|

市場調查報告書

商品編碼

1773314

汽車引擎蓋市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Engine Cover Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

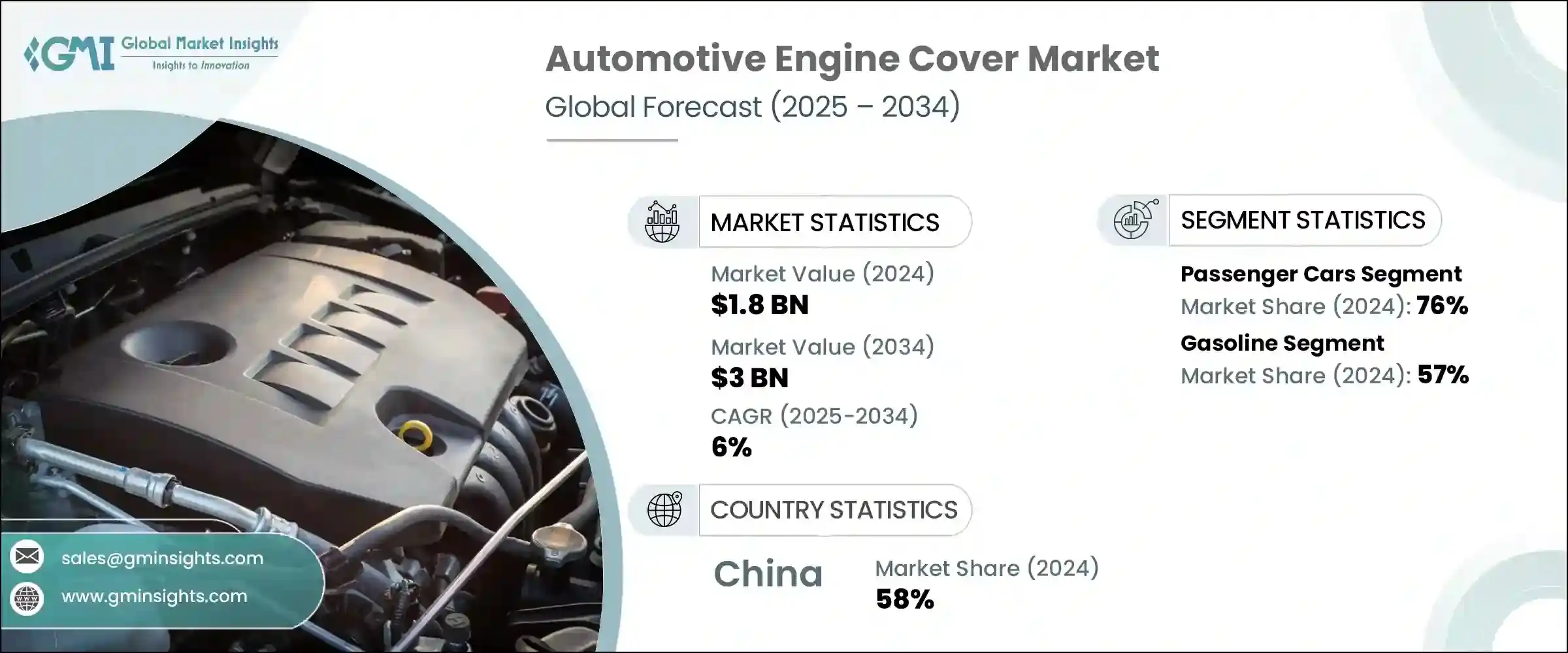

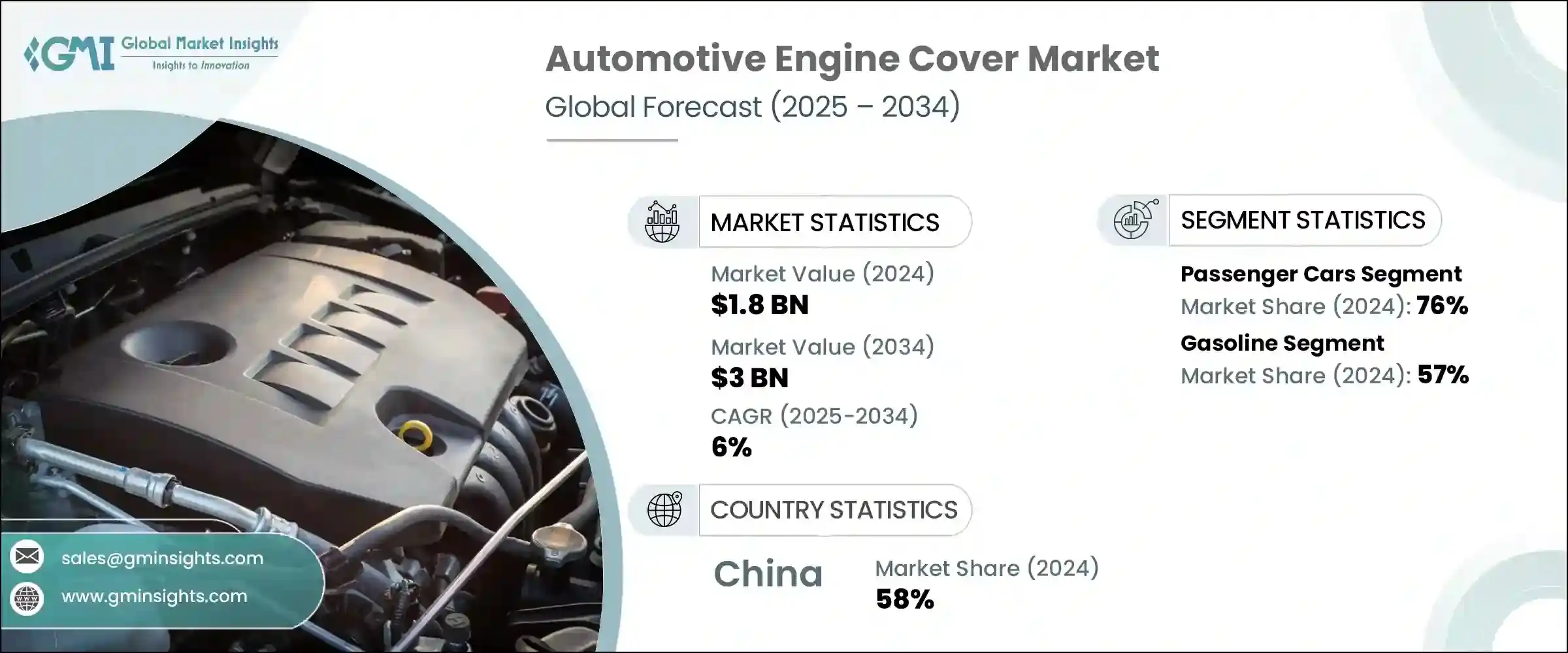

2024年,全球汽車引擎蓋市場規模達18億美元,預估年複合成長率為6%,2034年將達30億美元。這一成長主要源於全球汽車產量的成長以及對更輕量化、更高效汽車零件日益成長的需求。隨著汽車產業向更高性能和更經濟的轉型,引擎蓋已從基礎外殼轉變為提供熱控制、隔音性能以及與整體車輛設計協調統一的關鍵部件。隨著內燃機和混合動力汽車平台在全球範圍內的持續擴張,引擎蓋正成為各種車型和應用動力系統設計中的關鍵元件。

由於複合材料和熱塑性塑膠等先進材料的興起,市場也呈現出強勁成長動能。這些材料在耐用性、耐熱性和輕量化之間實現了完美平衡,使製造商能夠滿足日益嚴格的排放法規和燃油效率標準。原始設備製造商和一級供應商正在採用可擴展的模組化覆蓋設計,以支援緊湊型轎車、運動型多用途車和輕型卡車的生產。這些平台有助於實現統一的NVH(噪音、振動和聲振粗糙度)性能,同時加快產品上市時間並降低製造複雜性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 30億美元 |

| 複合年成長率 | 6% |

乘用車領域在2024年佔據了76%的市場佔有率,預計到2034年將以6.8%的複合年成長率成長。引擎蓋已成為現代乘用車設計中不可或缺的部件,因為緊湊的引擎室和更高的引擎輸出要求更嚴格的散熱和噪音管理。將它們整合到轎車、掀背車和豪華車中,有助於製造商提升性能和車內體驗。輕質熱塑性塑膠和增強複合材料用於打造時尚、符合空氣動力學且與品牌形象相符的引擎罩,將隔熱性能與高階外觀完美結合。

汽油動力汽車領域在2024年佔據57%的市場佔有率,佔據市場主導地位,預計到2034年複合年成長率將達到7.1%。儘管電動車蓬勃發展,汽油引擎在許多地區仍佔據主導地位。這些車輛的引擎蓋旨在控制高燃燒熱量、降低引擎噪音,同時提升視覺吸引力。製造商正在轉向複合材料和聚合物共混物,以更低的生產成本提供最佳化的隔熱性能和輕量化優勢。

亞太地區汽車引擎蓋市場佔據58%的市場佔有率,2024年市場規模達5.531億美元。中國市場佔據主導地位,得益於其龐大的汽車製造基礎設施、不斷成長的消費需求以及全球原始設備製造商和國內零件製造商的積極參與。中國領先的企業正專注於大批量生產熱塑性和複合材料引擎罩,以支援多樣化的汽車平台。政府鼓勵本土創新和綠色技術的政策正在推動對輕量化、減排零件的需求。本土企業透過全球合作夥伴關係持續擴張,提供符合下一代移動出行趨勢的客製化引擎蓋系統。

該行業的主要公司包括 Rochling Group、Denso Corporation、MAHLE GmbH、Woco Industrietechnik、Montaplast、Toyota Boshoku Corporation、Aisin Corporation、Valeo SA、ElringKlinger 和 Continental。市場參與者正在利用先進的製造技術來提供符合全球燃油效率要求的輕質耐用引擎蓋。該公司正在投資材料科學創新,特別是熱塑性塑膠和複合材料配方,以在減輕重量的同時提高耐熱性。與汽車製造商的策略聯盟有助於製造商根據不斷發展的平台需求調整產品開發。模組化和可擴展的設計方法擴大被採用,以支援各種車型,最大限度地降低工具成本並加快生產週期。數位類比和原型製作工具允許快速客製化,幫助公司滿足特定的OEM標準和美學要求。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 全球汽車產量不斷成長

- 對輕量化零件的需求不斷增加

- 內燃機(ICE)汽車的成長

- OEM專注於組件整合

- 產業陷阱與挑戰

- 整合動力系統的設計複雜性

- 原料成本波動

- 市場機會

- 高檔豪華汽車銷售成長

- 擴大採用永續和可回收材料

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 生產統計

- 生產中心

- 消費中心

- 匯出和匯入

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 掀背車

- 越野車

- 商用車

- 輕型

- 中型

- 重負

第6章:市場估計與預測:以推進方式,2021 - 2034 年

- 主要趨勢

- 汽油

- 柴油引擎

- 電的

- 插電式混合動力

- 油電混合車

- 燃料電池電動車

第7章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 複合材料

- 金屬

- 熱塑性塑膠

- 其他

第8章:市場估計與預測:依功能分類,2021 - 2034 年

- 主要趨勢

- 美觀的引擎罩

- 功能性引擎罩

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Aisin Corporation

- Continental

- Denso Corporation

- ElringKlinger

- Futaba Industrial

- Hanil E-Hwa Automotive Systems

- Magna International

- MAHLE

- Mann+Hummel

- Montaplast

- Motherson Sumi Systems

- Plastic Omnium

- Polytec Group

- Rochling Group

- Simoldes Plasticos

- SRG Global

- Toyota Boshoku Corporation

- Valeo SA

- Woco Industrietechnik

- YAPP Automotive Systems

The Global Automotive Engine Cover Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 3 billion by 2034. This growth is driven by rising global vehicle production and the increasing need for lighter, more efficient automotive components. As industry shifts toward greater performance and fuel economy, engine covers have transformed from basic enclosures into key components that deliver thermal control, sound insulation, and visual cohesion with overall vehicle design. As both internal combustion and hybrid vehicle platforms continue to expand globally, engine covers are being engineered as critical elements in powertrain design across a wide range of models and applications.

The market is also seeing strong traction due to the shift toward advanced materials like composites and thermoplastics. These materials provide the right balance of durability, heat resistance, and weight reduction, enabling manufacturers to meet tightening emission regulations and fuel efficiency standards. Original equipment manufacturers and Tier-1 suppliers are adopting scalable, modular cover designs to support production across compact cars, sport utility vehicles, and light-duty trucks. These platforms help achieve uniform NVH (noise, vibration, and harshness) performance while accelerating time to market and reducing manufacturing complexity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3 Billion |

| CAGR | 6% |

The passenger cars segment held a 76% share in 2024 and is projected to grow at a CAGR of 6.8% through 2034. Engine covers have become essential components in the design of modern passenger vehicles, where tighter engine bays and higher engine outputs demand greater heat and noise management. Their integration into sedans, hatchbacks, and luxury vehicles is helping manufacturers enhance both performance and in-cabin experience. Lightweight thermoplastics and reinforced composites are used to create sleek, aerodynamic, and brand-aligned covers, combining insulation with premium aesthetics.

Gasoline-powered vehicles segment led the market with a 57% share in 2024 and is expected to register a CAGR of 7.1% through 2034. Despite the rise of electric mobility, gasoline engines continue to dominate production volumes in many regions. Engine covers in these vehicles are designed to manage high combustion heat and reduce engine noise while enhancing visual appeal. Manufacturers are turning to composite and polymer blends to offer optimized thermal shielding and lightweight benefits at lower production costs.

Asia Pacific Automotive Engine Cover Market held a 58% share and generated USD 553.1 million in 2024. The country's dominance is supported by its large-scale automotive manufacturing infrastructure, rising consumer demand, and active presence of global OEMs and domestic component manufacturers. Leading companies in China are focusing on producing thermoplastic and composite engine covers in high volume to support diverse vehicle platforms. Government policies encouraging local innovation and greener technologies are driving demand for lightweight, emission-reducing components. Local firms continue expanding through global partnerships to deliver custom-engineered engine cover systems aligned with next-gen mobility trends.

Key companies operating in this industry include Rochling Group, Denso Corporation, MAHLE GmbH, Woco Industrietechnik, Montaplast, Toyota Boshoku Corporation, Aisin Corporation, Valeo S.A., ElringKlinger, and Continental. Market players are leveraging advanced manufacturing technologies to deliver lightweight, durable engine covers that align with global fuel efficiency mandates. Companies are investing in material science innovation, particularly in thermoplastics and composite formulations, to enhance heat resistance while reducing weight. Strategic alliances with automakers help manufacturers align product development with evolving platform needs. Modular and scalable design approaches are increasingly adopted to support a variety of vehicle models, minimizing tooling costs and speeding up production cycles. Digital simulation and prototyping tools allow rapid customization, helping firms meet specific OEM standards and aesthetic requirements.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Propulsion

- 2.2.4 Material

- 2.2.5 Functionality

- 2.2.6 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global vehicle production

- 3.2.1.2 Increasing demand for lightweight components

- 3.2.1.3 Growth in Internal Combustion Engine (ICE) vehicles

- 3.2.1.4 OEM focus on component integration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Design complexity with integrated powertrains

- 3.2.2.2 Raw material cost volatility

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in premium and luxury vehicle sales

- 3.2.3.2 Growing adoption of sustainable & recyclable materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Sedans

- 5.2.2 Hatchbacks

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light duty

- 5.3.2 Medium duty

- 5.3.3 Heavy duty

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

- 6.5 PHEV

- 6.6 HEV

- 6.7 FCEV

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Composites

- 7.3 Metals

- 7.4 Thermoplastics

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Functionality, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Aesthetic engine covers

- 8.3 Functional engine covers

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aisin Corporation

- 11.2 Continental

- 11.3 Denso Corporation

- 11.4 ElringKlinger

- 11.5 Futaba Industrial

- 11.6 Hanil E-Hwa Automotive Systems

- 11.7 Magna International

- 11.8 MAHLE

- 11.9 Mann+Hummel

- 11.10 Montaplast

- 11.11 Motherson Sumi Systems

- 11.12 Plastic Omnium

- 11.13 Polytec Group

- 11.14 Rochling Group

- 11.15 Simoldes Plasticos

- 11.16 SRG Global

- 11.17 Toyota Boshoku Corporation

- 11.18 Valeo S.A.

- 11.19 Woco Industrietechnik

- 11.20 YAPP Automotive Systems