|

市場調查報告書

商品編碼

1693917

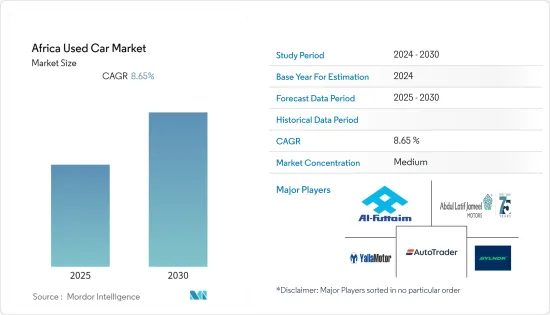

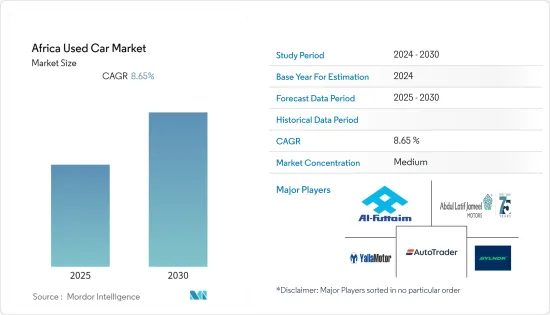

非洲二手車市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Africa Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計預測期內非洲二手車市場的複合年成長率將達到 8.65%

關鍵亮點

- 非洲是二手車進口大國,約佔進口總量的40%。這一趨勢主要由奈及利亞、利比亞和肯亞等非洲國家推動。二手車在非洲汽車持有中佔有相當大的比重,約佔總量的85%。為了應對二手車二氧化碳排放增加的擔憂,並為了保護當地的汽車製造業,各地方監管機構對二手車進口實施了限制。

- 非洲二手車市場正在不斷擴大。引入有組織的參與企業進入市場正在解決困擾二手車行業數十年的信貸短缺問題。

非洲二手車市場的趨勢

多家公司增加投資可能會增強二手車市場的需求軌跡—非洲二手車市場的趨勢

- 非洲是約40%二手輕型車輛的最終目的地。由於近年來該地區消費者的購買力提高和平均可支配收入增加,這些二手車受到極大青睞。有組織的二手車產業細分程度適中,只有少數零售商和經銷商大規模銷售所有細分市場的車輛。雖然這個市場中的多個參與者正在使用各種商業策略,但很少有人投資擴大他們的交付管道,並且經常採用不同的方法來釋放這個不斷成長的行業的潛力。

- 例如,2023 年 6 月,肯亞二手車市場 Peach Cars 宣佈在由日本東京大學 Edge Capital Partners (UTEC)主導的種子輪資金籌措中籌集了 500 萬美元。 Peach Cars 旨在透過提供透明、高效和可靠的線上平台來解決二手車市場買家和賣家面臨的挑戰。這家新興企業致力於提升客戶體驗和簡化購車流程,旨在顛覆現有產業並在肯亞汽車市場創造新的卓越標準。

- 2023 年 2 月,南非二手車市場 Planet42 投資 1 億美元擴大在南非和墨西哥的業務。 Planet42 董事總經理 Grant Wing 表示,該公司的目標是每年佔領二手車市場的 1% 左右,相當於總車隊規模約為 20 萬輛。這1億美元將有助於實現這一目標。

- 這些投資將改善基礎設施,例如擴大我們的經銷商網路和加強我們的線上平台,使客戶更容易獲得和購買二手車。此外,增加投資通常會提高人們對購買二手車的好處的認知,並增加行銷和促銷活動。因此,這些投資的累積效應可能會創造積極的勢頭,吸引更多的買家,並最終增強非洲對二手車的需求。

埃及和摩洛哥在市場中發揮關鍵作用

- 在非洲國家中,埃及和摩洛哥被公認為非洲二手車市場成長的推動力。同樣,南非、奈及利亞和肯亞是繼埃及和摩洛哥之後保持市場成長的國家。

- 摩洛哥是非洲成長最快的市場之一,由於各種政策發展和基礎設施投資,每年銷售超過 18 萬輛新車和約 56 萬輛二手車。短短十年間,摩洛哥汽車產業蓬勃發展,預計2023年將佔該國經濟活動的近四分之一,也是非洲最大的汽車出口國。這種快速成長意味著摩洛哥現在已成為汽車行業外國投資者的重要生產中心,其供應鏈由 250 家全球公司和中小企業組成,為全球 75 個出口目的地的汽車設施提供服務。

- 這些國家近年來二手車購買量大幅成長,一系列超越傳統旅遊出行方式的車款備受關注。該行業正在擴大其範圍以滿足日益成長的需求,並採購二手車來滿足乘客的需求,從而促進市場擴張。 COVID-19案例的增加導致人們對個人交通工具的需求增加。此外,無法購買新車的個人正在轉向二手車服務,預計這將在不久的將來進一步刺激產品需求。然而,二手車公司正在透過策略性舉措擴大其在不同國家的市場佔有率。例如,

- 2022 年 5 月,埃及線上零售商 Sylndr 宣布已成功獲得 RAED Ventures主導的1,260 萬美元種子前資金籌措。 Sylndr 的核心業務是從客戶那裡收購二手車,對其整修並進行嚴格的售前檢查,然後將這些升級版車輛連同保固和融資解決方案一起直接提供給客戶。在埃及,每天有超過 2,000 輛二手車進行交易,每年售出 75 萬輛二手車,存在著阻礙令人滿意的客戶體驗的重大挑戰。主要挑戰包括買家和賣家之間信任度低、優質二手車稀缺性以及融資選擇有限。

- 由於這些因素,預計未來幾年二手車需求將持續成長,這將對二手車市場產生積極影響。

非洲二手車產業概況

非洲二手車市場細分程度適中,主要企業包括 Al-Futtaim Group、Autocheck、Abdul Latif Jameel Motors、Yallamotor、Carzami、AutoTrader 和 Cars 4 Africa。非洲二手車市場的大多數參與企業都面臨著激烈的競爭,他們採取各種發展和策略來搶佔市場佔有率並吸引客戶。例如

2023 年 4 月,奈及利亞汽車銷售和購買平台 Autocheck 收購了埃及二手車市場 AutoTager 的多數股權。此次收購使 Autochek 能夠加強在北非的業務,首先是非洲大陸第二大汽車市場埃及。該公司目前業務遍及東非、西非和北非的九個國家。

2022 年 9 月,總部位於埃及的優質二手車和汽車融資線上零售商 Carzami Inc. 宣布完成由 Contact Financial Holding主導的種子輪融資,並提供可擴展的庫存融資工具。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 新車高成本以及對經濟承受能力的擔憂正在推動市場

- 其他

- 市場限制

- 嚴格的政府法規和進口稅限制了市場成長

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按車輛類型

- 掀背車

- 轎車

- 運動型多用途車與多用途車

- 按供應商

- 組織

- 非組織

- 按國家

- 南非

- 摩洛哥

- 阿爾及利亞

- 埃及

- 奈及利亞

- 迦納

- 肯亞

- 其他非洲國家

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Al-Futtaim Group

- Abdul Latif Jameel Motors

- Yallamotor

- AutoTrader South Africa

- Cars 4 Africa

- Carzami

- Autochek Africa

- AutoTager

- Cars45

- KIFAL Auto

- PeachCars

- Planet42

- Sylndr

- Mogo Auto LTD

- Schulenburg Motors

- Euroken Automobiles Ltd

- Global Cars Trading FZ LLC

- cars2africa

- Abi Sayara

- Cardealers.africa

- We Buy Cars(Pty)Ltd

- OLX Group

- CarMax East Africa Ltd

第7章 市場機會與未來趨勢

The Africa Used Car Market is expected to register a CAGR of 8.65% during the forecast period.

Key Highlights

- Africa constitutes the measurable share and accounts for approximately 40% of imported used vehicle transitions. This trend is predominantly propelled by African countries such as Nigeria, Libya, and Kenya. Used vehicles make up a significant portion, accounting for 85% of the overall vehicle fleet in Africa. In response to the concerns about elevated carbon emissions originating from pre-owned cars and to safeguard the local vehicle manufacturing sector, various regional regulatory entities have enforced restrictions on the importation of used vehicles.

- The market for used cars in Africa is continuously expanding. The introduction of organized participants into the market in developing countries has addressed the trust deficit that has plagued the used car industry in those countries for decades.

Africa Used Car Market Trends

Increasing Investments by Several Companies is Likely to Strengthen the Demand Trajectory for Used Car Market -

- Africa is the ultimate destination for some 40% of used light-duty vehicles. Consumers in the regions were deeply attracted to these used cars owing to an increase in their purchasing capabilities and a hike in their average disposable income during recent times. Yet, the organized sector of the used car has been moderately fragmented owing to only a few retailers and distributors selling the vehicles of all segments on a larger scale. Several companies in the market use various business strategies, and few are investing in expanding the offering channel and often employ different approaches to tap into the potential of this growing industry.

- For instance, in June 2023, Peach Cars, a Kenyan Used car marketplace, announced that it had raised $5 million in a seed funding round led by Japan-based University of Tokyo Edge Capital Partners (UTEC). Peach Cars aims to address the challenges faced by buyers and sellers in the used car market by providing a transparent, efficient, and trustworthy online platform. With a focus on enhancing the customer experience and streamlining the car purchasing process, the startup intends to disrupt the industry and create a new standard of excellence in the Kenyan automotive market.

- In February 2023, Planet42, a Used car marketplace in South Africa, invested $100 million to scale its operations across South Africa and Mexico. According to Planet42 managing director Grant Wing, they aimed to capture about 1% of the used car market annually, which translated to about 200,000 cars in total fleet size. The USD 100 million will come in handy in achieving this.

- These investments can result in improved infrastructure, such as expanded dealership networks and enhanced online platforms, making it easier for customers to access and purchase used cars. Additionally, increased investment often leads to higher marketing and promotional activities, raising awareness about the benefits of buying used cars. As a result, the cumulative effect of these investments is likely to create positive momentum, attracting more buyers and ultimately strengthening the demand for used cars in Africa.

The Egypt and Morocco to Play a Significant Role in the Market -

- Among all the countries in Africa, Egypt and Morocco have been identified as the growth enabler for Africa's used car market owing to the widespread consumer group for used cars in the region. Likewise, South Africa, Nigeria, and Kenya are the next countries keeping pace with the market with Egypt and Morocco.

- Morocco is one of the most developed automotive markets in Africa, with more than 180,000 new cars and around 560,000 used cars sold annually as a result of various policy developments and investments in infrastructure. In just a decade, Morocco's automotive sector has exploded, accounting for nearly a quarter of the country's economic activity in 2023. The country is also Africa's largest exporter of cars. This rapid growth means Morocco is now a key production hub for foreign investors in the automotive industry, with a supply chain of 250 global players and SMEs serving automotive facilities in 75 global export destinations.

- In the countries, used car buying has experienced substantial growth in recent years, with various models beyond the traditional tour trip approach gaining prominence. The sector is expanding its reach to meet rising demand and is procuring used vehicles to fulfill passengers' needs, thereby driving market expansion. The escalation in COVID-19 cases has heightened the desire for personal transportation. Additionally, individuals who cannot make a full new car purchase are turning to used car services, which is anticipated to further stimulate product demand in the near future. However, used car companies are enhancing their market presence in the countries through strategic initiatives. For instance,

- In May 2022, Egypt-based online retailer player Sylndr announced its successful attainment of $12.6 million in pre-seed funding led by RAED Ventures. Sylndr's core business involves acquiring used cars from customers, subjecting them to refurbishment and rigorous pre-sale inspections, and subsequently offering these enhanced cars directly to customers along with warranties and financing solutions within a market context where over 2,000 used cars are transacted daily and an annual figure of 750,000 used cars sold in Egypt, notable challenges hinder satisfactory customer experiences. Predominant issues encompass a dearth of trust between buyers and sellers, the scarcity of premium used cars, and limited access to financing options.

- Owing to such factors, the demand for pre-owned vehicles will remain in a growth trajectory over the coming years and will have a subsequent positive impact on the used car market.

Africa Used Car Industry Overview

The African used car market is moderately fragmented, with a few key players in the market being Al-Futtaim Group, Autocheck, Abdul Latif Jameel Motors, Yallamotor, Carzami, AutoTrader, Cars 4 Africa, and others. The majority of players in the African used car market engage in fierce competition by employing a variety of developments and strategies to capture market share and attract customers. For instance,

In April 2023, Nigeria-based car selling and buying platform Autocheck acquired a majority stake in Egypt's used cars marketplace, AutoTager. The acquisition enables Autochek to deepen its presence in North Africa, starting with Egypt, the second-largest automotive market in Africa. The company currently has a presence in nine countries across East, West, and North Africa.

In September 2022, Egypt-based Carzami Inc., an online retailer for quality used cars and vehicle financing, announced the close of a pre-seed round led by contact financial holding, together with a scalable inventory financing facility, which it plans to use to transform Egypt's used car market targeting USD 30 million in revenue by 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 High Cost Associated With the New Cars and Affordability Concerns Drive the Market

- 4.1.2 Others

- 4.2 Market Restraints

- 4.2.1 Stringent Governmental Regulations and Import Taxes Restrict the Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD)

- 5.1 By Vehicle Type

- 5.1.1 Hatchbacks

- 5.1.2 Sedan

- 5.1.3 Sports Utility Vehicles and Multi-Purpose Vehicles

- 5.2 By Vendor

- 5.2.1 Organized

- 5.2.2 Unorganized

- 5.3 By Country

- 5.3.1 South Africa

- 5.3.2 Morocco

- 5.3.3 Algeria

- 5.3.4 Egypt

- 5.3.5 Nigeria

- 5.3.6 Ghana

- 5.3.7 Kenya

- 5.3.8 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Al-Futtaim Group

- 6.2.2 Abdul Latif Jameel Motors

- 6.2.3 Yallamotor

- 6.2.4 AutoTrader South Africa

- 6.2.5 Cars 4 Africa

- 6.2.6 Carzami

- 6.2.7 Autochek Africa

- 6.2.8 AutoTager

- 6.2.9 Cars45

- 6.2.10 KIFAL Auto

- 6.2.11 PeachCars

- 6.2.12 Planet42

- 6.2.13 Sylndr

- 6.2.14 Mogo Auto LTD

- 6.2.15 Schulenburg Motors

- 6.2.16 Euroken Automobiles Ltd

- 6.2.17 Global Cars Trading FZ LLC

- 6.2.18 cars2africa

- 6.2.19 Abi Sayara

- 6.2.20 Cardealers.africa

- 6.2.21 We Buy Cars (Pty) Ltd

- 6.2.22 OLX Group

- 6.2.23 CarMax East Africa Ltd