|

市場調查報告書

商品編碼

1693640

西班牙輕型商用車:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Spain Light Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

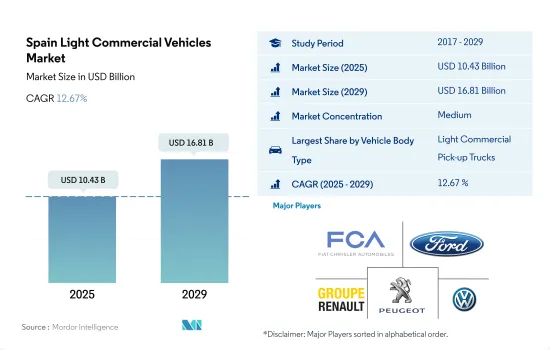

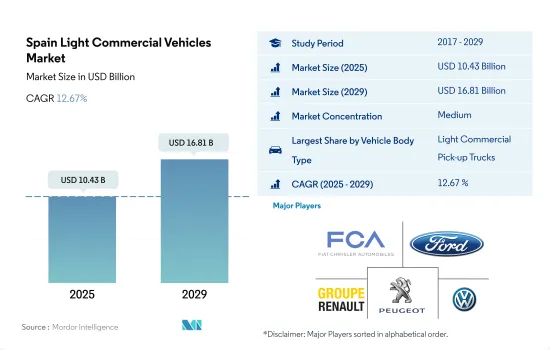

西班牙輕型商用車市場規模預計在 2025 年為 104.3 億美元,預計到 2029 年將達到 168.1 億美元,預測期內(2025-2029 年)的複合年成長率為 12.67%。

西班牙的戰略重點是實現輕型商用車多樣化,這將提高效率並滿足企業向更永續的經濟轉型的特定需求。

- 西班牙輕型商用車(LCV)市場擁有多種適合不同產業需求的車款。其中包括廂型車、皮卡車和小型卡車。廂型車憑藉其在各種商業活動中的適應性和多功能性,在西班牙輕型商用車市場佔據主導地位。它在狹窄的都市區街道上的機動性和安全運輸貨物的能力,特別是對於送貨和服務提供者來說,使其非常受歡迎。電子商務的成長進一步推動了對廂型車的需求,凸顯了對高效城市物流解決方案的需求。

- 皮卡在市場上扮演著小眾但重要的角色。皮卡車因其耐用性和適應各種地形的能力而受到農業、建築和公共營運商的歡迎。它的多功能性加上越野能力使其成為在農村地區營運或需要運輸到難以到達的地方的企業的必備之物。

- 小型卡車比廂型車或皮卡車具有更高的負載容量和更大的空間,是專門從事物流、建築和貿易的中小型企業的生命線。儘管永續性在各個領域都越來越受到重視,但電動和混合動力輕型卡車的採用仍然有限。成本和充電基礎設施等因素對更廣泛的採用構成了挑戰。

西班牙輕型商用車市場趨勢

受政府補貼和舉措推動,西班牙電動車需求增加

- 西班牙汽車產業多年來持續成長,近年來,尤其是2020年以來,電動車的需求大幅成長。政府在補貼方面採取了多種做法,例如,西班牙政府在2021年3月將其Moves II補貼計畫的預算從1億歐元擴大到1.2億歐元。該計畫為輕型商用車提供3,630歐元的補貼,為大型商用車購買者提供6,000歐元的補貼。因此,與 2020 年相比,2021 年西班牙電動商用車的年增率為 51.06%。

- 近年來,西班牙的電動車產業也經歷了令人矚目的成長。 2020年,西班牙政府宣布了2030年至少有500萬輛電動車上路的目標。政府的規範和補貼正在幫助增加電動車的銷售量。這些因素正在推動消費者選擇電動車。因此,2022 年電動車銷量較 2021 年成長 17.90%。

- 政府和不同的公司正在合作進行各種計劃,以加速西班牙的電動車發展。 2023 年 3 月,政府在包括西班牙在內的整個歐洲推行了 Moves 3 計畫。政府為電動車提供4,500歐元(不報廢)和7,000歐元(報廢)的補貼,該計畫持續到2023年12月31日。預計這些補貼將在2024年至2030年間加速西班牙對電動車的需求。

西班牙輕型商用車產業概況

西班牙輕型商用車市場適度整合,前五大企業佔60.77%的市佔率。市場的主要企業是:飛雅特克萊斯勒汽車公司、福特汽車公司、雷諾集團、標緻汽車公司和大眾汽車公司(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均GDP

- 消費者汽車支出(cvp)

- 通貨膨脹率

- 汽車貸款利率

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 新款 Xev 車型發布

- 物流績效指數

- 燃油價格

- OEM生產統計

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 車輛類型

- 商用車

- 輕型商用皮卡車

- 輕型商用廂型車

- 商用車

- 推進類型

- 混合動力汽車和電動車

- 按燃料類別

- BEV

- FCEV

- HEV

- PHEV

- ICE

- 按燃料類別

- 天然氣

- 柴油引擎

- 汽油

- LPG

- 混合動力汽車和電動車

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Fiat Chrysler Automobiles NV

- Ford Motor Company

- Groupe Renault

- IVECO SpA

- Mercedes-Benz

- Peugeot SA

- Toyota Motor Corporation

- Volkswagen AG

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 93028

The Spain Light Commercial Vehicles Market size is estimated at 10.43 billion USD in 2025, and is expected to reach 16.81 billion USD by 2029, growing at a CAGR of 12.67% during the forecast period (2025-2029).

Spain's strategic focus on diversifying light commercial vehicle types will boost efficiency and meet the specific needs of businesses in transitioning to a more sustainable economy

- The Spanish light commercial vehicles (LCV) market boasts a diverse range of vehicle types tailored to meet the specific needs of different sectors. These include panel vans, pickup trucks, and small trucks. Panel vans reign supreme in the Spanish LCV market, owing to their adaptability and versatility across a wide range of commercial activities. Their maneuverability in narrow urban streets and ability to securely transport goods, especially for deliveries and service providers, make them highly sought-after. The growth in e-commerce has further fueled the demand for panel vans, highlighting the need for efficient urban logistics solutions.

- Pickup trucks, though occupying a niche, play a crucial role in the market. They find favor among businesses in agriculture, construction, and utilities, owing to their durability and ability to handle diverse terrains. Their versatility, coupled with off-road capabilities, makes them indispensable for businesses operating in rural areas or those requiring transportation to less accessible sites.

- Small trucks, offering higher payload capacities and more space than panel vans or pickups, are a lifeline for logistics, construction, and trade-focused small and medium-sized enterprises (SMEs). While sustainability is gaining traction across segments, the introduction of electric and hybrid small trucks is still limited. Factors like cost and charging infrastructure pose challenges to their wider adoption.

Spain Light Commercial Vehicles Market Trends

Increasing demand for electric vehicles in Spain is driven by government subsidies and initiatives

- The Spanish automobile industry has been growing continuously over the past few years, and the demand for electric vehicles has grown significantly in recent years, especially after 2020. Various government practices in terms of rebates, such as in March 2021, the government of Spain expanded the budget for the Moves II subsidy program from EUR 100 million to EUR 120 million. Under the program, the light commercial vehicle will be subsidized by EUR 3,630, and heavy commercial vehicle buyers are eligible for a subsidy of EUR 6,000. As a result, electric commercial vehicles witnessed an annual growth of 51.06% in 2021 compared to 2020 across Spain.

- The electric car industry in Spain has also grown tremendously in recent years. In 2020, the government of Spain announced a target of having at least 5 million electric vehicles by 2030. The impact of government norms and subsidies offered has contributed to the growth in the sales of electric cars. Such factors have encouraged consumers to opt for EVs. As a result, the country witnessed a growth in the sale of electric cars by 17.90% in 2022 over 2021.

- The government and various companies are making efforts through various projects that are going to accelerate electric mobility in Spain. In March 2023, the government introduced the Moves 3 plan in Europe, including Spain. The government offered subsidies of EUR 4,500 (without scrapping) and EUR 7,000 (with scrapping) for electric vehicles; the plan was offered until December 31, 2023. Such offerings are expected to accelerate the demand for electric cars in Spain between 2024 and 2030.

Spain Light Commercial Vehicles Industry Overview

The Spain Light Commercial Vehicles Market is moderately consolidated, with the top five companies occupying 60.77%. The major players in this market are Fiat Chrysler Automobiles N.V, Ford Motor Company, Groupe Renault, Peugeot S.A. and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Light Commercial Pick-up Trucks

- 5.1.1.2 Light Commercial Vans

- 5.1.1 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.2.1.4 LPG

- 5.2.1 Hybrid and Electric Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Fiat Chrysler Automobiles N.V

- 6.4.2 Ford Motor Company

- 6.4.3 Groupe Renault

- 6.4.4 IVECO S.p.A

- 6.4.5 Mercedes-Benz

- 6.4.6 Peugeot S.A.

- 6.4.7 Toyota Motor Corporation

- 6.4.8 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219