|

市場調查報告書

商品編碼

1644562

標準邏輯 IC:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Standard Logic IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

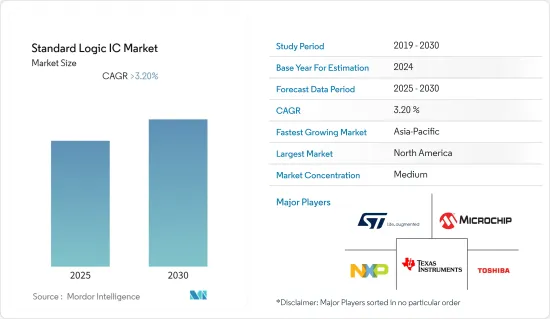

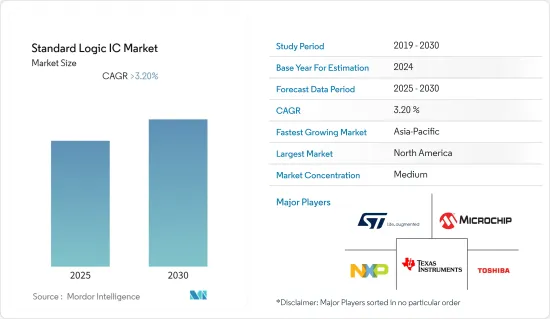

預計預測期內標準邏輯 IC 市場複合年成長率將超過 3.2%。

主要亮點

- 標準邏輯IC是積體電路形式的邏輯閘。此 IC 採用帶引腳封裝,以便在電路中進一步使用。由於BiPolar技術與CMOS技術的製造流程和架構差異,導致工作電壓、反應時間和輸出形式有所不同。邏輯閘在電子設計和功率最佳化中的貢獻至關重要。

- 透過改進陶瓷和塑膠來實現封裝解決方案的小型化對於根據特定用途選擇正確的邏輯 IC 起著至關重要的作用。 7400 和 4000 系列是最廣泛使用的標準邏輯 IC 之一。對設備小型化的不懈關注,特別是在家用電子電器領域,已經塑造了整個產業。

- 製造商正在強調使用具有更好的溫度監控和適應性的新型改進邏輯IC,確保在汽車等行業提供全方位服務。例如,2021年11月,三星電子宣布了三種針對下一代汽車的全新邏輯解決方案:Exynos Auto T5123、Exynos V7、S2VPS01。 S2VPS01 是一款電源管理積體電路 (PMIC),可調節和整流車載資訊娛樂系統的電源輸入。此 IC 捆綁了各種功能以防止惡劣的熱條件,包括過壓保護 (OVP) 和熱感關斷 (TSD)。

- 在新冠疫情期間,半導體裝置的需求轉向消費性電子產品和醫療設備中的計算設備。這影響了邏輯積體電路製造業客自訂生產的正常需求週期。除了這種轉變之外,對標準 IC 解決方案的需求仍然保持中等至強勁,受影響的工業應用被家用電子電器產品線所抵消。後疫情時代,隨著各行各業復甦,半導體需求將大幅成長,邏輯IC市場也將迎來加速發展。

標準邏輯IC市場趨勢

汽車產業需求最大

- 汽車產業經常期待大規模的電氣化和發展。智慧互聯技術和自動駕駛功能的引入正在推動對半導體封裝的需求。這導致了電路、MPU、感測器的使用增加,以及用於電源調節和整流的標準邏輯IC的部署日益增多。

- 致力於提高安全性和乘坐舒適度的新時代技術正在大力增加半導體在乘用車中的使用。為了滿足安全氣囊、自動駕駛功能、電子穩定控制 (ESC) 程序等的安全標準,公司遵守電路級的嚴格規定,並使用一些市場上最好的邏輯 IC。例如,德克薩斯(TI) 等公司提供通過 AEC-Q100 認證的汽車邏輯設備。該IC支援5V至1.2V的寬電源電壓範圍,以滿足所有汽車系統的要求,包括資訊娛樂系統、車身控制模組、汽車照明和ADAS(高級駕駛輔助系統)。

- 物聯網服務和遠端存取功能(例如地理圍欄、遠端資訊處理、車隊管理系統、自動駕駛和半自動駕駛輔助、車載資訊娛樂和其他基於 SIM 卡的實用公共事業)正在推動汽車行業走向通訊密集型應用。這推動了通訊模組和感測器的引入,為進一步處理提供詳細和概要的輸入參數。特別是在電動車中,模組和感測器大量使用邏輯IC來維持電氣安全標準和電源效率。

- 隨著世界向電動車 (EV) 邁進,需要對電氣參數進行廣泛的監管,從而使用邏輯閘 IC 來實現更安全的充電和放電技術。汽車公司正在整個車輛、最終部署和充電基礎設施中利用邏輯積體電路的潛力及其廣泛的電壓處理能力。這些因素正在推動標準邏輯積體電路產業的創新和進步,以最佳化功耗、工作電壓和縮放特性。

亞太地區推動市場成長

- 亞洲最大的製造地包括中國大陸、台灣、韓國和日本。廉價的技術勞動力、有利的氣候條件、政府的激勵措施、強大的電力和水利基礎設施、運輸和物流以及誘人的投資條件有助於半導體製造業蓬勃發展。這些行業對邏輯積體電路和儲存設備的標準化製造做出了重大貢獻。

- 根據美國半導體產業協會(SIA)的《2021年美國半導體產業狀況》,全球約75%的半導體製造產能位於東亞。目前運作的製造設備已具備7奈米及以下尖端能力。鑑於當前的市場狀況,該地區的整體主導地位預計在預測期內將繼續上升。如此高的發展率的主要原因是政府的激勵措施,與其他地區相比,顯著降低了總營運成本(TCO)。

- 據SIA稱,台灣公司在1980年代末和1990年代建立了代工模式。這些單位專門生產由其他地區的公司設計的晶片。如今,台灣擁有全球五大晶圓代工廠中的兩家,佔全球整體總產能的20%。台積電是另外三家能夠生產先進節點(10 奈米或更低)邏輯晶片的公司之一,另外兩家是英特爾(美國)和三星(韓國)。這些尖端的邏輯晶片將安裝在個人電腦、資料中心/AI伺服器和智慧型手機等運算密集型設備中。全球大部分最先進節點(5奈米和7奈米)產能位於台灣。

- 半導體製造所需的材料濃度很高,包括光阻劑、矽晶圓、構裝基板、化學品和特殊氣體,這也決定了邏輯積體電路的製造地點。例如,蝕刻過程需要 C4F6,它可以比最接近的替代品快 30% 完成該過程。亞洲國家,特別是台灣,意識到了這些因素。其他地區可能需要投入大量的時間和精力來聚集這樣的資源,以削弱亞洲的主導地位。

標準邏輯 IC 產業概況

標準邏輯IC市場競爭適中。在這個市場中,製造商和客戶公司定期合作進行系統開發。該行業正在共用專業知識並利用新的先進邏輯閘積體電路來提高運作和電源效率。改善溫度控管、系統回應時間和最佳化功耗是一些關鍵目標。

- 2022 年 3 月-恩智浦半導體和日立能源聯手加速碳化矽 (SiC) 功率半導體模組在電動車領域的應用。此次合作旨在提供基於 SiC MOSFET 的更有效率、更可靠、功能更安全的解決方案。這些解決方案將利用恩智浦先進的高性能隔離高壓閘極驅動器GD3160和日立能源的RoadPak汽車SiC MOSFET功率模組,並部署在動力傳動系統逆變器中。

- 2021 年 5 月-三星電子宣佈到 2030 年分配 171 兆韓元的邏輯晶片價值。該計畫比2019年4月宣布的計畫增加了38兆韓元。該公司還宣布將在韓國平澤建造一條新的生產線。該設施將有助於提供採用極紫外線 (EUV)微影術技術的 5 奈米邏輯半導體和 14 奈米 DRAM 製造製程。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 市場促進因素

- 工業 4.0 推動邏輯 IC 的廣泛應用

- 應用驅動的半導體和電路需求

- 市場限制

- 製造過程高度依賴代工廠

第5章 市場區隔

- 按類型

- 數字雙極

- CMOS

- MOS閘陣列

- MOS 通用邏輯

- MOS標準單元

- MOS顯示驅動器

- MOS觸控螢幕控制器

- 按應用

- 通訊

- 車

- 消費性電子產品

- 工業的

- 衛生保健

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭格局

- 公司簡介

- Diodes Incorporated

- Texas Instruments Incorporated

- Xilinx, Inc.

- STMicroelectronics NV

- Toshiba Electronic Devices and Storage Corporation

- ROHM Co., Ltd.

- Microchip Technology Incorporated

- NXP Semiconductors NV

- ON Semiconductor Corporation

- Samsung Electronics Company Ltd.

- Intel Corporation

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 90671

The Standard Logic IC Market is expected to register a CAGR of greater than 3.2% during the forecast period.

Key Highlights

- Standard logic ICs are logic gates in the form of integrated circuits. The ICs are packaged with pins meant for further use in circuitry. The different manufacturing processes and architectures of BiPolar and CMOS technologies provide the difference in operational voltages, response time, and output form. The contributions of logic gates in electronic design and power optimization are essential.

- The scaling down of packaging solutions driven by improvements in ceramics and plastics has played an integral role in choosing the appropriate logic IC for specific purposes. 7400 and 4000 series are among the most broadly used standard logic ICs. The constant focus on scaling down devices, especially consumer electronics, has shaped the industry.

- Manufacturers highlight the use of new and improved logic ICs with better temperature monitoring and adaptability, promising full service in industries like the automotive industry. For instance, in November 2021, Samsung Electronics introduced three new Logic solutions for the next generation of automobiles, including Exynos Auto T5123, Exynos V7, and S2VPS01. The S2VPS01 is a power management IC (PMIC) that regulates and rectifies electrical power input to in-vehicle infotainment performance. The IC is bundled with various features for protection from harsh thermal conditions, including over-voltage protection (OVP) and thermal shut down (TSD).

- The demand for semiconductor devices during the COVID-19 pandemic shifted towards consumer electronics and computing devices for healthcare equipment. This affected the regular demand cycle in the logic IC manufacturing industry for custom builds. Apart from the shift, the demand for standard IC solutions was moderate to steady, with the affected industrial applications compensated by the consumer electronics product lines. In the post-pandemic world, as several industries revive, the demand for semiconductors spikes, accelerating the logic IC market.

Standard Logic IC Market Trends

Automotive Industry to Generate the Maximum Demand

- The automotive industry is looking forward to wide-scale electrification and advancements regularly. The introduction of smart connected tech and autonomous features is driving the demand for the implementation of semiconductors. Hence, the increased use of circuitry, MPUs, and sensors directs the increased deployment of standard logic ICs for power regulation and rectification.

- The new-age technology catering to safety and modification of ride dynamics is aggressively increasing the use of semiconductors in passenger vehicles. To meet safety norms like airbags, autonomous features, electronic stability control (ESC) programs, and others, companies follow strict regulations on circuit level and use one of the best logic ICs available. For instance, companies like Texas Instruments (TI) offers automotive logic devices compliant with the AEC-Q100 standard. The ICs support a wide range of supply voltages, ranging between 5V and 1.2V, to meet the requirements of any automotive system, including infotainment systems, body control modules, automotive lighting, and advanced driver assistance systems (ADAS).

- IoT Services and remote access features like geofencing, telematics, fleet management systems, autonomous and semiautonomous driving assists, in-vehicle infotainment, and other SIM-based utilities are taking the automotive sector towards dense application of communication. This encourages the deployment of communication modules and more sensors to provide detailed schematic input parameters for further processing. The modules and sensors are extensively using logic ICs to maintain electrical safety standards and power efficiency, especially in electric vehicles.

- As the world is shifting toward Electric Vehicles (EVs), the requirement of extensive regulation of electrical parameters invites logic gate ICs for safer implementation of the charging and discharging technologies. Automotive companies utilize the potential and wide range of voltage handling capabilities of logic ICs through the vehicles' and final deployment stages and charging infrastructure. These factors drive the innovation and advancement in the standard logic IC industry to optimize power consumption, operating voltages, and scaling properties.

Asia Pacific Region to Drive the Market Growth

- Some of Asia's biggest manufacturing hubs include China, Taiwan, South Korea, and Japan. The availability of a cheaper skilled workforce, favorable weather conditions, government incentives, robust power, and water infrastructure, transportation and logistics, and attractive investment conditions help the semiconductor fabrication industries flourish. These industries contribute significantly to standard manufacturing logic ICs and storage devices.

- According to the 2021 State of the U.S. Semiconductor industry provided by the Semiconductor Industry Association (SIA), about 75% of the world's total semiconductor manufacturing capacity lies in East Asia. The currently operating manufacturing units have 7 nm and below leading-edge capabilities. The current market conditions promise the region's overall domination to continue rising over the forecast period. Major credit for this high rate of development goes to the significant government incentives that significantly bring down the Total Cost of Operation (TCO) compared to the alternate locations.

- According to SIA, Taiwanese firms founded the foundry model in the late 1980s and 1990s. These units specialized in manufacturing the chips designed by firms from other regions. Today Taiwan comprises two of the five largest foundries globally, hosting 20% of the total global capacity. TSMC is one of the three firms, along with Intel (US) and Samsung (South Korea), that can produce logic chips in advanced nodes (10 nanometers or below). These advanced logic chips are deployed in compute-intensive devices like PCs, data center/AI servers, and smartphones. Most of the world's capacity in the top nodes (5 and 7 nanometers) is located in Taiwan.

- The high concentration of the materials required for semiconductor manufacturing like photoresists, silicon wafers, chemicals including packaging substrates, or specialty gases also defines the location of manufacturing logic ICs. For instance, C4F6 is required for the etching process, enabling the process completion 30% faster than the closest alternative. Asian countries, especially Taiwan, have figured out such factors. It would take a notable amount of investment and time for the other regions to align such resources to disrupt the Asian dominance.

Standard Logic IC Industry Overview

The standard logic IC market is moderately competitive. The market witnesses regular collaboration among manufacturers and client companies to venture into developing systems. The industry observes sharing expertise, leveraging new advanced logic gate ICs, and boosting operational and power efficiency. Improved heat management, system response time, and power consumption optimization are some of the critical goals.'

- March 2022 - NXP Semiconductors and Hitachi Energy collaborated to fasten the adoption of silicon carbide (SiC) power semiconductor modules in e-mobility. The partnership aims to provide SiC MOSFET-based, more efficient, reliable, and functionally safe solutions. These solutions will be deployed for powertrain inverters, leveraging NXP's advanced, high-performance GD3160 isolated HV Gate Drivers and Hitachi Energy's RoadPak automotive SiC MOSFET power modules.

- May 2021 - Samsung electronics announced the allocation of KRW 171 Trillion in Logic Chip Buniesses by 2030. The plan displays an increase of KRW 38 Trillion compared to the one conveyed in April 2019. The company has also declared constructing a new production line in Pyeongtaek, Korea, expected to be completed by the 2022 second half. The plant will contribute to carrying out 5-nanometer logic semiconductors and 14-nanometer DRAM manufacturing processes, featuring Extreme Ultraviolet (EUV) lithography technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Industry 4.0 Driving the Deployment of Logic ICs

- 4.3.2 Application-Centric Demands for Semiconductor and Circuitry

- 4.4 Market Restraints

- 4.4.1 High Dependence on Foundries for Manufacturing

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Digital Bipolar

- 5.1.2 CMOS

- 5.1.3 MOS Gate Arrays

- 5.1.4 MOS General Purpose Logic

- 5.1.5 MOS Standard Cells

- 5.1.6 MOS Display Drives

- 5.1.7 MOS Touch Screen Controllers

- 5.2 By Application

- 5.2.1 Communication

- 5.2.2 Automotive

- 5.2.3 Consumer Electronics

- 5.2.4 Industrial

- 5.2.5 Healthcare

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Diodes Incorporated

- 6.1.2 Texas Instruments Incorporated

- 6.1.3 Xilinx, Inc.

- 6.1.4 STMicroelectronics N.V

- 6.1.5 Toshiba Electronic Devices and Storage Corporation

- 6.1.6 ROHM Co., Ltd.

- 6.1.7 Microchip Technology Incorporated

- 6.1.8 NXP Semiconductors N.V.

- 6.1.9 ON Semiconductor Corporation

- 6.1.10 Samsung Electronics Company Ltd.

- 6.1.11 Intel Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219