|

市場調查報告書

商品編碼

1693662

北美電動卡車:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)North America Electric Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

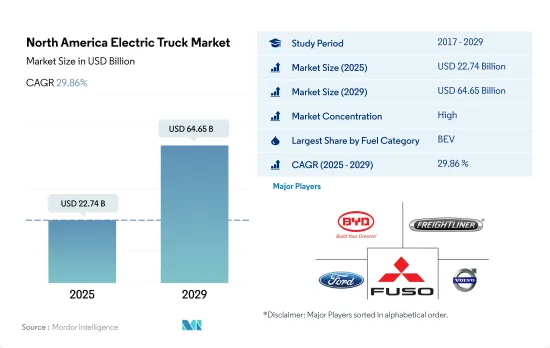

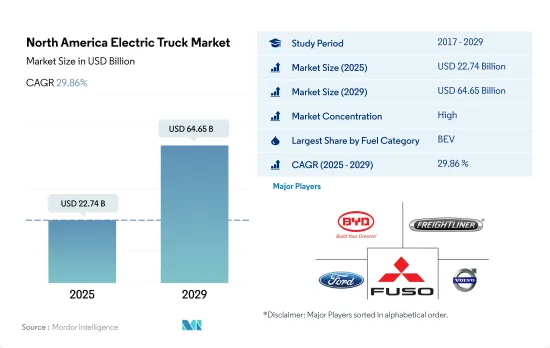

北美電動卡車市場規模預計在 2025 年達到 227.4 億美元,預計到 2029 年將達到 646.5 億美元,預測期內(2025-2029 年)的複合年成長率為 29.86%。

電動商用卡車市場經歷了顯著成長,預計到 2030 年將快速成長,成為永續交通的關鍵參與者。

- 燃料電池電動車在整個電動車類別中佔比最大,這得益於物流行業的成長、政府排放法規的嚴格、物流公司將內燃機汽車替換為電動車以及物流公司對電動車的訂單不斷增加。

- 大型快遞公司開始用電動和低排放氣體汽車取代燃氣引擎汽車,以應對氣候變遷和城市污染。各大電子商務公司已經宣布了全面電動化的計畫。例如,聯邦快遞於2021年3月宣布了一項全球目標,即到2025年實現50%的新車電動化,到2030年實現100%的新車電動化。聯邦快遞的目標是到2040年在全球範圍內實現碳中和,並已將配送車輛的電動化確定為實現這一目標的重點投資領域。

- 美國政府一直積極制定政策鼓勵電動車的普及。例如,紐約市於 2020 年 6 月重新啟動了清潔卡車計劃,提供資金激勵從柴油汽車轉向電動車的轉變。對於將舊款 4 級柴油卡車更換,可獲得 12,000 美元至 185,000 美元不等的獎勵。該計劃預計將幫助該市在2050年實現碳中和目標。

- 隨著物流和電子商務行業的蓬勃發展,對電動卡車的需求預計會增加。預計2021年美國零售電商銷售額將達7,680億美元,與前一年同期比較增19.25%。 2020年零售電子商務銷售額約6,450億美元。因此,預計 2024 年至 2030 年間電動卡車的需求複合年成長率將達到 2.9%。

北美對電動卡車的興趣日益濃厚,全國範圍內的採用率受到監管獎勵和綠色物流推動的影響。

- 北美電動卡車市場正在經歷向永續交通的顯著轉變。在美國,受新興企業和老牌汽車製造商的大量投資推動,市場正在快速擴張。這種快速成長受到州和聯邦政府政策的進一步刺激,例如加州的《先進清潔卡車》法規,該法規要求增加零排放卡車的銷售量。

- 企業對永續性的承諾日益增強,加上聯邦政府的獎勵,正在鼓勵北美各地的車隊營運商和公司探索電動卡車作為傳統內燃機汽車的可行替代方案。加拿大的電動卡車市場尚處於起步階段,但在政府環境目標和獎勵的推動下,市場前景廣闊。加拿大政府對減少碳排放的承諾延伸到對零排放汽車(ZEV)的支持,包括電動卡車。 iZEV 零排放汽車計劃等項目和充電基礎設施投資表明了加拿大致力於培育電動車生態系統。

- 魁北克省和不列顛哥倫比亞省等省份擁有自己的零排放汽車法規和獎勵,在電動卡車應用方面處於領先地位,尤其是在城市物流和市政服務領域。在墨西哥,受對城市空氣品質的擔憂和對永續交通的需求的推動,電動卡車市場才剛開始起步。值得注意的是,墨西哥的舉措主要集中在墨西哥城等大型城市中心,因為那裡的污染問題十分迫切。

北美電動卡車市場趨勢

在政府支持和環保意識不斷增強的推動下,北美對電動車的需求正在成長。

- 近年來,俄羅斯共產黨經歷了顯著的起伏。從 2017 年的 2.082 億美元穩步上升至 2019 年的高峰。然而,由於新冠疫情帶來的經濟挑戰,2020 年這一數字下降至 1.939 億美元。值得注意的是,該市場預計將在 2022 年強勁復甦,達到 2.698 億美元。復甦凸顯了俄羅斯汽車產業的韌性以及獎勵策略的潛在影響。

- 政府的激勵和補貼對客戶(尤其是物流和電子商務公司)採用電動商用車具有強大的吸引力。其中一個例子是加拿大和北美,政府宣布將於 2022 年 4 月為輕型和中型電動車提供 5,000 美元的聯邦退稅。預計這些努力將推動2024年至2030年間北美對電動商用車的需求大幅成長。

- 電動車部署計劃、有吸引力的稅收優惠和外國投資津貼等政府措施將推動北美國家的電動車市場發展。引人注目的是,2022 年 3 月,福斯承諾斥資 70 億美元在北美建立電動車製造工廠。至2030年,福斯汽車計畫為美國、墨西哥和加拿大的客戶推出25款新型電動車型。因此,預計 2024 年至 2030 年間北美對電動車的需求將顯著成長。

北美電動卡車產業概況

北美電動卡車市場相當集中,前五大公司佔了89.48%的市場。市場的主要企業是:比亞迪汽車、戴姆勒北美卡車有限公司(福萊納卡車)、福特汽車公司、三菱扶桑卡客車公司和沃爾沃集團(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均GDP

- 消費者汽車支出(cvp)

- 通貨膨脹率

- 汽車貸款利率

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 新款 Xev 車型發布

- 物流績效指數

- 燃油價格

- OEM生產統計

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 車輛配置

- 追蹤

- 大型商用卡車

- 中型商用卡車

- 追蹤

- 燃料類別

- BEV

- FCEV

- HEV

- PHEV

- 國家

- 加拿大

- 墨西哥

- 美國

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- BYD Auto Co. Ltd.

- Daimler Truck North America LLC(Freightliner Trucks)

- Ford Motor Company

- Mitsubishi Fuso Truck and Bus Corporation

- Nikola Corporation

- Orange EV

- PACCAR Inc.

- Sany Heavy Industry Co. Ltd.

- Volvo Group

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 93055

The North America Electric Truck Market size is estimated at 22.74 billion USD in 2025, and is expected to reach 64.65 billion USD by 2029, growing at a CAGR of 29.86% during the forecast period (2025-2029).

The electric commercial truck market witnesses remarkable growth, becoming a key player in sustainable transport with a growth spurt expected through 2030

- Fuel cell electric vehicles hold the largest share in the overall electric vehicle category due to the growing logistics industry, stringent emission regulations by the government, logistics companies replacing IC engines with electric fleets, and logistics companies placing more electric vehicle orders.

- Major delivery firms are beginning to replace their gas-powered fleets with electric or low-emission vehicles to combat climate change and urban pollution. Big e-commerce companies have already announced plans to turn their entire fleets electric. For instance, in March 2021, FedEx announced its global target for 50% of all newly procured vehicles to be electric by 2025, rising to 100% of all new purchases by 2030. FedEx aims to achieve carbon-neutral operations globally by 2040, with the electrification of its pickup and delivery vehicles as a major investment area.

- The US government has been proactive in enacting policies to encourage the adoption of electric vehicles. For instance, New York City relaunched its Clean Trucks Program in June 2020, which provides funding to incentivize the transition from diesel to electric models. Incentive funding between USD 12,000 and USD 185,000 is available for replacing older diesel Class 4 to Class 8 trucks. This program will be instrumental in helping the city achieve its goal of carbon neutrality by 2050.

- The demand for electric trucks is anticipated to increase as the logistics and e-commerce industries are growing rapidly. Retail e-commerce sales in the United States were estimated at USD 768 billion in 2021, with a y-o-y growth of 19.25%. In 2020, retail e-commerce sales were around USD 645 billion. Thus, the demand for electric trucks is anticipated to register a CAGR of 2.9% between 2024 and 2030.

North America registering emerging interest in electric trucks, with country-specific adoption rates influenced by regulatory incentives and the push for green logistics

- The electric truck market in North America is witnessing a notable shift toward sustainable transportation. In the United States, this market is experiencing rapid expansion, driven by substantial investments from both startups and established automotive manufacturers. The surge is further bolstered by state and federal policies, exemplified by California's Advanced Clean Trucks regulation, which mandates a rise in zero-emission truck sales.

- Increasing corporate sustainability commitments, coupled with federal incentives, are prompting fleet operators and businesses across North America to explore electric trucks as viable alternatives to traditional ICE vehicles. While Canada's electric truck market is in its early stages, it shows promise, propelled by the government's environmental goals and incentives. The Canadian government's focus on carbon emissions reduction extends to support for zero-emission vehicles (ZEVs), including electric trucks. Programs like the Incentives for Zero-Emission Vehicles Program (iZEV) and investments in charging infrastructure underscore the country's dedication to fostering an electric mobility ecosystem.

- Provinces like Quebec and British Columbia, with their own ZEV mandates and incentives, are at the forefront of electric truck adoption, particularly in urban logistics and municipal services. In Mexico, the electric truck market is still emerging, driven by concerns over urban air quality and the demand for sustainable transportation. Notably, initiatives in Mexico are concentrated in major urban centers, such as Mexico City, where pollution is a pressing issue.

North America Electric Truck Market Trends

Growing demand for electric vehicles in North America driven by government support and growing environmental concerns

- The CVP in Russia has experienced significant fluctuations in recent years. It climbed steadily from USD 208.2 million in 2017, peaking in 2019. However, it dipped to USD 193.9 million in 2020, largely due to the economic challenges brought on by the COVID-19 pandemic. Notably, the market rebounded sharply in 2022, reaching USD 269.8 million. This resurgence highlights both the resilience of the Russian automotive sector and the potential impact of economic stimulus measures and heightened consumer demand.

- Government incentives and subsidies are proving to be a strong draw for customers, particularly logistics and e-commerce firms, in their adoption of electric commercial vehicles. A case in point is Canada and North America, where, in April 2022, the government unveiled federal rebates of USD 5000 for electric light- and medium-duty vehicles. These initiatives are expected to significantly bolster the demand for electric commercial vehicles in North America from 2024 to 2030.

- Government initiatives, including plans for EV deployment, attractive incentives, and foreign investment allowances, are set to propel the electric vehicle market across North American nations. In a notable move, in March 2022, Volkswagen committed a staggering USD 7 billion to establish an electric car manufacturing facility in North America. By 2030, the automaker plans to roll out 25 new EV models, catering to customers in the US, Mexico, and Canada. As a result, the demand for electric vehicles is projected to witness a notable surge across various North American countries from 2024 to 2030.

North America Electric Truck Industry Overview

The North America Electric Truck Market is fairly consolidated, with the top five companies occupying 89.48%. The major players in this market are BYD Auto Co. Ltd., Daimler Truck North America LLC (Freightliner Trucks), Ford Motor Company, Mitsubishi Fuso Truck and Bus Corporation and Volvo Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Trucks

- 5.1.1.1 Heavy-duty Commercial Trucks

- 5.1.1.2 Medium-duty Commercial Trucks

- 5.1.1 Trucks

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 US

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Auto Co. Ltd.

- 6.4.2 Daimler Truck North America LLC (Freightliner Trucks)

- 6.4.3 Ford Motor Company

- 6.4.4 Mitsubishi Fuso Truck and Bus Corporation

- 6.4.5 Nikola Corporation

- 6.4.6 Orange EV

- 6.4.7 PACCAR Inc.

- 6.4.8 Sany Heavy Industry Co. Ltd.

- 6.4.9 Volvo Group

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219