|

市場調查報告書

商品編碼

1851373

印度二手車市場:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)India Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

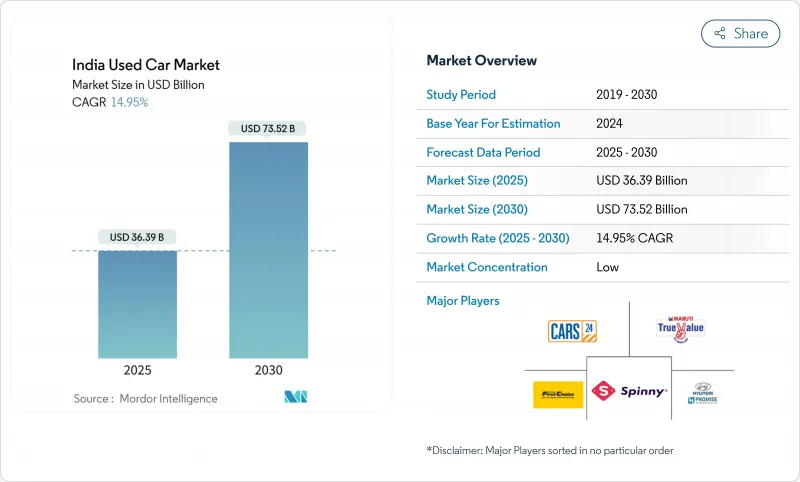

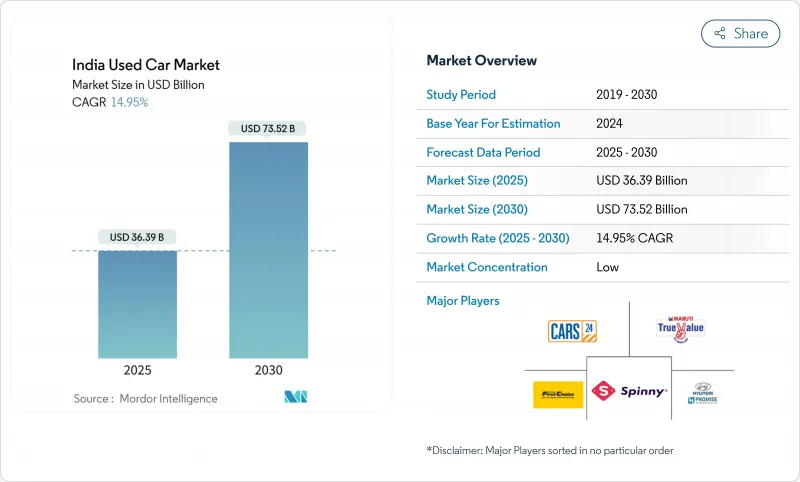

印度二手車市場預計到 2025 年將成長至 363.9 億美元,到 2030 年將成長至 735.2 億美元,複合年成長率為 14.95%。

快速的數位化、不斷上漲的新車價格、日益完善的信貸管道以及不斷變化的燃料結構偏好,持續重塑市場動態。隨著價格透明、融資方案和保固服務等優勢的提升,正規經銷商和線上平台正在削弱傳統的本地經銷商主導地位,提振了消費者信心。供應限制,尤其是在3000至5000盧比價格頻寬,正推動二手車年均價格上漲8%至10%,而報廢政策和消費稅(GST)的調整則加速了更換週期,使規模較大的企業佔據優勢。 SUV、緊湊型跨界車和純電動車型透過拓展產品組合和目標客戶群,開闢了新的成長點。

印度二手車市場趨勢與洞察

有組織的數位零售平台的興起

數位轉型正為傳統上不透明的市場帶來前所未有的透明度,預計到2030年,有組織的零售市場佔有率將從30%成長到50%。 Cars24斥資50億印度盧比進行技術投資,並聘請了100多名技術專家,顯示建立即時評估演算法和維護追蹤系統需要大量的資金投入。 CarTrade Tech每年擁有1.5億不重複訪客,自然流量佔比高達90%,證明了其輕資產數位平台模式的擴充性。女性購車者對數位化交易的偏好尤其明顯,她們的購車比例已從2024會計年度第三季的35%上升至46%,其中德里-NCR地區以48%的女性參與率領先。隨著融資整合日益重要,平台整合也加速推進,Cars24 60%的交易都採用了融資解決方案。二、三線城市採用新技術將減少先前有利於本地經銷商的資訊不對稱,並在市場中產生民主化效應,透過改進價格發現機制使買賣雙方受益。

新車價格上漲與折舊免稅額加速

新車價格壓力正從根本上改變消費者的購買決策,預計2023會計年度二手車銷售量將達到517萬輛,到2028會計年度將翻倍,達到1,000萬輛。平均車齡已從6-8年縮短至4-5年,加快了供應速度,有利於二手車市場的發展。 Cars24的平均售價上漲至5.50印度盧比,反映了消費者對高階車的偏好,其中40%的銷售量集中在4-8印度盧比的價格區間。供需失衡導致價格每年上漲8-10%,尤其影響首次購車者,他們佔車主總數的63%,但卻面臨購車能力的限制。高階車市場折舊免稅額的現象最為顯著,技術過時和功能更新正在加速更換週期。市場動態表明,二手車正成為人們進入汽車市場的主要途徑,而新車銷售越來越專注於更換用戶,而非首次購車者。

品質不明和里程表造假

資訊不對稱仍是市場擴張的主要障礙,品質評估的挑戰在佔市場佔有率70%的非正規市場尤為突出。傳統的檢測方法缺乏標準化,導致消費者不信任,限制了市場准入,並削弱了授權經銷商的定價權。數位平台正在大力投資標準化檢測通訊協定,例如Cars24就實施了200項檢測流程和即時競標機制,以確保價格透明且具競爭力。區塊鏈技術在印度汽車產業的應用有望透過不可竄改的記錄來解決可追溯性問題,但與全球汽車巨頭相比,其應用仍然有限。品質不確定性問題在車齡超過八年的車輛中最為突出,因為評估車輛的機械狀況需要專業知識,而許多買家缺乏這方面的知識。消費者教育和標準化的評級體係正成為競爭優勢,正規企業利用科技建立信任,並以此證明其高於非正規企業的定價合理性。

細分市場分析

作為入門級出行解決方案,微型車/掀背車預計在2024年將佔據34.23%的市場佔有率,而SUV將以16.20%的複合年成長率(2025-2030年)實現最快成長。福特翼搏(EcoSport)儘管已於2021年停產,但其持續的熱銷表明,某些車型憑藉其久經考驗的可靠性和完善的售後服務,依然保持著強勁的二手車需求。隨著消費者轉向SUV和掀背車,轎車的偏好正在下降,傳統的三廂轎車設計也逐漸失去年輕消費者的青睞,他們更看重車輛的離地間隙和靈活的載貨空間。多功能車/MPV細分市場則滿足了特定商用車和大家庭的需求,在二線城市保持穩定的需求,因為這些城市仍然普遍存在大家庭模式。

豪華車和跑車市場受益於都市區消費者對高階車型的追求,寶馬、奧迪和賓士等品牌紛紛推出認證二手項目,以滿足這一需求並維護品牌股權。這種市場區隔反映了更廣泛的汽車發展趨勢:SUV 正在成為各個價格分佈的主流車型,這得益於燃油效率和乘坐舒適性的提升,彌補了傳統 SUV 的不足。消費者偏好的變化預示著 SUV 市場佔有率將持續成長,尤其是在緊湊型和中型 SUV 領域,因為製造商將不斷推出新車型以滿足新車和二手車二手的需求。

到2024年,非正規本地經銷商將維持71.43%的市場佔有率,這反映出市場分散性以及消費者在高價值交易中更傾向於建立人際關係。線上平台將實現最快成長,2025年至2030年的複合年成長率將達到27.50%,這主要得益於透明度舉措和融資整合,這些舉措解決了二手車交易中的傳統痛點。原廠認證的特許經銷商專案利用品牌信任和標準化流程,吸引注重品質、願意為車輛狀況和保固服務支付溢價的買家。大型多品牌線下經銷商則佔據中間位置,它們提供的車型選擇比原廠認證專案更豐富,同時也提供線上平台所不具備的實車檢驗服務。

隨著數位平台在技術基礎設施和客戶獲取方面投入巨資,供應商格局正在迅速演變。 Cars24 高達 500 億盧比的投資顯示了其引領市場所需的雄厚資本。 CarTrade Tech 每年 1.5 億不重複訪客和 90% 的自然流量證明了數位平台模式的擴充性和客戶獲取效率。隨著正規企業在資金籌措、物流和客戶服務方面獲得非正規經銷商無法比擬的規模優勢,市場整合似乎不可避免。然而,由於本地經銷商擁有關係和成本優勢,這項轉型的時間表仍存在不確定性。

到2024年,汽油動力車將以61.47%的市佔率佔據主導地位,這得益於完善的加油基礎設施和消費者對其的熟悉程度。同時,儘管基數較低,純電動車(BEV)仍將以35.60%的複合年成長率(2025-2030年)實現顯著成長。然而,電動車的成長軌跡面臨二手車殘值方面的挑戰,51%的電動車車主由於充電和維護成本的擔憂,正在考慮轉換購買燃油車。柴油車在商業和遠距運輸場景中仍然具有吸引力,但由於排放法規和購買成本的上升,其偏好正在下降。壓縮天然氣(CNG)汽車在基礎設施完善的市場中佔據著一定的市場佔有率,尤其是在德里-NCR地區,當地的監管支援和成本優勢正在推動其普及。

混合動力汽車是一種過渡性技術,它既能解決里程焦慮,又能提高燃油效率,但由於購買成本高且車型選擇有限,其市場滲透率仍然有限。燃料類型的細分反映了印度能源轉型的複雜性,基礎設施的限制和成本考量導致了多種可行的動力傳動系統選擇,而非出現一種明顯的技術贏家。市場動態表明,內燃機汽車在短期內仍將佔據主導地位,而隨著充電基礎設施的擴展和電池成本的下降,電動車的普及速度將會加快。然而,鑑於目前二手車殘值方面的挑戰,這項轉型的時間表仍存在不確定性。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 有組織的數位零售平台的興起

- 新車價格高且折舊免稅額迅速

- 擴大信貸供應和金融科技貸款

- SUV車型在保值方面越來越受歡迎

- 車輛報廢政策旨在加快車輛周轉率。

- 放棄車隊模式,回歸訂閱模式

- 市場限制

- 品質不明和里程表造假

- 針對車齡超過8年的車輛,融資方案有限

- 更嚴格的排放法規/零排放車輛法規將降低舊式內燃機汽車的價值

- 微出行和叫車將降低對首批汽車的需求。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按車輛類型

- 微型/掀背車

- 轎車

- 運動型多用途車

- 多用途車輛

- 豪華與運動

- 按供應商

- OEM認證特許經營

- 線上平台

- 大型多品牌線下經銷商

- 當地非正規經銷商

- 按燃料類型

- 汽油

- 柴油引擎

- CNG

- 混合

- 電動車

- 車齡

- 不到3年

- 3至5年

- 6至8歲

- 8年以上

- 以擁有車輛數量計算

- 第一任車主

- 第二任車主

- 第三任或以上所有者

- 按價格分佈

- 不到30萬

- 30萬至50萬

- 50萬至80萬

- 80萬至120萬

- 120萬盧比以上

- 透過傳輸

- 手動的

- 自動的

- 按地區

- 印度北部

- 西印度群島

- 南印度

- 東印度

- 印度中部

- 印度東北部

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- CARS24

- Maruti Suzuki True Value

- Mahindra First Choice Wheels

- Hyundai H Promise

- Honda Auto Terrace

- Toyota U Trust

- Ford Assured

- Big Boy Toyz

- BMW Premium Selection

- Audi Approved Plus

- Mercedes-Benz Certified

- CarTrade Exchange

- OLX Autos

- Spinny

- CarDekho Gaadi

- Droom Auto

- Truebil

- Quikr Cars

- Tata Motors Certified Advantage

- Volkswagen Das WeltAuto

- MG Reassure

- Renault Selection

- Nissan Intelligent Choice

第7章 市場機會與未來展望

The India used car market stands at USD 36.39 billion in 2025 and is forecast to advance to USD 73.52 billion by 2030, delivering a 14.95% CAGR.

Rapid digitization, higher new-car prices, deeper credit access, and shifting fuel-mix preferences continue to reshape market dynamics. Organized dealers and online platforms are eroding traditional local dominance as transparent pricing, embedded financing, and warranty services raise consumer confidence. Supply constraints, especially in the INR 3-5 lakh band, push annual resale prices up by 8-10%, while the scrappage policy and GST changes accelerate replacement cycles and favor scale players. SUVs, compact crossovers, and battery-electric models add new growth layers by widening the product mix and extending the addressable customer base.

India Used Car Market Trends and Insights

Rise of Organized and Digital Retail Platforms

Digital transformation is creating unprecedented transparency in a traditionally opaque market, with organized retail expected to grow from 30% to 50% market share by 2030. Cars24's INR 5 billion technology investment and hiring of 100+ tech experts demonstrate the capital intensity required to build real-time valuation algorithms and maintenance tracking systems. CarTrade Tech's achievement of 150 million yearly unique users with 90% organic traffic validates the asset-light digital platform model's scalability. The shift toward digital-first transactions is particularly pronounced among women buyers, who now represent 46% of purchases compared to 35% in Q3 FY2024, with Delhi-NCR leading at 48% female participation. Platform consolidation accelerates as financing integration becomes critical, with 60% of Cars24 transactions now including embedded lending solutions. Technology adoption in tier-2 and tier-3 cities reduces information asymmetry that historically favored local dealers, creating market democratization effects that benefit buyers and sellers through improved price discovery mechanisms.

High New-Car Prices and Faster Depreciation

New vehicle pricing pressures fundamentally reshape consumer purchase decisions, with used car sales reaching 5.17 million units in FY23 and projected to double to 10 million by FY28. The average ownership period has contracted from 6-8 to 4-5 years, creating increased supply velocity that benefits the used car ecosystem. Cars24's average selling price increase to INR 5.5 lakh reflects this premium migration, with 40% of sales concentrated in the INR 4-8 lakh range, where value-conscious buyers seek maximum utility. Supply-demand imbalances generate annual price appreciation of 8-10%, particularly affecting first-time buyers who represent 63% of ownership count but face increasing affordability constraints. The depreciation acceleration is most pronounced in premium segments, where technology obsolescence and feature updates drive faster replacement cycles. Market dynamics suggest that used cars are becoming the primary entry point for vehicle ownership, with new car sales increasingly concentrated among replacement buyers rather than first-time purchasers.

Quality Opacity and Odometer Fraud

Information asymmetry remains the primary barrier to market expansion, with quality assessment challenges particularly acute in the unorganized segment that controls 70% of the market share. Traditional inspection methods lack standardization, creating consumer distrust that limits market participation and constrains pricing power for legitimate dealers. Digital platforms are investing heavily in standardized inspection protocols, with Cars24 implementing 200-point inspection processes and live auction mechanisms to ensure competitive pricing transparency. Blockchain technology adoption in the Indian automotive industry could address traceability concerns through immutable record-keeping, though implementation remains limited compared to global automotive giants. The quality opacity problem is most pronounced in vehicles over 8 years old, where mechanical condition assessment requires specialized expertise that many buyers lack. Consumer education and standardized grading systems are emerging as competitive differentiators, with organized players leveraging technology to build trust and justify premium pricing over unorganized alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Credit Availability and Fintech Lending

- Growing Preference for SUVs in Value-Retention

- Limited Financing for More Than 8-Year-Old Vehicles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Micro/hatchbacks command 34.23% market share in 2024, reflecting their role as entry-level mobility solutions, while SUVs demonstrate the fastest growth at 16.20% CAGR (2025-2030), driven by value retention perceptions and versatility demands. The Ford EcoSport's continued popularity despite production discontinuation in 2021 illustrates how certain models maintain strong resale demand due to proven reliability and service network availability. Sedans face declining preference as consumers migrate toward SUVs and hatchbacks, with traditional three-box designs losing appeal among younger buyers who prioritize ground clearance and cargo flexibility. MUV/MPV segments serve niche commercial and large family requirements, maintaining steady demand in tier-2 cities where joint family structures remain prevalent.

Luxury and sports car segments benefit from aspirational purchasing in metro cities, with brands like BMW, Audi, and Mercedes-Benz establishing certified pre-owned programs to capture this demand while maintaining brand equity. The segmentation reflects broader automotive trends where SUVs are becoming the dominant body style across price points, supported by improved fuel efficiency and ride quality that address traditional SUV limitations. Consumer preference evolution suggests continued SUV market share expansion, particularly in compact and mid-size categories, where manufacturers are launching new models to capture both new and eventual used car demand.

Unorganized local dealers maintain 71.43% market share in 2024, reflecting the market's fragmented nature and consumers' preference for personal relationships in high-value transactions. Online platforms achieve the fastest growth at 27.50% CAGR (2025-2030), driven by transparency initiatives and financing integration that address traditional pain points in used car transactions. OEM-certified franchise programs leverage brand trust and standardized processes to capture quality-conscious buyers willing to pay premiums for assured vehicle condition and warranty coverage. Large multi-brand offline dealers occupy the middle ground, offering a wider selection than OEM programs while providing physical inspection capabilities that online platforms cannot match.

The vendor landscape is experiencing rapid evolution as digital platforms invest heavily in technology infrastructure and customer acquisition, with Cars24's INR 5 billion investment demonstrating the capital requirements for market leadership. CarTrade Tech's 150 million yearly unique users with 90% organic traffic validate the digital platform model's scalability and customer acquisition efficiency. Market consolidation appears inevitable as organized players gain scale advantages in financing, logistics, and customer service that unorganized dealers cannot match. However, the transition timeline remains uncertain given local dealers' embedded relationships and cost advantages.

Petrol vehicles dominate with a 61.47% market share in 2024, benefiting from widespread refueling infrastructure and consumer familiarity, while battery-electric vehicles demonstrate an exceptional 35.60% CAGR (2025-2030) despite a current low base. The EV growth trajectory faces headwinds from resale value concerns, with 51% of EV owners considering switching to ICE vehicles due to charging anxiety and maintenance costs. Diesel vehicles face declining preference due to emission norms and higher acquisition costs, though they maintain appeal in commercial applications and long-distance usage scenarios. CNG vehicles occupy a niche position in markets with established infrastructure, particularly in Delhi-NCR, where regulatory support and cost advantages drive adoption.

Hybrid vehicles represent a transitional technology that addresses range anxiety while providing fuel efficiency benefits, though market penetration remains limited due to higher acquisition costs and limited model availability. The fuel type segmentation reflects India's energy transition complexity, where infrastructure limitations and cost considerations create multiple viable powertrain options rather than clear technology winners. Market dynamics suggest continued ICE dominance in the near term, with electric vehicle adoption accelerating as charging infrastructure expands and battery costs decline. However, the transition timeline remains uncertain given the challenges of the current resale value.

The India Used Car Market Report is Segmented by Vehicle Type (Micro/Hatchback, SUV, and More), Vendor Type (OEM-Certified Franchise, and More), Fuel Type (Petrol, Battery-Electric, and More), Vehicle Age (Less Than 3 Years, and More), Ownership Count (First-Owner, and More), Transmission (Manual and Automatic), Price Band, and Region. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- CARS24

- Maruti Suzuki True Value

- Mahindra First Choice Wheels

- Hyundai H Promise

- Honda Auto Terrace

- Toyota U Trust

- Ford Assured

- Big Boy Toyz

- BMW Premium Selection

- Audi Approved Plus

- Mercedes-Benz Certified

- CarTrade Exchange

- OLX Autos

- Spinny

- CarDekho Gaadi

- Droom Auto

- Truebil

- Quikr Cars

- Tata Motors Certified Advantage

- Volkswagen Das WeltAuto

- MG Reassure

- Renault Selection

- Nissan Intelligent Choice

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise of organised and digital retail platforms

- 4.2.2 High new-car prices and faster depreciation

- 4.2.3 Expanding credit availability and fintech lending

- 4.2.4 Growing preference for SUVs in value-retention

- 4.2.5 Vehicle-scrappage policy accelerating turnover

- 4.2.6 Mobility-fleet de-fleeting and subscription returns

- 4.3 Market Restraints

- 4.3.1 Quality opacity and odometer fraud

- 4.3.2 Limited financing for more than 8-year-old vehicles

- 4.3.3 Stricter emission / ZEV norms devaluing older ICE stock

- 4.3.4 Micro-mobility and ride-hailing reducing first-car demand

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Micro/Hatchback

- 5.1.2 Sedan

- 5.1.3 Sport Utility Vehicle

- 5.1.4 Multi-Purpose Vehicle

- 5.1.5 Luxury and Sports

- 5.2 By Vendor Type

- 5.2.1 OEM-Certified Franchise

- 5.2.2 Online Platforms

- 5.2.3 Large Multi-brand Offline Dealers

- 5.2.4 Unorganized Local Dealers

- 5.3 By Fuel Type

- 5.3.1 Petrol

- 5.3.2 Diesel

- 5.3.3 CNG

- 5.3.4 Hybrid

- 5.3.5 Battery-Electric

- 5.4 By Vehicle Age

- 5.4.1 Less than 3 Years

- 5.4.2 3 to 5 Years

- 5.4.3 6 to 8 Years

- 5.4.4 More than 8 Years

- 5.5 By Ownership Count

- 5.5.1 First-Owner

- 5.5.2 Second-Owner

- 5.5.3 Third-Owner and Above

- 5.6 By Price Band

- 5.6.1 Less than ₹3 lakh

- 5.6.2 ₹3 to ₹5 lakh

- 5.6.3 ₹5 to ₹8 lakh

- 5.6.4 ₹8 to ₹12 lakh

- 5.6.5 More than ₹12 lakh

- 5.7 By Transmission

- 5.7.1 Manual

- 5.7.2 Automatic

- 5.8 By Region

- 5.8.1 North India

- 5.8.2 West India

- 5.8.3 South India

- 5.8.4 East India

- 5.8.5 Central India

- 5.8.6 North-East India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 CARS24

- 6.4.2 Maruti Suzuki True Value

- 6.4.3 Mahindra First Choice Wheels

- 6.4.4 Hyundai H Promise

- 6.4.5 Honda Auto Terrace

- 6.4.6 Toyota U Trust

- 6.4.7 Ford Assured

- 6.4.8 Big Boy Toyz

- 6.4.9 BMW Premium Selection

- 6.4.10 Audi Approved Plus

- 6.4.11 Mercedes-Benz Certified

- 6.4.12 CarTrade Exchange

- 6.4.13 OLX Autos

- 6.4.14 Spinny

- 6.4.15 CarDekho Gaadi

- 6.4.16 Droom Auto

- 6.4.17 Truebil

- 6.4.18 Quikr Cars

- 6.4.19 Tata Motors Certified Advantage

- 6.4.20 Volkswagen Das WeltAuto

- 6.4.21 MG Reassure

- 6.4.22 Renault Selection

- 6.4.23 Nissan Intelligent Choice

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment