- General Electric Co.

- Schneider Electric SE

- Ansaldo Energia SpA

- Ballard Power Systems Inc.

- Bloom Energy Corp.

- Capstone Turbine Corp.

- FuelCell Energy Inc.

- Rolls-Royce plc(mtu Onsite Energy)

- Aggreko Ltd.

- Yanmar Holdings Co., Ltd.

- Wartsila Corp.

- Kohler Co.

- Canadian Solar Inc.

- Sunverge Energy Inc.

- MTU Aero Engines AG Microgrid Solutions

- Generac Power Systems Inc.

- Plug Power Inc.

第7章 市場機會與未來展望

The Distributed Power Generation Market size is estimated at USD 277.71 billion in 2025, and is expected to reach USD 415.08 billion by 2030, at a CAGR of 8.37% during the forecast period (2025-2030).

The expansion reflects a structural move from centralized supply toward local assets that combine solar, fuel-flexible engines, and digital controls. Widespread equipment cost reductions, pro-renewable regulations, and rising grid-resilience needs are the main accelerants. Asia-Pacific anchors volume and momentum, while North America leverages abundant gas, and Europe focuses on energy security. Technology competition revolves around hydrogen-ready fuel cells and integrated microgrid offerings that bundle storage, software, and services. At the same time, interconnection bottlenecks, energy-storage capital needs, and tightening emission caps shape investment risk.

Global Distributed Power Generation Market Trends and Insights

Rapid Decline in Small-Scale Solar-PV LCOE

Chinese TOPCon module prices fell to USD 0.16 per watt in 2024, driving a region-wide drop in levelized electricity costs and reshaping distributed economics. Installation labor standardization, low-cost inverters, and concessional finance amplify the effect, positioning Asia-Pacific as the global benchmark for small-scale PV. Governments streamline permitting and grid-code rules, further shortening project cycles. The price pressure forces suppliers elsewhere to differentiate on efficiency and application-specific design.

Booming Commercial & Industrial Behind-the-Meter Installations

European firms accelerate on-site generation to hedge volatile wholesale prices and meet corporate decarbonization pledges. Record rooftop additions in Germany follow EU rules that require solar on new commercial buildings from 2026, broadening to retrofits by 2028. Battery systems paired with PV allow load shifting and ancillary service income, making distributed assets a financial and environmental tool. North American businesses replicate the model, spurred by federal tax incentives and state clean-energy mandates.

Distribution-Network Interconnection Barriers in Emerging Economies

Renewables waiting in global interconnection queues exceed 3,000 GW, and 80% of applications are withdrawn due to escalating costs or long studies. Emerging grids lack modern standards and workforce capacity, so small projects face disproportionate delays. Although a "first-ready, first-served" reform is underway, progress outside advanced markets remains slow, restraining near-term deployment.

Other drivers and restraints analyzed in the detailed report include:

- Microgrid Adoption for Telecom Towers across Africa & Islands

- Natural-Gas Price Volatility Shifting Demand toward Biogas Gensets

- Capital-Intensive Energy-Storage Pairing for Intermittent DG

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The solar segment commanded 35% of 2024 revenues, anchored by residential and light-commercial rooftops that capitalize on simplified mounting and inverter kits. Solar's share of the distributed power generation market size for 2024 stood at USD 88.9 billion. Though smaller today, fuel cells deliver the highest 11.8% CAGR, led by projects at data-center campuses where operators seek diesel-free uptime. Caterpillar validated a 1.5 MW hydrogen fuel-cell backup system that met a 99.999% service-level target for a hyperscale facility in Wyoming. Wind micro-turbines and reciprocating gas engines round out the mix, serving niche sites that value either land-use efficiency or combined heat-and-power capability. Competitive dynamics now center on integrating storage and power electronics rather than standalone generation hardware.

Household and small-business systems in the 0-100 kW bracket captured 47% of 2024 demand, reflecting kit-based procurement and turnkey installation models. The segment accounted for the largest distributed power generation market share in unit terms. At the other extreme, Above 1,000 kW solutions will record a 10.2% CAGR through 2030 as industrial campuses opt for on-site generation to bypass grid constraints. Vendors differentiate through digital twins and O&M analytics that fine-tune dispatch against utility tariffs. Mid-range 101-1,000 kW packages serve hospitals and university estates, balancing standardized skids with limited custom engineering.

The Distributed Power Generation Market Report is Segmented by Technology (Solar, Wind Turbines, Gas Turbines, Diesel Gensets, Fuel Cells, and More), by Rating (0 To 100 KW, 101 To 1, 000 KW, and More), Fuel Type (Renewable and Non-Renewable), Connectivity (On-Grid and Off-Grid), End-User (Residential, Telecom and Data Centers, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific dominated the distributed power generation market with a 44% revenue share in 2024 and continues to post the fastest 11.1% CAGR to 2030. Regional leadership rests on mass-manufactured PV modules, extensive policy incentives, and surging electricity demand. China's rooftop program alone realized more than 50 GW of new capacity in 2024, while India's distribution utilities aggregate rooftop installations into virtual power plants. Several Southeast Asian governments are formalizing net-billing regimes, unlocking behind-the-meter investment.

North America ranks second in absolute value and combines an abundant natural gas supply with favorable tax credits. American Municipal Power's 20 MW behind-the-meter program in Michigan typifies how municipal utilities leverage local generation for peak shaving. Thirty state-level renewable portfolio standards catalyze solar-plus-storage at schools and municipal facilities. Data-center clusters in Virginia, Texas, and Alberta drive early adoption of dual-fuel or hydrogen-ready engines, further lifting the region's demand profile.

Europe's distributed strategy aligns with energy-security imperatives following geopolitical gas disruptions. The EU Solar Standard obliges new commercial buildings to integrate PV from 2026, pushing developers toward distributed layouts. France mandates 50% solar coverage on parking lots over 1 500 m2, with fines up to EUR 40 000 for non-compliance, accelerating commercial-real-estate retrofits. Germany simplified the registration of "balcony power plants" up to 800 W, broadening household participation. Heritage-site constraints and lengthy city-level permitting temper growth in historic urban cores.

- Caterpillar Inc.

- Cummins Inc.

- Siemens AG

- General Electric Co.

- Schneider Electric SE

- Ansaldo Energia SpA

- Ballard Power Systems Inc.

- Bloom Energy Corp.

- Capstone Turbine Corp.

- FuelCell Energy Inc.

- Rolls-Royce plc (mtu Onsite Energy)

- Aggreko Ltd.

- Yanmar Holdings Co., Ltd.

- Wartsila Corp.

- Kohler Co.

- Canadian Solar Inc.

- Sunverge Energy Inc.

- MTU Aero Engines AG Microgrid Solutions

- Generac Power Systems Inc.

- Plug Power Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Decline in Small-Scale Solar-PV LCOE in Asia

- 4.2.2 Booming Commercial & Industrial (C&I) Behind-the-Meter Installations in Europe

- 4.2.3 Microgrid Adoption for Telecom Towers across Africa & Islands

- 4.2.4 Natural-Gas Price Volatility Shifting Demand toward Biogas Gensets in North America

- 4.2.5 Mandated Renewable Portfolio Standards (RPS) in U.S. Municipal Utilities

- 4.2.6 Hydrogen-Ready Fuel-Cell Pilots in Middle-East Data Centers

- 4.3 Market Restraints

- 4.3.1 Distribution-Network Interconnection Barriers in Emerging Economies

- 4.3.2 Capital-Intensive Energy-Storage Pairing for Intermittent DG

- 4.3.3 Stringent NOx/PM Limits Curtailing Diesel Genset Sales in EU Urban Areas

- 4.3.4 Complex Permitting for Rooftop PV in Historic City Centers

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products & Services

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (Rooftop & Ground-Mounted <=5 MW)

- 5.1.2 Wind Turbines (<=5 MW)

- 5.1.3 Microturbines

- 5.1.4 Gas Turbines (<=50 MW)

- 5.1.5 Fuel Cells (PEMFC, SOFC, Others)

- 5.1.6 Diesel Gensets

- 5.1.7 Natural-Gas Gensets

- 5.1.8 Hydrokinetic and Small Hydro (<=10 MW)

- 5.1.9 Others (Biomass CHP, Stirling Engines)

- 5.2 By Power Rating

- 5.2.1 0 to 100 kW

- 5.2.2 101 to 1,000 kW

- 5.2.3 Above 1,000 kW

- 5.3 By Fuel Type

- 5.3.1 Renewable

- 5.3.2 Non-Renewable

- 5.4 By Connectivity

- 5.4.1 On-Grid

- 5.4.2 Off-Grid and Remote

- 5.5 By End-user

- 5.5.1 Residential

- 5.5.2 Commercial and Institutional

- 5.5.3 Industrial and Manufacturing

- 5.5.4 Utility and IPP Peaking/Reserve

- 5.5.5 Telecom and Data Centers

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Nordic Countries

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Malaysia

- 5.6.3.6 Thailand

- 5.6.3.7 Indonesia

- 5.6.3.8 Vietnam

- 5.6.3.9 Australia

- 5.6.3.10 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Egypt

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Caterpillar Inc.

- 6.4.2 Cummins Inc.

- 6.4.3 Siemens AG

- 6.4.4 General Electric Co.

- 6.4.5 Schneider Electric SE

- 6.4.6 Ansaldo Energia SpA

- 6.4.7 Ballard Power Systems Inc.

- 6.4.8 Bloom Energy Corp.

- 6.4.9 Capstone Turbine Corp.

- 6.4.10 FuelCell Energy Inc.

- 6.4.11 Rolls-Royce plc (mtu Onsite Energy)

- 6.4.12 Aggreko Ltd.

- 6.4.13 Yanmar Holdings Co., Ltd.

- 6.4.14 Wartsila Corp.

- 6.4.15 Kohler Co.

- 6.4.16 Canadian Solar Inc.

- 6.4.17 Sunverge Energy Inc.

- 6.4.18 MTU Aero Engines AG Microgrid Solutions

- 6.4.19 Generac Power Systems Inc.

- 6.4.20 Plug Power Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment