|

市場調查報告書

商品編碼

1444280

能源儲存-市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Thermal Energy Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

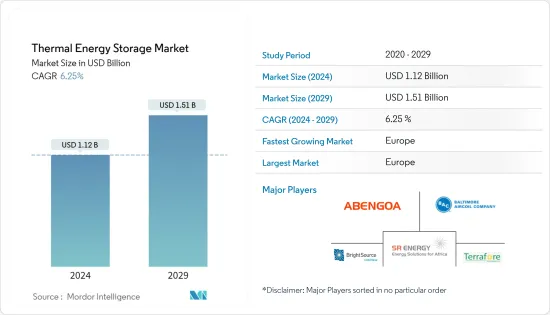

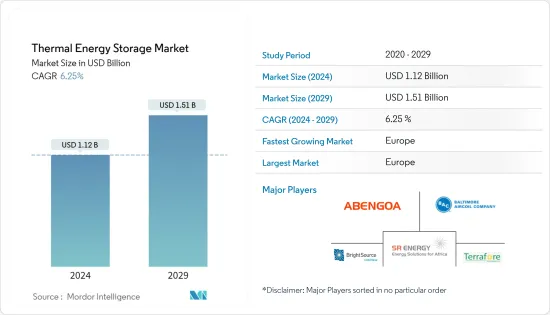

預計2024年能源儲存市場規模為11.2億美元,預計到2029年將達到15.1億美元,預測期間(2024-2029年)年複合成長率為6.25%。

由於工業封鎖和發電行業電力需求急劇下降,COVID-19 疫情對市場產生了負面影響。熱能能源儲存產業的企業出現了巨大的收益損失。 ABENGOA 2020 年銷售額為 12.5 億歐元,比 2019 年的 14.93 億歐元下降 16%。由於工業領域大型企業對技術的需求不斷增加,預計未來幾年熱能能源儲存市場將快速成長。 -大規模暖氣和冷氣應用的選項以及節省尖峰時段能源的環保方式。然而,來自電池能源儲存等其他能源儲存替代方案的競爭預計將阻礙未來市場的成長。

主要亮點

- 由於擴大採用能源儲存系統的聚光太陽能(CSP)技術,預計發電應用在預測期內將顯著成長。

- 產業相關人員和政府機構正在努力透過研究和創新使技術範圍多樣化,從而在市場上創造充足的機會。最近,歐盟在「地平線 2020」計畫下為能源儲存技術進步撥款。

- 由於對季節性能源儲存的高需求,歐洲在預測期內可能會成長更快。

熱能能源儲存市場趨勢

發電量預計將大幅成長

- 世界對可再生能源發電和能源安全方法的採用正在加速對太陽能發電中的聚光太陽能發電(CSP)等技術的需求。這些技術在當前場景下經常被應用在能源儲存系統中。

- 由於世界各地光熱發電設備安裝量的增加,光熱發電電源的發電量正在顯著增加。例如,根據 IRENA 的數據,2022 年 CSP 總裝置容量約為 6.50 GW,而 2021 年為 6.37 GW。工業和商業領域的技術應用有所成長。太陽能 CSP 發電組合中將增加幾個計劃以及能源儲存系統。

- 2022年1月,中國政府宣布計畫在2024年興建11個熱能源儲存光熱發電計劃。預計中國國有企業將在未來與其他產業相關人員聯盟的計劃中發揮主導作用。這些是千兆瓦級混合可再生能源計劃,兩年內還將增加更多項目。

- 2023年6月,Vast Solar Pty授予Worley一份澳洲VS1 CSP計劃的重要工程合約。該計劃涉及在南澳大利亞奧古斯塔港建設一座30兆瓦或288兆瓦時的光熱電站。該設施採用Vast的模組化CSP塔v3.0技術,旨在利用超過8小時的熱能來生產清潔、可輸送、低成本的電力。

- 由於這些發展,發電行業預計將在預測期內佔據最大的市場佔有率。

預計歐洲將經歷最高成長

- 歐洲在過去十年中一直在西班牙、奧地利、北歐和中歐等國家的都市區安裝各種能源儲存系統。這一戰略步驟的主要推動力是冬季能源消費量的增加和尋找可再生的區域供暖方法。

- 該地區正在規劃更多大型能源儲存計劃,以滿足日益成長的季節性和短期能源儲存需求,大多數設施採用熔鹽技術和地下熱水箱。這些預計將成為未來區域供熱和其他用途的多功能能源中心。

- 2022年8月,挪威京都集團與瓦楞紙板製造商Groma Papp簽署了意向書(LoI),為京都提供基於熔鹽的能源儲存解決方案「HeatCube」。該系統計劃於 2023 年投入運作。

- 2022年1月,歐盟和歐洲投資銀行選擇電網規模能源儲存供應商馬耳他公司在西班牙執行Sun2Store熱能能源儲存計劃。這是一個 1,000 MWh/10 小時的能源儲存系統,結合了舉陞技術和熔鹽。該計劃可能與阿法拉伐合作開發。

- 預計此類發展將顯著推動歐洲能源儲存市場。

熱能源儲存產業概況

熱能源儲存市場適度整合。一些主要企業(排名不分先後)包括 BrightSource Energy Inc.、Abengoa SA、Baltimore Aircoil Company、Terrafore Technologies LLC 和 SR Energy。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 調查先決條件

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2028 年之前的市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府政策法規

- 市場動態

- 促進因素

- 工業領域對大規模暖氣和冷氣應用技術的需求不斷成長

- 能源儲存系統需求不斷成長

- 抑制因素

- 與替代能源儲存系統的競爭

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 類型

- 熔鹽

- 熱水

- 其他類型

- 目的

- 發電

- 加熱

- 冷卻

- 科技

- 顯能源儲存

- 潛熱能能源儲存

- 熱化學能源儲存

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東/非洲

- 北美洲

第6章 競爭形勢

- 併購、合資、合作與協議

- 主要企業採取的策略

- 公司簡介

- BrightSource Energy Inc.

- Aalborg CSP AS

- Abengoa SA

- Baltimore Aircoil Company

- Burns &McDonnell

- SaltX Technology Holding AB

- Terrafore Technologies LLC

- Trane Technologies PLC

- SR Energy

- Vantaa Energy

第7章市場機會與未來趨勢

- 研究和創新的興起使技術範圍多樣化

The Thermal Energy Storage Market size is estimated at USD 1.12 billion in 2024, and is expected to reach USD 1.51 billion by 2029, growing at a CAGR of 6.25% during the forecast period (2024-2029).

The COVID-19 outbreak negatively impacted the market due to the industrial lockdowns and plummeted power demand in the power generation industry. The thermal energy storage industry players witnessed huge losses in their revenues. The ABENGOA company recorded a revenue of EUR 1,250 million for 2020, a 16% decline from EUR1,493 million in 2019. The thermal energy storage market is likely to boom in the future due to the increased demand for technology in the industrial sector for large-scale heating and cooling applications and the option for an eco-friendly method of saving energy for power generation during peak hours. However, the competition from other energy storage alternatives like battery energy storage is expected to hamper the market's growth in the future.

Key Highlights

- The power generation application is expected to witness significant growth during the forecast period due to the growing adoption of concentrated solar power (CSP) technology with thermal energy storage systems.

- The research and innovation endeavors to diversify the scope of the technology by the industry players and government organizations create ample opportunities for the market. Very recently, the European Union allotted funds for the technological advancement of thermal energy storage under the Horizon 2020 program.

- Europe is likely to grow faster during the forecast period due to the high demand for seasonal energy storage.

Thermal Energy Storage Market Trends

Power Generation Expected to Witness Significant Growth

- The global installation of renewable power generation and energy security methods has accelerated the need for technologies like concentrated solar power (CSP) in solar power generation. These technologies are often used with thermal energy storage systems in the current scenario.

- The power generation through CSP sources is increasing significantly due to the increasing installation of CSP capacities globally. For instance, in 2022, the total installed CSP capacity was around 6.50 GW, which was 6.37 GW in 2021, as per IRENA. The growth in the technology application was witnessed in the industrial and commercial sectors. Several projects will be added to the solar CSP power generation portfolio, along with thermal energy storage systems.

- In January 2022, the Chinese government announced plans to build 11 CSP projects with thermal energy storage by 2024. The country's state-owned firms are expected to play a leading role in the upcoming projects in consortium with other industry players. They are gigawatt-scale mixed renewable energy projects to be added within two years.

- In June 2023, Vast Solar Pty awarded crucial engineering contracts for the VS1 CSP project in Australia to Worley. The project involves the construction of a 30 MW or 288 MWh CSP plant in Port Augusta, South Australia. This facility will utilize modular CSP tower v3.0 technology of Vast, intending to generate clean, dispatchable, and low-cost power with more than 8 hours of thermal energy.

- Due to these developments, the power generation segment is expected to occupy the largest market share during the forecast period.

Europe Expected to Witness the Highest Growth

- Europe has been installing various thermal energy storage systems for a decade in the urban districts of countries like Spain, Austria, and Northern and Central Europe. The major driver of such a strategic step is the high energy consumption during winters and exploring renewable ways of district heating.

- The region has planned even more large-scale thermal storage projects to meet the ever-growing seasonal and short-term storage demand, with most installations with molten salt technology and underground hot water tanks. They are expected to serve as multifunctional energy hubs for future district heating sources and other applications.

- In August 2022, Kyoto Group in Norway signed a letter of intent (LoI) with Glomma Papp, a cardboard manufacturer, to enter a supply agreement for Kyoto's thermal energy storage molten-salt-based solution, Heatcube. This system is expected to be commissioned in 2023.

- In January 2022, the European Union and the European Investment Bank chose Malta Inc., the grid-scale thermal energy storage provider, to execute the Sun2Store thermal energy storage project in Spain. It is a 1,000-MWh/ten-hour energy storage system combining pumped heat technology with molten salt. The project will likely be developed in partnership with Alfa Laval.

- Such developments are expected to boost the European thermal energy storage market significantly.

Thermal Energy Storage Industry Overview

The thermal energy storage market is moderately consolidated. Some of the key players (not in particular order) are BrightSource Energy Inc., Abengoa SA, Baltimore Aircoil Company, Terrafore Technologies LLC, and SR Energy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Technology in the Industrial Sector for Large-scale Heating and Cooling Applications

- 4.5.1.2 Risising Demand for Energy Storage Systems

- 4.5.2 Restraints

- 4.5.2.1 Competition from Alternative Energy Storage Systems

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Molten Salt

- 5.1.2 Hot water

- 5.1.3 Other Types

- 5.2 Application

- 5.2.1 Power Generation

- 5.2.2 Heating

- 5.2.3 Cooling

- 5.3 Technology

- 5.3.1 Sensible Heat Storage

- 5.3.2 Latent Heat Storage

- 5.3.3 Thermochemical Heat Storage

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BrightSource Energy Inc.

- 6.3.2 Aalborg CSP AS

- 6.3.3 Abengoa SA

- 6.3.4 Baltimore Aircoil Company

- 6.3.5 Burns & McDonnell

- 6.3.6 SaltX Technology Holding AB

- 6.3.7 Terrafore Technologies LLC

- 6.3.8 Trane Technologies PLC

- 6.3.9 SR Energy

- 6.3.10 Vantaa Energy

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Risisng Research and Innovation Endeavors to Diversify the Scope of the Technology