|

市場調查報告書

商品編碼

1850200

綠色資料中心:市場佔有率分析、產業趨勢、統計資料和成長預測(2025-2030 年)Green Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

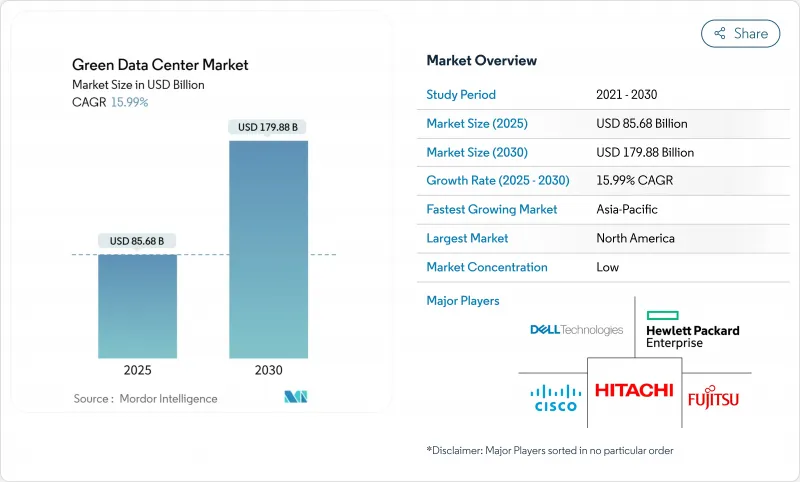

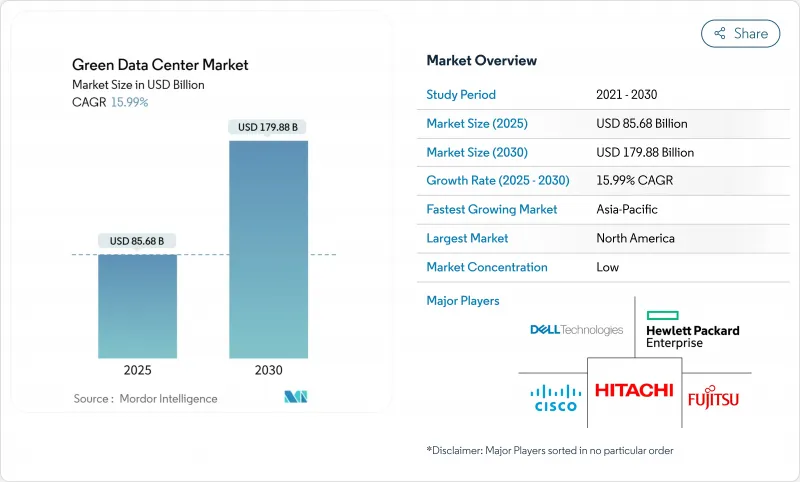

綠色資料中心市場預計到 2025 年將達到 856.8 億美元,到 2030 年將達到 1,798.8 億美元,複合年成長率為 15.99%。

為了應對不斷上漲的電費並滿足日益嚴格的ESG(環境、社會和治理)要求,營運商正在加快對再生能源購電協議、液冷晶片冷卻和人工智慧能源管理軟體的資本投入。超大規模雲端服務供應商透過預先預留數吉瓦級可再生能源組合,並發布開放原始碼液冷參考設計供託管服務供應商後續採用,從而影響技術標準。經合組織成員國的監管機構目前正將PUE(電源使用效率)≤1.3作為設施的基準,鼓勵快速維修和新建項目採用整合餘熱回收和氫能發電系統的設計。基於位置的可再生能源信用額度溢價也提振了投資意願,部分抵消了綠色建築的前期投資溢價,而不斷成長的人工智慧工作負載則支撐了對採用低全球暖化潛值(GWP)冷媒的高密度園區的需求。

全球綠色資料中心市場趨勢與洞察

超大規模雲端建設轉向100%再生能源

綠色資料中心市場正受惠於超大規模營運商紛紛簽約風能、太陽能和電池混合計劃。亞馬遜計畫在2024年實現其營運100%使用可再生能源,微軟承諾到2030年實現碳負排放,谷歌則將多餘的再生能源投入市政區域供熱計劃,進一步實現餘熱貨幣化。這些策略有助於營運商確保穩定的電價,透過出售可再生能源證書來獲得對沖收益,並為託管機房業主建立採購範本。

推動所有經合組織經濟體制定要求PUE≤1.3的法規

歐盟新指令和美國更新的能源法規要求透明地報告電源使用效率 (PUE)、用水效率和碳排放強度。德國的《能源效率法》強制要求揭露冷卻效率。同時,AWS 報告稱,其 2024 年全球 PUE 為 1.15,證明透過將基於人工智慧的工作負載調度與液冷相結合,可以實現合規。儘早維修的營運商可以透過降低風扇能耗和增加機械冗餘來節省成本,從而在續約託管合約時更具競爭力。違規的處罰逐年增加,促使人們採用節能設備。

與棕地維修相比,初始投資溢價為 30-40%。

高性能隔熱材料、與浸沒式冷卻機架相容的結構化佈線以及現場太陽能發電和儲能系統,與傳統機房相比,會使建造成本增加高達 40%。即使到了 2025 年,低碳混凝土和相變保溫牆等建築材料的供應仍然有限,這為綠色資料中心市場的發展帶來了進度風險。小型業者通常更注重逐步提高效率的維修,而不是全面採用綠色建築,這導致整體容量成長放緩,直到組件價格恢復正常。

細分市場分析

2024年,解決方案將佔總營收的63.2%,鞏固綠色資料中心市場在資本密集度的主導。隨著營運商優先考慮電源調節器、熱回收冷卻器和人工智慧驅動的資料中心基礎設施管理(DCIM)軟體以滿足能源效率要求,液冷產品線實現了兩位數的銷售成長。服務業務雖然絕對值較小,但預計將以15.7%的複合年成長率成長,因為設施業主需要聘請專家進行生命週期永續性審核、人工智慧主導的工作負載編配、ESG報告等服務。

電力系統升級,包括採用效率高達98%的UPS模組和智慧電網介面,提高了系統的韌性並降低了營運成本。冷卻解決方案也從高位空氣處理機組轉向後門式熱交換器結合熱水循環系統。在服務方面,整合合作夥伴現在提供碳計量會計儀錶板和可再生能源證書交易平台等服務。這種永續性管理的專業化標誌著綠色資料中心產業的結構性改進。

隨著企業持續推動外包策略,託管公司在2024年將佔到總支出的37.2%,但超大規模資料中心將以16.5%的複合年成長率超越此領域,從而擴大自有容量綠色資料中心的整體市場規模。數十億美元的可再生能源購電協議(PPA)和客製化的浸沒式系統推動了技術普及,並正逐步滲透到零售託管套件中。

企業營運商表現強勁,透過貨櫃式模組和模組化電池儲能系統對棕地設施進行改造,以滿足董事會層面的排放目標。邊緣微型設施雖然仍處於起步階段,但已採用被動式冷卻和太陽能UPS來支援5G行動通訊基地台的處理。雲端服務巨頭的採購能力正在拉低組件供應商的成本,間接降低了二線供應商的進入門檻。

綠色資料中心市場按組件(服務、解決方案)、資料中心類型(託管服務提供者、超大規模資料中心業者/雲端服務供應商、企業級資料中心、邊緣資料中心)、層級(一級和二級、三級、四級)、垂直行業(醫療保健、銀行、金融服務和保險、政府等)以及地區進行細分。市場預測以美元計價。

區域分析

北美地區憑藉可靠的可再生能源、強力的稅收優惠以及集中在維吉尼亞、奧勒岡州和德克薩斯州的超大規模資料中心活動,將在 2024 年佔全球收入的 26.5%。各州監管機構正在實施細緻的 ESG 資訊揭露,鼓勵儘早採用基於人工智慧的能源管理,使該地區的綠色資料中心市場在技術成熟度方面處於領先。

在亞太地區,日本的碳中和資料中心計畫、印度的資料主權政策以及澳洲的可再生能源區將刺激新建資料中心,到 2030 年的複合年成長率將達到 23.4%。東南亞的電網瓶頸正在推動透過專用線路進行太陽能和電池交易,互聯升級將顯著提高該地區的效率。

歐洲憑藉《氣候中和資料中心營運商協議》等統一政策,在綠色資料中心領域保持核心地位。北歐資料中心利用近乎免費的冷卻技術和豐富的水力資源,將餘熱輸送至市政電網,從而將有效PUE值降低至1.1。太陽能混合計劃在南歐加速發展,而德國法蘭克福的企業購電協議(PPA)正在推動多重雲端架構的普及。區域政策的一致性將維持綠色資料中心市場的投資動能。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 超大規模雲端建設轉向100%再生能源

- 推動制定法規,使經合組織國家的PUE值達到1.3或更低。

- 10兆瓦以上校園現場氫燃料電池試點計畫(2025-2028年)

- 人工智慧工作負載在區域供熱網路中的餘熱再利用

- 將基於位置的可再生能源信用額度貨幣化

- 液冷承包生態系與伺服器OEM聯盟

- 市場限制

- 初始資本支出溢價(30-40%)和棕地維修

- 新興經濟體綠色電網容量短缺

- 城市中心附近缺乏再生水權益

- 低全球暖化潛勢冷媒(R-718、R-1234yf)供應鏈不穩定

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 評估市場中的宏觀經濟因素

第5章 市場規模與成長預測

- 按組件

- 透過服務

- 系統整合

- 監控服務

- 專業服務

- 其他服務

- 透過解決方案

- 電力

- 冷卻

- 伺服器

- 網路裝置

- 管理軟體

- 其他解決方案

- 透過服務

- 依資料中心類型

- 託管服務提供者

- 超大規模資料中心業者/雲端服務供應商

- 企業和邊緣運算

- 依層級類型

- 一級和二級

- 三級

- 第四級

- 按行業

- 衛生保健

- BFSI

- 政府

- 通訊/IT

- 製造業

- 媒體與娛樂

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 荷蘭

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Fujitsu Ltd

- Cisco Systems Inc.

- Hewlett Packard Enterprise Co.

- Dell Technologies Inc.

- Hitachi Ltd

- Schneider Electric SE

- IBM Corporation

- Eaton Corporation

- Vertiv Holdings Co

- Equinix Inc.

- Digital Realty Trust Inc.

- NTT Communications Corp.

- Amazon Web Services Inc.

- Microsoft Corp.

- Google LLC

- Huawei Technologies Co. Ltd

- Rittal GmbH and Co. KG

- Siemens AG

- Vapor IO Inc.

- Iron Mountain Inc.

- QTS Realty Trust Inc.

- Keppel Data Centres

第7章 市場機會與未來展望

The green data center market stood at USD 85.68 billion in 2025 and is on track to reach USD 179.88 billion by 2030, reflecting a 15.99% CAGR.

Operators are accelerating capital deployment into renewable power purchase agreements, liquid-to-chip cooling, and AI-enabled energy-management software to curb escalating electricity costs while meeting tightening ESG mandates. Hyperscale cloud providers influence technology standards by pre-booking multi-gigawatt renewable portfolios and publishing open-source liquid-cooling reference designs that colocation players later adopt. Regulatory bodies in OECD economies now benchmark facilities to a <=1.3 PUE, prompting rapid retrofits and new-build designs that integrate waste-heat reuse and hydrogen-ready power systems. Investment appetite also benefits from premium pricing of location-based renewable-energy credits, which offsets a portion of up-front capital premiums for green builds, while AI workload growth sustains demand for high-density campuses equipped with low-GWP refrigerants.

Global Green Data Center Market Trends and Insights

Hyperscale Cloud Build-outs Shifting to 100% Renewable Power

The green data center market is benefiting from hyperscale operators that now contract for wind, solar, and battery-hybrid projects sized well beyond their direct consumption. Amazon achieved company-wide 100% renewable energy in 2024, Microsoft has pledged carbon-negative operations by 2030, and Google channels surplus renewable power into municipal district-heating projects that further monetise waste heat. These strategies help operators lock in price-stable electricity, create hedging income through renewable-energy credit sales, and establish procurement templates that colocation landlords subsequently follow

Regulatory Push for PUE <= 1.3 Across OECD Economies

New directives in the EU and updated U.S. energy codes require transparent reporting of PUE, water-usage effectiveness, and carbon intensity. Germany's Energy Efficiency Act mandates cooling-efficiency disclosures, while AWS reported a global PUE of 1.15 in 2024, proving compliance is feasible when AI-based workload scheduling and liquid cooling are combined. Operators that retrofit early capture cost savings from lower fan energy and reduced mechanical redundancy, improving competitiveness during colocation contract renewals. Penalties for non-compliance increase each fiscal year, creating a near-term rush to commission energy-efficient equipment.

Up-front CAPEX Premium (30-40%) Versus Brownfield Retrofits

High-performance insulation, structured cabling rated for immersion-cooled racks, and on-site solar plus storage systems inflate build costs by as much as 40% relative to conventional shells. Construction inputs such as low-carbon concrete and phase-change thermal walls remain supply-constrained in 2025, adding schedule risk to green data center market deployments. Smaller operators often pivot to incremental efficiency retrofits instead of full green builds, slowing overall capacity additions until component prices normalise.

Other drivers and restraints analyzed in the detailed report include:

- On-site Hydrogen Fuel-Cell Pilots in Greater than 10 MW Campuses (2025-2028)

- AI-workload Waste-Heat Reuse for District Heating Networks

- Limited Green-Power Grid Capacity in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 63.2% of 2024 revenue, underpinning the green data center market size leadership in capital intensity. Operators prioritised power-conditioning gear, heat-recovery chillers, and artificial-intelligence DCIM software to satisfy efficiency mandates, while liquid-to-chip cooling lines experienced double-digit unit shipment growth. Services, though smaller in absolute value, are forecast for 15.7% CAGR as facility owners engage specialists for lifecycle sustainability audits, AI-driven workload orchestration, and ESG reporting.

Power-train upgrades, including 98%-efficient UPS modules and smart grid interfaces, strengthened resilience and trimmed operating costs. Cooling solutions shifted from raised-floor air handlers to rear-door heat exchangers coupled with warm-water loops. On the services side, integration partners now bundle carbon accounting dashboards and renewable-certificate trading platforms. This professionalisation of sustainability management marks a structural uplift in the green data center industry.

Colocation firms held 37.2% of 2024 spending as enterprises continued outsourcing strategies, yet hyperscalers outpaced the field with a 16.5% CAGR, enlarging the overall green data center market size for self-owned capacity. Their billion-dollar renewable PPAs and custom-designed immersion systems set technology adoption curves that trickle down into retail colocation suites.

Enterprise operators remained steady, refreshing brownfield assets with containment pods and modular battery storage to meet board-level emissions targets. Edge micro-facilities, though nascent, adopted passive cooling and solar-powered UPS to support 5G cell-site processing. The procurement heft of cloud majors keeps component suppliers' cost curves descending, indirectly lowering barriers for second-tier providers.

Green Data Center Market is Segmented by Component (Service, Solution), Data Center Type (Colocation Providers, Hyperscalers/Cloud Service Providers, Enterprise, and Edge), Tier Type (Tier 1 and 2, Tier 3, Tier 4), Industry Vertical (Healthcare, BFSI, Government and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 26.5% revenue in 2024, buttressed by reliable renewable generation, robust tax incentives, and hyperscale activity clustering around Virginia, Oregon, and Texas. State regulators impose granular ESG disclosures, prompting early adoption of AI-based energy management that pushes the regional green data center market ahead in technology maturity.

Asia Pacific is forecast for a 23.4% CAGR through 2030 as Japan's carbon-neutral data center initiative, India's data-sovereignty policy, and Australia's renewable energy zones catalyse new builds. Grid bottlenecks in Southeast Asia have spurred private-wire solar plus battery deals, positioning the region for leap-frog efficiency gains once interconnect upgrades materialise.

Europe maintains a central role through unified policy such as the Climate Neutral Data Centre Operator Pact. Nordic campuses leverage near-free cooling and ample hydropower, exporting heat into municipal networks and thereby lowering effective PUE to 1.1. Southern Europe accelerates solar-hybrid projects, and Germany's corporate PPAs fuel multicloud adoption in Frankfurt. Collectively, regional policy coherence sustains investment momentum within the green data center market

- Fujitsu Ltd

- Cisco Systems Inc.

- Hewlett Packard Enterprise Co.

- Dell Technologies Inc.

- Hitachi Ltd

- Schneider Electric SE

- IBM Corporation

- Eaton Corporation

- Vertiv Holdings Co

- Equinix Inc.

- Digital Realty Trust Inc.

- NTT Communications Corp.

- Amazon Web Services Inc.

- Microsoft Corp.

- Google LLC

- Huawei Technologies Co. Ltd

- Rittal GmbH and Co. KG

- Siemens AG

- Vapor IO Inc.

- Iron Mountain Inc.

- QTS Realty Trust Inc.

- Keppel Data Centres

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Hyperscale cloud build-outs shifting to 100 % renewable power

- 4.2.2 Regulatory push for PUE Less than or Equal to 1.3 across OECD economies

- 4.2.3 On-site hydrogen fuel-cell pilots in Greater Than 10 MW campuses (2025-2028)

- 4.2.4 AI-workload waste-heat reuse for district heating networks

- 4.2.5 Location-based renewable-energy credits monetization

- 4.2.6 Liquid-cooling turnkey ecosystems from server-OEM alliances

- 4.3 Market Restraints

- 4.3.1 Up-front CAPEX premium (30-40 %) versus brownfield retrofits

- 4.3.2 Limited green-power grid capacity in emerging economies

- 4.3.3 Scarcity of recycled-water rights near urban cores

- 4.3.4 Supply-chain volatility for low-GWP refrigerants (R-718, R-1234yf)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitute Products

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 By Service

- 5.1.1.1 System Integration

- 5.1.1.2 Monitoring Services

- 5.1.1.3 Professional Services

- 5.1.1.4 Other Services

- 5.1.2 By Solution

- 5.1.2.1 Power

- 5.1.2.2 Cooling

- 5.1.2.3 Servers

- 5.1.2.4 Networking Equipment

- 5.1.2.5 Management Software

- 5.1.2.6 Other Solutions

- 5.1.1 By Service

- 5.2 By Data Center Type

- 5.2.1 Colocation Providers

- 5.2.2 Hyperscalers/Cloud Service Providers

- 5.2.3 Enterprise and Edge

- 5.3 By Tier Type

- 5.3.1 Tier 1 and 2

- 5.3.2 Tier 3

- 5.3.3 Tier 4

- 5.4 By Industry Vertical

- 5.4.1 Healthcare

- 5.4.2 BFSI

- 5.4.3 Government

- 5.4.4 Telecom and IT

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Other Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Netherlands

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia_Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Fujitsu Ltd

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Hewlett Packard Enterprise Co.

- 6.4.4 Dell Technologies Inc.

- 6.4.5 Hitachi Ltd

- 6.4.6 Schneider Electric SE

- 6.4.7 IBM Corporation

- 6.4.8 Eaton Corporation

- 6.4.9 Vertiv Holdings Co

- 6.4.10 Equinix Inc.

- 6.4.11 Digital Realty Trust Inc.

- 6.4.12 NTT Communications Corp.

- 6.4.13 Amazon Web Services Inc.

- 6.4.14 Microsoft Corp.

- 6.4.15 Google LLC

- 6.4.16 Huawei Technologies Co. Ltd

- 6.4.17 Rittal GmbH and Co. KG

- 6.4.18 Siemens AG

- 6.4.19 Vapor IO Inc.

- 6.4.20 Iron Mountain Inc.

- 6.4.21 QTS Realty Trust Inc.

- 6.4.22 Keppel Data Centres

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment