|

市場調查報告書

商品編碼

1692112

邏輯IC(積體電路) -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Logic IC (Integrated Circuit) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

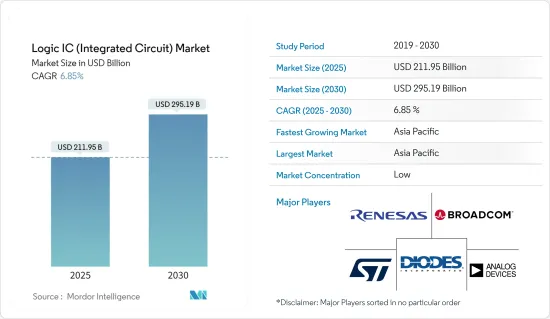

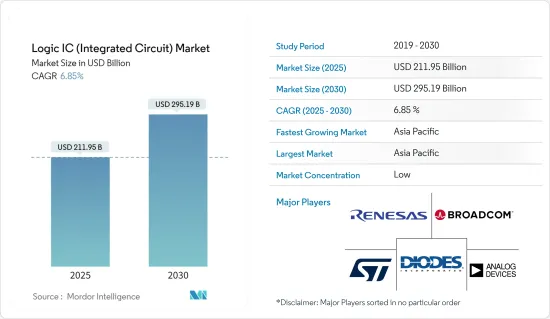

邏輯積體電路市場規模預計在 2025 年為 2,119.5 億美元,預計到 2030 年將達到 2,951.9 億美元,預測期內(2025-2030 年)的複合年成長率為 6.85%。

就出貨量而言,預計將從 2025 年的 679.7 億台成長到 2030 年的 834.6 億台,預測期間(2025-2030 年)的複合年成長率為 4.19%。

隨著半導體製造製程的不斷發展,更加複雜、高效的邏輯積體電路正在被開發出來。更小的電晶體尺寸、更高的性能以及更低的功耗使得開發適用於廣泛應用的高性能邏輯積體電路成為可能。邏輯積體電路非常靈活,可用於各種各樣的應用。它可以配置為執行多種邏輯功能,例如 AND、OR、NOT 和 XOR。這種靈活性使得能夠設計和開發滿足各行業要求的智慧電路,包括消費性電子、汽車、通訊和工業自動化。

主要亮點

- 邏輯積體電路對電子設備的小型化和整合化做出了重大貢獻。半導體製造技術的最新發展使得小型、複雜的邏輯電路能夠整合單晶片。這種整合使得電子系統能夠增加功能,同時減少其物理尺寸和消費量,從而能夠用於攜帶式設備、無線技術和其他空間受限的應用。顯示器驅動器、通用邏輯和 MOS 觸控螢幕控制器是近年來在市場上受到廣泛關注的一些邏輯組件。

- 此外,終端用戶產業的進步也推動了對小型、堅固的半導體設備的需求。例如,與傳統 PCB基板相比,現代智慧型手機需要更小的 PCB基板。此外還出現了一些形狀不規則、各異的物聯網設備,例如穿戴式設備,這些設備只有透過小型化才能實現。因此,預計對小型化 IC 元件的需求將大幅增加。

- 隨著智慧家庭、辦公室、穿戴式裝置、遠端監控和控制技術的引入,物聯網和工業物聯網的出現對電子設備的設計和尺寸產生了重大影響。此外,在開發穿戴式技術時,小型化是OEM和設計師的首要任務。

- 另一個需要小型化電子元件的進步是攜帶式電子產品,它需要更小、更薄的半導體系統來節省空間並縮小尺寸。對於航太和電動車等高度整合、高速的應用,改善電氣性能以最大限度地減少噪音影響的需求也很明顯。由於在設計最終產品時考慮到這些因素,邏輯 IC 組件在先進電子系統的開發中變得越來越重要。

- 邏輯積體電路有望執行各種複雜的功能。隨著技術的進步,電子設備有望具有更多尖端的功能和性能。設計師必須結合複雜的邏輯和演算法來滿足這些需求。功能的增加導致設計更大、更複雜,使得管理和最佳化各個元件之間的複雜互動成為一項挑戰。

- 新冠疫情引發重大市場變化,影響了客戶行為、企業收益和公司營運的多個方面。此次疫情暴露了先前未被注意到的供應方面的風險,可能導致重要零件短缺。因此,半導體公司正在積極重組其供應鏈,以提高其彈性,這些調整可能會持續到後疫情時代。

邏輯IC(積體電路)市場趨勢

快速成長的汽車領域

- 邏輯積體電路對於汽車控制和通訊系統至關重要。它們用於引擎控制單元(ECU)、變速箱控制單元(TCU)、防鎖死煞車系統、資訊娛樂、安全氣囊控制模組、系統和許多其他電控系統。這些積體電路能夠處理和執行用於車輛控制、監控和通訊的先進演算法和邏輯功能。

- 消費者期望他們的車輛能夠提供先進的功能、便利性和無縫的用戶體驗,包括舒適性、安全性和便利性,包括先進的駕駛輔助系統 (ADAS)、智慧照明系統、個人化設定、語音控制等。滿足消費者期望和提供創新功能正在推動汽車產業對邏輯積體電路的需求。

- 自動緊急煞車、車道偏離警告和主動式車距維持定速系統等各種 ADAS 技術在現代汽車中變得越來越普遍。邏輯積體電路對於處理感測器資料、做出即時決策和控制車輛功能至關重要。未來的趨勢可能會看到更先進的 ADAS 功能的發展,這將需要具有更高運算能力、更低延遲和增強感測器融合能力的邏輯 IC。

- 在汽車產業,安全性和功能性要求至關重要。邏輯積體電路可確保各種汽車系統(包括 ADAS、自動駕駛和動力傳動系統控制)的安全可靠運作。汽車市場對符合 ISO 26262 等嚴格安全標準的高性能、可靠邏輯 IC 的需求推動著這個市場的發展。

- 追求自動駕駛汽車是汽車產業的關鍵趨勢。邏輯積體電路對於自動駕駛所需的複雜處理和決策至關重要。

- 根據羅蘭貝格預測,2025年4級輕型自動駕駛汽車的滲透率預計將達到1%,此後市場佔有率將逐步提升。此外,預計到 2030 年,4 級小型自動駕駛汽車將佔據全球市場的 5%。隨著自動駕駛技術的進步,對具有更強處理能力、先進的感測器整合和強大安全功能的邏輯積體電路的需求可能會增加。

- 此外,環境問題和政府法規正在加速向電動車的轉變。電動車基於先進的電力電子和電池管理,需要專門的邏輯積體電路來確保最佳的能源利用、馬達控制和充電基礎設施整合。

- 根據IEA最新報告,2022年全球電動車購買量將超過1,000萬輛,預計2023年銷量將成長35%,達到1,400萬輛。到2023年,中國、歐洲、美國等地區的電動車銷量將達到1,390萬輛。

亞太地區實現強勁成長

- 亞太地區僅包括中國和日本的分析。該地區是全球半導體產業中一個充滿活力且快速成長的領域。憑藉新興經濟體、強大的製造能力和不斷成長的電子設備需求,亞太地區在推動邏輯積體電路的創新、生產和消費方面發揮關鍵作用。

- 亞太地區是全球半導體製造中心,中國和日本等國家在半導體製造和組裝處於領先地位。領先的半導體代工廠、組裝和測試設施以及電子製造服務的存在使得邏輯積體電路的生產高效且具有成本效益。中國擁有龐大且快速擴張的消費性電子和汽車市場,工業化和自動化程度的提高正在推動 ADAS 和電動車的發展。

- 中國被譽為全球汽車及旅遊產業的領導者,國內市場表現穩定,潛力大。中國工業和資訊化部預測,到2025年國內汽車產量將達到3,500萬輛,進一步鞏固中國作為世界領先汽車製造商之一的地位。根據中汽協數據顯示,2023年8月中國新能源車銷量為84.6萬輛,其中搭乘用80.8萬輛,商用車3.9萬輛。其中,純電動車(BEV)保有量為55.9萬輛,插電式混合動力車(PHEV)保有量為24.8萬輛。

- 此外,根據中國汽車物流市場預測,到2025年,新能源乘用車類別中的純電動車(BEV)預計將佔據84%的市場佔有率,這將推動該領域出現重大技術進步,例如將ADAS整合到BEV中。 2024年,中國很可能在智慧駕駛系統的採用上達到閾值。由於 AD 等級的採用速度快於預期,車輛更換週期可能會縮短。供應量的增加,可能伴隨著密集的消費者教育和媒體曝光,將加速中國消費者向智慧駕駛的轉變。

- 亞太地區電動車市場的快速成長預計將對邏輯積體電路(IC)市場產生重大影響。隨著電動車融入 ADAS 和智慧駕駛系統等更先進的技術,對積體電路(尤其是處理和控制系統積體電路)的需求可能會激增。此外,向電動車的轉變需要開發充電基礎設施,而這在很大程度上依賴積體電路技術。因此,專門從事邏輯積體電路的半導體公司預計全部區域不斷擴大的電動車市場中獲益。

邏輯IC(積體電路)市場概況

由於全球參與者和小型參與者的存在,邏輯積體電路市場變得分散。市場的主要企業包括意法半導體公司 (STMicroelectronics NV)、瑞薩電子公司 (Renesas Electronics Corp.)、ADI 公司 (Analog Devices Inc.)、博通公司 (Broadcom Inc.) 和 Diodes 公司 (Diodes Incorporated)。市場上的各種公司正在採用收購和聯盟等各種策略來加強其產品供應並獲得永續的競爭優勢。

- 2024年4月,Centrica Energy與意法半導體簽署了一份長期契約,為義大利供應可再生能源電力。這是一份為期 10 年的契約,涉及義大利一座新建太陽能發電廠生產的能源。

- 2024 年 4 月,瑞薩電子開始營運僅生產晶圓的甲府工廠。位於山梨縣甲斐市。甲府工廠先前由瑞薩電子旗下的瑞薩半導體製造株式會社營運150毫米和200毫米晶圓生產線。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 市場宏觀經濟走勢分析

- 技術簡介

第5章市場動態

- 市場促進因素

- 更加重視設備整合

- 加大工廠設備投資,擴大產能

- 市場限制

- 邏輯IC設計的複雜度不斷增加

第6章市場區隔

- 按 IC 類型

- 數字雙極

- 採用MOS邏輯

- MOS通用

- MOS閘陣列

- MOS驅動器/控制器

- MOS標準單元

- MOS 特殊用途

- 按應用

- 家用電子電器

- 車

- 資訊科技和通訊

- 電腦

- 其他

- 按地區

- 美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 中東和非洲

第7章競爭格局

- 公司簡介

- STMicroelectronics NV

- Renesas Electronics Corp.

- Analog Devices Inc.

- Broadcom Inc.

- Diodes Incorporated

- NXP Semiconductors NV

- ON Semiconductor Corporation

- Texas Instruments Inc.

- Intel Corporation

- Toshiba Corporation

第8章投資分析

第9章:市場的未來

The Logic IC Market size is estimated at USD 211.95 billion in 2025, and is expected to reach USD 295.19 billion by 2030, at a CAGR of 6.85% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 67.97 billion units in 2025 to 83.46 billion units by 2030, at a CAGR of 4.19% during the forecast period (2025-2030).

Ongoing advancements in semiconductor manufacturing processes have led to the development of more complex and efficient logic ICs. Smaller transistor sizes, improved performance, and lower power consumption enable the creation of high-performance logic ICs for a wide range of applications. A logic IC is very flexible and can be used in various applications. One can configure them to perform multiple logical functions, such as AND, OR, NOT, and XOR. This flexibility allows for designing and developing intelligent circuits that meet requirements in different industries, such as consumer electronics, automotive, telecommunications, and industry automation.

Key Highlights

- Logic ICs have significantly aided the miniaturization and integration of electronic devices. The development of the technology to manufacture semiconductors has produced small, more complex logic circuits on a single chip in recent years. This integration increases functionality while reducing electronic systems' physical size and energy consumption so that they can be used in portable devices, wireless technology, or space-constrained applications. Display drivers, general purpose logic, and MOS touch screen controllers are some of the logic components that have gained significant market traction in recent years.

