|

市場調查報告書

商品編碼

1849834

進階通訊服務:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Rich Communication Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

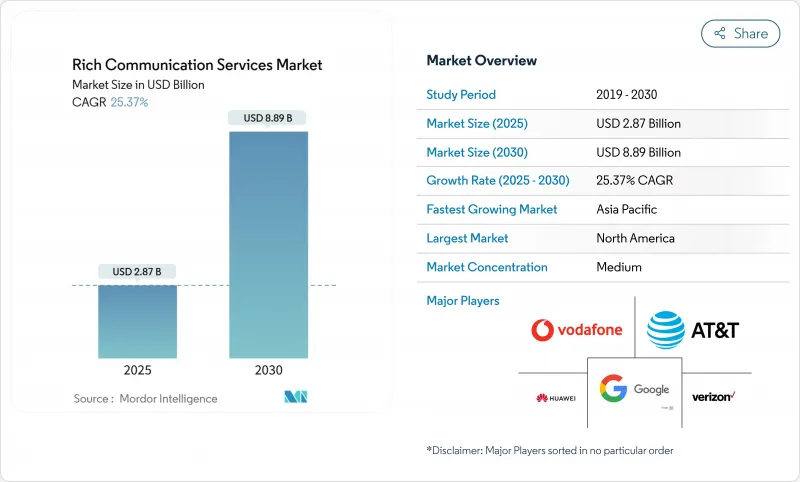

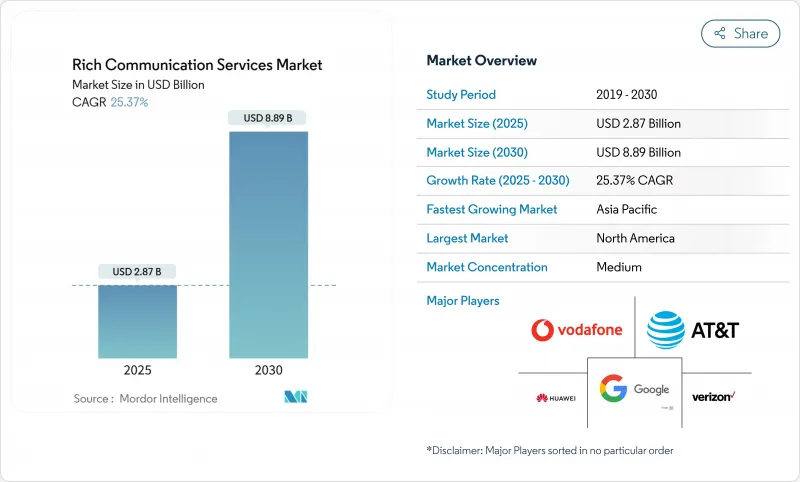

進階通訊服務市場預計在 2025 年達到 28.7 億美元,到 2030 年將成長到 88.9 億美元,複合年成長率為 25.37%。

企業對富媒體、品牌客戶參與的需求日益成長,這推動了從簡單簡訊到支援圖像、影片和可操作按鈕的互動式通訊的轉變。不斷擴大的通訊業者支援、iOS 18 中 RCS 的加入以及谷歌報告的美國每天超過 10 億條 RCS訊息,證實了主流採用的轉折點。雖然大型企業仍然是主要的收益驅動力,但雲端原生 CPaaS 平台正在降低中小企業的進入門檻。亞太地區發展勢頭最強勁,因為該地區的通訊業者使用 5G 網路來支援富媒體流量,而北美憑藉著多年的通訊業者互通性保持領先地位。監管機構朝著發送者身份驗證的方向邁進,為需要安全、經過身份驗證的客戶聯繫管道的企業提供了進一步的吸引力。

全球進階通訊服務市場趨勢與洞察

企業對 A2P RCS 商業訊息的需求

A2P宣傳活動的轉換率和點擊率遠高於傳統短信,這促使銀行和零售品牌將大量資金投入此管道。多媒體卡片和提案回應使負責人能夠在單線程對話中引導消費者從認知到購買,其投資回報率是傳統文字推送的 6.2 倍。 CPaaS 供應商正在透過整合低程式碼範本、合規性工作流程和即時分析來量化電子郵件和應用推播程式的提升。全球銀行等早期採用者報告稱,個人化貸款追加提升銷售聊天帶來了 10% 的轉換率和檢驗的收益提升。隨著越來越多的公司看到這種效果,A2P 的採用可能會在預測期內支援整個進階通訊服務市場的擴張。

擴展 iOS-18 支援和 Android OEM 預裝

蘋果決定將 RCS 整合到 iOS 18 中,此舉彌合了歷史上一項互通性缺口,該缺口曾為 OTT 應用帶來了流量,並透過營運商級的富文本通訊功能,讓約 9 億部活躍 iPhone 能夠即時訪問。三星將 Google 資訊應用程式設為 Galaxy 裝置的預設應用,進一步擴大了全球影響力。統一的體驗消除了像素化圖像、不流暢的群組聊天以及碎片化的綠/藍聊天等令消費者望而卻步的問題。企業無需維護並行的 OTT 管道,即可解鎖更大的目標受眾,並在不同作業系統上獲得可預測的覆蓋範圍。這種網路效應已在一項試點宣傳活動,在蘋果推出 RCS 後,參與度提高了 25%。

碎片化世界中的通訊業者互通性

目前只有 57通訊業者符合 GSMA Universal Profile 3.0 標準,導致跨境體驗不佳。向多個地區投放宣傳活動的公司必須維護備用簡訊和 OTT 管道,這增加了成本和營運複雜性。 Google Jibe 和 GSMA 的 Interconnect計劃等樞紐旨在簡化路由,但實施差異限制了其擴展能力。跨國公司在遷移高價值流量之前仍要求一致的服務等級協定 (SLA),這延遲了向 RCS 的收益調整。

細分分析

2024年,A2P流量將占到收益的61.8%,成為進階通訊服務市場的支柱。銀行、零售商和航空公司正在利用多媒體卡片和快速回复,將日常通知轉化為推動銷售的對話觸點。隨著人工智慧聊天機器人的成熟以及消費者越來越習慣在同一個會話中完成交易,目前規模較小的人與應用程式之間的對話將以每年31.5%的速度成長。預計到2030年,此成長將推動P2A流量的進階通訊服務市場規模達到兩位數成長。

企業將忠誠度促銷活動從簡訊遷移到 RCS 後,轉換率提升了 8-10 個百分點。印度的案例研究顯示,CPaaS 供應商 Gupshup 在整合 Vertex AI 聊天機器人後,流量激增了 358%。在 iOS 和 Android 無縫互聯的市場中,人際使用量也在成長,但收益是主導的。遊戲和票務等高參與度產業依賴 P2A 流程來管理候補名單和身分驗證,這表明溝通類型組合的層級結構正在不斷演變。

到2024年,雲端託管平台將佔總收入的72.9%,反映出企業正在更廣泛地採取行動,淘汰高資本支出的本地通訊閘道器。公共雲端RCS受到跨國品牌的青睞,因為它可以透過REST API與現有的CRM、CDP和行銷自動化堆疊整合。

在國防、醫療保健和政府機構等資料居住法律要求本地處理的領域,本地部署環境仍然至關重要。在這樣的環境中,敏感內容在防火牆後呈現,而利用公共雲端互聯的混合架構則實現了全球覆蓋。 Twilio 的公測版凸顯了該供應商致力於將營運商的複雜性抽像到 SDK 背後,並使開發人員能夠在單一儀表板中與簡訊、WhatsApp 和電子郵件一起啟動 RCS。

進階通訊服務市場按通訊類型(應用程式對個人 (A2P)、個人對個人 (P2P)、其他)、部署模式(雲端、本地)、最終用戶公司規模(大型企業、中小型企業)、最終用戶垂直行業(金融服務、保險、其他)和地區進行細分。市場預測以美元計算。

區域分析

2024年,北美地區將佔總營收的38.5%,這得益於Verizon、ATandT和T-Mobile等公司率先採用通用設定檔(Universal Profile)。谷歌在美國每天推出超過10億條RCS訊息,標誌著消費者對RCS的採用日趨成熟。美國聯邦通訊委員會(FCC)現已允許使用RCS發送911緊急短信,鼓勵市政當局和企業採用經過身份驗證的管道。該地區較高的ARPU值使通訊業者能夠透過商業通訊費率獲得增量收入。

亞太地區是成長最快的地區,複合年成長率高達30.4%,這得益於超高的智慧型手機普及率和政府數位化計畫。印度每月在單一CPaaS平台上記錄的商業訊息高達5,000萬條,預計2027年其流量將超過北美。日本和韓國的RCS用戶比例成長了70%,證明了5G密度與富媒體應用之間的關聯。儘管通訊業者格局較為分散,但諸如GSMA互聯中心等旨在簡化跨境路由的舉措,正在進一步推動該地區進階通訊服務市場的發展。

在歐洲,由於資料保護條例和數位市場法律中的互通性規則更傾向於經過檢驗、營運商控制的通訊,而非不受監管的OTT應用,對話式商務正在穩步擴張。德國電信2024年的收入為1158億歐元,其中包括支持RCS的附加價值服務收入。相反,英國圍繞合法攔截與蘋果加密RCS的爭論表明,監管的不確定性可能會暫時抑制其應用。儘管拉丁美洲仍處於早期階段,但對話式商務在巴西的普及程度尤為強勁,頂級通訊業者將在2024年開展其首次重大宣傳活動。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 企業對 A2P RCS 商業通訊的需求

- iOS-17 支援和擴充的 Android OEM 預安裝

- 5G部署將推動高解析度富媒體流量

- 檢驗寄件者 ID 和反垃圾郵件規則的監管遷移

- 透過 CPaaS 整合實現全通路編配

- 訊息內支付(RCS MaaP)協助對話式商務

- 市場限制

- 全球營運商互通性分散

- 缺乏完整的端對端加密

- OTT超級應用程式蠶食企業錢包佔有率

- 營運商收益模式不明確導致定價延遲

- 價值鏈分析

- 監管格局

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 產業相關利益者分析

- RCS 的演變與實施

- RCS的演變

- 使用案例和實施研究

- 主要用途

- RCS 如何影響原生簡訊

- A2P 與 OTT 流量趨勢分析

- 對數位廣告收益分成的影響

- 預期的 P2P 遷移模式

- 主要行動網路營運商的 RCS藍圖

第5章市場規模及成長預測

- 依溝通類型

- A2P(應用到個人)

- P2P(個人對個人)

- P2A(人對應用程式)

- 其他

- 按部署模型

- 雲

- 本地部署

- 按最終用戶公司規模

- 小型企業

- 主要企業

- 按最終用戶產業

- BFSI

- 媒體和娛樂

- 零售與電子商務

- 旅遊與飯店

- 衛生保健

- 資訊科技和通訊

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 西班牙

- 瑞士

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 新加坡

- 越南

- 印尼

- 其他亞太地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 奈及利亞

- 南非

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ATandT Inc.

- Verizon Communications Inc.

- Telefonaktiebolaget LM Ericsson

- Google LLC

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- ZTE Corporation

- Mavenir Systems, Inc.

- Sinch AB

- Global Message Services AG

- Juphoon System Software Co., Ltd.

- Summit Tech

- T-Mobile USA, Inc.

- SK Telecom Co., Ltd.

- Telstra Corporation Limited

- Vodafone Group plc

- Orange SA

- Deutsche Telekom AG

- Twilio Inc.

- Infobip Ltd.

- Gupshup Technology India Pvt. Ltd.

- Route Mobile Limited

- MessageBird BV

第7章 市場機會與未來展望

The rich communication services market reached USD 2.87 billion in 2025 and is projected to grow to USD 8.89 billion by 2030, reflecting a 25.37% CAGR.

Growing enterprise appetite for media-rich, branded customer engagement is pushing businesses to migrate from plain SMS to interactive messaging that supports images, video, and actionable buttons. Expanded carrier support, the inclusion of RCS in iOS 18, and Google's report of more than 1 billion U.S. RCS messages per day underscore a tipping point in mainstream adoption. Large enterprises remain the principal revenue source, yet cloud-native CPaaS platforms are lowering entry barriers for small and medium businesses. Geographic momentum is strongest in Asia-Pacific as regional operators use 5G networks to support rich media traffic, while North America holds its lead on the back of long-standing carrier interoperability. Regulatory moves toward verified sender IDs are creating additional pull for enterprises that need secure, authenticated channels for customer contact.

Global Rich Communication Services Market Trends and Insights

Enterprise Demand for A2P RCS Business Messaging

A2P campaigns deliver markedly higher conversion and click-through rates than legacy SMS, encouraging brands in banking and retail to shift considerable spend to the channel. Multi-media cards and suggested replies let marketers guide shoppers from awareness to purchase within a single threaded conversation, generating 6.2 times the ROI of basic text pushes. CPaaS vendors have responded by embedding low-code templates, compliance workflows, and real-time analytics that quantify lift against email and app-push programs. Early adopters such as global banks report 10% conversion from personalized loan-upsell chats, validating the revenue upside. As more enterprises witness the impact, A2P usage is set to underpin overall rich communication services market expansion during the forecast window.

iOS-18 Support and Expanding Android OEM Pre-installs

Apple's decision to embed RCS in iOS 18 removes the historic interoperability gap that steered traffic to OTT apps; nearly 900 million active iPhones instantly become reachable via operator-grade rich messaging. Samsung's default adoption of Messages by Google on Galaxy devices further amplifies global reach. The unified experience eliminates pixelated images, broken group chats, and green/blue chat fragmentation that deterred consumers. Enterprises gain predictable reach across operating systems, unlocking larger addressable audiences without maintaining parallel OTT channels. This network effect is already visible in pilot campaigns that recorded 25% higher engagement after Apple rollout.

Fragmented Global Operator Interoperability

Only 57 carriers have aligned with GSMA Universal Profile 3.0, creating gaps that degrade cross-border experience. Enterprises sending campaigns into multiple regions must maintain fallback SMS or OTT channels, raising cost and operational complexity. While hubs such as Google's Jibe and GSMA's Interconnect projects are intended to streamline routing, uneven implementation throttles scale. Multinationals continue to lobby for consistent SLAs before migrating high-value traffic, delaying revenue realignment toward RCS.

Other drivers and restraints analyzed in the detailed report include:

- 5G Roll-outs Boosting High-Resolution Rich Media Traffic

- Regulatory Shift Toward Verified Sender ID and Anti-Spam Rules

- Absence of Full End-to-End Encryption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

A2P traffic delivered 61.8% of 2024 revenue, making it the backbone of the rich communication services market. Banks, retailers, and airlines use multimedia cards and quick replies to convert routine notifications into conversational touchpoints that drive incremental sales. Person-to-Application conversations, though currently smaller, are expanding 31.5% annually as AI chatbots mature and consumers grow comfortable completing transactions inside a thread. This uptick will increase the rich communication services market size for P2A flows at a double-digit clip through 2030.

Enterprises are documenting conversion jumps of 8-10 percentage points when migrating loyalty promotions from SMS to RCS. Case studies in India show a 358% traffic surge for CPaaS provider Gupshup after integrating Vertex AI chatbots. Person-to-Person usage also climbs in markets with seamless iOS-Android interconnect, though monetization is operator-driven rather than enterprise-driven. High-engagement sectors such as gaming and ticketing rely on P2A flows to manage waitlists and authentication, signaling an evolving mix within the communication-type hierarchy.

Cloud-hosted platforms generated 72.9% of 2024 revenue, mirroring broader enterprise moves to eliminate cap-ex-heavy, on-premise messaging gateways. Multinational brands favor public-cloud RCS because it dovetails with existing CRM, CDP, and marketing-automation stacks via REST APIs.

On-premise environments remain non-trivial in sectors such as defense, healthcare, and government where data-residency laws require local processing. Those deployments stand to benefit from hybrid architectures in which sensitive content is rendered behind the firewall while global reach rides public-cloud interconnects. Twilio's public beta underscores the vendor push to abstract carrier complexity behind SDKs, letting developers spin up RCS alongside SMS, WhatsApp, and email within one dashboard.

Rich Communication Services Market is Segmented by Communication Type (A2P (Application-To-Person), P2P (Person-To-Person), and More), Deployment Mode (Cloud and On-Premise), End-User Enterprise Size (Large Enterprises and Small and Medium Enterprises (SMEs)), End-User Vertical (BFSI, Media and Entertainment and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.5% of 2024 revenue, underpinned by early universal profile adoption across Verizon, ATandT, and T-Mobile. Google's disclosure of more than 1 billion daily RCS messages in the U.S. illustrates mature consumer uptake. Regulatory clarity also helps: the FCC now recognizes RCS for emergency 911 texts, encouraging municipalities and enterprises alike to adopt authenticated channel. The region's high ARPU lets carriers capture incremental revenue through business messaging fees.

Asia-Pacific is the fastest-growing geography at a 30.4% CAGR, stimulated by ultra-high smartphone penetration and government digitization programs. India records 50 million monthly enterprise messages on a single CPaaS platform and is projected to eclipse North America in traffic volume by 2027. Japan and South Korea exhibit plus-70% RCS user ratios, proving how 5G density correlates with rich-media adoption. Despite fragmented operator landscapes, initiatives such as the GSMA Interconnect Hub aim to streamline cross-border routing, further boosting the rich communication services market in the region.

Europe posts steady expansion as data-protection regulations and Digital Markets Act interoperability rules favor verified, operator-controlled messaging over unregulated OTT apps. Deutsche Telekom's EUR 115.8 billion 2024 revenue includes a growing slice from RCS-enabled value-added services. Conversely, the UK debate over lawful interception vis-a-vis Apple's encrypted RCS shows that regulatory uncertainty can temporarily dampen deployment, yet enterprises continue pilot projects to gauge engagement lift. Latin America remains early-stage but is notable for outsized conversational commerce usage, especially in Brazil where tier-one carriers completed their first large-scale campaigns during 2024.

- ATandT Inc.

- Verizon Communications Inc.

- Telefonaktiebolaget LM Ericsson

- Google LLC

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- ZTE Corporation

- Mavenir Systems, Inc.

- Sinch AB

- Global Message Services AG

- Juphoon System Software Co., Ltd.

- Summit Tech

- T-Mobile USA, Inc.

- SK Telecom Co., Ltd.

- Telstra Corporation Limited

- Vodafone Group plc

- Orange S.A.

- Deutsche Telekom AG

- Twilio Inc.

- Infobip Ltd.

- Gupshup Technology India Pvt. Ltd.

- Route Mobile Limited

- MessageBird B.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Enterprise demand for A2P RCS business messaging

- 4.2.2 iOS-17 support and expanding Android OEM pre-installs

- 4.2.3 5G roll-outs boosting high-resolution rich media traffic

- 4.2.4 Regulatory shift toward verified sender ID and anti-spam rules

- 4.2.5 CPaaS integration unlocking omni-channel orchestration

- 4.2.6 In-message payments (RCS MaaP) enabling conversational commerce

- 4.3 Market Restraints

- 4.3.1 Fragmented global operator interoperability

- 4.3.2 Absence of full end-to-end encryption

- 4.3.3 OTT super-apps cannibalising enterprise wallet share

- 4.3.4 Unclear operator monetisation models delaying pricing

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Industry Stakeholder Analysis

- 4.9 RCS Evolution and Implementation

- 4.9.1 Evolution of RCS

- 4.9.2 Use-Cases and Implementation Studies

- 4.9.3 Major Applications

- 4.10 Impact of RCS on Native SMS

- 4.10.1 A2P vs OTT traffic trend analysis

- 4.10.2 Digital advertising revenue share implications

- 4.10.3 Anticipated P2P migration patterns

- 4.11 RCS Roadmap for Major MNOs

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Communication Type

- 5.1.1 A2P (Application-to-Person)

- 5.1.2 P2P (Person-to-Person)

- 5.1.3 P2A (Person-to-Application)

- 5.1.4 Others

- 5.2 By Deployment Model

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.3 By End-user Enterprise Size

- 5.3.1 Small and Medium Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By End-User Industry

- 5.4.1 BFSI

- 5.4.2 Media and Entertainment

- 5.4.3 Retail and E-commerce

- 5.4.4 Travel and Hospitality

- 5.4.5 Healthcare

- 5.4.6 IT and Telecom

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Spain

- 5.5.3.7 Switzerland

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Malaysia

- 5.5.4.6 Singapore

- 5.5.4.7 Vietnam

- 5.5.4.8 Indonesia

- 5.5.4.9 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 Nigeria

- 5.5.5.2.2 South Africa

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview)

- 6.4.1 ATandT Inc.

- 6.4.2 Verizon Communications Inc.

- 6.4.3 Telefonaktiebolaget LM Ericsson

- 6.4.4 Google LLC

- 6.4.5 Huawei Technologies Co., Ltd.

- 6.4.6 Samsung Electronics Co., Ltd.

- 6.4.7 ZTE Corporation

- 6.4.8 Mavenir Systems, Inc.

- 6.4.9 Sinch AB

- 6.4.10 Global Message Services AG

- 6.4.11 Juphoon System Software Co., Ltd.

- 6.4.12 Summit Tech

- 6.4.13 T-Mobile USA, Inc.

- 6.4.14 SK Telecom Co., Ltd.

- 6.4.15 Telstra Corporation Limited

- 6.4.16 Vodafone Group plc

- 6.4.17 Orange S.A.

- 6.4.18 Deutsche Telekom AG

- 6.4.19 Twilio Inc.

- 6.4.20 Infobip Ltd.

- 6.4.21 Gupshup Technology India Pvt. Ltd.

- 6.4.22 Route Mobile Limited

- 6.4.23 MessageBird B.V.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment