|

市場調查報告書

商品編碼

1850397

自動化即服務:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Automation-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

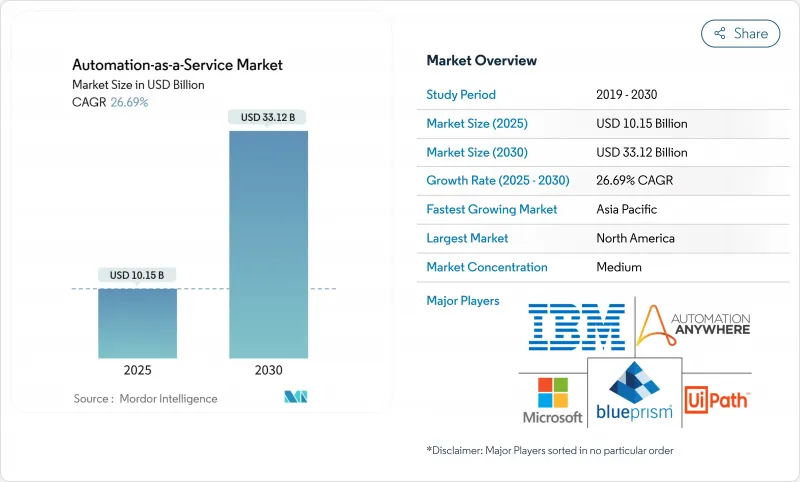

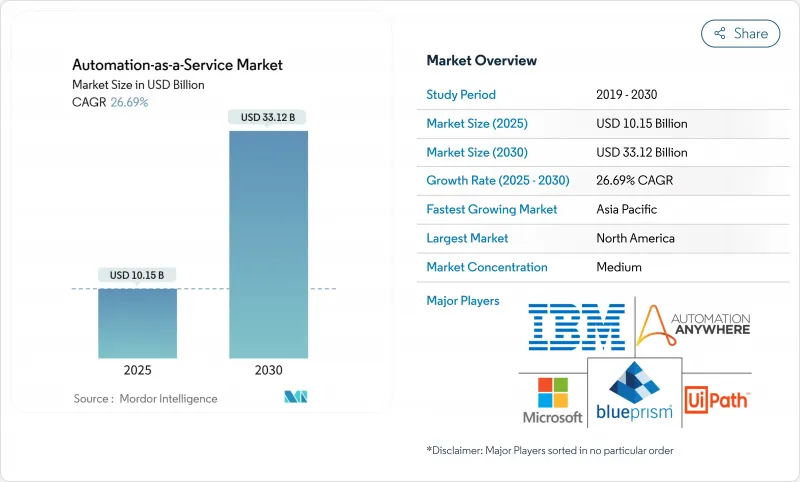

預計到 2025 年,自動化即服務市場規模將達到 101.5 億美元,到 2030 年將達到 331.2 億美元,年複合成長率為 26.7%。

隨著企業將生成式人工智慧功能嵌入現有的機器人流程自動化投資中,並透過訂閱收費降低資本支出,人工智慧的普及速度正在加快。強大的雲端生態系、低程式設計工作室的興起以及現成機器人領域市場的湧現,都在擴大潛在客戶群。將流程挖掘診斷與事件驅動編配結合的整合,能夠實現即時最佳化,從而將自動化程序從任務級改進提升到端到端的工作流程重構。擁有涵蓋發現、建構和運行階段的垂直整合技術堆疊的供應商,正在不斷取代零散的解決方案,尤其是在需要統一管治的受監管行業。

全球自動化即服務市場趨勢與洞察

業務流程自動化的需求不斷成長

如今,44% 的新增自動化工作流程由業務部門創建,這表明非專業開發者正在為中央 IT 團隊提供補充。營收營運計劃佔自動化工作流程的近一半,預示著自動化工作流程正向面向客戶的用例轉變。隨著跨職能團隊重新設計交接流程,市場對能夠實現低程式碼組合併同時管理細粒度權限的平台的需求日益成長。複雜性也不斷增加:61% 的活躍機器人執行的是多步驟邏輯,而非單任務巨集。客戶支援流程實現了三位數的成長,這表明在成本受限的經濟週期中,自動化與客戶留存策略緊密相關。

以雲端優先的IT策略加速AaaS採用

多租用戶架構使服務提供者能夠在不安排停機的情況下向所有客戶端實例推出新功能,從而縮短創新週期。基礎設施即程式碼模板透過標準化測試、預發布和生產層級的環境配置,進一步減少了摩擦。付費使用制使中小企業能夠將自動化支出轉移到營運預算中,並消除伺服器維護開銷。採用混合架構的企業將對延遲敏感的工作負載部署在邊緣,同時在雲端集中編配策略,從而在自主規則和彈性擴展之間取得平衡。因此,以雲端為中心的部署成長速度超過了整個自動化即服務市場的成長速度。

多租戶雲端中的資料安全和隱私問題

共用基礎設施模型會增加橫向移動的風險,尤其是在隔離控制失效的情況下,這對於金融服務和醫療保健行業的買家來說至關重要。當 AI Copilot 繼承了廣泛的 OAuth 權限範圍時,這個問題會更加突出,因為它可能會透過提示注入的方式洩露敏感內容。歐洲監管機構正在強制執行嚴格的駐留權和自動決策揭露規則,要求供應商強制執行身份驗證和日誌隔離以符合加密標準。供應商則透過客戶管理的金鑰、固定的區域資料儲存和持續合規性儀表板來應對這些挑戰。儘管採用新模式的勢頭強勁,但高度監管行業的買家正在分階段採用風險較低的流程。

細分市場分析

到2024年,本地部署仍將佔據自動化即服務市場68.4%的佔有率,這反映了各國政府嚴格的義務以及金融和公共部門的硬體投資。然而,隨著企業將非關鍵工作流程和開發沙箱遷移到雲端以減少基礎設施維護,雲端部署將以28.4%的複合年成長率成長。供應商現在提供滿足審核要求的單一租戶VPC選項,同時保持彈性擴充性和自動修補功能。邊緣配置在本地處理對延遲敏感的任務數據,然後將增強後的有效負載路由到中央分析,從而創建兼顧性能和管治的混合拓撲結構。管理員可以根據成本和合規觸發條件動態調整工作負載。這種靈活性使雲端模式成為自動化即服務市場的長期成長引擎,尤其適用於從未擁有資料中心資產的待開發區數位化企業。

到2024年,解決方案將佔總收入的66.8%,平台授權和機器人創作工作室將成為大多數買家的切入點。然而,隨著企業尋求設計思維、變革管理和持續改進方面的專業知識,預計到2030年,服務業的收入將以28.1%的複合年成長率超過軟體產業。託管服務提供者負責管理運作手冊、監控機器人健康狀況並應用安全補丁,使客戶能夠專注於核心創新。供應商生態系統中的顧問公司將流程挖掘診斷和超自動化藍圖打包,在不增加人員編制的情況下加快價值實現速度。隨著複雜性的增加,服務品質成為關鍵的差異化因素,從而增強生態系統鎖定,並提高整個自動化即服務市場的合約生命週期價值。

自動化即服務市場報告按部署類型(本地部署和雲端部署)、組件(解決方案和服務)、業務功能(資訊科技、財務和會計、其他)、公司規模(大型企業和中小企業)、最終用戶垂直行業(銀行、金融服務和保險、通訊和 IT、零售和消費品、其他)以及地區進行細分。

區域分析

北美將在2024年以38.6%的收入主導,這得益於成熟的超大規模資料中心、密集的合作夥伴網路以及金融、醫療保健和公共服務等領域對平台的早期採用。美國企業正在部署認知機器人來協調ERP、CRM和垂直雲平台上的數據,推動平台使用率高於全球平均。加拿大正在加速公共部門的採用,而墨西哥則利用自動化來增強其製造業近岸外包的競爭力。

亞太地區將實現最快成長,到2030年複合年成長率將達到27.3%。 《東協2025年數位發展總體規劃》將促進跨國數位服務的標準化,推動公共部門自動化並迅速滲透到私部門。中國將擴大工廠機器人和城市機器人的應用規模,印度將實現IT服務工作流程的現代化,日本將利用對話式智慧體解決老年護理領域的勞動力短缺問題。韓國將試辦5G賦能的邊緣自動化,澳洲將專注於提升採礦業的流程效率。

歐洲正在努力平衡創新與嚴格的資料保護監管。 GDPR 和提案的人工智慧管治法律要求納入可解釋的工作流程和審核日誌。瑞士、瑞典和德國的採用率最高,銀行和製造商已將 AI Copilot 整合到關鍵營運中。南歐經濟體依賴歐盟的數位化資金,從而催生了對平台即服務 (PaaS) 合約的新競標。這些動態使自動化即服務 (AaaS) 市場在不同的宏觀經濟背景下保持了韌性。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 業務流程自動化的需求不斷成長

- 雲端優先的IT策略加速AaaS的採用

- 結合RPA和基因人工智慧實現超自動化

- 訂閱和按使用量計費降低了中小企業的進入門檻。

- 特定領域機器人市場的出現

- 整合流程挖掘洞察,推動端到端自動化

- 市場限制

- 多租戶雲端中的資料安全和隱私問題

- 與傳統/本地系統整合的複雜性

- 監管機構對演算法透明度和道德的審查

- 低程式碼自動化管治人才短缺

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟趨勢對市場的影響

第5章 市場規模與成長預測

- 依部署類型

- 本地部署

- 雲

- 按組件

- 解決方案

- 服務

- 按業務職能

- 資訊科技

- 財會

- 人力資源

- 銷售與行銷

- 營運/供應鏈

- 按公司規模

- 主要企業

- 小型企業

- 最終用戶

- BFSI

- 通訊/IT

- 零售和消費品

- 醫療保健和生命科學

- 製造業

- 政府和公共部門

- 其他終端使用者區域

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Automation Anywhere

- UiPath

- Blue Prism

- IBM

- Microsoft

- HCLTech

- Hewlett Packard Enterprise

- Kofax

- NICE

- Pegasystems

- ServiceNow

- Appian

- SAP

- Oracle

- Salesforce(MuleSoft/RPA)

- WorkFusion

- Celonis

- Nintex

- Workato

- AutomationEdge

第7章 市場機會與未來展望

The Automation-as-a-Service market size stands at USD 10.15 billion in 2025 and is forecast to reach USD 33.12 billion by 2030, advancing at a 26.7% CAGR.

Adoption is accelerating as enterprises embed generative-AI features into existing robotic-process-automation investments while containing capital outlays through subscription billing. Robust cloud ecosystems, the rise of low-code design studios, and the emergence of domain marketplaces for ready-made bots are widening the addressable customer base. Integrations that combine process-mining diagnostics with event-driven orchestration allow real-time optimization, pushing automation programs from task level gains to end-to-end workflow redesign. Vendors with vertically integrated stacks that span discovery, build and run phases continue to displace point solutions, especially in regulated industries that demand unified governance.

Global Automation-as-a-Service Market Trends and Insights

Rising Demand for Business-Process Automation

Business units now originate 44% of all newly automated workflows, signalling that citizen developers are complementing central IT teams. Revenue-operations projects account for nearly half of live automations, underscoring a pivot toward customer-facing use cases. As cross-functional teams re-engineer hand-offs, demand rises for platforms that can manage granular permissions while enabling low-code composition. Complexity is also increasing: 61% of active bots execute multistep logic rather than single-task macros. Customer support processes experienced triple-digit growth, showing that automation is firmly linked to retention strategies during cost-constrained economic cycles.

Cloud-First IT Strategies Accelerating AaaS Adoption

Multi-tenant architectures let providers roll out new capabilities to every client instance without scheduled downtime, shortening innovation cycles. Infrastructure-as-Code templates further reduce friction by standardising environment provisioning across testing, staging and production tiers. For SMEs, pay-as-you-go consumption shifts automation spending to operating budgets and removes server maintenance overhead. Enterprises with hybrid footprints place latency-sensitive workloads at the edge while orchestrating policies centrally in the cloud, balancing sovereignty rules with elastic scale. As a result, cloud-centric deployments are outpacing overall Automation-as-a-Service market growth.

Data-Security and Privacy Concerns in Multi-Tenant Clouds

Shared-infrastructure models increase lateral-movement risk if isolation controls fail, a top worry for financial-services and healthcare buyers. The issue is amplified when AI copilots inherit broad OAuth scopes, potentially exposing confidential content through prompt injections. European regulators enforce strict residency and automated-decision disclosure rules, forcing providers to certify encryption standards and segregate logs. Vendors respond with customer-managed keys, regionally pinned data stores and continuous compliance dashboards. Adoption momentum remains solid but buyers in highly regulated sectors proceed with staged rollouts that start with low-risk processes.

Other drivers and restraints analyzed in the detailed report include:

- Convergence of RPA with Generative AI for Hyper-Automation

- Subscription and Usage-Based Pricing Lowering SME Entry Barriers

- Integration Complexity with Legacy/On-Prem Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premise installations retained 68.4% share of the Automation-as-a-Service market in 2024, reflecting strict sovereignty mandates and sunk hardware investments within finance and public-sector domains. Nevertheless, cloud variants are expanding at a 28.4% CAGR as organisations migrate non-critical workflows and development sandboxes to reduce infrastructure upkeep. Vendors now provide single-tenant VPC options that satisfy audit requirements while preserving elastic scale and automated patching. Edge deployments process data locally for latency-sensitive tasks before routing enriched payloads to central analytics, creating a hybrid topology that balances performance with governance. Contracts increasingly bundle both operating modes under unified dashboards, enabling administrators to shift workloads dynamically based on cost or compliance triggers. This flexibility positions cloud models as the long-run growth engine of the Automation-as-a-Service market, particularly for green-field digital businesses that never owned data-centre assets.

Solutions accounted for 66.8% revenue in 2024 as platform licences and bot-authoring studios formed the entry point for most buyers. The services segment, however, is forecast to outpace software sales at 28.1% CAGR through 2030 as enterprises seek design thinking, change management and continuous-improvement expertise. Managed-service providers curate runbooks, monitor bot health and apply security patches, letting customers focus on core innovation. Advisory firms within the vendor ecosystem package process-mining diagnostics with hyper-automation blueprints, accelerating time to value without ballooning headcount. As complexity rises, service quality becomes a key differentiator, reinforcing ecosystem lock-in and boosting lifetime contract values across the Automation-as-a-Service market.

The Automation As A Service Market Report is Segmented by Deployment Type (On-Premise and Cloud), Component (Solution and Services), Business Function (Information Technology, Finance and Accounting, and More), Enterprise Size (Large Enterprises and Small and Medium Enterprises (SMEs)), End-User Vertical (BFSI, Telecom and IT, Retail and Consumer Goods, and More), and Geography.

Geography Analysis

North America holds leadership with 38.6% revenue in 2024, supported by mature hyperscale data centres, a dense partner network and early platform adoption that spans finance, healthcare and public services. United States corporations deploy cognitive bots that reconcile data across ERP, CRM and vertical clouds, pushing platform utilisation rates above global averages. Canada accelerates public-sector use, while Mexico leverages automation to enhance near-shoring competitiveness in manufacturing.

Asia-Pacific registers the fastest growth at 27.3% CAGR through 2030. The ASEAN Digital Masterplan 2025 catalyses cross-border digital-service standards, spurring public-sector automation that quickly permeates private enterprises. China scales factory-floor robotics and city-administration bots, India modernises IT-service workflows, and Japan addresses labour shortages with conversational agents for elder-care. South Korea pilots 5G-enabled edge automations, while Australia focuses on mining-sector process efficiency.

Europe adopts a measured stance that balances innovation with rigorous data-protection oversight. GDPR and proposed AI-governance acts prompt demand for explainable workflows and built-in audit logs. Switzerland, Sweden and Germany exhibit the highest penetration rates, with banks and manufacturers integrating AI copilots into critical operations. Southern-European economies rely on EU funding for digitalisation, creating fresh bids for platform-as-a-service contracts. These dynamics keep the Automation-as-a-Service market resilient across varying macro-economic backdrops.

- Automation Anywhere

- UiPath

- Blue Prism

- IBM

- Microsoft

- HCLTech

- Hewlett Packard Enterprise

- Kofax

- NICE

- Pegasystems

- ServiceNow

- Appian

- SAP

- Oracle

- Salesforce (MuleSoft/RPA)

- WorkFusion

- Celonis

- Nintex

- Workato

- AutomationEdge

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for business-process automation

- 4.2.2 Cloud-first IT strategies accelerating AaaS adoption

- 4.2.3 Convergence of RPA with Gen-AI for hyper-automation

- 4.2.4 Subscription and usage-based pricing lowering SME entry barriers

- 4.2.5 Emergence of domain-specific bot marketplaces

- 4.2.6 Integration of process-mining insights to drive end-to-end automation

- 4.3 Market Restraints

- 4.3.1 Data-security and privacy concerns in multi-tenant clouds

- 4.3.2 Integration complexity with legacy/on-prem systems

- 4.3.3 Regulatory scrutiny over algorithmic transparency and ethics

- 4.3.4 Scarcity of low-code automation governance talent

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Type

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Component

- 5.2.1 Solution

- 5.2.2 Services

- 5.3 By Business Function

- 5.3.1 Information Technology

- 5.3.2 Finance and Accounting

- 5.3.3 Human Resources

- 5.3.4 Sales and Marketing

- 5.3.5 Operations / Supply-Chain

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By End-user Vertical

- 5.5.1 BFSI

- 5.5.2 Telecom and IT

- 5.5.3 Retail and Consumer Goods

- 5.5.4 Healthcare and Life Sciences

- 5.5.5 Manufacturing

- 5.5.6 Government and Public Sector

- 5.5.7 Other End-user Verticals

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Nigeria

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Automation Anywhere

- 6.4.2 UiPath

- 6.4.3 Blue Prism

- 6.4.4 IBM

- 6.4.5 Microsoft

- 6.4.6 HCLTech

- 6.4.7 Hewlett Packard Enterprise

- 6.4.8 Kofax

- 6.4.9 NICE

- 6.4.10 Pegasystems

- 6.4.11 ServiceNow

- 6.4.12 Appian

- 6.4.13 SAP

- 6.4.14 Oracle

- 6.4.15 Salesforce (MuleSoft/RPA)

- 6.4.16 WorkFusion

- 6.4.17 Celonis

- 6.4.18 Nintex

- 6.4.19 Workato

- 6.4.20 AutomationEdge

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment