|

市場調查報告書

商品編碼

1686228

家庭護理包裝:市場佔有率分析、行業趨勢和統計、2025-2030 年成長預測Home Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

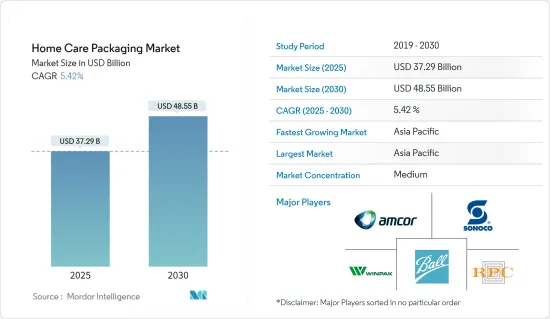

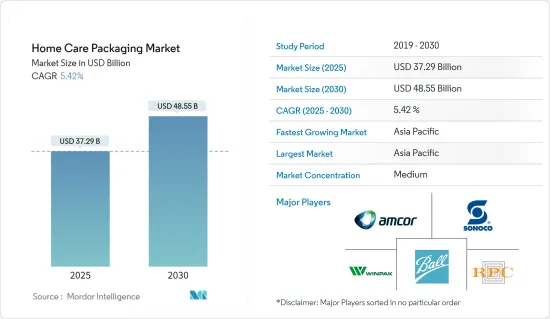

預計 2025 年家庭護理包裝市場規模為 372.9 億美元,到 2030 年將達到 485.5 億美元,預測期內(2025-2030 年)的複合年成長率為 5.42%。

家庭護理包裝市場包括為清潔和衛生目的而設計的產品。包裝極為重要,因為安全性、功能性和易用性是關鍵因素。由於都市化的加速、生活水準的提高以及人們對整體健康和福祉的認知的不斷提高,全球對家庭護理產品的需求正在成長。

主要亮點

- 由於價格實惠、易於使用和儲存的緊湊型包裝越來越受到人們的歡迎,市場正在不斷擴大。消費者偏好向軟質包裝的重大轉變以及對面向消費者的包裝生產的日益關注正在推動市場成長。

- 低成本、易於使用和儲存等包裝趨勢繼續成為市場上的主要消費趨勢。小包裝尺寸可以為消費者提供可負擔的價格,已成為品牌所有者在市場中獲得競爭優勢的更受歡迎的選擇。

- 由於人們健康和衛生意識的增強,家庭護理包裝解決方案市場正在迅速擴張,而全球疫情進一步加速了這一進程。隨著消費者將健康和安全放在首位,對創新高效的家庭護理包裝解決方案的需求日益增加。

- 健康意識的增強、生活水準的提高和人均收入的增加在印度等新興經濟體尤為明顯。例如,根據國家統計局 (NSO) 的數據,2022-23 年印度的人均淨國民收入(以現價計算)為 172,000 印度盧比。這比2014-15年的人均收入增加了近100%。這些因素正在推動家庭護理行業的成長。

- 此外,家居護理品牌正致力於透過展示其優勢來贏得消費者,例如使用不影響功效的天然配方,同時在包裝上清晰易懂地傳達永續性訊息。

- 原料價格的波動給包裝製造商帶來了成本和供應方面的挑戰。塑膠包裝行業所有塑膠材料的價格都在上漲,這是由多種因素造成的。成本上漲幅度巨大且範圍廣泛,影響原料、勞動力、配送和能源。

居家照護包裝市場趨勢

塑膠的柔韌性、強度和耐用性使其成為包裝的理想選擇

- 塑膠在所有主要包裝類型的廣泛使用塑造了塑膠市場。這種材料的柔韌性、強度和耐用性使其適合包裝行業中的許多液體、乳霜和粉末產品。與市場上其他材料相比,塑膠具有高度的柔韌性,可以模製成任何形狀。零售業的需求不斷成長、雙收入家庭的增加以及對寶特瓶的需求不斷增加是塑膠產品成長的主要驅動力。

- 除了其優越的特性之外,防篡改瓶蓋和封口等技術創新越來越受歡迎,為品牌所有者帶來了顯著的附加價值。這就是為什麼塑膠被廣泛應用於各種產品的原因。根據美國人口普查局的數據,華盛頓州個人洗衣服務銷售額為 2,933,820,000 美元,預計到 2024 年將達到 2,990,890,000 美元。洗衣服務的興起預計將推動家庭護理市場的發展。

- 此外,由於便利性和永續性問題,消費者對軟質塑膠塑膠包裝的偏好逐漸超過硬質塑膠包裝。軟質塑膠包裝比同類的硬質塑膠包裝重量輕 80%,且價格更便宜。

- 製造商正在開發含有較少原生材料且具有更高水平消費後回收材料 (PCR) 和工業後回收材料 (PIR) 的包裝。儘管人們非常重視消費後回收實踐,但許多供應商仍然透過在生產過程中回收和再研磨廢棄物獲得了成功。此外,該公司正在探索生質塑膠和生物基塑膠樹脂以改善其碳足跡。

- 包裝技術的進步在塑造家庭護理包裝的未來方面發揮關鍵作用。不斷創新提高了包裝解決方案的性能,從而為家庭護理產品提供了更大的保護、便利性和永續性。這些改進使得家庭護理包裝成為各種產品和用途的理想選擇。

亞太地區引領居家照護包裝市場需求

- 由於人口成長、對家庭護理產品的新需求以及生活方式的改變,預計亞太地區將引領市場。受零售額高成長的推動,該地區的市場發展預計主要在印度和中國等新興市場。消費品銷售額的成長和消費者支出的增加是推動市場發展的關鍵因素。

- 廁所清潔劑主要供應印度的都市區和半都市區市場。 「清潔印度」等政府措施是促進廁所清潔劑市場發展的關鍵因素。在該地區經營的家庭護理品牌正專注於推出新產品,作為其擴張的一部分。例如,2023 年 3 月,Reliance Retail FMCG 宣布推出一系列家用產品,包括盥洗用品和地板清潔劑。

- 亞太地區家庭護理包裝市場競爭激烈。成熟的包裝公司和新興企業正在投資研發,為市場帶來創新、永續且經濟高效的包裝解決方案。這種競爭格局正在推動產業的技術進步和成本降低。

- 此外,都市化帶來的經濟成長也增加了對居家照護服務的需求。新興經濟體消費者的衛生和環保意識不斷增強,加上生活條件改善,使得他們願意在奢侈服務上花費更多,從而進一步增加了對家庭護理產品的需求。

- 新冠疫情對居家照護包裝產業產生了好壞參半的影響,這種影響最初出現在最先遭遇疫情的國家,例如中國和韓國。此外,食品、保健產品和電子商務運輸包裝的需求激增,而工業、奢侈品和一些B2B運輸包裝市場的需求則下降。

居家照護包裝產業概況

家庭護理包裝市場相當分散,有幾家大型企業。從市場佔有率來看,目前市場處於半整合狀態,少數大型企業佔據主導地位。這些擁有較大市場佔有率的大公司正致力於擴大海外基本客群。這些公司正在利用策略合作措施來增加市場佔有率和盈利。

- 2024 年 2 月,家居護理產品供應商 Constantia Flexibles 簽署協議,收購包裝製造商 Aluflexpack 約 57% 的股份。此次收購標誌著 Constantia Flexibles 在其細分市場中加強鋁箔包裝影響力邁出了重要一步。透過此次收購,我們將擴大在土耳其和波蘭的地理覆蓋範圍,並擴展到東南亞國家。

- 2023 年 10 月 Silgan Dispensing 是一家全球性公司,為香水、個人護理、醫療保健以及家居和花園市場設計、開發和銷售高度工程化的泵和噴霧器,該公司宣布推出 Replay,這是一種採用該公司專利的 LifeCycle 技術的全塑膠補充系統。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

