|

市場調查報告書

商品編碼

1693419

亞太地區氰基丙烯酸酯黏合劑-市場佔有率分析、產業趨勢與成長預測(2025-2030年)Asia-Pacific Cyanoacrylate Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

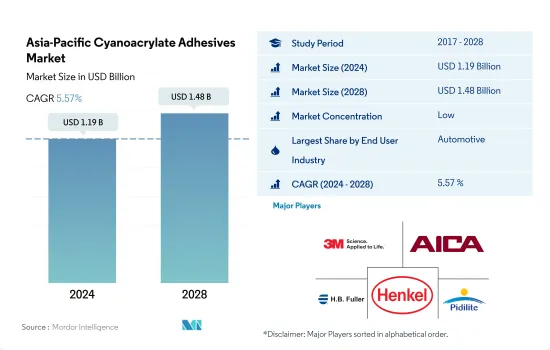

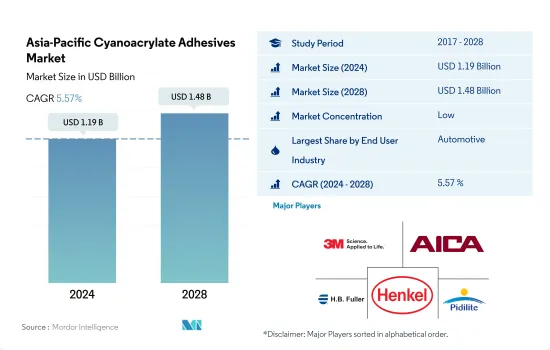

亞太地區氰基丙烯酸酯黏合劑市場規模預計在 2024 年為 11.9 億美元,預計到 2028 年將達到 14.8 億美元,預測期內(2024-2028 年)的複合年成長率為 5.57%。

氰基丙烯酸酯黏合劑在航太和醫療產業中的應用和需求不斷成長是一個主要的成長要素。

- 由於預測期內 DIY 和電子應用的需求快速成長,亞太地區氰基丙烯酸酯黏合劑市場可能由其他終端用戶產業主導。氰基丙烯酸酯具有獨特的性能,能夠在短時間內與木材、金屬、塑膠、陶瓷和彈性體等各種基材形成優異的黏合力,適合 DIY 領域的專業人士使用。

- 由於氰基丙烯酸酯黏合劑在汽車等各行各業的關鍵組裝作業中的應用不斷增加,其消費量近期有所增加。氰基丙烯酸酯可提供永久性黏合,且在很寬的熱度和溫度範圍內保持穩定。此外,汽車製造商正在努力生產輕量化零件,以在不犧牲安全性的情況下減輕車輛的整體重量。因此,預計未來幾年汽車產業對氰基丙烯酸酯黏合劑的消費量將顯著成長。

- 由於氰基丙烯酸酯具有不易燃、固化速度快、在機械和結構操作中應用方便等特點,航太業很可能成為氰基丙烯酸酯消費量成長最快的產業。此外,氰基丙烯酸酯正迅速被用作各種醫療外科應用中的組織黏合劑,以取代傳統的縫合工藝。此外,氰基丙烯酸酯的口服使用在過去幾年中也持續改善。這些因素將推動亞太地區氰基丙烯酸酯黏合劑的未來成長。

醫療產業推動印尼氰基丙烯酸酯黏合劑市場高速成長

- 亞太地區是全球最大的氰基丙烯酸酯膠黏劑消費地區,佔2021年氰基丙烯酸酯膠黏劑總消費量的42.9%。氰基丙烯酸酯膠粘劑是該地區汽車、醫療、DIY和其他行業消費的瞬間膠粘劑。

- 中國是該地區乃至全球最大的氰基丙烯酸酯膠黏劑消費國。這些黏合劑主要用於該國的汽車和醫療行業。中國汽車產業約消耗23036噸氰基丙烯酸酯膠黏劑。預計到 2025 年,汽車產量將達到 3,420 萬輛,高於 2021 年的 2,620 萬輛。汽車行業日益成長的需求預計將推動該國對氰基丙烯酸酯黏合劑的需求。

- 航太是該地區氰基丙烯酸酯黏合劑成長最快的終端用戶產業,預計在 2022-2028 年預測期內,其產量複合年成長率將達到 6.26%。中國正在實施「製造2025」計劃,要求飛機製造商100%在中國採購和製造飛機,限制外國公司進入。同時,預計當地航太黏合劑和密封劑製造商將受益於政府計劃。該地區其他國家正在實施的類似措施預計將促進該地區航太業的發展。

- 印尼是該地區乃至全球市場成長最快的國家,預計在 2022-2028 年預測期內,受醫療保健產業成長的推動,其複合年成長率將達到 7%。預計到 2027 年,印尼的醫療設備市場規模將達到 28.3 億美元。這些因素預計將在預測期內推動亞太地區對氰基丙烯酸酯黏合劑的需求。

亞太地區氰基丙烯酸酯膠黏劑市場趨勢

電動車的普及正在推動該產業

- 亞太地區的汽車產業是市場驅動力之一,因為汽車銷量大幅成長。中國是最大的汽車生產國,約佔該地區汽車產量的57%。其次是日本(17%)、印度(10%)和韓國(8%)。

- 該地區的汽車銷售和產量均大幅下降,影響了黏合劑的使用。 2017- 與前一年同期比較變動為-1.8%,而2018-19年度則進一步下降-6.4%。 2019-20年度,受新冠疫情影響,該地區產量再次受到負面影響,較去年同期與前一年同期比較10.2%。由於製造工廠停工和供應鏈中斷,汽車零件短缺,生產水準受到限制。然而,預計汽車需求將在 2021 年再次增加並持續成長,從而導致預測期內全部區域的黏合劑使用量增加。

- 亞太電動車市場為黏合劑市場帶來了另一個成長機會。電動和混合動力汽車的產量和採用率的不斷提高,推動了汽車電子組裝中黏合劑的使用量。中國是世界上最大的電動車生產國,也是全部區域最大的電動車生產國。 2016年至2021年間,商用電動車數量從562,603輛增加到1,116,382輛,成長率約98%。預計這些因素將增加對黏合劑的需求,有助於預測期內的市場成長。

亞太地區家具製造商的強大影響力推動產業發展

- 在亞太地區,中國是最大的家具製造國、出口國和消費國。由於中國人口眾多,都市區家庭可支配所得不斷增加,家具消費量較高。全球超過35%的家具貿易來自中國,全球40%的金屬家具出口以及超過60%的軟體木質和金屬座椅都來自中國。

- 儘管與美國存在利益衝突,但中國家具市場在2017年至2019年期間仍成長了約18%。在亞太地區,由於新冠疫情造成的營運、貿易和供應鏈限制,家具業在2020年下降了約7%。然而,由於中國、印度和日本等國家的需求增加,家具業已恢復到疫情前的水準。 2022年,中國向全球出口家具價值690億美元。

- 印度是世界第五大家俱生產國。由於印度家庭可支配收入的增加、中產階級的壯大以及都市化的穩步推進,家具製造業在 2017 年至 2019 年期間實現了健康成長。印度的家具製造業基本上是無組織的,印度政府已經認知到其潛力並將其命名為冠軍產業。為確保國內家俱生產穩定成長,國家正大力組織、規範國內家俱生產。

- 受中國、印度和日本等國家木工和細木工行業顯著成長的推動,預計預測期內(2022-2028 年)市場規模的複合年成長率約為 4.2%。

亞太地區氰基丙烯酸酯膠黏劑產業概況

亞太地區氰基丙烯酸酯膠黏劑市場細分化,前五大公司佔31.95%的市佔率。該市場的主要企業包括 3M、Aica Kogyo、HB Fuller Company、Henkel AG & Co. KGaA 和 Pidilite Industries Ltd.。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 鞋類皮革

- 木製品和配件

- 法律規範

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 新加坡

- 韓國

- 泰國

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 鞋類和皮革

- 醫療保健

- 木製品和配件

- 其他

- 科技

- 反應性

- 紫外線固化膠合劑

- 國家

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 新加坡

- 韓國

- 泰國

- 其他亞太地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Aica Kogyo Co..Ltd.

- Arkema Group

- HB Fuller Company

- Henkel AG & Co. KGaA

- Hubei Huitian New Materials Co. Ltd

- Kangda New Materials(Group)Co., Ltd.

- NANPAO RESINS CHEMICAL GROUP

- Pidilite Industries Ltd.

- ThreeBond Holdings Co., Ltd.

第7章 CEO 的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 92478

The Asia-Pacific Cyanoacrylate Adhesives Market size is estimated at 1.19 billion USD in 2024, and is expected to reach 1.48 billion USD by 2028, growing at a CAGR of 5.57% during the forecast period (2024-2028).

The rising applications and demand for cyanoacrylate adhesives across the aerospace and healthcare industries are the major growth factors

- Asia-Pacific's cyanoacrylate adhesives market is likely to dominate by other end-user industries owing to rapidly increasing demand from DIY and electronics applications throughout the projected timeframe. Cyanoacrylates have unique characteristics to create an exceptional bond in a shorter time period with different substrates such as wood, metal, plastics, ceramics, and elastomers, which make them suitable to be used by professionals in the DIY sector.

- Cyanoacrylate adhesive consumption has recently increased for automotive due to rising applications of critical assembly operations across the industry. Cyanoacrylates offer a permanent bond that can be stable under a wide range of heat and temperature. Moreover, automotive manufacturers are engaging themselves in producing lightweight parts and components to reduce the overall vehicle's weight without sacrificing safety. Thus, cyanoacrylate adhesives consumption in the automotive industry will showcase significant growth in the upcoming years.

- The aerospace industry is likely to witness a fastest-growing sector in terms of cyanoacrylate consumption owing to its non-flammable, fast-curing ability, and hassle-free applications in mechanical and structural operations. In addition, cyanoacrylates are rapidly adopted as a tissue adhesive for a variety of medical and surgical applications to replace traditional suturing processes. Furthermore, oral applications of cyanoacrylates have exhibited continuous improvements over the last few years. These factors collectively impetus the growth of cyanoacrylate adhesives across the Asia-Pacific region in the upcoming years.

High value growth forecasted for the cyanoacrylate adhesives led by the Indonesian healthcare industry

- Asia-Pacific is the world's largest regional consumer of cyanoacrylate adhesives, accounting for 42.9% of total cyanoacrylate adhesive consumption in 2021. Cyanoacrylate adhesives are instant adhesives consumed in the region's automotive, healthcare, DIY, and other industries.

- China is the largest consumer of cyanoacrylate adhesives in the region and the world. These adhesives are majorly used in the country's automotive and healthcare industries. The Chinese automotive industry consumes about 23,036 tons of cyanoacrylate adhesives. Automotive production is expected to reach 34.2 million units by 2025 from 26.2 million units in 2021. Such growing demand from the automotive industry is expected to drive the demand for cyanoacrylate adhesives in the country.

- Aerospace is the fastest-growing end-user industry of cyanoacrylate adhesives in the region and is expected to record a CAGR of 6.26% in volume terms during the forecast period 2022-2028. China is implementing the 'Made in 2025' plan, which requires aircraft manufacturers to source and manufacture 100% of aircraft in China, restricting foreign players' entry. On the other hand, the local aerospace adhesives and sealants manufacturers are expected to benefit from this government scheme. Similar policies being implemented by other countries in the region are expected to boost the aerospace industry in the region.

- Indonesia is the fastest-growing country in the region and globally for the market and is expected to record a CAGR of 7% during the forecast period 2022-2028, owing to its growing healthcare industry. The medical device market in Indonesia is expected to reach USD 2.83 billion by 2027. These factors are expected to boost the demand for cyanoacrylate adhesives in the Asia-Pacific region over the forecast period.

Asia-Pacific Cyanoacrylate Adhesives Market Trends

Increasing adoption of electric vehicles to drive the industry

- The Asia-Pacific automotive industry is one of the leading industries in the market, as the sales of automotive vehicles are largely increasing. Among all the countries, China is the largest automotive producer, accounting for about 57% of the regional production, followed by Japan with 17%, India with 10%, and South Korea with 8%.

- Vehicle sales in the region have majorly declined along with production, owing to which the utilization of adhesives has been impacted. While the Y-o-Y variation in 2017-18 was -1.8%, it fell further by -6.4% in 2018-19. In 2019-20, regional production was again impacted negatively and recorded a -10.2% decline from the previous year due to the COVID-19 pandemic. The shutdown of manufacturing facilities and the shortage of vehicle components due to disruptions in the supply chain constrained the production level. However, in 2021, the demand for automobiles rose again and is expected to continue, thereby increasing the utilization of adhesives across the region over the forecast period.

- The EV market in Asia-Pacific offers another opportunity for the adhesives market to grow. The rising production and adoption of EVs and hybrid vehicles are boosting the usage of adhesives for electronic component assembly in vehicles. China is the largest producer of EVs globally as well as across the region. From 2016 to 2021, the volume of commercial electric vehicles increased from 562,603 to 1,116,382 units, recording a growth rate of about 98%. These factors are expected to increase the demand for adhesives and result in the higher market growth over the forecast period.

High presence of furniture manufacturers in the Asia-Pacific region will propel the industry

- In Asia-Pacific, China is the largest furniture manufacturer, exporter, and consumer. China's high furniture consumption is due to its large population and the growing disposable income of urban households. More than 35% of the world's furniture trade originates from China, and 40% of the world's metal furniture exports and over 60% of upholstered wooden and metal seats are produced in China.

- The Chinese furniture market grew by around 18% during 2017-19 despite the conflict of interests with the United States. In Asia-Pacific, the furniture industry witnessed a decline of around 7% in 2020 due to the operational, trade, and supply chain restrictions resulting from the COVID-19 pandemic. However, the furniture industry has bounced back to its pre-pandemic levels in line with the rising demand from countries such as China, India, and Japan. In 2022, China exported USD 69 billion worth of furniture globally.

- India is the fifth largest producer of furniture in the world. The furniture manufacturing industry witnessed healthy growth from 2017 to 2019 because of factors like rising disposable income in Indian households, increasing middle-income families, and steady growth in urbanization. The Indian furniture manufacturing industry is largely unorganized, and the Indian government has recognized its potential and named it a champion sector. Efforts are being made to organize and regulate it in a structured way to ensure steady growth in domestic furniture production.

- Owing to the significant growth in the woodworking and joinery sector in countries like China, India, and Japan, the market is expected to register a CAGR of around 4.2% in terms of volume during the forecast period (2022-2028).

Asia-Pacific Cyanoacrylate Adhesives Industry Overview

The Asia-Pacific Cyanoacrylate Adhesives Market is fragmented, with the top five companies occupying 31.95%. The major players in this market are 3M, Aica Kogyo Co..Ltd., H.B. Fuller Company, Henkel AG & Co. KGaA and Pidilite Industries Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Australia

- 4.2.2 China

- 4.2.3 India

- 4.2.4 Indonesia

- 4.2.5 Japan

- 4.2.6 Malaysia

- 4.2.7 Singapore

- 4.2.8 South Korea

- 4.2.9 Thailand

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Woodworking and Joinery

- 5.1.7 Other End-user Industries

- 5.2 Technology

- 5.2.1 Reactive

- 5.2.2 UV Cured Adhesives

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 Singapore

- 5.3.8 South Korea

- 5.3.9 Thailand

- 5.3.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Aica Kogyo Co..Ltd.

- 6.4.3 Arkema Group

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Hubei Huitian New Materials Co. Ltd

- 6.4.7 Kangda New Materials (Group) Co., Ltd.

- 6.4.8 NANPAO RESINS CHEMICAL GROUP

- 6.4.9 Pidilite Industries Ltd.

- 6.4.10 ThreeBond Holdings Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219