|

市場調查報告書

商品編碼

1644608

通訊專用邏輯積體電路:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Communication Special Purpose Logic IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

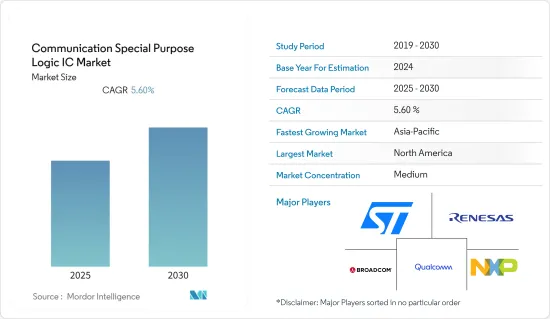

預計預測期內通訊專用邏輯積體電路市場複合年成長率為 5.6%。

專用積體電路 (IC) 旨在解決實現閉合迴路運動和馬達速度控制所需的任務。專用積體電路 (IC) 也被設計用於解決實現閉合迴路運動和馬達速度控制所需的任務。

開發人員越來越注重打造能夠以小封裝提供所需效能並最大限度降低功耗的小元件。因此,預計在預測期內,專用邏輯積體電路市場將受到對設備整合日益關注的推動。

隨著網路普及率的提高以及對手機、筆記型行動電話和平板電腦等消費性設備的需求不斷成長,通訊積體電路市場正在擴大。由於全球對高頻段連接服務的需求不斷增加,COVID-19 疫情對市場成長產生了積極影響。此外,醫療設備產量的增加也促進了市場的擴大。

由於車輛連網服務的不斷增加,汽車產業的快速擴張對市場成長產生了積極影響。此外,預計連網汽車市場將在整個預測期內推動市場成長。

通訊專用邏輯 IC 的市場趨勢

汽車產業推動市場成長

通用積體電路用於多種任務,包括計算和資料傳輸。通用積體電路(IC)存在於電腦處理器中。溫度控制、速度控制和其他各種業務由專用 IC 執行。專用IC廣泛應用於空調、智慧電視、馬達工廠設備、行動電話等。

由於消費者對環境污染意識的增強和油價的飆升,全球對電動車的需求不斷擴大,這也擴大了通訊邏輯IC的市場。車對車 (V2V)通訊的潛力在於,它可以透過無線方式傳輸附近車輛的速度和位置資訊,有望幫助緩解交通堵塞、防止碰撞並改善環境。

由於車輛連接選項的增加而導致的汽車銷售增加對行業成長產生了積極影響。此外,由於汽車行業的快速成長,預計預測期內市場將繼續發展。

該地區擁有強大的汽車製造基礎設施和龐大的消費市場。亞太地區是本田、現代、豐田和塔塔等主要汽車製造商的所在地。該地區也是一個巨大的汽車行業市場,擁有各行各業的消費者。根據OICA 2022年的資料,中國2021年生產了約2,140萬輛乘用車,而日本生產了約660萬輛,印度生產了約360萬輛。中國與全球汽車製造商建立了合作夥伴關係,成為該地區最大的汽車生產國,超過韓國、日本和印度,這些國家的國內汽車產業都實力雄厚。隨著該地區汽車工業的崛起,研究市場的需求也預計將成長。

中國佔很大市場佔有率

中國擬成立專門機構,鼓勵國內企業與英特爾等國際半導體巨頭合作,共建軟體、材料及製造設備開發中心。北京正加緊發展不受美國制裁的國內半導體供應鏈。同時,外國政府可能對該計劃持懷疑態度,擔心關鍵技術轉移到中國。

2015年,北京推出了「中國製造2025」策略,將半導體列為優先事項。中國透過國家投資平台支持 NAND 快閃記憶體公司長江儲存科技等公司,並向晶片產業投入了超過 200 億美元的資金。在習近平的領導下,政府部門正準備投資中芯國際的新設施,並向材料和製造設備投入資金,以增強供應鏈。但考慮到中國的技術不足,新建立的海外合作論壇可能對這項努力至關重要。

2021年9月,中國最大的晶片代工製造商中芯國際(SMIC)宣布將在上海自貿區的臨港特區建立新工廠。擬建的投資 88.7 億美元的晶圓廠每月將生產 10 萬片 12 吋晶圓。中芯國際將持有合資公司至少 51% 的股份,其餘 25% 由上海市政府指定的投資公司持有。今年3月,中芯國際宣布將與深圳市政府合作,投資23.5億美元建造月產4萬片28奈米以上積體電路12吋晶圓的計劃。

中國針對半導體和軟體產業制定了許多有利法規,包括免稅、優惠貸款、智慧財產權保護以及對研發、進出口和人力資源開發的支援。對積體電路製造企業以及積體電路設計、設備、材料、封裝、測試、軟體等企業給予稅務減免或優惠。

隨著與美國的技術競爭加劇,中國正加強支持本土軟體公司。此趨勢涵蓋晶片存取、5G網路建置、社群媒體應用、網路監管等多個領域。北京認為科技產業具有戰略重要性,預計未來幾年政府資金將會增加。

通訊專用邏輯積體電路 (IC) 產業概況

通訊專用邏輯積體電路市場競爭激烈,有多家製造商存在。產品創新、併購是市場參與企業採用的一些技巧。此外,隨著積體電路製造流程的改進以適應更多的應用,新的市場參與企業正在擴大其市場佔有率並擴大其在新興國家的足跡。

2021年11月,先進半導體技術供應商瑞薩電子株式會社宣布推出通訊(PLC) 數據機 IC R9A06G061。 R9A06G061無需使用繼電器即可在1公里以上的遠距上實現高達1Mbps的高速通訊,擴大了PLC的應用範圍。

2021 年 8 月 - 領先的先進半導體解決方案提供商瑞薩電子株式會社和領先的電池和電源管理、Wi-Fi、藍牙、低功耗和工業邊緣運算解決方案提供商 Dialog Semiconductor Plc 宣布瑞薩完成對 Dialog 全部已發行和即將發行股本的收購。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

第5章 市場區隔

- 按地區

- 中國

- 日本

- 台灣

- 印度

- 其他亞太地區

第6章 競爭格局

- 公司簡介

- STMicroelectronics

- Renesas Electronics

- ADI

- Broadcom Inc.

- Qualcomm Inc.

- NXP Semiconductors NV

- Marvell Semiconductor, Inc.

- Mediatek, Inc.

- Intel Corporation

- Toshiba Corporation

第7章投資分析

第 8 章:市場的未來

The Communication Special Purpose Logic IC Market is expected to register a CAGR of 5.6% during the forecast period.

Special-purpose ICs are designed to tackle the duties required to accomplish closed-loop motion and motor speed control. Special-purpose ICs have also been designed to tackle the duties required to accomplish closed-loop motion and motor speed control.

Manufacturers are increasingly focusing on developing gadgets that minimize power consumption while delivering the desired performance in a small package. Consequently, the market for Special Purpose Logic ICs is expected to be driven by the increased focus on device integration over the forecast period.

The communication ICs market is expanding due to rising internet penetration and demand for consumer devices such as mobile phones, laptops, and tablets. Because of the rising need for high-band connectivity services around the world, the COVID-19 pandemic is positively impacting the market's growth. Furthermore, the increased production of medical equipment contributed to the market's expansion.

Rapid expansion in the automotive industry is favorably influencing market growth due to the increasing deployment of connection services in cars. Furthermore, the connected automobiles market is expected to drive the market's growth throughout the forecast period.

Communication Special Purpose Logic IC Market Trends

Automotive Industry to drive the Market Growth

While general-purpose ICs are used for various tasks like calculation, data transfer, and other comparable tasks. General-purpose integrated circuits (ICs) are found in computer processors. Temperature control, speed control, and various other duties are performed by special purpose ICs. Specific purpose ICs can be found in air conditioners, smart televisions, factory devices with motors, and mobile phones.

Because of rising consumer awareness about environmental pollution and rising oil prices, the demand for electric vehicles is expanding globally, driving the market for communication logic IC to rise. The potential of vehicle-to-vehicle (V2V) communication to wirelessly transmit information on the speed and position of nearby cars holds enormous promise for reducing traffic congestion, avoiding crashes, and improving the environment.

Increased sales of autos due to increased connectivity options in vehicles are positively impacting the industry growth. Furthermore, the market is expected to develop in the forecast period due to the rapid growth of the automotive sector.

The region has a strong infrastructure for automobile manufacturing and a huge consumption market. Asia-Pacific is the home of major automobile manufacturers such as Honda, Hyundai, Toyota, TATA, etc. The region is also a huge market for the automobile industry, with consumers of all classes. According to the 2022 data by OICA, in 2021, China produced approximately 21.4 million passenger cars, while Japan and India produced approx. 6.6 and 3.6 million cars. While China has partnerships and collaborations with global automobile manufacturers, making it the biggest auto producer in the region, ahead of South Korea, Japan, and India, these countries enjoy a strong domestic automotive sector. With the rise of the auto industry in the region, the demand for the studied market will also grow.

China to hold a significant share in the Market

China intends to create a special agency to encourage collaboration between domestic enterprises and international semiconductor powerhouses like Intel to build software, material, and manufacturing equipment development centers. Beijing is rushing to develop a domestic supply chain for semiconductors that is not subject to US sanctions. On the other hand, foreign governments are likely to be suspicious of this initiative, fearing the transfer of vital technology to China.

In 2015, Beijing introduced the "China Manufacturing 2025" strategy, prioritizing semiconductors. China has supported enterprises like Yangtze Memory Technologies, a NAND flash memory company, through government-backed investment institutions with a war chest of more than USD 20 billion committed to the chip industry. Under Xi's instructions, government-backed institutions are preparing to invest in new SMIC facilities and pump money into materials and manufacturing equipment to strengthen the supply chain. Given the lack of Chinese technology, however, the newly developed forum for foreign collaboration could be critical to the attempt.

In September 2021 - Semiconductor Manufacturing International Corp. (SMIC), China's largest contract chipmaker, announced the establishment of a new plant in the Lin-Gang Special Area, which is part of Shanghai's free trade zone. The proposed USD 8.87 billion foundry is expected to produce 100,000 12-inch wafers monthly. SMIC will own at least 51 % of the joint venture, with a 25% interest held by a Shanghai, government-designated investment company. SMIC stated in March that it would partner with the Shenzhen government to invest USD 2.35 billion in a project to produce 40,000 12-inch wafers per month using 28nm and higher integrated circuits.

China has enacted plenty of beneficial regulations for the semiconductor and software industries, including tax rebates, attractive financing, IP protection, and support for R&D, import and export, and talent development, among other things. Tax exemptions and discounts will be available to IC manufacturing companies and IC design, equipment, materials, packaging, testing, and software companies.

Due to the escalating technology standoff with the United States, China is strengthening its efforts to strengthen local software companies. This trend has touched many sectors, including chip access, 5G network construction, social media applications, and internet regulation. Beijing considers the technology industry strategically important, and government funding is projected to grow in the coming years.

Communication Special Purpose Logic IC Industry Overview

The Communication Special Purpose Logic IC Market is highly competitive, with multiple manufacturers. Product innovation, mergers, and acquisitions are some of the techniques used by market players. Furthermore, as the IC manufacturing process improves, allowing for more applications, new industry participants are extending their market presence and expanding their corporate footprint in emerging nations.

In November 2021 - The R9A06G061 power line communication (PLC) modem IC was introduced by Renesas Electronics Corporation, a leading provider of sophisticated semiconductor technologies. The R9A06G061 provides high-speed communication of up to 1 Mbps across extended distances of a kilometre or more without the use of relays, broadening the scope of PLC applications.

In August 2021 - Renesas Electronics Corporation, a leading provider of advanced semiconductor solutions, and Dialog Semiconductor Plc, a leading provider of battery and power management, Wi-Fi, Bluetooth, low energy, and Industrial edge computing solutions, have announced the completion of Renesas' acquisition of Dialog's entire issued and to be issued share capital.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Value Chain / Supply Chain Analysis

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 By Geography

- 5.1.1 China

- 5.1.2 Japan

- 5.1.3 Taiwan

- 5.1.4 India

- 5.1.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 STMicroelectronics

- 6.1.2 Renesas Electronics

- 6.1.3 ADI

- 6.1.4 Broadcom Inc.

- 6.1.5 Qualcomm Inc.

- 6.1.6 NXP Semiconductors N.V.

- 6.1.7 Marvell Semiconductor, Inc.

- 6.1.8 Mediatek, Inc.

- 6.1.9 Intel Corporation

- 6.1.10 Toshiba Corporation