第5章 市場動態

- 市場促進因素

- 產品創新、差異化與品牌

- 人均收入的增加將對購買力產生正面影響

- 市場限制

- 原物料價格波動

第6章 市場細分

- 按材質

- 塑膠

- 紙

- 金屬

- 玻璃

- 按類型

- 瓶子和容器

- 金屬罐

- 紙箱和紙板

- 袋子和包包

- 其他類型

- 按產品

- 洗碗

- 殺蟲劑

- 衣物洗護

- 化妝品

- 拋光

- 空氣護理

- 其他產品

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Amcor PLC

- Ball Corporation

- RPC Group

- Winpak Ltd

- Aptar Group Inc.

- Sonoco Products Company

- Silgan Holdings

- Constantia Flexibles Group GmbH

- DS Smith PLC

- Can-Pack SA

- ProAmpac LLC

第8章投資分析

第9章:市場的未來

The Home Care Packaging Market size is estimated at USD 37.29 billion in 2025, and is expected to reach USD 48.55 billion by 2030, at a CAGR of 5.42% during the forecast period (2025-2030).

The home care packaging market comprises products designed for cleaning and hygiene purposes. Packaging is vital, as safety, functionality, and ease of use are key factors. The need for home care products is increasing globally due to rapid urbanization, rising living standards, and growing awareness about overall health and well-being.

Key Highlights

- The market is growing due to the rising adoption of compact packages that are affordable and easy to use and store. There is a significant shift in consumer preferences toward flexible packaging, and the focus is increasingly on consumer-oriented packaging production, boosting the market's growth.

- Packaging trends, such as low cost and ease of use and storage, have stayed the major consumer trends in the market. Small pack sizes, offering affordability to the entire consumer base, emerged as more favorable alternatives among the brand owners to gain a competitive edge in the market.

- The market for homecare packaging solutions is expanding rapidly due to improved awareness of health and hygiene, further accelerated by the global pandemic. Consumers prioritize their well-being and safety, so the need for innovative and efficient homecare packaging solutions is growing.

- Increasing health awareness, improving living standards, and raising the per capita income, especially in emerging countries such as India. For instance, India's per capita net national income (at current prices) for 2022-23 stands at INR 172,000, according to the National Statistical Office (NSO). This marks an almost 100% increase from the per capita income in 2014-15. Such factors drive the growth of the home care industry.

- Moreover, home care brands focus on winning over consumers by demonstrating their strengths, such as using naturally derived formulas that do not compromise efficacy while keeping on-pack sustainability messages clear and easy to understand.

- Fluctuation in raw material prices has challenged the packaging manufacturers regarding costs and supply. The plastic packaging industry has been witnessing a surge in the prices of all plastic materials, which has been attributed to several factors. Cost inflation was significant and broad-based, affecting raw materials, labor, distribution, and energy.

Home Care Packaging Market Trends

Flexibility, Strength, and Durability of Plastic Make it Ideal for Packaging

- The broad usage of plastic through all main packaging types creates a plastic market. The material's flexibility, strength, and durability make it suitable for packaging many liquids, cream, and powder products in the industry. Compared to other materials available in the market, plastic remains highly flexible and can be molded into any shape. Growth in demand from the retail sector, increasing dual-income households, and rising demand for PET bottles are the major drivers for plastic products.

- Apart from its favorable properties, innovations like tamper-evidence caps and closures are gaining popularity, leading to a crucial value add for the brand owners. This has driven the use of plastics across a variety of products. According to the US Census Bureau, the revenue of personal and laundry services in Washington was USD 2,933.82 million and is expected to reach USD 2,990.89 million in 2024. An increase in laundry services is expected to leverage the homecare market.

- Moreover, there is a gradual shift in customer preference toward adopting flexible plastic packaging over its rigid counterpart because of convenience and sustainability issues. Flexible plastic packaging materials are 80% lighter in weight than their equivalent rigid plastic materials and are cheaper.

- Manufacturers are developing packaging that contains less virgin material and higher levels of post-consumer recycling (PCR) or post-industrial recycling (PIR). Although significant emphasis has been placed on consumer recycling practices, many vendors have found success by collecting and regrinding waste material throughout manufacturing. Moreover, companies are exploring bioplastics and bio-derived plastic resins to improve their carbon footprint.

- Advancements in packaging technology are playing a crucial role in shaping the future of homecare packaging. Continual innovations are improving the performance of packaging solutions, resulting in better protection, convenience, and sustainability of home care products. These enhancements are making homecare packaging desirable for various products and applications.

Asia-Pacific is Leading in Demand in the Homecare Packaging Market

- Asia-Pacific is forecast to lead the market due to the increasing population, new demand for home care products, and changing lifestyles. Growth in this region is expected mainly in the developing markets, such as India and China, due to high retail sales growth. Higher sales growth percentage of consumer goods and rising consumer expenditures are the key factors boosting the market.

- Toilet cleaners primarily cater to the urban and semi-urban markets in India. Government initiatives like Swach Bharath' are significant enablers for the toilet cleaners market. Home care brands operating in the region are focused on introducing new products as part of their business expansion. For instance, in March 2023, Reliance Retail's FMCG announced the launch of a home products range that includes toiletries and floor cleaners.

- The Asia-Pacific homecare packaging market is experiencing increasing levels of competition. Established packaging companies and new players are investing in research and development to bring innovative, sustainable, and cost-effective packaging solutions to the market. This competitive landscape is driving technological advancements and cost reductions within the industry.

- Additionally, urbanization-related economic growth has increased the need for home care services. The rising relationship of consumers in emerging economies toward hygiene and the environment and an improvement in living conditions allow them to spend more on upscale services, which further increases the need for home care products.

- The impact of the COVID-19 pandemic on the home care packaging industry was mixed with the pattern initially playing out in countries such as China and South Korea, which were the first to confront the pandemic. Demand also rose sharply for packaging for groceries, healthcare products, and e-commerce transportation while the demand from the industrial, luxury, and some B2B-transport packaging markets reduced.

Home Care Packaging Industry Overview

The home care packaging market is moderately fragmented and has several major players. In terms of market share, few of the major players currently dominate, and the market is semi-consolidated. These major players with a prominent share of the market are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability.

- February 2024: Constantia Flexibles, a company that offers home care products, signed a contract to acquire approximately 57% of the shares of the packaging producer Aluflexpack. This acquisition is a sizable step in Constantia Flexibles' foil packaging presence across market segments. The acquisition gives access to an extended geographical footprint in Turkey and Poland and expands to Southeast European countries.

- October 2023: Silgan Dispensing, a global company in the design, development, and distribution of highly engineered pumps and sprayers in the fragrance, personal care, healthcare, and home and garden markets, announced the launch of Replay, an all-plastic refill system using the company's patented LifeCycle Technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Product Innovation, Differentiation, and Branding

- 5.1.2 Rising Per Capita Income Positively Impacting Purchase Power

- 5.2 Market Restraints

- 5.2.1 Fluctuations in Raw Material Prices

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Glass

- 6.2 By Type

- 6.2.1 Bottles and Containers

- 6.2.2 Metal Cans

- 6.2.3 Cartons and Corrugated Box

- 6.2.4 Pouches and Bags

- 6.2.5 Other Types

- 6.3 By Products

- 6.3.1 Dishwashing

- 6.3.2 Insecticides

- 6.3.3 Laundry Care

- 6.3.4 Toiletries

- 6.3.5 Polishes

- 6.3.6 Air Care

- 6.3.7 Other Products

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Ball Corporation

- 7.1.3 RPC Group

- 7.1.4 Winpak Ltd

- 7.1.5 Aptar Group Inc.

- 7.1.6 Sonoco Products Company

- 7.1.7 Silgan Holdings

- 7.1.8 Constantia Flexibles Group GmbH

- 7.1.9 DS Smith PLC

- 7.1.10 Can-Pack SA

- 7.1.11 ProAmpac LLC