|

市場調查報告書

商品編碼

1913482

奈米纖維素市場機會、成長要素、產業趨勢分析及2026年至2035年預測Nanocellulose Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

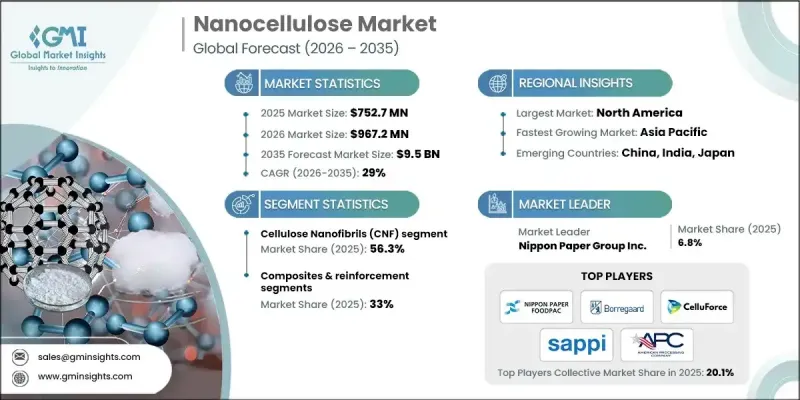

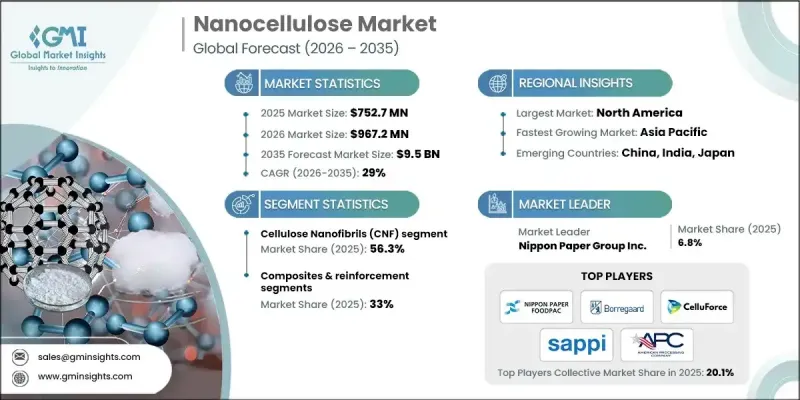

全球奈米纖維素市場預計到 2025 年將達到 7.527 億美元,到 2035 年將達到 95 億美元,年複合成長率為 29%。

奈米纖維素是一種源自纖維素(地球上最豐富的生物聚合物)的生物基奈米材料,具有優異的剛度重量比、高比表面積和可客製化的表面化學性質。其拉伸強度可達約10 GPa,纖維素奈米晶體的楊氏模數為140-150 GPa,使其成為高要求應用中石油基添加劑的理想替代品。目前,奈米纖維素市場主要圍繞著三種類型:纖維素奈米晶體(CNC)、纖維素奈米纖維(CNF)和細菌奈米纖維素(BNC),每種類型都具有獨特的形貌和製造方法,適用於特定的工業應用。永續包裝的日益普及、生物醫學解決方案(例如創傷護理支架和水凝膠)的開發,以及奈米纖維素在穿戴式裝置和下一代電池等儲能裝置中的應用,都進一步推動了永續纖維素市場的擴張。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 7.527億美元 |

| 預測金額 | 95億美元 |

| 複合年成長率 | 29% |

由於纖維素奈米纖維(CNF)在流變改質、塗層和增強等方面的廣泛應用,預計到2025年,其市場佔有率將達到56.3%。挪威和日本等地區的大規模工業活動支撐著CNF的生產,CNF廣泛應用於建築外加劑、水性塗料和其他商業領域。透過酸水解法製備的纖維素奈米晶體(CNC)具有棒狀晶體結構,結晶質度高,氧氣阻隔性能優異,因此適用於先進薄膜和複合材料。

預計到2025年,複合材料和增強材料領域將佔據33%的市場佔有率,因為汽車製造商和一級供應商都在尋求使用CNF增強工程塑膠來製造輕量化且耐用的汽車零件。在紙張和紙板應用領域,CNF用於提高拉伸強度和表面性能,同時減少纖維用量;而在包裝和阻隔薄膜領域,對耐氧性和可堆肥性的應用需求持續成長。

預計到2025年,北美奈米纖維素市場佔有率將達到39.3%,這得益於其強大的研究基礎設施、先導工廠以及產學研之間的積極合作。研究機構和政府部門的商業化支持措施進一步鞏固了該地區的市場領先地位。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 產業潛在風險與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特五力分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按形式

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 專利狀態

- 貿易統計(HS編碼)(註:僅提供主要國家的貿易統計)

- 主要進口國

- 主要出口國

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 業務拓展計劃

第5章 2022-2035年按產品分類的市場估算與預測

- 纖維素奈米晶體(CNCs)

- 硫酸化C控制

- 羧基化CNC

- 其他化學改質纖維素奈米晶體

- 纖維素奈米纖維(CNF)

- 酵素處理的CNF

- TEMPO介導的氧化

- 羧甲基化

- 細菌奈米纖維素(BNC)

- 纖維素微晶(CMC/MCC)

- 表面改質和功能化的奈米纖維素

第6章 按應用領域分類的市場估算與預測,2022-2035年

- 複合材料和增強材料

- 聚合物基質的類型

- 熱塑性複合材料

- 熱固性複合材料

- 生物基聚合物複合材料

- 聚合物基質的類型

- 包裝/阻隔膜

- 食品接觸應用

- 氧氣阻隔膜

- 防潮塗層

- 耐油包裝

- 主動式智慧包裝

- 可生物分解包裝解決方案

- 食品接觸應用

- 油漆和塗料

- 流變學調整

- 阻隔及保護塗層

- 防腐蝕應用

- 提高紙張和紙板的質量

- 生醫醫療保健

- 過濾和薄膜技術

- 水處理應用

- 空氣過濾

- 油水分離

- 重金屬去除

- 儲能和電子

- 電池隔離膜

- 超級電容電極

- 軟性電子基板

- 感測器和致動器

- 流變改性劑和添加劑

- 農業用途

- 建築材料

- 水泥和混凝土添加劑

- 黏合劑和密封劑

- 木質複合材料/結構木材

第7章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

第8章:公司簡介

- Sappi Limited

- Borregaard ASA

- CelluForce Inc.

- FPInnovations

- American Process Inc.(API)

- Kruger Inc.

- Daicel Corporation

- Nippon Paper Group Inc.

- Melodea Ltd.

- J. Rettenmaier &Sohne GmbH+Co. KG

- CelluComp Ltd.

- Asahi Kasei Corporation

- Oji Holdings Corporation

- Stora Enso

- Holmen AB

- Anomera

The Global Nanocellulose Market was valued at USD 752.7 million in 2025 and is estimated to grow at a CAGR of 29% to reach USD 9.5 billion by 2035.

Nanocellulose, a bio-based nanomaterial derived from cellulose, the planet's most abundant biopolymer, offers a remarkable stiffness-to-weight ratio, high specific surface area, and customizable surface chemistry. Its tensile strength can reach approximately 10 GPa, with a Young's modulus of 140-150 GPa for cellulose nanocrystals, enabling it to replace petroleum-based additives in demanding applications. The market revolves around three main types: cellulose nanocrystals (CNC), cellulose nanofibrils (CNF), and bacterial nanocellulose (BNC), each with unique morphologies and production methods suited to specific industrial applications. Growing adoption of sustainable packaging, development of biomedical solutions such as wound care scaffolds and hydrogels, and integration into energy storage devices for wearables and next-generation batteries are further accelerating market expansion.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $752.7 Million |

| Forecast Value | $9.5 Billion |

| CAGR | 29% |

The cellulose nanofibrils (CNF) segment captured 56.3% share in 2025 owing to their versatility in rheology modification, coatings, and reinforcement. CNF production is supported by large-scale industrial operations in regions such as Norway and Japan, and is applied across construction admixtures, waterborne coatings, and other commercial uses. Cellulose nanocrystals (CNC), produced through acid hydrolysis, deliver rod-like crystals with high crystallinity and excellent oxygen barrier properties, making them suitable for advanced films and composites.

The composites and reinforcement segment accounted for 33% share in 2025, driven by automakers and Tier 1 suppliers exploring CNF-reinforced engineering plastics for lightweight yet durable automotive components. Paper and paperboard applications leverage CNF to enhance tensile strength and surface properties while reducing fiber use, and packaging and barrier films continue to gain traction for applications requiring oxygen resistance and compostability.

North America Nanocellulose Market held 39.3% share in 2025, backed by robust research infrastructure, pilot plants, and active collaboration between industry and academia. Initiatives by research institutions and government agencies supporting commercialization have further strengthened the region's market leadership.

Key companies operating in the Global Nanocellulose Market include Borregaard ASA, Kruger Inc., FPInnovations, Sappi Limited, Stora Enso, CelluForce Inc., Oji Holdings Corporation, Holmen AB, Melodea Ltd., J. Rettenmaier & Sohne GmbH + Co. KG, CelluComp Ltd., Asahi Kasei Corporation, Daicel Corporation, and American Process Inc. (API). Market players in the Global Nanocellulose Market are adopting multiple strategies to solidify their presence and expand market share. These include investing in R&D for novel applications, forming strategic partnerships with end-use industries, and expanding production capacities through commercial-scale facilities. Companies are also prioritizing sustainable sourcing, enhancing process efficiencies, and exploring high-value applications in biomedical, packaging, and energy storage sectors. Additionally, marketing initiatives, intellectual property protection, and global distribution network expansion are key tactics employed to strengthen brand visibility and maintain leadership in a rapidly evolving market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By form

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2022-2035 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Cellulose Nanocrystals (CNC)

- 5.2.1 Sulfated CNC

- 5.2.2 Carboxylated CNC

- 5.2.3 Other chemically modified CNC

- 5.3 Cellulose Nanofibrils (CNF)

- 5.3.1 Enzymatically treated CNF

- 5.3.2 TEMPO-Mediated Oxidation

- 5.3.3 Carboxymethylation

- 5.4 Bacterial Nanocellulose (BNC)

- 5.5 Cellulose Microcrystals (CMC/MCC)

- 5.6 Surface-Modified & Functionalized Nanocellulose

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 Composites & Reinforcement

- 6.2.1 Polymer Matrix Types

- 6.2.1.1 Thermoplastic Composites

- 6.2.1.2 Thermoset Composites

- 6.2.1.3 Bio-Based Polymer Composites

- 6.2.1 Polymer Matrix Types

- 6.3 Packaging & Barrier Films

- 6.3.1 Food Contact Applications

- 6.3.1.1 Oxygen Barrier Films

- 6.3.1.2 Moisture Barrier Coatings

- 6.3.1.3 Grease-Resistant Packaging

- 6.3.2 Active & Intelligent Packaging

- 6.3.3 Biodegradable Packaging Solutions

- 6.3.1 Food Contact Applications

- 6.4 Coatings & Paints

- 6.4.1 Rheology Modification

- 6.4.2 Barrier & Protective Coatings

- 6.4.3 Anti-Corrosion Applications

- 6.5 Paper & Paperboard Enhancement

- 6.6 Biomedical & Healthcare

- 6.7 Filtration & Membranes

- 6.7.1 Water Treatment Applications

- 6.7.2 Air Filtration

- 6.7.3 Oil-Water Separation

- 6.7.4 Heavy Metal Removal

- 6.8 Energy Storage & Electronics

- 6.8.1 Battery Separators

- 6.8.2 Supercapacitor Electrodes

- 6.8.3 Flexible Electronics Substrates

- 6.8.4 Sensors & Actuators

- 6.9 Rheology Modifiers & Additives

- 6.10 Agricultural Applications

- 6.11 Construction Materials

- 6.11.1 Cement & Concrete Additives

- 6.11.2 Adhesives & Sealants

- 6.11.3 Wood Composites & Engineered Wood

Chapter 7 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Sappi Limited

- 8.2 Borregaard ASA

- 8.3 CelluForce Inc.

- 8.4 FPInnovations

- 8.5 American Process Inc. (API)

- 8.6 Kruger Inc.

- 8.7 Daicel Corporation

- 8.8 Nippon Paper Group Inc.

- 8.9 Melodea Ltd.

- 8.10 J. Rettenmaier & Sohne GmbH + Co. KG

- 8.11 CelluComp Ltd.

- 8.12 Asahi Kasei Corporation

- 8.13 Oji Holdings Corporation

- 8.14 Stora Enso

- 8.15 Holmen AB

- 8.16 Anomera