- Furthermore, advances in end-user industries have created the need for small and robust semiconductor devices. For instance, nowadays, smartphones require a smaller PCB board, unlike traditional PCB boards. There has also been the advent of IoT devices, such as wearables with irregular and different shapes, which can only be achieved through miniaturization. This is expected to boost the need for miniaturized IC components significantly.

- The advent of the IoT and IIoT has largely impacted the design and size of electronics, with the introduction of technologies like smart homes, offices, wearables, remote monitoring, and control. Moreover, OEMs and designers consider miniaturization a primary focus while creating wearable technologies.

- Another advancement that demands miniaturized electronic components is portable electronic equipment, which requires smaller and thinner semiconductor systems for saving space and miniaturization. Due to highly integrated, high-speed applications like aerospace and electric vehicles, the demand for improved electrical performance to minimize noise effects is also evident. As a result of these considerations when designing end products, logic IC components are becoming increasingly important in developing advanced electronic systems.

- Logic ICs are expected to perform a wide range of complex functions. The demand for more state-of-the-art features and capabilities in electronic devices grows as technology advances. Designers need to incorporate complex logic circuits and algorithms to meet these requirements. This increased functionality leads to larger and more intricate designs, making it challenging to manage and optimize the complex interactions between different components.

- The market has undergone substantial changes due to the COVID-19 pandemic, impacting customer behavior, business revenues, and various aspects of corporate operations. The pandemic revealed previously unnoticed risks on the supply side, potentially resulting in shortages of essential parts and components. Consequently, semiconductor companies are proactively restructuring their supply chains to enhance resilience, and these adjustments may persist in the post-pandemic era.

Logic IC (Integrated Circuit) Market Trends

The Automotive Segment to Witness Rapid Growth

- Logic ICs are essential in vehicle control and communications systems. They are used in engine control units (ECUs), transmission control units (TCUs), antilock braking systems infotainment, airbag control modules, systems, and various other electronic control units. ICs can process and execute sophisticated algorithms and logical functions for vehicle control, monitoring, and communication.

- Consumers expect vehicles to offer advanced features, convenience, and a seamless user experience, including comfort, safety, and convenience, such as advanced driver assistance, intelligent lighting systems, personalized settings, and voice control. Meeting consumer expectations and providing innovative features drive the demand for logic ICs in the automotive industry.

- Various ADAS technologies, such as automatic emergency braking, lane departure warning, and adaptive cruise control, are becoming more prevalent in modern vehicles. Logic ICs are critical in processing sensor data, enabling real-time decision-making, and controlling vehicle functions. Future trends may involve the development of more advanced ADAS features, requiring logic ICs with higher computational power, low latency, and enhanced sensor fusion capabilities.

- In the automotive industry, safety and functional requirements are of great importance. Logic ICs ensure various automotive systems' safe and reliable operation, including ADAS, autonomous driving, and powertrain control. The need for high-performance, reliable logic ICs that meet stringent safety standards, such as ISO 26262, drives the demand in the automotive market.

- The pursuit of autonomous vehicles is a significant trend in the automotive industry. Logic ICs are essential for the complex processing and decision-making required for autonomous driving.

- According to Roland Berger, in 2025, the penetration rate of level 4 light autonomous vehicles is expected to be 1%, with a gradually increasing market share in subsequent years. Furthermore, 5% of the global market is anticipated to comprise level 4 light autonomous vehicles by 2030. As self-driving technology advances, logic ICs with increased processing power, advanced sensor integration, and robust safety features are likely to be in demand.

- Moreover, due to environmental concerns and government regulations, the shift toward the use of electric vehicles is gaining momentum. EVs are based on advanced power electronics and battery management, which requires specialized logic ICs to ensure optimum energy use, motor control, or charging infrastructure integration.

- According to the latest report from IEA, over 10 million electric vehicles were bought worldwide in 2022, and sales were estimated to increase by 35% in 2023 to reach 14 million. In 2023, China, Europe, the United States, and other regions sold 13.9 million electric vehicles.

Asia-Pacific to Register Major Growth

- Asia-Pacific consists of the analysis of only China and Japan. The region is a dynamic and rapidly growing segment of the global semiconductor industry. With emerging economies, strong manufacturing capabilities, and growing demand for electronic devices, Asia-Pacific is pivotal in driving innovation, production, and consumption of logic ICs.

- Asia-Pacific is a global manufacturing hub for semiconductor production, with countries such as China and Japan leading in semiconductor manufacturing and assembly. The presence of leading semiconductor foundries, assembly and testing facilities, and electronics manufacturing services enables efficient and cost-effective production of logic ICs. It is home to a vast and rapidly expanding consumer electronics market and automotive market with developments in ADAS and EVs along with increasing industrialization and automation.

- China is known as a global leader in the automotive and mobility industry owing to the consistent performance of the domestic market and its enormous potential. The Chinese Ministry of Industry and Information Technology projects that domestic vehicle production will reach 35 million by 2025, further strengthening its position as the world's leading car manufacturer. According to CAAM, China's new energy vehicle sales amounted to 846,000 units, 808,000 of which were passenger EVs and 39,000 were commercial electric vehicles during August 2023. Sales of BEVs and PHEVs recorded 559,000 and 248,000 vehicles, respectively.

- Furthermore, according to the forecast from China's automotive logistics market, it is expected that the battery electric vehicles (BEV) in the new energy passenger vehicle category will have 84% of the market share by 2025, which leads to major technological advancements in the segment like integration of ADAS in BEVs. In 2024, China is likely to achieve a threshold in adopting intelligent driving systems. The replacement cycle of vehicles could be shortened by more rapid adoption of AD levels than anticipated. An increase in supply may be accompanied by intensive consumer education and media exposure, which will accelerate Chinese consumers' shift toward smart driving.

- The rapid growth of EV markets in Asia-Pacific is expected to impact the logic integrated circuit (IC) market significantly. As EVs incorporate more advanced technologies like ADAS and intelligent driving systems, the demand for ICs, especially those for processing and control systems, will likely surge. Additionally, the shift toward EVs necessitates developing charging infrastructure, which relies heavily on IC technology. As a result, semiconductor companies specializing in logic ICs are poised to benefit from the expanding EV markets across the region.

Logic IC (Integrated Circuit) Market Overview

The logic IC market is fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are STMicroelectronics NV, Renesas Electronics Corp., Analog Devices Inc., Broadcom Inc., and Diodes Incorporated. The various players in the market are adopting different strategies, such as acquisitions and partnerships, to enhance their product offerings and gain a sustainable competitive advantage.

- In April 2024, a long-term agreement was signed between Centrica Energy and STMicroelectronics for the supply of electricity produced from renewable sources in Italy. It is a 10-year contract for energy produced by a new solar farm in Italy.

- In April 2024, Renesas started the operation of Kofu Factory, a dedicated wafer fab. It is located in Kai City, Yamanashi Prefecture, Japan. The Kofu Factory previously operated both 150 mm and 200 mm wafer fabrication lines under Renesas Semiconductor Manufacturing Co., a subsidiary of Renesas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Analysis of Macroeconomic Trends on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Focus on Device Integration

- 5.1.2 Increasing Capital Expenditure of Fabs to Augment Production Capacity

- 5.2 Market Restraints

- 5.2.1 Complexity Associated with Logic IC Design

6 MARKET SEGMENTATION

- 6.1 By IC Type

- 6.1.1 Digital Bipolar

- 6.1.2 By MOS Logic

- 6.1.2.1 MOS General Purpose

- 6.1.2.2 MOS Gate Arrays

- 6.1.2.3 MOS Drivers/Controllers

- 6.1.2.4 MOS Standard Cells

- 6.1.2.5 MOS Special Purpose

- 6.2 By Application

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 IT and Communication

- 6.2.4 Computer

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics NV

- 7.1.2 Renesas Electronics Corp.

- 7.1.3 Analog Devices Inc.

- 7.1.4 Broadcom Inc.

- 7.1.5 Diodes Incorporated

- 7.1.6 NXP Semiconductors NV

- 7.1.7 ON Semiconductor Corporation

- 7.1.8 Texas Instruments Inc.

- 7.1.9 Intel Corporation

- 7.1.10 Toshiba Corporation