|

市場調查報告書

商品編碼

1692460

亞太地區電動二輪車市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia Pacific Electric Two-Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

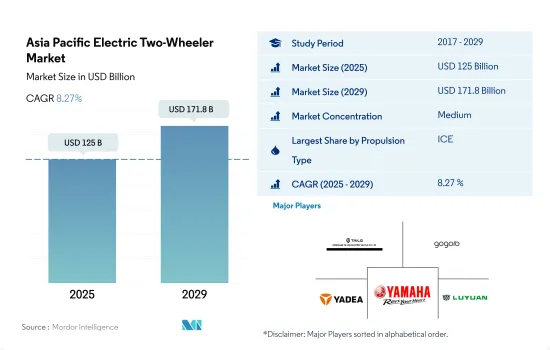

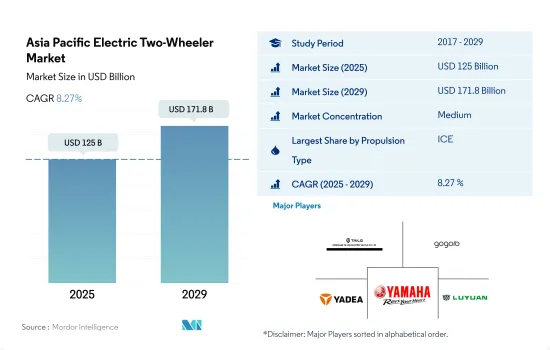

亞太電動二輪車市場規模預計在 2025 年達到 1,250 億美元,預計到 2029 年將達到 1,718 億美元,預測期內(2025-2029 年)的複合年成長率為 8.27%。

在環境問題、政府支持和技術進步的推動下,亞太摩托車市場正在經歷向電動車的重大轉變。

- 隨著亞太地區環保意識的不斷增強、政府補貼和激勵等支持性政策的訂定以及電動車價格和性能的不斷提高,電動二輪車在該地區迅速普及。中國是全球最大的E2W)市場,由於早期療育,旨在防止污染和建立全面的電動車生態系統,中國在這一領域處於領先地位。印度也正在成為一個重要的市場,其 FAME India 等政策舉措和國家級獎勵刺激了電動車普及的宏偉目標。

- E2W在這些國家之所以受歡迎,是因為它們與 ICE 汽車相比具有環境效益且營運成本較低。然而,ICE 二輪車繼續佔據市場主導地位,尤其是在電氣基礎設施仍在發展且政府對E2W的獎勵不太明顯的亞太國家。在越南、印尼和菲律賓等國家,大多數摩托車都是汽油驅動的,這主要是因為汽油價格便宜,而且維護和加油網完善。

- 亞太地區摩托車市場的未來可能受到多種因素的影響,包括電池和充電基礎設施的技術進步、旨在減少碳排放的政府政策以及消費者對移動性和環境永續性的認知。雖然預計內燃機二輪車暫時仍將保持重要地位,尤其是在新興經濟體,但向電動車的轉變是不可否認的,並將繼續影響亞太地區的市場動態。

亞太地區電動摩托車市場趨勢

受政府措施和商用車電氣化推動,亞太地區電動車需求和銷售快速成長

- 近年來,亞太地區電動車(EV)的需求和銷售量激增。主要市場中國2022年電動車銷量較2021年成長2.90%,日本同期電動車銷量成長11.11%。推動這一趨勢的因素包括人們對環境問題的日益關注、嚴格的法規以及電動車的優勢,例如良好的燃油經濟性、低維護成本和零二氧化碳排放。政府補貼進一步推動了亞洲國家對電動車的採用。

- 傳統燃料商用車輛(主要是卡車和巴士)正在加劇亞太國家的污染水平。為此,該地區許多國家正在大力投資,將內燃機 (ICE) 汽車轉型為電動車,以減少二氧化碳排放。例如,2020 年 12 月,印尼城市公車營運商 Transjakarta 宣布了雄心勃勃的計劃,到 2030 年將其電動公車車隊擴大到 10,000 輛。類似這樣的全部區域努力正在推動商用車的電氣化。

- 亞太地區各國政府機構正積極提案逐步淘汰石化燃料汽車的措施,此舉可望提振電動商用車市場。值得注意的進展是,2022 年 5 月,塔塔汽車贏得了一份政府契約,根據 FAME 2 計劃,向印度供應 5,450 輛電動公車,價值 5,000 億印度盧比。該公司還宣布計劃向六家大型電子商務公司交付20,000 輛小型電動卡車。預計電動車領域的這些進步將在 2024 年至 2030 年間進一步推動亞太地區對電動商用車的需求。

亞太地區電動二輪車產業概況

亞太地區電動二輪車市場適度整合,前五大公司佔 50.90% 的市場。市場的主要企業為:東莞台鈴電動車、Gogoro有限公司、雅迪集團控股有限公司、雅馬哈摩托車有限公司和浙江綠源電動車(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均GDP

- 消費者汽車支出(cvp)

- 通貨膨脹率

- 汽車貸款利率

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 新款 Xev 車型發布

- 燃油價格

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 推進類型

- 混合動力汽車和電動車

- 國家

- 中國

- 印度

- 日本

- 韓國

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Ampere Vehicles Private Limited

- Ather Energy Pvt. Ltd.

- Bajaj Auto Ltd.

- Dongguan Tailing Electric Vehicle Co. Ltd.

- Gogoro Limited

- Hero Electric Vehicles Pvt. Ltd.

- NIU Technologies

- Okinawa Autotech Pvt. Ltd.

- Ola Electric Mobility Pvt. Ltd.

- REVOLT Intellicorp Pvt. Ltd.

- TVS Motor Company Limited

- Yadea Group Holdings Ltd.

- Yamaha Motor Company Limited

- Zhejiang Luyuan Electric Vehicle

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

The Asia Pacific Electric Two-Wheeler Market size is estimated at 125 billion USD in 2025, and is expected to reach 171.8 billion USD by 2029, growing at a CAGR of 8.27% during the forecast period (2025-2029).

The two-wheeler market in Asia-Pacific is experiencing a significant shift toward electric mobility, fueled by environmental concerns, government support, and technological advancements

- Electric two-wheelers are gaining rapid traction across Asia-Pacific, driven by the region's escalating environmental awareness, supportive government policies in the form of subsidies and incentives, and the increasing affordability and performance of electric vehicles. China leads this charge, boasting the world's largest E2W market due to early government interventions aimed at pollution control and the establishment of a comprehensive EV ecosystem. India is emerging as another significant market, with ambitious targets for electric mobility adoption spurred by policy initiatives like FAME India and state-level incentives.

- The popularity of E2Ws in these countries is attributed to their environmental benefits and lower operational costs compared to ICE vehicles. However, ICE two-wheelers continue to dominate the market in several Asia-Pacific countries, especially where electric infrastructure is still developing or where government incentives for E2Ws are less pronounced. In countries like Vietnam, Indonesia, and the Philippines, the vast majority of two-wheelers run on gasoline, primarily due to their affordability, wide availability, and a well-established network for maintenance and fueling.

- The future of the two-wheeler market in Asia-Pacific is likely to be shaped by several factors, including technological advancements in battery and charging infrastructure, government policies aimed at reducing carbon emissions, and consumer attitudes toward mobility and environmental sustainability. While ICE two-wheelers are expected to remain relevant in the near term, especially in emerging economies, the shift toward electric mobility is undeniable and will continue to reshape the market dynamics in Asia-Pacific.

Asia Pacific Electric Two-Wheeler Market Trends

APAC's rapid electric vehicle demand and sales growth are driven by government initiatives and commercial vehicle electrification

- Electric vehicle (EV) demand and sales have surged in the APAC region in recent years. China, the dominant market, saw a 2.90% rise in electric car sales in 2022 compared to 2021, while Japan experienced an 11.11% increase during the same period. Factors driving this trend include mounting environmental concerns, stringent regulations, and the advantages of EVs, such as fuel efficiency, lower maintenance costs, and zero carbon emissions. Government subsidies further bolster the adoption of EVs in Asian nations.

- Conventional fuel-powered commercial vehicles, notably trucks and buses, are contributing to the escalating pollution levels in several Asia-Pacific countries. In response, many nations in the region are making substantial investments to transition their internal combustion engine (ICE) vehicles to electric ones, aiming to curb carbon emissions. For instance, in December 2020, TransJakarta, a city-owned bus operator in Indonesia, unveiled an ambitious plan to expand its electric bus (e-bus) fleet to 10,000 units by 2030. Such initiatives across the region are propelling the electrification of commercial vehicles.

- Government bodies in various APAC countries are actively proposing measures to phase out fossil fuel vehicles, a move that is poised to bolster the market for electric commercial vehicles. In a notable development, in May 2022, Tata Motors secured a government contract in India to supply 5,450 electric buses worth INR 5,000 crore under the FAME 2 scheme. Additionally, the company announced plans to deliver 20,000 light electric trucks to six major e-commerce players. These advancements in the EV space are anticipated to further fuel the demand for electric commercial vehicles in the APAC region from 2024 to 2030.

Asia Pacific Electric Two-Wheeler Industry Overview

The Asia Pacific Electric Two-Wheeler Market is moderately consolidated, with the top five companies occupying 50.90%. The major players in this market are Dongguan Tailing Electric Vehicle Co. Ltd., Gogoro Limited, Yadea Group Holdings Ltd., Yamaha Motor Company Limited and Zhejiang Luyuan Electric Vehicle (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Fuel Price

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Hybrid and Electric Vehicles

- 5.2 Country

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Japan

- 5.2.4 South Korea

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Ampere Vehicles Private Limited

- 6.4.2 Ather Energy Pvt. Ltd.

- 6.4.3 Bajaj Auto Ltd.

- 6.4.4 Dongguan Tailing Electric Vehicle Co. Ltd.

- 6.4.5 Gogoro Limited

- 6.4.6 Hero Electric Vehicles Pvt. Ltd.

- 6.4.7 NIU Technologies

- 6.4.8 Okinawa Autotech Pvt. Ltd.

- 6.4.9 Ola Electric Mobility Pvt. Ltd.

- 6.4.10 REVOLT Intellicorp Pvt. Ltd.

- 6.4.11 TVS Motor Company Limited

- 6.4.12 Yadea Group Holdings Ltd.

- 6.4.13 Yamaha Motor Company Limited

- 6.4.14 Zhejiang Luyuan Electric Vehicle

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms