|

市場調查報告書

商品編碼

1693414

環氧樹脂膠黏劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Epoxy Adhesive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

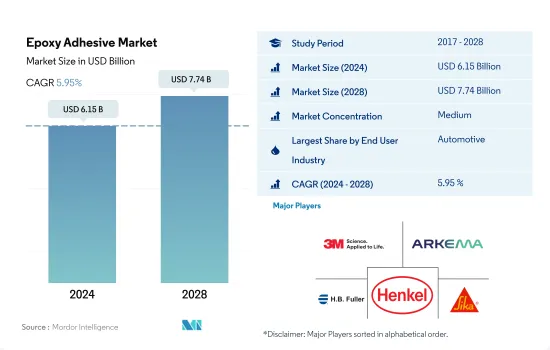

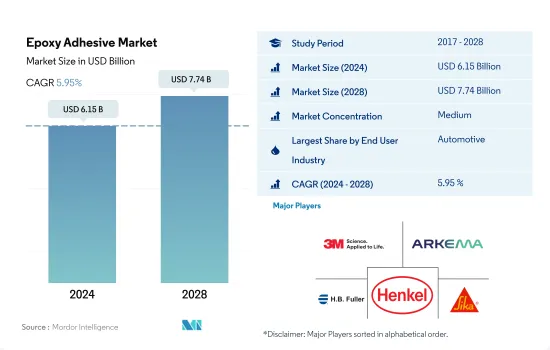

環氧膠黏劑市場規模預計在 2024 年為 61.5 億美元,預計到 2028 年將達到 77.4 億美元,預測期內(2024-2028 年)的複合年成長率為 5.95%。

醫療投資增加推動環氧樹脂膠合劑需求

- 環氧樹脂膠黏劑廣泛應用於建築業,例如地板材料、屋頂和黏合木質零件等。預計到 2030 年,全球建築業將以每年 3.5% 的速度成長。中國、印度、美國和印尼預計將佔全球整體建築業成長的 58.3%。因此,以金額為準,建築膠黏劑目前佔全球市場佔有率的近 18%。

- 環氧樹脂膠黏劑廣泛應用於汽車工業,因為其可應用於玻璃、金屬、塑膠和油漆表面等表面,且其附著力強、耐用、壽命長等特點在汽車工業中很有用。這些產品用於引擎和汽車墊圈。由於發展中國家的需求不斷成長,預測期內全球整體汽車產業的電動車領域預計將以 17.75% 的複合年成長率成長。預計這將在預測期內增加對汽車環氧膠黏劑的需求。

- 環氧樹脂膠粘劑廣泛應用於電子和電氣設備製造,因為它們可以用來粘合感測器和電纜。預計全球電子和家用電子電器產業的複合年成長率將分別達到 2.51% 和 5.77%,從而導致 2022-2028 年預測期內對環氧膠合劑的需求增加。

- 環氧樹脂基黏合劑用於醫療產業,用於組裝和黏合醫療設備組件等應用。全球醫療保健投資的增加將導致預測期內需求的增加。

電動車需求推動環氧膠合劑需求

- 環氧膠黏劑主要由環氧樹脂和硬化劑組成。雙組分環氧膠黏劑由環氧樹脂和硬化劑成分單獨包裝而成。兩種成分混合後,它們會迅速變硬。幾乎任何雙組分室溫固化環氧膠粘劑都可以使用。所有成分,包括環氧樹脂和硬化劑,都經過預先混合,以形成單組分環氧黏合劑。環氧樹脂黏合劑可與多種基材很好地黏合,可用於黏合金屬、玻璃、混凝土、陶瓷、木材和許多聚合物。硬化收縮極小。固化環氧樹脂的交聯化學結構堅固而剛性,使其適用於結構性黏合應用。透過結合不同的環氧樹脂和硬化劑,已經開發出適用於各種應用的各種環氧黏合劑。

- 亞太地區是全球環氧膠黏劑的最大消費地區,約佔47%的市場佔有率,其次是北美(佔25%)、歐洲(佔23.5%)、中東和非洲(佔3.3%)、南美(佔3.1%)。預計全部區域建設活動的成長以及由於 COVID-19 疫情後銷量增加而導致的汽車產量增加將成為推動環氧膠黏劑成長的關鍵因素。

- 在所有終端使用領域中,汽車是全球環氧樹脂的最大消費者,約佔 30.7% 的佔有率。其次是建築施工、醫療、航太和木工,分別佔約 19.2%、10.2%、7% 和 6.6% 的佔有率。其他終端用途工業部門約佔28%。為了增強永續性,電動車的普及預計將推動全球對環氧膠的需求。

全球環氧膠黏劑市場趨勢

政府推行的電動車優惠政策將推動汽車產業

- 預計 2021 年後全球汽車產業將穩定成長,但成長速度將放緩,因為消費者對擁有個人汽車的偏好降低,而對共用出行的偏好。預計預測期內全球汽車產業將以每年 2% 的速度成長,總收益增加價值將達到 1.5 兆美元。

- 2020年,受新冠疫情影響,汽車銷量下滑,但2021年卻迅速回升。汽車市場通常對GDP貢獻巨大,因此世界各國政府紛紛推出措施支持經濟。汽車銷量從2019年的9000萬輛下降到2020年的7800萬輛。

- 由於電動車能源成本低廉、環保且移動性能高效,其在全球範圍內的普及對全球汽車市場的總收益做出了重大貢獻。各種政府政策和標準也在推動電動車產量的成長。例如,歐盟二氧化碳排放標準在2021年增加了對電動車的需求。根據國際能源總署的永續發展情景,到2030年將需要2.3億輛電動車取代燃油汽車。 2021年,最大的電動車製造商特斯拉的電動車產量增加了157%。預計預測期內(2022-2028 年),消費者對電動車的偏好將進一步成長。

隨著住宅基礎建設的擴大,建築業蓬勃發展

- 建築業呈現穩定成長,2017 年至 2019 年的複合年成長率為 2.6%。這一成長受到全球經濟活動好轉和獨棟住宅需求增加的推動。 2020年,新冠疫情對全球建築業產生了重大影響。勞動力供應限制、建築融資和供應鏈中斷以及經濟不確定性對全球 AEC 產業產生了負面影響。

- 雖然2021年呈現正成長,但疫情對供應鏈的衝擊導致原物料價格上漲,仍在困擾產業。不過,由於建築業對一個國家的經濟影響重大,北美和亞太國家都透過提供支持計畫來重新啟動經濟週期。支持計劃包括澳大利亞的HomeBuilder計劃和歐盟國家的經濟復甦計劃。

- 亞太地區的建設活動,預計到 2028 年仍將是最大的建築市場,這得益於其龐大的人口、不斷加快的都市化以及中國、印度、日本、印尼和韓國等國家對基礎設施建設的投資不斷增加。

- 預計在預測期內,對綠色建築的日益重視和減少全球建設活動排放的努力將帶來更永續的營運程序。例如,法國對其建築業實施了75億歐元的製裁,以努力轉型為低碳能源經濟。

環氧膠黏劑產業概況

環氧膠黏劑市場適度整合,前五大公司佔40.37%的市佔率。該市場的主要企業包括 3M、阿科瑪集團、HB Fuller 公司、漢高股份公司、西卡股份公司等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 鞋類皮革

- 包裝

- 木製品和配件

- 法律規範

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 中國

- EU

- 印度

- 印尼

- 日本

- 馬來西亞

- 墨西哥

- 俄羅斯

- 沙烏地阿拉伯

- 新加坡

- 南非

- 韓國

- 泰國

- 美國

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 鞋類和皮革

- 醫療保健

- 包裝

- 木製品和配件

- 其他

- 科技

- 反應性

- 溶劑型

- 紫外線固化膠合劑

- 水性

- 地區

- 亞太地區

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 新加坡

- 韓國

- 泰國

- 其他亞太地區

- 歐洲

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 英國

- 其他歐洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地區

- 亞太地區

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Arkema Group

- HB Fuller Company

- Henkel AG & Co. KGaA

- Hubei Huitian New Materials Co. Ltd

- Huntsman International LLC

- Illinois Tool Works Inc.

- Jowat SE

- Kangda New Materials(Group)Co., Ltd.

- KLEBCHEMIE MG Becker GmbH & Co. KG

- MAPEI SpA

- NANPAO RESINS CHEMICAL GROUP

- Pidilite Industries Ltd.

- Sika AG

- Soudal Holding NV

第7章 CEO 的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 92473

The Epoxy Adhesive Market size is estimated at 6.15 billion USD in 2024, and is expected to reach 7.74 billion USD by 2028, growing at a CAGR of 5.95% during the forecast period (2024-2028).

Increasing healthcare investments to drive the demand for epoxy resin-based adhesives

- Epoxy resin-based adhesives are widely used in the construction industry because of their applications, such as for flooring, roofing, wooden components joinery, etc. The construction industry globally is expected to grow at 3.5% per annum up to 2030. China, India, the United States, and Indonesia are expected to account for 58.3% of the overall construction growth globally. As a result, construction adhesives account for a nearly 18% share of the global epoxy adhesive market share by value.

- Epoxy resin-based adhesives are widely used in the automotive industry because of their applicability to surfaces such as glass, metal, plastic, painted surfaces, etc., and their features are helpful in the automotive industry, such as for strong bonding, durability, and long-lasting. These products are used in engines and car gaskets. The electric vehicles segment of the automotive industry is expected to record a CAGR of 17.75% globally in the forecast period because of the increased demand for the same in growing economies. This is expected to increase the demand for automotive epoxy adhesives in the forecast period.

- Epoxy adhesives are widely used for electronics and electrical equipment manufacturing as they can be used for sticking sensors and cables. The global electronics and household appliances industries are expected to record CAGRs of 2.51% and 5.77%, respectively, which is expected to lead to an increase in demand for epoxy adhesives in the forecast period 2022-2028.

- Epoxy resin-based adhesives are used in the healthcare industry for applications such as assembling and bonding medical device parts. The increase in healthcare investments worldwide will lead to an increase in their demand in the forecast period.

Electric vehicles demand to drive the demand for epoxy adhesives

- Epoxy adhesives are made up largely of epoxy resin and a curing agent. Two-component epoxy adhesives are made by separately packaging the epoxy and curing agent components. They cure quickly after combining the two components. Almost all two-component room-temperature cure epoxy adhesives are available. All formulated components, including epoxy resin and curing agent, are mixed in advance to make one-component epoxy adhesives. Epoxy adhesives adhere well to various substrates and can be used to attach metals, glass, concrete, ceramics, wood, and many polymers. Curing shrinkage is extremely minimal. The cross-linked chemical structure of cured epoxy resin is strong and rigid, making it appropriate for structural bonding applications. Various epoxy adhesives for diverse uses have been developed by combining various epoxy resins and curing agents.

- Asia-Pacific is the top consumer of epoxy adhesives globally, holding a share of about 47%, followed by North America, Europe, Middle East and Africa, and South America, with shares of 25%, 23.5%, 3.3%, and 3.1%, respectively. Growing construction activities and the rising production of automotive vehicles due to an increase in sales after the COVID-19 pandemic across the region is expected to be the major factor driving the growth of epoxy adhesives.

- Across all the end-use sectors, automotive is the leading consumer of epoxy globally, holding a share of about 30.7%, followed by building and construction, healthcare, aerospace, and woodworking, with shares of about 19.2%, 10.2%, 7%, and 6.6%, respectively. The other end-use industries segment holds about 28%. The rising adoption of EVs to increase sustainability is expected to boost the demand for epoxy adhesives globally.

Global Epoxy Adhesive Market Trends

Favorable government policies to promote electric vehicles will propel automotive industry

- Since 2021, the global automotive industry has been expected to grow steadily but at a slower pace because of the decline in consumers' preferences for individual ownership of passenger vehicles and their increased preference for shared mobility in transportation. The global automotive industry is expected to experience a growth rate of 2% annually, with an expected value addition of USD 1.5 trillion in total revenue during the forecast period.

- In 2020, due to the impact of the COVID-19 pandemic, vehicle sales declined but recovered rapidly in 2021 because the governments of various countries took measures to support their economies, as automotive markets usually contribute majorly to their GDP. Vehicle sales declined from 90 million units of passenger vehicles in 2019 to 78 million units in 2020.

- The introduction of electric vehicles worldwide has contributed significantly to the overall revenue of the global automotive market because of their cheaper energy costs, environmentally benign nature, and efficient mobility features. Various government policies and standards also work as driving factors to increase EV production. For instance, the EU standards for CO2 emissions increased the demand for electric vehicles in 2021. As per the IEA's Sustainable Scenario, 230 million electric vehicles are required to replace combustion fuel-based vehicles by 2030. In 2021, Tesla, the largest EV manufacturer, recorded a rise of 157% in the number of electric vehicles manufactured. This growing trend of consumers preferring electric vehicles is expected to rise further during the forecast period (2022-2028).

Growing residential and infrastructural development to thrive the construction sector

- The building and construction industry witnessed steady growth, with a CAGR of 2.6% from 2017 to 2019. This growth was driven by the upswing in global economic activity and increasing demand for single-family homes. In 2020, the COVID-19 pandemic had a major impact on the global building and construction industry. Constraints in labor supply, disruptions in construction finances and the supply chain, and economic uncertainty negatively impacted the global building and construction industry.

- Though the industry showed positive growth in 2021, the pandemic's effect on supply chains, which resulted in a hike in raw material prices, is still plaguing the industry. However, as the construction industry heavily influences a nation's economy, countries in Europe, North America, and Asia-Pacific have used the construction industry to restart their economic cycles by offering support schemes. Some support schemes include the Homebuilder Programme in Australia and the economic recovery plan of EU countries.

- The Asia-Pacific region experiences the highest volume of construction activities, and it is expected to remain the largest construction market till 2028 due to its huge population, increasing urbanization, and increasing investments in infrastructural development in countries like China, India, Japan, Indonesia, and South Korea.

- Increasing emphasis on green buildings and efforts to reduce emissions from global construction activities are expected to result in more sustainable operational procedures during the forecast period. For example, France has sanctioned EUR 7.5 billion for the construction industry to transform itself into a low-carbon energy economy.

Epoxy Adhesive Industry Overview

The Epoxy Adhesive Market is moderately consolidated, with the top five companies occupying 40.37%. The major players in this market are 3M, Arkema Group, H.B. Fuller Company, Henkel AG & Co. KGaA and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Argentina

- 4.2.2 Australia

- 4.2.3 Brazil

- 4.2.4 Canada

- 4.2.5 China

- 4.2.6 EU

- 4.2.7 India

- 4.2.8 Indonesia

- 4.2.9 Japan

- 4.2.10 Malaysia

- 4.2.11 Mexico

- 4.2.12 Russia

- 4.2.13 Saudi Arabia

- 4.2.14 Singapore

- 4.2.15 South Africa

- 4.2.16 South Korea

- 4.2.17 Thailand

- 4.2.18 United States

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Reactive

- 5.2.2 Solvent-borne

- 5.2.3 UV Cured Adhesives

- 5.2.4 Water-borne

- 5.3 Region

- 5.3.1 Asia-Pacific

- 5.3.1.1 Australia

- 5.3.1.2 China

- 5.3.1.3 India

- 5.3.1.4 Indonesia

- 5.3.1.5 Japan

- 5.3.1.6 Malaysia

- 5.3.1.7 Singapore

- 5.3.1.8 South Korea

- 5.3.1.9 Thailand

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 Europe

- 5.3.2.1 France

- 5.3.2.2 Germany

- 5.3.2.3 Italy

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 United Kingdom

- 5.3.2.7 Rest of Europe

- 5.3.3 Middle East & Africa

- 5.3.3.1 Saudi Arabia

- 5.3.3.2 South Africa

- 5.3.3.3 Rest of Middle East & Africa

- 5.3.4 North America

- 5.3.4.1 Canada

- 5.3.4.2 Mexico

- 5.3.4.3 United States

- 5.3.4.4 Rest of North America

- 5.3.5 South America

- 5.3.5.1 Argentina

- 5.3.5.2 Brazil

- 5.3.5.3 Rest of South America

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 H.B. Fuller Company

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 Hubei Huitian New Materials Co. Ltd

- 6.4.6 Huntsman International LLC

- 6.4.7 Illinois Tool Works Inc.

- 6.4.8 Jowat SE

- 6.4.9 Kangda New Materials (Group) Co., Ltd.

- 6.4.10 KLEBCHEMIE M. G. Becker GmbH & Co. KG

- 6.4.11 MAPEI S.p.A.

- 6.4.12 NANPAO RESINS CHEMICAL GROUP

- 6.4.13 Pidilite Industries Ltd.

- 6.4.14 Sika AG

- 6.4.15 Soudal Holding N.V.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219