|

市場調查報告書

商品編碼

1851256

汽車機器人:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

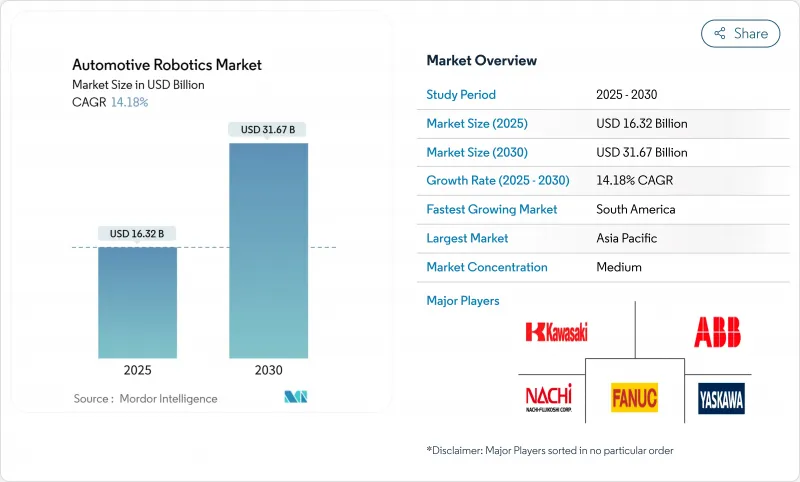

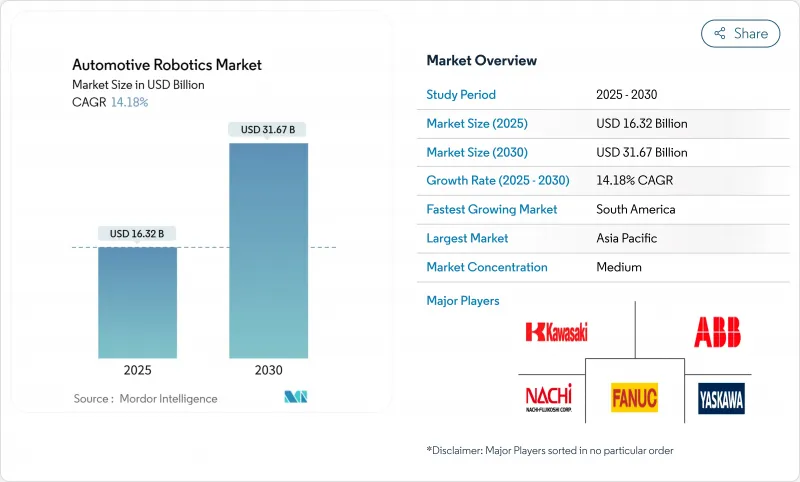

預計到 2025 年,汽車機器人市場規模將達到 163.2 億美元,到 2030 年將達到約 316.7 億美元,複合年成長率為 14.18%。

快速的電氣化、日益擴大的勞動力缺口以及不斷提高的品質要求正迫使汽車製造商用智慧聯鎖和協調的單元取代人工操作工位。電動車電池組整合、電動動力傳動系統組裝以及整車品質檢驗對操作精度的要求越來越高,而人工操作已無法滿足此要求,尤其是在整車製造商要求100%檢驗的情況下。

全球汽車機器人市場趨勢與洞察

自動化提高了產量和質量

65.3% 的製造商認為自動化是消除生產瓶頸的最快路徑,並計劃投資新的機器人以提高生產線產量。國際機器人聯合會 (IFR) 的數據顯示,到 2024 年,工業機器人的運作將增加 14%,這是自 2018 年以來最快的年成長率。先進的檢測單元的零件檢測速度比座標測量機快 10 倍,無需延長生產週期即可達到 100% 檢測。人工智慧視覺技術能夠檢測出小於 0.05 毫米的缺陷,為白車身焊接和最終修整制定了新的品質標準。硬體價格的下降使得許多工廠能夠在 1 到 3 年內收回資本支出,從而增強了擴大機器人數量的商業理由。

電動車電池和電動動力傳動系統製造需求

電動車組裝引入了更重、更少的次組件,這需要獨特的搬運、密封和焊接方法。 ABB 估計,即使規劃建造 80 座超級工廠,電池供應仍無法滿足需求,凸顯了高產能機器人生產的必要性。將電池生產線與組裝線集中佈局有助於提高永續性並減少物流,但這只有在機器人能夠在電池和車身拆解之間靈活切換的情況下才能實現。專用鋁焊接單元和報廢車身拆解機器人(例如 Thoth 公司的 DisMantleBot)體現了向電動車轉型過程中湧現的新興領域。

高昂的資本投資和安裝成本

儘管價格下降,但規模較小的供應商仍然認為價值六位數的機器人單元風險很高。像Rapid Robotics這樣的FANUC即服務(RaaS)供應商透過捆綁硬體、服務和軟體的月度契約,降低了高額的資本支出。整合通常會使初始成本翻倍,因為它需要對生產線進行改造,以配備防護裝置、視覺校準和操作員培訓。 Fanuc斥資1.1億美元擴建位於奧本山的園區,顯示要實現承包部署,需要進行大量的生態系統投資。總擁有成本還取決於維護、軟體更新和網路安全補丁,而這些成本在商業案例中往往被低估。

細分市場分析

到2024年,汽車製造商將佔據汽車機器人市場61.18%的佔有率,這反映出它們有能力承擔資本成本,並將焊接、噴漆和密封等機器人整合到所有主要生產線中。目前,該領域優先考慮將人工智慧視覺技術應用於內裝和最終檢驗,並尋求協作機器人來完成以往由人工完成的人體工學任務。服務中心是成長最快的細分市場,年複合成長率高達14.31%,這得益於電動車診斷和ADAS校準技術推動了售後維修車間機械化流程的發展。

技能提升依然至關重要。像梅賽德斯-奔馳這樣的汽車製造商正在引入人形機器人,以使員工擺脫重複性的取貨工作;而獨立維修廠則在投資機器人四輪定位系統,以縮短預約時間。複雜維修業務持續從經銷商轉移到多品牌服務中心,這很可能在未來十年推動汽車機器人市場的發展。

到2024年,機械臂將佔總收入的36.54%,但價值正迅速轉移到分析、視覺和網路安全控制器。軟體和服務正以14.64%的複合年成長率成長,使其成為策略競爭的焦點。雲端託管的儀錶板可以追蹤使用率、提供預測性警報,並將一次性資本支出轉化為持續的收益。

車隊級編配平台將數百個單元整合到一個虛擬實體中,使生產計劃人員能夠在幾分鐘內而非幾天內重新分配任務。隨著硬體淨利率的下降,供應商透過持續的軟體更新和應用商店生態系統來實現差異化競爭,這進一步推動了汽車機器人市場轉向基於結果的合約模式。

區域分析

到2024年,亞太地區將佔據全球汽車機器人市場46.55%的佔有率,其中中國以42.95萬台的產量和每萬人470台機器人的密度領先。像新松和易斯頓這樣的國內廠商受益於政府激勵政策,從而降低了採購成本;而日本整合商則持續改進用於多品種組裝的精益機器人單元。東南亞各國政府正在擴大與生產掛鉤的獎勵,以鼓勵整車製造商實現電動車生產線的本地化,並配備全自動電池組生產站。

南美洲的複合年成長率最高,達到14.94%,這主要得益於跨國公司大量湧入:Stellantis公司累計56億歐元用於建設靈活的電動汽車生產能力,通用汽車則在巴西投資14億美元興建了一座機器人車身工廠。這些交易均包含技術轉移條款,允許當地整合商獲得先進焊接軟體的許可,加速提升本土技術水準。不斷上漲的薪資通膨正在加速向機器人轉型,尤其是在巴西的底盤和動力傳動系統工廠。

北美正積極推動製造業回流,以降低地緣政治風險。美墨加協定(USMCA)的原產地規則鼓勵供應商自動化,以在勞動力短缺的情況下保持成本競爭力。聯邦政府對電池生產的補貼政策刺激了新的超級工廠計劃,這些項目將整合用於電池堆疊和模組組裝的重型機器人。歐洲市場依然強勁,但高功能安全合規要求促使高階機器人解決方案更受青睞。德國仍然是領先的研發中心,但利潤壓力正迫使汽車製造商將大規模生產轉移到成本更低的地區。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 自動化提高了產量和質量

- 電動車電池和電動動力傳動系統製造需求

- 汽車產業中心勞動力短缺與薪資上漲

- 原始設備製造商越來越重視品質一致性

- 協作機器人能夠實現靈活的混合型生產線

- 新興市場的生產連結獎勵計畫

- 市場限制

- 高昂的資本投資和安裝成本

- 熟練機器人程式設計師短缺

- 互聯小區內的網路安全風險

- 伺服馬達/晶片供電波動

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按最終用戶類型

- 汽車製造商(OEM)

- 零件製造商(一級和二級供應商)

- 售後市場及服務中心

- 依組件類型

- 控制器

- 機械臂

- 末端執行器

- 驅動器和感測器

- 軟體和服務

- 依產品類型

- 笛卡兒機器人

- SCARA機器人

- 關節機器人

- 協作機器人(cobots)

