|

市場調查報告書

商品編碼

1876533

汽車雷射焊接系統市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Automotive Laser Welding System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

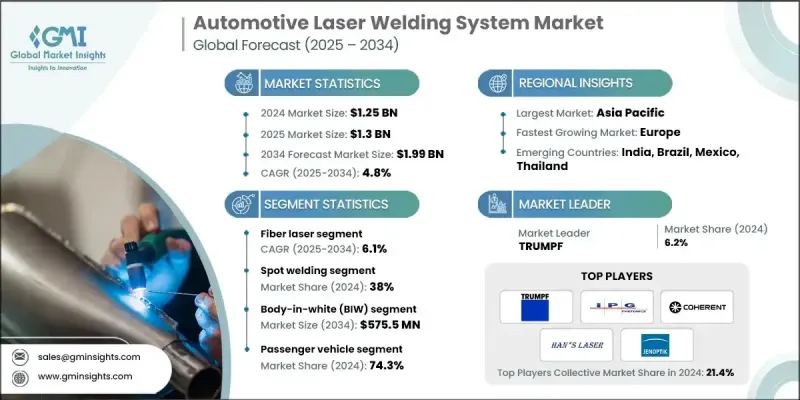

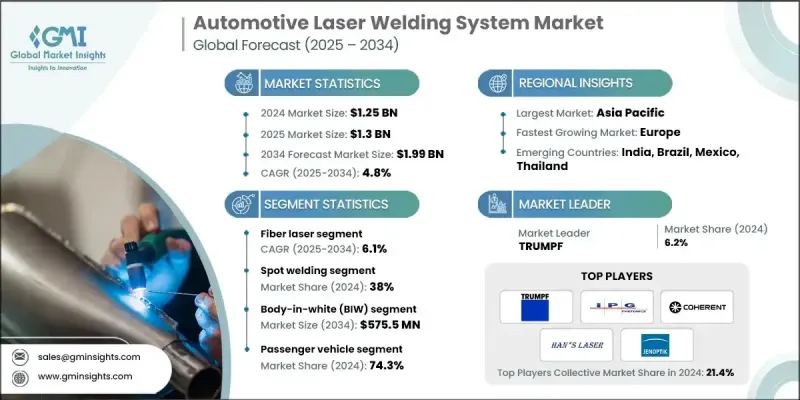

2024 年全球汽車雷射焊接系統市場價值為 12.5 億美元,預計到 2034 年將以 4.8% 的複合年成長率成長至 19.9 億美元。

在汽車產量不斷成長和發展中經濟體需求日益旺盛的推動下,汽車行業的穩步擴張為先進製造解決方案創造了強勁的發展機會。汽車製造商正積極投資雷射焊接技術,以期在滿足不斷演進的生產標準的同時,實現更高的精度、生產效率和更穩定的品質。高性能、輕量化汽車(尤其是採用鋁合金和混合合金製造的汽車)的日益普及,進一步提升了對雷射焊接系統的需求。雷射焊接具有卓越的精度、極小的熱變形和優異的強度保持率,使其成為連接薄型或異種材料的理想選擇,且不會影響結構完整性。光束控制、自適應感測器和自動化監控技術的持續創新,提高了可靠性並減少了製造缺陷。這些進步不僅提高了生產效率,還確保了大規模生產環境中品質的一致性和可重複性,從而凸顯了雷射焊接在現代汽車製造流程中的重要性。汽車生產中對自動化、數位化和永續性的日益重視,正在塑造市場的發展趨勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12.5億美元 |

| 預測值 | 19.9億美元 |

| 複合年成長率 | 4.8% |

預計2025年至2034年間,光纖雷射器市場將以6.1%的複合年成長率成長。光纖雷射具有卓越的光束精度、高能效以及焊接輕質和混合材料的能力,因此在汽車行業備受青睞。其焊接速度快、運行成本低等性能優勢,正推動其在電動車製造和先進車身結構領域的應用。隨著汽車製造商日益重視精度、耐用性和成本效益,光纖雷射系統正成為下一代生產設施的關鍵組成部分。

到2024年,點焊市佔率將達到38%。雷射點焊仍然是車身組裝的關鍵工藝,能夠實現快速、牢固且精準的焊接。將機器人自動化和高功率光纖雷射整合到點焊製程中,可提高生產效率,最大限度地減少材料浪費,並確保焊接品質的穩定性。這項技術進步與汽車產業日益重視輕量化設計、加速生產週期和減少生產停機時間的趨勢相契合。

2024年,美國汽車雷射焊接系統市佔率達85.4%。美國在採用先進雷射焊接技術方面持續保持領先地位,尤其是在精度和可靠性要求極高的應用領域。電動車的日益普及、強勁的研發投入以及產業界與研究機構之間的緊密合作,共同推動了美國雷射焊接市場的創新發展。製造商們正著力提升生產品質和自動化水平,進一步推動了全國各地汽車工廠的技術整合。

全球汽車雷射焊接系統市場的主要企業包括TRUMPF、IPG Photonics、Coherent、Jenoptik、Han's Laser Technology、FANUC、Amada Weld Tech、Laserline、Golden Laser和Baison Laser。這些領導企業正透過技術創新、產能擴張和策略合作來鞏固其市場地位。他們大力投資研發,以開發先進的雷射光源、即時監控解決方案和節能系統,從而滿足不斷變化的製造需求。與汽車OEM廠商和工業自動化供應商的合作,協助他們打造針對電動車和輕量化材料最佳化的客製化焊接平台。此外,各企業也不斷擴大其業務版圖和生產規模,以滿足日益成長的全球需求。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 原物料供應商

- 零件製造商

- 系統整合商

- OEM

- 最終用途

- 供應商格局

- 產業影響因素

- 成長促進因素

- 汽車產能擴張

- 對高精度和輕質材料的需求

- 轉向節能型製造程序

- 雷射光束控制和監測系統的進展

- 電動車和混合動力車的普及率不斷提高

- 產業陷阱與挑戰

- 初始投資成本高

- 熟練的雷射焊接操作人員數量有限。

- 市場機遇

- 電動和混合動力汽車領域的成長

- 電池模組和動力總成焊接應用領域的拓展

- 工業4.0和智慧製造的日益普及

- 多材料焊接解決方案的技術進步

- 成長促進因素

- 成長潛力分析

- 監管環境

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 目前技術

- 新興技術

- 專利分析

- 價格趨勢分析

- 按組件

- 按地區

- 成本分解分析

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 未來趨勢

- 汽車技術路線圖與創新軌跡

- 新興應用及市場拓展機遇

- 自動駕駛車輛的影響及組件要求

- 永續製造與綠色技術融合

- 數位轉型與智慧製造整合

- 汽車產業客戶需求及產業優先事項

- 汽車品質對精度和重複性有很高的要求

- 機器人與自動化整合要求

- 電動車電池焊接規範與標準

- 符合 AWS D8.10 M 和 AIAG CQI-15 標準

- 汽車的能源效率和總擁有成本

- 本地服務網路和技術支援預期

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 重要新聞和舉措

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:雷射市場估算與預測:2021-2034年

- 主要趨勢

- 光纖雷射

- 二氧化碳雷射

- 固態雷射

- 二極體雷射

第6章:市場估算與預測:依焊接產業分類,2021-2034年

- 主要趨勢

- 點焊

- 縫焊

- 混合焊接

- 遠端焊接

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 白車身(BIW)

- 動力總成部件

- 電池製造(電動車)

- 排氣系統

- 底盤和結構件

第8章:市場估算與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- SUV

- 掀背車

- 轎車

- 商用車輛

- 低容量性狀

- MCV

- C型肝炎

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 荷蘭

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳新銀行

- 新加坡

- 泰國

- 越南

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- Bystronic Laser

- Coherent

- FANUC

- Han's Laser Technology

- IPG Photonics

- Jenoptik

- TRUMPF

- 區域玩家

- Amada Weld Tech

- HGTECH

- Laser Photonics

- Laserax

- Precitec

- Prima Power

- Sino-Galvo Technology

- Emerson Electric (Branson Ultrasonics)

- 新興參與者和顛覆者

- ALPHA LASER

- Baison Laser

- Control Laser

- Golden Laser

- KEYENCE

- Laserline

- LaserStar Technologies

- Miyachi Unitek

- Perfect Laser

- Sahajanand Laser Technology

The Global Automotive Laser Welding System Market was valued at USD 1.25 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 1.99 billion by 2034.

The steady expansion of the automotive sector, driven by rising vehicle production and growing demand in developing economies, is creating strong opportunities for advanced manufacturing solutions. Automakers are actively investing in laser welding technologies to achieve higher precision, productivity, and consistent quality while meeting evolving production standards. The increasing shift toward high-performance, lightweight vehicles made from aluminum and hybrid alloys is further amplifying the demand for laser-based welding systems. Laser welding offers exceptional accuracy, minimal thermal distortion, and superior strength retention, making it ideal for joining thin or dissimilar materials without compromising structural integrity. Continued innovation in beam control, adaptive sensors, and automated monitoring technologies enhances reliability and reduces manufacturing defects. These advancements not only improve production efficiency but also ensure uniform quality and repeatability across mass-production environments, reinforcing the importance of laser welding in modern automotive manufacturing processes. The market's evolution is being shaped by a growing focus on automation, digitalization, and sustainability in vehicle production.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.25 Billion |

| Forecast Value | $1.99 Billion |

| CAGR | 4.8% |

The fiber laser segment is anticipated to register a CAGR of 6.1% between 2025 and 2034. Its superior beam precision, energy efficiency, and ability to weld lightweight and mixed materials make fiber lasers highly favored in the automotive industry. Their performance benefits, including high welding speed and lower operating costs, are driving adoption in electric vehicle manufacturing and advanced body structures. As automakers emphasize precision, durability, and cost-effectiveness, fiber laser systems are becoming essential components of next-generation production facilities.

The spot welding segment accounted for a 38% share in 2024. Laser spot welding remains a critical process in vehicle body assembly, offering rapid, strong, and accurate welds. The integration of robotic automation and high-powered fiber lasers in spot welding enhances productivity, minimizes material waste, and ensures consistent weld quality. This technological progress aligns with the automotive industry's increasing focus on lightweight design, faster production cycles, and reduced downtime in manufacturing operations.

U.S. Automotive Laser Welding System Market held a share of 85.4% in 2024. The country continues to lead in adopting advanced laser welding technologies for applications demanding maximum precision and reliability. The growing commercialization of electric vehicles, robust R&D investments, and strong collaboration between industry and research institutions are sustaining innovation in laser welding within the U.S. market. Manufacturers are emphasizing high-quality production and automation, further driving technological integration in automotive plants nationwide.

Key companies operating in the Global Automotive Laser Welding System Market include TRUMPF, IPG Photonics, Coherent, Jenoptik, Han's Laser Technology, FANUC, Amada Weld Tech, Laserline, Golden Laser, and Baison Laser. Leading companies in the Automotive Laser Welding System Market are strengthening their market position through technological innovation, capacity expansion, and strategic partnerships. They are investing extensively in R&D to develop advanced laser sources, real-time monitoring solutions, and energy-efficient systems that meet evolving manufacturing needs. Collaborations with automotive OEMs and industrial automation providers are enabling the creation of customized welding platforms optimized for electric vehicles and lightweight materials. Companies are also expanding their geographic presence and production facilities to meet increasing global demand.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Laser

- 2.2.2 Welding

- 2.2.3 Application

- 2.2.4 Vehicle

- 2.2.5 Region

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component manufacturers

- 3.1.1.3 System integrators

- 3.1.1.4 OEM

- 3.1.1.5 End use

- 3.1.1 Supplier landscape

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of automotive production capacity

- 3.2.1.2 Demand for high precision and lightweight materials

- 3.2.1.3 Shift toward energy-efficient manufacturing processes

- 3.2.1.4 Advancements in laser beam control and monitoring systems

- 3.2.1.5 Growing adoption of electric and hybrid vehicles

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment cost

- 3.2.2.2 Limited availability of skilled laser welding operators

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of electric and hybrid vehicle segment

- 3.2.3.2 Expansion in battery module and powertrain welding applications

- 3.2.3.3 Rising adoption of Industry 4.0 and smart manufacturing

- 3.2.3.4 Technological advancements in multi-material welding solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle east and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.8 Patent analysis

- 3.9 Price Trends Analysis

- 3.9.1 By component

- 3.9.2 By region

- 3.10 Cost Breakdown Analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

- 3.14 Future trends

- 3.14.1 Technology roadmap & innovation trajectory in automotive

- 3.14.2 Emerging applications & market expansion opportunities

- 3.14.3 Autonomous vehicle impact & component requirements

- 3.14.4 Sustainable manufacturing & green technology integration

- 3.14.5 Digital transformation & smart manufacturing integration

- 3.15 Automotive client requirements & industry priorities

- 3.15.1 High precision & repeatability demands for automotive quality

- 3.15.2 Robotics & automation integration requirements

- 3.15.3 Ev battery welding specifications & standards

- 3.15.4. Compliance with AWS D8.10 M:2021 & AIAG CQI-15 standards

- 3.15.5 Energy efficiency & total cost of ownership in automotive

- 3.15.6 Local service network & technical support expectations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Laser, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Fiber laser

- 5.3 CO2 laser

- 5.4 Solid-state laser

- 5.5 Diode laser

Chapter 6 Market Estimates & Forecast, By Welding, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Spot welding

- 6.3 Seam welding

- 6.4 Hybrid welding

- 6.5 Remote welding

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Body-in-White (BIW)

- 7.3 Powertrain components

- 7.4 Battery manufacturing (EVs)

- 7.5 Exhaust systems

- 7.6 Chassis & structural parts

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Passenger Vehicle

- 8.2.1 SUV

- 8.2.2 Hatchback

- 8.2.3 Sedan

- 8.3 Commercial Vehicle

- 8.3.1 LCV

- 8.3.2 MCV

- 8.3.3 HCV

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 Singapore

- 9.4.6 Thailand

- 9.4.7 Vietnam

- 9.4.8 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Bystronic Laser

- 10.1.2 Coherent

- 10.1.3 FANUC

- 10.1.4 Han's Laser Technology

- 10.1.5 IPG Photonics

- 10.1.6 Jenoptik

- 10.1.7 TRUMPF

- 10.2 Regional Players

- 10.2.1 Amada Weld Tech

- 10.2.2 HGTECH

- 10.2.3 Laser Photonics

- 10.2.4 Laserax

- 10.2.5 Precitec

- 10.2.6 Prima Power

- 10.2.7 Sino-Galvo Technology

- 10.2.8 Emerson Electric (Branson Ultrasonics)

- 10.3 Emerging Players and Disruptors

- 10.3.1 ALPHA LASER

- 10.3.2 Baison Laser

- 10.3.3 Control Laser

- 10.3.4 Golden Laser

- 10.3.5 KEYENCE

- 10.3.6 Laserline

- 10.3.7 LaserStar Technologies

- 10.3.8 Miyachi Unitek

- 10.3.9 Perfect Laser

- 10.3.10 Sahajanand Laser Technology