|

市場調查報告書

商品編碼

1822572

邏輯 IC 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Logic IC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

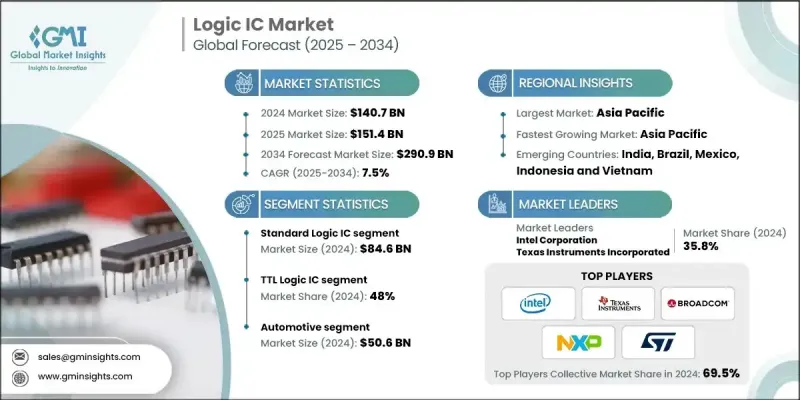

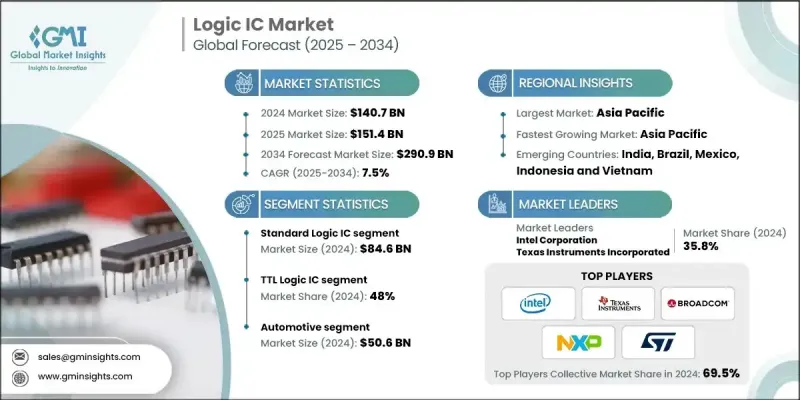

2024 年全球邏輯 IC 市場價值為 1,407 億美元,預計到 2034 年將以 7.5% 的複合年成長率成長至 2,909 億美元。

消費性電子產品的爆炸性成長是邏輯積體電路市場最重要的驅動力之一。智慧型手機、平板電腦、筆記型電腦、智慧型電視、遊戲機和穿戴式科技等設備已成為全球數十億用戶日常生活中不可或缺的一部分。這些產品嚴重依賴邏輯積體電路來管理資料處理、訊號路由、電源管理和系統控制等任務。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1407億美元 |

| 預測值 | 2909億美元 |

| 複合年成長率 | 7.5% |

標準邏輯IC將獲得發展

標準邏輯IC領域在2024年實現了可觀的成長,這得益於其在工業、消費性電子和運算設備中的基本訊號處理、定時和控制應用中的廣泛應用。這些IC因其可靠性、相容性以及易於整合到各種電路設計中而備受推崇。雖然標準邏輯IC被認為是成熟的技術,但它在支援嵌入式系統、電源管理單元和周邊介面的基礎操作方面仍然具有重要意義。

TTL邏輯IC需求不斷成長

受高速開關和一致邏輯電平驅動,TTL 邏輯 IC 領域在 2024 年佔據了相當大的佔有率。儘管在較新的應用中 TTL IC 已被 CMOS 替代品所取代,但由於其堅固耐用和簡單易用,仍在傳統系統、測試設備和某些工業控制中使用。在教育工具和小批量工業應用中,TTL 領域繼續發揮其價值,因為這些應用更重視訊號穩定性和速度,而不是功耗。

汽車領域採用率不斷上升

2024年,汽車產業收入強勁成長,這得益於先進駕駛輔助系統(ADAS)、資訊娛樂系統、電動動力系統和電池管理系統等電子設備快速融入汽車。汽車製造商越來越依賴邏輯積體電路 (IC) 進行即時資料處理、安全監控和車聯網 (V2X) 通訊。隨著汽車朝向更高自動化程度邁進,對高可靠性、低延遲邏輯元件的需求持續成長。

區域洞察

亞太地區將崛起為利潤豐厚的地區

2024年,亞太地區邏輯IC市場佔據了相當大的佔有率,這得益於其強大的製造業基礎、不斷成長的消費電子產品需求以及對工業自動化不斷成長的投資。中國大陸、韓國、日本和台灣等國家和地區不僅是邏輯IC的主要消費國,也是其重要的生產國,並擁有成熟的半導體生態系統和政府支持的創新政策。

邏輯 IC 市場的主要參與者包括萊迪思半導體公司、意法半導體公司、格羅方德公司、美滿電子公司、亞德諾半導體公司、高通公司、英飛凌科技股份公司、三星電子有限公司、博通公司、賽靈思公司 (AMD)、英特爾公司、安升美林半導體公司、升特科技公司、德州儀器公司和電導公司。

為了鞏固其在邏輯積體電路市場的地位,各大公司正在採取一系列措施,包括技術領先、供應鏈敏捷性和以應用為中心的創新。許多公司正在大力投入研發,以更小的製程節點和先進的封裝技術開發邏輯積體電路,以滿足速度、功率效率和整合度的需求。與代工廠和無晶圓廠設計公司的策略性收購和合作,正在幫助公司加快產品上市時間並取得新技術。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 衝擊力

- 成長動力

- 工業自動化和智慧製造的需求不斷成長

- 16 位元和 BiCMOS 邏輯 IC 技術的進步

- 汽車電子和ADAS中的邏輯IC整合

- 邏輯積體電路在消費性電子產品和邊緣運算設備的應用

- 電信和資料中心基礎架構中邏輯積體電路部署的擴展

- 產業陷阱與挑戰

- 實施和升級成本高

- 來自替代處理和整合技術的競爭

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 新興商業模式

- 合規性要求

- 消費者情緒分析

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 市場集中度分析

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 數位轉型計劃

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 標準邏輯IC

- CMOS邏輯積體電路

- TTL邏輯IC

- BiCMOS邏輯積體電路

- 可程式邏輯裝置(PLD)

- 可程式邏輯陣列(PLA)

- 可程式陣列邏輯(PAL)

- 複雜可程式邏輯裝置(CPLD)

- 現場可程式閘陣列(FPGA)

第6章:市場估計與預測:依技術,2021-2034

- 主要趨勢

- CMOS邏輯積體電路

- TTL邏輯IC

- BiCMOS邏輯積體電路

第7章:市場估計與預測:依最終用途產業,2021-2034

- 主要趨勢

- 汽車

- 消費性電子產品

- 工業的

- 衛生保健

- 航太與國防

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- PNY Technologies Inc.

- Intel Corporation

- Texas Instruments Incorporated

- Broadcom Inc.

- NXP Semiconductors NV

- ON Semiconductor Corporation

- STMicroelectronics NV

- Microchip Technology Inc.

- Analog Devices, Inc.

- Infineon Technologies AG

- Renesas Electronics Corporation

- Xilinx, Inc. (AMD)

- Lattice Semiconductor Corporation

- Marvell Technology, Inc.

- Qualcomm Incorporated

- Semtech Corporation

- GlobalFoundries Inc.

- Samsung Electronics Co., Ltd.

The Global Logic IC Market was valued at USD 140.7 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 290.9 billion by 2034.

The explosive growth in consumer electronics is one of the most significant drivers of the logic IC market. Devices such as smartphones, tablets, laptops, smart TVs, gaming consoles, and wearable technology have become essential parts of daily life for billions of users around the world. These products rely heavily on logic integrated circuits to manage tasks like data processing, signal routing, power management, and system control.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $140.7 billion |

| Forecast Value | $290.9 billion |

| CAGR | 7.5% |

Standard Logic IC to Gain Traction

The standard logic IC segment held sizable growth in 2024 owing to its widespread use in basic signal processing, timing, and control applications across industrial, consumer, and computing devices. These ICs are valued for their reliability, compatibility, and ease of integration into a variety of circuit designs. While considered mature technology, standard logic ICs remain relevant in supporting foundational operations in embedded systems, power management units, and peripheral interfaces.

Rising Demand for TTL Logic IC

The TTL logic IC segment held a significant share in 2024, driven by high-speed switching and consistent logic levels. Though replaced by CMOS alternatives in newer applications, TTL ICs are still used in legacy systems, test equipment, and certain industrial controls due to their robustness and simplicity. The segment continues to find value in educational tools and low-volume industrial applications where signal stability and speed are prioritized over consumption.

Rising Adoption in the Automotive Segment

The automotive segment generated robust revenues in 2024, driven by the rapid integration of electronics into vehicles for advanced driver assistance systems (ADAS), infotainment, electric powertrains, and battery management systems. Automakers are increasingly relying on logic ICs for real-time data processing, safety monitoring, and vehicle-to-everything (V2X) communications. As vehicles transition toward higher automation levels, the demand for high-reliability, low-latency logic components continues to rise.

Regional Insights

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific logic IC market held a significant share in 2024, fueled by its strong manufacturing base, rising demand for consumer electronics, and growing investments in industrial automation. Countries like China, South Korea, Japan, and Taiwan are not only major consumers but are key producers of logic ICs, supported by mature semiconductor ecosystems and government-backed innovation policies.

Major players in the logic IC market are Lattice Semiconductor Corporation, STMicroelectronics N.V., GlobalFoundries Inc., Marvell Technology, Inc., Analog Devices, Inc., Qualcomm Incorporated, Infineon Technologies AG, Samsung Electronics Co., Ltd., Broadcom Inc., Xilinx, Inc. (AMD), Intel Corporation, ON Semiconductor Corporation, Semtech Corporation, Texas Instruments Incorporated, Renesas Electronics Corporation, Microchip Technology Inc., and NXP Semiconductors N.V.

To strengthen their presence in the logic IC market, companies are adopting a mix of technology leadership, supply chain agility, and application-focused innovation. Many are investing heavily in R&D to develop logic ICs using smaller process nodes and advanced packaging techniques to meet demands for speed, power efficiency, and integration. Strategic acquisitions and collaborations with foundries and fabless design firms are helping companies accelerate time-to-market and access new technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Offering trends

- 2.2.2 Operating trends

- 2.2.3 Application trends

- 2.2.4 End use industry trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand from industrial automation and smart manufacturing

- 3.2.1.2 Advancements in 16-bit and BiCMOS logic IC technologies

- 3.2.1.3 Integration of logic ICs in automotive electronics and ADAS

- 3.2.1.4 Use of logic ICs in consumer electronics and edge computing devices

- 3.2.1.5 Expansion of logic IC deployment in telecommunications and data center infrastructure

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High implementation and upgrade costs

- 3.2.2.2 Competition from alternative processing and integration technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Consumer sentiment analysis

- 3.11 Patent and IP analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion and Units)

- 5.1 Key trends

- 5.2 Standard Logic ICs

- 5.2.1 CMOS Logic ICs

- 5.2.2 TTL Logic ICs

- 5.2.3 BiCMOS Logic ICs

- 5.3 Programmable Logic Devices (PLDs)

- 5.3.1 Programmable Logic Arrays (PLAs)

- 5.3.2 Programmable Array Logic (PAL)

- 5.3.3 Complex Programmable Logic Devices (CPLDs)

- 5.3.4 Field Programmable Gate Arrays (FPGAs)

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion and Units)

- 6.1 Key trends

- 6.2 CMOS Logic ICs

- 6.3 TTL Logic ICs

- 6.4 BiCMOS Logic ICs

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion and Units)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Consumer Electronics

- 7.4 Industrial

- 7.5 Healthcare

- 7.6 Aerospace & Defense

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion and Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 PNY Technologies Inc.

- 9.2 Intel Corporation

- 9.3 Texas Instruments Incorporated

- 9.4 Broadcom Inc.

- 9.5 NXP Semiconductors N.V.

- 9.6 ON Semiconductor Corporation

- 9.7 STMicroelectronics N.V.

- 9.8 Microchip Technology Inc.

- 9.9 Analog Devices, Inc.

- 9.10 Infineon Technologies AG

- 9.11 Renesas Electronics Corporation

- 9.12 Xilinx, Inc. (AMD)

- 9.13 Lattice Semiconductor Corporation

- 9.14 Marvell Technology, Inc.

- 9.15 Qualcomm Incorporated

- 9.16 Semtech Corporation

- 9.17 GlobalFoundries Inc.

- 9.18 Samsung Electronics Co., Ltd.