|

市場調查報告書

商品編碼

1859006

熱能收集市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Thermal Energy Harvesting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

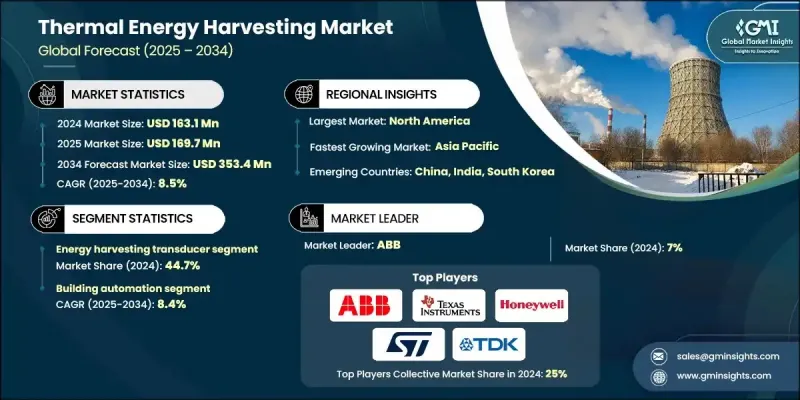

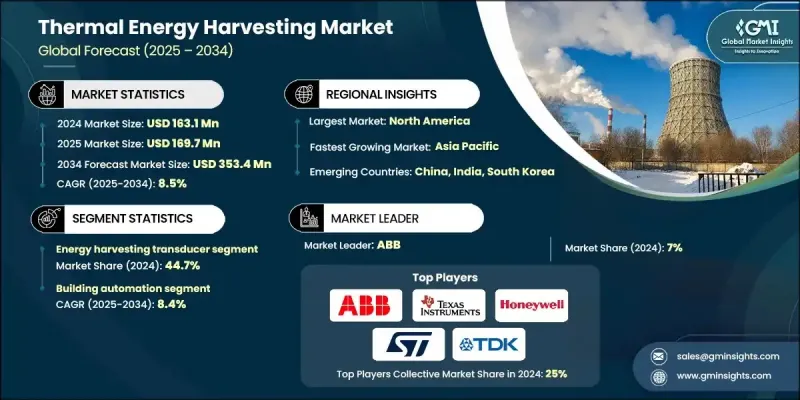

2024 年全球熱能收集市場價值為 1.631 億美元,預計到 2034 年將以 8.5% 的複合年成長率成長至 3.534 億美元。

隨著清潔能源轉型步伐加快,對熱能回收和轉換系統的需求也加速成長。政府支持的脫碳計畫將熱能技術作為減少工業二氧化碳排放的優先途徑,而工業二氧化碳排放仍是全球最大的排放源之一。研究機構、私人製造商和能源新創公司之間的技術合作正在推動創新,將實驗室概念轉化為全面的商業解決方案。這些努力不僅針對工業工廠,還擴展到航太、國防和離網應用領域,在這些領域,能源的可靠性和持久性至關重要。從為衛星供電到提高遠端監控系統的效率,熱能收集技術正在傳統能源供應不足的環境中得到應用。極端環境下的溫度梯度正透過緊湊型熱電裝置轉化為可用能源,這使得市場更加活躍和多元化。對材料科學,特別是軟性穿戴熱電化合物的投資,正在催生健康監測和個人電子產品領域的新應用。這一發展勢頭反映了全球範圍內向以永續性為中心、分散式和智慧化的電力系統轉變的趨勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.631億美元 |

| 預測值 | 3.534億美元 |

| 複合年成長率 | 8.5% |

2024年,能量採集感測器細分市場佔據44.7%的市場佔有率,預計到2034年將以8.6%的複合年成長率成長。這一成長得益於市場對適用於緊湊型和穿戴式應用的小型化、高效能熱電材料的需求不斷成長。軟性聚合物基熱電系統的創新正在取代傳統的笨重模組,為智慧織物、植入式設備和健康監測穿戴式裝置等領域開闢了新的機會。這些先進材料提高了與皮膚或曲面的貼合性,幫助製造商開發出兼具功能性和人體工學的產品。

2024年,建築自動化領域佔據37.9%的市場佔有率,預計到2034年將以8.4%的複合年成長率成長。住宅和商業房地產對節能型暖通空調系統和熱電整合技術的需求都在成長。透明隔熱材料和蓄熱技術因其能夠降低能耗並滿足日益嚴格的建築排放法規而備受關注。歐洲等地實施的政策強制措施正鼓勵建築商和開發商將熱能收集技術融入自動化系統,以幫助達到能源和排放標準。這種轉變正使暖通空調和照明系統變得更靈活節能。

受新規的推動,歐洲熱能收集市場預計到2034年將以8.3%的複合年成長率成長。這些新規強調在工業和區域供熱系統中重複利用廢熱。修訂後的《能源效率指令》和歐盟其他監管指南強制要求更廣泛地利用廢熱為系統供電,從而推動對熱電和熱電解決方案的投資。成員國之間政策的高度一致性增強了國內和跨境熱能收集計畫的商業前景。

主導全球熱能收集市場的關鍵企業包括:Analog Devices Inc.、Honeywell International Inc.、STMicroelectronics、ABB、Kinergizer、Perpetua Power、Mide Technology (Piezo.com)、TDK Corporation、Powercast Corporation、ZF Friedrichshafen AG、Texas Instruments、EnFuxOceant、EnuserS. Components America Inc.、Microchip Technology Inc.、Laird Thermal Systems、Micropelt GmbH、Asahi Kasei Microdevices Corporation 和 Renesas Electronics Corporation。這些熱能收集領域的領導者正透過持續投資先進材料和下一代熱電技術來鞏固其市場地位。許多公司專注於開發軟性、輕量化和小型化的感測器,以滿足穿戴式裝置、物聯網設備和生物醫學應用領域日益成長的需求。與研究機構和跨行業企業的策略合作正在幫助這些公司加速產品開發和商業化部署。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 新興機會與趨勢

- 數位化和物聯網整合

- 新興市場滲透

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 競爭性標竿分析

- 戰略儀錶板

- 創新與技術格局

第5章:市場規模及預測:依組件分類,2021-2034年

- 主要趨勢

- 能量採集換能器

- 電源管理積體電路(PMIC)

- 其他

第6章:市場規模及預測:依最終用途分類,2021-2034年

- 主要趨勢

- 無線感測器網路

- 消費性電子產品

- 建築自動化

- 汽車

- 其他

第7章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ABB

- Advanced Linear Devices Inc.

- Analog Devices Inc.

- Asahi Kasei Microdevices Corporation

- Cedrat Technologies

- EnOcean GmbH

- Fujitsu Components America Inc.

- Honeywell International Inc.

- Kinergizer

- Laird Thermal Systems, Inc.

- Microchip Technology Inc.

- Micropelt GmbH

- Mide Technology (Piezo.com)

- Mouser Electronics

- Perpetua Power

- Powercast Corporation

- Renesas Electronics Corporation

- STMicroelectronics

- TDK Corporation

- Texas Instruments

- ZF Friedrichshafen AG

The Global Thermal Energy Harvesting Market was valued at USD 163.1 million in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 353.4 million by 2034.

As clean energy transitions gain momentum, the demand for thermal energy recovery and conversion systems is accelerating. Government-backed decarbonization plans are prioritizing thermal technologies as a pathway to reducing industrial CO2 output, which remains one of the largest contributors to emissions worldwide. Technological collaboration between research institutions, private manufacturers, and energy startups is driving innovation from lab-level concepts to full-scale commercial solutions. These efforts are not only targeting industrial plants but also extending into aerospace, defense, and off-grid applications where energy reliability and endurance are vital. From powering satellites to enhancing efficiency in remote surveillance systems, thermal harvesting is being adopted in environments where conventional power sources fall short. Temperature gradients in extreme settings are being transformed into usable energy through compact thermoelectric devices, making the market more dynamic and diversified. Investment in materials science, especially flexible and wearable thermoelectric compounds, is shaping new applications in health monitoring and personal electronics. This momentum reflects a broader shift toward sustainability-focused, decentralized, and intelligent power systems globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $163.1 Million |

| Forecast Value | $353.4 Million |

| CAGR | 8.5% |

In 2024, the energy harvesting transducers segment held a 44.7% share and is projected to grow at a CAGR of 8.6% through 2034. This growth is supported by increasing demand for miniaturized, high-efficiency thermoelectric materials suited for compact and wearable applications. Innovations in flexible, polymer-based thermoelectric systems are replacing conventional bulky modules, opening opportunities in smart fabrics, implantables, and health-monitoring wearables. These advanced materials improve conformability to skin or curved surfaces, helping manufacturers develop products that are both functional and ergonomic.

The building automation segment held a 37.9% share in 2024 and is expected to grow at a CAGR of 8.4% by 2034. The demand for energy-efficient HVAC systems and thermoelectric integration is rising in both residential and commercial properties. Transparent thermal insulation and thermal storage technologies are gaining attention for their ability to reduce energy consumption and meet stricter building emission regulations. Policy mandates, such as those implemented in Europe, are encouraging builders and developers to incorporate thermal harvesting into automation systems to help meet energy and emissions benchmarks. This shift is enabling HVAC and lighting systems to become more adaptive and energy conscious.

Europe Thermal Energy Harvesting Market will grow at a CAGR of 8.3% through 2034, driven by updated regulations emphasizing waste heat reuse in industrial and district heating setups. The revised Energy Efficiency Directive and additional EU regulatory guidance are mandating broader use of waste heat for powering systems, thereby pushing investments into thermoelectric and heat-to-power solutions. Strong policy alignment across member nations is strengthening the commercial outlook for both domestic and cross-border thermal energy harvesting ventures.

Key players shaping the Global Thermal Energy Harvesting Market include Analog Devices Inc., Honeywell International Inc., STMicroelectronics, ABB, Kinergizer, Perpetua Power, Mide Technology (Piezo.com), TDK Corporation, Powercast Corporation, ZF Friedrichshafen AG, Texas Instruments, EnOcean GmbH, Mouser Electronics, Cedrat Technologies, Advanced Linear Devices Inc., Fujitsu Components America Inc., Microchip Technology Inc., Laird Thermal Systems, Micropelt GmbH, Asahi Kasei Microdevices Corporation, and Renesas Electronics Corporation. Leading companies in the thermal energy harvesting sector are strengthening their foothold through continuous investment in advanced materials and next-generation thermoelectric technologies. Many firms are focusing on flexible, lightweight, and miniaturized transducers to serve growing demand in wearables, IoT devices, and biomedical applications. Strategic partnerships with research institutions and cross-industry players are helping companies accelerate product development and commercial deployment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East and Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Energy harvesting transducer

- 5.3 Power management integrated circuits (PMIC)

- 5.4 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Wireless sensor networks

- 6.3 Consumer electronics

- 6.4 Building automation

- 6.5 Automotive

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Advanced Linear Devices Inc.

- 8.3 Analog Devices Inc.

- 8.4 Asahi Kasei Microdevices Corporation

- 8.5 Cedrat Technologies

- 8.6 EnOcean GmbH

- 8.7 Fujitsu Components America Inc.

- 8.8 Honeywell International Inc.

- 8.9 Kinergizer

- 8.10 Laird Thermal Systems, Inc.

- 8.11 Microchip Technology Inc.

- 8.12 Micropelt GmbH

- 8.13 Mide Technology (Piezo.com)

- 8.14 Mouser Electronics

- 8.15 Perpetua Power

- 8.16 Powercast Corporation

- 8.17 Renesas Electronics Corporation

- 8.18 STMicroelectronics

- 8.19 TDK Corporation

- 8.20 Texas Instruments

- 8.21 ZF Friedrichshafen AG