|

市場調查報告書

商品編碼

1842651

中國汽車租賃:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)China Vehicle Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

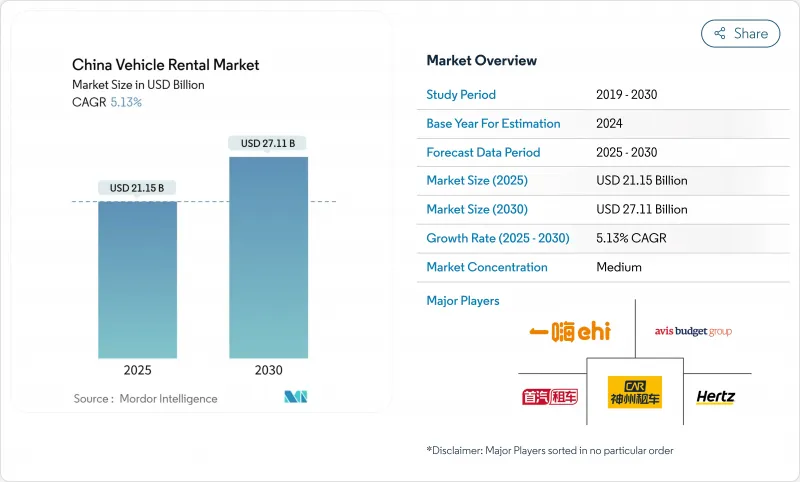

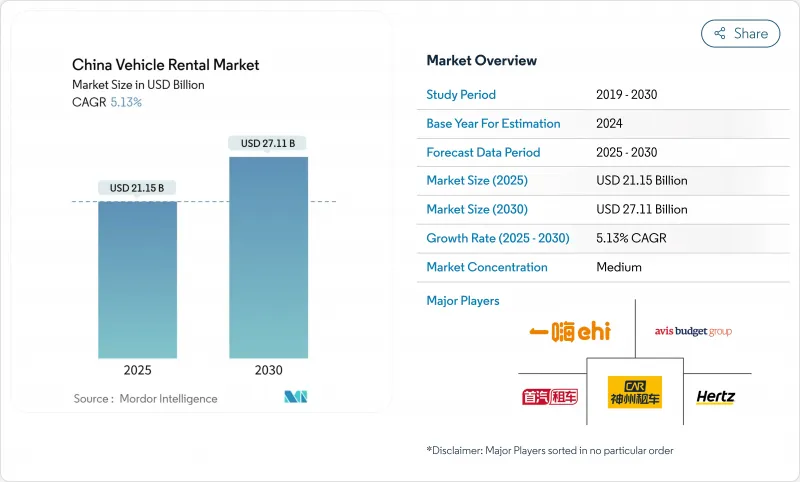

預計 2025 年中國汽車租賃市場價值將達到 211.5 億美元,到 2030 年預計將達到 271.1 億美元,預測期內(2025-2030 年)的複合年成長率為 5.13%。

國內休閒旅遊的復甦、一線城市車牌配額的收緊以及全國範圍內80%新能源汽車的強制要求,將推動消費者和企業管道的需求。二、三線城市中階駕照持有者數量的成長、人工智慧租車應用程式的快速普及以及政策向電動車型傾斜,正在以過去五年來最快的速度重塑汽車結構。

中國汽車租賃市場趨勢與洞察

國內旅遊業復甦推動休閒租賃市場

根據相關部門報告,2024年五一假期期間,國內旅客達2.95億人次,消費超過200億美元。休閒預訂量激增,推動了縣級旅遊目的地的汽車需求。柳州和淄博等城市吸引了首次出行的遊客,他們更傾向於選擇私家車而非公共交通,導致許多內陸地區的平均租車時間超過四天。租車在四個月內獲得了3000家國內供應商合作夥伴,彰顯了其數位市場平台的擴充性優勢。文化遺產地的夜間旅遊活動即使在深夜也保持著高利用率,支撐了高階定價。文化和旅遊部預測,到2025年,國內遊客數量將超過60億人次,證實了休閒是中國汽車租賃市場的支柱。

一線城市車牌分配刺激租賃需求

北京每年的私家車牌照搖號限額為10萬個,其中70%預留給電動車。這些限制使得許多通勤者選擇日租車輛比購買車輛更便宜。天津計畫每年發放8萬個綠色牌照,但仍維持對石化燃料的限制以緩解成本壓力。牌照配額制已使受影響城市的消費量和廢氣排放減少了近50%,同時也催生了一群穩定的租車者,他們將汽車視為偶爾使用的公共設施,而非資產。該政策也使租車公司向電動車傾斜,從而強化了政府的碳排放目標,並重塑了中國的汽車租賃市場。

叫車和自動駕駛計程車替代風險

百度Apollo Go在2023年第四季成功完成83.9萬次自動駕駛出行,票價比傳統計程車低60%至70%,展現了顛覆性的定價策略。小馬智行的目標是到2025年擁有1000輛自動駕駛汽車,而文遠知行則於2025年2月推出了連接北京大興國際機場的無人駕駛服務。機器人計程車業者擁有全天候服務以及較低的駕駛人相關費用的優勢,吸引了那些先前選擇租車接送機場和市區出行的人潮。顧問公司預測,到2030年,機器人計程車產業的規模將達到約760億美元,這意味著除非現有企業能夠獲得自動駕駛領域的夥伴關係,否則中國汽車租賃市場將面臨競爭阻力。

細分分析

2024年,休閒旅遊將佔中國汽車租賃市場佔有率的51.27%,這得益於度假出行成長7.6%以及人們對縣級文化景點重新燃起的興趣。自駕車是短程自駕遊和家庭聚會的首選,尖峰時段平均入住率可達74%。商務旅行預計將以5.22%的複合年成長率成長,這將受益於邊境重新開放以及企業ESG目標傾向於租賃而非擁有汽車。

休閒旅客的預訂時間比疫情前平均時間延長了2.1天,而商務旅客也擴大選擇捆綁了遠端資訊處理和排放氣體儀錶板報告的專車套餐。平台與景點的整合實現了一鍵式車輛和門票捆綁,從而擴大了每次租賃的收益窗口。

到2024年,線上預訂將佔總收益的64.38%,證明無摩擦移動旅行已成為主流,到2030年,其複合年成長率將達到5.41%。預測定價引擎將搜尋到預訂的時間縮短至平均四分鐘,輔助提升銷售增加18%,並提升每位客戶的終身價值。此外,全通路交接站允許顧客透過QR碼領取鑰匙,無需店員協助,縮小了便利性差距。

持續投資於雲端客戶關係管理和車載物聯網感測器,將使用數據反饋至平台,從而實現跨區域的當日庫存週轉。因此,使用動態線上叫車服務的車隊營運商比依賴靜態線下預訂的同業每輛車的收入高出12%,預計這一差距將在中國汽車租賃市場進一步擴大。

受自由行文化和日益成長的駕駛信心的推動,到2024年,自駕合約將佔總銷售額的71.32%。然而,企業採購團隊正以每年5.45%的比例轉向帶司機套餐,因為他們認為這種套餐更安全,更符合ESG審核。帶司機車輛的新能源汽車滲透率超過60%,高於整體平均水平,非常適合北京和深圳中央商務區的低排放氣體區域。

自動駕駛持續強勁成長,這得益於家庭友善行程、戶外露營趨勢以及在陌生地區使用應用程式導航的便利性。同時,專車服務產品也正在多元化發展,涵蓋活動物流和往返香港的跨境接駁車,從而擴大了中國汽車租賃市場的潛在需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 國內旅遊業復甦推動休閒租賃市場

- 一線城市車牌分配推動租賃需求

- 擁有駕照的中階日益壯大

- 強制車輛電氣化開啟零排放區

- 轉向數位和行動預訂平台

- 企業 ESG 目標推動長期綠色合約

- 市場限制

- 被叫車和自動駕駛計程車取代的風險

- 車輛購置和資金籌措成本上升

- 各州牌照分配波動擾亂車隊物流

- 電動車殘值的不確定性會對盈利造成壓力

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測

- 按用途

- 休閒/旅遊

- 商務旅行

- 按預訂類型

- 離線訪問

- 線上查詢

- 按最終用戶

- 自己

- 包括司機

- 按車輛類別

- 經濟

- 中檔

- 奢華

- SUV/MPV

- 按動力傳動系統

- 內燃機(ICE)

- 混合動力汽車(HEV)

- 純電動車(BEV)

- 按租賃期限

- 短期(少於一週)

- 中期(1週至1個月)

- 長期(1個月或以上)

- 按服務管道

- 機場內

- 機場/市中心外

- 按地區

- 華東地區

- 中國中南部

- 中國北方

- 中國西部

- 中國東北地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Beijing China Auto Rental(CAR Inc.)

- eHi Car Service

- Shouqi Car Rental

- Avis Budget Group

- Hertz Corporation

- Shenzhen Topone Car Rental

- Didi Car Rental

- EVCard

- Gofun Travel

- Xiangdao Chuxing

- UCAR Inc.

- Zuzuche

- Caocao Mobility

- PonyCar

- T3 Go Mobility

- Shenzhou Joy Travel

- Tongcheng-Elong Car Rental

- Huizuche

- Hello Chuxing Car Rental

- Meituan Car Rental

第7章 市場機會與未來展望

The China Vehicle Rental Market size is estimated at USD 21.15 billion in 2025, and is expected to reach USD 27.11 billion by 2030, at a CAGR of 5.13% during the forecast period (2025-2030).

A rebound in domestic leisure travel, stricter license-plate quotas in tier-1 cities, and a nationwide 80% new-energy fleet mandate are aligning to keep demand elevated across consumer and corporate channels. Rising middle-class licensed-driver numbers in tier-2 and tier-3 cities, the rapid diffusion of AI-enabled booking apps, and a policy tilt toward electric models are reshaping fleet composition faster than in any prior five-year period.

China Vehicle Rental Market Trends and Insights

Domestic Tourism Rebound Fuels Leisure Rentals

Leisure bookings surged after authorities reported 295 million domestic trips during the 2024 May Day holiday, spending more than 20 billion and lifting vehicle demand in county-level destinations. Cities such as Liuzhou and Zibo attracted first-time visitors who preferred self-drive access over public transport, pushing average rental duration above four days in many inland locations. Zuzuche responded by onboarding 3,000 domestic supplier partners inside four months, demonstrating the platform scalability advantage of digital marketplaces. Cultural-nighttime tourism at heritage sites kept utilization high into late evenings, supporting premium pricing windows. Momentum remains intact as the Ministry of Culture and Tourism forecasts domestic trips to exceed 6 billion in 2025, cementing leisure as the backbone of the China vehicle rental market.

License-Plate Quotas in Tier-1 Cities Spur Rental Demand

Beijing's annual lottery caps private cars at 100,000 new plates, 70% reserved for EVs, while Shanghai auctions often exceed CNY 95,000 per plate. These restrictions make daily rental cheaper than ownership for many commuters. Tianjin plans to issue 80,000 more green plates yearly but retains fossil-fuel limits, keeping cost pressure in place. Plate quotas have cut fuel consumption and tailpipe emissions by nearly 50% in affected cities, but they have simultaneously created a reliable flow of renters who view cars as occasional utilities rather than assets. The policy also skews fleets toward EVs, reinforcing government carbon goals and reshaping the China vehicle rental market.

Ride-Hailing & Robotaxi Substitution Risk

Baidu's Apollo Go completed 839,000 autonomous rides in Q4 2023 at fares 60-70% beneath traditional taxis, illustrating a disruptive price gap. Pony.ai targets a 1,000-vehicle fleet by 2025, while WeRide launched unmanned services linking Beijing Daxing International Airport in February 2025. Robotaxi operators benefit from 24/7 availability and lower driver-related expenses, diverting demand that historically favored rentals for airport transfers and intra-city errands. Consultancy forecasts place the robotaxi segment at nearly USD 76 billion by 2030, signalling competitive headwinds for the China vehicle rental market if incumbents cannot secure autonomous partnerships.

Other drivers and restraints analyzed in the detailed report include:

- Growing Licensed-Driver Middle Class

- Shift to Digital & Mobile Booking Platforms

- Rising Vehicle Acquisition & Financing Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Leisure and tourism held 51.27% of China vehicle rental market share in 2024, underpinned by a 7.6% jump in holiday trips and renewed interest in county-level cultural sites. Short road vacations and family reunions make self-drive cars the preferred option, driving average utilization to 74% during peak weeks. Business travel trails in absolute size but records the highest growth; its projected 5.22% CAGR benefits from border reopenings and corporate ESG targets favoring rental over owned fleets.

Second-order effects are already visible in spending patterns: leisure customers reserve 2.1 days longer than pre-pandemic averages, while business travelers increasingly opt for chauffeur-driven packages that bundle telematics and emissions dashboards for reporting purposes. Platform integrations with tourist attractions enable one-click car plus ticket bundles, extending the monetization window per rental.

Online reservations captured 64.38% of revenue in 2024-proof that frictionless mobile journeys have become table stakes, it is also growing at a CAGR of 5.41% through 2030. Predictive pricing engines reduce search-to-booking windows to four minutes on average and increase ancillary upselling by 18%, raising lifetime value per customer. Offline stores still matter in lower-tier cities where walk-in foot traffic remains notable, but omnichannel hand-over stations now allow QR-code key retrieval without staff, closing the convenience gap.

Investment continues to tilt toward cloud CRM and in-car IoT sensors that feed usage data back to the platform, enabling same-day inventory rotation across multiple districts. As a result, fleet operators using dynamic online allocation achieve 12% higher revenue-per-vehicle than peers relying on static offline reservations, a differential expected to expand in the China vehicle rental market.

Self-drive contracts controlled 71.32% of total revenue in 2024, fuelled by the cultural preference for independent travel and growing confidence behind the wheel. Yet chauffeur-driven packages advance at 5.45% annually because corporate procurement teams view them as safer and more compliant with ESG audit trails. Chauffeur fleets feature NEV penetration above 60%, exceeding the broader average and positioning them well for low-emission zones in Beijing or Shenzhen Central Business Districts.

Self-drive growth remains robust through family-oriented itineraries, outdoor camping trends, and the ease of app-based navigation in unfamiliar provinces. Simultaneously, chauffeur products diversify into event logistics and cross-border shuttles into Hong Kong, expanding addressable demand inside the China vehicle rental market.

The China Vehicle Rental Market Report is Segmented by Application (Leisure/Tourism and Business Travel), Booking Type (Offline Access and Online Access), End-User Type (Self-Driven and Chauffeur-Driven), Vehicle Class (Economy and More), Powertrain (ICE, HEV and BEV), Rental Duration (Short-Term and More), Service Channel (On-Airport and More), and Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Beijing China Auto Rental (CAR Inc.)

- eHi Car Service

- Shouqi Car Rental

- Avis Budget Group

- Hertz Corporation

- Shenzhen Topone Car Rental

- Didi Car Rental

- EVCard

- Gofun Travel

- Xiangdao Chuxing

- UCAR Inc.

- Zuzuche

- Caocao Mobility

- PonyCar

- T3 Go Mobility

- Shenzhou Joy Travel

- Tongcheng-Elong Car Rental

- Huizuche

- Hello Chuxing Car Rental

- Meituan Car Rental

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Domestic tourism rebound fuels leisure rentals

- 4.2.2 License-plate quotas in Tier-1 cities spur rental demand

- 4.2.3 Growing licensed-driver middle class

- 4.2.4 Fleet-electrification mandates open zero-emission zones

- 4.2.5 Shift to digital & mobile booking platforms

- 4.2.6 Corporate ESG targets drive long-term green subscriptions

- 4.3 Market Restraints

- 4.3.1 Ride-hailing & robotaxi substitution risk

- 4.3.2 Rising vehicle acquisition & financing costs

- 4.3.3 Provincial plate-quota volatility disrupts fleet logistics

- 4.3.4 EV residual-value uncertainty pressures profitability

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Application

- 5.1.1 Leisure / Tourism

- 5.1.2 Business Travel

- 5.2 By Booking Type

- 5.2.1 Offline Access

- 5.2.2 Online Access

- 5.3 By End-User Type

- 5.3.1 Self-Driven

- 5.3.2 Chauffeur-Driven

- 5.4 By Vehicle Class

- 5.4.1 Economy

- 5.4.2 Mid-Scale

- 5.4.3 Luxury

- 5.4.4 SUV / MPV

- 5.5 By Powertrain

- 5.5.1 Internal Combustion Engine (ICE)

- 5.5.2 Hybrid Electric Vehicle (HEV)

- 5.5.3 Battery Electric Vehicle (BEV)

- 5.6 By Rental Duration

- 5.6.1 Short-Term (Less than or equal to 1 Week)

- 5.6.2 Medium-Term (1 Week to 1 Month)

- 5.6.3 Long-Term (More than 1 Month)

- 5.7 By Service Channel

- 5.7.1 On-Airport

- 5.7.2 Off-Airport / Downtown

- 5.8 By Region

- 5.8.1 East China

- 5.8.2 South-Central China

- 5.8.3 North China

- 5.8.4 West China

- 5.8.5 Northeast China

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Beijing China Auto Rental (CAR Inc.)

- 6.4.2 eHi Car Service

- 6.4.3 Shouqi Car Rental

- 6.4.4 Avis Budget Group

- 6.4.5 Hertz Corporation

- 6.4.6 Shenzhen Topone Car Rental

- 6.4.7 Didi Car Rental

- 6.4.8 EVCard

- 6.4.9 Gofun Travel

- 6.4.10 Xiangdao Chuxing

- 6.4.11 UCAR Inc.

- 6.4.12 Zuzuche

- 6.4.13 Caocao Mobility

- 6.4.14 PonyCar

- 6.4.15 T3 Go Mobility

- 6.4.16 Shenzhou Joy Travel

- 6.4.17 Tongcheng-Elong Car Rental

- 6.4.18 Huizuche

- 6.4.19 Hello Chuxing Car Rental

- 6.4.20 Meituan Car Rental

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment