|

市場調查報告書

商品編碼

1692144

歐洲二手車市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

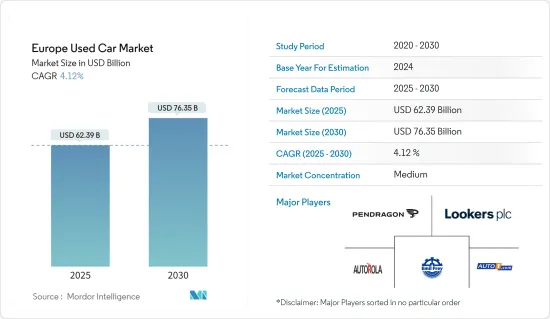

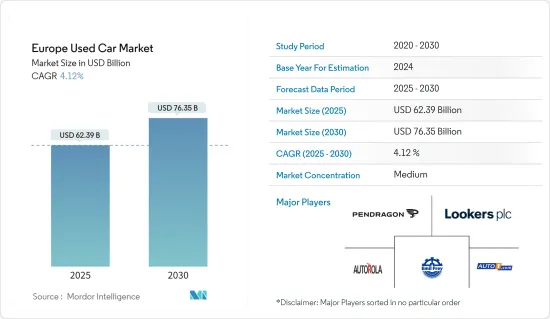

預計 2025 年歐洲二手車市場規模為 623.9 億美元,到 2030 年將達到 763.5 億美元,預測期內(2025-2030 年)的複合年成長率為 4.12%。

受經濟、技術和消費者偏好因素的推動,歐洲二手車市場充滿活力且快速發展。每年交易量達數百萬單位,其中德國、英國、法國、西班牙和義大利的交易量最大。這些國家不僅對整體市場規模做出了巨大貢獻,而且還提供了各種各樣的車輛,從經濟型到豪華型。經濟狀況有著重大影響。在不確定或經濟低迷時期,消費者往往傾向於購買價格實惠的二手車而不是新車。

二手車最大的吸引力在於其成本績效,不僅可以節省購買價格,還可以節省折舊免稅額、保險和登記費用。雖然新車折舊免稅額很快,在購買後的頭幾年內會損失很多價值,但二手車對許多買家來說是一個更有吸引力的選擇。此外,保證高品質和可靠性的認證二手車(CPO)計劃的興起正在增加消費者的信心和需求。

在技術進步的推動下,數位平台和線上市場徹底改變了市場,簡化了二手車的買賣。這些平台提供廣泛的清單、評論和車輛歷史報告,使其透明且值得信賴。在政府激勵措施和營運成本降低的推動下,二手電動車(EV)的供應量不斷增加,凸顯了市場向永續的轉變。

然而,挑戰依然存在,包括對品質和可靠性的擔憂、資金籌措障礙以及歐洲國家之間的監管差異。儘管如此,線上和非接觸式商務的爆炸性成長、CPO 計劃的日益普及以及對永續性的整體關注等趨勢正在塑造市場。隨著技術的發展和消費者偏好的變化,歐洲二手車市場也將適應並成長,為買家和賣家提供各種機會。

歐洲二手車市場的趨勢

線上業務強勁成長

在整個歐洲,線上市場正在重塑消費者與二手車市場的互動方式,成為該產業發展的關鍵力量。該部分包括大量線上平台、市場和數位管道,以簡化買賣雙方之間的交易。這些平台不僅增加了便利性和可近性,也為市場參與企業提供了更多的選擇。

隨著數位設備逐漸主宰從購物到研究的日常生活,線上平台已成為人們尋求二手車交易的首選。這種轉變刺激了 AutoScout24、eBay Motors 和 Gumtree 等線上市場的興起,它們各自滿足了歐洲數十億人的龐大需求。

線上平台為買家和賣家提供了無數好處,並且在歐洲二手車市場變得越來越突出。買家可以享受各種各樣的車輛、全面的搜尋過濾器以及帶有照片、描述和規格的詳細清單。這使得買家可以在自己舒適的家中進行徹底的研究和比較。

這種數位化便利性不僅節省了時間,還簡化了流程,使買家能夠以有競爭力的價格購買理想的車輛,而無需麻煩地訪問多家經銷商或私人賣家。

此外,線上部分促進了跨境貿易並簡化了國際交易。此功能允許二手車在歐洲各國進行買賣,擴大了市場。買家和賣家現在可以探索更廣泛的車輛,為業務成長開闢新的機會。例如

2023 年 7 月,STELLANTIS 透過其 Spoticar 部門在英國推出二手車線上直銷。 STELLANTIS 透過從公司汽車計畫和金融合作夥伴處採購的 100 多輛二手車啟動了該舉措。該系列包括標緻、雪鐵龍、飛雅特和沃克斯豪爾車型。消費者可以透過 spoticar.co.uk 直接從位於 Corby 的 Stellantis 再製造中心購買,並安排在任何 Spoticar 經銷商處送貨,無需支付送貨費。此外,該網站還提供來自其經銷商網路的認證二手車。

鑑於這些動態,二手車市場在未來幾年將大幅成長。

德國經濟強勁成長

德國二手車市場正在經歷重大轉型,主要受電動車(EV)需求旺盛的推動。 2023年,新車市場面臨動盪,而二手車市場保持韌性。汽車保有量將超過 60.3 億輛,較 2022 年成長 6.9%,證實了德國對汽車的強勁需求。

德國著名汽車俱樂部 ADAC 強調,二手電動車正在成為注重預算的買家的「真正選擇」。大眾、特斯拉和現代等熱門電動車品牌近幾個月已將降價下調了 13-22%。

儘管據報導供應量下降,但德國二手車市場正經歷明顯的價格下跌趨勢,正如歐洲領先的二手車廣告平台 Autoscout24 在 2023 年 11 月所強調的那樣。

根據AGPI指數,二手車平均價格較上月下跌1歐元至27,640歐元。雖然電動車的平均價格小幅上漲1.2%,但2023年電動車的需求卻急遽下降16%。

不過,並非所有車型的價格都出現一致下降。豪華車的價格下降幅度最大,顯示消費者的偏好正在改變。此外,新車和舊車價格都大幅下跌,凸顯了二手車市場的複雜動態。

AGPI指數自2023年3月達到高峰以來已連續七個月下跌,平均價格從29,180歐元下跌5.3%至27,640歐元。這種持續的下降趨勢表明存在影響供需的潛在因素,導致賣家調整定價策略並影響買家的購買選擇。

鑑於這些發展,德國二手車市場在未來幾年可能會大幅成長。

歐洲二手車產業概況

歐洲二手車市場由 Lookers Plc、Pendragon PLC、AUTO ONE Group、Autorola Group Holding 和 Emil Frey AG 等主要企業主導。隨著客戶需求的激增,無論是正規產業還是非正規產業都湧入了二手車經銷商。這些企業擴大採用擴張和合作等成長策略來加強其市場地位和收益。例如

- 2023 年 3 月,Emil Frey AG 與領先的 B2B 數位保險公司 iptiQ 合作,推出了名為 Emil Frey Protect 的數位保險解決方案,以滿足新車和二手車買家的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 認證二手(CPO) 計劃的日益普及以及品牌和型號的多樣化推動了市場的成長

- 市場限制

- 品質和可靠性問題限制了市場成長

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 車型

- 掀背車

- 轎車

- 運動型多用途車

- 多用途車輛

- 供應商類型

- 組織學

- 無組織

- 燃料類型

- 汽油

- 柴油引擎

- 電

- 其他燃料(LPG、CNG等)

- 國家

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Auto One Group

- Pendragon Plc

- Autorola Group Holding

- Lookers Plc

- Emil Frey AG

- Penske Automotive Group

- Gottfried-schultz

- wellergruppe

- AVAG Holding

- Fahrzeug-werke LUEG AG

- Auto Empire Trading GmbH

- Arnold Clark Automobiles Limited

第7章 市場機會與未來趨勢

The Europe Used Car Market size is estimated at USD 62.39 billion in 2025, and is expected to reach USD 76.35 billion by 2030, at a CAGR of 4.12% during the forecast period (2025-2030).

Driven by economic, technological, and consumer preference factors, the used car market in Europe is both dynamic and rapidly evolving. Millions of transactions occur annually, with Germany, the UK, France, Spain, and Italy leading the charge. These nations not only contribute significantly to the market's overall size but also offer a diverse range of vehicles, from budget-friendly options to premium luxury cars. Economic conditions wield considerable influence; during uncertain or recessionary periods, consumers often gravitate towards more affordable used cars over new ones.

Used cars' cost-effectiveness is a primary allure, offering savings not just in purchase price but also in depreciation, insurance, and registration costs. While new cars experience swift depreciation, losing much of their value in the initial years, used cars present a more attractive option for many buyers. Additionally, the rise of certified pre-owned (CPO) programs, ensuring high standards of quality and reliability, has bolstered consumer trust and demand.

Digital platforms and online marketplaces, fueled by technological advancements, have revolutionized the market, simplifying the buying and selling of used cars. These platforms enhance transparency and trust by providing extensive listings, reviews, and vehicle history reports. The growing availability of used electric vehicles (EVs), spurred by government incentives and reduced operating costs, underscores the market's shift towards sustainability.

Yet, challenges persist in the form of quality and reliability concerns, financing hurdles, and regulatory discrepancies across European nations. Nevertheless, the market is being shaped by trends like the surge in online and contactless transactions, the rising popularity of CPO programs, and an overarching focus on sustainability. As technology evolves and consumer preferences shift, Europe's used car market is poised for adaptation and growth, presenting diverse opportunities for both buyers and sellers.

Europe Used Car Market Trends

Online Segment Witnessing Major Growth

Across Europe, the online segment is reshaping how consumers engage in the used car market, becoming a pivotal force in the industry's evolution. This segment includes a myriad of online platforms, marketplaces, and digital channels, streamlining transactions between buyers and sellers. These platforms not only enhance convenience and accessibility but also present a diverse array of options to market participants.

As digital devices increasingly dominate daily activities, from shopping to research, online platforms have emerged as the primary choice for those looking to trade in used cars. This shift has spurred the rise of online marketplaces like AutoScout24, eBay Motors, and Gumtree, each catering to the vast needs of billions across Europe.

Online platforms present a myriad of benefits to both buyers and sellers, fueling their growing prominence in Europe's used car landscape. Buyers enjoy an expansive vehicle selection, comprehensive search filters, and detailed listings-complete with photos, descriptions, and specifications. This empowers them to conduct thorough research and make comparisons, all from the comfort of their homes.

This digital convenience not only saves time but also streamlines the process, allowing buyers to secure the ideal car at a competitive price without the hassle of visiting multiple dealerships or private sellers.

Moreover, the online segment champions cross-border trade, simplifying international transactions. This capability allows used cars to be bought and sold across various European nations, broadening the market's reach. Both buyers and sellers can now explore a wider vehicle selection and seize fresh business growth opportunities. For instance,

In July 2023, STELLANTIS, through its Spoticar division, rolled out online direct sales of pre-owned vehicles in the UK. STELLANTIS kicked off the initiative with over 100 used cars, sourced from its company car scheme and finance partners. The lineup featured models from Peugeot, Citroen, Fiat, and Vauxhall. Shoppers could purchase directly from Stellantis' reconditioning center in Corby via spoticar.co.uk, with delivery arranged at any Spoticar dealership-sans delivery fees. Additionally, the site showcased approved used cars from its dealer network.

Given these dynamics, the used car market is poised for significant growth in the coming years.

Germany Witnessing Major Growth

Germany's used car market is undergoing a notable transformation, driven largely by the surging demand for electric vehicles (EVs). In 2023, while the new-car market faced disruptions, the used-car segment stood resilient. Over 6.03 billion cars changed hands, marking a 6.9% uptick from 2022, underscoring the nation's robust demand for vehicles.

ADAC, Germany's prominent motorist club, highlights that second-hand EVs are becoming "a true alternative" for budget-conscious buyers. This shift is evident in the pricing landscape, with popular EV brands like VW, Tesla, and Hyundai seeing price reductions of 13 to 22 percent in recent months.

Despite a reported decline in supply, the German used car market is witnessing a notable trend of falling prices, as highlighted by Autoscout24, a leading European platform for used car advertising, in November 2023.

The AGPI index reveals that the average price of a used vehicle has dipped by 1 to 27,640 euros from the previous month. While the average price of electric cars saw a modest uptick of 1.2 percent, their demand plummeted by a striking 16% in 2023.

However, this price decline isn't consistent across all vehicle types. Luxury vehicles faced the steepest price drops, signaling shifts in consumer preferences. Moreover, both newer and older vehicles experienced significant price reductions, underscoring the intricate dynamics of the used car market.

Marking the seventh consecutive month of decline since peaking in March 2023, the AGPI index slid from 29,180 Euros to 27,640 Euros, a 5.3% dip in average prices. This persistent downward trend hints at underlying factors shaping supply and demand, leading sellers to adjust pricing strategies and influencing buyers' purchasing choices.

Given these developments, the German used car market is poised for significant growth in the coming years.

Europe Used Car Industry Overview

Europe's Used Car Market is dominated by key players like Lookers Plc, Pendragon PLC, AUTO ONE Group, Autorola Group Holding, and Emil Frey AG. As customer demand surges, both organized and unorganized sectors are seeing an influx of used car dealers. These players are increasingly adopting growth strategies, including expansions and partnerships, to bolster their market presence and revenue. For instance,

- In March 2023, Emil Frey AG partnered with iptiQ, a leading B2B digital insurer, launching a digital insurance solution named Emily Frey Protect, catering to both new and used car buyers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Availability of Certified Pre-owned (CPO) Programs and The Wide Variety of Makes and Models Is Driving The Market Growth

- 4.2 Market Restraints

- 4.2.1 Quality and Reliability Concerns Is Restraining The Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 Vehicle Type

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 Sports Utility Vehicle

- 5.1.4 Multi-purpose Vehicle

- 5.2 Vendor Type

- 5.2.1 Organized

- 5.2.2 Unorganized

- 5.3 Fuel Type

- 5.3.1 Gasoline

- 5.3.2 Diesel

- 5.3.3 Electric

- 5.3.4 Other Fuel Types (LPG, CNG, etc.)

- 5.4 Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Russia

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Auto One Group

- 6.2.2 Pendragon Plc

- 6.2.3 Autorola Group Holding

- 6.2.4 Lookers Plc

- 6.2.5 Emil Frey AG

- 6.2.6 Penske Automotive Group

- 6.2.7 Gottfried-schultz

- 6.2.8 wellergruppe

- 6.2.9 AVAG Holding

- 6.2.10 Fahrzeug -werke LUEG AG

- 6.2.11 Auto Empire Trading GmbH

- 6.2.12 Arnold Clark Automobiles Limited