|

市場調查報告書

商品編碼

1913418

香水產品市場機會、成長促進因素、產業趨勢分析及預測(2026-2035)Fragrance Product Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

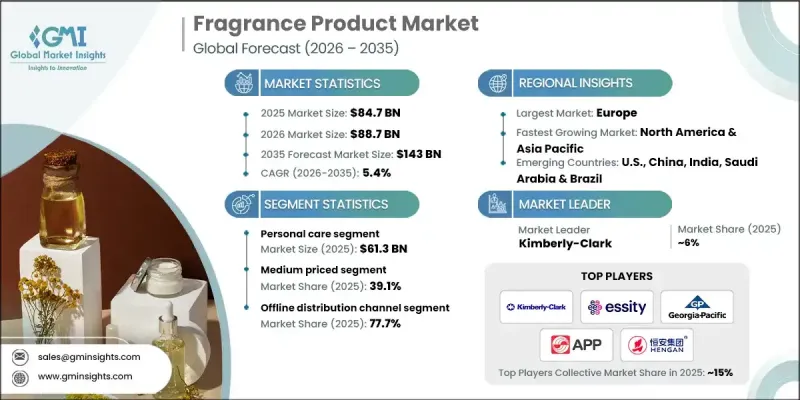

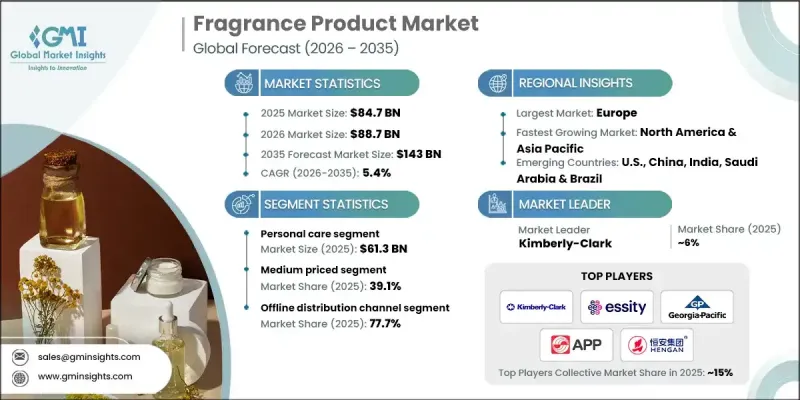

全球香水產品市場預計到 2025 年將達到 847 億美元,到 2035 年將達到 1,430 億美元,年複合成長率為 5.4%。

成熟經濟體和發展中經濟體購買力的提升支撐了香水產品的持續需求。消費者越來越將香水與個人身分、情緒健康和日常自我護理聯繫起來,而不再僅僅將其視為可有可無的美容產品。人們對健康、透明度和環境責任的日益關注正在改變他們的購買行為,進一步強化了對潔淨標示和負責任採購產品的需求。永續性因素在購買決策中扮演關鍵角色,促使品牌以更高的課責和道德誠信重新設計產品。這種轉變為那些優先考慮天然成分、可追溯採購和環境責任實踐的公司提供了長期成長機會。不斷變化的消費者生活方式、優質化趨勢以及香水在日常生活中日益重要的作用,持續推動著香水市場的發展,鞏固了其作為具有韌性和情感驅動力的消費品類的地位。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始金額 | 847億美元 |

| 預測金額 | 1430億美元 |

| 複合年成長率 | 5.4% |

預計到2025年,個人護理市場規模將達到613億美元,2026年至2035年的複合年成長率(CAGR)為5.6%。收入水準的提高,尤其是在發展中地區,持續推動消費者對高價值個人保健產品的支出成長。香水產品正日益融入各類消費者的日常整裝儀容流程。數位化影響力和品牌知名度的提升也支撐著市場需求,而配方和使用方式的不斷創新則推動了消費者參與度的提升和該領域的成長。

中價位產品市佔率佔比達39.1%,預計到2035年將以5.1%的複合年成長率成長。消費者對兼具品質與價格優勢的產品的需求,支撐了此價位區間的穩定需求。中等收入階層的壯大和零售通路的便利化,推動了該細分市場的強勁表現,而數位化銷售管道的拓展則提升了品牌覆蓋率和知名度。

美國香水產品市場預計到2025年將達到160億美元,2026年至2035年的複合年成長率(CAGR)為5.4%。對自我表達和整裝儀容的重視是支撐其穩定消費的基礎。成熟的品牌、快速的創新週期和先進的數位化零售基礎設施進一步鞏固了其市場領先地位。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 可支配所得增加

- 個人儀容和自我護理領域的發展趨勢

- 對天然和有機成分的需求不斷成長

- 產業潛在風險與挑戰

- 競爭激烈,市場飽和。

- 原物料價格波動

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 監管環境

- 標準和合規要求

- 區域法規結構

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 波特分析

- PESTEL 分析

- 消費行為分析

- 購買模式

- 偏好分析

- 消費行為的區域差異

- 電子商務如何影響購買決策

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 業務拓展計劃

第5章 市場估算與預測:依產品分類(2022-2035 年)

- 個人護理

- 香水

- 香水或淡香水

- 香水(EDP)

- 淡香水(EDT)

- 古龍水(EDC)

- 其他(清新淡香水、香精油)

- 除臭劑和止汗劑

- 身體噴霧

- 其他(古龍水、香粉等)

- 家居香氛

- 蠟燭

- 擴散器

- 空氣清新劑和凝膠袋

- 室內噴霧和香氛

- 精油

- 其他(蠟燭熔塊和保溫器、珠子等)

- 香水

第6章 市場估算與預測:依香型分類(2022-2035 年)

- 自然的

- 合成香料

- 混合

第7章 市場估計與預測:依價格分類(2022-2035 年)

- 低價位

- 中價位

- 高價位範圍

第8章 依最終用途分類的市場估算與預測(2022-2035 年)

- 供個人/住宅使用

- 商業的

- 飯店及餐飲業

- 水療和健康中心

- 零售

- 公司

- 其他(教育機構、醫療機構等)

第9章 按分銷管道分類的市場估計和預測(2022-2035 年)

- 電子商務網站

- 公司網站

- 離線

- 專賣店

- 大型零售商店

- 其他(百貨公司、私人商店等)

第10章 各地區市場估計與預測(2022-2035 年)

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第11章 公司簡介

- Chanel

- Coty

- Elizabeth Arden

- Estee Lauder

- Firmenich

- Givaudan

- Inter Parfums

- International Flavors &Fragrances

- L'Oreal

- LVMH

- Procter &Gamble

- Puig

- Shiseido

- Symrise

- Unilever

The Global Fragrance Product Market was valued at USD 84.7 billion in 2025 and is estimated to grow at a CAGR of 5.4% to reach USD 143 billion by 2035.

Rising purchasing power across both mature and developing economies supports sustained demand for fragrance products. Consumers increasingly associate fragrances with personal identity, emotional well-being, and everyday self-care rather than viewing them as optional beauty items. Heightened awareness of health, transparency, and environmental responsibility is reshaping buying behavior, leading to stronger demand for products developed with clean-label positioning and responsibly sourced inputs. Sustainability considerations now play a critical role in purchase decisions, encouraging brands to reformulate offerings with greater accountability and ethical alignment. This shift supports long-term growth opportunities for companies that prioritize natural composition, traceable sourcing, and environmentally conscious practices. The market continues to benefit from evolving consumer lifestyles, premiumization trends, and the growing role of fragrance in daily routines, reinforcing its position as a resilient and emotionally driven consumer category.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $84.7 Billion |

| Forecast Value | $143 Billion |

| CAGR | 5.4% |

The personal care segment generated USD 61.3 billion in 2025 and is expected to grow at a CAGR of 5.6% between 2026 and 2035. Rising income levels, particularly in developing regions, continue to drive spending on higher-value personal care solutions. Fragrance products are increasingly integrated into everyday grooming habits across a broad consumer base. Digital influence and brand visibility further support demand, while ongoing innovation in formulation and delivery enhances consumer engagement and segment growth.

The medium-priced products segment held a 39.1% share and is forecast to grow at a CAGR of 5.1% through 2035. Consumers gravitate toward offerings that balance perceived quality with affordability, supporting steady demand within this tier. The expansion of middle-income populations and improved retail accessibility contribute to the segment's strong performance, while digital sales channels enhance reach and brand awareness.

United States Fragrance Product Market was valued at USD 16 billion in 2025 and is projected to grow at a CAGR of 5.4% from 2026 to 2035. Strong cultural emphasis on personal expression and grooming supports consistent consumption. The presence of established brands, rapid innovation cycles, and advanced digital retail infrastructure further strengthens market leadership.

Prominent companies operating in the Global Fragrance Product Market include L'Oreal, Estee Lauder, Chanel, Coty, Givaudan, Firmenich, Symrise, International Flavors & Fragrances, LVMH, Puig, Shiseido, Inter Parfums, Unilever, Procter & Gamble, and Elizabeth Arden. Companies in the Global Fragrance Product Market strengthen their market position through continuous innovation, sustainability-driven reformulation, and strategic brand positioning. Investments in responsible sourcing, transparency, and clean-label development align offerings with evolving consumer values. Digital marketing, direct-to-consumer platforms, and data-driven personalization enhance customer engagement and loyalty. Strategic collaborations and portfolio diversification support expansion across regions and price tiers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Fragrance type

- 2.2.4 Price

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing disposable income

- 3.2.1.2 Growing personal grooming & self-care trends

- 3.2.1.3 Increasing demand for natural & organic ingredients

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High competition & market saturation

- 3.2.2.2 Volatility in raw material prices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2035, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Personal care

- 5.2.1 Perfumes

- 5.2.1.1 Parfum or De Parfum

- 5.2.1.2 Eau De Parfum (EDP)

- 5.2.1.3 Eau De Toilette (EDT)

- 5.2.1.4 Eau De Cologne (EDC)

- 5.2.1.5 Others (Eau Fraiche, Perfume Oil)

- 5.2.2 Deodorants and antiperspirants

- 5.2.3 Body mists

- 5.2.4 Others (colognes, powder, etc.)

- 5.2.5 Home fragrances

- 5.2.5.1 Candles

- 5.2.5.2 Diffusers

- 5.2.5.3 Air fresheners & gel pockets

- 5.2.5.4 Room sprays and mists

- 5.2.5.5 Essential oils

- 5.2.5.6 Others (wax melts & warmer, beads, etc.)

- 5.2.1 Perfumes

Chapter 6 Market Estimates & Forecast, By Fragrance Type, 2022 - 2035, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Natural

- 6.3 Synthetic

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Price, 2022 - 2035, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End Use, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Personal/Residential

- 8.3 Commercial

- 8.4 Hotel and hospitality

- 8.5 Spa and wellness centers

- 8.6 Retail

- 8.7 Corporates

- 8.8 Others (Educational institutes, healthcare, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.1.1 E-commerce sites

- 9.1.2 Company websites

- 9.2 Offline

- 9.2.1 Specialty stores

- 9.2.2 Mega retail stores

- 9.2.3 Others (departmental stores, individual stores, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Chanel

- 11.2 Coty

- 11.3 Elizabeth Arden

- 11.4 Estee Lauder

- 11.5 Firmenich

- 11.6 Givaudan

- 11.7 Inter Parfums

- 11.8 International Flavors & Fragrances

- 11.9 L'Oreal

- 11.10 LVMH

- 11.11 Procter & Gamble

- 11.12 Puig

- 11.13 Shiseido

- 11.14 Symrise

- 11.15 Unilever