|

市場調查報告書

商品編碼

1822664

汽車租賃市場機會、成長動力、產業趨勢分析及2025-2034年預測Car Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

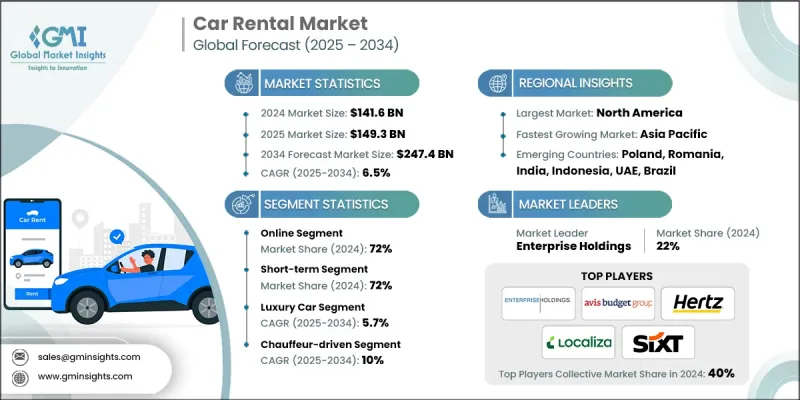

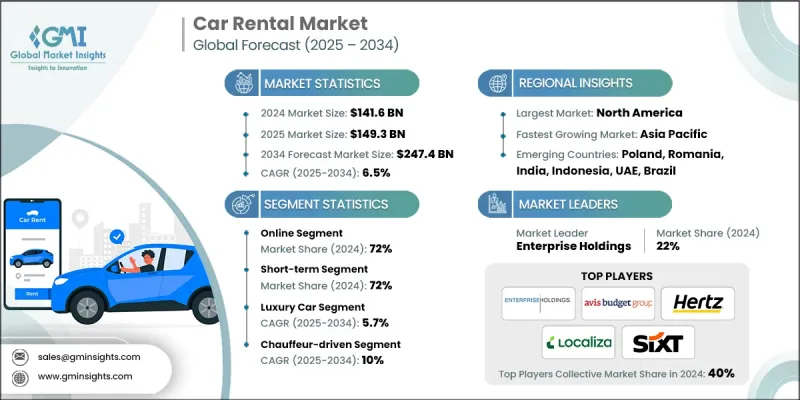

根據 Global Market Insights Inc. 發布的最新報告,2024 年全球汽車租賃市場規模估計為 1,416 億美元,預計將從 2025 年的 1,493 億美元成長到 2034 年的 2,474 億美元,複合年成長率為 6.5%。

國內和國際旅行的穩定成長是汽車租賃市場的重要驅動力。隨著越來越多人探索新的休閒或商務目的地,對靈活且便利的交通解決方案的需求也隨之成長。租車讓旅客能夠自由地以自己的步調探索,無需依賴大眾運輸時刻表或昂貴的計程車。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1416億美元 |

| 預測值 | 2474億美元 |

| 複合年成長率 | 6.5% |

在線領域需求不斷成長

2024年,線上預訂市場佔據了顯著佔有率,這得益於透過網站和行動應用程式為客戶提供無縫且便利的預訂體驗。這一市場受益於網路普及率和智慧型手機使用率的提高,使用戶可以即時比價、選擇車輛和管理預訂。各大公司正在大力投資數位平台,以增強用戶介面、整合人工智慧驅動的個人化功能並提供即時客戶支援。

短期租賃日益盛行

2024年,短期租車市場收入可觀,這得益於旅客和城市消費者尋求靈活、短期的用車體驗,且無需承擔購車負擔。這一市場的成長得益於旅遊和商務出行的日益成長,也得益於消費者對便利性和經濟性的日益偏好。從幾小時到幾天的租車時間,使用者能夠有效率地滿足即時的出行需求。市場參與者專注於提供具有競爭力的價格、豐富的車隊選擇以及便捷的車輛獲取,以佔領這一市場。

豪華車的普及率不斷提高

2024年,豪華汽車租賃市場佔據了相當大的佔有率,這得益於富裕消費者可支配收入的成長和對高階體驗日益成長的需求。豪華汽車租賃提供先進的功能、卓越的舒適度和品牌聲望,吸引了那些注重身份地位和專屬體驗的客戶。租賃公司正在透過與豪華汽車製造商合作、提供個人化服務以及利用數位平台針對高階客戶進行精準行銷來鞏固其市場地位。

北美將成為利潤豐厚的地區

受國內旅行成長、商業領域拓展以及技術創新等因素的共同推動,北美汽車租賃市場將在2034年之前保持強勁成長。各大公司正在利用資料分析和行動技術來提升客戶體驗、最佳化車隊管理並推出非接觸式租賃服務。與共享出行平台的策略合作以及電動車在租賃車隊中的引入,將進一步鞏固其市場地位。

汽車租賃市場的主要參與者有 Movida、Advantage Rent-a-car、Uber、Sixt、Europcar、CAR Inc.、Hertz、Localiza、Avis Budget Group 和 Enterprise Holdings。

汽車租賃市場的公司正在實施一系列策略性舉措,以鞏固其市場地位並滿足不斷變化的客戶期望。數位轉型是其中的重點,它們投資於行動應用程式、線上預訂平台和人工智慧客戶服務工具,以提升便利性並簡化租賃體驗。許多公司正在擴大其車隊規模,提供從經濟型到豪華型和電動車等更廣泛的選擇,以滿足不同客戶群的需求。

目錄

第1章:方法論

- 研究設計

- 研究方法

- 資料收集方法

- GMI 專有 AI 系統

- 人工智慧驅動的研究增強

- 來源一致性協議

- 基礎估算與計算

- 基準年計算

- 預測模型

- 市場評估的主要趨勢

- 量化市場影響分析

- 生長參數對預測的數學影響

- 情境分析框架

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 付費來源

- 來源(按地區)

- 付費來源

- 研究路徑和信心評分

- 研究路徑組件

- 評分組件

- 研究透明度附錄

- 來源歸因框架

- 品質保證指標

- 我們對信任的承諾

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 旅遊和商務旅行的興起

- 從所有權轉向使用權

- 數位平台和非接觸式租賃

- 永續發展推動

- 產業陷阱與挑戰

- 車隊維護和折舊成本高昂

- 監管和競爭壓力

- 市場機會

- 訂閱和 MaaS 整合

- 新興市場的成長

- 企業合作夥伴關係

- 技術差異化

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

- 用例

- 最佳情況

- 收入最佳化和輔助服務

- 每輛車收入(RPV)分析和基準化分析

- RPV:車輛類別、位置類型和季節

- 地理RPV變化與市場動態

- 企業與休閒領域的RPV比較

- RPV的歷史趨勢與未來預測

- 輔助收入來源與追加銷售策略

- GPS和導航系統收入貢獻

- 保險及保障產品銷售

- 燃油服務費和便利費

- 配件及設備租賃收入

- 升級和優質服務收入

- 動態定價和收入管理

- 人工智慧驅動的定價最佳化和效能

- 需求預測準確度和收入影響

- 競爭性定價情報與因應策略

- 季節性和基於事件的定價策略

- 交叉銷售與客戶價值提升

- 忠誠度計劃收入和客戶保留率

- 企業帳戶擴展和服務整合

- 數位平台貨幣化和佣金收入

- 酒店和旅遊服務合作夥伴關係

- 每輛車收入(RPV)分析和基準化分析

- 客戶獲取與終身價值分析

- 按通路和細分市場分類的客戶獲取成本 (CAC)

- 數位行銷 CAC 和轉換率

- 傳統廣告與合作通路成本

- 企業帳戶獲取投資和投資報酬率

- 推薦計劃的有效性和成本分析

- 客戶生命週期價值 (LTV) 建模和細分

- 按客戶類型和租賃頻率分類的 LTV

- 企業與休閒顧客價值比較

- 地域 LTV 差異和市場特徵

- 忠誠度計劃對 LTV 提升的影響

- 客戶保留與流失分析

- 按客戶細分和服務水準分類的保留率

- 客戶流失預測與預防策略

- 服務恢復和客戶贏回計劃

- 淨推薦值 (NPS) 對留存和成長的影響

- 按通路和細分市場分類的客戶獲取成本 (CAC)

- 保險與風險管理分析

- 保險成本結構與管理策略

- 車輛損壞和損失預防

- 詐欺防制和安全措施

- 責任管理和法律合規

- 車隊生命週期與資產管理

- 車輛採購和購置策略

- OEM合作夥伴關係和批量談判策略

- 購買與租賃決策框架與財務影響

- 車隊組合最佳化與需求調整

- 新車與二手車整合及成本分析

- 車隊利用率和性能最佳化

- 地理車隊分配和需求平衡

- 季節性車隊管理和容量規劃

- 車輛輪換和位置轉移最佳化

- 車輛維護和生命週期管理

- 預防性維護計劃最佳化

- 維護成本分析和供應商管理

- 最大限度地減少車輛停機時間並提高服務效率

- 預測性維護的技術整合

- 殘值管理與處置策略

- 轉售價值最佳化和市場時機

- 批發與零售處置通路表現

- 車輛狀況和翻新投資

- 處置成本管理和收益最大化

- 車輛採購和購置策略

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

- 服務品質和客戶滿意度基準

- 選址策略和市場覆蓋分析

- 品牌定位與行銷成效對比

第5章:市場估計與預測:按預訂量,2021 - 2034 年

- 主要趨勢

- 線上

- 離線

第6章:市場估計與預測:依租賃期限,2021 年至 2034 年

- 主要趨勢

- 短期

- 長期

第7章:市場估計與預測:依車型,2021 - 2034

- 主要趨勢

- 豪華轎車

- 行政車

- 經濟型轎車

- SUV

- MUV

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 休閒/旅遊

- 商業

第9章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 自我驅動

- 有司機駕駛

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Global companies

- Alamo Rent-a-Car

- Avis Budget Group

- eHi Car Services

- Enterprise Holdings

- Europcar

- Hertz Global Holdings

- Localiza

- Sixt

- Uber Technologies

- Zipcar

- Regional companies

- Advantage Rent A Car

- CAR Inc.

- Fox Rent A Car

- Green Motion

- Movida

- Payless Car Rental

- Rent-A-Wreck

- Thrifty Car Rental

- U-Save Car & Truck Rental

- 新興企業

- Book2wheel

- Drivezy

- Fluid Truck

- Getaround

- Gett

- HyreCar

- Maven

- Ola Cabs

- Rent Centric

- SHARE NOW

- Turo

- Zoomcar

The global car rental market was estimated at USD 141.6 billion in 2024 and is expected to grow from USD 149.3 billion in 2025 to USD 247.4 billion by 2034 at a CAGR of 6.5%, according to the latest report published by Global Market Insights Inc.

The steady growth in domestic and international travel is a significant driver of the car rental market. As more people explore new destinations for leisure or business, the need for flexible and convenient transportation solutions rises. Rental cars offer travelers the freedom to explore at their own pace without relying on public transit schedules or costly taxis.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $141.6 Billion |

| Forecast Value | $247.4 Billion |

| CAGR | 6.5% |

Rising Demand in the Online Segment

The online segment held a notable share in 2024, driven by offering customers seamless, convenient booking experiences through websites and mobile apps. This segment benefits from rising internet penetration and smartphone usage, allowing users to compare prices, select vehicles, and manage reservations in real time. Companies are investing heavily in digital platforms to enhance user interface, integrate AI-driven personalization, and provide instant customer support.

Increasing Prevalence of Short-Term Rentals

The short-term car rental segment generated significant revenues in 2024, backed by travelers and urban customers seeking flexible, short-duration vehicle use without the burden of ownership. This segment's growth, driven by increasing tourism and business travel, is supported by rising consumer preference for convenience and affordability. Rentals spanning from a few hours to several days allow users to meet immediate transportation needs efficiently. Market players focus on offering competitive pricing, diverse fleet options, and quick vehicle access to capture this segment.

Increasing Adoption of Luxury Cars

The luxury car rental segment held a sizeable share in 2024, propelled by growing disposable incomes and rising demand for premium experiences among affluent consumers. Luxury rentals offer advanced features, superior comfort, and brand prestige, attracting customers who prioritize status and exclusivity. Rental companies are strengthening their market foothold by partnering with luxury car manufacturers, offering personalized services, and leveraging digital platforms for targeted marketing to upscale clientele.

North America to Emerge as a Lucrative Region

North America car rental market will witness robust growth through 2034, driven by a combination of rising domestic travel, expanding business sectors, and technological innovation. Companies are leveraging data analytics and mobile technology to enhance customer experience, optimize fleet management, and introduce contactless rentals. Strategic collaborations with ride-sharing platforms and the introduction of electric vehicles in rental fleets are further strengthening market positions.

Major players in the car rental market are Movida, Advantage Rent-a-car, Uber, Sixt, Europcar, CAR Inc., Hertz, Localiza, Avis Budget Group, and Enterprise Holdings.

Companies operating in the car rental market are implementing a range of strategic initiatives to strengthen their market position and meet evolving customer expectations. A major focus is on digital transformation, with investments in mobile apps, online booking platforms, and AI-powered customer service tools to enhance convenience and streamline the rental experience. Many firms are expanding their vehicle fleets, offering a wider variety of options-from economy to luxury and electric vehicles-to cater to different customer segments.

Table of Contents

Chapter 1 Methodology

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 GMI proprietary AI system

- 1.1.3.1 AI-Powered research enhancement

- 1.1.3.2 Source consistency protocol

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.3 Forecast model

- 1.3.1 Key trends for market estimation

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Research Trail & Confidence Scoring

- 1.6.1 Research Trail Components

- 1.6.2 Scoring Components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Booking

- 2.2.3 Rental length

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising tourism & business travel

- 3.2.1.2 Shift from ownership to access

- 3.2.1.3 Digital platforms & contactless rentals

- 3.2.1.4 Sustainability push

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High fleet maintenance & depreciation costs

- 3.2.2.2 Regulatory & competitive pressures

- 3.2.3 Market opportunities

- 3.2.3.1 Subscription & MaaS Integration

- 3.2.3.2 Emerging markets growth

- 3.2.3.3 Corporate partnerships

- 3.2.3.4 Technology differentiation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

- 3.13 Revenue optimization and ancillary services

- 3.13.1 Revenue Per Vehicle (RPV) Analysis and Benchmarking

- 3.13.1.1 RPV: vehicle category, location type, and season

- 3.13.1.2 Geographic RPV variations and market dynamics

- 3.13.1.3 Corporate vs. Leisure segment RPV comparison

- 3.13.1.4 Historical RPV trends and future projections

- 3.13.2 Ancillary revenue streams and upselling strategies

- 3.13.2.1 GPS and navigation system revenue contribution

- 3.13.2.2 Insurance and protection product sales

- 3.13.2.3 Fuel service and convenience fees

- 3.13.2.4 Accessories and equipment rental revenue

- 3.13.2.5 Upgrade and premium service revenue

- 3.13.3 Dynamic pricing and revenue management

- 3.13.3.1 AI-powered pricing optimization and performance

- 3.13.3.2 Demand forecasting accuracy and revenue impact

- 3.13.3.3 Competitive pricing intelligence and response strategies

- 3.13.3.4 Seasonal and event-based pricing strategies

- 3.13.4 Cross-selling and customer value enhancement

- 3.13.4.1 Loyalty program revenue and customer retention

- 3.13.4.2 Corporate account expansion and service integration

- 3.13.4.3 Digital platform monetization and commission revenue

- 3.13.4.4 Hotel and travel service partnerships

- 3.13.1 Revenue Per Vehicle (RPV) Analysis and Benchmarking

- 3.14 Customer acquisition and lifetime value analysis

- 3.14.1 Customer acquisition cost (CAC) by channel and segment

- 3.14.1.1 Digital marketing CAC and conversion rates

- 3.14.1.2 Traditional advertising and partnership channel costs

- 3.14.1.3 Corporate account acquisition investment and ROI

- 3.14.1.4 Referral program effectiveness and cost analysis

- 3.14.2 Customer lifetime value (LTV) modeling and segmentation

- 3.14.2.1 LTV by customer type and rental frequency

- 3.14.2.2 Corporate vs. Leisure customer value comparison

- 3.14.2.3 Geographic LTV variations and market characteristics

- 3.14.2.4 Loyalty program impact on LTV enhancement

- 3.14.3 Customer retention and churn analysis

- 3.14.3.1 Retention rate by customer segment and service level

- 3.14.3.2 Churn prediction and prevention strategies

- 3.14.3.3 Service recovery and customer win-back programs

- 3.14.3.4 Net promoter score (NPS) impact on retention and growth

- 3.14.1 Customer acquisition cost (CAC) by channel and segment

- 3.15 Insurance and risk management analysis

- 3.15.1 Insurance cost structure and management strategies

- 3.15.2 Vehicle damage and loss prevention

- 3.15.3 Fraud prevention and security measures

- 3.15.4 Liability management and legal compliance

- 3.16 Fleet lifecycle and asset management

- 3.16.1 Vehicle procurement and acquisition strategy

- 3.16.1.1 OEM partnership and volume negotiation strategies

- 3.16.1.2 Purchase vs. Lease decision framework and financial impact

- 3.16.1.3 Fleet mix optimization and demand alignment

- 3.16.1.4 New vs. Used vehicle integration and cost analysis

- 3.16.2 Fleet utilization and performance optimization

- 3.16.2.1 Geographic fleet allocation and demand balancing

- 3.16.2.2 Seasonal fleet management and capacity planning

- 3.16.2.3 Vehicle rotation and location transfer optimization

- 3.16.3 Vehicle maintenance and lifecycle management

- 3.16.3.1 Preventive maintenance program optimization

- 3.16.3.2 Maintenance cost analysis and vendor management

- 3.16.3.3 Vehicle downtime minimization and service efficiency

- 3.16.3.4 Technology integration for predictive maintenance

- 3.16.4 Residual value management and disposal strategy

- 3.16.4.1 Resale value optimization and market timing

- 3.16.4.2 Wholesale vs. Retail disposal channel performance

- 3.16.4.3 Vehicle condition and refurbishment investment

- 3.16.4.4 Disposal cost management and revenue maximization

- 3.16.1 Vehicle procurement and acquisition strategy

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Service quality and customer satisfaction benchmarking

- 4.8 Location strategy and market coverage analysis

- 4.9 Brand positioning and marketing effectiveness comparison

Chapter 5 Market Estimates & Forecast, By Booking, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Online

- 5.3 Offline

Chapter 6 Market Estimates & Forecast, By Rental length, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Short term

- 6.3 Long term

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Luxury cars

- 7.3 Executive cars

- 7.4 Economy cars

- 7.5 SUVs

- 7.6 MUVs

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Leisure/ Tourism

- 8.3 Business

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Self-driven

- 9.3 Chauffeur-driven

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 Alamo Rent-a-Car

- 11.1.2 Avis Budget Group

- 11.1.3 eHi Car Services

- 11.1.4 Enterprise Holdings

- 11.1.5 Europcar

- 11.1.6 Hertz Global Holdings

- 11.1.7 Localiza

- 11.1.8 Sixt

- 11.1.9 Uber Technologies

- 11.1.10 Zipcar

- 11.2 Regional companies

- 11.2.1 Advantage Rent A Car

- 11.2.2 CAR Inc.

- 11.2.3 Fox Rent A Car

- 11.2.4 Green Motion

- 11.2.5 Movida

- 11.2.6 Payless Car Rental

- 11.2.7 Rent-A-Wreck

- 11.2.8 Thrifty Car Rental

- 11.2.9 U-Save Car & Truck Rental

- 11.3 Emerging players

- 11.3.1 Book2wheel

- 11.3.2 Drivezy

- 11.3.3 Fluid Truck

- 11.3.4 Getaround

- 11.3.5 Gett

- 11.3.6 HyreCar

- 11.3.7 Maven

- 11.3.8 Ola Cabs

- 11.3.9 Rent Centric

- 11.3.10 SHARE NOW

- 11.3.11 Turo

- 11.3.12 Zoomcar