|

市場調查報告書

商品編碼

1693555

越南肥料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Vietnam Fertilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

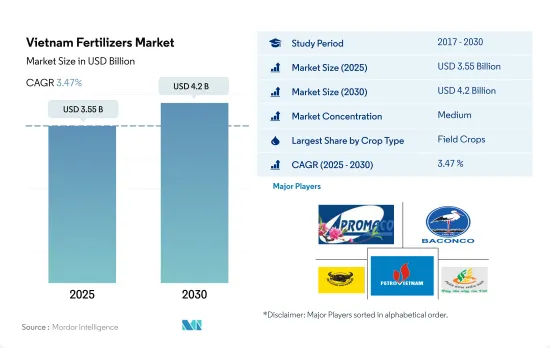

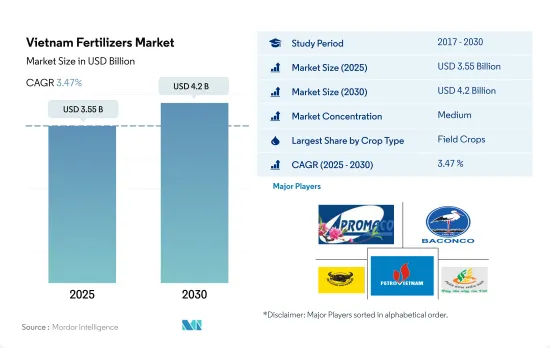

預計 2025 年越南肥料市場規模將達到 35.5 億美元,到 2030 年將達到 42 億美元,預測期內(2025-2030 年)的複合年成長率為 3.47%。

由於市場吸引力不斷增強和需求不斷上升,肥料需求預計將大幅成長。

- 預計預測期內越南化肥市場的複合年成長率將達到 4.6%。這種成長背後的主要因素是亞洲料理的日益普及、人們對健康飲食的興趣日益濃厚以及有利的氣候條件。

- 田間作物佔據市場主導地位,佔81.6%的市場。雖然耕地面積減少了,但作物產量卻大幅增加,因此需要增加化學肥料的使用。

- 其中,稻米、豌豆和大豆是越南主要的田間作物。 2022年,農業部門的目標是生產4830萬噸穀物,目標產量為4300-4390萬噸,重點是米。這證實了未來幾年田間作物市場的預期成長。

- 2022年園藝作物在越南肥料市場的佔有率為25.8%。歐盟和越南將於 2023 年簽署一項作物出口為重點的自由貿易協定,這將進一步促進該產業的成長。

- 預計草坪和觀賞植物部分的複合年成長率為 4.4%。值得注意的是,花卉和觀賞植物生產取得了巨大進步,產生了巨大的經濟價值。正如農業和農村發展部所強調的,對花卉和盆景的需求正在上升。 2022年,草坪和觀賞作物將佔越南肥料市場的0.4%。

- 鑑於市場吸引力不斷增強和需求不斷成長,越南化肥市場預計將顯著成長。

越南肥料市場趨勢

越南政府正在推行降低生產成本的政策,預計將增加田間作物的種植面積。

- 越南有大量土地用於田間作物,主要作物是水稻、玉米和各種其他主食。越南多樣的氣候和地形適合種植多種作物。然而,在研究期間,越南田間作物種植面積減少了 6.6%。

- 稻米是越南的主要田間作物,種植面積最大,為 81.8%,其次是玉米,為 10.2%,這反映了其作為主食的重要性。 2022年,越米的生產量達到約4,390萬噸。越南是主要米生產國之一,其米出口到世界許多國家。

- 每年有三個主要生長季節:從冬季到春季的早期生長季節,從夏季到秋季的中期生長季節,以及從秋季到冬季的長雨季生長季節。紅河Delta、湄公河Delta和南部梯田是主要農業區。水稻是這三個地區的主要作物。越南一半的米出口來自湄公河三角洲。

- 為了提高田間作物的產量、品質和利潤,越南政府正在推行減少化肥和農藥使用、鼓勵使用農場自製或本地生產的化肥等降低生產成本的政策。由於營養缺乏導致的農作物減產不斷增加,以及對防止植物矮化的高效肥料的需求不斷成長也是導致越南肥料市場成長的因素。

氮是許多田間作物的必需營養素,需要大量施用。

- 2022年田間作物主要養分平均施用量為每公頃123.94公斤。在田間作物中,穀物和穀類是越南化肥消費量的最大部分。越南最廣泛生產的穀物是米、小麥和玉米。同年這田間作物平均一次養分施用量分別為155.49公斤/公頃、228.90公斤/公頃、148.49公斤/公頃。

- 在所有主要養分中,氮肥施用量最高,田間作物平均施用221.43公斤/公頃。這是因為氮有助於犁地、葉面積發育、籽粒形成、籽粒灌漿和增加蛋白質合成,從而提高田間作物的產量和籽粒品質。小麥施氮量最高,為每公頃492.06公斤,其次為水稻,為328.04公斤。

- 在越南永福省,大部分土壤劣化,有機質含量低。總有效氮小於0.08%,總磷小於0.04%,總鉀小於1.0%。此外,有效磷含量不足 10 ppm。這些營養缺陷導致越南的平均化肥消費量從1969年的49.2公斤/公頃增加到2018年的415.3公斤/公頃,年均成長率為6.71%。在越南,43%的人口從事農業,但農業產值僅佔GDP的12.36%左右,不到GDP的五分之一。因此,為穩定農業生產,化肥的需求進一步增加,帶動越南化肥市場的成長。

越南肥料產業概況

越南肥料市場適度整合,前五大公司佔41.26%。該市場的主要企業是:農產品和材料股份公司(APROMACO)、Baconco、平田化肥股份公司(BFC)、越南石油化肥和化學公司和南方化肥股份公司(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 主要作物種植面積

- 田間作物

- 園藝作物

- 平均養分施用量

- 微量營養素

- 田間作物

- 園藝作物

- 主要營養素

- 田間作物

- 園藝作物

- 次要宏量營養素

- 田間作物

- 園藝作物

- 微量營養素

- 灌溉農田

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 類型

- 複合型

- 直的

- 微量營養素

- 硼

- 銅

- 鐵

- 錳

- 鉬

- 鋅

- 其他

- 氮

- 尿素

- 其他

- 磷酸

- DAP

- MAP

- TSP

- 其他

- 鉀

- MoP

- SoP

- 其他

- 次要營養物質

- 鈣

- 鎂

- 硫

- 形式

- 傳統的

- 特別的

- CRF

- 液體肥料

- SRF

- 水溶性

- 施肥方式

- 受精

- 葉面噴布

- 土壤

- 作物類型

- 田間作物

- 園藝作物

- 草坪和觀賞植物

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- AGRICULTURAL PRODUCTS AND MATERIALS JSC(APROMACO)

- Baconco

- Binh Dien Fertilizer JSC(BFC)

- Duc Giang Chemicals Group

- Grupa Azoty SA(Compo Expert)

- Haifa Group

- Ninh Binh Phosphate Fertilizer JSC

- PetroVietnam Fertilizer and Chemical Corp.

- Southern Fertilizer JSC

- Yara International ASA

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 92649

The Vietnam Fertilizers Market size is estimated at 3.55 billion USD in 2025, and is expected to reach 4.2 billion USD by 2030, growing at a CAGR of 3.47% during the forecast period (2025-2030).

With the increased market attractiveness coupled with rising demand, the demand for fertilizer is anticipated to grow substantially

- The fertilizers market in Vietnam is projected to record a CAGR of 4.6% during the forecast period. This growth is primarily driven by the rising popularity of Asian cuisine, a growing emphasis on healthy eating, and favorable climatic conditions.

- Field crops dominate the market, accounting for 81.6% of the total. Despite a decrease in the area under cultivation, the country is witnessing a notable increase in crop yields, necessitating higher fertilizer usage.

- Notably, rice, peas, and soybeans are key field crops in Vietnam. In 2022, the agriculture sector aimed to produce 48.3 million tons of grain, with a specific focus on rice, targeting an output of 43-43.9 million tons. This underscores the expected growth in the field crop market in the coming years.

- Horticultural crops held a 25.8% share in Vietnam's fertilizer market in 2022. The upcoming free trade agreement between the European Union and Vietnam, specifically for horticultural crop exports starting in 2023, is poised to further bolster this segment's growth.

- The turf and ornamental sector is set to record a CAGR of 4.4%. Notably, flower and ornamental plant production has seen significant advancements, yielding substantial economic value. The demand for flowers and bonsai trees is on the rise, as highlighted by the Ministry of Agriculture and Rural Development. In 2022, turf and ornamental crops accounted for 0.4% of Vietnam's fertilizers market.

- Given the increasing market attractiveness and rising demand, the fertilizer market in Vietnam is poised for substantial growth.

Vietnam Fertilizers Market Trends

The Vietnamese government has been promoting policies to reduce production costs, which is expected to increase the cultivation area under field crops

- Vietnam dedicates substantial acreages to field crops; major cultivations include rice, maize (corn), and various other staples. The country's diverse climate and topography allow the cultivation of a wide range of crops. However, the area under the cultivation of field crops in Vietnam decreased by 6.6% during the study period.

- Rice is a primary field crop in Vietnam, reflecting its importance as a staple food, and it occupies the maximum area under cultivation, accounting for an 81.8% share, followed by corn with a 10.2% share. In 2022, rice production volume in Vietnam amounted to approximately 43.9 million metric tons. Vietnam is one of the leading rice producers and exports to countries worldwide.

- There are three major cropping seasons during a year: winter-spring or early season, summer-autumn or midseason, and autumn-winter or a longer rainy season crop. Major agricultural regions in the country include the Red River Delta, the Mekong River Delta, and the Southern Terrace region. Rice is the principal crop in all three regions. Half of Vietnam's exported rice comes from the Mekong Delta.

- The Vietnamese government has been promoting policies to reduce production costs by reducing fertilizer and pesticide usage and encouraging farm-made or locally-produced fertilizers to increase field crops' productivity, quality, and profit. The increasing incidence of crop failures due to a lack of nutrients and the rise in the requirement of high-efficiency fertilizers to prevent dwarfism in plants are some of the other factors contributing to the growth of the Vietnam fertilizers market.

Nitrogen is a vital nutrient required for a range of field crops, and its application is very high

- The average application rate of primary nutrients in field crops was 123.94 kg per hectare in 2022. Among field crops, grains and cereals comprise the largest segment in terms of fertilizer consumption in Vietnam. The top-producing cereals in Vietnam are rice, wheat, and maize. The average primary nutrient application rates of these field crops were 155.49 kg/ha, 228.90 kg/ha, and 148.49 kg/ha, respectively, in the same year.

- Among all the primary nutrients, nitrogen is applied in a higher quantity, which is 221.43 kg/hectare on average for the field crops because nitrogen aids in increased tillering, leaf area development, grain formation, grain filling, and protein synthesis and also enhances grain yield and grain quality in field crops. Wheat has the maximum nitrogen application rate, which is 492.06 kg per hectare, followed by rice with 328.04 kg per hectare.

- In Vinh Phuc province of Vietnam, large areas of the soil are degraded and characterized by low organic matter; total available nitrogen is less than 0.08%, total phosphorus is below 0.04%, and total potassium is below 1.0%. Also, the available P is less than 10 ppm. These nutrient deficiencies led to an increase in the average fertilizer consumption in Vietnam from 49.2 kg/ha in 1969 to 415.3 kilograms per hectare by 2018, increasing at an average annual growth rate of 6.71%. In Vietnam, 43% of the population is involved in agriculture, but the production capacity is still less than one-fifth of the total GDP of the country, grossing only about 12.36%. Hence, to stabilize the production of agricultural products, the demand for fertilizers is further increasing, driving the growth of the Vietnam fertilizers market.

Vietnam Fertilizers Industry Overview

The Vietnam Fertilizers Market is moderately consolidated, with the top five companies occupying 41.26%. The major players in this market are AGRICULTURAL PRODUCTS AND MATERIALS JSC (APROMACO), Baconco, Binh Dien Fertilizer JSC (BFC), PetroVietnam Fertilizer and Chemical Corp. and Southern Fertilizer JSC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Micronutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.2 Primary Nutrients

- 4.2.2.1 Field Crops

- 4.2.2.2 Horticultural Crops

- 4.2.3 Secondary Macronutrients

- 4.2.3.1 Field Crops

- 4.2.3.2 Horticultural Crops

- 4.2.1 Micronutrients

- 4.3 Agricultural Land Equipped For Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Type

- 5.1.1 Complex

- 5.1.2 Straight

- 5.1.2.1 Micronutrients

- 5.1.2.1.1 Boron

- 5.1.2.1.2 Copper

- 5.1.2.1.3 Iron

- 5.1.2.1.4 Manganese

- 5.1.2.1.5 Molybdenum

- 5.1.2.1.6 Zinc

- 5.1.2.1.7 Others

- 5.1.2.2 Nitrogenous

- 5.1.2.2.1 Urea

- 5.1.2.2.2 Others

- 5.1.2.3 Phosphatic

- 5.1.2.3.1 DAP

- 5.1.2.3.2 MAP

- 5.1.2.3.3 TSP

- 5.1.2.3.4 Others

- 5.1.2.4 Potassic

- 5.1.2.4.1 MoP

- 5.1.2.4.2 SoP

- 5.1.2.4.3 Others

- 5.1.2.5 Secondary Macronutrients

- 5.1.2.5.1 Calcium

- 5.1.2.5.2 Magnesium

- 5.1.2.5.3 Sulfur

- 5.2 Form

- 5.2.1 Conventional

- 5.2.2 Speciality

- 5.2.2.1 CRF

- 5.2.2.2 Liquid Fertilizer

- 5.2.2.3 SRF

- 5.2.2.4 Water Soluble

- 5.3 Application Mode

- 5.3.1 Fertigation

- 5.3.2 Foliar

- 5.3.3 Soil

- 5.4 Crop Type

- 5.4.1 Field Crops

- 5.4.2 Horticultural Crops

- 5.4.3 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 AGRICULTURAL PRODUCTS AND MATERIALS JSC (APROMACO)

- 6.4.2 Baconco

- 6.4.3 Binh Dien Fertilizer JSC (BFC)

- 6.4.4 Duc Giang Chemicals Group

- 6.4.5 Grupa Azoty S.A. (Compo Expert)

- 6.4.6 Haifa Group

- 6.4.7 Ninh Binh Phosphate Fertilizer JSC

- 6.4.8 PetroVietnam Fertilizer and Chemical Corp.

- 6.4.9 Southern Fertilizer JSC

- 6.4.10 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219