|

市場調查報告書

商品編碼

1693420

歐洲氰基丙烯酸酯黏合劑:市場佔有率分析、產業趨勢和統計數據、成長預測(2025-2030 年)Europe Cyanoacrylate Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

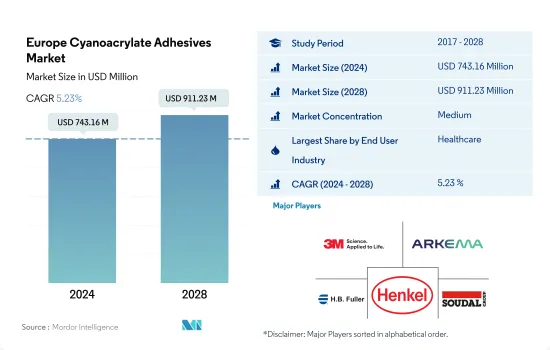

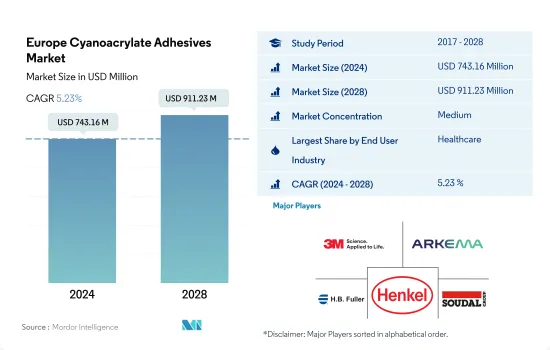

預計 2024 年歐洲氰基丙烯酸酯黏合劑市場規模為 7.4316 億美元,到 2028 年將達到 9.1123 億美元,預測期內(2024-2028 年)的複合年成長率為 5.23%。

航太對反應性氰基丙烯酸酯黏合劑的需求推動歐洲市場成長

- 歐洲擁有龐大的製造地和成熟的出口網路。醫療保健、航太、汽車、建築和船舶是該地區少數幾個在 2017 年至 2019 年期間對氰基丙烯酸酯黏合劑產生穩定需求的成熟行業。德國、法國和英國等國家佔歐洲地區對氰基丙烯酸酯黏合劑需求的較大佔有率。

- 2020 年,由於新冠疫情的影響,氰基丙烯酸酯黏合劑的需求量與 2019 年相比下降了 11.24%。營運、貿易和供應鏈的限制迫使汽車和航太等產業減少產量。這對該地區在此期間對氰基丙烯酸酯黏合劑的需求產生了負面影響。

- 在所有地區中,歐洲的汽車、航太、木工和細木工等產業的研發最為活躍。該地區所有行業都致力於減少碳足跡,並在 2050 年實現淨零排放。在預測期內,汽車和航太等行業對氰基丙烯酸酯黏合劑的需求可能會激增,因為燃油效率和輕量化在其中起著關鍵作用。在所有歐洲國家中,預計法國對氰基丙烯酸酯黏合劑的需求將成長最快,預測期內(2022-2028 年)的複合年成長率為 6.27%。

- 由於用途廣泛,醫療保健在氰基丙烯酸酯黏合劑的需求中佔據最大佔有率。然而,航太終端用戶產業對採用反應技術的氰基丙烯酸酯黏合劑的需求成長預計在 2022-2028 年期間以 6.95% 的最高複合年成長率成長。

歐洲航太工業的發展將最大程度地推動市場成長

- 氰基丙烯酸酯黏合劑有助於縮短組裝時間,主要用於醫療保健產業。歐洲醫療保健產業消耗了約 37,362 噸黏合劑,佔 2021 年歐洲氰基丙烯酸酯黏合劑市場的 36.21%。這些黏合劑用於製造一次性醫療設備和其他醫療保健應用。

- 德國是歐洲最大的氰基丙烯酸酯黏合劑消費國。 2021年,約有40%的黏合劑用於德國醫療保健產業,該產業位居世界第三。 2021年,該國醫療保健支出約為7,920億美元,佔全國GDP的近12%。同年,該國醫療設備出口成長11.85%。預計未來幾年中國醫療保健產業不斷成長的需求將推動氰基丙烯酸酯黏合劑的需求。

- 航太工業是歐洲氰基丙烯酸酯黏合劑消費成長最快的終端用戶產業,預計在 2022-2028 年預測期間內複合年成長率為 7.24%。德國航太業以創新為動力,2021年在研發上的投入約25億歐元。在法國,空中巴士宣布計畫將生產力和產能從2021年的每月40架飛機提高到2023年的每月64架飛機,到2024年初提高到每月70架飛機。受這些因素影響,預計未來幾年歐洲對氰基丙烯酸酯黏合劑的需求將會增加。

- 反應性氰基丙烯酸酯膠黏劑主要在歐洲消費,佔 2021 年氰基丙烯酸酯總需求的 75%。預計在預測期內,需求將進一步成長。

歐洲氰基丙烯酸酯膠黏劑市場趨勢

政府大力推廣電動車的舉措將推動電動車產業的發展

- 歐洲人均GDP為34,230美元,2022與前一年同期比較成長1.6%。汽車工業部門約佔GDP總量的2%。 2021年,歐洲汽車產量將佔乘用車81%,商用車17%,其他2%。

- 2020年,歐洲多個國家受到新冠疫情影響,包括德國、義大利、西班牙、俄羅斯、英國等。疫情擾亂了供應鏈,導致各國工廠關閉,並造成晶片短缺,影響了歐洲的汽車生產。汽車產量與2019年相比大幅下降22%。

- 美國25.3%的汽車進口來自歐洲,其中德國和英國是主要進口國,2021年分別佔10.3%和4.7%。 2022年初,俄羅斯入侵烏克蘭導致新車銷售下降20.5%,也反映在汽車產量上。 2022年第一季歐洲汽車市場與去年同期相比下降了10.6%。

- 由於許多歐洲國家正在對電動車進行新的投資,因此在 2022-2027 年期間,汽車產量的複合年成長率可能達到 2.25%。例如,西班牙計劃投資51億美元用於電動車生產。

對美觀和智慧家具的需求不斷成長將推動產業成長

- 歐洲是世界主要家俱生產國之一。該地區佔全球家具產量的近30%,僅次於亞太地區。德國、義大利、俄羅斯和西班牙是家具及其製品的最大生產國。然而,該地區在 2020 年受到了新冠疫情的影響,迫使多個國家的生產設施暫停營運。結果,家具產量與前一年同期比較下降了7.14%。

- 德國是歐洲最大的家俱生產國。 2021年,其家具產量將接近3.236億件,佔歐洲家具產量的23%。德國零售商已經開始提供 3D 產品視覺化和擴增實境應用程式,這透過該國的電子商務入口網站推動了對家具產品的需求。

- 義大利也是歐洲家具和家具產品的主要生產國,因此義大利家具成為熱門的選擇。該國佔歐洲家具產量的15%。該國有出口維持穩定成長率,2018年約2.7%,2019年約3%。義大利木工和細木工行業的技術進步在全球範圍內採用。

- 歐洲引領家具市場的高階領域。據稱,全球銷售的每三件豪華家具產品中,近兩件都是在歐盟生產的。歐洲家具製造商在生產中使用松木、橡木和山毛櫸等環保材料,這增加了該地區的需求。這些因素可能會導致未來幾年歐洲家具產量增加。

歐洲氰基丙烯酸酯膠黏劑產業概況

歐洲氰基丙烯酸酯膠黏劑市場適度整合,前五大公司佔63.01%的市佔率。該市場的主要企業有:3M、阿科瑪集團、HB Fuller Company、漢高股份公司和Soudal Holding NV(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 鞋類和皮革

- 木製品和配件

- 法律規範

- EU

- 俄羅斯

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 鞋類和皮革

- 衛生保健

- 木製品和配件

- 其他最終用戶產業

- 科技

- 反應性

- 紫外線固化膠合劑

- 國家

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 英國

- 其他歐洲國家

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Arkema Group

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- HB Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- Jowat SE

- Permabond LLC.

- Soudal Holding NV

- ThreeBond Holdings Co., Ltd.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 92479

The Europe Cyanoacrylate Adhesives Market size is estimated at 743.16 million USD in 2024, and is expected to reach 911.23 million USD by 2028, growing at a CAGR of 5.23% during the forecast period (2024-2028).

Demand for cyanoacrylate adhesives based on reactive technology in aerospace to lead in growth rate in Europe

- Europe has a large manufacturing base and well-established export networks. Healthcare, aerospace, automotive, building and construction, and marine are among the few well-established industries in the region which have collectively generated steady demand for cyanoacrylate adhesives from 2017 to 2019. Countries like Germany, France, and The United Kingdom have occupied a larger share of the demand generated for cyanoacrylate adhesives from the Europe region.

- In 2020, the demand for cyanoacrylate adhesives declined by 11.24% compared to the 2019 levels because of the covid-19 pandemic. Operational, trade and supply chain restrictions have forced industries like automotive, aerospace, and others to have production cuts. This has negatively affected the demand for cyanoacrylate adhesives from the region during this period.

- Among all regions, European automotive, aerospace and woodworking and joinery, and other industries are heavily engaged in R&D activities. All Industries in the region are focusing on reducing their carbon footprint to achieve a net zero emissions goal by 2050. Industries like automotive and aerospace, where fuel efficiency and weight reduction play an important role, might witness a surge in demand for cyanoacrylate adhesives during the forecast period. Among all countries in Europe, France is expected to witness the highest growth in the demand for cyanoacrylate adhesives, with a CAGR of 6.27% during the forecast period (2022-2028).

- Healthcare occupies the largest share of the demand for cyanoacrylate adhesives because of the large number of applications. However, the growth in demand for cyanoacrylate adhesives with reactive technology from the aerospace end-user industry is expected to be with the highest CAGR of 6.95% in 2022-2028.

Developments in the aerospace industry across the European countries to have boost the market's growth the most

- Cyanoacrylate adhesives help in the reduction of assembly times and are consumed mainly in the healthcare industry. The healthcare industry consumes around 37,362 tons of adhesives in Europe, which accounted for 36.21% of the European cyanoacrylate adhesives market in 2021. These adhesives are used to manufacture disposable medical devices and other healthcare applications.

- Germany is the largest consumer of cyanoacrylate adhesives in Europe. In 2021, around 40% of these adhesives were used in the healthcare industry of Germany, which is the third largest healthcare industry globally. In 2021, the healthcare expenditure in the country was around USD 792 billion and contributed nearly 12% of the country's GDP. In the same year, the exports of medical devices by the country increased by 11.85%. Such rising demand from the healthcare industry in the country is expected to drive the demand for cyanoacrylate adhesives over the coming years.

- Aerospace is the fastest-growing end-user industry in the consumption of cyanoacrylate adhesives in Europe and is expected to record a CAGR of 7.24% during the forecast period 2022-2028. Germany's aerospace industry is driven by technological innovation, and around EUR 2.5 billion was spent on research and development in 2021. In France, Airbus announced plans to increase production speeds and capacity from 40 aircraft per month in 2021 to 64 per month in 2023 and as many as 70 per month by early 2024. These abovementioned factors are expected to boost the demand for cyanoacrylate adhesives over the coming years in Europe.

- Reactive cyanoacrylate adhesives are primarily consumed in Europe and accounted for 75% of the total cyanoacrylate demand in 2021. Their demand is expected to grow further over the forecast period.

Europe Cyanoacrylate Adhesives Market Trends

Supportive government initiatives to promote electric vehicles will raise the industry size

- Europe has a GDP of 34,230 USD per capita with a growth rate of 1.6% y-o-y in 2022. The automotive industry sector contributes a percentage of around 2% of the total GDP. The European vehicle production comprises 81% passenger vehicles, 17% commercial vehicles, and 2% other vehicles in 2021.

- In 2020, many European countries were affected by the COVID-19 pandemic, including Germany, Italy, Spain, Russia, and the United Kingdom. The pandemic resulted in supply chain disruptions, lockdowns in the countries, and chip shortages which affected automotive production in Europe. The production of vehicles sharply declined by 22% compared to 2019.

- The United States imports 25.3% worth of cars from Europe and became one of the leading importers of the United States, where Germany accounted for 10.3% and the United Kingdom for 4.7% of total imports of vehicles in the country in 2021. At the beginning of 2022, the sale of the new vehicle dropped by 20.5% due to the invasion of Ukraine by Russia, which reflected in vehicle production as well. In the first quarter of 2022, the European automotive market was down by 10.6% compared to the same period last year.

- Vehicle production is likely to grow with a CAGR of 2.25% during the period (2022 to 2027) due to the new investments being made in electric vehicles by many European countries. For instance, Spain is going to invest USD 5.1 billion in electric vehicle production.

Rising demand for aesthetic and smart furniture to aid the industry growth

- Europe is one of the largest producers of furniture in the world. The region contributes nearly 30% of global furniture production after the Asia-Pacific region. Germany, Italy, Russia, and Spain are the top producers of furniture and its products. However, the region was impacted by the COVID-19 outbreak in 2020, which resulted in the shutdown of production facilities in several countries. This has reduced their furniture production by 7.14% compared to the previous year.

- Germany is the largest producer of Furniture units in Europe. The country produced nearly 323.6 million units in 2021, which is 23% of Europe's furniture production. German retailers have started offering 3D product visualizations or augmented reality apps which are boosting the demand for furniture products through e-commerce portals in the country.

- Italy is another major producer of furniture and its products in Europe, and the country is popular for Italian Furniture. The country holds 15% of Europe's furniture production. The country's furniture exports recorded a constant growth rate, which was about 2.7% in 2018 and 3% in 2019. The technological advancement in the woodworking and joinery industry of Italy is adopted worldwide.

- Europe is a leader in the high-end segment of the furniture market. It is said that nearly two out of every three high-end furniture products sold in the world are produced in the European Union. The furniture manufacturers in Europe are using eco-friendly materials such as pine wood, oak wood, beech wood, and a few others for production, which is gaining demand in the region. These factors will raise furniture production in the coming years in Europe.

Europe Cyanoacrylate Adhesives Industry Overview

The Europe Cyanoacrylate Adhesives Market is moderately consolidated, with the top five companies occupying 63.01%. The major players in this market are 3M, Arkema Group, H.B. Fuller Company, Henkel AG & Co. KGaA and Soudal Holding N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 EU

- 4.2.2 Russia

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Woodworking and Joinery

- 5.1.7 Other End-user Industries

- 5.2 Technology

- 5.2.1 Reactive

- 5.2.2 UV Cured Adhesives

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Russia

- 5.3.5 Spain

- 5.3.6 United Kingdom

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 DELO Industrie Klebstoffe GmbH & Co. KGaA

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Illinois Tool Works Inc.

- 6.4.7 Jowat SE

- 6.4.8 Permabond LLC.

- 6.4.9 Soudal Holding N.V.

- 6.4.10 ThreeBond Holdings Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219