- 其他類型(平行型、圓柱型)

- 依功能類型

- 焊接機器人

- 繪畫機器人

- 組裝和拆卸機器人

- 切割和銑削機器人

- 物料輸送機器人

- 檢測和品質測試機器人

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 土耳其

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries(Robotics)

- Omron Adept Technologies

- Honda Motor Co(Robotics)

- Nachi-Fujikoshi Corp

- Harmonic Drive Systems

- RobCo SWAT Ltd

- Denso Wave Inc

- Comau SpA

- Staubli Robotics

- Universal Robots A/S

- Hyundai Robotics

- Epson Robots

- OTC Daihen

- Siasun Robot & Automation

- Estun Automation

- Techman Robot

第7章 市場機會與未來展望

The automotive robotics market stood at USD 16.32 billion in 2025 and is forecast to reach about USD 31.67 billion by 2030, advancing at a 14.18% CAGR.

Rapid electrification, widening labor gaps, and mounting quality expectations are prompting vehicle makers to replace manual stations with intelligent articulated and collaborative cells. Electric-vehicle battery pack integration, e-powertrain assembly, and full-body quality verification increasingly require motion precision that manual processes cannot match, especially as OEMs press for 100% inspection.

Global Automotive Robotics Market Trends and Insights

Automation to Boost Throughput & Quality

Manufacturers cite automation as the quickest route to alleviate production bottlenecks; 65.3% plan new robot investments to raise line throughput. The International Federation of Robotics logged a 14% rise in operational industrial robots during 2024, marking the steepest annual jump since 2018. Advanced inspection cells now test parts 10 times faster than coordinate-measuring machines, opening the door to 100% inspection without extending cycle time. AI-enabled vision detects defects smaller than 0.05 mm, creating a new quality baseline for body-in-white welding and final trim. As hardware prices drop, many plants recover capital outlays in one to three years, reinforcing the business case for expanded fleets.

EV-Battery & E-Powertrain Manufacturing Needs

Electric-vehicle assembly introduces heavier yet fewer sub-assemblies that require distinct handling, sealing, and welding methods. ABB estimates that 80 planned gigafactories will still leave battery supply short of demand, underscoring the need for high-throughput robotic production . Co-locating battery lines with final assembly promotes sustainability and reduces logistics, but only if robots can alternate between battery and body tasks. Specialized aluminum welding cells and end-of-life disassembly robots such as Thoth's DisMantleBot illustrate new niches emerging from the EV shift.

High Capex & Installation Costs

Small and medium suppliers still view six-figure robot cells as risky despite falling price points. Robotics-as-a-service vendors such as Rapid Robotics offset sticker shock through monthly contracts that bundle hardware, service, and software. Integration often doubles upfront spend because lines must be re-rigged for guarding, vision calibration, and operator training. FANUC's USD 110 million Auburn Hills campus expansion shows the ecosystem investment needed to make turnkey deployment viable. Total cost of ownership also hinges on maintenance, software refreshes, and cyber-patching, often underestimated in business cases.

Other drivers and restraints analyzed in the detailed report include:

- Labor Shortages & Wage Inflation in Auto Hubs

- Tighter OEM Quality-Consistency Mandates

- Scarcity of Skilled Robot Programmers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vehicle makers held 61.18% of the automotive robotics market in 2024, reflecting their ability to absorb capital costs and embed articulated welders, painters, and sealers across every major line. This cohort now prioritizes AI vision for trim-and-final inspection and seeks cobots that can tackle ergonomic tasks once left to humans. Service centers form the fastest-growing slice, riding a 14.31% CAGR as EV diagnostics and ADAS calibration push mechanized processes into aftermarket bays.

Upskilling remains critical. OEMs such as Mercedes-Benz integrate humanoid robots to relieve staff from repetitive fetching tasks, while independent garages invest in robotic wheel alignment systems to shorten appointment times. Continued migration of complex repairs from dealerships to multi-brand centers will buoy the automotive robotics market into the next decade.

Robotic arms represented 36.54% of revenue in 2024, yet value is quickly shifting toward analytics, vision, and cyber-secure controllers. Software and services are advancing at a 14.64% CAGR, making this the prime strategic battleground. Cloud-hosted dashboards track utilization and issue predictive alerts, converting one-time capex into annuity streams.

Fleet-level orchestration platforms unify hundreds of cells into one virtual entity, enabling production planners to redeploy tasks in minutes rather than days. As hardware margins compress, vendors differentiate through continuous software updates and app-store ecosystems, reinforcing the automotive robotics market's move toward outcome-based contracting.

The Automotive Robotics Market Report is Segmented by End-User Type (Vehicle Manufacturers (OEMs), Component Manufacturers (Tier-1 and 2), and More), Component Type (Controllers, Robotic Arms, and More), Product Type (Cartesian Robots, SCARA Robots, and More), Function Type (Painting Robots, Welding Robots, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 46.55% of the automotive robotics market in 2024, anchored by China's 429,500 unit output and a robot density of 470 per 10,000 workers. Domestic vendors such as Siasun and Estun benefit from state incentives that keep acquisition costs low, while Japanese integrators continue to refine lean robotic cells for high-mix assembly. Southeast Asian governments extend production-linked incentives, inviting OEMs to localize EV lines with fully automated battery pack stations.

South America logs the highest 14.94% CAGR as multinationals commit fresh capital: Stellantis has earmarked EUR 5.6 billion for flexible EV capacity, and General Motors is spending USD 1.4 billion on robotic body shops in Brazil. Technology-transfer clauses in these deals allow local integrators to license advanced welding software, accelerating domestic expertise. Rising wage inflation reinforces the shift to robotics, particularly in Brazil's chassis and powertrain plants.

North America pursues reshoring to mitigate geopolitical risk. USMCA rules of origin encourage suppliers to automate to maintain cost competitiveness despite labor shortages. Federal credits targeting battery production spark new gigafactory projects that integrate high-payload robots for cell stacking and module assembly. Europe holds steady yet demands high functional-safety compliance that favors premium robotic solutions. Germany continues to act as an R&D hub, even as margin pressure spurs automakers to transfer volume production to lower-cost regions.

- ABB Ltd

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries (Robotics)

- Omron Adept Technologies

- Honda Motor Co (Robotics)

- Nachi-Fujikoshi Corp

- Harmonic Drive Systems

- RobCo SWAT Ltd

- Denso Wave Inc

- Comau SpA

- Staubli Robotics

- Universal Robots A/S

- Hyundai Robotics

- Epson Robots

- OTC Daihen

- Siasun Robot & Automation

- Estun Automation

- Techman Robot

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automation to boost throughput and quality

- 4.2.2 EV-battery and e-powertrain manufacturing needs

- 4.2.3 Labor shortages and wage inflation in auto hubs

- 4.2.4 Tighter OEM quality-consistency mandates

- 4.2.5 Cobots enabling flexible mixed-model lines

- 4.2.6 Emerging-market production-linked incentives

- 4.3 Market Restraints

- 4.3.1 High capex and installation costs

- 4.3.2 Scarcity of skilled robot programmers

- 4.3.3 Cyber-security risks in connected cells

- 4.3.4 Servo-motor / chip supply volatility

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By End-User Type

- 5.1.1 Vehicle Manufacturers (OEMs)

- 5.1.2 Component Manufacturers (Tier-1 and 2)

- 5.1.3 After-market and Service Centers

- 5.2 By Component Type

- 5.2.1 Controllers

- 5.2.2 Robotic Arms

- 5.2.3 End Effectors

- 5.2.4 Drives and Sensors

- 5.2.5 Software and Services

- 5.3 By Product Type

- 5.3.1 Cartesian Robots

- 5.3.2 SCARA Robots

- 5.3.3 Articulated Robots

- 5.3.4 Collaborative Robots (Cobots)

- 5.3.5 Other Types (Parallel, Cylindrical)

- 5.4 By Function Type

- 5.4.1 Welding Robots

- 5.4.2 Painting Robots

- 5.4.3 Assembly and Disassembly Robots

- 5.4.4 Cutting and Milling Robots

- 5.4.5 Material-Handling Robots

- 5.4.6 Inspection and Quality-Testing Robots

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 South-East Asia

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Turkey

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share, Products & Services, and Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 FANUC Corporation

- 6.4.3 KUKA AG

- 6.4.4 Yaskawa Electric Corporation

- 6.4.5 Kawasaki Heavy Industries (Robotics)

- 6.4.6 Omron Adept Technologies

- 6.4.7 Honda Motor Co (Robotics)

- 6.4.8 Nachi-Fujikoshi Corp

- 6.4.9 Harmonic Drive Systems

- 6.4.10 RobCo SWAT Ltd

- 6.4.11 Denso Wave Inc

- 6.4.12 Comau SpA

- 6.4.13 Staubli Robotics

- 6.4.14 Universal Robots A/S

- 6.4.15 Hyundai Robotics

- 6.4.16 Epson Robots

- 6.4.17 OTC Daihen

- 6.4.18 Siasun Robot & Automation

- 6.4.19 Estun Automation

- 6.4.20 Techman Robot

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment