|

市場調查報告書

商品編碼

1849879

亞太地區綠色資料中心:市場佔有率分析、產業趨勢、統計資料和成長預測(2025-2030 年)APAC Green Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

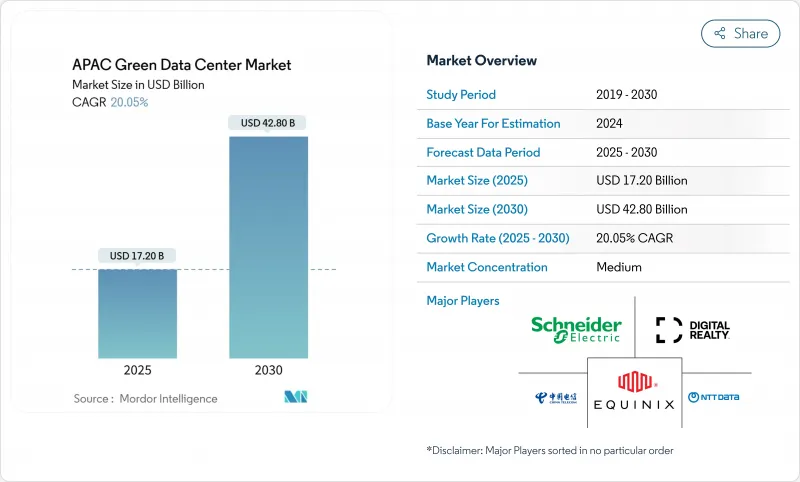

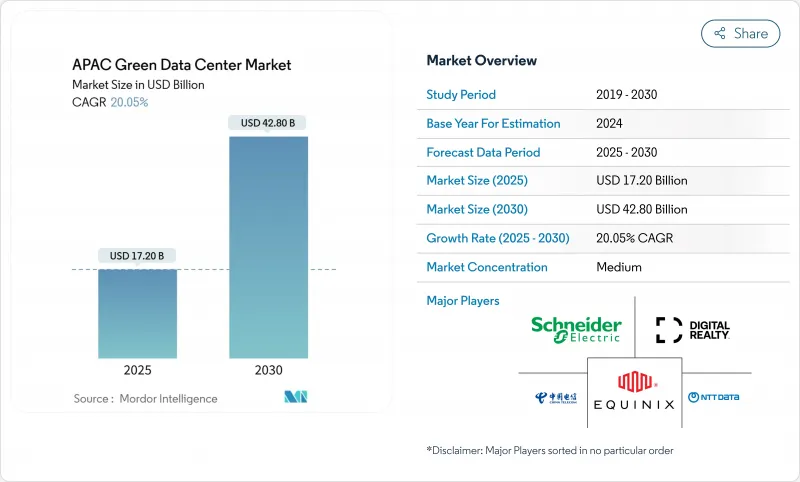

亞太地區綠色資料中心市場目前在 2025 年的價值為 172 億美元,預計到 2030 年將達到 428 億美元,年複合成長率為 20.05%。

超大規模配置的興起、嚴格的淨零排放政策以及雲端運算的快速普及,正推動資本流向中國、印度、日本和東南亞等地的節能設施。液冷和混合冷卻平台、企業購電協議的擴展以及綠色金融帶來的加權平均資本成本下降,都在推動計劃建設。企業也重新配置其電力架構以適應100kW以上的機架,政府則鼓勵企業在可再生能源豐富的二線城市位置。託管服務商、雲端超大規模資料中心業者和基礎設施房地產投資信託基金正在競相爭奪稀缺的土地、電網存取和熟練勞動力。

亞太地區綠色資料中心市場趨勢與洞察

高密度人工智慧主導的工作負載需要液冷和混合冷卻

GPU密集型伺服器的機架密度正從10kW飆升至100kW以上,推動直接式、浸沒式和精密液冷系統的普及。 SK Telecom等業者正與硬體製造商合作,將下一代熱感解決方案商業化,與風冷相比,這些方案可降低高達30%的能耗。 Equinix已在包括新加坡在內的100多個設施中部署了液冷系統,以在保持AI服務性能的同時減少用水量。早期採用者可以獲得成本優勢,因為更高的機架密度可以減少占地面積,並提高每平方英尺的收益。

東南亞新興城市超大規模和託管資料中心建設激增

泰國已累計27億美元用於建設三個超大規模資料中心園區;印尼將從Digital Realty獲得1億美元投資,用於其雅加達的擴張;馬來西亞將從谷歌獲得20億美元投資,其中包括建設一個現場水處理設施。對於在新加坡和東京面臨電力和土地短缺的超大規模資料中心業者而言,在這些市場設立新址將加快部署速度,但也會對開關設備、變壓器和專業供應鏈帶來壓力。

成熟樞紐地區的土地和電力供應暫停

新加坡於2024年解除了為期四年的電力開發禁令,但僅允許新增80兆瓦的裝置容量,迫使開發人員必須滿足嚴格的能源效率和人工智慧相關規定。東京也面臨類似的挑戰:其電網無法滿足需求,迫使計劃遷往千葉和北海道。有限的授權推高了地價,導致計劃延期開工,並將資金推向吉隆坡、雅加達和曼谷。

細分市場分析

到2024年,解決方案將佔據亞太綠色資料中心市場62.1%的佔有率,因為企業正在採用可快速部署到人工智慧叢集的整合式電力、冷卻和自動化堆疊。雖然電力設備仍然是最大的細分市場,因為資料中心正在重新佈線以提高密度,但隨著液冷技術的日益普及,先進的冷卻系統正經歷兩位數的成長。服務雖然目前規模較小,但其複合年成長率高達22.1%,超過了所有其他類別,這主要得益於對設計建造工程、可再生能源整合和認證諮詢的需求。預計亞太綠色資料中心服務市場將隨著複雜維修的增加而成長,到2030年將達到154億美元。能夠將軟體定義能源管理平台與液冷硬體捆綁在一起的供應商,正在將自己定位為超大規模資料中心的一站式解決方案合作夥伴。

企業也開始尋求碳計量審核、綠色債券結構設計和購電協議談判等專業服務。亞馬遜的低碳水泥替代品使東京一棟建築的體積碳排放量減少了64%,凸顯了組件創新與諮詢服務之間的關聯。電氣、機械和IT系統整合的專家能夠降低試運行風險,並縮短投資者的收益實現週期。

到2024年,託管超大規模資料中心業者提供者將佔據36.1%的市場佔有率,對於那些尋求可擴展容量但又不想前期投資的企業而言,託管服務提供者仍然至關重要。然而,受人工智慧模型訓練和自主雲端合約的驅動,超大規模資料中心供應商才是主要的成長引擎,其複合年成長率高達24.4%。與超大規模資料中心供應商相關的亞太地區綠色資料中心市場預計到2030年規模將成長三倍以上。隨著TikTok等公司承諾在五年內向泰國託管計畫投資88億美元,雅加達、柔佛和巴淡島的土地競爭日益激烈。

託管服務商正透過提供可直接用於液態儲存的閒置頻段、晶片級冷卻通道以及每機架超過 40kW 的高密度電力供應來應對這項挑戰。同時,超大規模資料中心營運商正在其建置進度超過需求的准入區域擴展託管服務。通訊業者部署又增加了一層需求,需要在 5G基地台附近部署微型站點以支援即時分析。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- AI驅動的高密度工作負載需要液冷和混合冷卻

- 東南亞新興大都市地區超大規模資料中心和託管資料中心的快速建設

- 政府淨零排放指示及環境稅收優惠政策

- 電網脫碳和企業購電協議加速可再生能源採購

- 通報不足:小型模組化反應器(SMR)零碳基本負載試驗

- 低估:房地產投資信託基金式的綠色融資降低了華盛頓特區開發商的加權平均資本成本

- 市場限制

- 成熟樞紐城市(如新加坡、東京)的土地和電力開發暫停令

- 三級及以上永續建築的資本投資溢價較高(15-20%)

- 先進冷卻和資料中心互連(DCIM)技術方面的技術純熟勞工短缺

- 漏報:水資源緊張法規限制了蒸發冷卻

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟趨勢對市場的影響

第5章 市場規模及成長預測(數值)

- 按組件

- 服務

- 系統整合

- 監控服務

- 專業服務

- 其他服務

- 解決方案

- 電力

- 冷卻

- 伺服器

- 網路裝置

- 管理軟體

- 其他解決方案

- 服務

- 依資料中心類型

- 託管服務提供者

- 超大規模資料中心業者/雲端服務供應商

- 企業和邊緣運算

- 依層級類型

- 一級和二級

- 三級

- 第四級

- 按行業

- 衛生保健

- 金融服務

- 政府

- 通訊/IT

- 製造業

- 媒體與娛樂

- 其他行業

- 按國家/地區

- 中國

- 印度

- 日本

- 馬來西亞

- 澳洲

- 印尼

- 泰國

- 新加坡

- 韓國

- 亞太其他地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Fujitsu Limited

- Cisco Systems Inc.

- HP Inc.

- Dell Technologies Inc.

- Hitachi Ltd.

- Schneider Electric SE

- IBM Corporation

- Eaton Corporation plc

- Vertiv Holdings Co

- Equinix Inc.

- Digital Realty Trust Inc.

- NTT DATA Group Corp.

- China Telecom Corp. Ltd.

- ST Telemedia Global Data Centres

- Keppel DC REIT

- AirTrunk Operating Pty Ltd.

- Huawei Technologies Co. Ltd.

- Amazon Web Services Inc.

- Microsoft Corp.

- Alibaba Cloud Computing Co. Ltd.

第7章 市場機會與未來展望

The Asia-Pacific green data center market is currently valued at USD 17.2 billion in 2025 and is forecast to reach USD 42.8 billion by 2030, advancing at a 20.05% CAGR.

Rising hyperscale deployments, strict net-zero policies, and rapid cloud adoption are steering capital toward energy-efficient facilities across China, India, Japan, and Southeast Asia. Liquid and hybrid cooling platforms, wider corporate power-purchase agreements, and lower weighted-average cost of capital from green financing are accelerating project pipelines. Companies are also re-engineering power architectures to support racks that now exceed 100 kW, while governments push location decisions toward secondary cities with abundant renewable energy. Competitive intensity is mounting as colocation specialists, cloud hyperscalers, and infrastructure real-estate investment trusts compete for scarce land, grid access, and skilled labor.

APAC Green Data Center Market Trends and Insights

AI-Driven High-Density Workloads Require Liquid and Hybrid Cooling

Rack densities have ballooned from 10 kW to beyond 100 kW for GPU-rich servers, prompting a shift toward direct, immersion, and precision liquid cooling systems. Operators such as SK Telecom are partnering with hardware manufacturers to commercialize next-generation thermal solutions that can trim energy use by up to 30% compared with air cooling. Equinix is rolling out liquid cooling in more than 100 facilities, including Singapore, to maintain performance for AI services while curbing water usage. Early adopters gain a cost advantage because higher rack density reduces floor space requirements and accelerates revenue per square foot.

Rapid Hyperscale and Colocation Build-Outs Across Emerging Southeast Asia Metros

Thailand has earmarked USD 2.7 billion for three hyperscale campuses, while Indonesia is receiving USD 100 million from Digital Realty for a Jakarta expansion. Malaysia has attracted a USD 2 billion pledge from Google that includes on-site water-treatment plants. New sites in these markets shorten deployment timelines for hyperscalers facing power and land caps in Singapore and Tokyo, though they strain regional supply chains for switchgear, transformers, and specialist contractors.

Land and Power Moratoriums in Mature Hubs

Singapore lifted its four-year moratorium in 2024 but released only 80 MW of new capacity, pushing developers to meet strict efficiency and AI-readiness rules. Tokyo faces similar challenges as grid upgrades lag demand, forcing projects to relocate to Chiba or Hokkaido. Limited permits inflate land prices and slow project starts, redirecting capital toward Kuala Lumpur, Jakarta, and Bangkok.

Other drivers and restraints analyzed in the detailed report include:

- Government Net-Zero Mandates and Green-Tax Incentives

- Grid Decarbonization and Corporate PPAs Accelerating Renewable Sourcing

- Skilled-Labour Shortage for Advanced Cooling and DCIM

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions captured 62.1% share of the Asia-Pacific green data center market in 2024 as enterprises favor integrated power, cooling, and automation stacks that can be deployed quickly for AI clusters. Power equipment remains the largest subsegment because facilities are re-wiring electrical backbones for higher density, while advanced cooling systems record double-digit growth as liquid technologies spread. Services are smaller today yet outpace all other categories with a 22.1% CAGR, fueled by demand for design-build engineering, renewable-energy integration, and certification consulting. The Asia-Pacific green data center market size for Services is projected to reach USD 15.4 billion by 2030, expanding alongside complex retrofits. Vendors able to bundle software-defined energy-management platforms with liquid cooling hardware position themselves as single-throat-to-choke partners for hyperscalers.

Enterprises also turn to professional services for carbon-accounting audits, green-bond structuring, and power-purchase agreement negotiations. Low-carbon materials, such as Amazon's cement replacements that cut embodied carbon by 64% in Tokyo builds, underscore how component innovation dovetails with service advisory. Integration specialists who can orchestrate electrical, mechanical, and IT systems reduce commissioning risk, shortening revenue realization cycles for investors.

Colocation operators held a 36.1% share in 2024 and remain vital for enterprises seeking scalable capacity without upfront capital. Yet hyperscalers, propelled by AI model training and sovereign-cloud contracts, are registering a 24.4% CAGR, making them the primary growth locomotive. The Asia-Pacific green data center market size tied to hyperscalers is projected to more than triple by 2030. Competition for land bank parcels in Jakarta, Johor, and Batam is intensifying as companies like TikTok pledge USD 8.8 billion over five years for Thailand hosting.

Colocation firms respond by offering liquid-ready white space, direct-to-chip cooling corridors, and high-density power feeds exceeding 40 kW per rack. Hyperscalers, in turn, expand colocation usage for on-ramp regions where self-build timelines exceed demand. Edge deployments by telecom operators add another layer, requiring micro-sites near 5G base stations to support real-time analytics.

Asia Pacific Green Data Center Market Report is Segmented by Services (System Integration, Monitoring Services, and More), Solutions (Power, Servers, Management Software, and More), Users (Colocation Providers, Cloud Service Providers, Enterprises), End-User Industries (Healthcare, Financial Services, and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Fujitsu Limited

- Cisco Systems Inc.

- HP Inc.

- Dell Technologies Inc.

- Hitachi Ltd.

- Schneider Electric SE

- IBM Corporation

- Eaton Corporation plc

- Vertiv Holdings Co

- Equinix Inc.

- Digital Realty Trust Inc.

- NTT DATA Group Corp.

- China Telecom Corp. Ltd.

- ST Telemedia Global Data Centres

- Keppel DC REIT

- AirTrunk Operating Pty Ltd.

- Huawei Technologies Co. Ltd.

- Amazon Web Services Inc.

- Microsoft Corp.

- Alibaba Cloud Computing Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-driven high-density workloads require liquid and hybrid cooling

- 4.2.2 Rapid hyperscale and colocation build-outs across emerging SE-Asia metros

- 4.2.3 Government net-zero mandates and green-tax incentives

- 4.2.4 Grid decarbonisation and corporate PPAs accelerating renewable sourcing

- 4.2.5 Under-reported: SMR (Small Modular Reactor) pilots for zero-carbon baseload

- 4.2.6 Under-reported: REIT-style green financing lowering WACC for DC developers

- 4.3 Market Restraints

- 4.3.1 Land and power moratoriums in mature hubs (e.g., Singapore, Tokyo)

- 4.3.2 High capex premium (15-20 %) for Tier III+ sustainable builds

- 4.3.3 Skilled-labour shortage for advanced cooling and DCIM

- 4.3.4 Under-reported: Water-stress regulations limiting evaporative cooling

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Service

- 5.1.1.1 System Integration

- 5.1.1.2 Monitoring Services

- 5.1.1.3 Professional Services

- 5.1.1.4 Other Services

- 5.1.2 Solution

- 5.1.2.1 Power

- 5.1.2.2 Cooling

- 5.1.2.3 Servers

- 5.1.2.4 Networking Equipment

- 5.1.2.5 Management Software

- 5.1.2.6 Other Solutions

- 5.1.1 Service

- 5.2 By Data Center Type

- 5.2.1 Colocation Providers

- 5.2.2 Hyperscalers/Cloud Service Providers

- 5.2.3 Enterprise and Edge

- 5.3 By Tier Type

- 5.3.1 Tier 1 and 2

- 5.3.2 Tier 3

- 5.3.3 Tier 4

- 5.4 By Industry Vertical

- 5.4.1 Healthcare

- 5.4.2 Financial Services

- 5.4.3 Government

- 5.4.4 Telecom and IT

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Other Verticals

- 5.5 By Country

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 Malaysia

- 5.5.5 Australia

- 5.5.6 Indonesia

- 5.5.7 Thailand

- 5.5.8 Singapore

- 5.5.9 South Korea

- 5.5.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Fujitsu Limited

- 6.4.2 Cisco Systems Inc.

- 6.4.3 HP Inc.

- 6.4.4 Dell Technologies Inc.

- 6.4.5 Hitachi Ltd.

- 6.4.6 Schneider Electric SE

- 6.4.7 IBM Corporation

- 6.4.8 Eaton Corporation plc

- 6.4.9 Vertiv Holdings Co

- 6.4.10 Equinix Inc.

- 6.4.11 Digital Realty Trust Inc.

- 6.4.12 NTT DATA Group Corp.

- 6.4.13 China Telecom Corp. Ltd.

- 6.4.14 ST Telemedia Global Data Centres

- 6.4.15 Keppel DC REIT

- 6.4.16 AirTrunk Operating Pty Ltd.

- 6.4.17 Huawei Technologies Co. Ltd.

- 6.4.18 Amazon Web Services Inc.

- 6.4.19 Microsoft Corp.

- 6.4.20 Alibaba Cloud Computing Co. Ltd.

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment