|

市場調查報告書

商品編碼

1849844

歐洲綠色資料中心:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Europe Green Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

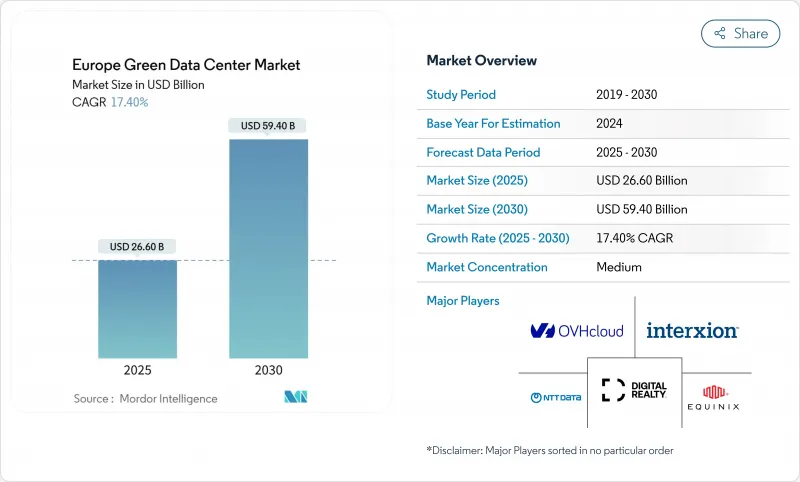

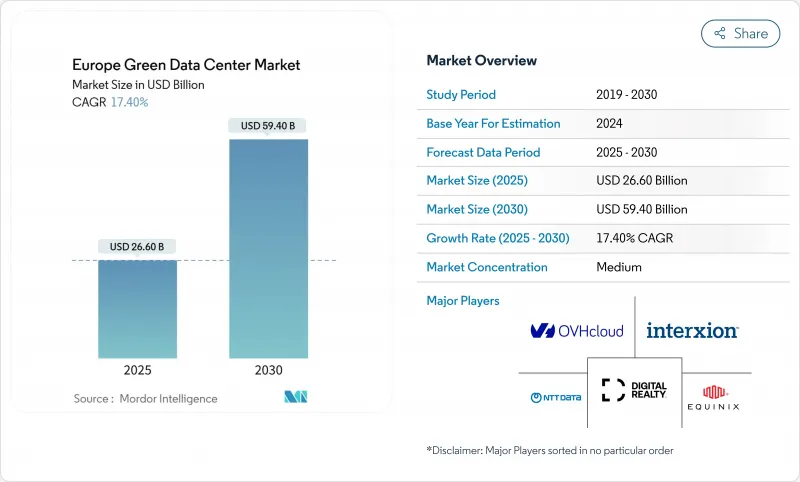

歐洲綠色資料中心市場預計到 2025 年將創造 266 億美元的收入,到 2030 年將達到 594 億美元,年複合成長率為 17.4%。

歐盟綠色新政推動的監管日益嚴格、對下一代人工智慧基礎設施的大規模投資以及企業範圍內的數位化,持續推高了市場需求,從而支持了產能擴張和永續性創新。由於能源效率指令要求500千瓦以上的設施必須報告能源指標並達到可再生能源閾值,營運商正將資金投入超高效的電力和冷卻技術。北歐購電協議(PPA)的獎勵確保了低碳電力供應,並使營運商能夠累計接近物理最低值的電力使用效率(PUE)比率。儘管電網存在堵塞,但FLAP-D樞紐在互聯密度方面仍然具有吸引力。提供監控、生命週期管理和合規性報告等服務的供應商的擴張速度超過了以硬體為中心的同行,這反映出市場正從一次性建設轉向持續最佳化。能夠將範圍3報告支持與高密度液冷技術相結合的供應商將獲得最大的成長機會。

歐洲綠色資料中心市場趨勢與洞察

雲端運算和巨量資料工作負載正在爆炸性成長

預計到2024年,人工智慧和機器學習任務將消耗歐洲資料中心8%的電力,到2028年這一比例可能達到20%,促使液冷技術迅速普及。液冷散熱速度比風冷快15到25倍。微軟已累計25億美元在利茲建造一個專注於人工智慧的園區,該園區到2026年將容納超過2萬個GPU,這表明超大規模資料中心營運商正在圍繞高密度機架重建其設施架構。邊緣的小規模推理工作負載正在創建連接到中央訓練叢集的分散式微型站點,從而在降低延遲的同時實現可再生能源目標。企業雲端策略現在包含量化的永續性指標,38%的歐洲營運商計劃在2024年投資綠色設施,以平衡人工智慧的成長與碳減排承諾。液冷設計和機架級熱回收利用兼具性能和合規性優勢,鞏固了它們在不久的將來成為需求促進因素的地位。

歐盟綠色交易及其55年來的合規義務

能源效率指令要求裝置容量超過 500 千瓦的資料中心公佈年度資源指標,並在 2030 年前將消費量降低 11.7%。德國的《能源效率法》規定,自 2026 年 7 月起,新建資料中心的 PUE 值上限為 1.2,並強制要求在 2027 年實現 100%再生能源。一項將於 2024 年 9 月生效的泛歐盟永續性評估框架將使營運商能夠對標自身績效,並確保從受《企業永續性報告指令》約束的公司獲得優先採購權。合規支出推動了產品創新:Equinix 正在試行一個餘熱網路,該網路在降低設施 PUE 值的同時,也能為附近居民供暖。能夠證明其指標透明的營運商在企業招標中獲得競爭優勢,從而推動自動化監控和生命週期碳計量平台的普及應用。

液冷和現場再生能源的資本支出較高

儘管全生命週期成本更低,但直接晶片冷卻和浸沒式冷卻系統比風冷系統成本高出 20-40%,導致缺乏低成本資金的營運商投資回收期更長。功率超過 20kW 的人工智慧機架增加了對這些升級的需求,但改裝工作需要重新配置樓層佈局、改造電氣系統以及對員工進行再培訓。現場安裝太陽能光電和電池面臨長達六個月的授權期限,這會使工期更加複雜並增加擁有成本。大型跨國公司正透過與永續性相關的貸款來降低成本,而規模較小的託管業者則面臨利潤率壓縮的風險,直到資金籌措創新和夥伴關係模式能夠減輕前期投資負擔。

細分市場分析

到2024年,解決方案收入將達到161億美元,佔總支出的60.54%,營運商採購高效動力傳動系統、高密度伺服器和先進冷卻設備以滿足主導PUE基準的要求。歐洲綠色資料中心服務市場預計將達到105億美元,到2030年將以22.1%的複合年成長率成長,這反映出對碳計量、生命週期監測和監管諮詢的強勁需求。專用系統整合方法可在改裝專案中整合液冷和風冷,提高資源效率並縮短遷移時間。利用資料中心基礎設施管理(DCIM)軟體進行持續監控可自動產生能源報告,這是歐盟綠色交易透明度審核的先決條件。隨著範圍3追蹤要求的不斷深化,專注於供應商審核和隱含碳評估的專業服務組合正在獲得市場佔有率,這再次印證了以服務主導在補充硬體更新周期方面的成熟度。

到2024年,超大規模資料中心營運商將佔總收入的35.2%,年複合成長率將達到24.4%,這得益於他們利用自身雄厚的資產負債表鎖定可再生能源合約並試驗大規模液冷技術。由超大規模園區驅動的歐洲綠色資料中心市場預計到2030年將超過250億美元,而購電協議中嵌入的永續性條款將支撐其長期競爭力。託管服務供應商正透過捆綁可再生積分和餘熱回收方案來吸引中型企業,從而實現差異化競爭。儘管企業內部部署規模持續縮小,但對延遲敏感的工作負載企業仍採用混合模式,依賴配備高效冷卻系統的邊緣節點。邊緣節點提供者正在人口中心附近部署250kW至1MW的模組,並透過空氣回收節熱器和模組化電池儲能來確保符合法規要求。大型超大規模資料中心營運商已公開宣佈在建設過程中減少碳排放,例如AWS在瑞典使用低碳鋼,將體積排放減少了高達70%,而規模較小的競爭對手也在努力效仿。

歐洲綠色資料中心市場細分包括服務(系統整合、監控服務、專業服務及其他服務)、解決方案(電源、伺服器、管理軟體及其他)、使用者(主機服務供應商、雲端服務供應商、企業)和終端用戶產業(醫療保健、金融服務、政府機構及其他)。市場預測以美元計價。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 主流促進因素

- 雲端運算和巨量資料工作負載的爆炸性成長

- 歐盟綠色交易和「適合55歲族群」義務

- FLAP-D Hub 的超大規模和邊緣構建

- 一位低調的司機

- 北歐超低PUE的PPA

- 區域供熱廢熱補貼

- 對綠色服務等級協定(SLA)的需求,尤其關注範圍 3。

- 市場限制

- 主流限制

- 對液冷和現場可再生能源的高資本投入

- 電力短缺地區電網連接延遲

- 謹慎克制

- 碳鋼和混凝土的審查

- 永續直流工程領域的人才短缺

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟趨勢對市場的影響

第5章 市場規模與成長預測

- 按組件

- 透過服務

- 系統整合

- 監控服務

- 專業服務

- 其他服務

- 透過解決方案

- 電力

- 冷卻

- 伺服器

- 網路裝置

- 管理軟體

- 其他解決方案

- 透過服務

- 依資料中心類型

- 託管服務提供者

- 超大規模資料中心業者/雲端服務供應商

- 企業和邊緣運算

- 依層級類型

- 一級和二級

- 三級

- 第四級

- 按行業

- 衛生保健

- 金融服務

- 政府

- 通訊/IT

- 製造業

- 媒體與娛樂

- 其他行業

- 按國家/地區

- 德國

- 英國

- 法國

- 荷蘭

- 愛爾蘭

- 挪威

- 瑞典

- 丹麥

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Equinix Inc.

- Digital Realty Trust Inc.

- NTT Global Data Centers EMEA GmbH

- Schneider Electric SE

- Fujitsu Ltd.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Co.

- IBM Corporation

- Eaton Corporation plc

- Vertiv Holdings Co.

- OVH Groupe SAS

- Interxion Holding NV

- Vantage Data Centers LLC

- Bulk Infrastructure AS

- Green Mountain AS

- EcoDataCenter AB

- Stack Infrastructure Inc.

- Iron Mountain Inc.

- Deep Green Data Centres Ltd.

- Verne Global Ltd.

第7章 市場機會與未來展望

The Europe green data center market generated USD 26.6 billion in 2025 and is forecast to reach USD 59.4 billion by 2030, advancing at a 17.4% CAGR.

Heightened regulatory ambition under the EU Green Deal, hyperscale investments in next-generation AI infrastructure, and enterprise-wide digitization are reinforcing a sustained demand curve that supports both capacity growth and sustainability innovation. Operators are steering capital toward ultra-efficient power and cooling technologies as the Energy Efficiency Directive requires facilities above 500 kW to report energy metrics and meet renewable-energy thresholds. Nordic incentives for power-purchase agreements (PPAs) ensure low-carbon electricity and enable operators to post power-usage-effectiveness (PUE) ratios close to the physical minimum, while FLAP-D hubs remain attractive for interconnection density despite grid backlogs. Service providers that bundle monitoring, lifecycle management, and compliance reporting are expanding faster than hardware-centric peers, reflecting the shift from one-off builds to continuous optimization. Vendors able to align Scope 3 reporting support with high-density liquid cooling stand to capture the strongest upside.

Europe Green Data Center Market Trends and Insights

Cloud & Big-Data Workload Surge

AI and machine-learning tasks consumed 8% of data-center electricity in Europe during 2024 and may hit 20% by 2028, prompting rapid adoption of liquid cooling that removes heat 15-25 times faster than air. Microsoft earmarked USD 2.5 billion for an AI-focused campus in Leeds hosting more than 20,000 GPUs by 2026, signalling how hyperscalers reshape facility architecture around high-density racks. Smaller inference workloads at the edge are spawning distributed micro-sites tethered to central training clusters, reducing latency while sustaining renewable-energy targets. Enterprise cloud strategies now include quantitative sustainability metrics; 38% of European operators invested in greener facilities in 2024 to balance AI growth with carbon-reduction pledges. Liquid-ready designs and rack-level heat reuse deliver both performance and compliance benefits that reinforce the driver's position in near-term demand formation.

EU Green Deal & Fit-for-55 Mandates

The Energy Efficiency Directive obliges data centers above 500 kW to publish annual resource metrics and to cut energy consumption by 11.7% by 2030. Germany's Energy Efficiency Act sets a PUE ceiling of 1.2 for new builds from July 2026 and a 100% renewable-electricity mandate by 2027. A pan-EU sustainability-rating framework entering force in September 2024 enables operators to benchmark performance and secure procurement preference from corporates bound by the Corporate Sustainability Reporting Directive. Compliance spending is unlocking product innovation: Equinix is piloting waste-heat networks that warm neighboring homes while lowering facility PUE. Operators able to evidence transparent metrics gain a competitive edge in enterprise RFPs, intensifying adoption of automated monitoring and lifecycle-carbon accounting platforms.

High CAPEX for Liquid-Cooling & On-site RE

Direct-to-chip and immersion systems cost 20-40% more than air cooling despite life-cycle savings, stretching payback timelines for operators lacking low-cost capital. AI racks topping 20 kW magnify the need for these upgrades, yet retrofit works demand floorplate reconfiguration, electrical refits, and staff reskilling. On-site solar or battery installations face six-month permitting windows, complicating schedules and raising holding costs. Larger multinationals mitigate expense through sustainability-linked loans, but smaller colocation players risk margin compression until financing innovation or partnership models neutralize upfront burdens.

Other drivers and restraints analyzed in the detailed report include:

- Hyperscale & Edge Build-outs in FLAP-D Hubs

- Nordic PPAs Enabling Ultra-Low PUE

- Grid-Connection Delays in Power-Scarce Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions revenue reached USD 16.1 billion in 2024, equal to 60.54% of overall expenditure, as operators procured efficient power trains, high-density servers, and advanced cooling to satisfy Directive-driven PUE benchmarks. Europe green data center market size for services registered USD 10.5 billion and is on track for a 22.1% CAGR to 2030, reflecting surging demand for carbon accounting, lifecycle monitoring, and regulatory advisory. Dedicated system-integration practices align liquid and air cooling within retrofit footprints, compressing migration time while raising resource efficiency. Continuous monitoring via data-center-infrastructure-management (DCIM) software automates energy reporting, a mandatory prerequisite for transparency audits under the EU Green Deal. As Scope 3 tracking obligations deepen, professional-services portfolios focused on supplier audits and embodied-carbon assessments capture an incremental share, reaffirming a services-led maturity phase that complements hardware refresh cycles.

Hyperscalers held 35.2% of 2024 revenue and expand at 24.4% CAGR, capitalizing on balance-sheet strength to lock renewable contracts and trial liquid-cooling at scale. The Europe green data center market size attributed to hyperscale campuses is projected to exceed USD 25 billion by 2030, with sustainability clauses embedded in power-purchase agreements anchoring long-term competitiveness. Colocation providers differentiate by bundling renewable credits and waste-heat-reuse schemes that appeal to mid-sized enterprises. Enterprise on-premises footprints continue to shrink, yet firms with latency-sensitive workloads maintain hybrid models that lean on edge nodes outfitted with efficient cooling. Edge providers deploy 250 kW-1 MW modules near population centers, ensuring regulatory compliance through recycled-air economizers and modular battery storage. Larger hyperscalers publicize construction-phase carbon cuts, such as AWS adopting low-carbon steel in Sweden to trim embodied emissions by up to 70%, setting a bar smaller competitors strive to match.

Europe Green Data Center Market Report Segments the Industry Into Service (System Integration, Monitoring Services, Professional Services, Other Services), Solution (Power, Servers, Management Software, and More), User (Colocation Providers, Cloud Service Providers, Enterprises), and End-User Industry (Healthcare, Financial Services, Government, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Equinix Inc.

- Digital Realty Trust Inc.

- NTT Global Data Centers EMEA GmbH

- Schneider Electric SE

- Fujitsu Ltd.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Co.

- IBM Corporation

- Eaton Corporation plc

- Vertiv Holdings Co.

- OVH Groupe SAS

- Interxion Holding N.V.

- Vantage Data Centers LLC

- Bulk Infrastructure AS

- Green Mountain AS

- EcoDataCenter AB

- Stack Infrastructure Inc.

- Iron Mountain Inc.

- Deep Green Data Centres Ltd.

- Verne Global Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream Drivers

- 4.2.2 Cloud and Big-Data Workload Surge

- 4.2.3 EU Green Deal and Fit-for-55 Mandates

- 4.2.4 Hyperscale and Edge Build-outs in FLAP-D Hubs

- 4.2.5 Under-the-Radar Drivers

- 4.2.6 Nordic PPAs Enabling Ultra-Low PUE

- 4.2.7 District-Heating Waste-Heat Subsidies

- 4.2.8 Scope-3-Focused Green SLAs Demand

- 4.3 Market Restraints

- 4.3.1 Mainstream Restraints

- 4.3.2 High CAPEX for Liquid-Cooling and On-site RE

- 4.3.3 Grid-Connection Delays in Power-Scarce Hubs

- 4.3.4 Under-the-Radar Restraints

- 4.3.5 Embodied-Carbon Steel and Concrete Scrutiny

- 4.3.6 Sustainable-DC Engineering Talent Shortage

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assessment of the impact of Macro Economic Trends on the Market

5 Market Size and Growth Forecasts (Value)

- 5.1 By Component

- 5.1.1 By Service

- 5.1.1.1 System Integration

- 5.1.1.2 Monitoring Services

- 5.1.1.3 Professional Services

- 5.1.1.4 Other Services

- 5.1.2 By Solution

- 5.1.2.1 Power

- 5.1.2.2 Cooling

- 5.1.2.3 Servers

- 5.1.2.4 Networking Equipment

- 5.1.2.5 Management Software

- 5.1.2.6 Other Solutions

- 5.1.1 By Service

- 5.2 By Data Center Type

- 5.2.1 Colocation Providers

- 5.2.2 Hyperscalers/Cloud Service Providers

- 5.2.3 Enterprise and Edge

- 5.3 By Tier Type

- 5.3.1 Tier 1 and 2

- 5.3.2 Tier 3

- 5.3.3 Tier 4

- 5.4 By Industry Vertical

- 5.4.1 Healthcare

- 5.4.2 Financial Services

- 5.4.3 Government

- 5.4.4 Telecom and IT

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Other Verticals

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Netherlands

- 5.5.5 Ireland

- 5.5.6 Norway

- 5.5.7 Sweden

- 5.5.8 Denmark

- 5.5.9 Spain

- 5.5.10 Italy

- 5.5.11 Russia

- 5.5.12 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global?level Overview, Market?level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Equinix Inc.

- 6.4.2 Digital Realty Trust Inc.

- 6.4.3 NTT Global Data Centers EMEA GmbH

- 6.4.4 Schneider Electric SE

- 6.4.5 Fujitsu Ltd.

- 6.4.6 Cisco Systems Inc.

- 6.4.7 Dell Technologies Inc.

- 6.4.8 Hewlett Packard Enterprise Co.

- 6.4.9 IBM Corporation

- 6.4.10 Eaton Corporation plc

- 6.4.11 Vertiv Holdings Co.

- 6.4.12 OVH Groupe SAS

- 6.4.13 Interxion Holding N.V.

- 6.4.14 Vantage Data Centers LLC

- 6.4.15 Bulk Infrastructure AS

- 6.4.16 Green Mountain AS

- 6.4.17 EcoDataCenter AB

- 6.4.18 Stack Infrastructure Inc.

- 6.4.19 Iron Mountain Inc.

- 6.4.20 Deep Green Data Centres Ltd.

- 6.4.21 Verne Global Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment