|

市場調查報告書

商品編碼

1690927

亞太虛擬行動服務業者(MVNO) -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia Pacific Mobile Virtual Network Operator (MVNO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

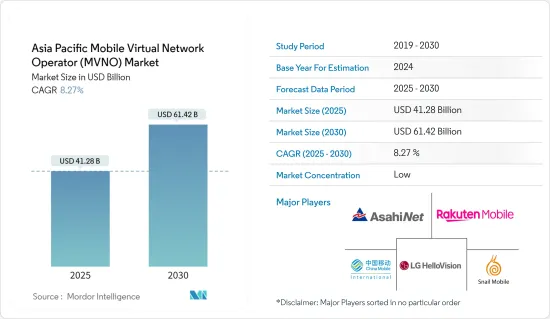

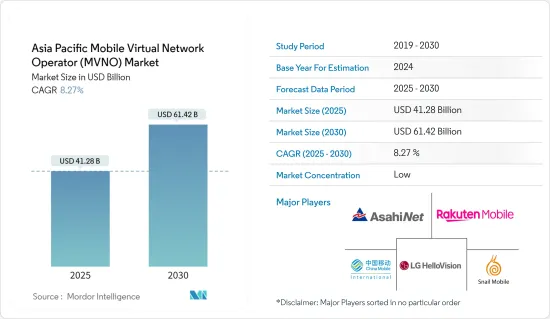

亞太虛擬行動服務業者市場規模預計在 2025 年為 412.8 億美元,預計到 2030 年將達到 614.2 億美元,預測期內(2025-2030 年)的複合年成長率為 8.27%。

關鍵亮點

- 對低成本資料和語音服務的不斷成長的需求正在推動市場成長。這導致服務供應商以批發價從行動網路營運商(MNO)購買網路服務,然後以低於 MNO 服務的價格將其作為配套服務出售。這種低成本的資訊服務使行動虛擬網路營運商(MVNO)能夠吸引本地消費者和企業以具有成本效益的價格從 MVNO 購買資料方案。

- 智慧型手機的普及和行動用戶數量的增加預計將對該行業的成長做出重大貢獻。例如,根據GSMA的資料,預計2025年南亞的行動用戶將達到10.89億,其次是東南亞,用戶將達到5.1億人。

- 此外,GSMA預測東北亞地區的行動用戶數量將達到1.62億人。行動用戶的增加為亞太地區的行動虛擬網路營運商創造了增加市場佔有率的成長機會。

- 亞太虛擬行動服務業者市場因依賴主機行動通訊業者而面臨重大挑戰。這種依賴性影響了行動虛擬網路營運商的營運和策略能力,抑制了其成長和市場潛力。 MVNO 依賴 MNO 進行網路存取,因此對服務品質和網路覆蓋的控制有限。主機網路的任何缺陷都會直接影響MVNO的服務品質。

- 新冠疫情增加了消費者和企業對線上連線的依賴,這在疫情期間大幅增加了對虛擬網路營運商 (MVNO) 具有成本效益的資料和語音服務的需求。此外,疫情過後亞太地區企業數位轉型浪潮席捲,進一步拉動了資訊服務的需求,從而對亞太地區MVNO市場的成長產生了正面影響。

- 在後疫情時代,亞太地區的虛擬業者將推出創新的新服務,以滿足消費者和企業不斷變化的需求。從增強的資料產品到創新的費率方案,MVNO 預計將利用數位技術、機器學習和人工智慧來提供個人化和無縫的客戶體驗。預計這些發展將對未來幾年亞太地區 MVNO 市場的成長產生積極影響。

亞太地區MVNO市場趨勢

企業用戶群預計將顯著成長

- 未來幾年,企業部門將見證亞太地區 MVNO 市場的顯著成長,這得益於亞太地區各國各行業正在進行的數位轉型、MVNO 營運商因該地區 5G 服務的不斷推廣而將重點轉向 B2B 模式,以及該地區企業對經濟實惠的網際網路連接的需求不斷增加。

- 對於 MVNO 營運商來說,企業市場正變得越來越有利可圖,因為與傳統的消費者市場相比,連接到其網路的許多設備流失的可能性較小。靈活的收費、創新的定價、BYOD(自帶設備)、安全性和易於管理是推動亞太地區 MVNO 市場企業部門成長的一些關鍵因素和趨勢。

- 此外,隨著印度等亞太國家的 5G 部署不斷擴大,5G 獨立和物聯網等 5G 用例預計將為企業領域的 MVNO 提供巨大的成長機會。隨著物聯網生態系統在亞太國家/地區不斷發展和演變,許多市場供應商將重點轉向 B2B 客戶,因為企業尋求跨一系列設備的即時連接。

- 從國家層級來看,由於韓國擁有大量提供企業連接解決方案的行動虛擬網路營運商、其有利的監管政策、5G 服務的不斷擴展以及企業正在進行的數位轉型,預計韓國將推動企業領域的成長。此外,新參與企業正在進入企業領域,以有效滿足某些細分市場對經濟實惠的通訊服務的需求。

- 例如,2024年6月,友利銀行與LG Uplus在友利銀行首爾總部簽署了合作備忘錄,以鞏固在行動虛擬網路營運商領域的合作。兩家銀行計劃在年內推出MVNO服務,重點在於確定銀行業的特定通訊需求。隨著合作備忘錄的簽署,兩家公司將建立長期夥伴關係關係,並加速創造獨特的產品和服務。

- 總體而言,隨著亞太地區各行各業的不斷發展和數位轉型,虛擬網路營運商將利用從行動銀行到物聯網的新機會來塑造連接的未來。隨著企業尋求透過客製化的企業解決方案來簡化行動業務、降低成本並提高生產力,企業語音和資訊服務的需求預計將獲得顯著成長。

- 智慧型手機的普及和行動用戶的增加預計將對該行業的成長做出重大貢獻。例如,根據GSMA的資料,預計2025年南亞的行動用戶將達到10.89億,其次是東南亞,用戶將達到5.1億人。此外,GSMA預測東北亞地區的行動用戶數量將達到1.62億人。行動用戶的增加為行動虛擬網路營運商增加了市場佔有率,提供了成長機會。

中國當地佔較大市場佔有率

- 中國在亞太地區MVNO市場佔有較大的佔有率。該國在採用技術進步方面一直處於領先地位,包括 5G 技術、連網行動裝置和智慧型手機的廣泛普及。

- 5G網路的部署為MVNO提供高速資料、物聯網、智慧解決方案等先進服務開啟了新的機會。 eSIM 技術的採用使 MVNO 能夠提供更靈活、更便捷的服務激活,從而吸引更多精通技術的客戶。

- GSMA 的 2024 年報告《中國移動經濟》顯示,中國將擁有超過 8 億個 5G行動連線。據預測,今年5G連線佔有率將超過50%,鞏固其在中國領先行動技術的地位。到2024年底,5G連接總數預計將超過10億人。此外,中國目前擁有12.8億獨立行動用戶,普及率高達88%。

- 中國繼續擴大其行動電話基地台台網路。值得一提的是,中國移動計畫在 2024 年新增 41 萬個基地台,使基地台總數達到 240 萬個,以加強其 5G 基礎設施。此次擴張也正值該公司尋求減少資本支出之際。截至2023年底,中國移動已加大5G佈局,當年基地台數量達190萬個,較前一年大幅成長。值得注意的是,其中62萬個站點是與中國寬頻網路合作建立的,主要使用700MHz頻段。

- 中國政府正在推動中國5G產業的發展,並支持華為和中興等生產5G技術所需設備的公司。預計到2025年,中國將成為全球5G連線數最多的國家。

亞太地區MVNO產業概覽

亞太地區MVNO市場高度細分,主要參與者包括朝日網路株式會社、樂天移動株式會社(樂天集團)、LG Hello Vision株式會社、中國移動國際有限公司(中國移動主要企業)和世紀蝸牛通訊科技等。所研究市場的參與企業正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2024 年 5 月:Giga 推出 5G eSIM 計劃,可在五個主要城市免費漫遊資料。這些計劃是 Giga 三項新服務的一部分,讓客戶享受快速、安全且無憂的 5G 連線。增強型 Giga Mobile 計畫提供了 Giga 廣泛的 5G 覆蓋範圍,並凸顯了 eSIM 技術的便利性。此外,用戶還可享受印尼、泰國、韓國和印度等熱門目的地的免費月度資料漫遊優惠。

- 2024年3月,中國移動國際公司(CMI)與新加坡電信有限公司(Singtel)在2024世界行動通訊大會上簽署合作備忘錄。根據備忘錄,CMI和Singtel將共同為企業客戶打造創新的連接解決方案,進軍中國和新加坡市場,並拓展亞太地區業務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 影響市場的宏觀經濟因素 COVID-19 的影響

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- MVNO滲透率及特性與歐洲主要國家相似

- 大多數亞洲國家的法規環境對 MVNO 非常有利

- 網路普及率和 e-SIM 解決方案推動該地區 MVNO 市場的發展

- 市場限制

- 依賴主機行動網路營運商 (MNO)

第6章市場區隔

- 依管理類型

- 經銷商

- 服務提供者

- 完整的行動虛擬網路營運商

- 其他業務類型

- 用戶

- 企業

- 消費者

- 按國家

- 中國

- 日本

- 印度

- 韓國

第7章競爭格局

- 公司簡介

- Asahi Net Inc.

- Rakuten Mobile Inc.(Rakuten Group, Inc.)

- LG Hello Vision Corporation

- China Mobile International Limited(China Mobile Limited)

- Century Snail Communication Technology Co. Ltd

- Exetel Pty Ltd

- Circles.life

- Tune Talk Sdn Bhd

- SK Telink Co. Ltd(SK Telecom Co. Ltd)

- Japan Communications Inc

- EG Mobile Co. Ltd

- Sakura Mobile

- Mobal Communications Inc.

- BIGLOBE Inc.(KDDI Corporation)

- Giga(Starhub)

- Feels Telecom Corporation Co. Ltd

- Tangerine Telecom

- Amaysim Mobile Pty Ltd

- Altel Communications Sdn Bhd

- reDone Network Sdn Bhd

- Geenet Pte Ltd

- 主要市場供應商的市場佔有率分析

第8章投資分析

第9章 市場潛力

The Asia Pacific Mobile Virtual Network Operator Market size is estimated at USD 41.28 billion in 2025, and is expected to reach USD 61.42 billion by 2030, at a CAGR of 8.27% during the forecast period (2025-2030).

Key Highlights

- The constantly growing need for low-cost data and voice services is boosting market growth. This encourages service providers to purchase network services from mobile network operators (MNOs) at wholesale rates and sell them as bundled services at lower rates than those of MNOs. Such low-cost data services allow mobile virtual network operators (MVNOs) to attract consumers and enterprises in the region to purchase data plans from MVNOs at cost-effective rates.

- The increasing smartphone adoption and mobile subscriber base are expected to contribute significantly to industry growth. For instance, according to the data from GSMA, the number of mobile subscribers in South Asia is anticipated to reach 1,089 million by 2025, followed by 510 million subscribers in Southeast Asia.

- In addition, according to the GSMA forecast, the number of mobile subscribers in Northeast Asia is expected to reach 162 million. Such increasing growth of mobile subscribers presents growth opportunities for mobile virtual network operators to expand their market share in the Asia-Pacific region.

- The Asia-Pacific mobile virtual network operators market faces significant challenges due to its dependency on host mobile network operators. This dependency impacts MVNOs' operational and strategic capabilities, restraining their growth and market potential. MVNOs rely on MNOs for network access, which means they have limited control over the quality of service and network coverage. Any shortcomings in the host network directly affect the MVNO's service quality.

- The COVID-19 pandemic has positively fueled the demand for MVNOs' cost-effective data and voice services during the pandemic due to the increased reliance of consumers and businesses on online connectivity. In addition, the digital transformation among businesses in the region spiked post-pandemic, which has further fueled the demand for data services, thus positively impacting the growth of the MVNO market in the Asia-Pacific region.

- In the post-pandemic era, MVNOs in Asia-Pacific countries are analyzed to innovate and introduce new services to meet consumers' and enterprises' evolving needs. From enhanced data offerings to innovative pricing plans, MVNOs are expected to leverage digital technologies, machine learning, and artificial intelligence to deliver personalized and seamless customer experiences. Such developments are expected to positively support the growth of the Asia-Pacific MVNO market in the coming years.

Asia-Pacific MVNOs Market Trends

Enterprise Subscriber Segment is Expected to Witness Significant Growth

- The enterprise segment is analyzed to witness significant growth in the Asia-Pacific MVNO market in the coming years owing to the rising digital transformation among various sectors in Asia-Pacific countries, the growing focus of MVNO operators toward the B2B model considering the growth in the rollout of 5G services in the region, and the rising demand for affordable internet connectivity in businesses across the region.

- The enterprise market is becoming lucrative for MVNO companies, as so many devices connected to a network are less likely to churn compared with the traditional consumer segment. Flexible billing, novel pricing, Bring Your Own Device (BYOD), security, and easy administration are some of the major factors and trends driving the growth of the enterprise segment in the Asia-Pacific MVNO market.

- Moreover, with growing 5G rollouts in Asia-Pacific countries such as India, 5G use cases such as 5G stand-alone and IoT are analyzed to create significant growth opportunities for MVNOs in the enterprise segment. As the IoT ecosystem continues to develop and evolve in Asia-Pacific countries, most of the market vendors are shifting their focus to B2B customers as enterprises increasingly seek real-time connectivity via an array of devices.

- By country, South Korea is analyzed to drive the growth of the enterprise segment owing to the significant presence of MVNOs offering enterprise connectivity solutions, favorable regulatory policies, the growing rollout of 5G services, and digital transformation of businesses in the country. Moreover, new players are entering the enterprise segment to effectively serve the needs of affordable telecommunication services in particular sectors.

- For instance, in June 2024, Woori Bank and LG Uplus signed a memorandum of understanding (MoU) at Woori Bank's Seoul headquarters, solidifying their collaboration in the mobile virtual network operator sector. Their joint focus lies in identifying the specific telecommunication needs within the banking industry, with plans to roll out their MVNO service within the year. With the MoU in place, both entities are set to expedite the creation of unique products and services, fostering a long-term partnership.

- Overall, as industries in the Asia-Pacific region continue to evolve and leverage digital transformation, MVNOs are analyzed to capitalize on new opportunities, from mobile banking to IoT, shaping the future of connectivity. The demand for enterprise voice and data services is analyzed to gain significant traction in businesses to streamline their mobile operations, reduce costs, and improve productivity through customized enterprise solutions.

- The increasing smartphone adoption and mobile subscriber base are expected to contribute significantly to industry growth. For instance, according to the data from GSMA, the number of mobile subscribers in South Asia is anticipated to reach 1,089 million by 2025, followed by 510 million subscribers in Southeast Asia. In addition, according to the GSMA forecast, the number of mobile subscribers in Northeast Asia is expected to reach 162 million. Such increasing growth of mobile subscribers presents growth opportunities for mobile virtual network operators to expand their market share in the Asia-Pacific region.

Mainland China Holds Significant Market Share

- China holds a significant share of the Asia-Pacific MVNO market. The country has always remained at the forefront in the adoption of technological advancements, like 5G technology, connected mobile devices, and smartphone penetration.

- The rollout of 5G networks has opened new opportunities for MVNOs to offer advanced services such as high-speed data, IoT, and smart solutions. The adoption of eSIM technology allows MVNOs to offer more flexible and convenient service activation, attracting tech-savvy customers.

- GSMA's 2024 report, "The Mobile Economy China," reveals that China boasts over 800 million 5G mobile connections. Projections indicate that this year, the share of 5G connections will surpass 50%, solidifying its position as the primary mobile technology in the nation. By the close of 2024, the total number of 5 G connections is expected to exceed 1 billion. In addition, China currently hosts 1.28 billion unique mobile subscribers, showcasing an impressive 88% penetration rate.

- China has been on a consistent trajectory of expanding its mobile phone base station network. In a notable move, China Mobile plans to bolster its 5G infrastructure by adding 410,000 new base stations in 2024, pushing its total count to 2.4 million. This expansion comes even as the company looks to trim its capital expenditure. By the close of 2023, China Mobile had already ramped up its 5G presence, ending the year with 1.9 million stations, a significant jump from the previous year, with an addition of 480,000 sites. Notably, within this count, 620,000 sites were established in collaboration with China Broadnet, focusing on the 700 MHz spectrum.

- The Government of China is pushing the development of the Chinese 5G industry, favoring companies such as Huawei and ZTE, which manufacture the equipment necessary for the technology to work. China is expected to account for the most 5G connections globally in 2025.

Asia-Pacific MVNOs Industry Overview

The Asia-Pacific MVNOs market is highly fragmented, with the presence of major players like Asahi Net Inc., Rakuten Mobile Inc. (Rakuten Group, Inc.), LG Hello Vision Corporation, China Mobile International Limited (China Mobile Limited), and Century Snail Communication Technology Co. Ltd. Players in the market studied are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2024: Giga launched 5G eSIM plans featuring complimentary data roaming to five top destinations. These plans, part of Giga's trio of new offerings, ensure customers enjoy swift, secure, and hassle-free 5G connectivity. The enhanced giga! Mobile plans provided Giga's expansive 5G coverage and highlighted the convenience of eSIM technology. Moreover, subscribers got the benefit of free monthly data roaming in popular spots like Indonesia, Thailand, South Korea, and India.

- March 2024: China Mobile International (CMI) and Singapore Telecommunications Limited (Singtel) signed an MoU during the Mobile World Congress 2024. According to the MoU, CMI and Singtel will jointly build innovative connectivity solutions for enterprise customers to cultivate China and Singapore markets and expand business across the wider Asia-Pacific region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Factors on the Market COVID-19 Impact

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 MVNO Penetration and Characteristics Similar to Major European Countries

- 5.1.2 Regulatory Environment in Most Asian Countries Became Much More Supportive of MVNOs

- 5.1.3 Internet Penetration and e-SIM Solutions Driving the MVNO Market in the Region

- 5.2 Market Restraints

- 5.2.1 Dependency on Host Mobile Network Operators (MNO)

6 MARKET SEGMENTATION

- 6.1 By Operational Mode

- 6.1.1 Reseller

- 6.1.2 Service Operator

- 6.1.3 Full MVNO

- 6.1.4 Other Operational Modes

- 6.2 By Subscriber

- 6.2.1 Enterprise

- 6.2.2 Consumer

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Asahi Net Inc.

- 7.1.2 Rakuten Mobile Inc. (Rakuten Group, Inc.)

- 7.1.3 LG Hello Vision Corporation

- 7.1.4 China Mobile International Limited (China Mobile Limited)

- 7.1.5 Century Snail Communication Technology Co. Ltd

- 7.1.6 Exetel Pty Ltd

- 7.1.7 Circles.life

- 7.1.8 Tune Talk Sdn Bhd

- 7.1.9 SK Telink Co. Ltd (SK Telecom Co. Ltd)

- 7.1.10 Japan Communications Inc

- 7.1.11 EG Mobile Co. Ltd

- 7.1.12 Sakura Mobile

- 7.1.13 Mobal Communications Inc.

- 7.1.14 BIGLOBE Inc. (KDDI Corporation)

- 7.1.15 Giga (Starhub)

- 7.1.16 Feels Telecom Corporation Co. Ltd

- 7.1.17 Tangerine Telecom

- 7.1.18 Amaysim Mobile Pty Ltd

- 7.1.19 Altel Communications Sdn Bhd

- 7.1.20 reDone Network Sdn Bhd

- 7.1.21 Geenet Pte Ltd

- 7.2 Market Share Analysis for Major Market Vendors