|

市場調查報告書

商品編碼

1823727

全球電動公車市場(按公車長度、電池類型、電池容量、功率輸出、續航里程、載客量、應用、消費者、車輛總重、推進系統、零件、自主水平和地區分類)- 預測至 2032 年Electric Bus Market by Propulsion, Battery, Length, Battery Capacity, Application, Seating Capacity, Range, Power Output, Autonomy Level, Component, Consumer and Region - Global Forecast to 2032 |

||||||

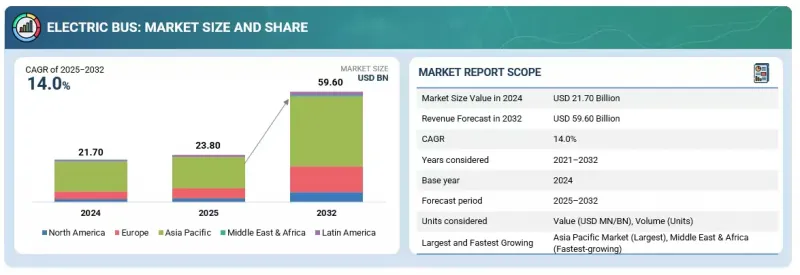

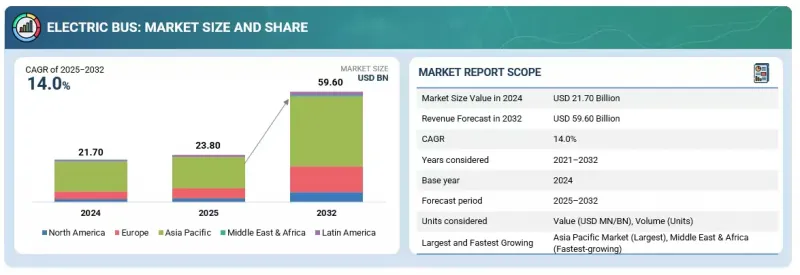

電動公車市場預計將從 2025 年的 238 億美元成長到 2032 年的 596 億美元,複合年成長率為 14.0%。

在政府支持和重大技術進步的推動下,全球電動公車市場正在持續成長。電池能量密度的提升和充電速度的提升正在緩解續航里程焦慮等問題,並使電動公車的性能達到與柴油公車相當的水平。

| 調查範圍 | |

|---|---|

| 調查年份 | 2020-2032 |

| 基準年 | 2024 |

| 預測期 | 2025-2032 |

| 目標單位 | 數量(單位)和價值(百萬美元/十億美元) |

| 部分 | 公車長度、電池類型、電池容量、功率輸出、行駛里程、載客量、用途、消費者、車輛總重量、推進功率、組件、自主水平、地區 |

| 目標區域 | 亞太地區、北美、歐洲、拉丁美洲、中東和非洲 |

開發先進的電池管理系統並採用磷酸鐵鋰電池 (LFP) 化學技術將提高安全性、使用壽命和效率。此外,由於電動公車在車輛生命週期內燃料和維護成本較低,總擁有成本 (TCO) 是推動電動公車需求的關鍵因素之一。

由於政府部門提供的大量補貼和強制規定,電動公車預計將在政府部門廣泛應用,主要透過公共交通車隊進行推廣。這些補貼和強制規定使得電動公車能夠在城市和城際線路上廣泛部署。都市區和市級政府正積極鼓勵地方交通部門透過補貼、強制性法規和車輛更新強制要求購買電動公車。例如,中國政府為深圳市的電動公車隊提供補貼,導致深圳公車集團等市政公司營運超過1.6萬輛公共電動公車。在印度,FAME-II 計畫為每輛電動公車向國家交通實體提供 2 萬至 4 萬美元的補貼,促使孟買 BEST 等城市採購了 7,120 輛公共電動公車,全國目標是到 2027 年實現 5 萬輛電動公車的目標。美國聯邦運輸管理局根據《兩黨基礎設施法案》撥款 17 億美元,資助 1300 多輛零排放公共交通公車,例如比佛頓學區的 28 輛電動校車,覆蓋了奧勒岡州70% 的公立學校電動公車車隊。在歐洲,歐盟清潔巴士計劃正在推動漢堡 Hochbahn 等公共在 2024 年註冊 7779 輛電動公車,並為零排放汽車提供補貼,以到 2030 年實現 100% 電氣化的目標。

相較之下,私部門的應用,例如企業班車和宅配服務,雖然仍屬於小眾市場,但由於初始成本高昂且缺乏相應的政府支持,發展緩慢。在荷蘭,私人公司根據政府主導營運公共巴士。規模和資金優勢有利於政府主導的舉措,而私人應用則僅限於機場接駁車等專業應用。

燃料電池電動公車 (FCEV) 作為純電動公車 (BEV) 的競爭對手,正備受關注,尤其是在遠距線路和充電基礎設施有限的地區。根據《電動公車》雜誌報道,歐洲註冊的 FCEV 公車數量將從 2023 年的 207 輛增加 82%,到 2024 年將達到 378 輛,但這仍僅佔零排放公車的 4.6% 左右。

FCEV 公車的主要供貨合約包括義大利博洛尼亞的公共交通公司 TPER(Tédération Perles Enfants Transport des Produits des Produits des Produits des Produits des Produits),該公司於 2023 年底訂購了 130 輛 Solaris Urbino 12 氫動力車,計劃於 2026 年開始交付。在英國,利物浦市將於 2023 年引進 20 輛 Alexander Dennis Enviro400 FCEV,Wrightbus(英國)將於 2024 年向科隆交付Hydroliner FCEV 雙層公車。在亞洲,現代的 Elec City FCEV 自 2019 年開始商業化銷售,2024 年 9 月在韓國的銷量突破 1,000 輛。在印度,第一輛氫燃料電池公車將於 2025 年初在拉達克開始營運,這標誌著在具有挑戰性的地形上取得的重要里程碑。

燃料電池公車相比純電動車 (BEV) 的優勢在於加氫時間短、續航里程長,非常適合城際和區域服務。然而,FCEV 的能源效率較低,能量轉換率僅為 60-70%,而純電動車的轉換率高達 85-90%。此外,FCEV 的價格也比純電動車公車高出兩到三倍。 2023 年在義大利博爾扎諾進行的一項研究發現,FCEV 的運行成本是純電動汽車公車的兩倍多,這主要是由於氫氣生產、配送和加氫的基礎設施成本。這種成本差距解釋了為什麼政府和公共交通組織通常會選擇 FCEV,而不是私人業者。

預計北美,特別是美國和加拿大,將在預測期內成為電動公車最重要的市場之一。在美國,電動校車產業正在主導從柴油到電動公車的轉變。這得歸功於美國環保署的清潔校車計劃,該計劃到2026年將提供50億美元的資金,支持用電動公車取代柴油校車。到2024年底,美國環保署將為1000個學區的約12,000輛電動式校車提供補貼,使其成為該地區最重要的需求驅動力。交通運輸機構也正在提高電動公車的採用率,這得益於聯邦運輸管理局的低排放氣體計畫(Low-No計畫),該計畫在2023年撥款17億美元,預計將繼續為零排放公車和充電基礎設施提供資金,直到2025年。

加拿大也採取了類似的舉措,其零排放交通基金 (ZETF) 將在2026年之前提供20億美元,幫助各市政府購買電動公車並建造充電設施。截至2024年,加拿大已售出700多輛電動公車,預計到2025年這數字還將增加。這些聯邦和省級激勵措施使美國和加拿大在北美電動公車普及方面處於領先地位。儘管中國和歐洲繼續主導電動公車的整體銷售,但北美對校車電氣化的關注在該地區獨樹一幟。

本報告研究了全球電動公車市場,並提供了有關公車長度、電池類型、電池容量、功率輸出、續航里程、乘客容量、應用、消費者、車輛總重量、推進功率、組件、自主性水平、區域趨勢以及參與市場的公司概況的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概況

- 介紹

- 市場動態

第6章 產業趨勢

- 人工智慧/生成式人工智慧對電動公車市場的影響

- 貿易分析

- 生態系分析

- 供應鏈分析

- 總擁有成本:柴油公車與電動公車

- 定價分析

- 專利分析

- 監管狀況

- 案例研究分析

- 影響客戶業務的趨勢和中斷

- 材料清單分析

- 2025-2026年主要會議和活動

- 主要相關人員和採購標準

- 供應商分析

- 投資金籌措場景

第7章 OEM分析

第8章 技術分析

- 技術分析

- 主要技術

- 鄰近技術

- 互補技術

第9章 電動公車市場(依公車長度)

- 介紹

- 小於 9M

- 9~14M

- 超過 1400 萬

- 關鍵產業洞察

第10章 電動公車市場(以電池類型)

- 介紹

- NMC電池

- LFP電池

- NCA電池

- 其他

- 關鍵產業洞察

第11章 電動巴士市場(以電池容量)

- 介紹

- 少於400KWH

- 超過400度

- 關鍵產業洞察

第12章 電動公車市場(依產量)

- 介紹

- 小於250kW

- 250kW以上

- 關鍵見解

第13章 電動公車市場(依範圍)

- 介紹

- 少於300英里

- 超過300英里

- 關鍵見解

第14章 電動公車市場(依載客量)

- 介紹

- 少於40個席位

- 40至70個席位

- 70個或更多座位

- 關鍵產業洞察

第15章 電動公車市場(依應用)

- 介紹

- 城市公車/路線公車

- 教練

- 校車

- 其他

- 關鍵產業洞察

第16章 電動公車市場(依消費者)

- 介紹

- 私人的

- 政府

- 關鍵產業洞察

第 17 章電動公車市場(依車輛總重量(GVW))

- 介紹

- 少於10噸

- 10至20噸

- 超過20噸

- 關鍵產業洞察

第18章 電動公車市場(依動力系統)

- 介紹

- 純電動巴士

- 燃料電池電動公車

- 關鍵產業洞察

第 19 章電動公車市場(按組件)

- 介紹

- 引擎

- 電池

- 燃料電池堆

- 電池管理系統

- 電池冷卻系統

- DC-DC轉換器

- 逆變器

- 交流/直流充電器

- 電動汽車連接器

- 關鍵產業洞察

第 20 章電動公車市場(依自主程度)

- 介紹

- 半自動

- 自主

- 關鍵產業洞察

第21章 電動公車市場(按地區)

- 介紹

- 亞太地區

- 宏觀經濟展望

- 中國

- 日本

- 印度

- 韓國

- 新加坡

- 印尼

- 澳洲

- 歐洲

- 宏觀經濟展望

- 法國

- 德國

- 西班牙

- 義大利

- 挪威

- 瑞典

- 丹麥

- 荷蘭

- 比利時

- 英國

- 芬蘭

- 波蘭

- 北美洲

- 宏觀經濟展望

- 美國

- 加拿大

- 拉丁美洲

- 宏觀經濟展望

- 阿根廷

- 巴西

- 智利

- 墨西哥

- 哥倫比亞

- 中東和非洲

- 宏觀經濟展望

- 南非

- 阿拉伯聯合大公國

- 卡達

第22章 競爭態勢

- 概述

- 主要參與企業的策略/優勢

- 電動公車市場佔有率分析(2024年)

- 收益分析

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 企業評估

- 財務指標

- 品牌/產品比較

- 競爭場景

第23章:公司簡介

- 主要參與企業

- BYD COMPANY LTD.

- YUTONG BUS CO., LTD.

- ZHEJIANG GEELY HOLDING GROUP

- DAIMLER TRUCK AG

- NFI GROUP

- AB VOLVO

- CAF(SOLARIS BUS & COACH SP. Z OO)

- ZHONGTONG BUS HOLDING CO., LTD.

- CRRC CORPORATION LIMITED

- VDL GROEP

- EBUSCO

- XIAMEN KING LONG INTERNATIONAL TRADING CO., LTD.

- 其他公司

- BLUE BIRD CORPORATION

- GILLIG LLC.

- THE LION ELECTRIC COMPANY

- TATA MOTORS LIMITED.

- ASHOK LEYLAND

- SUNDA NEW ENERGY TECHNOLOGY CO., LTD.

- GREE ALTAIRNANO NEW ENERGY INC.

- XIAMEN GOLDEN DRAGON BUS CO. LTD.

- JBM GROUP

- SCANIA AB

- IRIZAR GROUP

- IVECO SPA

- BLUEBUS

- BOZANKAYA

- CAETANOBUS

- CHARIOT MOTORS

- HEULIEZ BUS

- OTOKAR OTOMOTIV VE SAVUNMA SANAYI AS

- TEMSA

- URSUS SA

- VAN HOOL

- KARSAN

- MELLOR

- HINO MOTORS, LTD.

- ANHUI ANKAI AUTOMOBILE CO., LTD.

- OLECTRA GREENTECH LIMITED

第24章 市場建議

第25章 附錄

The electric bus market is projected to grow from USD 23.80 billion in 2025 to USD 59.60 billion by 2032, at a CAGR of 14.0%. The global electric bus market is experiencing consistent growth, driven by government support and significant technological advancements. Improvements in battery energy density and charging speeds address concerns like range anxiety and allow electric buses to match the operational performance of diesel fleets.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (Units) and Value (USD Million/Billion) |

| Segments | The Electric Bus Market By Propulsion, By Battery Type, By Consumer Type, By Length of Bus, By Seating Capacity, Level of Autonomy, Range, By Application, By GVW |

| Regions covered | Asia Pacific, North America, Europe, Latin America, the Middle East & Africa |

Developing advanced battery management systems and adopting LFP battery chemistry enhances safety, longevity, and efficiency. Additionally, the total cost of ownership (TCO) is one of the critical factors driving the demand for electric buses as they have lower fuel and maintenance costs over the vehicle's lifecycle.

"The government sector is estimated to generate the largest demand for electric buses in 2025."

Electric buses are poised to have significant applications in the government sector, primarily through public transit fleets, due to large-scale subsidies and mandates that enable widespread deployment for urban and intercity routes. National and city-level governments actively push local transport authorities to procure electric buses through subsidies, binding regulations, and fleet replacement mandates. For instance, China's government has subsidized electric bus fleets in Shenzhen, resulting in over 16,000 public e-buses operated by municipal companies like Shenzhen Bus Group. In India, the FAME-II scheme provides ₹20-40 lakh subsidies per e-bus for state transport undertakings, leading to 7,120 public e-buses procured for municipal fleets like BEST in Mumbai, targeting 50,000 e-buses nationwide by 2027. The US Federal Transit Administration's USD 1.7 billion allocation under the Bipartisan Infrastructure Law has funded over 1,300 zero-emission public transit buses, as seen in Beaverton School District's 28 e-school buses, covering 70% of Oregon's public-school electric bus fleet. In Europe, the EU's Clean Bus Deployment Initiative has driven 7,779 e-bus registrations in 2024 for public operators like Hochbahn in Hamburg, with subsidies for zero-emission fleets achieving 100% electrification targets by 2030.

In contrast, private sector applications, such as corporate shuttles or delivery fleets, remain niche but lag due to higher upfront costs without equivalent government support. Private companies in the Netherlands operate public buses under government contracts; the scale and funding favor government-led initiatives, with private adoption limited to specialized uses like airport shuttles, where e-buses save USD 125,000 in maintenance over diesel counterparts but require custom infrastructure.

"The fuel cell electric bus market is projected to witness a positive growth rate during the forecast period."

Fuel-cell electric buses (FCEVs) are gaining attention as a counterpart to battery electric buses (BEVs), especially for longer routes and regions with limited charging infrastructure. According to an electric bus magazine, in Europe, registrations of FCEV buses increased from 207 in 2023 to 378 in 2024, an 82% jump, yet they still represent only about 4.6% of zero-emission buses.

Major supply contracts related to FCEV buses include the public transport company (TPER) in Bologna, Italy, placing an order for 130 Solaris Urbino 12 hydrogen buses in late 2023, with deliveries planned from 2026. In the UK, Liverpool city introduced 20 Alexander Dennis Enviro400FCEVs in 2023, while Wrightbus (UK) delivered its Hydroliner FCEV double-decker buses to Cologne in 2024. In Asia, Hyundai's Elec City FCEV has been commercially available since 2019 and has surpassed 1,000-unit sales in South Korea by September 2024. In India, the first hydrogen fuel-cell bus entered service in Ladakh in early 2025, marking an important milestone in challenging terrain.

The benefits of fuel cell buses compared to BEVs lie in their fast-refueling times and extended driving range, which make them better suited for intercity and regional services. However, FCEVs are less energy efficient, converting only 60 to 70% of energy compared to 85 to 90% for BEVs. These buses are also twice to three times as expensive as BEV buses. A 2023 study in Bolzano, Italy, found that the running costs of FCEBs were more than twice those of battery buses, primarily due to hydrogen production, distribution, and fueling infrastructure costs. This cost gap explains why only governments and public transport agencies opt for FCEVs rather than private operators.

"North America is projected to be one of the major electric bus markets."

North America, particularly the US and Canada, is emerging as one of the most important markets for electric buses during the forecast period. In the US, the electric school bus segment is leading the transition from diesel to electric buses. This is backed by the EPA's Clean School Bus Program, which is providing USD 5 billion in funding till 2026 to support the replacement of diesel school buses with electric alternatives. By late 2024, the EPA had awarded grants for nearly 12,000 electric school buses across 1,000 school districts, making it the region's most significant single driver of demand. Transit agencies are also improving adoption, supported by the Federal Transit Administration's Low-No Emission Vehicle Program (Low-No Program), which allocated USD 1.7 billion in 2023 and is expected to continue distributing funds through 2025 for zero-emission transit buses and charging infrastructure.

Canada is following a similar path, with the Zero Emission Transit Fund (ZETF) providing USD 2 billion in support till 2026 to help municipalities procure electric transit buses and build charging facilities. As of 2024, more than 700 electric buses have been sold in Canada, which is expected to increase further in 2025. These federal and state-level incentives are positioning the US and Canada as leaders in e-bus adoption in North America. While China and Europe still dominate in overall sales of electric buses, North America's focus on electrifying both school buses is a unique regional characteristic.

The break-up of the profile of primary participants in the electric bus market is as follows:

- By Company Type: Electric Bus OEM - 90%, Tier 1 - 10%

- By Designation: C Level - 60%, Director-level - 30%, Others - 10%

- By Region: North America- 10%, Europe - 40%, Asia Pacific - 50%

Prominent companies include BYD Company Ltd. (China), Yutong Co., Ltd. (China), Xiamen King Long (China), CRRC Corporation Limited (China), and Zhejiang Geely Holding Group (China), which are the leading manufacturers of electric buses in the global market.

Research Coverage:

The study segments the electric bus market and forecasts the market size based on propulsion (BEVs, FCEVs), range (up to 300 miles, above 300 miles), the length of the bus (less than 9 m, 9-14 m, more than 14m), consumer (private, government), application (transit buses, coaches, school buses, and others), battery capacity (up to 400 kWh, Above 400 kWh), component (motors, batteries, fuel cell stacks, battery management systems, battery cooling systems, DC-DC converters, inverters, AC/DC chargers, EV connectors), the level of autonomy (semi-autonomous, autonomous), power output (up to 250 kW, above 250 kW), seating capacity (up to 40 seats, 40-70 seats, above 70 seats), by GVW (Up to 10 tonnes, 10 to 20 tonnes and above 20 tonnes), and region (Asia Pacific, North America, Middle East & Africa [MEA], Europe, and Latin America). This report covers the competitive analysis of upcoming startups/SMEs in the electric bus market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall electric bus market and the subsegments. The report includes a comprehensive market share analysis, supply chain analysis, extensive lists and insights into component manufacturers, chapter segmentation based on materials, a thorough supply chain analysis, and a competitive landscape. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (rising GHG emissions, government incentives and policies, overall targets to reduce fleet-level emissions and increasing demand for emission-free vehicles), restraints (CNG and biofuel buses slowing the adoption of electric buses, safety concerns in EV batteries and high development cost), opportunities (development of advanced battery technologies, transition towards hydrogen fuel cell electric mobility), and challenges (high cost of developing charging infrastructure) influencing the growth of the electric bus market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the electric bus market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the electric bus market across varied regions)

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the electric bus market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the electric bus market, such as BYD Company Ltd. (China), Yutong Co., Ltd. (China), Xiamen King Long (China), CRRC Corporation Limited (China), and Zhejiang Geely Holding Group (China)

The report also helps stakeholders understand the pulse of the electric bus market by providing them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRIC BUS MARKET

- 4.2 ELECTRIC BUS MARKET, BY PROPULSION

- 4.3 ELECTRIC BUS MARKET, BY RANGE

- 4.4 ELECTRIC BUS MARKET, BY COMPONENT

- 4.5 ELECTRIC BUS MARKET, BY CONSUMER

- 4.6 ELECTRIC BUS MARKET, BY BATTERY CAPACITY

- 4.7 ELECTRIC BUS MARKET, BY BATTERY TYPE

- 4.8 ELECTRIC BUS MARKET, BY APPLICATION

- 4.9 ELECTRIC BUS MARKET, BY POWER OUTPUT

- 4.10 ELECTRIC BUS MARKET, BY LENGTH

- 4.11 ELECTRIC BUS MARKET, BY SEATING CAPACITY

- 4.12 ELECTRIC BUS MARKET, BY GVW

- 4.13 ELECTRIC BUS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising GHG emissions

- 5.2.1.1.1 Government incentives and policies

- 5.2.1.1.2 Target to reduce fleet-level emissions

- 5.2.1.2 Increasing demand for emission-free vehicles and decline in battery prices

- 5.2.1.1 Rising GHG emissions

- 5.2.2 RESTRAINTS

- 5.2.2.1 CNG and biofuel buses slowing adoption of electric buses

- 5.2.2.2 Safety concerns in EV batteries and high development costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of advanced battery technologies

- 5.2.3.2 Transition toward hydrogen fuel cell electric mobility

- 5.2.3.3 Emergence of charging services for electric buses

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of developing charging infrastructure

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 IMPACT OF AI/GEN AI ON ELECTRIC BUS MARKET

- 6.2 TRADE ANALYSIS

- 6.2.1 IMPORT SCENARIO

- 6.2.2 EXPORT SCENARIO

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 TOTAL COST OF OWNERSHIP: DIESEL BUSES VS. ELECTRIC BUSES

- 6.5.1 COST COMPARISON: ELECTRIC BUSES VS. ICE BUSES

- 6.6 PRICING ANALYSIS

- 6.6.1 BY APPLICATION

- 6.6.2 BY PROPULSION

- 6.6.3 BY REGION

- 6.7 PATENT ANALYSIS

- 6.7.1 INTRODUCTION

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 NORTH AMERICA

- 6.8.2 EUROPE

- 6.8.3 ASIA PACIFIC

- 6.8.4 LATIN AMERICA

- 6.8.5 MIDDLE EAST & AFRICA

- 6.8.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS, BY REGION

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 COMPLETE TRANSITION TO ELECTRIC BUSES IN SHENZHEN, CHINA

- 6.9.2 ZENOBE HELPED STAGECOACH INCORPORATE CHARGING INFRASTRUCTURE AND INSTALL CUSTOM MANAGEMENT SOFTWARE SYSTEM

- 6.9.3 A COMPREHENSIVE ANALYSIS TO EVALUATE FINANCIAL FEASIBILITY OF DEPLOYING ELECTRIC BUS FLEETS THAT REDUCE EMISSIONS

- 6.9.4 ELECTRIC BUS DEPLOYMENT WITH INFRASTRUCTURAL CHANGES

- 6.9.5 HSL WAS AWARDED OPERATIONS BASED ON OPEN TENDERS UNDER CHARGING-AS-A-SERVICE (CAAS) BUSINESS MODEL

- 6.9.6 AI-POWERED SOFTWARE IMPLEMENTED TO HELP FLEET OPERATORS CHARGE ELECTRIC BUSES

- 6.9.7 HIGHLAND ELECTRIC FLEETS, IN PARTNERSHIP WITH NATIONAL GRID, PROVIDED ELECTRIC SCHOOL BUSES AND COORDINATED ITS PARTICIPATION IN V2G PROGRAM FOR SCHOOL BUSES

- 6.9.8 VERMONT ELECTRIC SCHOOL AND TRANSIT BUS PILOT PROGRAM IMPLEMENTED TO FACILITATE COST-EFFECTIVE ELECTRIFICATION

- 6.9.9 FLEET TEST & EVALUATION TEAM AT NREL SUPPORTED AVTA BY CONDUCTING ASSESSMENTS OF MEDIUM- AND HEAVY-DUTY VEHICLES, ELECTRIC BUSES, AND TROLLEYS

- 6.9.10 EVENERGI DEVELOPED FRAMEWORK TO DETERMINE OPTIMAL COMBINATION OF DEPOT LAYOUTS, CHARGER SPEEDS, AND CHARGER TYPES

- 6.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.11 BILL OF MATERIALS ANALYSIS

- 6.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 SUPPLIER ANALYSIS

- 6.14.1 MAJOR ELECTRIC BUS BATTERY CELL MANUFACTURERS

- 6.14.2 KEY ELECTRIC BUS AXLE MANUFACTURERS

- 6.14.3 KEY ELECTRIC BUS HVAC SYSTEM MANUFACTURERS

- 6.14.4 MAJOR ELECTRIC BUS MOTOR MANUFACTURERS

- 6.15 INVESTMENT AND FUNDING SCENARIO

7 OEM ANALYSIS

- 7.1 INTRODUCTION

- 7.2 ELECTRIC AND ICE BUS MODELS: LENGTH VS. NUMBER OF SEATS

- 7.3 ELECTRIC BUS MODELS: LENGTH VS. NUMBER OF SEATS

- 7.4 BATTERY CAPACITY VS. DRIVE RANGE VS. PAX

- 7.5 ELECTRIC BUS SALES BY OEMS, 2021-2025

- 7.6 ELECTRIC BUS DRIVE MOTOR SUPPLIERS, BY OEM AND REGION

- 7.7 ELECTRIC BUS BATTERY CELL SUPPLIERS, BY OEM AND REGION

- 7.8 ELECTRIC BUS, OEM-WISE INSTALLED BATTERY CAPACITIES, 2021-2025 (IN MWH)

8 TECHNOLOGY ANALYSIS

- 8.1 TECHNOLOGY ANALYSIS

- 8.1.1 FUTURE TECHNOLOGY OVERVIEW

- 8.1.2 TECHNOLOGY ROADMAP

- 8.2 KEY TECHNOLOGIES

- 8.2.1 AUTONOMOUS BUSES

- 8.3 ADJACENT TECHNOLOGIES

- 8.3.1 CHARGING AS A SERVICE

- 8.3.2 BATTERY AS A SERVICE

- 8.3.3 PACKAGED FUEL CELL SYSTEM MODULE

- 8.3.4 METHANE FUEL CELLS

- 8.4 COMPLEMENTARY TECHNOLOGIES

- 8.4.1 UPCOMING BATTERY TECHNOLOGIES

- 8.4.1.1 NMC4

- 8.4.1.2 Solid-state battery technology

- 8.4.1.3 Sodium-ion battery technology

- 8.4.2 INNOVATIVE CHARGING SOLUTIONS

- 8.4.2.1 Off-board top-down pantograph charging system

- 8.4.2.2 On-board bottom-up pantograph charging system

- 8.4.2.3 Ground-based static/dynamic charging system

- 8.4.1 UPCOMING BATTERY TECHNOLOGIES

9 ELECTRIC BUS MARKET, BY LENGTH OF BUS

- 9.1 INTRODUCTION

- 9.2 LESS THAN 9 M

- 9.2.1 EASY MANEUVERING ON COMPACT ROADS

- 9.3 9-14 M

- 9.3.1 SUITABLE FOR FULL-DAY OPERATIONS

- 9.4 MORE THAN 14 M

- 9.4.1 GROWING NUMBER OF ARTICULATED ELECTRIC BUSES TO DRIVE MARKET

- 9.5 KEY INDUSTRY INSIGHTS

10 ELECTRIC BUS MARKET, BY BATTERY TYPE

- 10.1 INTRODUCTION

- 10.2 NMC BATTERIES

- 10.2.1 INCREASED PREFERENCE FOR HIGH ENERGY DENSITY

- 10.3 LFP BATTERIES

- 10.3.1 DEMAND FOR LOW-COST AND GOOD THERMAL STABILITY

- 10.4 NCA BATTERIES

- 10.4.1 BENEFITS ASSOCIATED WITH HIGH ENERGY DENSITY AND LONG-LIFE CYCLE

- 10.5 OTHER BATTERIES

- 10.6 KEY INDUSTRY INSIGHTS

11 ELECTRIC BUS MARKET, BY BATTERY CAPACITY

- 11.1 INTRODUCTION

- 11.2 UP TO 400 KWH

- 11.2.1 DEPLOYMENT IN INTRACITY TRANSPORT TO PROPEL GROWTH

- 11.3 ABOVE 400 KWH

- 11.3.1 USED FOR LONG-DISTANCE COMMUTE

- 11.4 KEY INDUSTRY INSIGHTS

12 ELECTRIC BUS MARKET, BY POWER OUTPUT

- 12.1 INTRODUCTION

- 12.2 UP TO 250 KW

- 12.2.1 WIDELY USED IN PUBLIC TRANSPORT BUSES

- 12.3 ABOVE 250 KW

- 12.3.1 DEMAND FOR HIGH-PERFORMANCE ELECTRIC BUSES TO DRIVE MARKET

- 12.4 KEY PRIMARY INSIGHTS

13 ELECTRIC BUS MARKET, BY RANGE

- 13.1 INTRODUCTION

- 13.2 UP TO 300 MILES

- 13.2.1 SUITABLE FOR URBAN AND SUBURBAN ROUTES WITH FREQUENT STOPS AND SHORTER DISTANCES BETWEEN CHARGING POINTS

- 13.3 ABOVE 300 MILES

- 13.3.1 INCREASING DEMAND FOR INTERCITY ELECTRIC BUSES TO DRIVE MARKET

- 13.4 KEY PRIMARY INSIGHTS

14 ELECTRIC BUS MARKET, BY SEATING CAPACITY

- 14.1 INTRODUCTION

- 14.2 UP TO 40 SEATS

- 14.2.1 NEED FOR ELECTRIC BUSES FOR SHORT-DISTANCE SHUTTLES TO DRIVE DEMAND

- 14.3 40-70 SEATS

- 14.3.1 SUITABLE FOR DENSELY POPULATED AREAS

- 14.4 ABOVE 70 SEATS

- 14.4.1 NEED FOR HIGHER PASSENGER-CARRYING CAPABILITIES TO DRIVE DEMAND

- 14.5 KEY INDUSTRY INSIGHTS

15 ELECTRIC BUS MARKET, BY APPLICATION

- 15.1 INTRODUCTION

- 15.2 CITY/TRANSIT BUS

- 15.2.1 NEED TO IMPROVE AIR QUALITY IN CITIES TO DRIVE DEMAND

- 15.3 COACHES

- 15.3.1 INCREASING DEMAND FOR SUSTAINABLE LONG-DISTANCE TRAVEL TO DRIVE GROWTH

- 15.4 SCHOOL BUSES

- 15.4.1 GROWING DEMAND IN NORTH AMERICA TO DRIVE ELECTRIC SCHOOL BUS MARKET

- 15.5 OTHER APPLICATIONS

- 15.6 KEY INDUSTRY INSIGHTS

16 ELECTRIC BUS MARKET, BY CONSUMER

- 16.1 INTRODUCTION

- 16.2 PRIVATE

- 16.2.1 GOVERNMENT SUBSIDIES TO PROMOTE ADOPTION OF ELECTRIC BUSES

- 16.3 GOVERNMENT

- 16.3.1 USE OF ELECTRIC BUSES FOR PUBLIC TRANSPORTATION

- 16.4 KEY INDUSTRY INSIGHTS

17 ELECTRIC BUS MARKET, BY GROSS VEHICLE WEIGHT (GVW)

- 17.1 INTRODUCTION

- 17.2 UP TO 10 TONNES

- 17.2.1 NEED FOR ELECTRIC BUSES FOR SHORT-DISTANCE SHUTTLES TO DRIVE GROWTH

- 17.3 10-20 TONNES

- 17.3.1 ASIA PACIFIC TO LEAD MARKET IN THIS SEGMENT

- 17.4 ABOVE 20 TONNES

- 17.4.1 ENGINEERED FOR BIGGER AND TEDIOUS OPERATIONS

- 17.5 KEY INDUSTRY INSIGHTS

18 ELECTRIC BUS MARKET, BY PROPULSION

- 18.1 INTRODUCTION

- 18.2 BATTERY ELECTRIC BUSES

- 18.2.1 FALLING BATTERY PRICES AND GOVERNMENT INCENTIVES TO ELECTRIFY PUBLIC BUS FLEETS

- 18.3 FUEL CELL ELECTRIC BUSES

- 18.3.1 SUSTAINABLE PRODUCTION OF HYDROGEN TO DRIVE GROWTH

- 18.4 KEY INDUSTRY INSIGHTS

19 ELECTRIC BUS MARKET, BY COMPONENT

- 19.1 INTRODUCTION

- 19.2 MOTORS

- 19.2.1 HIGHER EFFICIENCY THAN TRADITIONAL COMBUSTION ENGINES TO DRIVE GROWTH

- 19.3 BATTERIES

- 19.3.1 DECREASING PRICE OF LITHIUM-ION BATTERIES TO DRIVE GROWTH

- 19.4 FUEL CELL STACKS

- 19.4.1 INCREASING DEMAND FOR HYDROGEN FUEL CELL ELECTRIC BUSES TO DRIVE GROWTH

- 19.5 BATTERY MANAGEMENT SYSTEMS

- 19.5.1 NEED FOR EFFICIENT BATTERY OPTIMIZATION IN ELECTRIC BUSES TO DRIVE GROWTH

- 19.6 BATTERY COOLING SYSTEMS

- 19.6.1 GROWING FOCUS ON INCREASING BATTERY LIFE AND IMPROVING THERMAL MANAGEMENT TO DRIVE GROWTH

- 19.7 DC-DC CONVERTERS

- 19.7.1 KEY SAFETY SYSTEMS IN ELECTRIC BUSES

- 19.8 INVERTERS

- 19.8.1 GROWING DEMAND FOR ELECTRIC BUSES WITH HIGHER RANGE TO DRIVE GROWTH

- 19.9 AC/DC CHARGERS

- 19.9.1 CRITICAL TO OVERALL OPERATION AND EFFICIENCY OF ELECTRIC BUSES

- 19.10 EV CONNECTORS

- 19.10.1 INCREASING INVESTMENTS IN SUSTAINABLE URBAN TRANSPORTATION INITIATIVES TO DRIVE GROWTH

- 19.11 KEY INDUSTRY INSIGHTS

20 ELECTRIC BUS MARKET, BY LEVEL OF AUTONOMY

- 20.1 INTRODUCTION

- 20.2 SEMI-AUTONOMOUS

- 20.3 AUTONOMOUS

- 20.4 KEY INDUSTRY INSIGHTS

21 ELECTRIC BUS MARKET, BY REGION

- 21.1 INTRODUCTION

- 21.2 ASIA PACIFIC

- 21.2.1 MACROECONOMIC OUTLOOK

- 21.2.2 CHINA

- 21.2.2.1 Widespread adoption of electric buses in public transport and presence of leading OEMs to boost growth

- 21.2.3 JAPAN

- 21.2.3.1 Focus on developing advanced electric buses to drive market

- 21.2.4 INDIA

- 21.2.4.1 Government support for electrification of public transport to propel demand

- 21.2.5 SOUTH KOREA

- 21.2.5.1 Focus on electrification of public transport fleets to boost growth

- 21.2.6 SINGAPORE

- 21.2.6.1 Growing emphasis on promoting green public transport by 2040 to boost growth

- 21.2.7 INDONESIA

- 21.2.7.1 Government's commitment to improving air quality to spur demand

- 21.2.8 AUSTRALIA

- 21.2.8.1 Increasing awareness regarding climate change to drive growth

- 21.3 EUROPE

- 21.3.1 MACROECONOMIC OUTLOOK

- 21.3.2 FRANCE

- 21.3.2.1 Aim for all-electric public transport fleet by 2025 to promote use of electric buses

- 21.3.3 GERMANY

- 21.3.3.1 Increased government incentives and investments for infrastructure development to boost market

- 21.3.4 SPAIN

- 21.3.4.1 Government's focus on replacing existing public transport fleet with electric buses to boost growth

- 21.3.5 ITALY

- 21.3.5.1 Rising concerns about emissions to encourage government to adopt electrification of public transport system

- 21.3.6 NORWAY

- 21.3.6.1 Rising government support and schemes for electric buses to increase demand

- 21.3.7 SWEDEN

- 21.3.7.1 Presence of market-leading OEMs to support growth of electric bus market

- 21.3.8 DENMARK

- 21.3.8.1 Favorable government regulations to support growth of electric bus market

- 21.3.9 NETHERLANDS

- 21.3.9.1 Increased orders and deliveries of electric buses to boost demand

- 21.3.10 BELGIUM

- 21.3.10.1 Investments for electrification of public transport to drive growth

- 21.3.11 UK

- 21.3.11.1 Stringent regulations for emission-free buses to boost adoption of electric buses

- 21.3.12 FINLAND

- 21.3.12.1 Continuous need for reducing carbon emissions to drive growth

- 21.3.13 POLAND

- 21.3.13.1 Push toward sustainable public transportation to spur demand for electric buses

- 21.4 NORTH AMERICA

- 21.4.1 MACROECONOMIC OUTLOOK

- 21.4.2 US

- 21.4.2.1 Government programs to promote zero-emission vehicles to boost growth

- 21.4.3 CANADA

- 21.4.3.1 Government subsidies and presence of key players to boost adoption of electric school buses

- 21.5 LATIN AMERICA

- 21.5.1 MACROECONOMIC OUTLOOK

- 21.5.2 ARGENTINA

- 21.5.2.1 Demand for electrification of bus fleets to boost demand for advanced electric buses

- 21.5.3 BRAZIL

- 21.5.3.1 Growing environmental concerns to lead to demand for electric buses

- 21.5.4 CHILE

- 21.5.4.1 Government's focus on promoting emission-free public transport to encourage use of electric buses

- 21.5.5 MEXICO

- 21.5.5.1 Rapid strategies undertaken by government to indicate growth of electric bus market

- 21.5.6 COLOMBIA

- 21.5.6.1 Increasing government initiatives for electric bus purchases to drive market

- 21.6 MIDDLE EAST & AFRICA

- 21.6.1 MACROECONOMIC OUTLOOK

- 21.6.2 SOUTH AFRICA

- 21.6.2.1 Investments by leading OEMs in advanced technologies in automotive sector to drive market

- 21.6.3 UAE

- 21.6.3.1 Growing electrification trend in cities to boost demand for electric buses

- 21.6.4 QATAR

- 21.6.4.1 Net-zero aims to push incorporation of electric buses

22 COMPETITIVE LANDSCAPE

- 22.1 OVERVIEW

- 22.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 22.3 ELECTRIC BUS MARKET SHARE ANALYSIS, 2024

- 22.3.1 ASIA: ELECTRIC BUS MARKET SHARE ANALYSIS, 2024

- 22.3.2 EUROPE: ELECTRIC BUS MARKET SHARE ANALYSIS, 2024

- 22.3.3 NORTH AMERICA: ELECTRIC BUS MARKET SHARE ANALYSIS, 2024

- 22.4 REVENUE ANALYSIS

- 22.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 22.5.1 STARS

- 22.5.2 EMERGING LEADERS

- 22.5.3 PERVASIVE PLAYERS

- 22.5.4 PARTICIPANTS

- 22.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 22.5.5.1 Consumer footprint

- 22.5.5.2 Region footprint

- 22.5.5.3 Application footprint

- 22.5.5.4 Propulsion footprint

- 22.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 22.6.1 PROGRESSIVE COMPANIES

- 22.6.2 RESPONSIVE COMPANIES

- 22.6.3 DYNAMIC COMPANIES

- 22.6.4 STARTING BLOCKS

- 22.6.5 COMPETITIVE BENCHMARKING

- 22.6.5.1 List of key startups/SMEs

- 22.6.5.2 Competitive benchmarking of key startups/SMEs

- 22.7 COMPANY VALUATION

- 22.8 FINANCIAL METRICS

- 22.9 BRAND/PRODUCT COMPARISON

- 22.10 COMPETITIVE SCENARIO

- 22.10.1 PRODUCT LAUNCHES, DEVELOPMENTS, AND ENHANCEMENTS, SEPTEMBER 2022-JULY 2025

- 22.10.2 DEALS, AUGUST 2022-MARCH 2025

- 22.10.3 EXPANSIONS, JUNE 2021-JULY 2025

- 22.10.4 OTHERS, OCTOBER 2022-JULY 2025

23 COMPANY PROFILES

- 23.1 KEY PLAYERS

- 23.1.1 BYD COMPANY LTD.

- 23.1.1.1 Business overview

- 23.1.1.2 Products/Solutions offered

- 23.1.1.3 Recent developments

- 23.1.1.3.1 Product launches

- 23.1.1.3.2 Deals

- 23.1.1.3.3 Expansions

- 23.1.1.3.4 Others

- 23.1.1.4 MnM view

- 23.1.1.4.1 Right to win

- 23.1.1.4.2 Strategic choices

- 23.1.1.4.3 Weaknesses & competitive threats

- 23.1.2 YUTONG BUS CO., LTD.

- 23.1.2.1 Business overview

- 23.1.2.2 Products/Solutions offered

- 23.1.2.3 Recent developments

- 23.1.2.3.1 Product launches/enhancements

- 23.1.2.3.2 Deals

- 23.1.2.3.3 Expansions

- 23.1.2.3.4 Others

- 23.1.2.4 MnM view

- 23.1.2.4.1 Right to win

- 23.1.2.4.2 Strategic choices

- 23.1.2.4.3 Weaknesses & competitive threats

- 23.1.3 ZHEJIANG GEELY HOLDING GROUP

- 23.1.3.1 Business overview

- 23.1.3.2 Products/Solutions offered

- 23.1.3.3 Recent developments

- 23.1.3.3.1 Product launches

- 23.1.3.3.2 Deals

- 23.1.3.3.3 Others

- 23.1.3.4 MnM view

- 23.1.3.4.1 Right to win

- 23.1.3.4.2 Strategic choices

- 23.1.3.4.3 Weaknesses & competitive threats

- 23.1.4 DAIMLER TRUCK AG

- 23.1.4.1 Business overview

- 23.1.4.2 Products/Solutions offered

- 23.1.4.3 Recent developments

- 23.1.4.3.1 Product launches

- 23.1.4.3.2 Deals

- 23.1.4.3.3 Expansions

- 23.1.4.3.4 Others

- 23.1.4.4 MnM view

- 23.1.4.4.1 Right to win

- 23.1.4.4.2 Strategic choices

- 23.1.4.4.3 Weaknesses & competitive threats

- 23.1.5 NFI GROUP

- 23.1.5.1 Business overview

- 23.1.5.2 Products/Solutions offered

- 23.1.5.3 Recent developments

- 23.1.5.3.1 Product launches/developments/enhancements

- 23.1.5.3.2 Deals

- 23.1.5.3.3 Others

- 23.1.5.4 MnM view

- 23.1.5.4.1 Right to win

- 23.1.5.4.2 Strategic choices

- 23.1.5.4.3 Weaknesses & competitive threats

- 23.1.6 AB VOLVO

- 23.1.6.1 Business overview

- 23.1.6.2 Products/Solutions offered

- 23.1.6.3 Recent developments

- 23.1.6.3.1 Product launches

- 23.1.6.3.2 Deals

- 23.1.6.3.3 Others

- 23.1.7 CAF (SOLARIS BUS & COACH SP. Z O.O.)

- 23.1.7.1 Business overview

- 23.1.7.2 Products/Solutions offered

- 23.1.7.3 Recent developments

- 23.1.7.3.1 Product launches

- 23.1.7.3.2 Others

- 23.1.8 ZHONGTONG BUS HOLDING CO., LTD.

- 23.1.8.1 Business overview

- 23.1.8.2 Products/Solutions offered

- 23.1.8.3 Recent developments

- 23.1.8.3.1 Deals

- 23.1.9 CRRC CORPORATION LIMITED

- 23.1.9.1 Business overview

- 23.1.9.2 Products/Solutions offered

- 23.1.9.3 Recent developments

- 23.1.9.3.1 Product launches

- 23.1.9.3.2 Deals

- 23.1.9.3.3 Expansions

- 23.1.9.3.4 Others

- 23.1.10 VDL GROEP

- 23.1.10.1 Business overview

- 23.1.10.2 Products/Solutions offered

- 23.1.10.3 Recent developments

- 23.1.10.3.1 Product launches

- 23.1.10.3.2 Deals

- 23.1.10.3.3 Expansions

- 23.1.10.3.4 Others

- 23.1.11 EBUSCO

- 23.1.11.1 Business overview

- 23.1.11.2 Products/Solutions offered

- 23.1.11.3 Recent developments

- 23.1.11.3.1 Product enhancements

- 23.1.11.3.2 Deals

- 23.1.11.3.3 Others

- 23.1.12 XIAMEN KING LONG INTERNATIONAL TRADING CO., LTD.

- 23.1.12.1 Business overview

- 23.1.12.2 Products/Solutions offered

- 23.1.12.3 Recent developments

- 23.1.12.3.1 Product launches

- 23.1.12.3.2 Others

- 23.1.1 BYD COMPANY LTD.

- 23.2 OTHER PLAYERS

- 23.2.1 BLUE BIRD CORPORATION

- 23.2.2 GILLIG LLC.

- 23.2.3 THE LION ELECTRIC COMPANY

- 23.2.4 TATA MOTORS LIMITED.

- 23.2.5 ASHOK LEYLAND

- 23.2.6 SUNDA NEW ENERGY TECHNOLOGY CO., LTD.

- 23.2.7 GREE ALTAIRNANO NEW ENERGY INC.

- 23.2.8 XIAMEN GOLDEN DRAGON BUS CO. LTD.

- 23.2.9 JBM GROUP

- 23.2.10 SCANIA AB

- 23.2.11 IRIZAR GROUP

- 23.2.12 IVECO S.P.A

- 23.2.13 BLUEBUS

- 23.2.14 BOZANKAYA

- 23.2.15 CAETANOBUS

- 23.2.16 CHARIOT MOTORS

- 23.2.17 HEULIEZ BUS

- 23.2.18 OTOKAR OTOMOTIV VE SAVUNMA SANAYI A.S.

- 23.2.19 TEMSA

- 23.2.20 URSUS S.A.

- 23.2.21 VAN HOOL

- 23.2.22 KARSAN

- 23.2.23 MELLOR

- 23.2.24 HINO MOTORS, LTD.

- 23.2.25 ANHUI ANKAI AUTOMOBILE CO., LTD.

- 23.2.26 OLECTRA GREENTECH LIMITED

24 RECOMMENDATIONS BY MARKETSANDMARKETS

- 24.1 ASIA PACIFIC TO BE MAJOR ELECTRIC BUS MARKET

- 24.2 BATTERY ELECTRIC BUSES TO BE KEY FOCUS AREA FOR MANUFACTURERS

- 24.3 CONCLUSION

25 APPENDIX

- 25.1 KEY INDUSTRY INSIGHTS

- 25.2 DISCUSSION GUIDE

- 25.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 25.4 CUSTOMIZATION OPTIONS

- 25.5 RELATED REPORTS

- 25.6 AUTHOR DETAILS

List of Tables

- TABLE 1 EXCHANGE RATE, 2021-2024

- TABLE 2 COUNTRY/REGION-WISE INITIATIVES

- TABLE 3 POTENTIAL MARKETS FOR NEW ZERO-EMISSION BUSES ACROSS EUROPE

- TABLE 4 FUEL CELL ELECTRIC BUS MODELS

- TABLE 5 US: FUEL CELL ELECTRIC BUS PROJECTS

- TABLE 6 OEM-WISE DEVELOPMENTS

- TABLE 7 ITALY: IMPORT SCENARIO FOR HS CODE: 870240, BY COUNTRY, 2020-2024 (USD)

- TABLE 8 GERMANY: IMPORT SCENARIO FOR HS CODE: 870240, BY COUNTRY, 2020-2024 (USD)

- TABLE 9 SOUTH KOREA: IMPORT SCENARIO FOR HS CODE: 870240, BY COUNTRY, 2020-2024 (USD)

- TABLE 10 UK: IMPORT SCENARIO FOR HS CODE: 870240, BY COUNTRY, 2020-2024 (USD)

- TABLE 11 US: IMPORT SCENARIO FOR HS CODE: 870240, BY COUNTRY, 2020-2024 (USD)

- TABLE 12 BELGIUM: IMPORT SCENARIO FOR HS CODE: 870240, BY COUNTRY, 2020-2024 (USD)

- TABLE 13 CHINA: EXPORT SCENARIO FOR HS CODE: 870240, BY COUNTRY, 2020-2024 (USD)

- TABLE 14 POLAND: EXPORT SCENARIO FOR HS CODE: 870240, BY COUNTRY, 2020-2024 (USD)

- TABLE 15 BELGIUM: EXPORT SCENARIO FOR HS CODE: 870240, BY COUNTRY, 2020-2024 (USD)

- TABLE 16 ITLAY: EXPORT SCENARIO FOR HS CODE: 870240, BY COUNTRY, 2020-2024 (USD)

- TABLE 17 TURKIYE: EXPORT SCENARIO FOR HS CODE: 870240, BY COUNTRY, 2020-2024 (USD)

- TABLE 18 FRANCE: EXPORT SCENARIO FOR HS CODE: 870240, BY COUNTRY, 2020-2024 (USD)

- TABLE 19 ELECTRIC BUS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 20 AVERAGE SELLING PRICE, BY APPLICATION, 2024 (USD)

- TABLE 21 AVERAGE SELLING PRICE, BY PROPULSION, 2024 (USD)

- TABLE 22 AVERAGE SELLING PRICE, BY REGION, 2024 (USD)

- TABLE 23 LIST OF PATENTS GRANTED IN ELECTRIC BUS MARKET, 2020-2025

- TABLE 24 NORTH AMERICA: POLICIES AND INITIATIVES SUPPORTING ELECTRIC & HYDROGEN-POWERED BUSES AND INFRASTRUCTURE

- TABLE 25 EUROPE: POLICIES AND INITIATIVES SUPPORTING ELECTRIC & HYDROGEN-POWERED BUSES AND INFRASTRUCTURE

- TABLE 26 ASIA PACIFIC: POLICIES AND INITIATIVES SUPPORTING ELECTRIC & HYDROGEN-POWERED BUSES AND INFRASTRUCTURE

- TABLE 27 LATIN AMERICA: POLICIES AND INITIATIVES SUPPORTING ELECTRIC & HYDROGEN-POWERED BUSES AND INFRASTRUCTURE

- TABLE 28 MIDDLE EAST & AFRICA: POLICIES AND INITIATIVES SUPPORTING ELECTRIC & HYDROGEN-POWERED BUSES AND INFRASTRUCTURE

- TABLE 29 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 32 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 33 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 34 ANALYSIS TO EVALUATE FINANCIAL FEASIBILITY OF DEPLOYING ELECTRIC BUS FLEETS

- TABLE 35 DEPLOYMENT OF ELECTRIC BUSES WITH ONGOING INFRASTRUCTURAL CHANGES

- TABLE 36 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 37 INFLUENCE OF STAKEHOLDERS ON PURCHASE OF ELECTRIC BUSES

- TABLE 38 KEY BUYING CRITERIA FOR ELECTRIC BUS, BY PROPULSION

- TABLE 39 BATTERY CELL MANUFACTURERS

- TABLE 40 AXLE MANUFACTURERS

- TABLE 41 HVAC SYSTEM MANUFACTURERS

- TABLE 42 MOTOR MANUFACTURERS

- TABLE 43 OEM/BRAND-WISE SALES FOR ELECTRIC BUSES, 2021-2025

- TABLE 44 ELECTRIC BUS DRIVE MOTOR SUPPLIERS, BY BRAND/OEM AND REGION

- TABLE 45 ELECTRIC BUS BATTERY CELL SUPPLIERS, BY BRAND/OEM AND REGION

- TABLE 46 ELECTRIC BUS BRAND/OEM-WISE INSTALLED BATTERY CAPACITIES IN MWH, 2021-2025

- TABLE 47 ELECTRIC BUS MARKET, BY LENGTH OF BUS, 2021-2024 (UNITS)

- TABLE 48 ELECTRIC BUS MARKET, BY LENGTH OF BUS, 2025-2032 (UNITS)

- TABLE 49 ELECTRIC BUS MARKET, BY LENGTH OF BUS, 2021-2024 (USD MILLION)

- TABLE 50 ELECTRIC BUS MARKET, BY LENGTH OF BUS, 2025-2032 (USD MILLION)

- TABLE 51 LESS THAN 9 M: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 52 LESS THAN 9 M: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 53 LESS THAN 9 M: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 LESS THAN 9 M: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 55 9-14 M: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 56 9-14 M: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 57 9-14 M: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 9-14 M: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 59 MORE THAN 14 M: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 60 MORE THAN 14 M: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 61 MORE THAN 14 M: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 MORE THAN 14 M: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 63 ELECTRIC BUS MARKET, BY BATTERY TYPE, 2021-2024 (UNITS)

- TABLE 64 ELECTRIC BUS MARKET, BY BATTERY TYPE, 2025-2032 (UNITS)

- TABLE 65 ELECTRIC BUS MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 66 ELECTRIC BUS MARKET, BY BATTERY TYPE, 2025-2032 (USD MILLION)

- TABLE 67 NMC BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 68 NMC BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 69 NMC BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 NMC BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 71 LFP BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 72 LFP BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 73 LFP BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 LFP BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 75 NCA BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 76 NCA BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 77 NCA BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 NCA BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 79 OTHER BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 80 OTHER BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 81 OTHER BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 OTHER BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 83 ELECTRIC BUS MARKET, BY BATTERY CAPACITY, 2021-2024 (UNITS)

- TABLE 84 ELECTRIC BUS MARKET, BY BATTERY CAPACITY, 2025-2032 (UNITS)

- TABLE 85 ELECTRIC BUS MARKET, BY BATTERY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 86 ELECTRIC BUS MARKET, BY BATTERY CAPACITY, 2025-2032 (USD MILLION)

- TABLE 87 UP TO 400 KWH: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 88 UP TO 400 KWH: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 89 UP TO 400 KWH: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 UP TO 400 KWH: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 91 ABOVE 400 KWH: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 92 ABOVE 400 KWH: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 93 ABOVE 400 KWH: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 ABOVE 400 KWH: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 95 ELECTRIC BUS MARKET, BY POWER OUTPUT, 2021-2024 (UNITS)

- TABLE 96 ELECTRIC BUS MARKET, BY POWER OUTPUT, 2025-2032 (UNITS)

- TABLE 97 ELECTRIC BUS MARKET, BY POWER OUTPUT, 2021-2024 (USD MILLION)

- TABLE 98 ELECTRIC BUS MARKET, BY POWER OUTPUT, 2025-2032 (USD MILLION)

- TABLE 99 UP TO 250 KW: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 100 UP TO 250 KW: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 101 UP TO 250 KW: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 UP TO 250 KW: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 103 ABOVE 250 KW: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 104 ABOVE 250 KW: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 105 ABOVE 250 KW: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 ABOVE 250 KW: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 107 ELECTRIC BUS MARKET, BY RANGE, 2021-2024 (UNITS)

- TABLE 108 ELECTRIC BUS MARKET, BY RANGE, 2025-2032 (UNITS)

- TABLE 109 ELECTRIC BUS MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 110 ELECTRIC BUS MARKET, BY RANGE, 2025-2032 (USD MILLION)

- TABLE 111 UP TO 300 MILES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 112 UP TO 300 MILES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 113 UP TO 300 MILES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 UP TO 300 MILES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 115 ABOVE 300 MILES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 116 ABOVE 300 MILES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 117 ABOVE 300 MILES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 ABOVE 300 MILES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 119 ELECTRIC BUS MARKET, BY SEATING CAPACITY, 2021-2024 (UNITS)

- TABLE 120 ELECTRIC BUS MARKET, BY SEATING CAPACITY, 2025-2032 (UNITS)

- TABLE 121 ELECTRIC BUS MARKET, BY SEATING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 122 ELECTRIC BUS MARKET, BY SEATING CAPACITY, 2025-2032 (USD MILLION)

- TABLE 123 UP TO 40 SEATS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 124 UP TO 40 SEATS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 125 UP TO 40 SEATS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 126 UP TO 40 SEATS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 127 40-70 SEATS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 128 40-70 SEATS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 129 40-70 SEATS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 130 40-70 SEATS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 131 ABOVE 70 SEATS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 132 ABOVE 70 SEATS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 133 ABOVE 70 SEATS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 134 ABOVE 70 SEATS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 135 ELECTRIC BUS MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 136 ELECTRIC BUS MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 137 ELECTRIC BUS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 138 ELECTRIC BUS MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 139 CITY/TRANSIT BUSES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 140 CITY/TRANSIT BUSES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 141 CITY/TRANSIT BUSES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 142 CITY/TRANSIT BUSES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 143 COACHES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 144 COACHES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 145 COACHES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 146 COACHES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 147 SCHOOL BUSES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 148 SCHOOL BUSES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 149 SCHOOL BUSES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 150 SCHOOL BUSES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 151 OTHER APPLICATIONS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 152 OTHER APPLICATIONS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 153 OTHER APPLICATIONS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 154 OTHER APPLICATIONS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 155 ELECTRIC BUS MARKET, BY CONSUMER, 2021-2024 (UNITS)

- TABLE 156 ELECTRIC BUS MARKET, BY CONSUMER, 2025-2032 (UNITS)

- TABLE 157 ELECTRIC BUS MARKET, BY CONSUMER, 2021-2024 (USD MILLION)

- TABLE 158 ELECTRIC BUS MARKET, BY CONSUMER, 2025-2032 (USD MILLION)

- TABLE 159 PRIVATE: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 160 PRIVATE: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 161 PRIVATE: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 162 PRIVATE: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 163 GOVERNMENT: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 164 GOVERNMENT: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 165 GOVERNMENT: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 166 GOVERNMENT: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 167 ELECTRIC BUS MARKET, BY GVW, 2021-2024 (UNITS)

- TABLE 168 ELECTRIC BUS MARKET, BY GVW, 2025-2032 (UNITS)

- TABLE 169 UP TO 10 TONNES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 170 UP TO 10 TONNES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 171 10 - 20 TONNES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 172 10 - 20 TONNES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 173 ABOVE 20 TONNES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 174 ABOVE 20 TONNES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 175 ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 176 ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 177 ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 178 ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 179 BATTERY ELECTRIC BUSES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 180 BATTERY ELECTRIC BUSES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 181 BATTERY ELECTRIC BUSES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 182 BATTERY ELECTRIC BUSES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 183 FUEL CELL ELECTRIC BUSES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 184 FUEL CELL ELECTRIC BUSES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 185 FUEL CELL ELECTRIC BUSES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 186 FUEL CELL ELECTRIC BUSES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 187 ELECTRIC BUS MARKET, BY COMPONENT, 2021-2024 (UNITS)

- TABLE 188 ELECTRIC BUS MARKET, BY COMPONENT, 2025-2032 (UNITS)

- TABLE 189 ELECTRIC BUS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 190 ELECTRIC BUS MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 191 MOTORS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 192 MOTORS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 193 MOTORS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 194 MOTORS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 195 BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 196 BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 197 BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 198 BATTERIES: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 199 FUEL CELL STACKS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 200 FUEL CELL STACKS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 201 FUEL CELL STACKS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 202 FUEL CELL STACKS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 203 BATTERY MANAGEMENT SYSTEMS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 204 BATTERY MANAGEMENT SYSTEMS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 205 BATTERY MANAGEMENT SYSTEMS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 206 BATTERY MANAGEMENT SYSTEMS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 207 BATTERY COOLING SYSTEMS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 208 BATTERY COOLING SYSTEMS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 209 BATTERY COOLING SYSTEMS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 210 BATTERY COOLING SYSTEMS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 211 DC-DC CONVERTERS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 212 DC-DC CONVERTERS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 213 DC-DC CONVERTERS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 214 DC-DC CONVERTERS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 215 INVERTERS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 216 INVERTERS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 217 INVERTERS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 218 INVERTERS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 219 AC/DC CHARGERS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 220 AC/DC CHARGERS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 221 AC/DC CHARGERS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 222 AC/DC CHARGERS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 223 EV CONNECTORS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 224 EV CONNECTORS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 225 EV CONNECTORS: ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 226 EV CONNECTORS: ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 227 SEMI-AUTONOMOUS ELECTRIC BUS MODELS AND THEIR FEATURES, 2022

- TABLE 228 AUTONOMOUS ELECTRIC BUS MODELS AND THEIR FEATURES, 2023

- TABLE 229 ELECTRIC BUS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 230 ELECTRIC BUS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 231 ELECTRIC BUS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 232 ELECTRIC BUS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 233 ASIA PACIFIC: ELECTRIC BUS MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 234 ASIA PACIFIC: ELECTRIC BUS MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 235 ASIA PACIFIC: ELECTRIC BUS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 236 ASIA PACIFIC: ELECTRIC BUS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 237 CHINA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 238 CHINA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 239 CHINA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 240 CHINA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 241 JAPAN: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 242 JAPAN: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 243 JAPAN: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 244 JAPAN: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 245 INDIA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 246 INDIA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 247 INDIA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 248 INDIA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 249 SOUTH KOREA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 250 SOUTH KOREA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 251 SOUTH KOREA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 252 SOUTH KOREA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 253 SINGAPORE: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 254 SINGAPORE: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 255 SINGAPORE: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 256 SINGAPORE: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 257 INDONESIA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 258 INDONESIA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 259 INDONESIA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 260 INDONESIA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 261 AUSTRALIA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 262 AUSTRALIA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 263 AUSTRALIA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 264 AUSTRALIA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 265 EUROPE: ELECTRIC BUS MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 266 EUROPE: ELECTRIC BUS MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 267 EUROPE: ELECTRIC BUS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 268 EUROPE: ELECTRIC BUS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 269 FRANCE: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 270 FRANCE: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 271 FRANCE: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 272 FRANCE: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 273 GERMANY: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 274 GERMANY: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 275 GERMANY: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 276 GERMANY: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 277 SPAIN: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 278 SPAIN: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 279 SPAIN: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 280 SPAIN: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 281 ITALY: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 282 ITALY: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 283 ITALY: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 284 ITALY: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 285 NORWAY: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 286 NORWAY: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 287 NORWAY: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 288 NORWAY: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 289 SWEDEN: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 290 SWEDEN: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 291 SWEDEN: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 292 SWEDEN: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 293 DENMARK: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 294 DENMARK: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 295 DENMARK: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 296 DENMARK: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 297 NETHERLANDS: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 298 NETHERLANDS: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 299 NETHERLANDS: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 300 NETHERLANDS: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 301 BELGIUM: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 302 BELGIUM: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 303 BELGIUM: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 304 BELGIUM: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 305 UK: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 306 UK: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 307 UK: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 308 UK: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 309 FINLAND: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 310 FINLAND: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 311 FINLAND: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 312 FINLAND: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 313 POLAND: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 314 POLAND: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 315 POLAND: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 316 POLAND: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 317 NORTH AMERICA: ELECTRIC BUS MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 318 NORTH AMERICA: ELECTRIC BUS MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 319 NORTH AMERICA: ELECTRIC BUS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 320 NORTH AMERICA: ELECTRIC BUS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 321 US: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 322 US: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 323 US: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 324 US: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 325 CANADA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 326 CANADA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 327 CANADA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 328 CANADA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 329 LATIN AMERICA: ELECTRIC BUS MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 330 LATIN AMERICA: ELECTRIC BUS MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 331 LATIN AMERICA: ELECTRIC BUS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 332 LATIN AMERICA: ELECTRIC BUS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 333 ARGENTINA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 334 ARGENTINA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 335 ARGENTINA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 336 ARGENTINA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 337 BRAZIL: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 338 BRAZIL: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 339 BRAZIL: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 340 BRAZIL: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 341 CHILE: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 342 CHILE: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 343 CHILE: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 344 CHILE: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 345 MEXICO: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 346 MEXICO: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 347 MEXICO: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 348 MEXICO: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 349 COLOMBIA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 350 COLOMBIA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 351 COLOMBIA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 352 COLOMBIA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 353 MIDDLE EAST & AFRICA: ELECTRIC BUS MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 354 MIDDLE EAST & AFRICA: ELECTRIC BUS MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 355 MIDDLE EAST & AFRICA: ELECTRIC BUS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 356 MIDDLE EAST & AFRICA: ELECTRIC BUS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 357 SOUTH AFRICA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 358 SOUTH AFRICA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 359 SOUTH AFRICA: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 360 SOUTH AFRICA: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 361 UAE: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 362 UAE: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 363 UAE: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 364 UAE: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 365 QATAR: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 366 QATAR: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 367 QATAR: ELECTRIC BUS MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 368 QATAR: ELECTRIC BUS MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 369 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- TABLE 370 ASIAN ELECTRIC BUS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 371 EUROPEAN ELECTRIC BUS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 372 NORTH AMERICAN ELECTRIC BUS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 373 ELECTRIC BUS MARKET: CONSUMER FOOTPRINT, 2024

- TABLE 374 ELECTRIC BUS MARKET: REGION FOOTPRINT, 2024

- TABLE 375 ELECTRIC BUS MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 376 ELECTRIC BUS MARKET: PROPULSION FOOTPRINT, 2024

- TABLE 377 ELECTRIC BUS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 378 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 379 ELECTRIC BUS MARKET: PRODUCT LAUNCHES/ENHANCEMENTS/DEVELOPMENTS, SEPTEMBER 2022-JULY 2025

- TABLE 380 ELECTRIC BUS MARKET: DEALS, AUGUST 2022-MARCH 2025

- TABLE 381 ELECTRIC BUS MARKET: EXPANSIONS, JUNE 2021-JULY 2025

- TABLE 382 ELECTRIC BUS MARKET: OTHERS, OCTOBER 2022-JULY 2025

- TABLE 383 BYD COMPANY LTD.: COMPANY OVERVIEW

- TABLE 384 BYD COMPANY LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 385 BYD COMPANY LTD.: PRODUCT LAUNCHES

- TABLE 386 BYD COMPANY LTD.: DEALS

- TABLE 387 BYD COMPANY LTD.: EXPANSIONS

- TABLE 388 BYD COMPANY LTD.: OTHERS

- TABLE 389 YUTONG BUS CO., LTD.: COMPANY OVERVIEW

- TABLE 390 YUTONG BUS CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 391 YUTONG BUS CO., LTD.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 392 YUTONG BUS CO., LTD.: DEALS

- TABLE 393 YUTONG BUS CO., LTD.: EXPANSIONS

- TABLE 394 YUTONG BUS CO., LTD.: OTHERS

- TABLE 395 ZHEJIANG GEELY HOLDING GROUP: COMPANY OVERVIEW

- TABLE 396 ZHEJIANG GEELY HOLDING GROUP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 397 ZHEJIANG GEELY HOLDING GROUP: PRODUCT LAUNCHES

- TABLE 398 ZHEJIANG GEELY HOLDING GROUP: DEALS

- TABLE 399 ZHEJIANG GEELY HOLDING GROUP: OTHERS

- TABLE 400 DAIMLER TRUCK AG: COMPANY OVERVIEW

- TABLE 401 DAIMLER TRUCK AG: PRODUCTS/SOLUTIONS OFFERED

- TABLE 402 DAIMLER TRUCK AG: PRODUCT LAUNCHES

- TABLE 403 DAIMLER TRUCK AG: DEALS

- TABLE 404 DAIMLER TRUCK AG: EXPANSIONS

- TABLE 405 DAIMLER TRUCK AG: OTHERS

- TABLE 406 NFI GROUP: COMPANY OVERVIEW

- TABLE 407 NFI GROUP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 408 NFI GROUP: PRODUCT LAUNCHES/DEVELOPMENTS/ENHANCEMENTS

- TABLE 409 NFI GROUP: DEALS

- TABLE 410 NFI GROUP: OTHERS

- TABLE 411 AB VOLVO: COMPANY OVERVIEW

- TABLE 412 AB VOLVO: PRODUCTS/SOLUTIONS OFFERED

- TABLE 413 AB VOLVO: PRODUCT LAUNCHES

- TABLE 414 AB VOLVO: DEALS

- TABLE 415 AB VOLVO: OTHERS

- TABLE 416 CAF (SOLARIS BUS & COACH SP. Z O.O.): COMPANY OVERVIEW

- TABLE 417 CAF (SOLARIS BUS & COACH SP. Z O.O.): PRODUCTS/SOLUTIONS OFFERED

- TABLE 418 CAF (SOLARIS BUS & COACH SP. Z O.O.): PRODUCT LAUNCHES

- TABLE 419 CAF (SOLARIS BUS & COACH SP. Z O.O.): OTHERS

- TABLE 420 ZHONGTONG BUS HOLDING CO., LTD.: COMPANY OVERVIEW

- TABLE 421 ZHONGTONG BUS HOLDING CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 422 ZHONGTONG BUS HOLDING CO., LTD.: DEALS

- TABLE 423 CRRC CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 424 CRRC CORPORATION LIMITED: PRODUCTS/SOLUTIONS OFFERED

- TABLE 425 CRRC CORPORATION LIMITED: PRODUCT LAUNCHES

- TABLE 426 CRRC CORPORATION LIMITED: DEALS

- TABLE 427 CRRC CORPORATION LIMITED: EXPANSIONS

- TABLE 428 CRRC CORPORATION LIMITED: OTHERS

- TABLE 429 VDL GROEP: COMPANY OVERVIEW

- TABLE 430 VDL GROEP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 431 VDL GROEP: PRODUCT LAUNCHES

- TABLE 432 VDL GROEP: DEALS

- TABLE 433 VDL GROEP: EXPANSIONS

- TABLE 434 VDL GROEP: OTHERS

- TABLE 435 EBUSCO: COMPANY OVERVIEW

- TABLE 436 EBUSCO: PRODUCTS/SOLUTIONS OFFERED

- TABLE 437 EBUSCO: PRODUCT ENHANCEMENTS

- TABLE 438 EBUSCO: DEALS

- TABLE 439 EBUSCO: OTHERS

- TABLE 440 XIAMEN KING LONG INTERNATIONAL TRADING CO., LTD.: COMPANY OVERVIEW

- TABLE 441 XIAMEN KING LONG INTERNATIONAL TRADING CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 442 XIAMEN KING LONG INTERNATIONAL TRADING CO., LTD.: PRODUCT LAUNCHES

- TABLE 443 XIAMEN KING LONG INTERNATIONAL TRADING CO., LTD.: OTHERS

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH METHODOLOGY

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 9 KEY FACTORS IMPACTING ELECTRIC BUS MARKET

- FIGURE 10 REPORT SUMMARY

- FIGURE 11 ELECTRIC BUS MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 12 ELECTRIC BUS MARKET, BY PROPULSION, 2025 VS. 2032 (USD MILLION)

- FIGURE 13 INCREASING DEMAND FOR SUSTAINABLE TRANSPORT SOLUTIONS AND GREEN TRANSPORTATION TO DRIVE MARKET

- FIGURE 14 BATTERY ELECTRIC BUSES TO BE DOMINANT SEGMENT IN 2032

- FIGURE 15 UP TO 300 MILES SEGMENT TO HOLD DOMINANT MARKET SHARE IN 2032

- FIGURE 16 BATTERIES TO HOLD LARGEST MARKET SHARE IN 2032

- FIGURE 17 GOVERNMENT SEGMENT TO DOMINATE IN 2032

- FIGURE 18 UP TO 400 KWH TO BE DOMINANT SEGMENT IN 2032

- FIGURE 19 LFP TO BE LARGEST BATTERY TYPE IN 2032

- FIGURE 20 CITY/TRANSIT BUSES TO BE LARGEST SEGMENT IN 2032

- FIGURE 21 UP TO 250 KW TO BE DOMINANT SEGMENT IN 2032

- FIGURE 22 9-14 M TO BE LARGEST SEGMENT IN 2032

- FIGURE 23 40-70 SEATS TO BE LARGEST SEGMENT IN 2032

- FIGURE 24 10-20 TONNES SEGMENT TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 25 ASIA PACIFIC TO LEAD ELECTRIC BUS MARKET IN 2025

- FIGURE 26 ELECTRIC BUS MARKET DYNAMICS

- FIGURE 27 REGION-WISE PROGRAMS FOR ELECTRIC BUS ADOPTION

- FIGURE 28 INCREASING DEMAND FOR GREEN VEHICLES

- FIGURE 29 DECLINE IN BATTERY PRICE/KWH, 2010-2030

- FIGURE 30 SAFETY CONCERNS IN ELECTRIC VEHICLE BATTERIES

- FIGURE 31 BATTERY SAFETY ARCHITECTURE OUTLINE

- FIGURE 32 AVERAGE COST OF OPERATIONS: DIESEL BUS VS. ELECTRIC BUS (USD/YEAR)

- FIGURE 33 FUEL CELL PRODUCT LIFECYCLE

- FIGURE 34 ELECTRIC BUS AS A SERVICE

- FIGURE 35 ELECTRIC BUS MARKET ECOSYSTEM ANALYSIS

- FIGURE 36 ECOSYSTEM MAPPING

- FIGURE 37 ELECTRIC BUS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 38 TOTAL COST OF OWNERSHIP: 12-M ELECTRIC BUSES VS. 12-M DIESEL BUSES (USD)

- FIGURE 39 AVERAGE SELLING PRICE, BY APPLICATION, 2024 (USD)

- FIGURE 40 AVERAGE SELLING PRICE, BY PROPULSION, 2024 (USD)

- FIGURE 41 AVERAGE SELLING PRICE, BY REGION, 2024 (USD)

- FIGURE 42 NUMBER OF PATENTS GRANTED FOR ELECTRIC BUSES, JANUARY 2015-APRIL 2025

- FIGURE 43 OPEX-BASED ELECTRIC BUS DEPLOYMENT

- FIGURE 44 ELECTRIFICATION OF DOHA PUBLIC TRANSPORT IN 2022

- FIGURE 45 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 46 BILL OF MATERIALS ANALYSIS

- FIGURE 47 KEY BUYING CRITERIA FOR ELECTRIC BUSES, BY PROPULSION

- FIGURE 48 KEY SUPPLIERS FOR MAJOR COMPONENTS OF ELECTRIC BUSES

- FIGURE 49 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 50 ELECTRIC AND ICE BUS MODELS: BUS LENGTH VS. NUMBER OF SEATS

- FIGURE 51 ELECTRIC BUS MODELS: BUS LENGTH VS. NUMBER OF SEATS

- FIGURE 52 ELECTRIC BUS: BATTERY CAPACITY VS. DRIVE RANGE VS. PAX FOR MERCEDES-BENZ E-CITARO

- FIGURE 53 ELECTRIC BUS MARKET: FUTURE TECHNOLOGY OVERVIEW

- FIGURE 54 ELECTRIC BUS MARKET: TECHNOLOGY ROADMAP

- FIGURE 55 NEW PACKAGED FUEL CELL SYSTEM MODULE BY TOYOTA

- FIGURE 56 ELECTRIC BUS MARKET, BY LENGTH OF BUS, 2025 VS. 2032 (USD MILLION)

- FIGURE 57 ELECTRIC BUS MARKET, BY BATTERY TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 58 ELECTRIC BUS MARKET, BY BATTERY CAPACITY, 2025 VS. 2032 (USD MILLION)

- FIGURE 59 ELECTRIC BUS MARKET, BY POWER OUTPUT, 2025 VS. 2032 (USD MILLION)

- FIGURE 60 ELECTRIC BUS MARKET, BY RANGE, 2025 VS. 2032 (USD MILLION)

- FIGURE 61 ELECTRIC BUS MARKET: RANGE VS. DIFFERENT DRIVING CONDITIONS

- FIGURE 62 ELECTRIC BUS MARKET, BY SEATING CAPACITY, 2025 VS. 2032 (USD MILLION)

- FIGURE 63 ELECTRIC BUS MARKET, BY APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 64 ELECTRIC BUS MARKET, BY CONSUMER, 2025 VS. 2032 (USD MILLION)

- FIGURE 65 ELECTRIC BUS MARKET, BY GVW, 2025 VS. 2032 (UNITS)

- FIGURE 66 ELECTRIC BUS MARKET, BY PROPULSION, 2025 VS. 2032 (USD MILLION)

- FIGURE 67 ELECTRIC BUS MARKET, BY COMPONENT, 2025 VS. 2032 (USD MILLION)

- FIGURE 68 ELECTRIC BUS MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 69 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 70 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 71 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 72 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 73 ASIA PACIFIC: ELECTRIC BUS MARKET SNAPSHOT

- FIGURE 74 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 75 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 76 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 77 EUROPE MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 78 EUROPE: ELECTRIC BUS MARKET, BY COUNTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 79 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 80 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 81 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 82 NORTH AMERICA MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 83 NORTH AMERICA: ELECTRIC BUS MARKET SNAPSHOT

- FIGURE 84 LATIN AMERICA: REAL GDP ANNUAL PERCENTAGE CHANGE, 2024-2026

- FIGURE 85 LATIN AMERICA: GDP PER CAPITA, 2024-2026

- FIGURE 86 LATIN AMERICA: AVERAGE CPI INFLATION RATE, 2024-2026

- FIGURE 87 LATIN AMERICA: MANUFACTURING INDUSTRY'S VALUE (AS PART OF GDP), 2024

- FIGURE 88 LATIN AMERICA: ELECTRIC BUS MARKET, BY COUNTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 89 MIDDLE EAST & AFRICA: REAL GDP ANNUAL PERCENTAGE CHANGE, 2024-2026

- FIGURE 90 MIDDLE EAST & AFRICA: GDP PER CAPITA, 2024-2026

- FIGURE 91 MIDDLE EAST & AFRICA: AVERAGE CPI INFLATION RATE, 2024-2026

- FIGURE 92 MIDDLE EAST & AFRICA: MANUFACTURING INDUSTRY'S VALUE (AS PART OF GDP), 2024